SCHEDULE 14C PRELIMINARY

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE

14C INFORMATION

Proxy

Statement Pursuant to Section 14(c) of the Securities

Exchange Act of 1934

Filed

by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check

the appropriate box:

| [X] |

Preliminary Information

Statement |

| [ ] |

Confidential, for Use of the

Commission

(only as permitted by Rule 14c-5(d)(2)) |

| [] |

Definitive Information Statement |

| [ ] |

Definitive Additional Materials |

| AMERICAN

CANNABIS COMPANY, INC. |

| (Name

of Registrant as Specified in its Charter) |

| |

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED

NOT TO SEND US A PROXY. |

| |

| (Name

of Person(s) Filing Information Statement, if other than the Registrant) |

Payment

of Filing Fee (Check the appropriate box):

| [X] |

No fee required |

| |

|

| o |

Fee computed on table below per Exchange Act Rules 14c-5(g)

and 0-11. |

| |

(1) |

Title of each class of securities

to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate number of securities to which transaction

applies: |

| |

|

|

| |

(3) |

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was

determined): |

| |

|

|

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

(5) |

Total fee paid: |

| o |

Fee paid previously with preliminary

materials. |

| |

|

| o |

Check box if any part of the fee is offset as provided

by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous

filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

|

|

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

(3) |

Filing Party: |

| |

|

|

| |

(4) |

Date Filed: |

| |

|

|

| |

|

Persons who are to respond to the collection of

information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

Contact

Person:

Mailander

Law Office, Inc.

Tad

Mailander

4811

49th Street

San

Diego, CA 92115

(619)

549-1442

AMERICAN CANNABIS COMPANY, INC.

200 UNION STREET, STE. 200

LAKEWOOD, CO 80228

(303) 974-4770

__________

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE NOT REQUESTED TO SEND US A

PROXY

__________

NOTICE OF ACTION TAKEN BY UNANIMOUS WRITTEN

CONSENT OF

THE BOARD OF DIRECTORS AND MAJORITY VOTE OF 52% OF THE STOCKHOLDERS ELIGIBLE TO VOTE ON SEPTEMBER 5, 2023.

To the Stockholders of AMERICAN CANNABIS COMPANY, INC.:

The enclosed Preliminary Information Statement

is being distributed and published to the holders of record of common stock, par value $0.00001 per share ("Common Stock"),

of American Cannabis Company, Inc., a Delaware corporation (the "Company" or "we") as of the close of business on

September 5, 2023, under Rule 14c-2 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). The purpose of

the enclosed Preliminary Information Statement is to inform our stockholders of action taken by written consent by the holders of a majority

of our outstanding voting stock pursuant to Title 8, Chapter 1, § 242(a)(1)(3), and § 242(b)(1)(2) of the Delaware General Corporation

Law ("DGCL"), and Article II Section 9 of the Company’s By-laws. The enclosed Preliminary Information Statement shall

be considered the notice required under Section 228 of the DGCL.

The following actions were authorized, by written

consent, by holders of a majority of our outstanding voting stock on September 5, 2023 (the "Written Consent"):

| |

· |

The terms and conditions of the Agreement and Plan of Merger ("Agreement") with HyperScale Nexus Holding Corporation ("HyperScale"), previously disclosed on Form 8-K on September 5, 2023, are fair, just, and reasonable to the Company and its shareholders and that it is in the best interests of the Company and its shareholders for the Company to enter into the Agreement and all related transactions, on the terms and conditions set forth in the Agreement and all agreements and transactions contemplated thereby. |

The Written Consent constitutes the only stockholder

approval required under the Delaware General Corporation Law, our Certificate of Incorporation and Bylaws to approve the corporate actions.

No consents or proxies are being requested from stockholders, and our Board of Directors is not soliciting your consent or your proxy

in connection with these actions. Pursuant to Rule 14c-2 under the Exchange Act, the transaction approved in the Written Consent will

not become effective until the Definitive Information Statement is first mailed or otherwise published to our stockholders entitled to

receive notice thereof.

THIS IS NOT A NOTICE OF A SPECIAL MEETING

OF STOCKHOLDERS, AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

Important Notice Regarding the Availability

of the Materials in Connection with this Information Statement:

We will furnish a copy of this Information

Statement, without charge, to any stockholder upon written request to the following address: 200 Union Street, Ste. 200, Lakewood, CO

80228, Attention: Chief Financial Officer.

By Order of the Board of Directors,

/s/ Ellis Smith

Principal Executive Officer

Lakewood, CO 80228

September 21, 2023

AMERICAN CANNABIS COMPANY, INC.

200 UNION STREET, STE. 200

LAKEWOOD, CO 80228

(303) 974-4770

__________________________________________

PRELIMINARY INFORMATION STATEMENT

_____________________________________

WE ARE NOT ASKING YOU FOR A CONSENT OR PROXY

AND

YOU ARE REQUESTED NOT TO SEND US A CONSENT OR

PROXY.

PRELIMINARY INFORMATION STATEMENT PURSUANT TO SECTION

14C OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED

THIS IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS,

AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. THE ACTIONS DESCRIBED IN THIS PRELIMINARY INFORMATION

STATEMENT HAVE BEEN APPROVED BY HOLDERS OF A MAJORITY OF OUR COMMON STOCK. WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT

TO SEND US A PROXY. THERE ARE NO DISSENTERS’ RIGHTS WITH RESPECT TO THE SHARE EXCHANGE DESCRIBED IN THIS INFORMATION STATEMENT.

This Information Statement advises stockholders of American Cannabis Company,

Inc. (the "Company") of:

| · | The

consent of a majority of shareholders eligible to vote approving and consenting to the Agreement

and Plan of Merger ("Agreement") with HyperScale Nexus Holding Corporation, a Nevada

corporation ("HyperScale"), previously disclosed on Form 8-K on September 5, 2023.

The majority shareholders determined that the terms and conditions of the Agreement are fair,

just, and reasonable to the Company and its shareholders and that it is in the best interests

of the Company and its shareholders for the Company to enter into the Agreement and all related

transactions, on the terms and conditions set forth in the Agreement and all agreements and

transactions contemplated thereby. |

Our

Board of Directors approved the Certificate of Amendment on September 5, 2023, and approved the close of markets on September 5, 2023,

as the record date for determining shareholders eligible to vote to approve the Amendment (the "Voting Record Date"). The transaction

was subsequently approved, by Written

Consent, by stockholders holding 52.402% of our outstanding voting Common Stock on the Voting Record Date.

The

corporate action will not become effective until 20 calendar days after a Definitive Information Statement is first filed with the SEC

and the filing of a certificate of merger (the "Certificate of Merger") with the Secretary of State of Delaware in such form

as is required by and executed and acknowledged in accordance with, the provisions of the DGCL ("Effective Time").

