8-K0001365916FALSE00013659162023-10-022023-10-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

____________________

Date of report (Date of earliest event reported): October 2, 2023

Amyris, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-34885 | 55-0856151 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 5885 Hollis Street, Suite 100, | Emeryville, | CA | 94608 |

| (Address of Principal Executive Offices) | (Zip Code) |

| | | | | | | | | | | |

| | (510) | 450-0761 | |

| | (Registrant’s telephone number, including area code) | |

| | | | | | | | |

| | | |

| | (Former name or former address, if changed since last report.) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2 below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

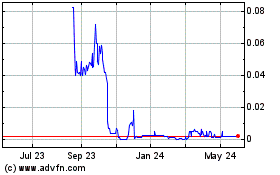

| Common Stock, $0.0001 par value per share | AMRSQ | N/A* |

* On September 8, 2023, Nasdaq filed a Form 25 with the Securities and Exchange Commission (the “SEC”) to delist our common stock from the Nasdaq Stock Market LLC. The delisting became effective on September 18, 2023. The deregistration of the ordinary shares under section 12(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) will be effective 90 days, or such shorter period as the SEC may determine, after the filing date of the Form 25, at which point the ordinary shares will be deemed registered under Section 12(g) of the Exchange Act. Our common stock currently trades on the OTC Pink Marketplace maintained by the OTC Markets Group, Inc. under the symbol “AMRSQ.”

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As previously reported, on August 9, 2023, Amyris, Inc. (the “Company”) and certain of its direct and indirect subsidiaries (collectively, the “Company Parties”) filed voluntary petitions for relief under Chapter 11 of Title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”), thereby commencing Chapter 11 cases for the Company Parties (the “Chapter 11 Cases”). The Company Parties continue to operate their business as “debtors in possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court.

| | | | | |

Item 1.01 | Entry into a Material Definitive Agreement.

|

On October 2, 2023, the Company, Amyris Clean Beauty, Inc., and Aprinnova, LLC (collectively, the “Borrowers”), and certain other subsidiaries of the Company (the “Guarantors”) entered into an amendment (the “Amendment No. 3”) to that certain Senior Secured Super Priority Debtor In Possession Loan Agreement (the “DIP Credit Agreement”), dated as of August 9, 2023 (as amended, restated, supplemented or otherwise modified from time to time), by and among the Borrowers, Guarantors, each lender from time to time party to the DIP Credit Agreement and Euagore, LLC, in its capacity as administrative agent (the “Administrative Agent”). Pursuant to Amendment No. 3, the parties agreed, among other matters, to extend the Plan Support Deadline by ten calendar days from October 2, 2023 to October 12, 2023. Capitalized terms used herein that are not otherwise defined herein shall have the meanings given to them in the Amendment No. 3.

The foregoing does not purport to be complete and is qualified in its entirety by reference to the Amendment No. 3 that is filed hereto as Exhibit 10.1 and is incorporated herein by reference.

| | | | | |

| Item 7.01 | Regulation FD Disclosure.

|

On October 2, 2023 and October 3, 2023, the Company Parties filed with the Bankruptcy Court amended monthly operating reports for certain Company Parties for the period beginning August 1, 2023 and ending August 31, 2023 (the “Amended MORs”). The Amended MORs are attached hereto as Exhibits 99.1, 99.2, 99.3, 99.4, 99.5, and 99.6. The information set forth in Item 7.01 of this Form 8-K will not be deemed an admission as to the materiality of any information required to be disclosed solely by Regulation FD. The Amended MORs and other filings with the Bankruptcy Court related to the Chapter 11 Cases may be available electronically at https://cases.stretto.com/Amyris. Documents and other information available on such website are not part of this Form 8-K and shall not be deemed incorporated by reference in this Form 8-K. The Company has included the website address in this Form 8-K as an inactive textual reference only.

The information contained in this Item 7.01 and in Exhibit 99.1 is being “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such a filing.

Cautionary Statement Regarding the Amended MORs

The Company cautions investors and potential investors not to place undue reliance upon the information contained in the Amended MORs, which were not prepared for the purpose of providing the basis for an investment decision relating to any of the securities of the Company. The Amended MORs are limited in scope, covers a limited time period and has been prepared solely for the purpose of complying with the monthly reporting requirements of the Bankruptcy Court. The Amended MORs were not audited or reviewed by independent accountants, were not prepared in accordance with generally accepted accounting principles in the United States, are in a format prescribed by applicable bankruptcy laws or rules, and are subject to future adjustment and reconciliation. The Amended MORs also contain information for periods shorter and otherwise different from those contained in the Company’s reports required to be filed pursuant to the Exchange Act. There can be no assurance that, from the perspective of an investor or potential investor in the Company’s securities, the Amended MORs are complete. Results set forth in the Amended MORs should not be viewed as indicative of future results.

Cautionary Statements Regarding Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements contained in this Current Report on Form 8-K include, but are not limited to, statements regarding the process and potential outcomes of the Company’s bankruptcy proceeding and the ability of the DIP Credit Agreement to provide sufficient liquidity for the Company’s obligations during the bankruptcy proceeding. These statements are based on management’s current expectations, and actual results and future events may differ materially due to risks and uncertainties, including, without limitation, risks inherent in the bankruptcy process, including the outcome of the bankruptcy proceeding; the Company’s financial projections and cost estimates; the Company’s ability to raise additional funds during the bankruptcy proceeding; the Company’s ability to sell any of its assets; and the effect of the bankruptcy proceeding on the Company’s business prospects, financial results and business operations. The Company may not actually achieve the plans, intentions or expectations disclosed in the forward-looking statements, and you should not place undue reliance on our forward-looking statements. These and other factors that may affect the Company’s future business prospects, results and operations are identified and described in more detail in the Company’s filings with the SEC, including the Company’s most recent Annual Report filed on Form 10-K and the subsequently filed Quarterly Report(s) on Form 10-Q. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this Form 8-K. Except as required by applicable law, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

| | | | | |

| Exhibit Number | Description |

| 10.1 | |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 99.4 | |

| 99.5 | |

| 99.6 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | AMYRIS, INC. | |

| | | | |

| | | | |

| Date: October 4, 2023 | By: | /s/ Han Kieftenbeld | |

| | | Han Kieftenbeld | |

| | Interim Chief Executive Officer and Chief Financial Officer |

AMENDMENT NO. 3

TO SENIOR SECURED SUPER PRIORITY DEBTOR IN POSSESSION LOAN AGREEMENT

This Amendment No. 3 (this “Amendment”) to the Senior Secured Super Priority Debtor in Possession Loan Agreement, dated as of August 9, 2023 (as amended, restated, supplemented or otherwise modified from time to time, the “Loan Agreement”) is made as of October 2, 2023, and is entered into by and among by and among AMYRIS, INC., a Delaware corporation (the “Parent”), each of the Subsidiaries of the Parent set out in Part 1 of Schedule 1 to this Amendment (together with the Parent, each, a “Borrower” and collectively, the “Borrowers”), the Subsidiaries of the Parent set out in Part 2 of Schedule 1 to this Amendment (such other Subsidiaries of the Parent that are guarantors, each, a “Guarantor” and collectively, the “Guarantors” and, together with the Borrowers, each an “Obligor” and collectively, the “Obligors”), each lender from time to time party hereto (each, a “Lender” and collectively, the “Lenders”) and Euagore, LLC, in its capacity as Administrative Agent (the “Administrative Agent”).

WHEREAS, on August 9, 2023, the Parent and certain of its Subsidiaries filed voluntary petitions with the Bankruptcy Court initiating their respective cases under chapter 11 of the Bankruptcy Code and have continued in the possession of their assets and the management of their business pursuant to Section 1107 and 1108 of the Bankruptcy Code;

WHEREAS, on August 9, 2023, the Obligors and the Lenders entered into the Loan Agreement to provide a super priority multiple-draw senior secured debtor-in-possession term loan credit facility (the “DIP Facility”), with all of the Borrowers’ obligations under the DIP Facility guaranteed by each Guarantor, and the Lenders agreed to extend the DIP Facility to the Borrowers on the terms and subject to the conditions set forth in the Loan Agreement;

WHEREAS, the Obligors and the Lenders have entered into Amendment No. 1 and Amendment No. 2 to the Loan Agreement, which modified, among other things, certain milestones in Section 7.25(d) of the Loan Agreement; and

WHEREAS, the Obligors have requested that the Administrative Agent and the Lenders further amend the Loan Agreement in certain respects, and the Administrative Agent and such Lenders are willing to do so, in each case, subject to the terms and conditions set forth herein,

NOW THEREFORE, in consideration of the premises and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties to this Amendment agree as follows:

1.Definitions. All terms used herein that are defined in the Loan Agreement and not otherwise defined herein shall have the meanings given to them in the Loan Agreement.

