Regulatory News:

Vicat (Paris:VCT):

▼ Strong growth in sales across all the Group’s

regions

▼ EBITDA of €740 million thanks to a strong increase in the

United States

▼ Group debt reduction (leverage ratio at 1.9x)

▼ Proposed dividend of €2.0 per share

Key figures for 2023:

(€ million)

2023

2022

Change reported

Change lfl*

Consolidated sales

3,937

3,642

+8.1%

+19.6%

EBITDA

740

570

+29.8%

+41.0%

Margin (%)

18.8%

15.7%

+3.1 pts

Recurring EBIT

433

284

+52.1%

+68.0%

Margin (%)

11.0%

7.8%

+3.2 pts

Consolidated net income

295

175

+68.3%

+88.1%

Margin (%)

7.5%

4.8%

+2.7 pts

Net income, Group share

258

156

+65.6%

+84.8%

Free cash flow

295

-121

*like-for-like, i.e. at constant scope and

exchange rates

Guy Sidos, Group Chairman and CEO commented:

“Vicat’s strong results in 2023 and the prospects hence raised

are a testament to the effectiveness of its development model. The

Group has achieved the highest EBITDA in its history; a performance

driven by the ramp-up in the Ragland plant in the United States and

the success of our commercial strategy in our various markets. I’d

like to congratulate all our teams for their hard work and their

contribution to this fine performance in 2023. Trends in emerging

markets also improved over the course of the year, especially in

Brazil and Turkey, where our profitability advanced significantly.

Nonetheless, the Group’s margins have not yet returned to their

pre-crisis levels. Despite a slowdown in Europe, Vicat should

achieve further growth in 2024, leveraging its performance in the

United States and the opportunities in emerging markets. The Group

is fully focused on its three priorities: deleveraging, restoring

its margins to pre-crisis levels and executing its decarbonation

strategy. We will be launching our “Low carbon to zero carbon”

initiative in 2024 by studying two final decarbonation projects

located in France and the United States that will capture carbon to

either stock or use it.”

Disclaimer:

- In this press release, and unless indicated otherwise, all

changes are stated on a year-on-year basis (2023/2022), and at

constant scope and exchange rates.

- The alternative performance measures (APMs), such as “at

constant scope and exchange rates”, “operational sales”, “EBITDA”,

“recurring EBIT”, “net debt” and “leverage” are defined in the

appendix to this press release.

- This press release may contain forward-looking statements. Such

forward-looking statements do not constitute forecasts regarding

results or any other performance indicator, but rather trends or

targets. These statements are by their nature subject to risks and

uncertainties as described in the Company’s Universal Registration

Document on its website (www.vicat.fr). These statements do not

reflect the future performance of the Company, which may differ

significantly. The Company does not undertake to provide updates of

these statements.

Further information about Vicat is available on its website

(www.vicat.fr).

The 2023 consolidated financial statements were approved by the

Board of Directors on 12 February 2024. The Statutory Auditors have

completed their audit of the consolidated financial statements and

will shortly issue their report.

The Group’s 2023 sales rose +8.1% on a reported basis to

€3,937 million. Organic growth in sales was +19.6% at constant

scope and exchange rates, with all the Group’s regions making a

positive contribution. This performance was achieved as a result

of:

- +6.3% growth in Cement volumes over the year, with trends

varying from one Group market to another, including:

- A slowdown in European markets (France and

Switzerland) attributable to weakness in the residential sector; -

Dynamic trends in the Mediterranean and Asia regions; - The ramp-up

in the Ragland plant’s new kiln in the United States, which made a

strong contribution to volume growth over the year.

- Higher selling prices across almost all Vicat’s markets

amid strong cumulative inflation in production costs.

The Group’s sales were impacted by an unfavourable currency

effect of -€417 million (-9.6%) chiefly arising from depreciation

in the Turkish lira and Egyptian pound against the euro over the

year. There were no changes in the scope of consolidation during

the year.

The Group’s EBITDA increased sharply in 2023 with the

ramp-up in the Ragland plant’s kiln in the United States, the

improvement in production performance across all countries and the

effectiveness of the Group’s commercial policy. Selling price

increases offset the cumulative increase in production costs,

without restoring the Group’s margins to their previous levels. The

2023 EBITDA margin was 100 basis points below the level of 19.8%

recorded in 2021. The trend in reported EBITDA reflects a negative

currency effect of -€64 million.

At constant scope and exchange rates, the EBITDA increase

reflects:

- The performance improvement in the United States, with the

ramp-up in the Ragland plant’s new kiln. Its start-up in June 2022

had weighed on last year’s results;

- The impact of price increases introduced across almost all the

Group’s markets, which offset the cumulative increase in variable

costs linked to inflation:

- In 2023, energy costs totalled €596

million, down from €664 million in 2022 on a constant volume basis,

but well above the 2021 level of €398 million; - Core inflation

(staff and maintenance costs) was close to 10% in 2023.

