Xali Gold Announces Stock Options Grant and Annual General Meeting Voting results

December 19 2024 - 4:07PM

Xali Gold Corp. (TSXV:XGC) ("Xali Gold” or the ”Company”) reports

that, pursuant to the terms and conditions of its Omnibus Equity

Incentive Plan, an aggregate of 4,100,000 stock options to purchase

common shares of the Company have been granted to certain

directors, officers and consultants of the Company. The options are

exercisable for a period of five years at a price of $0.05 per

share.

Xali Gold is pleased to announce the results of

the Company’s Annual General Meeting of Shareholders (the

“Meeting”) held on December 19th, 2024. A total of 14,006,597

common shares of the Company were voted at the meeting,

representing 9.83% of the total number of issued and outstanding

shares of the Company. At the Meeting, all five director nominees

listed in the Company’s information circular dated November 8th,

2024, were elected as directors of the Company. In addition,

shareholders voted to appoint Saturna Group, Chartered Professional

Accountants LLP, as auditors for the Company and re-approved the

Company’s Omnibus Equity Incentive Plan.

About Xali Gold

Xali Gold has gold and silver projects in Peru

and Mexico. The Company’s flagship project, El Oro, is a district

scale historic producer of gold and silver. While the Company’s

main goal at El Oro is to make a new discovery, similar to the

multi-million ounce (“oz”) gold and silver ore bodies mined

historically, the Company has entered into two agreements to bring

in cash flow. Two third parties now have signed agreements with

Xali Gold Corp. for the rights to produce gold and silver from the

El Oro Project. Kappes, Cassiday & Associates (“KCA”), in

partnership with Starcore International Mines Ltd., has the right

to reprocess tailings which contain 1.27 million tonnes at a grade

of 2.94 gpt gold and 75.12 gpt silver (3.85 gpt gold equivalent)

containing 119,900 oz of gold and 3,061,200 oz of silver*.

Remedioambiente S.A. de C.V. (“RM”) has the right to recover gold

and silver from mineralized veins and backfill left behind in the

historic mine workings. The agreements provide for Xali Gold to

receive funds from net smelter returns (“NSRs“) of up to 3% from

each of these two agreements. In addition, the underground work by

RM is expected to give the Company underground access for drilling

the high-grade targets identified by previous drilling below the

historic workings at El Oro and also assist in paying mineral

rights fees.

Future exploration in Mexico will be focused on

the El Oro property which covers 20 veins with past production and

more than 57 veins in total, from which approximately 6.4M ozs of

gold and 74M ozs of silver were reported to have been produced from

just two of these veins (Ref. Mexico Geological Service Bulletin

Nr. 37, Mining of the El Oro and Tlalpujahua Districts, by T.

Flores in 1920). Modern understanding of epithermal vein systems

indicates that several of the El Oro district’s veins hold

excellent discovery potential, particularly below and adjacent to

the historic workings of the San Rafael Vein, which was mined to an

average depth of only 200m.

With renewed interest in gold and silver

exploration in South America, Xali Gold has recently been reviewing

high sulphidation gold targets with features similar to Yanacocha

and Pierina, within proven high sulphidation epithermal belts in

Peru. The Company also still maintains other properties in

Peru.

Xali Gold is dedicated to being a responsible

community partner.

Joanne C. Freeze, P.Geo., President and CEO is

the Qualified Person as defined by National Instrument 43-101 for

the projects discussed above. Ms. Freeze has reviewed and approved

the contents of this release. Neither the TSX Venture Exchange nor

its Regulation Services Provider accepts responsibility for the

adequacy or accuracy of this release.

On behalf of the Board of Xali Gold

Corp.

“Joanne Freeze” P.Geo.President, CEO and

Director

For further information please contact:Joanne

Freeze, President & CEOTel: + 1 604-512-3359

info@xaligold.com

Forward-looking InformationThis news release may

contain forward-looking information (as such term is defined under

Canadian securities laws) including but not limited to historical

production records and resource estimates. While such

forward-looking information is expressed by Xali Gold in good faith

and believed by Xali Gold to have a reasonable basis, they may

address future events and conditions and are therefore subject to

inherent risks and uncertainties including those set out in Xali

Gold’s MD&A. Factors that cause the actual results to differ

materially from those in forward-looking information include,

without limitation, gold prices, results of exploration and

development activities, regulatory changes, defects in title,

availability of materials and equipment, timeliness of government

approvals, potential environmental issues, availability of capital

and financing and general economic, market or business conditions.

Xali Gold expressly disclaims any intention or obligation to update

or revise any forward-looking information, whether as a result of

new information, future events or otherwise, except in accordance

with applicable securities laws.

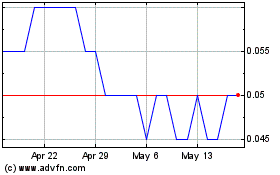

Xali Gold (TSXV:XGC)

Historical Stock Chart

From Nov 2024 to Dec 2024

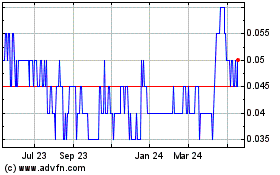

Xali Gold (TSXV:XGC)

Historical Stock Chart

From Dec 2023 to Dec 2024