Table

of Contents

| AUTHORIZATION

BY THE BOARD OF DIRECTORS AND THE MAJORITY STOCKHOLDERS |

7 |

| QUESTIONS

AND ANSWERS |

7 |

| DESCRIPTION

OF THE COMPANY’S CAPITAL STOCK |

10 |

| Vote

Obtained – Title 8 Section 228 of the Delaware General Corporation Law |

11 |

| ACTION

ONE |

11 |

| APPROVAL

OF ENTRY INTO THE MATERIAL DEFINITIVE AGREEMENT AND SHARE EXCHANGE. |

11 |

| General

Discussion of the Share Exchange Transaction in the Material Definitive Agreement. |

11 |

| Voting

Securities of the Company Pre-Closing of the Material Definitive Agreement. |

12 |

| Voting

Securities of HyperScale Pre-Closing of the Material Definitive Agreement. |

13 |

| Voting

Securities of the Company At the Post-Transaction Date. |

13 |

| Security

Ownership of Certain Beneficial Owners of More than Five Percent of our Common Stock |

13 |

| Security

Ownership of Management |

14 |

| Change

of Control |

14 |

| No

Dissenters Rights |

14 |

| Accounting

Matters |

14 |

| Tax

Consequences to Common Stockholders |

15 |

| Tax

Consequences for the Company |

15 |

| Fractional

Shares |

15 |

| Share

Certificate Transfer Instructions |

16 |

| DISTRIBUTION

AND COSTS |

16 |

| OVERVIEW

OF BUSINESS |

16 |

| American

Cannabis Company, Inc. |

16 |

| Industry

and Regulatory Overview |

17 |

| Business

Overview |

19 |

| Consulting

Services |

20 |

| Equipment

and Supplies |

21 |

| Naturaleaf |

22 |

| Market

For Common Equity, Related Stockholder Matters, And Issuer Purchases of Equity Securities |

23 |

| Dividend

Policy |

24 |

| Employees |

24 |

| Intellectual

Property |

24 |

| Significant

Customers |

25 |

| Competition |

25 |

| Properties |

25 |

| Legal

Proceedings |

26 |

| Experts |

26 |

| Changes

in and Disagreements with Accountants on Accounting and Financial Disclosure. |

27 |

| Directors,

Officers, and Corporate Governance |

27 |

| MANAGEMENT'S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

28 |

| HyperScale

Nexus Holding Corporation |

39 |

| Corporate

Overview |

39 |

| Contract

with xFusion Digital Technologies Co., Ltd. |

40 |

| Memorandum

of Understanding to Form a Joint Venture with Silicon Tech Park. |

41 |

| Products

and Services |

41 |

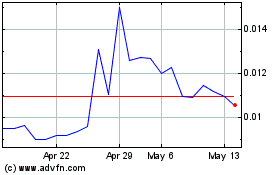

| Market

For Common Equity, Related Stockholder Matters, Market Information |

45 |

| Dividends |

45 |

| Equity

Compensation Plans |

45 |

| Markets

and Regulation |

45 |

| Employees |

46 |

| Intellectual

Property |

46 |

| Sales

and Marketing |

46 |

| Principal

Suppliers |

47 |

| Competition |

48 |

| Significant

Customers |

49 |

| Properties |

49 |

| Legal

Proceedings |

49 |

| Changes

in and Disagreements with Accountants on Accounting and Financial Disclosure. |

49 |

| Directors,

Officers, and Corporate Governance |

49 |

| IMPLICATIONS

OF BEING AN EMERGING GROWTH COMPANY, SMALLER REPORTING COMPANY AND CONTROLLED COMPANY. |

50 |

| Exhibits |

52 |

| WHERE

YOU CAN FIND MORE INFORMATION |

52 |

AUTHORIZATION

BY THE BOARD OF DIRECTORS AND THE MAJORITY STOCKHOLDERS

On

September 5, 2023, the Company's Board of Directors met to consider the advisability of entering into an agreement and plan of merger

("Material Definitive Agreement) with HyperScale. By resolution dated September 5, 2023, the Board unanimously agreed to execute

the Material Definitive Agreement and to recommend to the shareholders their approval of the transaction, pursuant to the DGCL and the

Company's restated by-laws. The Board set the Voting Record Date of September 5, 2023. The Company filed Form 8-K disclosing our entry

into the Material Definitive Agreement on September 5, 2023.

Under the DGCL and the Company’s Bylaws, any

action that can be taken at an annual or special meeting of stockholders may be taken without a meeting, without prior notice, and without

a vote if the holders of outstanding stock having not less than the minimum number of votes necessary to authorize or take such action

at a meeting at which all shares entitled to vote thereon were present and voted consent to such action in writing. As the holders of

the Company’s Common Stock are entitled to vote on such matters, approval of the Amendment requires the approval of a majority of

the Company’s outstanding voting rights. On the Voting Record Date, the Company had 171,402,938 shares of common stock issued and

outstanding, with the holders thereof being entitled to cast one vote per share. The written consent was executed by Timothy Matula, the

beneficial owner of 16,250,000 shares, or 9.536% of the Company's common stock), Kristian Kvavik, the beneficial owner of 16,250,000 shares,

or 9.536% of the Company's common stock, Thomas Stray, the beneficial owner of 16,250,000 shares, or 9.536% of the Company's common stock,

Tad Mailander, the beneficial owner of 18,000,000 shares or 10.563% of the Company's common stock, and Ellis Smith, the beneficial owner

of 22,546,853 shares or 13.231% of the Company's common stock, who together held 52.402% of the Company’s outstanding voting stock

as of the Voting Record Date.

We

have obtained all necessary corporate approvals in connection with the Material Definitive Agreement and share exchange transactions

contemplated therein. We are not seeking written consent from any other stockholder, and the other stockholders will not be given an

opportunity to vote with respect to the actions described in the Material Definitive Agreement or this Information Statement. This Information

Statement is furnished solely for the purposes of advising stockholders of the action approved by the Written Consent and giving stockholders

notice of the transactions contemplated in the Material Definitive Agreement as required by the DGCL and the Exchange Act. There are

no dissenter rights associated with the share exchange transaction under the DGCL, and no fractional shares shall be issued in connection

with the share exchange transaction contemplated by the Material Definitive Agreement.

As

the transactions contemplated by the Material Definitive Agreement were approved by the Written Consent, there will be no stockholders’

meeting, and representatives of the principal accountants for the current year and for the most recently completed fiscal year will not

have the opportunity to make a statement if they desire to do so and will not be available to respond to appropriate questions from our

stockholders.

QUESTIONS

AND ANSWERS

The following questions and answers are intended

to briefly address some commonly asked questions regarding the transaction, the Agreement and Plan of Merger, and the Share Exchange.

These questions and answers may not address all questions that may be important to you as a stockholder. Please refer to the information

and documents contained elsewhere in this Information Statement, which you should read carefully and in their entirety.

Q: Why am I receiving this Information Statement?

Upon closing of the Agreement and Plan of Merger and

Share Exchange, shares of HyperScale common stock will be issued to holders of shares of the Company based upon an exchange ratio of one

share of HyperScale common stock for every 300 shares of Company common stock. Each holder of Company common stock will be guaranteed

to own after the closing of the transaction the greater of either: (i) One hundred (100) shares of HyperScale Common Stock or (ii) The

number of shares of HyperScale Common Stock that represents a value of at least $2,500. Pursuant to the Agreement and Plan of Merger,

HyperScale Merger Sub, Inc., a Nevada corporation and wholly owned subsidiary of HyperScale, will merge with and into the Company, with

the Company surviving as an independent wholly-owned subsidiary of HyperScale, and HyperScale Merger Sub will cease to exist. The

Company, as a wholly owned subsidiary of HyperScale, will maintain its registered office in the State of Colorado. The transaction

will become effective upon the filing of a certificate of merger with the Secretary of State of the State of Delaware executed in accordance

with, and in such form as is required by, the relevant provisions of the DGCL.

Q: Who is HyperScale?

Following the Closing, the sole business and operations

will be the business and operations of HyperScale, and the Company will continue to run and operate its business and operations independently

of HyperScale as a wholly owned subsidiary. HyperScale is a Nevada corporation formed on July 3, 2023, whose business includes leveraging

its acquisition agreement with xFusion Digital Technologies, Co., Ltd. to provide NVIDIA H-100 GPU chipsets to existing Tier 3 Internet

data centers, developing its own tier 3 Internet data centers utilizing the NVIDIA H-100 GPU chipsets, and providing management and consulting

services to existing Tier 3 data centers as an "Internet as a Service" provider.

Q: What is the shareholder approval required to approve the transaction?

Under the DGCL and the Company’s Bylaws, any

action that can be taken at an annual or special meeting of stockholders may be taken without a meeting, without prior notice, and without

a vote if the holders of outstanding stock having not less than the minimum number of votes necessary to authorize or take such action

at a meeting at which all shares entitled to vote thereon were present and voted consent to such action in writing. As the holders of

the Company’s Common Stock are entitled to vote on such matters, approval of the Amendment requires the approval of a majority of

the Company’s outstanding voting rights. On the Voting Record Date, 52.402% of the Company’s outstanding voting stock approved

the entry into the Agreement and Plan of Merger. No meeting of the shareholders is required. Under Section 262 of the DGCL (8 Del. C.