- The improved production performance of the Cement business,

with greater use of alternatives to fossil fuels, which rose +3.9

points relative to 2022.

Recurring EBIT recorded a significant increase, with

margins up +320 basis points year-on-year after higher depreciation

and amortisation linked notably to the commissioning of the Ragland

plant’s new kiln.

Net financial income/(expense) fell by -€22 million

relative to 2022. This reflected the increase in the net cost of

debt, chiefly as a result of a change in the method used to account

for hedging derivatives introduced in July 2022.

Tax expense declined €7 million compared with 2022. The

effective tax rate was 16.8%, well below the 2022 rate of 28.6%.

This reduction in tax expense was the product of non-recurring

items (adoption in Turkey of hyperinflationary rules by the local

tax authorities and the cancellation of a deferred tax liability

following a merger between subsidiaries in Brazil), which gave rise

to a deferred tax benefit. Adjusted for these non-recurring items,

the effective tax rate was comparable to the 2022 rate.

Consolidated net income totalled €295 million, up +88.1%

at constant scope and exchange rates and up +68.3% on a reported

basis relative to 2022, which lifted the net margin to 7.5% of

sales.

Net income, Group share rose +84.8% at constant scope and

exchange rates and +65.6% on a reported basis to €258 million.

1. RESULTS BY GEOGRAPHICAL REGION

1.1. France

(€ million)

2023

2022

Change reported

Change lfl*

Consolidated sales

1,211

1,177

+2.8%

+2.8%

EBITDA

212

172

+23.3%

+23.3%

Recurring EBIT

111

75

+47.2%

+47.2%

*like-for-like, i.e. at constant scope and

exchange rates

In 2023, the Group’s business trends in France were mixed.

Cement volumes contracted slightly, and concrete and aggregates

volumes declined more significantly, whereas selling prices rose,

offsetting the cumulative rise in energy costs and inflation (staff

and maintenance costs). EBITDA in France recovered over the period,

benefiting from a favourable base of comparison effect relative to

2022. This effect derived from the sudden and substantial increase

in energy costs recorded in the second half and from the costs

arising from the operational upgrade of the Montalieu plant in the

first quarter of that same year.

Cement volumes, which had remained resilient in the first half

of the year when volumes declined only slightly, fell more

significantly in the second half by comparison with the same period

of 2022. The Cement business was affected by the slowdown in

residential construction in France. Non-residential construction

also experienced a slowdown, while public works projects held up.

The price hikes introduced at the beginning of the year helped

offset the cumulative increase in energy prices in France,

especially electricity (more than double historic costs) and other

expense items (staff and maintenance expenses). As a result, the

operational sales recorded by the Cement business rose +11.2% at

constant scope in 2023 and EBITDA posted a significant

improvement.

Concrete & Aggregates sales were affected in 2023 by a

contraction in volumes triggered by the slowdown in residential

construction and by the low level of public roadbuilding projects,

which consume large volumes of aggregates. Price hikes were

introduced during the year in both concrete and aggregates to cover

the substantial rise in costs since 2022. Concrete & Aggregates

operational sales declined -1.9% at constant scope in 2023, and

EBITDA increased slightly.

Other Products & Services sales and EBITDA posted a small

decline.

1.2 Europe (excluding France)

(€ million)

2023

2022

Change

reported

Change lfl*

Consolidated sales

407

388

+4.9%

+1.7%

EBITDA

101

85

+19.1%

+15.3%

Recurring EBIT

66

51

+29.0%

+25.0%

*like-for-like, i.e. at constant scope and

exchange rates

Cement volumes continued to contract during the second half

in Switzerland. This trend mirrored the decline in the first

six months of 2023 caused by the weakness in residential markets

and public works. Prices moved higher following the hikes

introduced at the beginning of the year to offset the effects of

the cumulative inflation in costs, especially energy. Cement

operational sales rose +4.4% at constant scope and exchange rates

in 2023 and EBITDA posted a large increase, which was supported by

an encouraging production performance.

Concrete & Aggregates operational sales in Switzerland edged

-1.6% lower at constant scope and exchange rates in 2023. The

volume weakness was only partially offset by the hikes in concrete

& aggregates prices. EBITDA moved lower over the year as a

whole.

Other Products & Services sales and EBITDA were stable in

Switzerland.

In Italy, consolidated sales rose +12.3% at constant

scope in 2023 amid stable volumes and a hike in selling prices

relative to the previous year. Overall, EBITDA also moved higher,

despite being held back by higher intrants and energy costs.

1.3 Americas

(€ million)

2023

2022

Change reported

Change lfl*

Consolidated sales

979

860

+13.9%

+15.8%

EBITDA

216

135

+59.9%

+62.5%

Recurring EBIT

139

72

+92.4%

+95.3%

*like-for-like, i.e. at constant scope and

exchange rates

In 2023, the Group’s sales in the Americas region posted

a very significant increase. They were supported by favourable

pricing conditions and by the strong volume growth generated by the

ramp-up in the Ragland plant’s new kiln (US). In the United States,

EBITDA totalled €151 million during 2023, representing an increase

of +76.4% at constant scope and exchange rates relative to

2022.

