American Power Group Corporation Reports Second Quarter Fiscal 2014

Results

LYNNFIELD, MA--(Marketwired - May 15, 2014) - American Power

Group Corporation (OTCQB: APGI), today announced results for the

three and six months ending March 31, 2014. Several areas of

notable progress are as follows:

Quarterly

Highlights:

- Domestic vehicular revenues for the three months ended March

31, 2014 increased $272,000 or 312 percent to $359,000 as the

early-adopter customer phase continues to grow. Over 200

vehicular dual fuel conversion systems have been shipped in North

America since 2012.

- APG's Dual Fuel Glider™ was named a 2014 Top 20 Product by

Heavy Duty Trucking Magazine in February 2014.

- North American oil and gas drilling revenues for the three

months ended March 31, 2014 were approximately $835,000 or 142

percent higher than drilling revenue for the same period a year

ago. Regarding North American oil & gas fracturing

revenue, we did not have a frac rig available during the quarter

for conversion as compared to the $1.3 million full turnkey

conversion completed in the same quarter a year ago. Over 335

stationary oil and gas dual fuel conversion systems have been

installed since 2011.

- Entering Q3 with a backlog of more than $600,000 with nearly

80% relating to vehicular dual fuel conversions.

Lyle Jensen, American Power Group Corporation's Chief Executive

Officer, stated, "Despite the cold weather start and lack of a

comparable fracturing conversion order during the second quarter,

there was much to be proud of. Notably, the adoption of

vehicular dual fuel systems by Class 8 heavy-duty 'early-adopter'

customers is accelerating. During the quarter we shipped 34

conversion systems and added another 46 conversion systems to

backlog for delivery during the balance of the year as compared to

6 conversion systems the same period last year. As of today, we

have shipped more vehicular conversion systems in fiscal 2014 than

all of fiscal 2013 and 6 times more than fiscal 2012. Through our

WheelTime Network and related associations, we are adding three to

four new 'early-adopter' customers per month which provides the

foundation for the next phase we call the 'early-growers' which are

planning to add ten, fifteen, and twenty additional dual fuel

trucks to their fleet."

Mr. Jensen added, "Despite several industry challenges,

including the recent dedicated 15L engine cancelation and its

impact on infrastructure build-out, APG's vehicular and stationary

natural gas business model marches on undeterred due to its

attractive economics, better up-time performance, and the

flexibility our system provides to the end user. More and more

natural gas industry leaders are concluding that APG's Dual Fuel

Turbocharged® technology "simply makes more sense" which we believe

APG can capitalize on for years to come."

Conference Call

Please join us today at 10:30 AM Eastern when we will discuss the

results for the three months ended March 31, 2014. To participate,

please call 1-888-481-2844 and

ask for the American Power Group call using pass code

2156307. A replay of the conference call can be accessed until

11:50 PM on May 31, 2014 by calling 1-888-203-1112 and

entering pass code 2156307.

Three Months ended March 31, 2014 Compared to the Three Months

ended March 31, 2013

Net sales for the three months ended March 31, 2014 decreased

$594,000 or 32 percent to $1,258,000 as compared to net sales of

$1,852,000 for the three months ended March 31, 2013. We

believe the unusually colder than normal weather conditions in

North America during the quarter negatively impacted the results

for the three months ended March 31, 2014 as customers delayed

conversions due harsh installation conditions or vehicle

availability. The results for the three months ended March 31, 2013

included approximately $1.3 million or 70 percent of the quarterly

revenue associated with an oil and gas conversion order relating to

the full turnkey conversion of multiple engines in the high

pressure fracturing market. North American stationary revenues

for the three months ended March 31, 2014 were approximately

$835,000 which was approximately $490,000 or 142 percent higher

when compared to North American stationary revenues of

approximately $345,000 for the same period of the prior year,

adjusted for the large turnkey conversion order discussed above.

Domestic vehicular revenues for the three months ended March 31,

2014 increased $272,000 or 312 percent to $359,000 due to increased

market exposure and sales through our WheelTime member

distributor/installer network and the ability to actively solicit

customer orders due to the increased number of EPA approvals

received to date.

During the three months ended March 31, 2014 our gross profit

was $347,000 or 28 percent of net sales as compared to a gross

profit of $716,000 or 39 percent of net sales for the three months

ended March 31, 2013. Selling, general and administrative expenses

for the three months ended March 31, 2014 decreased $334,000 or 26

percent to $932,000 as compared to $1,266,000 for the three months

ended March 31, 2013. The results for the three months ended March

31, 2013 included approximately $361,000 of one-time, non-cash

amortization expense associated with the WheelTime member incentive

warrants which vested in 2013.

Our net loss for the three months ended March 31, 2014 increased

$44,000 or 7 percent to $655,000 or ($0.01) per basic share as

compared to a net loss of $611,000 or ($0.01) per basic share for

the three months ended March 31, 2013. The calculation of net loss

per share available for Common shareholders for the three months

ended March 31, 2014 and 2013 reflects the inclusion of 10%

Convertible Preferred Stock quarterly dividends of $235,000 and

$187,000, respectively associated with the issuance of the 10%

Convertible Preferred Stock.

