Zenyatta; Ultra-High Purity of 99.96% Carbon Yielded from Second Series of Tests on Albany Graphite Samples

February 05 2013 - 7:00AM

Marketwired Canada

Zenyatta Ventures Ltd. ("Zenyatta" or "Company") (TSX VENTURE:ZEN) is pleased to

announce the following significant results from a second series of beneficiation

tests conducted at SGS Canada Inc. ("Lakefield") on samples from its 100% owned

Albany graphite deposit. Trials using two different leaching processes both

yielded results exceeding the target of greater than 99.0% Carbon ("C").

One process yielded 99.7% C while another different and cheaper process yielded

an exceptional purity of 99.96% C. This is further confirmation of earlier

mineralogical studies that showed the Albany 'vein-type' graphite material to be

of high quality and containing minor amounts of impurities. The ability to

produce a natural graphite product equivalent in purity to the highest grade

synthetic graphite using low-cost conventional processing techniques will allow

Zenyatta to target the growing market in high value-added graphite applications.

Aubrey Eveleigh, President and CEO stated, "Achieving these ultra-high purity

carbon values at such an early stage from a simple and relatively inexpensive

process is truly remarkable. This large 'vein-type' graphite deposit appears to

be 'one of a kind' globally in both size and quality." Eveleigh also stated,

"With accelerated global interest in the Albany graphite deposit, Zenyatta will

continue to discuss the merits of the project with potential strategic partners,

including graphite end-users."

Natural graphite material has varying levels of quality depending on the type

(vein, flake or amorphous). The degree of purity can vary greatly, which heavily

influences the use of the material in applications and its pricing. Carbon

purity of natural graphite can generally range from 70.0% all the way to 99.0%,

whereas synthetic graphite is usually greater than 99.0%. Given the ultra-high

purity at Zenyatta's Albany project, the Company will be positioning the

material to compete in the $13 billion (1.5 million tonnes annually) synthetic

market.

Synthetic graphite is significantly more expensive to make but commands the

highest market prices due to its purity. It can cost $4000 - $5000 per tonne

(99.5% purity) to produce but can be sold for $7000 - $9000 per tonne.

Ultra-high purity (99.9%) graphite can demand a price of $20,000 - $30,000 per

tonne. Processing and purification of natural graphite has improved greatly in

recent years and projects with initial high purity graphite, like the Albany

vein-type, require less purification and therefore lower cost to produce.

Synthetic graphite producers are faced with escalating energy costs associated

with turning petroleum coke into graphite. Petroleum coke is the solid waste

remaining after refining oil. To turn petroleum coke into graphite requires

extensive thermal treatment (up to 3000 degrees C), in various steps, to burn

off impurities and re-arrange graphite layers. Not only is this energy intensive

but also an environmental issue. Another big concern for synthetic producers is

the diminishing supply of petroleum (needle) coke derived from low sulfur, sweet

crude oil. Therefore, natural high purity graphite is gaining traction over

synthetic graphite for many applications due to lower cost of production. Also,

natural graphite has superior qualities such as higher specific capacity and

less porosity.

Zenyatta is developing a very rare 'vein-type' graphite deposit it discovered in

2011 in northeastern Ontario, Canada. It is the largest and only known 'vein

type' graphite deposit under development in the world. Previously announced

drill intersections at the Albany project have been as high as 170 metres

grading 6.6% C. Globally, the only graphite mines of this type are located in

Sri Lanka, which have been in production since 1847. The current high grade,

underground mining operations produce only 5,500 tonnes annually from narrow

(5-10cm) veins. Despite the lack of volume, Sri Lankan 'vein-type' graphite has

enjoyed great demand due to its unusually high purity and unique physical

properties. Graphite veins are quite rare and in many industrial applications

offer superior performance due to higher thermal and electrical conductivity.

