Superior Copper Announces $3,250,000 Best Efforts Non-Brokered Private Placement

April 23 2014 - 10:47AM

Marketwired

Superior Copper Announces $3,250,000 Best Efforts Non-Brokered

Private Placement

TORONTO, ONTARIO--(Marketwired - Apr 23, 2014) - Superior Copper

Corporation ("Superior Copper" or "the Company") (TSX-VENTURE:SPC)

is pleased to announce that it intends to complete a best efforts

non-brokered private placement financing of hard dollar units ("HD

Units") at a price of $0.10 per HD Unit, and flow-through common

shares ("FT Shares") at a price of $0.10 per FT Share, for gross

proceeds of up to $3,250,000 (the "Offering").

Each HD Unit will be comprised of one common share ("Common

Share") and one-half common share purchase warrant ("HD Warrant"),

with each HD Warrant being exercisable for one common share of the

Corporation at an exercise price of $0.15 for a period of 24 months

following the closing date of the Offering.

The securities issued pursuant to the Offering will be subject

to a statutory four month and one day hold period.

The proceeds of the Offering will be used for exploration and

general working capital purposes. The proceeds received from the

amount allocated to the FT Shares will be used to incur Canadian

Exploration Expenses as defined by the Income Tax Act

(Canada), and will be renounced with an effective date of no later

than December 31, 2014.

It is anticipated that insiders of the Company and their joint

actors may subscribe for up to 45% of the securities pursuant to

the Offering. The participation of each insider will be subject to

the approval of directors of the Company who are independent of

that insider. Any such participation would be considered to be a

"related party transaction" as defined under Multilateral

Instrument 61-101 ("MI 61-101"). Since both the fair market value

of the securities to be issued to insiders and the cash

consideration to be paid for such securities will not exceed 25% of

Superior Copper's market capitalization, the Company anticipates

that the sale of securities to insiders pursuant to the Offering

will be exempt from the valuation and minority shareholder approval

requirements of MI 61-101.

The Offering is subject to the approval of the TSX Venture

Exchange and applicable securities regulatory authorities. The

Company anticipates closing as soon as practicable subject to

receipt of all necessary regulatory approvals.

Superior Copper

Corporation

Superior Copper Corporation is a Canadian-based exploration

company focused on base and precious metal exploration. The

Company's primary objective is to target highly prospective and

underexplored mineral properties, particularly copper, in order to

meet the continual global demand. Its primary land position is its

100% owned Superior Project which covers 15,789 hectares or 158

square kilometers located approximately 85 km north of Sault Ste.

Marie, Ontario. The Company's property has the potential to host an

Iron Oxide, Copper Gold ("IOCG") deposit as the Corporation has

identified a large geophysical magnetic high with coincident

gravity anomalies, Copper-bearing hematitic breccias and IOCG type

alteration patterns throughout the property which is located on the

Proterozoic Mid-continental Rift.

CAUTIONARY STATEMENT: Neither the TSX Venture Exchange

("TSX-V") nor its Regulation Services Provider (as that term is

defined in the policies of the TSX-V) accepts responsibility for

the adequacy or accuracy of this release. This News Release

includes certain "forward-looking statements". These statements are

based on information currently available to the Company and the

Company provides no assurance that actual results will meet

management's expectations. Forward-looking statements include

estimates and statements that describe the Company's future plans,

objectives or goals, including words to the effect that the Company

or management expects a stated condition or result to occur.

Forward-looking statements may be identified by such terms as

"believes", "anticipates", "expects", "estimates", "may", "could",

"would", "will", or "plan". Since forward-looking statements are

based on assumptions and address future events and conditions, by

their very nature they involve inherent risks and uncertainties.

Actual results relating to, among other things, use of proceeds

from the Offering, results of exploration, project development,

reclamation and capital costs of the Company's mineral properties,

and the Company's financial condition and prospects, could differ

materially from those currently anticipated in such statements for

many reasons such as: changes in general economic conditions and

conditions in the financial markets; changes in demand and prices

for minerals; litigation, legislative, environmental and other

judicial, regulatory, political and competitive developments;

technological and operational difficulties encountered in

connection with the activities of the Company; and other matters

discussed in this news release. This list is not exhaustive of the

factors that may affect any of the Company's forward-looking

statements. These and other factors should be considered carefully

and readers should not place undue reliance on the Company's

forward-looking statements. The Company does not undertake to

update any forward-looking statement that may be made from time to

time by the Company or on its behalf, except in accordance with

applicable securities laws. Please see our public filings at

www.sedar.com for further information.

Shares Outstanding: 101,756,284

Superior Copper CorporationJohn TaitPresident and Chief

Executive

Officer416-628-5905jtait@superiorcopper.cawww.superiorcopper.ca

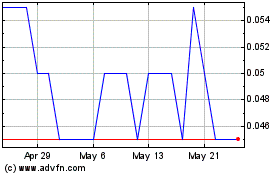

SPC Nickel (TSXV:SPC)

Historical Stock Chart

From Nov 2024 to Dec 2024

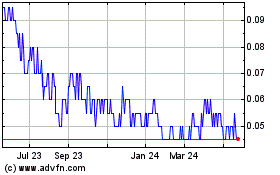

SPC Nickel (TSXV:SPC)

Historical Stock Chart

From Dec 2023 to Dec 2024