In the United States, Cement volumes achieved further

growth in the second half as the Ragland plant’s new kiln continued

to ramp up. It reached its full nominal capacity in the fourth

quarter. Demand in the South-East US held up at a high level thanks

to the boost provided by the local infrastructure programmes

launched in 2021 (IIJA1) and by the IRA2, which champions

reindustrialisation across the United States. The new rail

terminals that have opened in Georgia and Tennessee expanded the

Ragland plant’s catchment area and supported the ramp-up in its

output. This strong volume increase in the South-East US largely

offset the fall in volumes in California caused by unfavourable

meteorological conditions in the first half of the year. Prices

remained firm in both regions, with further hikes introduced at the

end of the summer to offset the cumulative effects of inflation

over the past two years. Cement operational sales rose +27.5% in

the United States at constant scope and exchange rates in 2023.

EBITDA increased sharply at constant scope and exchange rates.

The Concrete business in the United States also delivered growth

in 2023. Dynamic market conditions in the South-East more than

offset the volume contraction in California against the backdrop of

more sluggish local market conditions than in 2022. Selling prices

again moved higher in both regions. Concrete operational sales rose

+18.9% in the United States at constant scope and exchange rates in

2023. EBITDA surged higher on a year-on-year basis.

Amid broadly resilient macroeconomic conditions in 2023, the

Cement business in Brazil recorded a volume contraction as a

result of slower demand. Prices remained stable in the second half

by comparison with 2022, but were higher on a year-on-year basis.

Cement operational sales in Brazil fell -1.0% at constant scope and

exchange rates. EBITDA hit a record high in 2023. The substantial

increase was driven by a tight grip on production costs, strong

acceleration in the use of alternative fuels and the addition of

activated clays to cement, which helped lower CO2 emissions per

tonne produced.

The Concrete & Aggregates business showed resilience, with

aggregates and concrete volumes stable over the year. Concrete

prices moved higher, while aggregates prices held stable in 2023.

Concrete & Aggregates operational sales rose +9.8% in Brazil at

constant scope and exchange rates in 2023, and EBITDA posted a

smaller increase.

1.4 Asia (India and Kazakhstan)

(€ million)

2023

2022

Change

reported

Change lfl*

Consolidated sales

492

500

-1.6%

+5.4%

EBITDA

88

98

-10.2%

-4.1%

Recurring EBIT

56

64

-12.5%

-6.7%

*like-for-like, i.e. at constant scope and

exchange rates

The Group’s business in Asia recorded growth at constant

scope and exchange rates in 2023 thanks to a positive performance

in India and Kazakhstan in the second half of the year.

After a tough first six months, the Cement business in

India powered ahead in the second half, with volumes moving

higher over the year as a whole. The fall in cash costs helped

restore its competitiveness from the second half. Market conditions

remained dynamic amid pre-electoral conditions favourable for the

construction sector and were supported by a continuing drive to

develop infrastructure. In a competitive environment, selling

prices moved slightly lower over the year as a whole. Cement

operational sales in India moved up +5.6% at constant scope and

exchange rates in 2023. EBITDA also increased in local currency

terms.

After the tension seen across the rail logistics supply chain in

the first half of the year, the Cement business in

Kazakhstan recovered in the second six months of the year.

Volumes recorded strong growth in the second half of the year as an

additional fleet of wagons was secured. Prices fell back slightly

over the period amid fiercer competition. As a result, Cement

operational sales grew +5.2% in Kazakhstan at constant scope and

exchange rates. EBITDA fell significantly in 2023 as a result of

the downturn in selling prices, additional logistics costs and

higher electricity costs.

1.5 Mediterranean (Turkey and Egypt)

(€ million)

2023

2022

Change

reported

Change lfl*

Consolidated sales

464

374

+24.1%

+125.1%

EBITDA

68

44

+54.9%

+186.6%

Recurring EBIT

48

20

+142.3%

+350.0%

*like-for-like, i.e. at constant scope and

exchange rates

In 2023, the Group’s business in the Mediterranean region

was boosted by a volume recovery in Turkey and significantly higher

selling prices in local currency terms amid a hyperinflationary

environment. The business was affected by the strong fall in the

value of the Turkish lira and Egyptian pound against the euro.

Despite a hyperinflationary macroeconomic environment, the

Cement business in Turkey posted solid volume growth

throughout the year. The support provided by the government to the

construction sector and the direct and indirect effects of the

earthquake that struck south-east Turkey injected momentum into the

business. Selling prices were strongly hiked to offset the effects

of inflation on production costs. A waste heat recovery system3

commissioned at Bastas during the fourth quarter will help to lower

cash costs significantly. As a result, Cement operational sales in

Turkey grew +25.2% in 2023 (up +135.1% at constant scope and

exchange rates). EBITDA posted a significant increase thanks to a

tighter grip on costs, especially maintenance costs, during the

year and greater use of alternative fuels.