2.Amendments and Consents. With effect from the Effective Date:

(a)the first paragraph of Section 7.25(d) (Certain Case Milestones) and clauses (1) and (2) of Section 7.25(d) are deleted and replaced with:

“(d) no later than sixty four (64) calendar days following the Petition Date (i.e. October 12, 2023) (the “Plan Support Deadline”), the Debtors shall have executed a plan support

agreement (the “Plan Support Agreement”) by and among the Debtors, the Administrative Agent, the Lenders, the Foris Prepetition Secured Lenders, and such other party- or parties-in-interest determined by the Administrative Agent, the Required Lenders, and the Foris Prepetition Secured Lenders, in their sole and absolute discretion, to be necessary and sufficient for the Administrative Agent, the Lenders and the Foris Prepetition Secured Lenders to support a Chapter 11 Plan (collectively, the “Plan Support Persons”), with such Plan Support Agreement being acceptable to the Administrative Agent and the Foris Prepetition Secured Lenders in their sole discretion (the “Plan Support Agreement Milestone”); provided that (x) the Debtors shall not file a motion to sell any Other Amyris Assets on or prior to the Plan Support Deadline and (y) (A) if the Plan Support Agreement Milestone Date occurs on or prior to the Plan Support Deadline, the Plan Support Agreement shall include, and the Obligors shall achieve, each of the following Milestones:

(1)on the Plan Support Agreement Milestone Date (i.e. October 12, 2023), the Debtors shall file with the Bankruptcy Court a Chapter 11 Plan, a Disclosure Statement (each consistent with the Plan Support Agreement and in form and substance acceptable to the Administrative Agent), and a motion to approve the Plan, the Disclosure Statement and the related solicitation materials, dates and deadlines (the “Plan Filing Deadline”);

(2)no later than thirty-five (35) calendar days following the Plan Filing Deadline (i.e. November 16, 2023) (the “Disclosure Statement Hearing Order Deadline”), the Bankruptcy Court shall enter an order approving the Disclosure Statement, which order shall provide that the date upon which votes to accept or reject the Chapter 11 Plan must be submitted shall be no later than thirty-two (32) calendar days following the Disclosure Statement Hearing Order Deadline (i.e. December 18, 2023);”

3.Representations and Warranties; No Event of Default. Each Obligor hereby represents and warrants to the Administrative Agent and the Lenders that:

(a)the representations and warranties in Section 5 and in each other Loan Document, certificate or other writing delivered by or on behalf of the Obligors to the Administrative Agent or any Lender pursuant to any Loan Document on or before the Effective Date are true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations or warranties that already are qualified or modified as to “materiality” or “Material Adverse Effect” in the text thereof, which representations and warranties shall be true and correct in all respects subject to such qualification) on and as of the Effective Date as though made on and as of such date, except to the extent that any such representation or warranty expressly relates solely to an earlier date (in which case such representation or warranty shall be true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations or warranties that already are qualified or modified as to “materiality” or “Material Adverse Effect” in the text thereof, which representations and warranties shall be true and correct in all respects subject to such qualification) on and as of such earlier date), and no Default or Event of Default has occurred and is continuing as of the Effective Date or would result from this Amendment becoming effective in accordance with its terms;

(b)the execution, delivery and performance of this Amendment (i) are within its corporate, partnership, limited partnership or limited liability company power and do not contravene any provision of its organizational documents; (ii) have been duly authorized by all necessary or proper action of each Obligor; (iii) will not result in the creation or imposition of any Lien upon the Collateral, other than Permitted Liens; (iv) do not violate (A) any Laws or regulations to which it or its

Subsidiaries are subject, the violation of which would be reasonably expected to have a Material Adverse Effect or (B) any order, injunction, judgment, decree or writ of any Governmental Authority to which it or its Subsidiaries are subject; (v) do not conflict with, or result in the breach or termination of, constitute a default under or accelerate or permit the acceleration of any performance required by, any indenture mortgage, deed of trust, lease or agreement or other instrument, in each case, in respect of material Indebtedness to which it or its Subsidiaries is a party or by which it or its Subsidiaries or any of its property is bound; and (vi) do not violate any contract or agreement or require the consent or approval of any other Person or Governmental Authority which has not already been obtained. The individual or individuals executing this Amendment are duly authorized to do so. This Amendment has been duly executed and delivered on behalf of each Obligor party thereto; and

(c)this Amendment upon execution will constitute, a legal, valid and binding obligation of each Obligor party thereto, enforceable against each such Obligor in accordance with its terms, except as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting the enforcement of creditors’ rights generally and by general equitable principles (whether enforcement is sought by proceedings in equity or at law).

4.Conditions to Effectiveness. This Amendment shall become effective only upon the date (the “Effective Date”) on which the Administrative Agent and Required Lenders have received (or waived receipt of) the following documents and other evidence, each in form and substance satisfactory to them:

(a)this Amendment, signed by all Obligors party to it;

(b)the representations and warranties contained in Section 5 and in this Amendment shall be true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations or warranties that already are qualified or modified as to “materiality” or “Material Adverse Effect” in the text thereof, which representations and warranties shall be true and correct in all respects subject to such qualification) on and as of the Effective Date as though made on and as of such date, except to the extent that any such representation or warranty expressly relates solely to an earlier date (in which case such representation or warranty shall be true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations or warranties that already are qualified or modified as to “materiality” or “Material Adverse Effect” in the text thereof, which representations and warranties shall be true and correct in all respects subject to such qualification) on and as of such earlier date); and

(c)no Default or Event of Default shall have occurred and be continuing or shall result from this Amendment becoming effective in accordance with its terms.

5.Reaffirmation. Each Obligor, as debtor, grantor, pledgor, guarantor, assignor, or in any other similar capacity in which such Person grants liens or security interests in its property or otherwise acts as accommodation party or guarantor, as the case may be, in each case, pursuant to any Loan Document, hereby (a) confirms, ratifies and reaffirms all of its payment and performance obligations, contingent or otherwise, under the Loan Agreement and each other Loan Document to which it is a party (after giving effect hereto), (b) confirms and agrees that each Loan Document to which it is a party is, and shall continue to be, in full force and effect and is hereby ratified and confirmed in all

respects, except that on and after the Effective Date, all references in any such Loan Document to “the Loan Agreement”, the “Agreement”, “thereto”, “thereof”, “thereunder” or words of like import referring to the Loan Agreement shall mean the Loan Agreement as amended by this Amendment, and (c) confirms and agrees that, to the extent that any Loan Document to which it is party purports to assign or pledge to the Administrative Agent, for the benefit of the Secured Parties, or to grant to the Administrative Agent, for the benefit of the Secured Parties, a security interest in or Lien on any Collateral as security for the Secured Obligations of the Obligors from time to time existing in respect of the Loan Agreement (as amended hereby) and the other Loan Documents, or otherwise guaranteed the Secured Obligations under or with respect to the Loan Documents, such guarantee, pledge, assignment and/or grant of the security interest or Lien is hereby ratified, reaffirmed and confirmed in all respects and confirms and agrees that such guarantee, pledge, assignment and/or grant of the security interest or Lien hereafter guarantees and secures all of the Secured Obligations as amended hereby. This Amendment does not and shall not affect any of the obligations of the Obligors, other than as expressly provided herein, including, without limitation, the Obligors’ obligations to repay the Advances in accordance with the terms of Loan Agreement or the obligations of the Obligors under any Loan Document to which they are a party, all of which obligations shall remain in full force and effect. Except as expressly provided herein, the execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of the Administrative Agent or any Lender under any Loan Document, shall not constitute a waiver of any provision of any Loan Document, and shall not be construed as a substitution or novation of the Secured Obligations which shall remain in full force and effect.

6.No Representations. Each Obligor hereby acknowledges that it has not relied on any representation, written or oral, express or implied, by the Administrative Agent or any Lender in entering into this Amendment.

7.Miscellaneous.

(a)Sections 10.1 (Severability), 10.9 (Consent to Jurisdiction and Venue), 10.10 (Mutual Waiver of Jury Trial) and 10.15 (Counterparts) are deemed incorporated into this Amendment with all necessary changes.

(b)Section and paragraph headings herein are included for convenience of reference only and shall not constitute a part of this Amendment for any other purpose. References to “Sections” are to sections of the Loan Agreement, unless otherwise stated.

(c)EXCEPT TO THE EXTENT GOVERNED BY THE BANKRUPTCY CODE, THIS AGREEMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK APPLICABLE TO CONTRACTS MADE AND TO BE PERFORMED IN THE STATE OF NEW YORK WITHOUT GIVING EFFECT TO THE CONFLICT OF LAWS PROVISIONS THEREOF (OTHER THAN SECTION 5-1401 AND 5-1402 OF THE NEW YORK GENERAL OBLIGATIONS LAW).

