FORM

10-Q

| ☒ |

Quarterly Report pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934 |

| |

|

| |

For the quarterly period

ended December 31, 2023 |

| |

|

| ☐ |

Transition Report pursuant to 13 or 15(d) of the Securities

Exchange Act of 1934 |

| |

|

| |

For the transition period

from __________ to __________ |

| |

|

| |

Commission

File Number: 333-156091 |

Alterola

Biotech, Inc.

(Exact

name of Registrant as specified in its charter)

| Nevada |

82-1317032 |

| (State or other jurisdiction

of incorporation or organization) |

(IRS Employer Identification

No.) |

47

Hamilton Square Birkenhead Merseyside

CH41

5AR United Kingdom |

| (Address of principal executive

offices) |

| +44 151

601 9477 |

| (Registrant’s telephone

number) |

| |

| _______________________________________________________________ |

| (Former name, former address

and former fiscal year, if changed since last report) |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days

[X]

Yes [ ] No

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). [X] Yes [ ] No

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company.

| ☐ Large accelerated Filer |

☐ Accelerated Filer |

| ☒ Non-accelerated Filer |

☒ Smaller reporting company |

| |

☐ Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[

] Yes [X] No

State the number of shares outstanding of each of

the issuer’s classes of common stock, as of the latest practicable date: 1,382,662,952 shares

as of February 18, 2023.

PART

I - FINANCIAL INFORMATION

Item

1. Financial Statements

Our

consolidated financial statements included in this Form 10-Q are as follows:

| F-1 |

Consolidated Balance Sheets as of

December 31, 2023 (unaudited) and March 31, 2023; |

| F-2 |

Consolidated Statements of Operations

for the three and nine months ended December 31, 2023 and 2022 (unaudited); |

| |

|

| F-3 |

Consolidated Statement of Stockholders’ Deficit

for the nine months ended to December 31, 2023 and 2022 (unaudited); |

| F-4 |

Consolidated Statements of Cash

Flow for the nine months ended December 31, 2023 and 2022 (unaudited); |

| F-5 |

Notes to Consolidated Financial

Statements. |

These

consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States

of America for interim financial information and the Securities Exchange Commission (“SEC”) instructions to Form 10-Q. In

the opinion of management, all adjustments considered necessary for a fair presentation have been included. Operating results

for the interim period ended December 31, 2023 are not necessarily indicative of the results that can be expected for the full year.

ALTEROLA

BIOTECH, INC.

UNAUDITED

CONSOLIDATED BALANCE SHEETS

AS

OF DECEMBER 31, 2023 AND MARCH 31, 2023

| | |

December

31, 2023 | |

March

31, 2023 |

| | |

| |

(audited) |

| ASSETS | |

| | | |

| | |

| Current

Assets | |

| | | |

| | |

| Bank | |

$ | 2,574 | | |

$ | 8,890 | |

| VAT receivable | |

| — | | |

| 37,953 | |

| Deferred

tax asset | |

| — | | |

| 189,355 | |

| Inventories | |

| 1,015 | | |

| 986 | |

| | |

| | | |

| | |

| Total Current Assets | |

| 3,589 | | |

| 237,184 | |

| | |

| | | |

| | |

| Intangible

assets | |

| — | | |

| 12,139,779 | |

| | |

| | | |

| | |

| TOTAL

ASSETS | |

$ | 3,589 | | |

$ | 12,376,963 | |

| | |

| | | |

| | |

| LIABILITIES

AND STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| | |

| | | |

| | |

| Current

Liabilities | |

| | | |

| | |

| Accounts

payable | |

$ | 803,841 | | |

$ | 611,805 | |

| Accrued

expenses | |

| 310,522 | | |

| 254,864 | |

| Loan

payable, related party | |

| 244,061 | | |

| 1,260,434 | |

| Total

Current Liabilities | |

| 1,358,424 | | |

| 2,127,103 | |

| | |

| | | |

| | |

| Convertible

Note Payable | |

| — | | |

| 154,313 | |

| | |

| | | |

| | |

| Total

Liabilities | |

| 1,358,424 | | |

| 2,281,416 | |

| | |

| | | |

| | |

| Stockholders’

Equity (Deficit) | |

| | | |

| | |

| Preferred

Stock, $.001 par value, 10,000,000 shares authorized, -0- shares issued and outstanding | |

| — | | |

| — | |

| Common

Stock, $.001 par value, 2,000,000,000 shares authorized, 1,382,662,952 and 807,047,948 shares issued and outstanding, respectively | |

| 1,382,663 | | |

| 807,048 | |

| Treasury

stock, 29,015,993 and 0 shares held, respectively | |

| 29,016 | | |

| — | |

| Additional

paid-in capital | |

| 9,663,971 | | |

| 18,927,919 | |

| Accumulated

deficit | |

| (12,441,456 | ) | |

| (9,576,247 | ) |

| Foreign

currency translation adjustment | |

| 10,971 | | |

| (63,173 | ) |

| Total

Stockholders’ Equity (Deficit) | |

| (1,354,835 | ) | |

| 10,095,547 | |

| | |

| | | |

| | |

| TOTAL

LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

$ | 3,589 | | |

$ | 12,376,963 | |

See

accompanying notes to financial statements.

ALTEROLA

BIOTECH, INC.