The Concrete & Aggregates business in Turkey expanded in

2023 as a result of strong growth in concrete volumes and higher

selling prices. As a result, operational sales grew +38.7% in 2023

(up +160.5% at constant scope and exchange rates). EBITDA rose

significantly.

The Cement business in Egypt experienced sluggish

domestic market conditions, with volumes declining slightly over

the year. In a competitive environment governed by the market

regulation agreement introduced by the authorities in 2021 and

renewed annually since, prices moved sharply higher in 2023. The

Group grasped opportunities to export clinker to the Mediterranean

and Africa regions, benefiting from export incentives introduced by

the government. Cement operational sales in Egypt rose +11.1% in

2023 (up +82.9% at constant scope and exchange rates). EBITDA moved

into positive territory in 2023 after a breakeven performance in

2022.

1.6 Africa (Senegal, Mali, Mauritania)

(€ million)

2023

2022

Change

reported

Change lfl*

Consolidated sales

384

343

+11.9%

+12.0%

EBITDA

54

36

+51.5%

+51.9%

Recurring EBIT

13

2

+540.8%

+545.9%

*like-for-like, i.e. at constant scope and

exchange rates

The Group’s sales in Africa rose in 2023 with the return

of volumes to normal in Mali and the full-year impact of the price

hike introduced in September 2022 in Senegal.

The Cement business in Senegal recorded a small volume

contraction in 2023. Production is expected to remain constrained

until the new kiln enters service, which is scheduled for late

2024. Conditions remain dynamic in the domestic market, which is

supported by strong residential demand and various infrastructure

projects. Prices also rose throughout the year following the most

recent hike in regulated prices in September 2022. Cement

operational sales rose +3.7% in Senegal at constant scope in 2023.

EBITDA recovered sharply over the year as a whole.

The Aggregates business in Senegal posted growth in 2023 as a

result of positive price and volume effects. It again received a

boost as major public works projects went ahead. Operational sales

grew +15.6% at constant scope in 2023. EBITDA was stable given the

increase in maintenance costs.

The Cement business in Mali benefited from the strong

market recovery after the political crisis that significantly

reduced deliveries in 2022. In 2023, operational sales grew +58.8%

at constant scope. EBITDA rose significantly.

Cement operational sales rose +15.3% in Mauritania at

constant scope and exchange rates as a result of dynamic volume and

pricing trends. EBITDA rose significantly.

2. FINANCIAL POSITION AT 31 DECEMBER 2023

(€ million)

2023

2022

2021

Gross financial debt

1,915

2,070

1,845

Cash

(493)

(503)

(527)

Net financial debt (excluding

option)

1,422

1,567

1,318

EBITDA

740

570

619

Leverage ratio (x)

1.92x

2.75x

2.13x

At 31 December 2023, the Group’s financial structure remained

solid, with a strong equity base and net debt down €145 million

year-on-year. The leverage ratio was 1.92x, down from 2.75x at 31

December 2022.

Medium- to long-term borrowings are subject to special clauses

(covenants) requiring certain financial ratios to be met. Given the

level of Group’s net debt and balance sheet liquidity, the bank

covenants do not pose a risk for the Group’s financial

position.

The Group can call on confirmed credit lines, which have not

been drawn down or assigned to hedging the liquidity risk on

commercial paper amounting to €683 million at 31 December 2023

(versus €400 million at 31 December 2022).

3. CAPITAL EXPENDITURE AND FREE CASH FLOW

(€ million)

2023

2022

2021

Maintenance capex

151

161

155

Strategic capex

178

261

232

► o/w climate capex

40

85

75

► o/w growth capex

138

176

156

Total capital expenditure

outlays

329

422

387

Proceeds from sales of non-current

assets

(29)

(14)

(11)

Total net capex outlays

300

408

376

Capital expenditure totalled €329 million in 2023, below the

level recorded in 2022. A large proportion of this capex was

devoted to the final stages of the construction of the Ragland

plant’s new kiln in the United States and continuing construction

of the new kiln in Senegal. Certain capex related to construction

of kiln 6 in Senegal, which was not disbursed in 2023, will be

committed in early 2024.

Lastly, the Group allocated €40 million in strategic capex to

reducing its carbon footprint in 2023. This €40 million allocation

does not include any “climate share” of the strategic growth

investments in kiln 2 at the Ragland plant in the United States or

in kiln 6 in Senegal, which made a strong contribution to the

Group’s climate performance. These strategic growth investments

will significantly increase the use of alternative fuels, lower the

clinker rate and improve the energy efficiency of these production

facilities and thus bring Vicat closer towards its overall

decarbonisation targets.