(d)Each Obligor hereby acknowledges and agrees that this Amendment is a “Loan Document”.

(e)With respect to any Obligor, this Amendment is subject in all respects (including with respect to all obligations and agreements of the Obligors provided for hereunder) to the terms of the Interim Order (and, when applicable, the Final Order) and if any provision in this Amendment expressly conflicts or is inconsistent with any provision in the Interim Order or Final Order, the provisions in the applicable DIP Order shall govern and control.

[Remainder of page intentionally left blank.]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed and delivered as of the date set forth on the first page hereof.

COMPANIES:

AMYRIS, INC., a Delaware corporation

By: /s/ Han Kieftenbeld

Name: Han Kieftenbeld

Title: Interim Chief Executive Officer and Chief Financial Officer

AMYRIS CLEAN BEAUTY, INC., a Delaware corporation

By: /s/ Han Kieftenbeld

Name: Han Kieftenbeld

Title: Chief Financial Officer

APRINNOVA, LLC, a Delaware limited liability company

By: /s/ Han Kieftenbeld

Name: Han Kieftenbeld

Title: Chief Financial Officer

AB TECHNOLOGIES LLC, a Delaware limited liability company

By: /s/ Han Kieftenbeld

Name: Han Kieftenbeld

Title: Chief Financial Officer

AMYRIS FUELS, LLC, a Delaware limited liability company

By: /s/ Han Kieftenbeld

Name: Han Kieftenbeld

Title: Chief Financial Officer

AMYRIS-OLIKA, LLC, a Delaware limited liability company

By: /s/ Han Kieftenbeld

Name: Han Kieftenbeld

Title: Chief Financial Officer

ONDA BEAUTY INC., a Delaware corporation

By: /s/ Han Kieftenbeld

Name: Han Kieftenbeld

Title: Chief Financial Officer

UPLAND 1 LLC, a Delaware limited liability company

By: /s/ Han Kieftenbeld

Name: Han Kieftenbeld

Title: Chief Financial Officer

AMYRIS-ECOFAB LLC, a Delaware limited liability company

By: /s/ Han Kieftenbeld

Name: Han Kieftenbeld

Title: Chief Financial Officer

CLEAN BEAUTY 4U HOLDINGS, LLC, a Delaware limited liability company

By: /s/ Han Kieftenbeld

Name: Han Kieftenbeld

Title: CEO & President

AMYRIS CLEAN BEAUTY LATAM LTDA., a Brazilian limited liability company

By: /s/ Daniel Moreira

Name: Daniel Moreira

Title: Legal Director

By: /s/ Claudia Marina Nohara

Name: Claudia Marina Nohara

Title: Chief Financial Officer

INTERFACES INDUSTRIA E COMERCIO DE COSMETICOS LTDA., a Brazilian limited liability company

By: /s/ Claudia Marina Nohara

Name: Claudia Marina Nohara

Title: Chief Financial Officer

By: /s/ Daniel Moreira

Name: Daniel Moreira

Title: Legal Director

AMYRIS BIOTECNOLOGIA DO BRASIL LTDA., a Brazilian limited liability company

By: /s/ Claudia Marina Nohara

Name: Claudia Marina Nohara

Title: Chief Financial Officer

By: /s/ Daniel Moreira

Name: Daniel Moreira

Title: Legal Director

AMYRIS EUROPE TRADING B.V. (NETHERLANDS), a Netherlands limited liability company

By: /s/ Luca Galantucci

Name: Luca Galantucci

Title: Director

AMYRIS BIO PRODUCTS PORTUGAL, UNIPESSOAL, LDA., a Portugal liability company

By: /s/ Shannon Griffin

Name: Shannon Griffin

Title: Director

BEAUTY LABS INTERNATIONAL LIMITED, a United Kingdom limited company

By: /s/ Luca Galantucci

Name: Luca Galantucci

Title: Director

AMYRIS UK TRADING LIMITED, a United Kingdom limited company

By: /s/ Luca Galantucci

Name: Luca Galantucci

Title: Director

CLEAN BEAUTY 4U LLC, a Delaware limited liability company

By: Amyris, Inc.

Its: Manager

By: /s/ Han Kieftenbeld

Name: Han Kieftenbeld

Title: Interim Chief Executive Officer and Chief Financial Officer

CLEAN BEAUTY COLLABORATIVE, INC., a Delaware corporation

By: /s/ Caroline Hadfield

Name: Caroline Hadfield

Title: Chief Executive Officer & President

ADMINISTRATIVE AGENT:

EUAGORE, LLC, a Delaware limited liability company

By: /s/ Barbara S. Hager

Name: Barbara S. Hager

Title: Manager

LENDER:

EUAGORE, LLC, a Delaware limited liability company

By: /s/ Barbara S. Hager

Name: Barbara S. Hager

Title: Manager

UST Form 11-MOR (12/01/2021) 1 UNITED STATES BANKRUPTCY COURT DISTRICT OFFOR THE DELAWARE In Re. Amyris, Inc. Debtor(s) § § § § Case No. 23-11131 Lead Case No. 23-11131 Jointly Administered Amended Monthly Operating Report Chapter 11 Reporting Period Ended: 08/31/2023 Petition Date: 08/09/2023 Months Pending: 1 Industry Classification: 3 2 5 4 Reporting Method: Accrual Basis Cash Basis Debtor's Full-Time Employees (current): 446 Debtor's Full-Time Employees (as of date of order for relief): 449 Supporting Documentation (check all that are attached): (For jointly administered debtors, any required schedules must be provided on a non-consolidated basis for each debtor) Statement of cash receipts and disbursements Balance sheet containing the summary and detail of the assets, liabilities and equity (net worth) or deficit Statement of operations (profit or loss statement) Accounts receivable aging Postpetition liabilities aging Statement of capital assets Schedule of payments to professionals Schedule of payments to insiders All bank statements and bank reconciliations for the reporting period Description of the assets sold or transferred and the terms of the sale or transfer Signature of Responsible Party Printed Name of Responsible Party Date Address /s/ James E. O'Neill 09/29/2023 James E O'Neill 919 N. Market Street, 17th Flr., Wilmington, DE 19801 STATEMENT: This Periodic Report is associated with an open bankruptcy case; therefore, Paperwork Reduction Act exemption 5 C.F.R. § 1320.4(a)(2) applies. Case 23-11131-TMH Doc 421 Filed 10/02/23 Page 1 of 12 Exhibit 99.1

UST Form 11-MOR (12/01/2021) 2 Debtor's Name Amyris, Inc. Case No. 23-11131 Part 1: Cash Receipts and Disbursements Current Month Cumulative a. Cash balance beginning of month $7,982,093 b. Total receipts (net of transfers between accounts) $36,447,956 $36,447,956 c. Total disbursements (net of transfers between accounts) $26,235,447 $26,235,447 d. Cash balance end of month (a+b-c) $18,194,602 e. Disbursements made by third party for the benefit of the estate $0 $0 f. Total disbursements for quarterly fee calculation (c+e) $26,235,447 $26,235,447 Part 2: Asset and Liability Status Current Month (Not generally applicable to Individual Debtors. See Instructions.) a. Accounts receivable (total net of allowance) $14,175,594 b. Accounts receivable over 90 days outstanding (net of allowance) $275,251 c. Inventory ( (attach explanation))Book Market Other $16,378,762 d Total current assets $126,778,945 e. Total assets $817,754,877 f. Postpetition payables (excluding taxes) $9,736,533 g. Postpetition payables past due (excluding taxes) $285,258 h. Postpetition taxes payable $0 i. Postpetition taxes past due $0 j. Total postpetition debt (f+h) $9,736,533 k. Prepetition secured debt $167,740,402 l. Prepetition priority debt $105,440 m. Prepetition unsecured debt $729,157,923 n. Total liabilities (debt) (j+k+l+m) $906,740,298 o. Ending equity/net worth (e-n) $-88,985,421 Part 3: Assets Sold or Transferred Current Month Cumulative a. Total cash sales price for assets sold/transferred outside the ordinary course of business $0 $0 b. Total payments to third parties incident to assets being sold/transferred outside the ordinary course of business $0 $0 c. Net cash proceeds from assets sold/transferred outside the ordinary course of business (a-b) $0 $0 Part 4: Income Statement (Statement of Operations) Current Month Cumulative (Not generally applicable to Individual Debtors. See Instructions.) a. Gross income/sales (net of returns and allowances) $3,322,275 b. Cost of goods sold (inclusive of depreciation, if applicable) $783,016 c. Gross profit (a-b) $2,539,259 d. Selling expenses $9,720,402 e. General and administrative expenses $61,964 f. Other expenses $5,714,140 g. Depreciation and/or amortization (not included in 4b) $696,595 h. Interest $5,767,895 i. Taxes (local, state, and federal) $32 j. Reorganization items $0 k. Profit (loss) $-19,297,778 $-19,297,778 Case 23-11131-TMH Doc 421 Filed 10/02/23 Page 2 of 12