§262(b)(1), no dissenter's rights or appraisal rights are provided in a share exchange transaction.

Q: Is closing of the Agreement and Plan of Merger

and Share Exchange contingent upon any future approval by the holders of HyperScale common stock?

Following the execution of the Agreement and Plan

of Merger and Share Exchange, HyperScale obtained all approvals and consents of the holders of its capital stock necessary to affect the

Agreement and Plan of Merger and the other transactions contemplated by the Agreement and Plan of Merger. No further approvals by the

holders of HyperScale capital stock are required to consummate the transaction other than those already obtained.

Q: Has the board of directors of the Company and HyperScale approved

the Agreement and Plan of Merger and Share Exchange?

Yes. The board of directors of each of the Company

and HyperScale have approved the transaction and recommended that the stockholders of the Company and the shareholders of HyperScale, respectively,

vote in favor of the Agreement and Plan of Merger and Share Exchange and related transactions. As noted above, HyperScale has already

obtained all approvals and consents of the holders of its capital stock necessary to affect the transactions contemplated by the Agreement

and Plan of Merger and Share Exchange.

Q: What are the conditions to the consummation

of the Agreement and Plan of Merger and Share Exchange?

In addition to approval of the respective shareholders

as described above, completion of the transaction is subject to the satisfaction of a number of other conditions, including (among others)

the effectiveness of an S-4 Registration Statement; the accuracy of representations and warranties under the Agreement and Plan of Merger

and Share Exchange (subject to certain materiality exceptions); the absence of a material adverse effect on the respective parties; and,

the parties respective performance of their respective obligations under the Agreement and Plan of Merger and Share Exchange.

Q: When is the transaction expected to be closed?

Subject to the satisfaction or waiver of the closing

conditions described in the Agreement and Plan of Merger and Share Exchange, the parties expect that the transaction will be consummated

by or about October 31, 2023. However, it is possible that factors outside the control of both companies could result in the transaction

being closed at a different time. The Parties shall file with the Secretary of State of the State of Delaware a certificate of merger

(the "Certificate of Merger") in such form as is required by and executed and acknowledged in accordance with the provisions

of the DGCL. The Merger shall become effective at such time as the Certificate of Merger is duly filed with the Secretary of State of

the State of Delaware or at such later time as the Parties shall agree in compliance with the DGCL and as shall be set forth in the Certificate

of Merger. The Company will update shareholders as necessary by filing Form 8-K with the SEC.

Q: What happens if the transaction is not closed?

If the Agreement and Plan of Merger and Share Exchange

is not closed for any reason, neither the Company equity holders nor the HyperScale equity holders will receive shares of HyperScale

common stock in exchange for their American Cannabis Company equity, as applicable, and the parties would revert to their pre-transaction

positions.

Q: What will Company stockholders receive if the

transaction is closed?

At the effective time of the consummation of the Agreement

and Plan of Merger and Share Exchange, each holder of shares of Company common stock will automatically receive one share of HyperScale

common stock for each 300 shares of Company common stock beneficially owned. The number of HyperScale shares exchanged to each Company

equity holder shall be not less than the greater of either (i) One hundred (100) shares of HyperScale Common Stock post-transaction or

(ii) The number of shares of HyperScale Common Stock that represents a value of at least $2,500.

Q: Do any of the directors or executive officers

of the Company or HyperScale have any interests in the transaction that may be different from, or in addition to, those of the

Company's stockholders?

In

considering the Agreement and Plan of Merger and Share Exchange, you should be aware that the directors and executive officers of the

Company and HyperScale may have interests in the transaction that may be different from, or in addition to, those of the Company's

stockholders generally. Tad Mailander is a common director of both the Company and HyperScale and a Company shareholder. Mr. Mailander

informed the Company board of these facts and took no part in the Company board's action to approve the entry into the Agreement and

Plan of Merger and Share Exchange. The independent members of the board of directors of the Company were aware of and considered these

interests, among other matters, in evaluating and approving the Agreement and Plan of Merger and Share Exchange and in approving and

recommending that their respective shareholders (as applicable) vote to adopt the terms and conditions in the Agreement and Plan

of Merger and Share Exchange.

DESCRIPTION

OF THE COMPANY’S CAPITAL STOCK

General

The

Company’s authorized capital stock currently consists of a total of 500,000,000 shares of Common Stock, par value of $0.00001 per

share, and 5,000,000 shares of preferred stock, $0.01 par value per share (the "Preferred Stock"). As of the Voting Record

Date, there were (i) 171,402,938 outstanding shares of Common Stock and (ii) no shares of preferred stock outstanding.

Common

Stock

Holders

of our Common Stock are entitled to one vote for each share held on all matters submitted to a vote of the Company’s stockholders.

Holders of Common Stock are entitled to receive ratably any dividends that the Board may declare out of legally available funds. Upon

the Company’s liquidation, dissolution, or winding up, the holders of Common Stock are entitled to receive ratably the Company’s

net assets available after the payment of all debts and other liabilities and subject to the prior rights of any outstanding Preferred

Stock. Holders of Common Stock have no preemptive, subscription, redemption, or conversion rights. The outstanding shares of Common Stock

are fully paid and nonassessable. The rights, preferences, and privileges of holders of Common Stock are also subject to and may be adversely

affected by the rights of holders of shares of any series of Preferred Stock that the Company may designate and issue in the future without

further stockholder approval. As of the Voting Record Date, we have no designated issued and outstanding shares of Preferred Stock.

Preferred

Stock

We

are currently authorized to issue from time to time up to an aggregate of 5,000,000 shares of Preferred Stock in one or more series and

to fix or alter the designations, preferences, rights, qualifications, limitations, or restrictions of the shares of each series, including

the dividend rights, dividend rates, conversion rights, voting rights, term of redemption including sinking fund provisions, redemption

price or prices, liquidation preferences and the number of shares constituting any series or designations of such series without further

vote or action by the stockholders. The designation and issuance of Preferred Stock may have the effect of delaying, deferring, or preventing

a change in control of management without further action by the stockholders and may adversely affect the voting and other rights of

the holders of Common Stock. The issuance of Preferred Stock with voting and conversion rights may adversely affect the

voting power of the holders of Common Stock, including the loss of voting control to others. As of the Voting Record Date, we have no

designated issued and outstanding shares of Preferred Stock.

Vote

Obtained – Title 8 Section 228 of the Delaware General Corporation Law

Section

228 of the DGCL provides that any action required to be taken at any annual or special meeting of stockholders of a corporation, or any

action which may be taken at any annual or special meeting of such stockholders, may be taken without a meeting, without prior notice

and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of outstanding

stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which

all shares entitled to vote thereon were present and voted.

To eliminate the costs and management time involved

in soliciting and obtaining proxies to approve the Actions and to effectuate the Actions as early as possible to accomplish the purposes

of the Company as hereafter described, the Board of Directors of the Company voted to utilize and did, in fact, obtain, the written consent

of the holders of a majority of the voting power of the Company. The consenting shareholders, including our officers and directors, and

their respective approximate ownership percentage of the voting stock of the Company as of the Voting Record Date, which totals in the

aggregate 52.402% of the outstanding voting stock, are as follows: Timothy Matula, the beneficial owner of 16,250,000 shares, or 9.536%

of the Company's common stock), Kristian Kvavik, the beneficial owner of 16,250,000 shares, or 9.536% of the Company's common stock, Thomas

Stray, the beneficial owner of 16,250,000 shares, or 9.536% of the Company's common stock, Tad Mailander, the beneficial owner of 18,000,000

shares or 10.563% of the Company's common stock, and Ellis Smith, the beneficial owner of 22,546,853 shares or 13.231% of the Company's

common stock, who together held 52.402% of the Company’s outstanding voting stock as of the Voting Record Date.