UNAUDITED

CONSOLIDATED STATEMENT OF OPERATIONS

FOR

THE THREE AND NINE MONTHS ENDED DECEMBER 31, 2023 AND 2022

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | |

Three

months ended December 31, 2023 | |

Three

months ended December 31, 2022 | |

Nine

months ended December 31, 2023 | |

Nine

months ended December 31, 2022 |

| | |

| |

| |

| |

|

| REVENUES | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING

EXPENSES | |

| | | |

| | | |

| | | |

| | |

| Accounting

and audit fees | |

| 27,882 | | |

| 19,001 | | |

| 99,982 | | |

| 86,816 | |

| Professional

fees | |

| 273,659 | | |

| 249,183 | | |

| 280,844 | | |

| 363,193 | |

| Research

and development | |

| 2,880 | | |

| — | | |

| 2,880 | | |

| 41,086 | |

| Legal

fees | |

| 60,939 | | |

| 166,699 | | |

| 73,838 | | |

| 174,728 | |

| Directors

fees and expenses | |

| 31,575 | | |

| 27,931 | | |

| 227,575 | | |

| 546,571 | |

| Consulting

fees | |

| 661,421 | | |

| 198,335 | | |

| 995,099 | | |

| 481,429 | |

| Salaries

and wages | |

| 26,857 | | |

| (92,638 | ) | |

| 96,315 | | |

| 101,238 | |

| General

and administrative expenses | |

| 23,734 | | |

| (27,890 | ) | |

| 49,138 | | |

| 28,931 | |

| TOTAL

OPERATING EXPENSES | |

| 1,108,947 | | |

| 540,621 | | |

| 1,825,671 | | |

| 1,823,992 | |

| | |

| | | |

| | | |

| | | |

| | |

| LOSS

FROM OPERATIONS | |

| (1,108,947 | ) | |

| (540,621 | ) | |

| (1,825,671 | ) | |

| (1,823,992 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER

INCOME (EXPENSE) | |

| | | |

| | | |

| | | |

| | |

| Income tax expense for valuation allowance on deferred tax asset | |

| (194,800 | ) | |

| — | | |

| (194,800 | ) | |

| — | |

| Loss

on impairment of intangible assets | |

| (300,000 | ) | |

| — | | |

| (300,000 | ) | |

| — | |

| Gain

(loss) on conversion of note | |

| (406,575 | ) | |

| — | | |

| (544,738 | ) | |

| — | |

| TOTAL

OTHER INCOME (EXPENSE) | |

| (901,375 | ) | |

| — | | |

| (1,039,538 | ) | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| PROVISION

FOR INCOME TAXES | |

| — | | |

| (5,832 | ) | |

| — | | |

| 101,301 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET

LOSS | |

| (2,010,322 | ) | |

| (534,789 | ) | |

| (2,865,209 | ) | |

| (1,722,691 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Foreign exchange translation

gain (loss) |

|

|

(9,650) |

|

|

|

25,730 |

|

|

|

74,144 |

|

|

|

43,152 |

|

| Comprehensive loss |

|

|

(2,019,972) |

|

|

|

(509,059) |

|

|

|

(2,791,065) |

|

|

|

(1,679,539) |

|

| | |

| | | |

| | | |

| | | |

| | |

| NET

LOSS PER SHARE: BASIC AND DILUTED | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| WEIGHTED

AVERAGE NUMBER OF SHARES OUTSTANDING: BASIC AND DILUTED | |

| 1,265,220,104 | | |

| 807,047,948 | | |

| 948,110,596 | | |

| 806,766,837 | |

See

accompanying notes to financial statements.

ALTEROLA

BIOTECH, INC.

UNAUDITED

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY (DEFICIT)

FOR

THE PERIOD FROM MARCH 31, 2022 TO DECEMBER 31, 2023

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | |

Common

stock | |

Treasury Shares stock | |

| |

| |

| |

| |

|

| | |

Shares | |

Amount | |

Shares | |

Amount | |

Additional

paid in capital | |

Stock

Subscription | |

Accumulated

other comprehensive income ( loss) | |

Accumulated

Deficit | |

Stockholders’

Equity (deficit) |

| Balance,

March 31, 2022 | |

| 802,633,333 | | |

$ | 802,633 | | |

| — | | |

| — | | |

| 17,942,833 | | |

$ |

136,721 |

|

|

$ | 14,599 | | |

$ | (7,833,790 | ) | |

$ | 11,062,996 | |

| Change

in foreign currency | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

|

— |

|

|

| 43,152 | | |

| — | | |

| 43,152 | |

| Shares issued for cash |

|

|

280,000 |

|

|

|

280 |

|

|

|

— |

|

|

|

— |

|

|

|

136,721 |

|

|

|

(136,721 |

) |

|

|

— |

|

|

|

— |

|

|

|

280 |

| Shares issued for cash |

|

|

384,615 |

|

|

|

385 |

|

|

|

— |

|

|

|

— |

|

|

|

49,615 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

50,000 |

|

| Shares issued for services |

|

|

1,500,000 |

|

|

|

1,500 |

|

|

|

— |

|

|

|

— |

|

|

|

319,500 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

321,000 |

|

| Shares issued for services |

|

|

2,250,000 |

|

|

|

2,250 |

|

|

|

— |

|

|

|

— |

|

|

|

479,250 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

481,500 |

|

| Net

loss for the period ended December 31, 2022 | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

|

— |

|

|

| — | | |

| (1,722,691 | ) | |

| (1,722,691 | ) |

| Balance,

December 31, 2022 | |

| 807,047,948 | | |

$ | 807,048 | | |

| — | | |

| — | | |

| 18,927,919 | | |

|

— |

|

|

$ | 57,751 | | |

$ | (9,556,481 | ) | |

$ | 10,236,237 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

|

|

|

| | | |

| | | |

| | |

| Balance,

March 31, 2023 | |

| 807,047,948 | | |

$ | 807,048 | | |

| — | | |

| — | | |

| 18,927,919 | | |

$ |

— |

|

|

$ | (63,173 | ) | |

$ | (9,576,247 | ) | |

$ | 10,095,547 | |

|

Foreign currency translation | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