UST Form 11-MOR (12/01/2021) 3 Debtor's Name Amyris, Inc. Case No. 23-11131 Part 5: Professional Fees and Expenses Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative a. Debtor's professional fees & expenses (bankruptcy) Aggregate Total $0 $0 $0 $0 Itemized Breakdown by Firm Firm Name Role i Nothing to report $0 $0 $0 $0 ii iii iv v vi vii viii ix x xi xii xiii xiv xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi Case 23-11131-TMH Doc 421 Filed 10/02/23 Page 3 of 12

UST Form 11-MOR (12/01/2021) 4 Debtor's Name Amyris, Inc. Case No. 23-11131 xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii Case 23-11131-TMH Doc 421 Filed 10/02/23 Page 4 of 12

UST Form 11-MOR (12/01/2021) 5 Debtor's Name Amyris, Inc. Case No. 23-11131 lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii xcix c ci Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative b. Debtor's professional fees & expenses (nonbankruptcy) Aggregate Total $0 $0 $0 $0 Itemized Breakdown by Firm Firm Name Role i Nothing to report $0 $0 $0 $0 ii iii iv v vi vii viii ix x xi xii xiii xiv Case 23-11131-TMH Doc 421 Filed 10/02/23 Page 5 of 12

UST Form 11-MOR (12/01/2021) 6 Debtor's Name Amyris, Inc. Case No. 23-11131 xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi Case 23-11131-TMH Doc 421 Filed 10/02/23 Page 6 of 12

UST Form 11-MOR (12/01/2021) 7 Debtor's Name Amyris, Inc. Case No. 23-11131 lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii Case 23-11131-TMH Doc 421 Filed 10/02/23 Page 7 of 12

UST Form 11-MOR (12/01/2021) 8 Debtor's Name Amyris, Inc. Case No. 23-11131 xcix c c. All professional fees and expenses (debtor & committees) $0 $0 $0 $0 Part 6: Postpetition Taxes Current Month Cumulative a. Postpetition income taxes accrued (local, state, and federal) $0 $0 b. Postpetition income taxes paid (local, state, and federal) $0 $0 c. Postpetition employer payroll taxes accrued $340,382 $340,382 d. Postpetition employer payroll taxes paid $340,382 $340,382 e. Postpetition property taxes paid $0 $0 f. Postpetition other taxes accrued (local, state, and federal) $0 $0 g. Postpetition other taxes paid (local, state, and federal) $0 $0 Part 7: Questionnaire - During this reporting period: a. Were any payments made on prepetition debt? (if yes, see Instructions) Yes No b. Yes NoWere any payments made outside the ordinary course of business without court approval? (if yes, see Instructions) c. Yes NoWere any payments made to or on behalf of insiders? d. Yes NoAre you current on postpetition tax return filings? e. Yes NoAre you current on postpetition estimated tax payments? f. Were all trust fund taxes remitted on a current basis? Yes No g. Yes NoWas there any postpetition borrowing, other than trade credit? (if yes, see Instructions) h. Were all payments made to or on behalf of professionals approved by the court? Yes No N/A i. Do you have: Worker's compensation insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) Casualty/property insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) General liability insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) j. Has a plan of reorganization been filed with the court? Yes No k. Has a disclosure statement been filed with the court? Yes No l. Are you current with quarterly U.S. Trustee fees as set forth under 28 U.S.C. § 1930? Yes No Case 23-11131-TMH Doc 421 Filed 10/02/23 Page 8 of 12

UST Form 11-MOR (12/01/2021) 9 Debtor's Name Amyris, Inc. Case No. 23-11131 Part 8: Individual Chapter 11 Debtors (Only) a. Gross income (receipts) from salary and wages $0 b. Gross income (receipts) from self-employment $0 c. Gross income from all other sources $0 d. Total income in the reporting period (a+b+c) $0 e. Payroll deductions $0 f. Self-employment related expenses $0 g. Living expenses $0 h. All other expenses $0 i. Total expenses in the reporting period (e+f+g+h) $0 j. Difference between total income and total expenses (d-i) $0 k. List the total amount of all postpetition debts that are past due $0 l. Are you required to pay any Domestic Support Obligations as defined by 11 U.S.C § 101(14A)? Yes No m. Yes No N/AIf yes, have you made all Domestic Support Obligation payments? Privacy Act Statement 28 U.S.C. § 589b authorizes the collection of this information, and provision of this information is mandatory under 11 U.S.C. §§ 704, 1106, and 1107. The United States Trustee will use this information to calculate statutory fee assessments under 28 U.S.C. § 1930(a)(6). The United States Trustee will also use this information to evaluate a chapter 11 debtor's progress through the bankruptcy system, including the likelihood of a plan of reorganization being confirmed and whether the case is being prosecuted in good faith. This information may be disclosed to a bankruptcy trustee or examiner when the information is needed to perform the trustee's or examiner's duties or to the appropriate federal, state, local, regulatory, tribal, or foreign law enforcement agency when the information indicates a violation or potential violation of law. Other disclosures may be made for routine purposes. For a discussion of the types of routine disclosures that may be made, you may consult the Executive Office for United States Trustee's systems of records notice, UST-001, "Bankruptcy Case Files and Associated Records." See 71 Fed. Reg. 59,818 et seq. (Oct. 11, 2006). A copy of the notice may be obtained at the following link: http:// www.justice.gov/ust/eo/rules_regulations/index.htm. Failure to provide this information could result in the dismissal or conversion of your bankruptcy case or other action by the United States Trustee. 11 U.S.C. § 1112(b)(4)(F). I declare under penalty of perjury that the foregoing Monthly Operating Report and its supporting documentation are true and correct and that I have been authorized to sign this report on behalf of the estate. /s/ Han Kieftenbeld Signature of Responsible Party Interim CEO and CFO Printed Name of Responsible Party 09/29/2023 DateTitle Han Kieftenbeld Case 23-11131-TMH Doc 421 Filed 10/02/23 Page 9 of 12

UST Form 11-MOR (12/01/2021) 10 Debtor's Name Amyris, Inc. Case No. 23-11131 PageOnePartOne PageOnePartTwo PageTwoPartOne PageTwoPartTwo Case 23-11131-TMH Doc 421 Filed 10/02/23 Page 10 of 12

UST Form 11-MOR (12/01/2021) 11 Debtor's Name Amyris, Inc. Case No. 23-11131 Bankruptcy51to100 NonBankruptcy1to50 NonBankruptcy51to100 Bankruptcy1to50 Case 23-11131-TMH Doc 421 Filed 10/02/23 Page 11 of 12

UST Form 11-MOR (12/01/2021) 12 Debtor's Name Amyris, Inc. Case No. 23-11131 PageFour PageThree Case 23-11131-TMH Doc 421 Filed 10/02/23 Page 12 of 12

Page 1 of 1 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE In re: AMYRIS, INC., et al., Debtors. Chapter 11 Case No. 23-11131 (TMH) (Jointly Administered) SUPPLEMENTAL GLOBAL NOTES FOR THE AMENDED AUGUST 2023 MONTHLY OPERATING REPORT The Debtors are filing this amended monthly operating report (the “Amended MOR”) to correct amounts previously reported in the original MOR filed on September 26, 2023. The previously reported amounts under Part 4: Income Statement (Statement of Operations), Part 6: Postpetition Taxes and in Attachment 3: Statement of Operations were reported on a year- to-date basis. The amounts in the Amended MOR have been corrected to reflect month-to- date activity for August 2023. Only the supporting documentation that was affected by such additional information has been attached to the Amended MOR. Please refer to the original MOR filed at Docket Nos. 370 – 380 for all other attachments, including global notes. Case 23-11131-TMH Doc 421-1 Filed 10/02/23 Page 1 of 1