Pursuant

to Section 228(e) of the DGCL, the Company is required to provide prompt notice of the taking of the corporate action without a meeting

by less than unanimous written consent to those stockholders who have not consented in writing and who, if the action had been taken

at a meeting, would have been entitled to notice of the meeting. This Information Statement is intended to provide such notice. This

Information Statement is being distributed pursuant to the requirements of Section 14(c) of the Securities Exchange Act of 1934, as amended

(the "Exchange Act") to the Company’s stockholders on the Record Date. The corporate action described herein will be

effective approximately 20 days (the "20-day Period") after the mailing or filing of the Definitive Information Statement with

the SEC. The 20-day Period is expected to conclude on or about October 9, 2023.

The

Company will bear the entire cost of furnishing this and the Definitive Information Statement.

ACTION

ONE

APPROVAL

OF ENTRY INTO THE MATERIAL DEFINITIVE AGREEMENT AND SHARE EXCHANGE.

General

Discussion of the Share Exchange Transaction in the Material Definitive Agreement.

The

transactions contemplated by the Material Definitive Agreement include the following:

| o | Pursuant

to the Merger Agreement, HyperScale Nexus Merger Sub ("Merger Sub") at the Effective

Time, will be merged with and into the Company, and afterward, the separate corporate existence

of Merger Sub shall cease by operation of law, and the Company shall continue as the Surviving

Company and wholly owned subsidiary of HyperScale. As part of the transactions contemplated

by the Material Definitive Agreement, and subject to such equitable adjustments made by the

parties pursuant to Section 3.1(b) of the Material Definitive Agreement, each three hundred

(300) shares of common stock of the Company, par value $0.00001 per share, issued and outstanding

immediately prior to the Effective Time shall be converted into one (1) fully paid and nonassessable

share of common stock, par value $0.001 per shares, of HyperScale. |

| o | All

tangible and intangible assets, property, rights, privileges, powers, and franchises of the

Company shall vest in us as the surviving company, and all debts, liabilities, and duties

of the Company shall become separate debts, liabilities, and duties of us as the Surviving

Company, and wholly owned subsidiary of HyperScale, all as provided under the DGCL. HyperScale

expressly and explicitly will not and does not assume, and shall not be responsible for,

any of our debts, liabilities, obligations, or commitments, whether known or unknown, contingent

or otherwise, of us as the surviving company. All liabilities shall remain the sole responsibility

and obligation of us as the surviving company, and any claims, actions, or demands related

to such liabilities shall be asserted against and satisfied solely from the assets and resources

of us as the surviving company as Wholly Owned Subsidiary. HyperScale shall not take any

actions, directly or indirectly, that would result in the assumption of any our liabilities,

including, without limitation, the execution of any documents or agreements that could be

construed as an assumption of such liabilities. This Information Statement shall serve as

notification to all third parties having existing contractual relationships or obligations,

including creditors and suppliers, of the consummation of the merger and the fact that HyperScale

is not assuming any liabilities of the Company. |

| o | Subject

to the equitable adjustments provided in the Material Definitive Agreement at the Effective

Time, the number of shares of HyperScale Common Stock exchanged with the Company's shareholders

shall be not less than the greater of either: (i) One hundred (100) shares of HyperScale

Common Stock post-transaction, or (ii) The number of shares of HyperScale Common Stock that

represents a value of at least $2,500. |

The

foregoing does not purport to describe the transactions contemplated by the Merger Agreement fully. See the sections entitled "Material

Definitive Agreement," which is attached as an exhibit hereto.

Voting

Securities of the Company Pre-Closing of the Material Definitive Agreement.

Our

authorized capital stock consists of 500,000,000 shares of common stock, with a par value of $0.00001 per share, and 5,000,000 shares

of preferred stock, with a par value of $0.01 per share. As of Voting Effective Date, there were 171,402,938 shares of our common stock

issued and outstanding, and no shares of preferred stock issued and outstanding.

Voting

Securities of HyperScale Pre-Closing of the Material Definitive Agreement.

The

authorized capital stock of HyperScale Nexus Holding Corporation consists of 100,000,000 shares of common stock with a par value of $0.001

per share and 1,000 shares of preferred stock with a par value of $0.001 per share. As of the Voting Effective Date, there were a total

of 36,020,000 shares of common stock issued and outstanding and no shares of preferred stock issued and outstanding.

Voting

Securities of the Company At the Post-Transaction Date.

We anticipate that there will be 571,343 shares of

HyperScale common stock issued and outstanding as of the date the transactions contemplated by the Material Definitive Agreement have

been consummated (such date being hereinafter referred to as the “Post-Transaction Date”). Consistent with the agreement of

the Parties to guarantee all Company shareholders beneficial ownership of the greater of either (i) One hundred (100) shares of HyperScale

Common Stock Post-Transaction or (ii) That number of shares of HyperScale Common Stock having a value of at least $2,500, the parties

anticipate that approximately 250,000 additional HyperScale shares will be required to be issued in exchange to meet this requirement.

The tables below disclosing calculations of beneficial interest include the noted 250,000 shares. Including HyperScale's 34,515,000 shares

issued and outstanding at the Effective Time, there will be approximately 35,336,343 total Post-Transaction HyperScale shares issued and

outstanding. The Company's 500,000,000 authorized common shares and 5,000,000 authorized shares of Preferred Stock shall remain unchanged

because of the Material Definitive Agreement.

Security

Ownership of Certain Beneficial Owners of More than Five Percent of our Common Stock

The

following table sets forth information regarding each stockholder who will beneficially own more than five percent of our common stock

as of the Post-Transaction Date. Except as otherwise indicated, we believe, based on information furnished by such persons, that each

person listed below has sole voting and investment power over the voting securities shown as beneficially owned, subject to community

property laws, where applicable. Beneficial ownership is determined under the rules of the Securities and Exchange Commission (“SEC”)

and includes any shares which the person has the right to acquire within 60 days after the Post-Transaction Date through the exercise

of any stock option, warrant or other right.

| Name

of Beneficial Owner |

|

Amount

and Nature of Beneficial Ownership |

|

Percentage

of

Class (1) |

The

Titan Capital Irrevocable Trust

32 N Gould St

Sheridan,

WY 82801 |

|

33,525,000

(2) |

|

|

94.87 |

% |

____________________________

| (1) |

|

The

percentages are based on approximately 35,336,343 shares of our common stock outstanding as of the Post-Transaction Date, plus shares

of common stock that may be acquired by the beneficial owner within 60 days after the Post-Transaction Date, by the exercise of stock

conversions and/or warrants. |

| (2) |

|

The

voting power and investment power of the common shares beneficially owned by The Titan Capital Irrevocable Trust are with Nina Stray,

Trustee. |

Security

Ownership of Management

The

following table sets forth the number of shares of our common stock beneficially owned as of the Post-Transaction Date by our directors,

executive officers and our directors and executive officers as a group. Beneficial ownership is determined under the rules of the SEC

and includes any shares that the person has the right to acquire within 60 days after the Post-Transaction Date through the exercise

of any stock option, warrant, or other right.

| Name of Beneficial

Owner |

|

Amount

and Nature of Beneficial Ownership |

|

Percentage

of

Class (1) |

| |

|

|

|

|

|

|

|

|

| Tad Mailander, Director,

President, Treasurer, Secretary |

|

|

11,055,000 (2) |

|

|

|

29.98 |

% |

| Greg Forrest, Chief Executive

Officer |

|

|

10,995,000 (3) |

|

|

|

29.84 |

% |

| |

|

|

|

|

|

|

|

|

| Officers and Directors

as a group (2 persons) |

|

|

21,990,000 |

|

|

|

59.82 |

% |

| (1) |

|

The percentages are based approximately on 35,336,343 shares of our common stock outstanding as of the Post-Transaction Date, plus shares of common stock that may be acquired by the beneficial owner within 60 days after the Post-Transaction Date, by the exercise of stock conversions and/or warrants.

|

|

(2)

|

|

This total includes 495,000 shares of HyperScale common stock and a warrant entitling the holder to exercise 10,500,000 warrants eligible within 60 days after the Post-Transaction Date. Mr. Mailander also owns 18 million pre-transaction common shares that will be reduced to 60,000 shares after the closing of the transaction. |

| (3) |

|

This total includes 495,000 shares of HyperScale common stock and a warrant entitling the holder to exercise 10,500,000 warrants eligible within 60 days after the Post-Transaction Date. |

Change

of Control

Pursuant

to the terms of the Material Definitive Agreement and upon the effectiveness of the transactions contemplated thereby, we will become

a wholly owned subsidiary of HyperScale. In exchange for 100% of the common stock of the Company, the Company's former shareholders will

collectively own approximately 2.324% of our common stock on a fully diluted basis.