|

— |

|

|

| 74,144 | | |

| — | | |

| 74,144 | |

| Shares

reclaimed into treasury shares | |

| (44,064,000 | ) | |

| (44,064 | ) | |

| 44,064,000 | | |

| 44,064 | | |

| — | | |

|

— |

|

|

| — | | |

| — | | |

| — | |

| Shares

issued for warrants | |

| 13,500,000 | | |

| 13,500 | | |

| (13,500,000 | ) | |

| (13,500 | ) | |

| — | | |

|

— |

|

|

| — | | |

| — | | |

| — | |

| Shares

issued for acquisition of Alinova Resources | |

| 5,000,000 | | |

| 5,000 | | |

| (5,000,000 | ) | |

| (5,000 | ) | |

| 295,000 | | |

|

— |

|

|

| — | | |

| — | | |

| 295,000 | |

| Shares

issued for services | |

| 16,088,000 | | |

| 16,088 | | |

| (16,088,000 | ) | |

| (16,088 | ) | |

| 305,672 | | |

|

— |

|

|

| — | | |

| — | | |

| 305,672 | |

| Shares

issued for services- directors | |

| 9,000,000 | | |

| 9,000 | | |

| (9,000,000 | ) | |

| (9,000 | ) | |

| 171,000 | | |

|

— |

|

|

| — | | |

| — | | |

| 171,000 | |

| Shares

issued for settlement of debt | |

| 476,000 | | |

| 476 | | |

| (476,000 | ) | |

| (476 | ) | |

| 157,339 | | |

|

— |

|

|

| — | | |

| — | | |

| 157,339 | |

| Shares

reclaimed from asset sale | |

| (24,000,000 | ) | |

| (24,000 | ) | |

| 24,000,000 | | |

| 24,000 | | |

| (12,000,000 | ) | |

|

— |

|

|

| — | | |

| — | | |

| (12,000,000 | ) |

| Additional

shares reclaimed from asset sale | |

| (5,015,993 | ) | |

| (5,016 | ) | |

| 5,015,993 | | |

| 5,016 | | |

| — | | |

|

— |

|

|

| — | | |

| — | | |

| — | |

| Shares

issued for conversion of debt | |

| 587,499,996 | | |

| 587,500 | | |

| — | | |

| — | | |

| 1,762,500 | | |

| — | | |

| — | | |

| — | | |

| 2,350,000 | |

| Shares

issued for outside services | |

| 8,360,306 | | |

| 8,360 | | |

| — | | |

| — | | |

| 21,737 | | |

| — | | |

| — | | |

| — | | |

| 30,097 | |

| Shares

issued for services – internal | |

| 8,770,695 | | |

| 8,771 | | |

| — | | |

| — | | |

| 22,804 | | |

| — | | |

| — | | |

| — | | |

| 31,575 | |

| Net

loss for the period ended December 31, 2023 | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (2,865,209 | ) | |

| (2,865,209 | ) |

| Balance,

December 31, 2023 | |

| 1,382,662,952 | | |

$ | 1,382,663 | | |

| 29,015,996 | | |

| 29,016 | | |

| 9,663,971 | | |

| — | | |

$ | 10,971 | | |

$ | (12,441,456 | ) | |

$ | (1,354,835 | ) |

See

accompanying notes to financial statements.

ALTEROLA

BIOTECH, INC.

UNAUDITED

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR

THE NINE MONTHS ENDED DECEMBER 31, 2023

AND

2022

| | |

Nine Months Ended December 31, 2023 | |

Nine Months Ended December 31, 2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Net loss for the period | |

$ | (2,865,209 | ) | |

$ | (1,722,691 | ) |

| Adjustments to reconcile net loss to net cash flows used in operating activities | |

| | | |

| | |

| Non cash currency adjustments | |

| — | | |

| — | |

| Stock for services | |

| — | | |

| 802,500 | |

| Stock to directors | |

| — | | |

| — | |

| Income tax expense for

valuation allowance on deferred tax asset | |

| 189,355 | | |

| — | |

| Impairment of intangibles | |

| 439,779 | | |

| — | |

| Shares issued for warrants | |

| — | | |

| — | |

| Stock subscriptions delivered | |

| — | | |

| 136,721 | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Funds in attorney trust | |

| — | | |

| 12,409 | |

| Inventory | |

| — | | |

| — | |

| VAT receivable | |

| 66,637 | | |

| 15,308 | |

| Deferred tax asset | |

| — | | |

| (142,850 | ) |

| Accounts payable | |

| 740,284 | | |

| 126,162 | |

| Accrued liabilities | |

| 55,658 | | |

| (384,057 | ) |

| Net Cash Used by Operating Activities | |

| (1,373,496 | ) | |

| (1,156,498 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Acquisition of intangible assets | |

| — | | |

| (18,147 | ) |

| Net Cash (Used) Provided by Investing Activities | |

| — | | |

| (18,147 | ) |

| | |

| | | |

| | |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Purchase of common shares for cash | |

| (44,064 | ) | |

| 50,280 | |

| Shares issued for conversion of debt to equity | |

| 544,738 | | |

| — | |

| Loan from related parties | |

| 788,889 | | |

| 1,043,125 | |

| Net Cash Provided by Financing Activities | |

| 1,289,563 | | |

| 1,093,405 | |

| | |

| | | |

| | |

| Net change in cash | |

| (83,933 | ) | |

| (81,240 | ) |

| | |

| | | |

| | |

| Effect of exchange rate adjustments on cash | |

| 77,617 | | |

| 30,240 | |

| | |

| | | |

| | |

| Cash and cash equivalents, beginning of period | |

| 8,890 | | |

| 63,816 | |

| Cash and cash equivalents, end of period | |

$ | 2,574 | | |

$ | 12,816 | |

| | |

| | | |

| | |

| NON-CASH INVESTING AND FINANCING INFORMATION | |

| | | |

| | |

| Shares issued for services | |

$ | 335,769 | | |

$ | 802,500 | |

| Shares issued to directors | |

$ | 202,575 | | |

$ | — | |

| Shares issued for asset acquisition | |

$ | 295,000 | | |

$ | — | |

| Shares issued for exercise of warrants | |

$ | 13,500 | | |

$ | — | |

| Shares issued for conversion of notes payable | |

$ | 2,507,339 | | |

$ | — | |

See

accompanying notes to financial statements.

ALTEROLA

BIOTECH, INC.

NOTES

TO THE UNAUDITED CONSOIDATED FINANCIAL STATEMENTS

DECEMBER

31, 2023

NOTE

1 – NATURE OF BUSINESS, LIQUIDITY & GOING CONCERN

After

formation, the Company was in the business of mineral exploration. On May 3, 2010, the Company sold its mineral exploration business

and entered into an Intellectual Property Assignment Agreement (“IP Agreement”) with Soren Nielsen pursuant to which Mr.

Nielsen transferred his right, title and interest in all intellectual property relating to certain chewing gum compositions having appetite

suppressant activity (the “IP”) to the Company for the issuance of 55,000,000 shares of the Company’s common stock.

Following

the acquisition of the IP the Company changed its business direction to pursue the development of chewing gums for the delivery of Nutraceutical/functional

ingredients for applications such as appetite suppressant, cholesterol suppressant, vitamin delivery, antioxidant delivery and motion

sickness suppressant.

On

January 19, 2021, the Company entered into an Stock Purchase Agreement (the “Agreement”) with ABTI Pharma Limited, a company

registered in England and Wales (“ABTI Pharma”), pursuant to which the Company agreed to acquire all of the outstanding shares

of capital stock of ABTI Pharma from its shareholders in exchange for 600,000,000 shares of the Company pro rata to the ABTI Pharma shareholders.

The shares were issued on January 29, 2021 in anticipation of the closing and the parties to the transaction agreed in a March 24, 2021

amendment to close upon the ABTI Pharma Limited Shares being transferred to the Company, which was to occur upon the filing by the Company

of its outstanding September 30, 2020 quarterly report on Form 10-Q, which was filed on May 28, 2021 with the Securities and Exchange

Commission. The transaction closed on May 28, 2021.

The

transaction was accounted for as a reverse acquisition and recapitalization. ABTI Pharma is the acquirer for accounting purposes and

the Company is the issuer. The historical financial statements presented are the financial statements of ABTI. The Agreement was treated

as a recapitalization and not as a business combination; at the date of the acquisition, the net liabilities of the legal acquirer, Alterola,

were $389,721.

