UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

| Date of Report (Date of earliest event reported) |

September 9, 2015 |

| AQUA POWER SYSTEMS INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

333-183272 |

27-4213903 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 2-7-17 Omorihoncho, Tokyo, Ota-ku, Japan |

143-0011 |

| (Address of principal executive offices) |

(Zip Code) |

| Registrant’s telephone number, including area code |

+81 3-5764-3380 |

|

n/a |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

| ITEM 3.03 |

Material Modifications to Rights of Security Holders |

| |

|

| ITEM 5.03 |

Amendments to Articles of Incorporation or Bylaws |

| |

|

| ITEM 8.01 |

Other Items |

On September 9, 2015, we filed a Certificate

of Designation with the Nevada Secretary of State designating 5,000,000 shares of our preferred stock as Series A Preferred Stock,

which series shall have certain designations and number thereof, powers, preferences, rights, qualifications, limitations and restrictions,

in particular, Series A Preferred Shares are convertible into common shares of our company at a ratio of 1:100, meaning every one

(1) Preferred Series A Share shall convert into 100 common shares of stock. In addition, the holder of the each share of

Series A Preferred Stock shall have the right to one (1) vote for each share of common stock into which such Series A Preferred

Stock could then be converted.

The complete Certificate of Designation

is filed as Exhibit 10.1 and is effective with the Nevada Secretary of State on September 1, 2015.

| ITEM 3.02 |

Unregistered Sales of Equity Securities |

Effective September 1, 2015, Tadashi Ishikawa

returned 105,863,935 common shares of our company for cancellation in exchange for 1,500,000 shares of Series A Preferred Stock

to be issued to Mr. Tadashi Ishikawa.

| ITEM 9.01 |

Financial Statements and Exhibits |

| |

|

| 10.1 |

Certificate of Designation filed with the Nevada Secretary of State on September 1, 2015 with an effective date of September 1, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AQUA POWER SYSTEMS INC. |

|

| |

|

| /s/Tadashi Ishikawa |

|

| Tadashi Ishikawa |

|

| President and Director |

|

| |

|

| Date: |

September 10, 2015 |

|

| |

|

|

Exhibit 10.1

SCHEDULE

“A”

CERTIFICATE

OF DESIGNATIONS

OF

AQUA

POWER SYSTEMS INC.

ESTABLISHING

THE DESIGNATIONS, PREFERENCES,

LIMITATIONS

AND RELATIVE RIGHTS OF ITS

SERIES

A CONVERTIBLE PREFERRED STOCK

Pursuant

to Section 78.1955 of the Nevada Revised Statutes, Aqua Power Systems Inc., a corporation organized and existing under the Nevada

Revised Statutes (the “Company”),

DOES

HEREBY CERTIFY that pursuant to the authority conferred upon the Board of Directors by the Articles of Incorporation of the

Company, and pursuant to Section 78.1955 of the Nevada Revised Statutes, the Board of Directors, by unanimous written consent

of all members of the Board of Directors on September 1, 2015, duly adopted a resolution providing for the issuance of a series

of shares of Series A Convertible Preferred Stock, which resolution is and reads as follows:

RESOLVED,

that the Company designates 5,000,000 shares of Preferred Stock as the Series "A" Preferred Stock, which shares

shall have attached to them, in addition to the preferences, rights, privileges, restrictions and conditions attaching to all

of the preferred shares of the Company as a class, those rights, privileges, restrictions and conditions set forth herein; and

FURTHER

RESOLVED, that the series of preferred stock of the Company be, and it hereby is, given the distinctive designation of “Series

A Convertible Preferred Stock”; and

FURTHER

RESOLVED, that the Series A Convertible Preferred Stock shall consist of 5,000,000 shares; and

FURTHER

RESOLVED, that the Series A Convertible Preferred Stock shall have the powers and preferences, and the relative, participating,

optional and other rights, and the qualifications, limitations, and restrictions thereon set forth below (the “Designation”

or the “Certificate of Designations”):

Section

1. DESIGNATION OF SERIES; RANK. The shares of such series shall be designated as the “Series A Convertible

Preferred Stock” (the “Preferred Stock”) or “Series A Preferred Stock”)

and the number of shares initially constituting such series shall be up to 5,000,000 shares with a par value of $0.001.

Section

2. DEFINITIONS.

For

purposes of this Designation, the following definitions shall apply:

(a) “Business

Day” means a day in which a majority of the banks in the State of Nevada in the United States of America are open

for business.

(b)

“Common Stock” means the Company’s $0.0001 par value common stock, or any other class of stock

resulting from successive changes or reclassifications of such common stock consisting solely of changes in par value, or as a

result of a subdivision, combination, or merger, consolidation or similar transaction in which the Company is a constituent corporation.