The Group remains committed to its climate investment target of

€800 million over 10 years. The strategic “climate” capex in 2023

and 2024 is thus likely to be below the 10-year average given the

strategic growth capex committed over this period, with a catch-up

effect anticipated over the 2026-2030 period.

Free cash flow totalled €295 million, representing a strong

improvement over the year as a result of:

- The increase in EBITDA;

- The decline in “strategic” capex following the end of the

investment cycle for the new kiln at the Ragland plant in the

United States and the calendar shift in outlays on kiln 6 in

Senegal, which will now go ahead in 2024;

- A reduction in the working capital requirement.

4. CLIMATE PERFORMANCE

2023

2022

Change

Objectives

2030

Direct specific emissions

(kg CO2 net per tonne of cement

equivalent)

588

608

-3.3%

497

Direct specific emissions in

Europe

(kg CO2 net per tonne of cement

equivalent)

501

530

-5.5%

430

Alternative fuel rate (%)

32.0%

28.1%

+3.9 pts

50.0%

Clinker rate (%)

76.8%

77.5%

-0.7 pts

69.0%

All the indicators across all the Group’s geographical regions

pointed to further improvement in Vicat’s climate performance in

2023. In Brazil, there was a strong improvement in the clinker rate

and a significant increase in use of alternative fuels.

The Vicat Group is reiterating its climate roadmap and its 2030

target of reducing its direct specific carbon emissions to 497 kg

CO2 net per tonne of cement equivalent, and 430 kg CO2 net per

tonne of cement equivalent in Europe. This objective is solely

based on existing proven technologies and does not rely on any

technological breakthroughs, such as carbon capture and

storage/use.

The “Low carbon to Zero carbon” initiative will be launched in

2024. In addition to the ongoing drive to modernise and move away

from fossil fuels in the production process, alongside the advent

of sophisticated cement compounds, the Group is studying two final

decarbonisation projects to capture carbon by stocking it or using

it to manufacture synthetic fuels at the Montalieu (France) and

Lebec (California) plants. Major public subsidies will be required

to get these projects off the ground.

5. OUTLOOK FOR 2024

In 2024, the Group expects a continued increase in its

sales, supported by growth in the United States and the

resilience of emerging markets, even taking into account the

residential sector’s weakness in Europe.

EBITDA generated by the Group

in 2024 should be higher than the 2023 level.

This objective takes into account further operational savings at

the Ragland plant and an easing in energy cost inflation over the

period, with a favourable base of comparison effect in the first

half of the year.

In 2024, the Group’s capex is likely to total around €325

million following delays to investments in a new kiln in Senegal,

which will now take place in 2024. The cumulative investment budget

for 2023 and 2024 remains unchanged.

The increase in EBITDA, tight grip on the working capital

requirement and disciplined investment approach will pave the way

for a further decrease in the Group’s net debt. As a result, the

Group has set a target of lowering its leverage to below 1.3x by

year-end 2025.

Outlook by country:

In France, business trends are expected to be held back

by the marked slowdown in residential construction, offset

partially by demand from the infrastructure segment. The

progressive start-up in a large rail infrastructure project in the

South-East region should support the business in the future.

In Switzerland, stable business trends are expected, with

volumes holding steady at a low level amid a resilient pricing

environment.

In the United States, the growth in sales in the

South-East US should continue with the operation of kiln 2 at the

Ragland plant at full capacity over a full year. In addition,

business trends in California should benefit from a favourable base

of comparison effect relative to the first half of 2023. The

increased use of alternative fuels and more widespread uptake of

“1L”-type cement, which consumes less clinker, should support

margin improvement.

In stabilising market conditions in Brazil, sales and

earnings are expected to be close to the levels seen in 2023.

Production performance improvements should provide a further

boost.

In India, the market should continue to grow, especially

in the first half thanks to a favourable base of comparison and the

full-year impact of cost reductions amid a fiercely competitive

environment.

In Kazakhstan, the more competitive environment and

saturation of the production facilities are expected to curb the

growth in volumes and prices in a country less exposed than others

to energy cost inflation.

In Turkey, the macroeconomic environment is likely to

remain dominated by inflation and the weakness of the Turkish lira.

Business trends are expected to draw strength from the

reconstruction drive after the February 2023 earthquake and the

pre-electoral environment in the first six months of the year. The

Group will continue to pursue a pricing policy intended to at least

cover the strong inflation in costs.

In Egypt, domestic market conditions are expected to

remain sluggish in a competitive environment still regulated by the

authorities. As in 2023, the Group plans to pursue opportunities to

export clinker and cement.

In West Africa, visibility is declining following

mounting political instability in the region (postponement of the

presidential elections in Senegal, Mali’s exit from Ecowas), the

impact of which is hard to gauge as things stand. In

Senegal, the Cement business will remain hampered until kiln

6 starts up in a pricing environment regulated by the

government.