The

business plan of the company isl no longer focused on a chewing gum delivery system but was re-focused on the development of cannabinoid,

cannabinoid-like, and non-cannabinoid pharmaceutical active pharmaceutical ingredients (APIs), pharmaceutical medicines made from cannabinoid,

cannabinoid-like, and non-cannabinoid APIs and European novel food approval of cannabinoid-based, cannabinoid-like and non-cannabinoid

ingredients and products .In addition, the company plans to develop such bulk ingredients for supply into the cosmetic sector.

On

December 2, 2021, the Company closed an Asset Purchase Agreement (the “Purchase Agreement”) with C2 Wellness Corp., a Wyoming

corporation, and Dr. G. Sridhar Prasad (together, the “Seller”) and acquired certain IP assets (the “Assets”)

from Seller, which include:

| • | Novel

cannabinoid molecules and their associated intellectual property; |

| • | Novel

cannabinoid pro-drugs, and their associated intellectual property; |

| • | Novel

proprietary cannabinoid formulations, designed to target lymphatic delivery, and their associated

intellectual property; |

| • | Novel

proprietary nano-encapsulated cannabinoid formulations, in self-dissolving polymers, and

their associated intellectual property; and |

| • | Cannabinoids

and cannabinoid pro-drug formulations for topical ocular delivery, and their associated intellectual

property. |

In

exchange for the Assets, the Company issued to Seller shares of common stock. On September 8, 2023, the Company and Seller entered into

an Agreement to sell the assets, such that the Company sold the assets back to the Seller and the Seller paid 29,015,993

shares of ABTI common stock to the Company. The

assets were sold to the Seller in September 2023.

As

of July 5, 2023, we acquired intellectual property from Alinova Biosciences Ltd. We acquired Alinova’s joint interest in the patent

family of PTX 0001. We paid 35,000 Sterling in cash and 5,000,000 shares of ABTI Stock.

ALTEROLA

BIOTECH, INC.

NOTES

TO THE UNAUDITED CONSOIDATED FINANCIAL STATEMENTS

DECEMBER

31, 2023

LIQUIDITY & GOING CONCERN

Alterola

has negative working capital of $1,160,035, has incurred losses since inception of $11,946,656, and has not received revenues from sales

of products or services. These factors create substantial doubt about the Company’s ability to continue as a going concern. The

financial statements do not include any adjustment that might be necessary if the Company is unable to continue as a going concern.

The

ability of Alterola to continue as a going concern is dependent on the Company generating cash from the sale of its common stock and/or

obtaining debt financing and attaining future profitable operations. Management’s plans include selling its equity securities and

obtaining debt financing to fund its capital requirement and ongoing operations; however, there can be no assurance the Company will

be successful in these efforts.

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis

of Presentation

These

unaudited condensed financial statements have been prepared in accordance with accounting principles generally accepted in the United

States of America (“US GAAP”) and the rules and regulations of the Securities and Exchange Commission (“SEC”).

They include the accounts of Alterola and its wholly owned subsidiaries ABTI Pharma, Phytotherapeutix Ltd and Ferven Ltd.. All material

intercompany transactions and balances have been eliminated.

These

financial statements and the notes attached hereto should be read in conjunction with the financial statements and notes included in

the Company’s 10-K for its fiscal year ended March 31, 2023. In the opinion of the Company, all adjustments, including normal recurring

adjustments necessary to present fairly the financial position of the Company, as of December 31, 2023, and the results of its operations

and cash flows for the three and nine months then ended have been included. The results of operations for the interim period are not

necessarily indicative of the results for the full year ending March 31, 2024.

The

Company had a September 30 fiscal year end. Subsequent to the Agreement with ABTI Pharma, the Company has changed its year end from September

30 to March 31.

Use

of Estimates

The

preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date the financial statements and the reported

amount of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash

and Equivalents

For

purposes of the statement of cash flows, the Company considers highly liquid financial instruments purchased with a maturity of three

months or less to be cash equivalents.

Fair

Value of Financial Instruments

Alterola’s

financial instruments consist of cash and equivalents, accrued expenses, accrued interest and notes payable. The carrying amount of these

financial instruments approximates fair value (“FV”) due either to length of maturity or interest rates that approximate

prevailing market rates unless otherwise disclosed in these financial statements.

FV

is defined as the price that would be received upon sale of an asset or paid upon transfer of a liability in an orderly transaction between

market participants at the measurement date and in the principal or most advantageous market for that asset or liability. The FV should

be calculated based on assumptions that market participants would use in pricing the asset or liability, not on assumptions specific

to the entity. In addition, the FV of liabilities should include consideration of non-performance risk including our own credit risk.

ALTEROLA BIOTECH, INC.

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (CONTINUED)

In

addition to defining FV, the disclosure requirements around FV establish a FV hierarchy for valuation inputs which is expanded. The hierarchy

prioritizes the inputs into three levels based on the extent to which inputs used in measuring FV are observable in the market. Each

FV measurement is reported in one of the three levels which is determined by the lowest level input that is significant to the FV measurement

in its entirety. These levels are:

Level

1 – inputs are based upon unadjusted quoted prices for identical instruments traded in active markets.

Level

2 – inputs are based upon significant observable inputs other than quoted prices included in Level 1, such as quoted prices for

identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant assumptions

are observable in the market or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level

3 – inputs are generally unobservable and typically reflect management’s estimates of assumptions that market participants

would use in pricing the asset or liability. The FV are therefore determined using model-based techniques that include option pricing

models, discounted cash flow models, and similar techniques.

The

carrying value of the Company’s financial assets and liabilities which consist of cash, accounts payable and accrued liabilities,

and notes payable are valued using level 1 inputs. The Company believes that the recorded values approximate their FV due to the short

maturity of such instruments. Unless otherwise noted, it is management’s opinion that the Company is not exposed to significant

interest, exchange or credit risks arising from these financial instruments.

Income

Taxes

Income

taxes are computed using the asset and liability method. Under the asset and liability method, deferred income tax assets and liabilities

are determined based on the differences between the financial reporting and tax bases of assets and liabilities and are measured using

the currently enacted tax rates and laws. A valuation allowance is provided for the amount of deferred tax assets that, based on available

evidence, are not expected to be realized.

Foreign

Currency Translation

The

financial statements are presented in US Dollars. Transactions with foreign subsidiaries where US dollars are not the functional currency

will be recorded in accordance with Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”)

Topic 830 Foreign Currency Transaction. According to Topic 830, all assets and liabilities are translated at the exchange rate

on the balance sheet date, stockholders’ equity is translated at historical rates and statement of operations items are translated

at the weighted average exchange rate for the period. The resulting translation adjustments are reported under other comprehensive income

(loss) in accordance with ASC Topic 220, Comprehensive Income. Gains and losses resulting from the translations of foreign currency

transactions and balances are reflected in the statement of operations and comprehensive income (loss).