(c)

“Conversion Date” shall mean the date in which a Conversion Notice is received by the Company.

(d)

“Distribution” shall mean the transfer of cash or other property without consideration whether by way

of dividend or otherwise (other than dividends on Common Stock payable in Common Stock), or the purchase or redemption of shares

of the Company for cash or property other than: (i) repurchases of Common Stock issued to or held by employees, officers, directors

or consultants of the Company or its subsidiaries upon termination of their employment or services pursuant to agreements providing

for the right of said repurchase, (ii) repurchases of Common Stock issued to or held by employees, officers, directors or consultants

of the Company or its subsidiaries pursuant to rights of first refusal contained in agreements providing for such right, (iii)

repurchases of capital stock of the Company in connection with the settlement of disputes with any shareholder, (iv) any other

repurchase or redemption of capital stock of the Company approved by the holders of (a) a majority of the Common Stock and (b)

a majority of the Preferred Stock of the Company voting as separate classes.

| | Page 1 of 6

Aqua Power Systems Inc.

Certificate of Designations of Series A Convertible Preferred Stock | |

(e)

“Holder” shall mean the person or entity in which the Preferred Stock is registered on the books of

the Company, which shall initially be the person or entity which subscribes for the Preferred Stock, and shall thereafter be permitted

and legal assigns which the Company is notified of by the Holder and which the Holder has provided a valid legal opinion in connection

therewith to the Company.

(f)

“Holders” shall mean all Holders of the Series A Preferred Stock.

(g)

“Junior Stock” shall mean the Common Stock and each other class of capital stock or series of preferred

stock of the Company established prior to or after the Original Issue Date, the terms of which do not expressly provide that such

class or series ranks senior to or on parity with the Series A Preferred Stock upon the liquidation, winding-up or dissolution

of the Company.

(h)

“Liquidation Preference” shall mean the Original Issue Price per share for each share of Series A Preferred

Stock (as appropriately adjusted for any Recapitalizations).

(i)

“Original Issue Date” shall mean the date upon which the shares of Preferred Stock are first issued.

(j)

“Preferred Stock Certificates” means the certificates, as replaced from time to time, evidencing the

outstanding Preferred Stock shares.

(k)

“Recapitalization” shall mean any stock dividend, stock split, combination of shares, reorganization,

recapitalization, reclassification or other similar event.

(l)

“Restricted Shares” means shares of the Company’s Common Stock which are restricted from being

transferred by the Holder thereof unless the transfer is effected in compliance with the Securities Act of 1933, as amended and

applicable state securities laws (including investment suitability standards, which shares shall bear the following restrictive

legend (or one substantially similar):

“The

securities represented by this certificate have not been registered under the Securities Act of 1933 or any state securities act.

The securities have been acquired for investment and may not be sold, transferred, pledged or hypothecated unless (i) they shall

have been registered under the Securities Act of 1933 and any applicable state securities act, or (ii) the corporation shall have

been furnished with an opinion of counsel, satisfactory to counsel for the corporation, that registration is not required under

any such acts.”

SECTION

3. DIVIDENDS.

(a)

The holders of the Preferred Stock shall not be entitled to receive any dividends.

(b)

To the fullest extent permitted by the Nevada Revised Statutes, the Company shall be expressly permitted to redeem, repurchase

or make distributions on the shares of its capital stock in all circumstances other than where doing so would cause the Company

to be unable to pay its debts as they become due in the usual course of business.

| | Page 2 of 6

Aqua Power Systems Inc.

Certificate of Designations of Series A Convertible Preferred Stock | |

SECTION

4. LIQUIDATION PREFERENCE

(a)

Liquidation Preference. In the event of any liquidation, dissolution or winding up of the Company, either voluntary

or involuntary, the Holders of the Preferred Stock shall be entitled to receive, prior and in preference to any Distribution of

any of the assets of the Company to the Holders of the Junior Stock by reason of their ownership of such stock, but not prior

to any holders of the Company’s Senior Securities, which holders shall have priority to the distribution of any assets of

the Company, an amount per share for each share of Preferred Stock held by them equal to the sum of the Liquidation Preference

specified for such share of Preferred Stock. If upon the liquidation, dissolution or winding up of the Company, the assets of

the Company legally available for distribution to the Holders of the Preferred Stock are insufficient to permit the payment to

such Holders of the full amounts specified in this Section 4(a), subsequent to the payment to the Senior Securities then

the entire remaining assets of the Company following the payment to the Senior Securities legally available for distribution shall

be distributed with equal priority and pro rata among the Holders of the Preferred Stock in proportion to the full amounts they

would otherwise be entitled to receive pursuant to this Section 4(a).