6. DIVIDEND

On the strength of these full-year 2023 results showing net

profit per share of €5.76, up +65.5% on its 2022 level, and given

its confidence in the Group’s ability to continue pursuing

profitable growth, the Board of Directors decided at its meeting on

12 February 2024 to propose the distribution of a dividend of

€2.0 per share at the Group’s Annual General Meeting due to be

held on 12 April 2024.

PRESENTATION MEETING AND CONFERENCE CALL

To accompany this publication, the Vicat Group is holding an

information conference call in English on 14 February 2024 at 3pm

Paris time (2pm London time and 9am New York time).

To take part in the conference call live, dial in on one of the

following numbers:

France: +33 (0)1 70 37 71 66 United Kingdom: +44 (0)33 0551 0200

United States: +1 786 697 3501

The conference call will also be livestreamed from the Vicat

website or by clicking here. A replay of the conference call will

be immediately available for streaming via the Vicat website or by

clicking here.

The presentation supporting the event will be available from

12pm CET on Vicat’s website.

NEXT EVENTS

Annual General Meeting, 12 April 2024

First-quarter 2024 sales after the close on 29 April 2024

ABOUT THE VICAT GROUP

For 170 years, Vicat has been a leading player in the mineral

and biosourced building materials industry. Vicat is a group listed

on the Euronext Paris market and is under the majority control of

the founding Merceron-Vicat family. Committed to a trajectory that

will make it carbon-neutral across its value chain by 2050, the

Vicat Group now operates three core lines of business: Cement,

Ready-Mixed Concrete and Aggregates, as well as related activities.

The Vicat Group is present in 12 countries spanning both developed

and emerging markets. It has close to 10,000 employees and

generated consolidated sales of €3,937 million in 2023. With its

strong regional positions, Vicat is developing a circular economy

model beneficial for all and consistently innovating to reduce the

construction industry’s environmental impact.

Vicat Group – Financial data – Appendix

DEFINITION OF ALTERNATIVE PERFORMANCE MEASURES

(APMS):

- Performance at constant scope and exchange rates is used

to determine the organic growth trend in P&L items between two

periods and to compare them by eliminating the impact of exchange

rate fluctuations and changes in the scope of consolidation. It is

calculated by applying exchange rates and the scope of

consolidation from the prior period to figures for the current

period.

- A geographical (or a business) segment’s operational

sales are the sales posted by the geographical (or business)

segment in question less intra-region (or intra-segment)

sales.

- EBITDA (earnings before interest, tax, depreciation and

amortisation): sales less purchases used, staff costs and taxes

adjusted for other income and expenses on ongoing business.

- Recurring EBIT: (earnings before interest and tax):

EBITDA less net depreciation, amortisation, additions to provisions

and impairment losses on ongoing business.

- Free cash flow: net operating cash flow after deducting

capital expenditure net of disposals and financial investments and

before the dividend payment.

- Net debt represents gross debt (consisting of the

outstanding amount of borrowings from investors and credit

institutions, residual financial liabilities under finance leases,

any other borrowings and financial liabilities excluding options to

sell and bank overdrafts), net of cash and cash equivalents,

including remeasured hedging derivatives and debt.

- Leverage is a ratio based on a company’s profitability,

calculated as net debt/consolidated EBITDA.

2023 INCOME STATEMENT BY BUSINESS

Cement

(€ million)

2023

2022

Change

reported

Change lfl*

Volume (thousands of tonnes)

28,839

27,140

+6.3%

Operational sales

2,526

2,296

+10.0%

+24.4%

Consolidated sales

2,153

1,964

+9.6%

+23.9%

EBITDA

544

411

+32.2%

+44.9%

Recurring EBIT

346

233

+48.8%

+64.7%

*like-for-like, i.e. at constant scope and

exchange rates

Concrete & Aggregates

(€ million)

2023

2022

Change

reported

Change lfl*

Concrete volumes (thousands of

m3)

10,020

10,023

0.0%

Aggregates volumes (thousands of

tonnes)

24,273

25,310

-4.1%

Operational sales

1,510

1,398

+8.0%

+18.6%

Consolidated sales

1,470

1,363

+7.8%

+17.9%

EBITDA

169

132

+28.6%

+37.3%

Recurring EBIT

76

42

+83.4%

+103.2%

*like-for-like, i.e. at constant scope and

exchange rates

Other Products & Services

(€ million)

2023

2022

Change

reported

Change lfl*

Operational sales

453

454

-0.3%

+4.2%

Consolidated sales

314

315

-0.2%

-0.7%

EBITDA

27

27

-1.5%

+0.3%

Recurring EBIT

10

10

+0.2%

-0.5%

*like-for-like, i.e. at constant scope and

exchange rates

PRINCIPAL 2023 FINANCIAL STATEMENTS

Consolidated Income Statement

(in thousands of euros)

Notes

2023

2022

Revenue

4

3 937 195

3 642 063

Raw materials and consumables used

(2 598 496)

(2 509 400)