Revenue

Recognition

On

January 1, 2018, the Company adopted ASC Topic 606, Revenue from Contracts with Customers ("ASC 606"), using the modified

retrospective method applied to those contracts which were not completed as of January 1, 2018. Results for reporting periods

beginning after January 1, 2018 are presented under ASC 606, while prior period amounts are not adjusted and continue to be reported

in accordance with our historic accounting under ASC 605. As of and for the year ended December 31, 2022, the financial statements

were not materially impacted as a result of the application of Topic 606 compared to Topic 605.

ALTEROLA

BIOTECH, INC.

NOTES

TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER

31, 2023

NOTE

2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Loss

Per Common Share

Basic

loss per share is calculated using the weighted-average number of common shares outstanding during each reporting period. Diluted loss

per share includes potentially dilutive securities such as outstanding options and warrants, using various methods such as the treasury

stock or modified treasury stock method in the determination of dilutive shares outstanding during each reporting period. The Company

does not have any potentially dilutive instruments.

Stock-Based

Compensation

Stock-based

compensation is accounted for at FV in accordance with ASC Topic 718. To date, the Company has not adopted a stock option plan and has

not granted any stock options

Research

and development

We engage in a variety of research and development

activities to develop our technologies and work toward development of a saleable product. When it is determined that the research and

development products we are creating have reached a point where saleable products are possible, these amounts are capitalized. As of December

31, 2023 and March 31 ,2023 there are no capitalized research and development costs.

The research and development costs incurred by the

company relate to the following:

| |

• |

Licenses

for patent and know-how ( Nano 4 M) - this relates to the company’s formulation of Active Pharmaceutical Ingredients ( API)

for its lead pharmaceutical programs. |

| |

• |

Protein Technologies Ltd – this relates to the company’s research into production of cannabinoids by biosynthesis (as opposed to botanical production by growing plants). The company has genetically modified an organism to produce cannabinoids by fermentation ( similar to methodology used for the production of antibiotics) |

| |

• |

Apex Molecular Ltd.-

the company has a number of pharmaceutical development programs using both novel and natural molecules. The Company employs third

party chemistry / contract, manufacturing companies such as Apex Molecular Ltd. to synthesize and purify these compounds for their

pharmaceutical development programs. |

| |

• |

Acquisition of intellectual property from Alinova Biosciences Ltd. |

| |

• |

Continued patent prosecution and internationalization of company intellectual property. |

| |

• |

Staff costs and consultancy costs relating to R & D. |

Other

Intangible Assets

We

have recorded the assets acquired as part of the C2 Wellness acquisition as indefinite lived Intangible assets. Indefinite life intangible

assets recorded are not amortized and, as a result, are assessed for impairment at least annually, using either a qualitative or quantitative

process. We performed this annual assessment as of March 31, 2023, noting no factors indicating possible impairment of intangible assets

recognized.

Risks

and Uncertainties

On

January 30, 2020, the World Health Organization declared the coronavirus outbreak a “Public Health Emergency of International Concern”

and on March 10, 2020, declared it to be a pandemic. Actions taken around the world to help mitigate the spread of the coronavirus

include restrictions on travel, and quarantines in certain areas, and forced closures for certain types of public places and business.

The Coronavirus and actions taken to mitigate it have had and are expected to have an adverse impact on the economies and financial markets

of many countries, including the geographical area in which the Company plans to operate.

Recent

Accounting Pronouncements

Alterola

does not expect the adoption of recently issued accounting pronouncements to have a significant impact on the Company’s results

of operations, financial position or cash flow.

ALTEROLA BIOTECH, INC.

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2023

NOTE

3 – ACCRUED EXPENSES

Accrued

expenses consisted of the following at December 31, 2023 and March 31, 2023

| | |

December 31, 2023 | |

March 31,2023 |

| Audit fees | |

$ | — | | |

$ | 15,000 | |

| Accounting | |

| 7,407 | | |

| 7,407 | |

| Research and development | |

| 9,433 | | |

| 9,433 | |

| General and administrative | |

| 106,014 | | |

| 115,821 | |

| Legal fees and transfer agent | |

| 187,668 | | |

| 107,203 | |

| Total Accrued Expenses | |

$ | 310,522 | | |

$ | 254,864 | |

NOTE

4 – CAPITAL STOCK

The

Company has 2,000,000,000 shares of $0.001 par value common stock authorized and 10,000,000 shares of $0.001 par value preferred stock

authorized.

On

August 11, 2021, the Company issued 15,000,000

warrants to purchase common stock at $0.64

per share. The warrants were issued with a 5

year term. The warrants exercise price includes

a declining scale with the stock price. As of December 31, 2022, the warrants were exercisable at $0.001

per share and the

total potential impact on the financial statements of the exercise of the warrants was approximately $1 million dollars. The

warrants were exercised on June 13, 2023 (see below). The total potential impact on the financial statements of the exercise of the warrants

was approximately $13,500.

During September

2021,

the Company received an investment for £100,000 Sterling (or $136,721)

in exchange for a subscription for 280,000 shares. On May 2, 2022, the Company issued the 280,000 shares to the investor

On

October 29, 2021, the Company issued 7,500,000 shares of stock in exchange for services provided byEMC2 Capital. The shares were issued

at fair value of the date of exchange, or $2,399,250.

As

pursuant to the asset purchase agreement dated November 9, 2021, the Company acquired certain intellectual property rights of C2 Wellness

Corp. In exchanges for the assets acquired, the Company issued 24,000,000

shares of common stock valued at $0.50

per share. The intellectual property rights acquired

are recorded as intangible assets as of December 31, 2021 for $12,000,000.

On

December 21, 2021, the company issued 520,000 shares of stock in exchange for $130,000 of cash consideration.

On February 8, 2022, the

company issued 333,333 shares to an investor for an investment of $50,000 (at a price of $0.15 per share).

On or about March 3, 2022, the Company issued 16,000,000 shares of stock for services under a consulting

agreement. The shares were issued at fair value the date of the exchange, or $3,360,000.

On April 5, 2022, the company

issued 384,615 shares to an investor for an investment of $50,000 (at a price of $0.13 per share).

On April 29, 2022, the Company

issued 1,500,000 shares for services under a consultancy agreement at $0.214 per share, or $321,000.