In re: Amyris, Inc et al. Case Number: 23-11131 (TMH) Reporting Period: 8/1/2023 - 8/31/2023 Amyris, Inc. Amyris Fuels, LLC Aprinnova, LLC Amyris Clean Beauty, Inc. Onda Beauty Inc. Clean Beauty Collaborative, Inc. Clean Beauty 4U LLC Upland 1 LLC Clean Beauty 4U Holdings, LLC Amyris-Olika, LLC AB Technologies $ in actuals 23-11131 23-11136 23-11137 23-11134 23-11138 23-11224 23-11225 23-11139 23-11226 23-11133 23-11132 Total revenue 3,322,275 - 1,336,162 5,770,432 70,285 1,240,337 331,093 Cost of products sold 783,016 - 2,263,665 3,478,889 1,018 1,159,324 243,471 Cost of services - - - - - - - Cost of products/services sold - Other 85,495 - 376,690 464,134 2,259 53,686 63,104 Cost of products sold 868,511 - 2,640,355 3,943,023 3,277 1,213,010 306,575 - - - - Research and development 8,187,060 - - - - - - Sales, general and administrative 7,753,175 - (18,311) 13,966,052 447,836 1,083,578 322,971 Total operating expenses 15,940,235 - (18,311) 13,966,052 447,836 1,083,578 322,971 Total costs and expenses 16,808,745 - 2,622,044 17,909,075 451,114 2,296,588 629,546 Gain(Loss) From Operations (13,486,471) - (1,285,882) (12,138,643) (380,828) (1,056,251) (298,453) Other income(expense) (5,811,339) - (83,501) (116,793) - (4,459) - Gain(Loss) before inc taxes & min interest (19,297,810) - (1,369,384) (12,255,436) (380,828) (1,060,710) (298,453) Income taxes 32 - - - - - - Minority interest - - - - - - - Net Gain(Loss) (19,297,778) - (1,369,384) (12,255,436) (380,828) (1,060,710) (298,453) Attachment 3: Statement of Operations Case 23-11131-TMH Doc 421-2 Filed 10/02/23 Page 1 of 1

UST Form 11-MOR (12/01/2021) 1 UNITED STATES BANKRUPTCY COURT DISTRICT OFFOR THE DELAWARE In Re. Amyris Clean Beauty, Inc. Debtor(s) § § § § Case No. 23-11134 Lead Case No. 23-11131 Jointly Administered Amended Monthly Operating Report Chapter 11 Reporting Period Ended: 08/31/2023 Petition Date: 08/09/2023 Months Pending: 1 Industry Classification: 3 2 5 4 Reporting Method: Accrual Basis Cash Basis Debtor's Full-Time Employees (current): 181 Debtor's Full-Time Employees (as of date of order for relief): 181 Supporting Documentation (check all that are attached): (For jointly administered debtors, any required schedules must be provided on a non-consolidated basis for each debtor) Statement of cash receipts and disbursements Balance sheet containing the summary and detail of the assets, liabilities and equity (net worth) or deficit Statement of operations (profit or loss statement) Accounts receivable aging Postpetition liabilities aging Statement of capital assets Schedule of payments to professionals Schedule of payments to insiders All bank statements and bank reconciliations for the reporting period Description of the assets sold or transferred and the terms of the sale or transfer Printed Name of Responsible Party Date Address /s/ James E. O'Neill Signature of Responsible Party 10/02/2023 James E. O'Neill 919 N. Market Street, 17th Flr., Wilmington, DE 19801 STATEMENT: This Periodic Report is associated with an open bankruptcy case; therefore, Paperwork Reduction Act exemption 5 C.F.R. § 1320.4(a)(2) applies. Case 23-11131-TMH Doc 422 Filed 10/03/23 Page 1 of 12 Exhibit 99.2

UST Form 11-MOR (12/01/2021) 2 Debtor's Name Amyris Clean Beauty, Inc. Case No. 23-11134 Part 1: Cash Receipts and Disbursements Current Month Cumulative a. Cash balance beginning of month $489,895 b. Total receipts (net of transfers between accounts) $2,053,014 $2,053,014 c. Total disbursements (net of transfers between accounts) $1,382,376 $1,382,376 d. Cash balance end of month (a+b-c) $1,160,533 e. Disbursements made by third party for the benefit of the estate $0 $0 f. Total disbursements for quarterly fee calculation (c+e) $1,382,376 $1,382,376 Part 2: Asset and Liability Status Current Month (Not generally applicable to Individual Debtors. See Instructions.) a. Accounts receivable (total net of allowance) $6,701,108 b. Accounts receivable over 90 days outstanding (net of allowance) $2,196,341 c. Inventory ( (attach explanation))Book Market Other $53,855,873 d Total current assets $72,455,651 e. Total assets $-322,477,468 f. Postpetition payables (excluding taxes) $5,876,994 g. Postpetition payables past due (excluding taxes) $61,470 h. Postpetition taxes payable $0 i. Postpetition taxes past due $0 j. Total postpetition debt (f+h) $5,876,994 k. Prepetition secured debt $0 l. Prepetition priority debt $229,093 m. Prepetition unsecured debt $43,542,614 n. Total liabilities (debt) (j+k+l+m) $49,648,701 o. Ending equity/net worth (e-n) $-372,126,169 Part 3: Assets Sold or Transferred Current Month Cumulative a. Total cash sales price for assets sold/transferred outside the ordinary course of business $0 $0 b. Total payments to third parties incident to assets being sold/transferred outside the ordinary course of business $0 $0 c. Net cash proceeds from assets sold/transferred outside the ordinary course of business (a-b) $0 $0 Part 4: Income Statement (Statement of Operations) Current Month Cumulative (Not generally applicable to Individual Debtors. See Instructions.) a. Gross income/sales (net of returns and allowances) $5,770,432 b. Cost of goods sold (inclusive of depreciation, if applicable) $3,478,889 c. Gross profit (a-b) $2,291,543 d. Selling expenses $9,149,286 e. General and administrative expenses $1,113,872 f. Other expenses $3,981,037 g. Depreciation and/or amortization (not included in 4b) $213,878 h. Interest $88,906 i. Taxes (local, state, and federal) $0 j. Reorganization items $0 k. Profit (loss) $-12,255,436 $-12,255,436 Case 23-11131-TMH Doc 422 Filed 10/03/23 Page 2 of 12

UST Form 11-MOR (12/01/2021) 3 Debtor's Name Amyris Clean Beauty, Inc. Case No. 23-11134 Part 5: Professional Fees and Expenses Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative a. Debtor's professional fees & expenses (bankruptcy) Aggregate Total $0 $0 $0 $0 Itemized Breakdown by Firm Firm Name Role i Nothing to report $0 $0 $0 $0 ii iii iv v vi vii viii ix x xi xii xiii xiv xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi Case 23-11131-TMH Doc 422 Filed 10/03/23 Page 3 of 12

UST Form 11-MOR (12/01/2021) 4 Debtor's Name Amyris Clean Beauty, Inc. Case No. 23-11134 xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii Case 23-11131-TMH Doc 422 Filed 10/03/23 Page 4 of 12

UST Form 11-MOR (12/01/2021) 5 Debtor's Name Amyris Clean Beauty, Inc. Case No. 23-11134 lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii xcix c ci Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative b. Debtor's professional fees & expenses (nonbankruptcy) Aggregate Total $0 $0 $0 $0 Itemized Breakdown by Firm Firm Name Role i Nothing to report $0 $0 $0 $0 ii iii iv v vi vii viii ix x xi xii xiii xiv Case 23-11131-TMH Doc 422 Filed 10/03/23 Page 5 of 12

UST Form 11-MOR (12/01/2021) 6 Debtor's Name Amyris Clean Beauty, Inc. Case No. 23-11134 xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi Case 23-11131-TMH Doc 422 Filed 10/03/23 Page 6 of 12

UST Form 11-MOR (12/01/2021) 7 Debtor's Name Amyris Clean Beauty, Inc. Case No. 23-11134 lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii Case 23-11131-TMH Doc 422 Filed 10/03/23 Page 7 of 12

UST Form 11-MOR (12/01/2021) 8 Debtor's Name Amyris Clean Beauty, Inc. Case No. 23-11134 xcix c c. All professional fees and expenses (debtor & committees) $0 $0 $0 $0 Part 6: Postpetition Taxes Current Month Cumulative a. Postpetition income taxes accrued (local, state, and federal) $0 $0 b. Postpetition income taxes paid (local, state, and federal) $0 $0 c. Postpetition employer payroll taxes accrued $458,978 $458,978 d. Postpetition employer payroll taxes paid $458,978 $458,978 e. Postpetition property taxes paid $0 $0 f. Postpetition other taxes accrued (local, state, and federal) $0 $0 g. Postpetition other taxes paid (local, state, and federal) $458,978 $458,978 Part 7: Questionnaire - During this reporting period: a. Were any payments made on prepetition debt? (if yes, see Instructions) Yes No b. Yes NoWere any payments made outside the ordinary course of business without court approval? (if yes, see Instructions) c. Yes NoWere any payments made to or on behalf of insiders? d. Yes NoAre you current on postpetition tax return filings? e. Yes NoAre you current on postpetition estimated tax payments? f. Were all trust fund taxes remitted on a current basis? Yes No g. Yes NoWas there any postpetition borrowing, other than trade credit? (if yes, see Instructions) h. Were all payments made to or on behalf of professionals approved by the court? Yes No N/A i. Do you have: Worker's compensation insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) Casualty/property insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) General liability insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) j. Has a plan of reorganization been filed with the court? Yes No k. Has a disclosure statement been filed with the court? Yes No l. Are you current with quarterly U.S. Trustee fees as set forth under 28 U.S.C. § 1930? Yes No Case 23-11131-TMH Doc 422 Filed 10/03/23 Page 8 of 12