Pursuant

to the terms of the Merger Agreement and upon the effectiveness of the transactions contemplated thereby, including the

effectiveness of the Company’s Schedule 14f-1, Ellis Smith will resign from our Board, and Tad Mailander will appoint new

officers and directors to fill the vacancies created by the resignation of Mr. Smith. In addition, because of the change in the

composition of our Board

and officers and the issuance of securities pursuant to the Material Definitive Agreement, there will be a change of control of the Company

upon the effectiveness of the transactions contemplated by the Material Definitive Agreement.

Neither

the Company's name nor its CUSIP number will immediately change as a result of the closing of the Material Definitive Agreement.

Consummation of the transactions contemplated by the

Material Definitive Agreement is also conditioned upon, among other things, preparation, filing, and distribution to our stockholders

of this Information Statement. There can be no guarantee that the transactions contemplated by the Material Definitive Agreement will

be completed.

No

Dissenters Rights

In

connection with the approval of the share exchange, shareholders of the Company will not have a right to dissent and obtain payment for

their shares under the DGCL, the Articles of Incorporation, or Bylaws.

Accounting

Matters

The share exchange will not affect the par value of

the Company’s Common Stock. As a result, at the Effective Time of the share exchange approved by the Company’s Board of Directors,

the stated capital on the Company’s balance sheet attributable to Common Stock would be increased from the current amount by a factor

that equals the share exchange ratio, and the additional paid-in capital account would be debited with the amount by which the stated

capital is increased. The per-share net income or loss and net book value per share will be increased because there will be fewer shares

issued and outstanding.

Tax

Consequences to Common Stockholders

The following discussion sets forth the material United

States federal income tax consequences that the Company’s management believes will apply with respect to the Company and its shareholders

who are United States holders at the Effective Time of the share exchange. This discussion does not address the tax consequences of transactions

effectuated prior to or after the Share Exchange, including, without limitation, the tax consequences of the exercise of options, warrants,

or similar rights to purchase stock. For this purpose, a United States holder is a shareholder that is: (i) a citizen or resident of the

United States, (ii) a domestic corporation, (iii) an estate whose income is subject to United States federal income tax regardless of

its source, or (iv) a trust if a United States court can exercise primary supervision over the trust’s administration and one or

more United States persons are authorized to control all substantial decisions of the trust. This discussion does not describe all of

the tax consequences that may be relevant to a holder in light of his particular circumstances or to holders subject to special rules

(such as dealers in securities, financial institutions, insurance companies, tax-exempt organizations, foreign individuals, and entities

and persons who acquired their Common Stock as compensation). In addition, this summary is limited to shareholders who hold their Common

Stock as capital assets. This discussion also does not address any tax consequences arising under the laws of any state, local, or foreign

jurisdiction. Accordingly, each shareholder is strongly urged to consult with a tax adviser to determine the particular federal, state,

local, or foreign income or other tax consequences to such shareholder related to the share exchange.

For U.S. federal income tax purposes, (a) the share

exchange is intended to qualify as a "reorganization" within the meaning of Section 368(a) of the Internal Revenue Code of 1986,

as amended (the "Code") (such Tax treatment being referred to as the "Intended Tax Treatment") and (b) this Agreement

be, and is hereby, adopted as a "plan of reorganization" within the meaning of Treasury Regulations Section 1.368–2(g)

and for purposes of Sections 354 (I.R.C. § 354) and 361 (I.R.C. § 361) of the Code. Stockholders will not recognize any gain

or loss for federal income tax purposes as a result of the Share Exchange. The adjusted basis of the shares of Common Stock after the

Share Exchange will be the same as the adjusted basis of the shares of Common Stock before the Share Exchange, excluding the basis of

fractional shares.

THIS

SUMMARY IS NOT INTENDED AS TAX ADVICE TO ANY PARTICULAR PERSON. IN PARTICULAR, AND WITHOUT LIMITING THE FOREGOING, THIS SUMMARY ASSUMES

THAT THE SHARES OF COMMON STOCK ARE HELD AS "CAPITAL ASSETS" AS DEFINED IN THE CODE AND DOES NOT CONSIDER THE FEDERAL INCOME

TAX CONSEQUENCES TO THE COMPANY’S STOCKHOLDERS IN LIGHT OF THEIR INDIVIDUAL INVESTMENT CIRCUMSTANCES OR TO HOLDERS WHO MAY BE SUBJECT

TO SPECIAL TREATMENT UNDER THE FEDERAL INCOME TAX LAWS (SUCH AS DEALERS IN SECURITIES, INSURANCE COMPANIES, FOREIGN INDIVIDUALS AND ENTITIES,

FINANCIAL INSTITUTIONS, AND TAX EXEMPT ENTITIES). IN ADDITION, THIS SUMMARY DOES NOT ADDRESS ANY CONSEQUENCES OF ANY SHARE EXCHANGE UNDER

ANY STATE, LOCAL OR FOREIGN TAX LAWS. THE STATE AND LOCAL TAX CONSEQUENCES OF SHARE EXCHANGE MAY VARY FOR EACH STOCKHOLDER DEPENDING

ON THE STATE IN WHICH SUCH STOCKHOLDER RESIDES.

AS

A RESULT, IT IS THE RESPONSIBILITY OF EACH STOCKHOLDER TO OBTAIN AND RELY ON ADVICE FROM HIS, HER OR ITS TAX ADVISOR AS TO, BUT NOT LIMITED

TO, THE FOLLOWING: (A) THE EFFECT ON HIS, HER OR ITS TAX SITUATION OF THE SHARE EXCHANGE, INCLUDING, BUT NOT LIMITED TO, THE APPLICATION

AND EFFECT OF STATE, LOCAL AND FOREIGN INCOME AND OTHER TAX LAWS; (B) THE EFFECT OF POSSIBLE FUTURE LEGISLATION OR REGULATIONS; AND (C)

THE REPORTING OF INFORMATION REQUIRED IN CONNECTION WITH ANY SHARE EXCHANGE ON HIS, HER OR ITS OWN TAX RETURNS. IT WILL BE THE RESPONSIBILITY

OF EACH STOCKHOLDER TO PREPARE AND FILE ALL APPROPRIATE FEDERAL, STATE, LOCAL, AND, IF APPLICABLE, FOREIGN TAX RETURNS.

Tax

Consequences for the Company

The

Company should not recognize any gain or loss as a result of the share exchange.

Fractional

Shares

We will not issue fractional certificates for Post-Transaction

exchanged shares in connection with the Share Exchange.

Share

Certificate Transfer Instructions

The Company anticipates that the Share Exchange will

become effective by or about October 31, 2023, or as soon thereafter as is practicable, which we will refer to as the "Effective

Time." We will provide informational disclosures pertinent to the Effective Time and other matters related to the share exchange

on Form 8-K.