(b)

Remaining Assets. After the payment to the Holders of Preferred Stock of the full preferential amounts specified above,

the entire remaining assets of the Company legally available for distribution by the Company shall be distributed with equal priority

and pro rata among the Holders of the Junior Stock in proportion to the number of shares of Junior Stock, and the terms of such

Junior Stock, held by them.

(c)

Valuation of Non-Cash Consideration. If any assets of the Company distributed to shareholders in connection with any

liquidation, dissolution, or winding up of the Company are other than cash, then the value of such assets shall be their fair

market value as

determined in good faith by the Board of Directors. In the event of a merger or other acquisition of the Company by another entity,

the Distribution date shall be deemed to be the date such transaction closes.

SECTION

5. CONVERSION. The Preferred Stock shall not be convertible into Common Stock and have no other conversion rights except

as specifically set forth below:

(a) Conversion.

The “Conversion Ratio” per share of the Preferred Stock in connection with a Conversion shall be at

a ratio of 1:100, meaning for every (1) one Preferred A share shall convert into 100 common shares of stock of the Company. Holders

of Class A Preferred Shares shall have the right, exercisable at any time and from time to time (unless otherwise prohibited by

law, rule or regulation), to convert any or all their shares of the Class A Preferred Shares into Common Stock at the Conversion

Ratio.

(b) Taxes.

The Company shall not be required to pay any tax which may be payable in respect to any transfer involved in the issue and

delivery of shares of Common Stock upon conversion in a name other than that in which the shares of the Preferred Stock so converted

were registered, and no such issue or delivery shall be made unless and until the person requesting such issue or delivery has

paid to the Company the amount of any such tax, or has established, to the satisfaction of the Company, that such tax has been

paid. The Company shall withhold from any payment due whatsoever in connection with the Preferred Stock any and all required withholdings

and/or taxes the Company, in its sole discretion deems reasonable or necessary, absent an opinion from Holder’s accountant

or legal counsel, acceptable to the Company in its sole determination, that such withholdings and/or taxes are not required to

be withheld by the Company.

(c) Fractional

Shares. If any Conversion of Preferred Stock would result in the issuance of a fractional share of Common Stock (aggregating

all shares of Preferred Stock being converted pursuant to each Conversion), such fractional share shall be rounded up to the nearest

whole share and the Holder shall be entitled to receive, in lieu of the final fraction of a share, one additional whole share

of Common Stock.

| | Page 3 of 6

Aqua Power Systems Inc.

Certificate of Designations of Series A Convertible Preferred Stock | |

(d) Reservation

of Stock Issuable Upon Conversion. The Company shall at all times reserve and keep available out of its authorized but unissued

shares of Common Stock solely for the purpose of effecting the conversion of the shares of the Preferred Stock, such number of

its shares of Common Stock as shall from time to time be sufficient to effect the conversion of all then outstanding shares of

the Preferred Stock; and if at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to

effect the conversion of all then outstanding shares of the Preferred Stock, the Company will within a reasonable time period

make a good faith effort to take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized

but unissued shares of Common Stock to such number of shares as shall be sufficient for such purpose.

(e) Effect

of Conversion. On the date of any Conversion, all rights of any Holder with respect to the shares of the Preferred Stock so

converted, including the rights, if any, to receive distributions of the Company’s assets (including, but not limited to,

the Liquidation Preference) or notices from the Company, will terminate, except only for the rights of any such Holder to receive

certificates (if applicable) for the number of shares of Common Stock into which such shares of the Preferred Stock have been

converted.

SECTION

6. VOTING. The holder of each share of Series A Preferred Stock shall have the right to one vote for each share of Common

Stock into which such Series A Preferred Stock could then be converted, and with respect to such vote, such holder shall have

full voting rights and powers equal to the voting rights and powers of the holders of Common Stock, and shall be entitled, notwithstanding

any provision hereof, to notice of any stockholders’ meeting in accordance with the Bylaws of this Corporation, and shall

be entitled to vote, together with holders of Common Stock, with respect to any question upon which holders of Common Stock have

the right to vote. Fractional votes shall not, however, be permitted and any fractional voting rights available on an as-converted

basis (after aggregating all shares into which shares of Series A Preferred Stock held by each holder could be converted) shall

be rounded to the nearest whole number (with one-half being rounded upward).