Employees expenses

5

(569 002)

(528 635)

Taxes

(60 688)

(60 982)

Other operating income (expenses)

6

30 740

27 074

EBITDA

739 749

570 120

Net charges to operating depreciation,

amortization and provisions

6

(306 995)

(285 655)

Recurring EBIT

432 754

284 465

Non-operating income (expenses)

7

4 870

6 270

Net charges to non-operating depreciation,

amortization and provisions

7

(22 243)

(13 007)

Operating profit (loss)

415 381

277 728

Cost of net financial debt

(50 817)

(31 155)

Other financial income

37 773

31 900

Other financial expenses

(59 367)

(50 666)

Financial income (expenses)

8

(72 411)

(49 921)

Share of profit (loss) of associates

11.1

10 129

12 697

Profit (loss) before tax

353 099

240 504

Income tax

9

(57 771)

(65 060)

Consolidated net income

295 328

175 444

Portion attributable to minority

interests

36 903

19 357

Portion attributable to the

Group

258 425

156 086

Basic and diluted earnings per share (in

euros)

5,76

3,48

Comprehensive income

(in thousands of euros)

2023

2022

Consolidated net income

295 328

175 444

Other items not recycled to profit and

loss:

Remeasurement of defined benefit

(4 958)

30 649

Other items not recycled to profit and

loss

(1 991)

(9 744)

Tax on non-recycled items

1 339

(6 617)

Other items recycled to profit and

loss:

Changes in currency translation

adjustments

(120 911)

(20 849)

Cash-flow hedge instruments

(1 659)

7 914

Tax on recycled items

4 012

(2 053)

Other comprehensive income (after

tax)

(124 168)

(700)

TOTAL COMPREHENSIVE INCOME

171 160

174 744

Portion attributable to minority

interests

23 542

11 403

Portion attributable to the

Group

147 618

163 341

Consolidated statement of financial position

ASSETS

(in thousands of euros)

Notes

December 31, 2023

December 31, 2022

Goodwill

10.1

1 185 026

1 204 814

Other intangible assets

10.2

174 173

183 066

Property, plant and equipment

10.3

2 582 394

2 504 926

Right of use related to leases

10.4

185 416

193 122

Investment properties

30 706

32 124

Investments in associated companies

84 861

80 804

Deferred tax assets

112 229

126 212

Receivables and other non-current

financial assets

11

241 811

269 651

Total non-current assets

4 596 617

4 594 719

Inventories and work-in-progress

12.1

568 705

560 795

Trade and other receivables

12.2

491 986

464 216

Income tax receivables

3 092

45 201

Other current assets

193 487

204 690

Assets held for sale

16 910

21 780

Cash and cash equivalents

13

493 547

503 597

Total current assets

1 767 728

1 800 279

TOTAL ASSETS

6 364 344

6 394 998

SHAREHOLDERS’ EQUITY AND

LIABILITIES

(in thousands of euros)

Notes

December 31, 2023

December 31, 2022

Share capital

179 600

179 600

Additional paid-in capital

11 207

11 207

Treasury shares

(41 891)

(47 097)

Consolidated reserves

3 230 128

3 003 393

Translation reserves

(646 331)

(558 838)

Shareholders’ equity, Group

share

2 732 713

2 588 265

Minority interests

285 157

274 529

Total shareholders’ equity

14

3 017 870

2 862 794

Provisions for pensions and other

post-employment benefits

15.1

88 045

86 355

Other provisions more than one year

15.2

134 286

123 413

Financial debts and put options more than

one year

16.1

1 416 572

1 672 772

Lease liabilities more than one year

16.1

155 718

161 045

Deferred tax liabilities

9

273 349

325 188

Other non-current liabilities

18 696

21 594

Total non-current liabilities

2 086 665

2 390 367

Other provisions less than one year

15.2

21 943

12 570

Financial debts and put options at less

than one year

16.1

335 956

242 161

Lease liabilities at less than one

year

16.1

45 153

47 537

Trade and other accounts payable

17

503 490

540 374

Income tax payables

18 522

14 814

Other liabilities

334 745

284 381

Total current liabilities

1 259 810

1 141 837

Total liabilities

3 346 474

3 532 204

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

6 364 344

6 394 998

Consolidated statement of cash flow

(in thousands of euros)

Notes

2023

2022

CASH FLOWS FROM

OPERATING ACTIVITIES

Consolidated net income

295 328

175 444

Share of profit (loss) of associates

(10 129)

(12 697)

Dividends received from associated

companies

7 489

7 057

Elimination of non-monetary items:

- depreciation, amortization and

provisions

343 521

303 434

- deferred taxes

(28 680)

6 803

- net gain (loss) on disposal of

assets

(22 196)

(5 377)

- unrealized fair value gains (losses)

3 951

(14 688)

- other non-monetary items

(381)

1 055

Cash flows from operating

activities

588 900

461 031

Changes in working capital (1)

19 364

(104 132)

