UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Dated February 6, 2024

Commission

File Number: 001-35788

ARCELORMITTAL

(Translation

of registrant’s name into English)

24-26,

Boulevard d’Avranches

L-1160

Luxembourg

Grand

Duchy of Luxembourg

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

On

February 5, 2024, ArcelorMittal published the press release attached hereto as Exhibit 99.1 and hereby incorporated by reference

into this report on Form 6-K.

Exhibit

Index

| Exhibit No. |

Description |

| |

|

| Exhibit 99.1 |

Press release dated February

5, 2024, ArcelorMittal announces the publication of its fourth quarter and full year 2023 sell-side analyst consensus figures |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

ARCELORMITTAL

Date

6 February 2024

| By: | /s/ Henk Scheffer |

|

|

| Name: | Henk

Scheffer |

|

| Title: | Company Secretary & Group Compliance & Data Protection Officer |

|

ARCELORMITTAL 6-K

Exhibit 99.1

ArcelorMittal announces the publication

of its fourth quarter and full year 2023 sell-side analyst consensus figures

5 February 2024, 22:15 CET

ArcelorMittal (‘the Company’) today announces the publication

of its fourth quarter and full year 2023 sell-side analysts’ consensus figures.

The consensus figures are based on analysts’ estimates recorded on

an external web-based tool provided and managed by an independent company, Visible Alpha.

To arrive at the consensus figures below, Visible Alpha has aggregated the

expectations of sell-side analysts who, to the best of our knowledge, cover ArcelorMittal on a continuous basis. This is currently a group

of approximately 11 brokers.

The listed analysts follow ArcelorMittal on their own initiative and ArcelorMittal

is not responsible for their views. ArcelorMittal is neither involved in the collection of the information nor in the compilation of the

estimates.

This consensus includes the previously announced effects of the sale of

the Company’s Kazakhstan operations to the Qazaqstan Investment Corporation (‘QIC’) that took place on 7 December 2023.

4Q’23 and FY’23 consensus

estimates

| |

|

4Q’23 |

|

FY’23 |

| |

|

|

|

|

| |

|

|

|

|

| • |

EBITDA ($m) |

$1,200 |

|

$7,492 |

| • |

Net (loss) / income ($m)* |

$(1,645) |

|

$2,239 |

| • |

(Loss) / earnings per share ($)* |

$(2.00) |

|

$2.65 |

In addition, considering the downward revisions to the expected future cash

flows of Acciaierie d'Italia (ADI), together with the uncertainty regarding its future, the Company expects to fully impair its investment

in ADI (currently approximately $1.4 billion) in the 4Q results. The resulting charge would be recorded below operating income but is

not reflected in the consensus net income and earnings per share figures above.

The sell side analysts who cover ArcelorMittal and whose estimates are included

in the 4Q’23 group consensus outlined above are the following:

| |

1. |

Bank of America – Patrick Mann |

| |

2. |

CITI – Ephrem Ravi, Krishan Agarwal |

| |

3. |

Deutsche Bank – Bastian Synagowitz |

| |

4. |

Exane – Tristan Gresser* |

| |

5. |

Groupo Santander – Robert Jackson |

| |

7. |

Jefferies – Cole Hathorn |

| |

9. |

Morgan Stanley – Alain Gabriel |

Number of sell-side analyst

participation for EBITDA consensus: All 11 brokers.

* Number of sell-side analyst

participation for net (loss) / income and (loss) / earnings per share is 10 (excluding broker that has not updated their model to reflect

the impact of Kazakhstan sale discussed above).