Six Months ended March 31, 2014 Compared to the Six Months ended

March 31, 2013

Net sales for the six months ended March 31, 2014 increased

$374,000 or 14 percent to $3,101,000 as compared to net sales of

$2,727,000 for the six months ended March 31, 2013. We believe

the unusually colder than normal weather conditions in North

America during the quarter negatively impacted the results for the

three months ended March 31, 2014 as customers delayed conversions

due harsh installation conditions or vehicle availability. The

results for the six months ended March 31, 2013 included

approximately $1.3 million or 48 percent of the year to date

revenue associated with an oil and gas conversion order relating to

the full turnkey conversion of multiple engines in the high

pressure fracturing market. North American stationary revenues

for the six months ended March 31, 2014 were approximately $2.2

million which was approximately $1.4 million or 201 percent higher

when compared to North American stationary revenues of

approximately $171,000 for the same period of the prior year,

adjusted for the large turnkey conversion order discussed

above. Domestic vehicular revenues for the six months ended

March 31, 2014 increased approximately $317,000 or 56 percent

compared to last year. The increase was attributable to increased

market exposure and sales through our WheelTime member

distributor/installer network and the ability to actively solicit

customer orders due to the increased number of EPA approvals

received to date.

During the six months ended March 31, 2014, our gross profit was

$1,249,000 or 40 percent of net sales as compared to $1,017,000 or

37 percent of net sales for the six months ended March 31, 2013.

Selling, general and administrative expenses for the six months

ended March 31, 2014 decreased $225,000 or 10 percent to $1,924,000

as compared to $2,149,000 for the six months ended March 31, 2013.

The decrease was primarily attributable to the inclusion of

approximately $393,000 of one-time, non-cash amortization expense

associated with the WheelTime member incentive warrants which

vested during the six months ended March 31, 2013.

Our net loss for the six months ended March 31, 2014 decreased

$431,000 or 34 percent to $819,000 or ($0.02) per basic share as

compared to a net loss of $1,250,000 or ($0.03) per basic share for

the six months ended March 31, 2013. The calculation of net loss

per share available for Common shareholders for the six months

ended March 31, 2014 and 2013, reflects the inclusion of quarterly

dividends of $480,000 and $400,000, respectively, paid on our 10%

Convertible Preferred Stock.

Condensed Consolidated Statements of Operations

| |

|

|

|

|

|

| |

Three Months Ended March 31, |

|

|

Six Months Ended March 31, |

|

| |

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

$ |

1,258,000 |

|

|

$ |

1,852,000 |

|

|

$ |

3,101,000 |

|

|

$ |

2,727,000 |

|

| Cost of sales |

|

911,000 |

|

|

|

1,136,000 |

|

|

|

1,852,000 |

|

|

|

1,710,000 |

|

| |

Gross profit |

|

347,000 |

|

|

|

716,000 |

|

|

|

1,249,000 |

|

|

|

1,017,000 |

|

| Selling, general and administrative |

|

932,000 |

|

|

|

1,266,000 |

|

|

|

1,924,000 |

|

|

|

2,149,000 |

|

| |

Operating loss from continuing operations |

|

(585,000 |

) |

|

|

(550,000 |

) |

|

|

(675,000 |

) |

|

|

(1,132,000 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Interest and financing expense |