Our transfer agent, Pacific Stock Transfer Company

6725 Via Austi Pkwy, Suite 300, Las Vegas, NV 89119, will act as the exchange agent for purposes of implementing the exchange of stock

certificates. Holders of shares may choose to surrender to the exchange agent certificates representing shares in exchange for certificates

representing Post-Transaction shares. Until a stockholder forwards a completed letter of transmittal, together with certificates representing

such stockholder’s shares to the transfer agent and receives in return a certificate representing shares of Post-Transaction Common

Stock, such stockholder’s Common Stock shall be deemed equal to the number of whole shares of Post-Transaction Common Stock to which

such stockholder is entitled as a result of the share exchange.

DISTRIBUTION

AND COSTS

We

will pay the cost of preparing and publishing this Information Statement. Only one Information Statement will be published to multiple

stockholders sharing an address unless contrary instructions are received from one or more of such stockholders. Upon receipt of a written

request at the address noted above, we will deliver a single copy of this Information Statement and future stockholder communication

documents to any stockholders sharing an address to which multiple copies are now published.

OVERVIEW

OF BUSINESS

American

Cannabis Company, Inc.

American

Cannabis Company, Inc. and its subsidiary is a publicly listed company quoted on the OTC Markets OTCQB Trading Tier under the symbol

“AMMJ”. We are based in Denver, Colorado and operate a fully integrated business model that features end-to-end solutions

for businesses operating in regulated cannabis industry in states and countries where cannabis is regulated and/or has been decriminalized

for medical use and/or legalized for recreational use. We provide advisory and consulting services specific to this industry, design

industry-specific products and facilities, and manage a strategic group partnership that offers both exclusive and non-exclusive customer

products commonly used in the industry. We also are licensed operators of three medical cannabis dispensaries and a cannabis cultivation

facility in Colorado Springs, CO.

We

are a Delaware corporation formed on September 24, 2001 with the name Naturewell, Inc. Pursuant to a merger transaction on March 13,

2013, the Company changed its name to Brazil Interactive Media, Inc. (“BIMI”), and operated as the owner of a Brazilian interactive

television technology and television production company named BIMI, Inc. Pursuant to an Agreement and Plan of Merger dated May 15, 2014,

between the Company, Cannamerica Corp. (“Merger Sub”), a wholly-owned subsidiary of BIMI, and Hollister

& Blacksmith, Inc. a wholly owned subsidiary of American Cannabis Consulting (“American Cannabis Consulting”) we changed

our name to American Cannabis Company, Inc. Pursuant to the Merger Agreement, which was consummated and became effective on September

29, 2014, Merger Sub was merged with and into American Cannabis Consulting through a reverse triangular merger transaction, we changed

our name to “American Cannabis Company, Inc.”, and our officers and directors in office prior to the Merger Agreement resigned

and American Cannabis Consulting appointed new officers and directors to serve our Company. In concert with the Merger Agreement, we

consummated a complete divestiture of BIMI, Inc. pursuant to a Separation and Exchange Agreement dated May 16, 2014 (the “Separation

Agreement”) between the Company, BIMI, Inc., a Delaware corporation and wholly owned subsidiary of the Company, and Brazil Investment

Holding, LLC (“Holdings”), a Delaware limited liability company. On October 10, 2014, we changed our stock symbol from BIMI

to AMMJ.

Industry

and Regulatory Overview

As

of the date of this Information Statement, thirty-nine states, including the state of Colorado, the District of Columbia, and four U.S.

Territories, currently have laws broadly legalizing cannabis in some form for either medicinal or recreational use governed by state-specific

laws and regulations. Although legalized in some states, cannabis is a “Schedule 1” drug under the Controlled Substances

Act (21 U.S.C. § 811) (“CSA”) and is illegal under federal law.

On

August 29, 2013, The Department of Justice set out its prosecutorial priorities in light of various states legalizing cannabis for medicinal

and/or recreational use. The “Cole Memorandum” provided that when states have implemented strong and effective regulatory

and enforcement systems to control the cultivation, distribution, sale, and possession of cannabis, conduct in compliance with those

laws and regulations is less likely to threaten the federal priorities. Indeed, a robust system may affirmatively address those priorities

by, for example, implementing effective measures to prevent diversion of cannabis outside of the regulated system and to other states,

prohibiting access to cannabis by minors, and replacing an illicit cannabis trade that funds criminal enterprises with a tightly regulated

market in which revenues are tracked and accounted for. In those circumstances, consistent with the traditional allocation of federal-state

efforts in this area, the Cole Memorandum provided that enforcement of state law by state and local law enforcement and regulatory bodies

should remain the primary means of addressing cannabis-related activity. If state enforcement efforts are not sufficiently robust to

protect against the harms set forth above, the federal government may seek to challenge the regulatory structure itself in addition to

continuing to bring individual enforcement actions, including criminal prosecutions, focused on those harms.

On

January 4, 2018, Attorney General Jeff Sessions issued a memorandum for all United States Attorneys concerning cannabis enforcement under

the CSA. Mr. Sessions rescinded all previous prosecutorial guidance issued by the Department of Justice regarding cannabis, including

the August 29, 2013 “Cole Memorandum.”

In

rescinding the Cole Memorandum, Mr. Sessions stated that U.S. Attorneys must decide whether or not to pursue prosecution of cannabis

activity based upon factors including the seriousness of the crime, the deterrent effect of criminal prosecution, and the cumulative

impact of particular crimes on the community. Mr. Sessions reiterated that the cultivation, distribution, and possession of marijuana

continues to be a crime under the U.S. Controlled Substances Act.

On

March 23, 2018, President Donald J. Trump signed into law a $1.3 trillion-dollar spending bill that included an amendment known as “Rohrabacher-Blumenauer,”

which prohibits the Justice Department from using federal funds to prevent certain states “from implementing their own State laws

that authorize the use, distribution, possession or cultivation of medical cannabis.”

On

December 20, 2018, President Donald J. Trump signed into law the Agriculture Improvement Act of 2018, otherwise known as the “Farm

Bill.” Prior to its passage, hemp, a member of the cannabis family, was classified as a Schedule 1 controlled substance, and so

illegal under the federal CSA.

With

the passage of the Farm Bill, hemp cultivation is now broadly permitted. The Farm Bill explicitly allows the transfer of hemp-derived

products across state lines for commercial or other purposes. It also puts no restrictions on the sale, transport, or possession of hemp-derived

products, so long as those items are produced in a manner consistent with the law.

Under

Section 10113 of the Farm Bill, hemp cannot contain more than 0.3 percent THC. THC is the chemical compound found in cannabis that produces

the psychoactive “high” associated with cannabis. Any cannabis plant that contains more than 0.3 percent THC would be considered

non-hemp cannabis—or marijuana—under the CSA and would not be legally protected under this new legislation and would be treated

as an illegal Schedule 1 drug.

Additionally,

there will be significant, shared state-federal regulatory power over hemp cultivation and production. Under Section 10113 of the Farm

Bill, state departments of agriculture must consult with the state’s governor and chief law enforcement officer to devise a plan

that must be submitted to the Secretary of the United States Department of Agriculture (hereafter referred to as the “USDA”).

A state’s plan to license and regulate hemp can only commence once the Secretary of USDA approves that state’s plan. In states

opting not to devise a hemp regulatory program, USDA will construct a regulatory program under which hemp cultivators in those states

must apply for licenses and comply with a federally run program. This system of shared regulatory programming is similar to options states

had in other policy areas such as health insurance marketplaces under Affordable Care Act, or workplace safety plans under Occupational

Health and Safety Act—both of which had federally-run systems for states opting not to set up their own systems.

The

Farm Bill outlines actions that are considered violations of federal hemp law (including such activities as cultivating without a license

or producing cannabis with more than 0.3 percent THC). The Farm Bill details possible punishments for such violations, pathways for violators

to become compliant, and even which activities qualify as felonies under the law, such as repeat offenses.

One

of the goals of the previous 2014 Farm Bill was to generate and protect research into hemp. The 2018 Farm Bill continues this effort.