On May 2, 2022, the Company

issued 280,000 shares to an investor relating to a subscription agreement for an investment of £100,000 Sterling (or $136,721)

at $0.50 per share, or $140,000.

On May 4, 2022, we issued

2,250,000 shares of our common stock to our director, Mr. Michael Hunter Land, pursuant to his employment agreement dated October 18,

2021 and board decision to award him shares for his performance.

ALTEROLA

BIOTECH, INC.

NOTES

TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER

31, 2023

NOTE

4 – CAPITAL STOCK (CONTINUED)

On

June 6, 2023, the Company reclaimed 44,064,000 shares into Treasury.

On

June 13, 2023, we issued 13,500,000 shares of common stock to EMC2 Capital LLC following the cashless exercise of their 15,000,000 Warrants

issued in August 2021.

On

June 13, 2023, we issued 476,000 shares of common stock to Alison Rose Burgess as settlement of a £125,000 Sterling loan under

the terms and conditions of the loan dated 21 September 2021.

On

June 13, 2023, we issued 5,000,000 shares of common stock to Alinova Biosciences Ltd as part payment of consideration for the acquisition

of intellectual property.

June

13, 2023, we issued 5,999,900 shares of common stock to Long Eight Limited as part payment of consideration for services received by

Green Ocean Administration Limited.

June

13, 2023, we issued 10,088,100 shares of common stock to Warren Law Group to be held in escrow as potential part payment for services

received from Bridgeway Capital Partners LLC, Bridgeway Capital Partners II LLC and Entoro Securities LLC.

On

June 14, 2023, we issued 9,000,000 shares of common stock to our Directors as payment for their services as Directors.

On

September 8, 2023, the Company entered into an Agreement to Return Assets and Shares with C2 Wellness Corp. As part of the agreement,

the company received 29,015,993

shares of ABTI stock (24,000,000 shares originally

issued and 5,015,996 shares additionally issued) and sold all assets related to the acquisition, resulting in a write-off of $12,000,000

in intangibles.

On

October 16, 2023, the Company issued 587,499,996 shares in exchange of forgiveness of debt of approximately $2.35 million outstanding.

The exchange resulted in a loss on exchange of $406,575.

On

December 21, 2023, the Company issued 17,131,001 shares in exchange for services provided for the company for the period ended December

31, 2023, valued at $61,672 at the date of issuance.

The

Company has 1,382,662,952 and 807,047,948 shares of common stock issued and outstanding as of December 31, 2023 and March 31, 2023, respectively.

There are no shares of preferred stock issued and outstanding as of December 31, 2023 and March 31, 2023. The Company had

807,047,948 and 802,913,333 shares of common stock issued and outstanding as of December 31, 2022 and March 31, 2022, respectively. There

are no shares of preferred stock issued and outstanding as of December 31, 2022 and March 31, 2022.

NOTE

5 – NOTES PAYABLE

On

August 1, 2022, the Company issued a note payable for 90 days bearing zero interest for the term of the note, for cash received by the

Company on June 29, 2022 and July 18, 2022 totaling $75,000. As part of the note the Company committed delivery of 2,250,000 shares

to the note holders. The loans totaling $75,000 were repaid in full by December 23, 2022.

ALTEROLA

BIOTECH, INC.

NOTES

TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER

31, 2023

NOTE

6 – RELATED PARTY TRANSACTIONS

Alterola neither owns nor leases any real or personal

property. An officer has provided office space as an arms length transaction with rental at commercial rates. There is no obligation for

the officer to continue this arrangement. Such costs are immaterial to the financial statements and accordingly are not reflected herein.

The officers and directors are involved in other business activities and most likely will become involved in other business activities

in the future.

During

the period ended December 31, 2023, a shareholder made advances to the company to fund operating expenses in the amount of $244,061.

These advances are non – interest bearing and have no specified terms of repayment.

NOTE

7 – SUBSEQUENT EVENTS

In

accordance with ASC Topic 855-10, the Company analyzed its operations subsequent to December 31, 2023 to the date these financial statements

were issued, and determined it does not have any material subsequent events to disclose in these financial statements, except as noted

below.

Item

2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking

Statements

Certain statements, other than purely historical information,

including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions

upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These

forward-looking statements generally are identified by the words “believes,” “project,” “expects,”

“anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,”

“will,” “would,” “will be,” “will continue,” “will likely result,” and similar

expressions. We intend such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of complying with those

safe-harbor provisions. Forward-looking statements are based on current expectations and assumptions that are subject to risks

and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results

or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect

on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory

changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties

should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. We

undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events

or otherwise. Further information concerning our business, including additional factors that could materially affect our financial

results, is included herein and in our other filings with the SEC.

Overview

Our

Business

Our goal is to provide better medicines for patients

around the world. We believe in harnessing the therapeutic potential of cannabinoids and cannabinoid- like compounds, which can be developed

into valuable treatments to seriously ill patients. Rather than just focusing on one method of identifying, researching and developing

such medicines, we are interested in developing new medicines from all sources including botanical, traditional chemical synthesis and

biosynthetic methodologies.

On May 28, 2021, we acquired ABTI Pharma Limited,

a company registered in England and Wales (“ABTI Pharma”), with the purchase of all of its capital stock in exchange for 600,000,000

shares of our common stock pro rata to the ABTI Pharma shareholders.

As a result of the acquisition, we are a pharmaceutical

company working with cannabinoid and cannabinoid like molecules. We have three areas of focus:

| |

1) |

Development of regulated pharmaceuticals (human and animal health) and regulated food products. This has been achieved via the strategic acquisition of Phytotherapeutix Ltd.; |

| |

2) |

Production of low cost of goods Active Pharmaceutical Ingredient (API) and food-grade ingredients (supported by the strategic acquisition of Ferven Ltd); and |

| |

3) |

Formulation, and drug delivery, providing improved bioavailability, solubility and stability (supported by the exclusive licensing of IP and technology from Nano4M Ltd). |

Phytotherapeutix Ltd, a subsidiary of ABTI Pharma

Ltd, has generated a number of molecules with patents pending, some of which have demonstrable pharmacological activity, similar to that

of CBD. This means that some of these molecules are anticipated to have a similar market potential to CBD across a range of therapeutic

areas.

Ferven Ltd, another subsidiary of ABTI Pharma Ltd,

is looking to produce cannabinoids by fermentation. The exclusively licensed organism has the potential to be genetically modified to

produce multiple cannabinoids at an anticipated very low cost of goods. It is anticipated that the selected genetically modified organisms

will grow very quickly, which in turn, reduces the cost of production.

Nano4M Ltd is a company which has exclusively licensed

its nano-formulation patents and know-how to ABTI Pharma Ltd.