|

(45,000 |

) |

|

|

(47,000 |

) |

|

|

(91,000 |

) |

|

|

(87,000 |

) |

| |

Other, net |

|

(25,000 |

) |

|

|

(14,000 |

) |

|

|

(53,000 |

) |

|

|

(31,000 |

) |

| |

|

Other

expense, net |

|

(70,000 |

) |

|

|

(61,000 |

) |

|

|

(144,000 |

) |

|

|

(118,000 |

) |

| Net loss |

|

(655,000 |

) |

|

|

(611,000 |

) |

|

|

(819,000 |

) |

|

|

(1,250,000 |

) |

| |

10% Convertible Preferred dividends |

|

(235,000 |

) |

|

|

(187,000 |

) |

|

|

(480,000 |

) |

|

|

(400,000 |

) |

| Net loss available to Common shareholders |

$ |

(890,000 |

) |

|

$ |

(798,000 |

) |

|

$ |

(1,299,000 |

) |

|

$ |

(1,650,000 |

) |

| Loss from continuing operations per share - basic and

diluted |

|

$ (0.01 |

) |

|

|

$ (0.01 |

) |

|

|

$ (0.02 |

) |

|

|

$ (0.03 |

) |

| Net loss per Common share - 10% Convertible Preferred

dividend |

|

(0.01 |

) |

|

|

(0.01 |

) |

|

|

(0.01 |

) |

|

|

(0.01 |

) |

| Net loss attributable to Common shareholders per share

- basic and diluted |

|

$ (0.02 |

) |

|

$ |

(0.02 |

) |

|

|

$ (0.03 |

) |

|

|

$ (0.04 |

) |

| Weighted average shares outstanding - basic and

diluted |

|

49,062,000 |

|

|

|

46,354,000 |

|

|

|

48,723,000 |

|

|

|

45,972,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheet Data

|

|

|

|

|

|

|

March 31, 2014 |

|

September 30, 2013 |

|

Assets |

|

|

|

|

|

|

Current assets |

$ |

3,864,000 |

|

$ |

4,771,000 |

|

Property, plant and equipment, net |

|

875,000 |

|

|

930,000 |

| Other

assets |

|

4,683,000 |

|

|

4,696,000 |

|

|

$ |

9,422,000 |

|

$ |

10,397,000 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

Current liabilities |

$ |

2,204,000 |

|

$ |

2,657,000 |

| Notes

payable, net of current portion |

|

1,995,000 |

|

|

1,490,000 |

|

Obligations due under lease settlement, net of current portion |

|

506,000 |

|

|

506,000 |

|

Stockholders' equity |

|

4,717,000 |

|

|

5,744,000 |

|

|

$ |

9,422,000 |

|

$ |

10,397,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

About American Power

Group Corporation American Power Group's alternative energy

subsidiary, American Power Group, Inc., provides a cost-effective

patented Turbocharged Natural Gas® conversion technology for

vehicular, stationary and off-road mobile diesel engines. American

Power Group's dual fuel technology is a unique non-invasive energy

enhancement system that converts existing diesel engines into more

efficient and environmentally friendly engines that have the

flexibility to run on: (1) diesel fuel and liquefied natural gas;

(2) diesel fuel and compressed natural gas; (3) diesel fuel and

pipeline or well-head gas; and (4) diesel fuel and bio-methane,

with the flexibility to return to 100% diesel fuel operation at any

time. The proprietary technology seamlessly displaces up to 75% of

the normal diesel fuel consumption with the average displacement

ranging from 40% to 65%. The energized fuel balance is maintained

with a proprietary read-only electronic controller system ensuring

the engines operate at original equipment manufacturers' specified

temperatures and pressures. Installation on a wide variety of

engine models and end-market applications require no engine

modifications unlike the more expensive invasive fuel-injected

systems in the market. See additional information at:

www.americanpowergroupinc.com.

Caution Regarding

Forward-Looking Statements and Opinions With the exception

of the historical information contained in this release, the

matters described herein contain forward-looking statements and

opinions, including, but not limited to, statements relating to new

markets, development and introduction of new products, and

financial and operating projections. These forward-looking

statements and opinions are neither promises nor guarantees, but

involve risk and uncertainties that may individually or mutually

impact the matters herein, and cause actual results, events and

performance to differ materially from such forward-looking

statements and opinions. These risk factors include, but are not

limited to, the fact that our dual fuel conversion business has

lost money in the last five consecutive fiscal years, the risk that

we may require additional financing to grow our business, the fact

that we rely on third parties to manufacture, distribute and

install our products, we may encounter difficulties or delays in

developing or introducing new products and keeping them on the

market, we may encounter lack of product demand and market

acceptance for current and future products, we may encounter

adverse events economic conditions, we operate in a competitive

market and may experience pricing and other competitive pressures,

we are dependent on governmental regulations with respect to

emissions, including whether EPA approval will be obtained for

future products and additional applications, the risk that we may

not be able to protect our intellectual property rights, factors

affecting the Company's future income and resulting ability to

utilize its NOLs, the fact that our stock is thinly traded and our

stock price may be volatile, the fact that we have preferred stock

outstanding with substantial preferences over our common stock, the

fact that the conversion of the preferred stock and the exercise of

stock options and warrants will cause dilution to our shareholders,

the fact that we incur substantial costs to operate as a public

reporting company and other factors that are detailed from time to

time in the Company's SEC reports, including the report on Form

10-K for the year ended September 30, 2013 and the Company's

quarterly reports on Form 10-Q. Readers are cautioned not to place

undue reliance on these forward-looking statements and opinions,

which speak only as of the date hereof. The Company undertakes no

obligation to release publicly the result of any revisions to these

forward-looking statements and opinions that may be made to reflect

events or circumstances after the date hereof or to reflect the

occurrence of unanticipated events.

Media Information Contact: Kim Doran Quixote Group 336-413-1872 Email

Contact Investor Relations Contacts: Chuck Coppa CFO American Power

Group Corporation 781-224-2411 Email

Contact Mike Porter Porter, LeVay, & Rose, Inc. 212-564-4700 Email

Contact

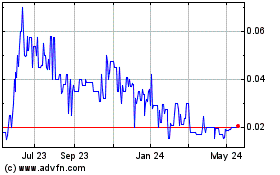

American Power (PK) (USOTC:APGI)

Historical Stock Chart

From Nov 2024 to Dec 2024

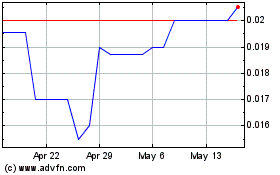

American Power (PK) (USOTC:APGI)

Historical Stock Chart

From Dec 2023 to Dec 2024