Disclaimer

Estimates based on Visible Alpha

consensus dated 2.2.24. The disclaimer is:

The information provided by Visible

Alpha cited herein is provided “as is” and “as available” without warranty of any kind. Use of any Visible Alpha

data is at a user’s own risk and Visible Alpha disclaims any liability for use of the Visible Alpha data. Although the information

is obtained or compiled from reliable sources Visible Alpha neither can nor does guarantee or make any representation or warranty, either

express or implied, as to the accuracy, validity, sequence, timeliness, completeness or continued availability of any information or data,

including third-party content, made available herein. In no event shall Visible Alpha be liable for any decision made or action or inaction

taken in reliance on any information or data, including third-party content. Visible Alpha further explicitly disclaims, to the fullest

extent permitted by applicable law, any warranty of any kind, whether express or implied, including warranties of merchantability, fitness

for a particular purpose and non-infringement.

The consensus estimate is based

on estimates, forecasts and predictions made by third party financial analysts, as described above. It is not prepared based on information

provided or checked by ArcelorMittal and can only be seen as a consensus view on ArcelorMittal's results from an outside perspective.

ArcelorMittal has not provided input on these forecasts, except by referring to past publicly disclosed information. ArcelorMittal does

not accept any responsibility for the quality or accuracy of any individual forecast or estimate. This web page may contain forward-looking

statements based on current assumptions and forecasts made by ArcelorMittal or third parties. Various known and unknown risks, uncertainties

and other factors could lead to material differences between ArcelorMittal's actual future results, financial situation, development or

performance, and the estimates given here. These factors include those discussed in ArcelorMittal's periodic reports available on http://corporate.arcelormittal.com/.

Additional share buyback disclosure

The Company has also provided additional

share buyback information on the Company’s website summarizing the latest share buyback transactions and provides a model for the

latest weighted average per share data. This information is updated each quarter shortly after quarter close.

ArcelorMittal share status as of

December 31, 2023 accessible on http://www.arcelormittal.com under “Investors” - “Equity

Investors” - “Share buyback program”

About ArcelorMittal

ArcelorMittal is the world's leading steel company,

with a presence in 60 countries and primary steelmaking facilities in 15 countries. In 2022, ArcelorMittal had revenues of $79.8 billion

and crude steel production of 59 million metric tonnes, while iron ore production reached 50.9 million metric tonnes.

Our purpose is to produce ever smarter steels that

have a positive benefit for people and planet. Steels made using innovative processes which use less energy, emit significantly less carbon

and reduce costs. Steels that are cleaner, stronger and reusable. Steels for electric vehicles and renewable energy infrastructure that

will support societies as they transform through this century. With steel at our core, our inventive people and an entrepreneurial culture

at heart, we will support the world in making that change. This is what we believe it takes to be the steel company of the future.

ArcelorMittal is listed on the stock exchanges of

New York (MT), Amsterdam (MT), Paris (MT), Luxembourg (MT) and on the Spanish stock exchanges of Barcelona, Bilbao, Madrid and Valencia

(MTS).

For more information about ArcelorMittal please

visit: http://corporate.arcelormittal.com/

| |

|

| Contact information ArcelorMittal Investor Relations |

|

| |

|

| General |

+44 20 7543 1128 |

| Retail |

+44 20 3214 2893 |

| SRI |

+44 20 3214 2801 |

|

Bonds/Credit

E-mail |

+33 171 921 026

investor.relations@arcelormittal.com |

| |

|

| |

|

| Contact information ArcelorMittal Corporate Communications |

|

|

Paul Weigh

Tel:

E-mail: |

+44 20 3214 2419

press@arcelormittal.com |

| |

|

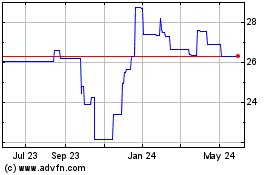

Arcelormittal (PK) (USOTC:AMSYF)

Historical Stock Chart

From Jan 2025 to Feb 2025

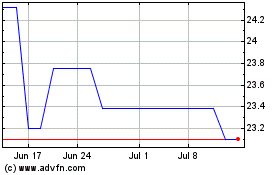

Arcelormittal (PK) (USOTC:AMSYF)

Historical Stock Chart

From Feb 2024 to Feb 2025