Additionally, we may consider entering into Joint

Venture Partnerships, or acquire companies with complimentary portfolios or enter into Licensing Agreements to enhance the product portfolio.

These are strategies the Company may implement and any such opportunities will be assessed on a case by case basis and on their merit

at the time.

Alterola and ABTI Pharma Ltd management have extensive

experience, know-how and connections in the cannabinoid medicines sector, and are looking to utilize this knowledge and experience for

the development of such medicines from existing cannabinoids and cannabinoid-like molecules.

Our address is 47 Hamilton Square Birkenhead Merseyside

CH41 5AR United Kingdom. Our telephone number is +44 151 601 9477. Our website is www.alterolabio.com. The company has a fully operational

US$ and a £ sterling bank account in the United Kingdom with the HSBC Group.

We do not incorporate the information on or accessible

through our websites into this Quarterly Report, and you should not consider any information on, or that can be accessed through, our

websites a part of this Quarterly Report.

Results of Operations for the Three and Nine Months

Ended December 31, 2023 and 2022

We

have generated no revenues since inception and we do not anticipate earning revenue until such time that we are able to market and sell

our ingredients and / or products / medicines.

We incurred operating expenses of $1,108,947 for the

three months ended December 31, 2023, as compared with $540,621 for the same period ended 2022. We incurred operating expenses of $1,825,671

for the nine months ended December 31, 2023, as compared with $1,823,992 for the same period ended 2022.

Our operating expenses for the nine months ended December

31, 2023 increased over the same period in 2022 mainly as a result of more spent on consulting fees and accounting and audit fees. Our

operating expenses for the nine months ended December 31, 2023 were mainly the result of $995,099 in consulting fees, $273,659 in professional

fees, $227,575 in director fees and expenses, $99,982 in accounting and audit fees, and $96,315 in salaries and wages. Our operating expenses

for the nine months ended December 31, 2022 were mainly the result of $546,571 in directors fees and expenses, $481,429 in consulting

fees, $363,193 in professional fees, $101,238 in salaries and wages, $86,816 in accounting and audit fees and $41,086 in research and

development.

We had other expenses of $406,575 and $544,738 for

the three and nine months ended December 31, 2023, respectively, for losses on the conversion of a note, with no other expense for the

same periods ended December 31, 2022.

If we are able to obtain financing, we expect that

our operational expenses will increase significantly for the balance of the fiscal year ended March 31, 2024 and beyond. This would be

the result of increased research and development expenses associated with our product candidates, the development of those candidates

in compliance with regulatory processes, laws and regulations, increased payroll as we take on more help, as well as the expenses associated

with our reporting obligations with the Securities and Exchange Commission.

We recorded a net loss of $1,515,522 for the three

months ended December 31, 2023, as compared with $534,789 for the same period ended 2022. We recorded a net loss of $2,370,409 for the

nine months ended December 31, 2023, as compared with $1,722,691 for the same period ended 2022.

As a relatively recently formed pharmaceutical company,

the company has limited operations to date, and expects to have reoccurring losses, as is typical with companies in the pharmaceutical

industry, for the foreseeable future. As explained above, the company intends to raise capital and ramp up its efforts to bring its product

candidates to market. This will require significant capital, product development to continue and complete and momentum on those product

candidates through the regulatory process. There are no assurances that we will be able to generate revenues and achieve profitable operations.

Liquidity and Capital Resources

As of December 31, 2023, we had $198,389 in current

assets, consisting mostly of a deferred tax credit, and current liabilities of $1,358,424. We had a working capital deficit of $1,160,035

as of December 31, 2023, compared with a working capital deficit of $2,322,023 as of September 30, 2023.

We used cash for operating activities of $1,513,275

for the nine months ended December 31, 2023, as compared with cash used of $1,156,498 for the same period ended 2022. Our negative operating

cash flow the nine months ended December 31, 2023 was mainly the result of a net loss, offset mainly by shares issued for services, to

directors and others. Our negative operating cash flow for 2022 was mainly the result of a net loss, net changes in operating assets and

liabilities and deferred tax credit offset by shares issued for services.

We

used $0 in cash for investing activities for the nine months ended December 31, 2023, as compared with $18,147 in cash provided

for the same period ended 2022.

Financing activities provided $1,289,563 for the nine

months ended December 31, 2023, mainly as a result of shares issued for conversion of debt to equity and loan from related parties. Financing

activities provided $1,093,405 for the nine months ended December 31, 2022, as a result of related party notes.

Based

upon our current financial condition, we do not have sufficient cash to operate our business at the current level for the next 12 months.

We intend to fund operations through short-term or long-term debt and/or equity financing arrangements, however this may be insufficient

to fund expenditures or other cash requirements. We plan to seek additional financing in a private equity offering to secure funding for

operations. There can be no assurance that we will be successful in raising additional funding. If we are not able to secure additional

funding, the implementation of our business plan will be impaired. There can be no assurance that such additional financing will be available

to us on acceptable terms or at all.

Off Balance Sheet Arrangements

As of December 31, 2023, we had no off-balance sheet

arrangements.

Going Concern

Our

financial statements were prepared assuming we will continue as a going concern which contemplates the realization of assets and satisfaction

of liabilities in the normal course of business. We have negative working capital of $1,160,035 as

of December 31, 2023, and have an accumulated deficit

of $11,946,656. We expect to incur further losses in the development of our business and have been dependent on funding operations from

inception. These conditions raise substantial doubt about our ability to continue as a going concern. Management’s plans include

continuing to finance operations through the private or public placement of debt and/or equity securities and the reduction of expenditures.

However, no assurance can be given at this time as to whether we will be able to achieve these objectives. The financial statements do

not include any adjustment relating to the recoverability and classification of recorded asset amounts or the amounts and classification

of liabilities that might be necessary should we be unable to continue as a going concern.

Item 3. Quantitative

and Qualitative Disclosures About Market Risk

A smaller reporting company is not required to provide

the information required by this Item.

Item 4. Controls and

Procedures

Disclosure Controls and Procedures

We carried out an evaluation of the effectiveness

of the design and operation of our disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) as of

December 31, 2023. This evaluation was carried out under the supervision and with the participation of our Chief Executive Officer and

our Chief Financial Officer. Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that, as of

December 31, 2023, our disclosure controls and procedures were not effective due to the presence of material weaknesses in internal control

over financial reporting.

A material weakness is a deficiency, or a combination

of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement

of the company’s annual or interim financial statements will not be prevented or detected on a timely basis. Management has identified

the following material weaknesses which have caused management to conclude that, as of December 31, 2023, our disclosure controls and

procedures were not effective: (i) inadequate segregation of duties and effective risk assessment; and (ii) insufficient written policies

and procedures for accounting and financial reporting with respect to the requirements and application of both US GAAP and SEC guidelines.