Section 7605 re-extends the protections for hemp research and the conditions under which such research can and should be conducted. Further,

section 7501 of the Farm Bill extends hemp research by including hemp under the Critical Agricultural Materials Act. This provision recognizes

the importance, diversity, and opportunity of the plant and the products that can be derived from it but also recognizes that there is

still a lot to learn about hemp and its products from commercial and market perspectives.

As

a result of the November 2020 federal elections and the election of Joseph R. Biden as president, there is speculation that the federal

government may move to amend parts of the CSA and de-schedule cannabis as a Schedule 1 drug.

In

late January 2021, Senate Majority Leader Chuck Schumer said lawmakers are in the process of merging various cannabis bills, including

his own legalization legislation. He is working to enact reform in this Congressional session. This would include the Marijuana Freedom

and Opportunity Act, which would federally de-schedule cannabis, reinvest tax revenue into communities most affected by the drug war,

and fund efforts to expunge prior cannabis records. It is likely that the Marijuana Opportunity, Reinvestment, and Expungement (MORE)

Act would be incorporated.

Other

federal legislation under review for possible submission includes the SAFE Banking Act (or Secure and Fair Enforcement Act), a bill that

would allow cannabis companies to access the federally insured banking system and capital markets without the risk of federal enforcement

action, and the Strengthening the Tenth Amendment Through Entrusting States Act (or STATES Act), a bill that seeks protections for businesses

and individuals in states that have legalized and comply with state laws).

The

fall of 2022 saw several key developments in federal and state marijuana regulation. In October 2022, President Biden granted clemency

to certain low-level federal marijuana offenders and directed the Attorney General to review the status of marijuana under federal law.

While some observers consider President Biden’s grant of clemency to represent a significant change in federal marijuana policy,

as a legal matter, it did little to alter the growing disparity between federal and state marijuana regulation. Then, in November 2022,

voters in five states considered ballot initiatives to legalize recreational marijuana at the state level, two of which were adopted.

Congress also subsequently enacted the Medical Marijuana and Cannabidiol Research Expansion Act, which aims to facilitate research on

marijuana and cannabidiol (CBD). Legislators and commentators have proposed a number of other legal reforms that would alter federal

marijuana regulation and potentially reduce the divergence between federal and state law.

As

of the date of this filing, cannabis remains an illegal Schedule 1 drug under the CSA, and none of the legislative initiatives being

discussed have become federal law.

Notably,

with respect to our business, on November 1, 2019, Colorado Bill HB-19-1090 was passed and made effective. This law allows publicly traded

corporations to apply for and qualify for the ownership of Colorado cannabis licenses. Other states that have legalized cannabis for

recreational and/or medicinal use restrict public companies from owning interests in state cannabis licenses altogether or have enacted

regulations that make it difficult for corporations to comply with application requirements, including all shareholders submitting to

and passing background checks.

Business

Overview

We

now primarily operate within the regulated cannabis industry with three operation divisions: (i) consulting and professional services;

(ii) the sale of products and equipment commonly utilized in the cultivation, processing, transportation, or retail sale of cannabis;

and (iii) our licensed owner-operator medical marijuana dispensaries and cultivation facilities located in Colorado Springs, Colorado

under the trade

name “Naturaleaf.” Our operations are limited to only those state jurisdictions where medical and/or recreational cannabis

business has been legalized.

Consulting

Services

We

offer consulting services for companies associated with the cannabis industry in all stages of development. Our service offerings include

the following:

| |

o |

Cannabis

Business Planning. Our commercial cannabis business planning services are structured to help those pursuing state based operational

licensing to create and implement effective, long-range business plans. We work with our clients to generate a comprehensive strategy

based on market need and growth opportunities, and be a partner through site selection, site design, the development of best operating

practices, the facility build-out process, and the deployment of products. We understand the challenges and complexities of the regulated

commercial cannabis and hemp markets and we have the expertise to help client businesses thrive. |

| |

o |

Cannabis

Business License Applications. Our team has the experience necessary to help clients obtain approval for their state license

and ensure their company remains compliant as it grows. We have crafted successful, merit-based medical marijuana business license

applications in multiple states, and we understand the community outreach and coordination of services necessary to win approval.

As part of the process for crafting applications, we collaborate with clients to develop business protocols, safety standards, a

security plan, and a staff training program. Depending on the nature of our clients’ businesses and needs, we can work with

our clients to draft detailed cultivation plans, create educational materials for patients, or design and develop products that comply

with legal state guidelines |

| |

o |

Cultivation

Build-out Oversight Services. We offer cultivation build-out consulting as part of our Cannabis and Hemp Business Planning service

offerings. We help clients ensure their project timeline is being met, facilities are being designed with compliance and the regulated

cannabis industry in mind, and that facilities are built to the highest of quality standards for cannabis and hemp production and/or

distribution. This enables a seamless transition from construction to cultivation, ensuring that client success is optimized and

unencumbered by mismanaged construction projects. |

| |

o |

Cannabis

Regulatory Compliance. Based on our understanding of regulated commercial cannabis and hemp laws nationwide, we can help client

cultivation operations, retail dispensaries and/or infused-product kitchen businesses to meet and maintain regulatory compliance

for both medical and recreational markets. We partner with our clients to establish standard operating procedures in accordance with

their state’s regulation and help them implement effective staff hiring and training practices to ensure that employees adhere

to relevant guidelines. |

| |

o |

Compliance

Audit Services. Our regulatory compliance service offerings include compliance auditing. The regulated cannabis and hemp

industries are developing rapidly with evolving laws and regulations and navigating through current and new regulations and systems

can be tedious and daunting. To assist our clients in addressing these challenges, we offer compliance audits performed by our experienced

and knowledgeable staff; our team members maintain comprehensive oversight of the cannabis and hemp industries while staying up to

date on current and new laws and regulations. Our compliance audits assess various regulatory topics, including: (1) licensing requirements;

(2) visitor intake procedures; (3) seed-to-sale inventory tracking; (4) proper waste disposal procedures; (5) recordkeeping and documentation

requirements; (6) cannabis transportation procedures; (7) packaging and labeling requirements; (8) security requirements; (9) product

storage; (10) mandatory signage; and (11) preparedness for state and local inspections. |

| |

o |

Cannabis

Business Growth Strategies. Our team shares its collective knowledge and resources with our clients to create competitive, forward-looking

cannabis and hemp business growth strategies formulated to minimize risk and maximize potential. We customize individual plans for

the unique nature of our client businesses, their market and big-picture goals, supported with a detailed analysis and a thorough

command of workflow best practices, product strategies, sustainability opportunities governed by a core understanding or regulatory

barriers and/or opportunities. |

| |

o |

Cannabis

Business Monitoring. The regulated commercial cannabis and hemp industries are constantly growing and shifting, and the ongoing

monitoring of a cannabis and hemp business allows it to remain responsive to evolving consumer demands and state regulations as well

as potential operations problems. We offer fully integrated business analysis solutions. Our monitoring services include sales tracking,

market assessment, loss prevention strategies, review of operational efficiency and workflow recommendations. Additionally, our services

include Strength, Weakness, Opportunity and Threat (“SWOT”) analysis, where we analyze client operations to pinpoint

strengths, weaknesses, opportunities and threats. Our SWOT analyses allow clients to focus their efforts and resources on the most

critical areas along these dimensions. |

Equipment

and Supplies

In

addition to professional consulting services, we operate an equipment and supplies division for customers in the cannabis industry. Our

Group Purchasing Organization, American Cultivator CO., enables customers to procure commonly used cultivation supplies at competitive

prices. Our major product offerings include the following:

| |

o |

The

Satchel™. The Satchel was invented in response to regulatory changes in Colorado and elsewhere that require childproof

exit containers. The Satchel is a pouch-like case designed as a high-quality, child-proof exit package solution for the regulated

cannabis industry. The Satchel meets child-safety requirements of the Consumer Products Safety Commission (“CPSC”), making

it compliant in all states, and the Satchel’s drawstring and toggle lock fulfills the requirements of the Poison Prevention