Zenyatta's Albany graphite deposit is located 30km north of the Trans Canada

Highway, power line and natural gas pipeline near the communities of Constance

Lake First Nation and Hearst. A rail line is located 70km away and an

all-weather road approximately 4-5km from the graphite deposit. The deposit is

near surface, underneath glacial till overburden and a thin veneer of Paleozoic

sedimentary cover rocks.

Graphite is a natural form of carbon with the chemical formula C, which it

shares with diamond and coal. The outlook for the global graphite market is very

promising with demand growing rapidly from new applications. It is now

considered one of the more strategic elements by many leading industrial

nations, particularly for its growing importance in high technology

manufacturing and in the emerging "green" industries such as electric vehicle

components. The application for graphitic material is constantly evolving due to

its unique chemical, electrical and thermal properties. It maintains its

stability and strength under temperatures in excess of 3,500 degrees C and is

very resistant to chemical corrosion. It is also one of the lightest of all

reinforcing elements and has high natural lubricating abilities. Some of these

key physical and chemical properties make it critical to modern industry.

The Company also wishes to announce that further to its press release of

November 22, 2012, it has received approval from the TSX Venture Exchange to

extend the terms of 11,740,000 common share purchase warrants (collectively, the

"Warrants") issued prior to the Company's initial public offering in December

2010. Each Warrant entitles the holder to acquire one common share of Zenyatta

for $1.00 per share and, pursuant to the Warrant term extension, the expiry date

of the Warrants is June 23, 2013. The remaining warrants of 1,054,000 at $0.25

and 1,261,549 at $0.60, which were due on 23 December 2012, were all exercised.

Zenyatta now has 42,385,862 common shares issued and outstanding with a total of

57,575,862 shares on a fully diluted basis. Mr. Aubrey Eveleigh, P.Geo.,

President and CEO, is the "Qualified Person" under NI 43-101 and has reviewed

the technical information contained in this news release. To find out more on

Zenyatta Ventures Ltd., please visit website www.zenyatta.ca or contact the

Company at info@zenyatta.ca or Tel. 807-346-1660.

This News Release includes certain "forward-looking statements". These

statements are based on information currently available to the Company and the

Company provides no assurance that actual results will meet management's

expectations. Forward-looking statements include estimates and statements that

describe the Company's future plans, objectives or goals, including words to the

effect that the Company or management expects a stated condition or result to

occur. Forward-looking statements may be identified by such terms as "believes",

"anticipates", "expects", "estimates", "may", "could", "would", "will", "should"

or "plan". Since forward-looking statements are based on assumptions and address

future events and conditions, by their very nature they involve inherent risks

and uncertainties. Actual results relating to, among other things, results of

exploration, project development, reclamation and capital costs of the Company's

mineral properties, and the Company's financial condition and prospects, could

differ materially from those currently anticipated in such statements for many

reasons such as: changes in general economic conditions and conditions in the

financial markets; changes in demand and prices for minerals; litigation,

legislative, environmental and other judicial, regulatory, political and

competitive developments; technological and operational difficulties encountered

in connection with the activities of the Company; and other matters discussed in

this news release. This list is not exhaustive of the factors that may affect

any of the Company's forward-looking statements. These and other factors should

be considered carefully and readers should not place undue reliance on the

Company's forward-looking statements. The Company does not undertake to update

any forward-looking statement that may be made from time to time by the Company

or on its behalf, except in accordance with applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Zenyatta Ventures Ltd

Mr. Aubrey Eveleigh, P.Geo.

President and CEO

807-346-1660

info@zenyatta.ca

www.zenyatta.ca

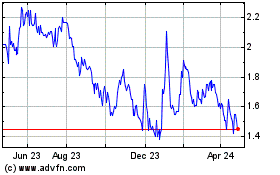

Zentek (TSXV:ZEN)

Historical Stock Chart

From Dec 2024 to Jan 2025

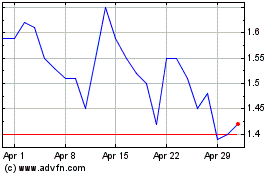

Zentek (TSXV:ZEN)

Historical Stock Chart

From Jan 2024 to Jan 2025