Remediation Plan to Address the Material Weaknesses

in Internal Control over Financial Reporting

Our company plans to take steps to enhance and improve

the design of internal controls over financial reporting. In October 2023, the company appointed a new Chief Financial Officer. During

the period covered by this quarterly report on Form 10-Q, we have not been able to remediate the material weaknesses identified above.

To remediate such weaknesses, we plan to implement the following changes during our fiscal year ending March 31, 2024: (i) appoint additional

qualified personnel to address inadequate segregation of duties and ineffective risk management; and (ii) adopt sufficient written policies

and procedures for accounting and financial reporting. The remediation efforts set out are largely dependent upon our securing additional

financing to cover the costs of implementing the changes required. If we are unsuccessful in securing such funds, remediation efforts

may be adversely affected in a material manner.

Changes in Internal Control over Financial Reporting

Aside from above, there were no changes in our internal

control over financial reporting during the three months ended December 31, 2023 that have materially affected, or are reasonable likely

to materially affect, our internal control over financial reporting.

PART

II – OTHER INFORMATION

Item 1. Legal Proceedings

We are not a party to any pending legal proceeding.

We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our

voting securities are adverse to us or have a material interest adverse to us.

Item 1A: Risk Factors

Please see the Risk Factors contained in our Annual

Report on Form 10-K filed with the SEC on July 10, 2023, which are incorporated herein by reference.

Item 2. Unregistered Sales of Equity Securities

and Use of Proceeds

On September 8, 2023, the Company entered into an

Agreement to sell assets to with C2 Wellness Corp. As part of the agreement, the company received 29,015,996 shares of ABTI stock and

sold all assets related to the acquisition, resulting in a write-off of $12,000,000 in intangibles.

On October 16, 2023, TPR Global Limited, Equipped

4 Holdings Limited and Phytotherapeutix Holdings Ltd converted a total of $2.35m USD of debt in the Company into common shares at a price

of $0.004 per share.

The issuance of the shares is exempt from registration

in reliance upon Section 4(2) and/or Regulation D of the Securities Act of 1933, as amended.

Item 3. Defaults upon Senior Securities

None

Item 4. Mine Safety

Disclosures

Not applicable.

Item 5. Other Information

On October 10, 2023, Mr. Tim Rogers resigned as Chief Financial Officer

and Mr. David Hitchcock resigned as company Secretary. On the same day, Mr. Nathan Thompson was appointed as Chief Financial Officer and

Secretary. At present, we do not have a compensation arrangement with Mr. Thompson.

On October 13, 2023, we revised the Audit Committee membership, with Mr.

Hunter Land appointed to serve on the audit committee of the company. The committee is now comprised of Ning Qu as Chairperson and Mr.

Land, both independent directors of ther company.

On October 16, 2023, Terry Raif was removed from the Board of Directors

by shareholder vote.

On October 20, 2023, the company dismissed Gries and Associtaes as the

company’s independent auditor and appointed GreenGrowth CPAs as the company’s independent auditor.

Item

6. Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| |

Alterola Biotech, Inc. |

| |

|

| Date: |

February 20, 2024 |

| |

|

| |

By:

/s/ David Hitchcock

David

Hitchcock

Title: Chief

Executive Officer (Principal Executive Officer) and Director |

| Date: |

February 20, 2024 |

| |

|

| |

By:

/s/ Nathan Thompson

Nathan

Thompson

Title:

Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer), and Director |

I, David Hitchcock, certify that;

| 1. |

|

I

have reviewed this Quarterly Report on Form 10-Q for the period ended December 31, 2023 of Alterola Biotech, Inc. (the

“registrant”); |

| 2. |

|

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. |

|

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| 4. |

|

The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| a. |

|

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| b. |

|

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| c. |

|

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| d. |

|

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| 5. |

|

The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

| a. |

|

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| b. |

|

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

Date: February 20, 2024

/s/ David Hitchcock

By: David Hitchcock

Title: Chief Executive Officer, Principal Executive Officer

and Director

I, Nathan Thompson, certify that

| 1. |

|

I

have reviewed this Quarterly Report on Form 10-Q for the period ended December 31, 2023 of Alterola Biotech, Inc. (the

“registrant”); |

| 2. |

|

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. |

|

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| 4. |

|

The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| a. |

|

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| b. |

|

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| c. |

|

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| d. |

|

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| 5. |

|

The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

| a. |

|

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| b. |

|

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

Date: February 20, 2024

/s/

Nathan Thompson

By:

Nathan Thompson

Title: Chief Financial Officer (Principal Financial Officer

and Principal Accounting Officer), and Director

CERTIFICATION OF CHIEF EXECUTIVE OFFICER

AND

CHIEF FINANCIAL OFFICER

PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF

2002

In connection with the Quarterly Report of

Alterola Biotech, Inc. (the “Company”) on Form 10-Q for the quarter ended December 31, 2023 filed with the Securities

and Exchange Commission (the “Report”), I, David Hitchcock, Chief Executive Officer and I, Nathan

Thompson, Chief Financial Officer of the Company, certify, pursuant to 18 U.S.C.

Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

| 1. | The Report fully complies with the requirements of Section 13(a)

of the Securities Exchange Act of 1934; and |

| 2. | The information contained in the Report fairly presents, in all material

respects, the consolidated financial condition of the Company as of the dates presented and the consolidated result of operations

of the Company for the periods presented. |

| By: |

/s/ David Hitchcock |

| Name: |

David Hitchcock |

| Title: |

Chief Executive Officer and Director |

| Date: |

February 20, 2024 |

| By: |

/s/ Nathan

Thompson |

| Name: |

Nathan

Thompson |

| Title: |

Chief Financial Officer (Principal Financial Officer

and Principal Accounting Officer), and Director |

| Date: |

February 20, 2024 |

This certification has been furnished solely pursuant to Section

906 of the Sarbanes-Oxley Act of 2002.

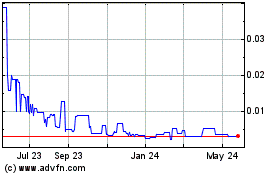

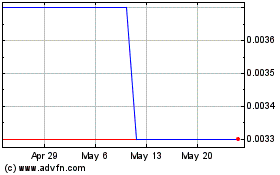

Alterola Biotech (PK) (USOTC:ABTI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Alterola Biotech (PK) (USOTC:ABTI)

Historical Stock Chart

From Dec 2023 to Dec 2024