Packaging Act of 1970 (16 CFR part 1700). There are few products meeting regulatory standards, and even fewer that offer distinctive

quality. The Satchel will meet all current exit packaging regulations, featuring a child-proof closure that completely conceals the

contents inside. On March 29, 2016, the U.S. Patent and Trademark Office issued us Patent No. 9,296,524 B2 for the Satchel. |

| |

o |

SoHum

Living Soil®. The right grow methodology is critical to the success of any cannabis cultivation operation, and SoHum

Living Soil™ is our solution to ensure that our customers can implement an optimal methodology that will maximize quality and

yields while simplifying the cultivation process and reducing risk of operator error and test failure. The SoHum medium is a fully

amended Just-add-water soil that contains none of the synthetic components found in other potting mixes and requires no chemical

additives to spur growth. Compared with comparable methodologies, SoHum Living Soil™ offers a number of key advantages, including:

(1) consistent Pyto-pharmaceutical-grade product quality; (2) improved plant resistance to disease; and (3) reduced operator error. |

| |

o |

High

Density Cultivation System (HDCS™). A key metric in the success of a cultivation operation is the maximization of

available space to grow. Our High-Density Cultivation System is a solution designed to ensure that space is used in the most efficient

manner possible. The system takes advantage of the existence of vertical space, with racks installed vertically and placed on horizontal

tracking to eliminate multiple isles and create multiple levels of space with which to grow plants. The High-Density Cultivation

System allows customers to increase production capacity without the need to add additional square footage to the operation. |

| |

o |

The

Cultivation Cube™. The Cultivation Cube™ is a self-contained, scalable cultivation system that is compliant

with regulatory guidelines. The Cultivation Cube™ allows commercial cannabis cultivation operations to maximize space, yield

and profit through an innovative design that provides a fully integrated growing solution. The Cultivation Cube utilizes more lights

per square foot than traditional grow systems, which translates to profit increases per square foot. The Cultivation Cube™

is also stackable, which allows customers to achieve vertical gains and effectively doubles productive square-footage. It is an ideal

solution for commercial-scale cultivation within limited space, with numerous advantages over other traditional grow systems, including:

(1) flexibility to fit customer build-out sites; (2) efficient speed-to-market with fast delivery and setup; (3) increased security

with limited access units; (4) risk mitigation through precision environmental controls; and, (5) is compatible with lean manufacturing

principles and operations. |

| |

o |

Other

Products. We offer our clients a diverse array of commonly utilized product offerings from across all areas of the regulated

cannabis industry, including cultivation operations, medicinal and recreational cannabis dispensary operations, and infused products.

Examples of products available include HID Ballasts, reflectors, MH and HPS bulbs, T5 fixtures, mediums, nutrients and fertilizers,

growing containers, flood tables, reservoirs, and various other supplies, including cleaning products and office supplies. |

Naturaleaf

On

December 16, 2020, the Company announced that it executed a non-binding letter of intent to purchase assets of Naturaleaf, a long-standing

licensed operator in the Colorado Springs medical cannabis market since 2009. Assets include three (3) retail dispensaries located throughout

the city along with one 10,000 square foot cultivation operation with non-volatile extraction capabilities.

On

March 11, 2021, we entered into an asset purchase agreement with Medihemp, LLC (“Medihemp”) and its wholly owned subsidiary

SLAM Enterprises, LLC (“SLAM”), and Medical Cannabis Caregivers, Inc. (“Medical Cannabis”), each an entity organized

and operating under the laws of the State of Colorado, and all doing business as “Naturaleaf.”

Medihemp

and SLAM respectively own fixed assets and operates two retail Medical Marijuana Centers located at 1004 S. Tejon Street, Colorado Springs,

CO 80903, and 2727 Palmer Park Blvd. Suite A, Colorado Springs, CO 80909.

Medical

Cannabis owns and operates fixed assets and operates a retail Medical Marijuana Center located at 5875 Lehman Drive, Ste. 100, Colorado

Springs, CO 80918.

Medical

Cannabis also owns and operates a Medical Marijuana Optional Premises Cultivation license, and a Medical Marijuana-Infused Product Manufacturer

license, along with fixed assets all located at 2611 Durango Drive, Colorado Springs, CO 80910.

On

April 30, 2021, the Colorado MED and the City of Colorado Springs granted approval for the change of ownership, and we completed the

asset purchase agreement. By virtue of the closing, we acquired, own, and operate the fixed assets and associated intellectual property

of Naturaleaf, including assignment of the following licenses issued by the Colorado Marijuana Enforcement Division (“MED”)

and the corresponding City of Colorado Springs (“City”):

| |

o |

Medihemp

and SLAM’s and Medical Cannabis’ respective Medical Marijuana Center licenses; |

| |

o |

Medical

Cannabis’ Medical Marijuana Infused Product Manufacturer license; and, |

| |

o |

Medical

Cannabis’ Medical Marijuana Optional Premises Cultivation license. |

We

also entered leases for Medihemp, SLAM, and Medical Cannabis’ respective retail Medical Marijuana Centers and entered into a separate

lease for Medical Cannabis’ Durango Drive cultivation facility.

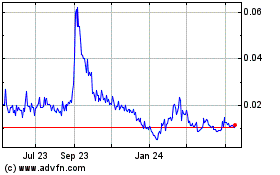

Market

For Common Equity, Related Stockholder Matters, And Issuer Purchases of Equity Securities

Our

common stock trades on the OTC Markets OTCQB Trading Tier under the ticker symbol “AMMJ.” As of the date of this Information

Statement, there were 500 holders of record of our common stock. The following table sets forth, for the periods indicated, the high

and low closing sales prices of our common stock:

| 2023 |

|

High |

|

Low |

| Quarter

ended June 30 |

|

$ |

0.02 |

|

$ |

0.01 |

|

| Quarter ended March

31 |

|

$ |

0.03 |

|

$ |

0.02 |

|

| 2022 |

|

High |

|

Low |

| Quarter

ended December 31 |

|

$ |

0.05 |

|

$ |

0.02 |

|

| Quarter ended September

30 |

|

$ |

0.05 |

|

$ |

0.03 |

|

| Quarter ended June

30 |

|

$ |

0.06 |

|

$ |

0.03 |

|

| Quarter ended March

31 |

|

$ |

0.07 |

|

$ |

0.04 |

|

| 2021 |

|

High |

|

Low |

|

| Quarter

ended December 31 |

|

$ |

0.11 |

|

$ |

0.05 |

|

| Quarter ended September

30 |

|

$ |

0.17 |

|

$ |

0.09 |

|

| Quarter ended June

30 |

|

$ |

0.25 |

|

$ |

0.18 |

|

| Quarter ended March

31 |

|

$ |

0.39 |

|

$ |

0.06 |

|

Dividend

Policy

We

have never declared or paid, and do not anticipate declaring or paying, any cash dividends on our common stock. Instead, we currently

anticipate that we will retain all of our future earnings, if any, to fund the operation and expansion of our business and to use as

working capital and for other general corporate purposes. Any future determination as to the declaration and payment of dividends, if

any, will be at the discretion of our board of directors and will depend on then-existing conditions, including our financial condition,

operating results, contractual restrictions, capital requirements, business prospects, and other factors our board of directors may deem

relevant.

Equity

Compensation Plans

We

adopted the 2015 Employee Incentive Plan (the “Plan”) to enable us to attract and retain the services of (i) selected employees,

officers, and directors of the Company or any parent or subsidiary of the Company and (ii) selected nonemployee agents, consultants,

advisors and independent contractors of the Company or any parent or subsidiary of the Company. The Plan is administered by the Board

of Directors, which has the authority in its discretion to determine the eligible persons to whom, the time or times at which awards

may be granted, the amount of cash, the number of shares, units, or other rights subject to each award, the exercise, base or purchase