UST Form 11-MOR (12/01/2021) 9 Debtor's Name Amyris Clean Beauty, Inc. Case No. 23-11134 Part 8: Individual Chapter 11 Debtors (Only) a. Gross income (receipts) from salary and wages $0 b. Gross income (receipts) from self-employment $0 c. Gross income from all other sources $0 d. Total income in the reporting period (a+b+c) $0 e. Payroll deductions $0 f. Self-employment related expenses $0 g. Living expenses $0 h. All other expenses $0 i. Total expenses in the reporting period (e+f+g+h) $0 j. Difference between total income and total expenses (d-i) $0 k. List the total amount of all postpetition debts that are past due $0 l. Are you required to pay any Domestic Support Obligations as defined by 11 U.S.C § 101(14A)? Yes No m. Yes No N/AIf yes, have you made all Domestic Support Obligation payments? Privacy Act Statement 28 U.S.C. § 589b authorizes the collection of this information, and provision of this information is mandatory under 11 U.S.C. §§ 704, 1106, and 1107. The United States Trustee will use this information to calculate statutory fee assessments under 28 U.S.C. § 1930(a)(6). The United States Trustee will also use this information to evaluate a chapter 11 debtor's progress through the bankruptcy system, including the likelihood of a plan of reorganization being confirmed and whether the case is being prosecuted in good faith. This information may be disclosed to a bankruptcy trustee or examiner when the information is needed to perform the trustee's or examiner's duties or to the appropriate federal, state, local, regulatory, tribal, or foreign law enforcement agency when the information indicates a violation or potential violation of law. Other disclosures may be made for routine purposes. For a discussion of the types of routine disclosures that may be made, you may consult the Executive Office for United States Trustee's systems of records notice, UST-001, "Bankruptcy Case Files and Associated Records." See 71 Fed. Reg. 59,818 et seq. (Oct. 11, 2006). A copy of the notice may be obtained at the following link: http:// www.justice.gov/ust/eo/rules_regulations/index.htm. Failure to provide this information could result in the dismissal or conversion of your bankruptcy case or other action by the United States Trustee. 11 U.S.C. § 1112(b)(4)(F). I declare under penalty of perjury that the foregoing Monthly Operating Report and its supporting documentation are true and correct and that I have been authorized to sign this report on behalf of the estate. /s/ Han Kieftenbeld Signature of Responsible Party Interim CEO and CFO Printed Name of Responsible Party 10/02/2023 DateTitle Han Kieftenbeld Case 23-11131-TMH Doc 422 Filed 10/03/23 Page 9 of 12

UST Form 11-MOR (12/01/2021) 10 Debtor's Name Amyris Clean Beauty, Inc. Case No. 23-11134 PageOnePartOne PageOnePartTwo PageTwoPartOne PageTwoPartTwo Case 23-11131-TMH Doc 422 Filed 10/03/23 Page 10 of 12

UST Form 11-MOR (12/01/2021) 11 Debtor's Name Amyris Clean Beauty, Inc. Case No. 23-11134 Bankruptcy51to100 NonBankruptcy1to50 NonBankruptcy51to100 Bankruptcy1to50 Case 23-11131-TMH Doc 422 Filed 10/03/23 Page 11 of 12

UST Form 11-MOR (12/01/2021) 12 Debtor's Name Amyris Clean Beauty, Inc. Case No. 23-11134 PageFour PageThree Case 23-11131-TMH Doc 422 Filed 10/03/23 Page 12 of 12

Page 1 of 1 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE In re: AMYRIS, INC., et al., Debtors. Chapter 11 Case No. 23-11131 (TMH) (Jointly Administered) SUPPLEMENTAL GLOBAL NOTES FOR THE AMENDED AUGUST 2023 MONTHLY OPERATING REPORT The Debtors are filing this amended monthly operating report (the “Amended MOR”) to correct amounts previously reported in the original MOR filed on September 26, 2023. The previously reported amounts under Part 4: Income Statement (Statement of Operations), Part 6: Postpetition Taxes and in Attachment 3: Statement of Operations were reported on a year- to-date basis. The amounts in the Amended MOR have been corrected to reflect month-to- date activity for August 2023. Only the supporting documentation that was affected by such additional information has been attached to the Amended MOR. Please refer to the original MOR filed at Docket Nos. 370 – 380 for all other attachments, including global notes. Case 23-11131-TMH Doc 422-1 Filed 10/03/23 Page 1 of 1

UST Form 11-MOR (12/01/2021) 1 UNITED STATES BANKRUPTCY COURT DISTRICT OFFOR THE DELAWARE In Re. Aprinnova, LLC Debtor(s) § § § § Case No. 23-11137 Lead Case No. 23-11131 Jointly Administered Amended Monthly Operating Report Chapter 11 Reporting Period Ended: 08/31/2023 Petition Date: 08/09/2023 Months Pending: 1 Industry Classification: 3 2 5 4 Reporting Method: Accrual Basis Cash Basis Debtor's Full-Time Employees (current): 33 Debtor's Full-Time Employees (as of date of order for relief): 34 Supporting Documentation (check all that are attached): (For jointly administered debtors, any required schedules must be provided on a non-consolidated basis for each debtor) Statement of cash receipts and disbursements Balance sheet containing the summary and detail of the assets, liabilities and equity (net worth) or deficit Statement of operations (profit or loss statement) Accounts receivable aging Postpetition liabilities aging Statement of capital assets Schedule of payments to professionals Schedule of payments to insiders All bank statements and bank reconciliations for the reporting period Description of the assets sold or transferred and the terms of the sale or transfer Printed Name of Responsible Party Date Address /s/ James E. O'Neill Signature of Responsible Party 10/02/2023 James E. O'Neill 919 N. Market Street, 17th Flr., Wilmington, DE 19801 STATEMENT: This Periodic Report is associated with an open bankruptcy case; therefore, Paperwork Reduction Act exemption 5 C.F.R. § 1320.4(a)(2) applies. Case 23-11131-TMH Doc 423 Filed 10/03/23 Page 1 of 12 Exhibit 99.3

UST Form 11-MOR (12/01/2021) 2 Debtor's Name Aprinnova, LLC Case No. 23-11137 Part 1: Cash Receipts and Disbursements Current Month Cumulative a. Cash balance beginning of month $751,076 b. Total receipts (net of transfers between accounts) $1,959,323 $1,959,323 c. Total disbursements (net of transfers between accounts) $74,159 $74,159 d. Cash balance end of month (a+b-c) $2,636,240 e. Disbursements made by third party for the benefit of the estate $0 $0 f. Total disbursements for quarterly fee calculation (c+e) $74,159 $74,159 Part 2: Asset and Liability Status Current Month (Not generally applicable to Individual Debtors. See Instructions.) a. Accounts receivable (total net of allowance) $14,175,594 b. Accounts receivable over 90 days outstanding (net of allowance) $218,284 c. Inventory ( (attach explanation))Book Market Other $3,301,330 d Total current assets $27,246,544 e. Total assets $247,659,190 f. Postpetition payables (excluding taxes) $817,944 g. Postpetition payables past due (excluding taxes) $67,916 h. Postpetition taxes payable $0 i. Postpetition taxes past due $0 j. Total postpetition debt (f+h) $817,944 k. Prepetition secured debt $0 l. Prepetition priority debt $43,182 m. Prepetition unsecured debt $1,554,190 n. Total liabilities (debt) (j+k+l+m) $2,415,316 o. Ending equity/net worth (e-n) $245,243,874 Part 3: Assets Sold or Transferred Current Month Cumulative a. Total cash sales price for assets sold/transferred outside the ordinary course of business $0 $0 b. Total payments to third parties incident to assets being sold/transferred outside the ordinary course of business $0 $0 c. Net cash proceeds from assets sold/transferred outside the ordinary course of business (a-b) $0 $0 Part 4: Income Statement (Statement of Operations) Current Month Cumulative (Not generally applicable to Individual Debtors. See Instructions.) a. Gross income/sales (net of returns and allowances) $1,336,162 b. Cost of goods sold (inclusive of depreciation, if applicable) $2,263,665 c. Gross profit (a-b) $-927,503 d. Selling expenses $296,746 e. General and administrative expenses $10,207 f. Other expenses $56,456 g. Depreciation and/or amortization (not included in 4b) $26,268 h. Interest $72,617 i. Taxes (local, state, and federal) $0 j. Reorganization items $0 k. Profit (loss) $-1,369,384 $-1,369,384 Case 23-11131-TMH Doc 423 Filed 10/03/23 Page 2 of 12