Net cash flows from operating

activities

18.1

608 265

356 899

CASH FLOWS FROM

INVESTING ACTIVITIES

Cash-out related to acquisitions of

non-current assets:

- tangible and intangible assets

(328 984)

(422 356)

- financial investments

(15 115)

(28 505)

Cash-in related to disposals of

non-current assets:

- tangible and intangible assets

28 777

13 975

- financial investments

3 244

4 392

Changes in consolidation scope

(861)

(45 404)

Net cash flows from investing

activities

18.2

(312 939)

(477 898)

CASH FLOWS FROM

FINANCING ACTIVITIES

Dividends paid

(93 592)

(82 355)

Increases/decreases in share capital

Proceeds from borrowings

16

170 077

462 197

Repayments of borrowings

16

(329 194)

(138 328)

Repayment of lease liabilities

16

(51 335)

(58 414)

Purchase of treasury shares

(16 690)

(18 366)

Disposals on treasury shares

19 246

20 191

Net cash flows from financing

activities

(301 488)

184 926

Currency translation effect on net cash

and cash equivalents

(25 953)

(23 022)

Change in cash position

(32 114)

40 905

Net cash and cash equivalents - opening

balance

13.2

471 347

430 442

Net cash and cash equivalents - closing

balance

13.2

439 232

471 347

(1) - Including cash flows from income taxes: € (54) million as

of December 31, 2023 and € (81.7) million as December 31, 2022.

- Cash flows from interests paid and

received: € (34.1) million as of December 31, 2023 including €

(9.6) million for financial expenses on IFRS16 leases and € (37.6)

million as of December 31, 2022 including € (9.2) million for

interest expenses on IFRS16 leases.

Statement of changes in consolidated shareholder’s

equity

(in thousands of euros)

Share capital

Additional paid-in capital

Treasury shares

Consolidated reserves

Translation reserves

Shareholders' equity, Group

share

Minority interests

Total shareholders'

equity

At January 1st, 2022

179 600

11 207

(52 018)

2 800 579

(579 950)

2 359 418

246 681

2 606 099

IAS29 adjusments

58 610

58 610

7 313

65 923

At January 1st, 2022 restated

179 600

11 207

(52 018)

2 859 189

(579 950)

2 418 028

253 994

2 672 022

Half year net income

156 086

156 086

19 357

175 444

Other comprehensive income (1)

(13 858)

21 112

7 254

(7 954)

(700)

Total comprehensive income

142 228

21 112

163 340

11 403

174 744

Dividends paid

(73 042)

(73 042)

(9 299)

(82 341)

Net change in treasury shares

4 921

(3 030)

1 891

1 891

Change in consolidation scope and

additional acquisitions

(13 330)

(13 330)

12 458

(872)

Application of IAS29

56 602

56 602

7 165

63 767

Other changes

34 776

34 776

(1 192)

33 584

At December 31, 2022

179 600

11 207

(47 097)

3 003 393

(558 838)

2 588 265

274 529

2 862 794

At January 1st, 2023

179 600

11 207

(47 097)

3 003 393

(558 838)

2 588 265

274 529

2 862 794

Net income

258 425

258 425

36 903

295 328

Other comprehensive income (1)

(23 314)

(87 493)

(110 807)

(13 361)

(124 168)

Total comprehensive income

235 111

(87 493)

147 618

23 542

171 160

Dividends paid

(73 227)

(73 227)

(20 400)

(93 627)

Net change in treasury shares

5 206

(2 691)

2 515

2 515

Changes in scope of consolidation and

additional acquisitions

(449)

(449)

(26)

(475)

Application of IAS29

65 895

65 895

7 460

73 355

Other changes

2 096

2 096

52

2 148

At December 31, 2023

179 600

11 207

(41 891)

3 230 128

(646 331)

2 732 713

285 157

3 017 870

1 Infrastructure Investment and Jobs Act 2 Inflation Reduction

Act 3System harnessing the hot gases produced to generate

electricity

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240213062207/en/

INVESTOR RELATIONS CONTACT:

Pierre Pedrosa Tel +33 (0)6 73 25 98 06

pierre.pedrosa@vicat.fr

PRESS CONTACTS:

Karine Boistelle-Adnet Tel +33 (0)4 74 27 58 04

karine.boistelleadnet@vicat.fr

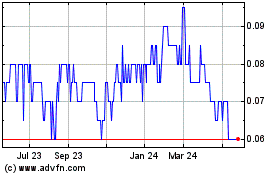

Volt Carbon Technologies (TSXV:VCT)

Historical Stock Chart

From Nov 2024 to Dec 2024

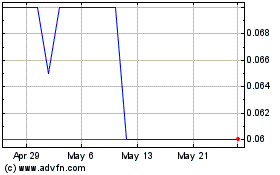

Volt Carbon Technologies (TSXV:VCT)

Historical Stock Chart

From Dec 2023 to Dec 2024