UST Form 11-MOR (12/01/2021) 3 Debtor's Name Aprinnova, LLC Case No. 23-11137 Part 5: Professional Fees and Expenses Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative a. Debtor's professional fees & expenses (bankruptcy) Aggregate Total $0 $0 $0 $0 Itemized Breakdown by Firm Firm Name Role i Nothing to report $0 $0 $0 $0 ii iii iv v vi vii viii ix x xi xii xiii xiv xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi Case 23-11131-TMH Doc 423 Filed 10/03/23 Page 3 of 12

UST Form 11-MOR (12/01/2021) 4 Debtor's Name Aprinnova, LLC Case No. 23-11137 xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii Case 23-11131-TMH Doc 423 Filed 10/03/23 Page 4 of 12

UST Form 11-MOR (12/01/2021) 5 Debtor's Name Aprinnova, LLC Case No. 23-11137 lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii xcix c ci Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative b. Debtor's professional fees & expenses (nonbankruptcy) Aggregate Total $0 $0 $0 $0 Itemized Breakdown by Firm Firm Name Role i Nothing to report $0 $0 $0 $0 ii iii iv v vi vii viii ix x xi xii xiii xiv Case 23-11131-TMH Doc 423 Filed 10/03/23 Page 5 of 12

UST Form 11-MOR (12/01/2021) 6 Debtor's Name Aprinnova, LLC Case No. 23-11137 xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi Case 23-11131-TMH Doc 423 Filed 10/03/23 Page 6 of 12

UST Form 11-MOR (12/01/2021) 7 Debtor's Name Aprinnova, LLC Case No. 23-11137 lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii Case 23-11131-TMH Doc 423 Filed 10/03/23 Page 7 of 12

UST Form 11-MOR (12/01/2021) 8 Debtor's Name Aprinnova, LLC Case No. 23-11137 xcix c c. All professional fees and expenses (debtor & committees) $0 $0 $0 $0 Part 6: Postpetition Taxes Current Month Cumulative a. Postpetition income taxes accrued (local, state, and federal) $0 $0 b. Postpetition income taxes paid (local, state, and federal) $0 $0 c. Postpetition employer payroll taxes accrued $22,092 $22,092 d. Postpetition employer payroll taxes paid $22,092 $22,092 e. Postpetition property taxes paid $0 $0 f. Postpetition other taxes accrued (local, state, and federal) $0 $0 g. Postpetition other taxes paid (local, state, and federal) $22,099 $22,099 Part 7: Questionnaire - During this reporting period: a. Were any payments made on prepetition debt? (if yes, see Instructions) Yes No b. Yes NoWere any payments made outside the ordinary course of business without court approval? (if yes, see Instructions) c. Yes NoWere any payments made to or on behalf of insiders? d. Yes NoAre you current on postpetition tax return filings? e. Yes NoAre you current on postpetition estimated tax payments? f. Were all trust fund taxes remitted on a current basis? Yes No g. Yes NoWas there any postpetition borrowing, other than trade credit? (if yes, see Instructions) h. Were all payments made to or on behalf of professionals approved by the court? Yes No N/A i. Do you have: Worker's compensation insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) Casualty/property insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) General liability insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) j. Has a plan of reorganization been filed with the court? Yes No k. Has a disclosure statement been filed with the court? Yes No l. Are you current with quarterly U.S. Trustee fees as set forth under 28 U.S.C. § 1930? Yes No Case 23-11131-TMH Doc 423 Filed 10/03/23 Page 8 of 12

UST Form 11-MOR (12/01/2021) 9 Debtor's Name Aprinnova, LLC Case No. 23-11137 Part 8: Individual Chapter 11 Debtors (Only) a. Gross income (receipts) from salary and wages $0 b. Gross income (receipts) from self-employment $0 c. Gross income from all other sources $0 d. Total income in the reporting period (a+b+c) $0 e. Payroll deductions $0 f. Self-employment related expenses $0 g. Living expenses $0 h. All other expenses $0 i. Total expenses in the reporting period (e+f+g+h) $0 j. Difference between total income and total expenses (d-i) $0 k. List the total amount of all postpetition debts that are past due $0 l. Are you required to pay any Domestic Support Obligations as defined by 11 U.S.C § 101(14A)? Yes No m. Yes No N/AIf yes, have you made all Domestic Support Obligation payments? Privacy Act Statement 28 U.S.C. § 589b authorizes the collection of this information, and provision of this information is mandatory under 11 U.S.C. §§ 704, 1106, and 1107. The United States Trustee will use this information to calculate statutory fee assessments under 28 U.S.C. § 1930(a)(6). The United States Trustee will also use this information to evaluate a chapter 11 debtor's progress through the bankruptcy system, including the likelihood of a plan of reorganization being confirmed and whether the case is being prosecuted in good faith. This information may be disclosed to a bankruptcy trustee or examiner when the information is needed to perform the trustee's or examiner's duties or to the appropriate federal, state, local, regulatory, tribal, or foreign law enforcement agency when the information indicates a violation or potential violation of law. Other disclosures may be made for routine purposes. For a discussion of the types of routine disclosures that may be made, you may consult the Executive Office for United States Trustee's systems of records notice, UST-001, "Bankruptcy Case Files and Associated Records." See 71 Fed. Reg. 59,818 et seq. (Oct. 11, 2006). A copy of the notice may be obtained at the following link: http:// www.justice.gov/ust/eo/rules_regulations/index.htm. Failure to provide this information could result in the dismissal or conversion of your bankruptcy case or other action by the United States Trustee. 11 U.S.C. § 1112(b)(4)(F). I declare under penalty of perjury that the foregoing Monthly Operating Report and its supporting documentation are true and correct and that I have been authorized to sign this report on behalf of the estate. /s/ Han Kieftenbeld Signature of Responsible Party Interim CEO and CFO Printed Name of Responsible Party 10/02/2023 DateTitle Han Keiftenbeld Case 23-11131-TMH Doc 423 Filed 10/03/23 Page 9 of 12

UST Form 11-MOR (12/01/2021) 10 Debtor's Name Aprinnova, LLC Case No. 23-11137 PageOnePartOne PageOnePartTwo PageTwoPartOne PageTwoPartTwo Case 23-11131-TMH Doc 423 Filed 10/03/23 Page 10 of 12

UST Form 11-MOR (12/01/2021) 11 Debtor's Name Aprinnova, LLC Case No. 23-11137 Bankruptcy51to100 NonBankruptcy1to50 NonBankruptcy51to100 Bankruptcy1to50 Case 23-11131-TMH Doc 423 Filed 10/03/23 Page 11 of 12

UST Form 11-MOR (12/01/2021) 12 Debtor's Name Aprinnova, LLC Case No. 23-11137 PageFour PageThree Case 23-11131-TMH Doc 423 Filed 10/03/23 Page 12 of 12

Page 1 of 1 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE In re: AMYRIS, INC., et al., Debtors. Chapter 11 Case No. 23-11131 (TMH) (Jointly Administered) SUPPLEMENTAL GLOBAL NOTES FOR THE AMENDED AUGUST 2023 MONTHLY OPERATING REPORT The Debtors are filing this amended monthly operating report (the “Amended MOR”) to correct amounts previously reported in the original MOR filed on September 26, 2023. The previously reported amounts under Part 4: Income Statement (Statement of Operations), Part 6: Postpetition Taxes and in Attachment 3: Statement of Operations were reported on a year- to-date basis. The amounts in the Amended MOR have been corrected to reflect month-to- date activity for August 2023. Only the supporting documentation that was affected by such additional information has been attached to the Amended MOR. Please refer to the original MOR filed at Docket Nos. 370 – 380 for all other attachments, including global notes. Case 23-11131-TMH Doc 423-1 Filed 10/03/23 Page 1 of 1

UST Form 11-MOR (12/01/2021) 1 UNITED STATES BANKRUPTCY COURT DISTRICT OFFOR THE DELAWARE In Re. Clean Beauty 4U, LLC Debtor(s) § § § § Case No. 23-11225 Lead Case No. 23-11131 Jointly Administered Amended Monthly Operating Report Chapter 11 Reporting Period Ended: 08/31/2023 Petition Date: 08/21/2023 Months Pending: 0 Industry Classification: 3 2 5 4 Reporting Method: Accrual Basis Cash Basis Debtor's Full-Time Employees (current): 9 Debtor's Full-Time Employees (as of date of order for relief): 9 Supporting Documentation (check all that are attached): (For jointly administered debtors, any required schedules must be provided on a non-consolidated basis for each debtor) Statement of cash receipts and disbursements Balance sheet containing the summary and detail of the assets, liabilities and equity (net worth) or deficit Statement of operations (profit or loss statement) Accounts receivable aging Postpetition liabilities aging Statement of capital assets Schedule of payments to professionals Schedule of payments to insiders All bank statements and bank reconciliations for the reporting period Description of the assets sold or transferred and the terms of the sale or transfer Signature of Responsible Party Printed Name of Responsible Party Date Address /s/ James E. O'Neill 09/29/2023 James E. O'Neill 919 N. Market Street, 17th Flr., Wilmington, DE 19801 STATEMENT: This Periodic Report is associated with an open bankruptcy case; therefore, Paperwork Reduction Act exemption 5 C.F.R. § 1320.4(a)(2) applies. Case 23-11131-TMH Doc 424 Filed 10/03/23 Page 1 of 12 Exhibit 99.4

UST Form 11-MOR (12/01/2021) 2 Debtor's Name Clean Beauty 4U, LLC Case No. 23-11225 Part 1: Cash Receipts and Disbursements Current Month Cumulative a. Cash balance beginning of month $17,733 b. Total receipts (net of transfers between accounts) $12,103 $12,103 c. Total disbursements (net of transfers between accounts) $0 $0 d. Cash balance end of month (a+b-c) $29,836 e. Disbursements made by third party for the benefit of the estate $0 $0 f. Total disbursements for quarterly fee calculation (c+e) $0 $0 Part 2: Asset and Liability Status Current Month (Not generally applicable to Individual Debtors. See Instructions.) a. Accounts receivable (total net of allowance) $508,289 b. Accounts receivable over 90 days outstanding (net of allowance) $36,372 c. Inventory ( (attach explanation))Book Market Other $2,099,701 d Total current assets $2,650,614 e. Total assets $-4,522,727 f. Postpetition payables (excluding taxes) $-25,219 g. Postpetition payables past due (excluding taxes) $-5,806 h. Postpetition taxes payable $0 i. Postpetition taxes past due $0 j. Total postpetition debt (f+h) $-25,219 k. Prepetition secured debt $0 l. Prepetition priority debt $12,211 m. Prepetition unsecured debt $2,502,362 n. Total liabilities (debt) (j+k+l+m) $2,489,354 o. Ending equity/net worth (e-n) $-7,012,081 Part 3: Assets Sold or Transferred Current Month Cumulative a. Total cash sales price for assets sold/transferred outside the ordinary course of business $0 $0 b. Total payments to third parties incident to assets being sold/transferred outside the ordinary course of business $0 $0 c. Net cash proceeds from assets sold/transferred outside the ordinary course of business (a-b) $0 $0 Part 4: Income Statement (Statement of Operations) Current Month Cumulative (Not generally applicable to Individual Debtors. See Instructions.) a. Gross income/sales (net of returns and allowances) $331,093 b. Cost of goods sold (inclusive of depreciation, if applicable) $243,471 c. Gross profit (a-b) $87,622 d. Selling expenses $331,696 e. General and administrative expenses $59,644 f. Other expenses $5,256 g. Depreciation and/or amortization (not included in 4b) $0 h. Interest $0 i. Taxes (local, state, and federal) $0 j. Reorganization items $0 k. Profit (loss) $-298,453 $-298,453 Case 23-11131-TMH Doc 424 Filed 10/03/23 Page 2 of 12

UST Form 11-MOR (12/01/2021) 3 Debtor's Name Clean Beauty 4U, LLC Case No. 23-11225 Part 5: Professional Fees and Expenses Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative a. Debtor's professional fees & expenses (bankruptcy) Aggregate Total $0 $0 $0 $0 Itemized Breakdown by Firm Firm Name Role i Nothing to report $0 $0 $0 $0 ii iii iv v vi vii viii ix x xi xii xiii xiv xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi Case 23-11131-TMH Doc 424 Filed 10/03/23 Page 3 of 12

UST Form 11-MOR (12/01/2021) 4 Debtor's Name Clean Beauty 4U, LLC Case No. 23-11225 xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii Case 23-11131-TMH Doc 424 Filed 10/03/23 Page 4 of 12

UST Form 11-MOR (12/01/2021) 5 Debtor's Name Clean Beauty 4U, LLC Case No. 23-11225 lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii xcix c ci Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative b. Debtor's professional fees & expenses (nonbankruptcy) Aggregate Total $0 $0 $0 $0 Itemized Breakdown by Firm Firm Name Role i Nothing to report $0 $0 $0 $0 ii iii iv v vi vii viii ix x xi xii xiii xiv Case 23-11131-TMH Doc 424 Filed 10/03/23 Page 5 of 12

UST Form 11-MOR (12/01/2021) 6 Debtor's Name Clean Beauty 4U, LLC Case No. 23-11225 xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi Case 23-11131-TMH Doc 424 Filed 10/03/23 Page 6 of 12

UST Form 11-MOR (12/01/2021) 7 Debtor's Name Clean Beauty 4U, LLC Case No. 23-11225 lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii Case 23-11131-TMH Doc 424 Filed 10/03/23 Page 7 of 12

UST Form 11-MOR (12/01/2021) 8 Debtor's Name Clean Beauty 4U, LLC Case No. 23-11225 xcix c c. All professional fees and expenses (debtor & committees) $0 $0 $0 $0 Part 6: Postpetition Taxes Current Month Cumulative a. Postpetition income taxes accrued (local, state, and federal) $0 $0 b. Postpetition income taxes paid (local, state, and federal) $0 $0 c. Postpetition employer payroll taxes accrued $11,783 $11,783 d. Postpetition employer payroll taxes paid $11,783 $11,783 e. Postpetition property taxes paid $0 $0 f. Postpetition other taxes accrued (local, state, and federal) $0 $0 g. Postpetition other taxes paid (local, state, and federal) $11,783 $11,783 Part 7: Questionnaire - During this reporting period: a. Were any payments made on prepetition debt? (if yes, see Instructions) Yes No b. Yes NoWere any payments made outside the ordinary course of business without court approval? (if yes, see Instructions) c. Yes NoWere any payments made to or on behalf of insiders? d. Yes NoAre you current on postpetition tax return filings? e. Yes NoAre you current on postpetition estimated tax payments? f. Were all trust fund taxes remitted on a current basis? Yes No g. Yes NoWas there any postpetition borrowing, other than trade credit? (if yes, see Instructions) h. Were all payments made to or on behalf of professionals approved by the court? Yes No N/A i. Do you have: Worker's compensation insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) Casualty/property insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) General liability insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) j. Has a plan of reorganization been filed with the court? Yes No k. Has a disclosure statement been filed with the court? Yes No l. Are you current with quarterly U.S. Trustee fees as set forth under 28 U.S.C. § 1930? Yes No Case 23-11131-TMH Doc 424 Filed 10/03/23 Page 8 of 12

UST Form 11-MOR (12/01/2021) 9 Debtor's Name Clean Beauty 4U, LLC Case No. 23-11225 Part 8: Individual Chapter 11 Debtors (Only) a. Gross income (receipts) from salary and wages $0 b. Gross income (receipts) from self-employment $0 c. Gross income from all other sources $0 d. Total income in the reporting period (a+b+c) $0 e. Payroll deductions $0 f. Self-employment related expenses $0 g. Living expenses $0 h. All other expenses $0 i. Total expenses in the reporting period (e+f+g+h) $0 j. Difference between total income and total expenses (d-i) $0 k. List the total amount of all postpetition debts that are past due $0 l. Are you required to pay any Domestic Support Obligations as defined by 11 U.S.C § 101(14A)? Yes No m. Yes No N/AIf yes, have you made all Domestic Support Obligation payments? Privacy Act Statement 28 U.S.C. § 589b authorizes the collection of this information, and provision of this information is mandatory under 11 U.S.C. §§ 704, 1106, and 1107. The United States Trustee will use this information to calculate statutory fee assessments under 28 U.S.C. § 1930(a)(6). The United States Trustee will also use this information to evaluate a chapter 11 debtor's progress through the bankruptcy system, including the likelihood of a plan of reorganization being confirmed and whether the case is being prosecuted in good faith. This information may be disclosed to a bankruptcy trustee or examiner when the information is needed to perform the trustee's or examiner's duties or to the appropriate federal, state, local, regulatory, tribal, or foreign law enforcement agency when the information indicates a violation or potential violation of law. Other disclosures may be made for routine purposes. For a discussion of the types of routine disclosures that may be made, you may consult the Executive Office for United States Trustee's systems of records notice, UST-001, "Bankruptcy Case Files and Associated Records." See 71 Fed. Reg. 59,818 et seq. (Oct. 11, 2006). A copy of the notice may be obtained at the following link: http:// www.justice.gov/ust/eo/rules_regulations/index.htm. Failure to provide this information could result in the dismissal or conversion of your bankruptcy case or other action by the United States Trustee. 11 U.S.C. § 1112(b)(4)(F). I declare under penalty of perjury that the foregoing Monthly Operating Report and its supporting documentation are true and correct and that I have been authorized to sign this report on behalf of the estate. /s/ Han Kieftenbeld Signature of Responsible Party Interim CEO and CFO Printed Name of Responsible Party 09/29/2023 DateTitle Han Kieftenbeld Case 23-11131-TMH Doc 424 Filed 10/03/23 Page 9 of 12