SECTION

7. REDEMPTION. The Preferred Stock shall have no redemption rights.

SECTION

8. PROTECTIVE PROVISIONS. Subject to the rights of series of Preferred Stock which may from time to time come into existence,

so long as any shares of Series A Preferred Stock are outstanding, this Company shall not without first obtaining the approval

(by written consent, as provided by law or otherwise) of the holders of a majority of the then outstanding shares of Series A

Preferred Stock, voting together as a class:

(a) Increase

or decrease (other than by redemption or conversion) the total number of authorized shares of Series A Convertible Preferred Stock;

(b) Effect

an exchange, reclassification, or cancellation of all or a part of the Series a Convertible Preferred Stock, but excluding a stock

split or reverse stock split of the Company’s Common Stock or Preferred Stock;

(c) Effect

an exchange, or create a right of exchange, of all or part of the shares of another class of shares into shares of Series A Convertible

Preferred Stock; or

(d) Alter

or change the rights, preferences or privileges of the shares of Series A Convertible Preferred Stock so as to affect adversely

the shares of such series, including the rights set forth in this Designation.

For

clarification, issuances of additional authorized shares of Series A Preferred under the terms herein shall not require the authorization

or approval of the existing shareholders of Preferred Stock.

| | Page 4 of 6

Aqua Power Systems Inc.

Certificate of Designations of Series A Convertible Preferred Stock | |

PROVIDED,

HOWEVER, that the Company may, by any means authorized by law and without any vote of the Holders of shares of the Preferred

Stock, make technical, corrective, administrative or similar changes in this Statement of Designations that do not, individually

or in the aggregate, adversely affect the rights or preferences of the Holders of shares of the Preferred Stock. The Company may

also designate and issue additional series of preferred stock from time to time in the sole discretion of the Company’s

Board of Directors, which such rights, privileges, preferences and limitations shall be determined by the Company’s Board

of Directors in its sole discretion, and which designations and issuances shall not require the approval of the holders of the

Preferred Stock.

SECTION

9. PREEMPTIVE RIGHTS. Holders of Preferred Stock and holders of Common Stock shall not be entitled to any preemptive,

subscription or similar rights in respect to any securities of the Company, except as specifically set forth herein or in any

other document agreed to by the Company.

SECTION

10. REPORTS. The Company shall mail to all holders of Preferred Stock those reports, proxy statements and other materials

that it mails to all of its holders of Common Stock.

SECTION

11. NOTICES. In addition to any other means of notice provided by law or in the Company’s Bylaws, any notice required

by the provisions of this Designation to be given to the holders of Preferred Stock shall be deemed given if deposited in the

United States mail, postage prepaid, and addressed to each Holder of record at such Holder’s address appearing on the books

of the Company.

SECTION

12. MISCELLANEOUS.

(a) The

headings of the various sections and subsections of this Certificate of Designation are for convenience of reference only and

shall not affect the interpretation of any of the provisions of this Certificate of Designation.

(b) Whenever

possible, each provision of this Certificate of Designation shall be interpreted in a manner as to be effective and valid under

applicable law and public policy. If any provision set forth herein is held to be invalid, unlawful or incapable of being enforced

by reason of any rule of law or public policy, such provision shall be ineffective only to the extent of such prohibition or invalidity,

without invalidating or otherwise adversely affecting the remaining provisions of this Certificate of Designation. No provision

herein set forth shall be deemed dependent upon any other provision unless so expressed herein. If a court of competent jurisdiction

should determine that a provision of this Certificate of Designation would be valid or enforceable if a period of time were extended

or shortened, then such court may make such change as shall be necessary to render the provision in question effective and valid

under applicable law.

(c) The

Company will provide to the Holders of the Series A Preferred Stock all communications sent by the Company to the holders of the

Common Stock.

(d) Except

as may otherwise be required by law, the shares of the Preferred Stock shall not have any powers, designations, preferences or

other special rights, other than those specifically set forth in this Certificate of Designations.

(e) Shares

of the Series A Preferred Stock converted into Common Stock shall be retired and canceled and shall have the status of authorized

but unissued shares of Preferred Stock of the Company undesignated as to series and may with any and all other authorized but

unissued shares of Preferred Stock of the Company be designated or re-designated and issued or reissued, as the case may be, as

part of any series of Preferred Stock of the Company.

(f) Notwithstanding

the above terms and conditions of this Designation, the Liquidation Preference and the dollar amounts and share numbers set forth

herein shall be subject to adjustment, as appropriate, whenever there shall occur a stock split, stock dividend, combination,

reclassification or other similar event involving shares of the Series A Preferred Stock. Such adjustments shall be made in such

manner and at such time as the Board of Directors in good faith determines to be equitable in the circumstances, any such determination

to be evidenced in a resolution duly adopted by the Board of Directors. Upon any such equitable adjustment, the Company shall

promptly deliver to each Holder a notice describing in reasonable detail the event requiring the adjustment and the method of

calculation thereof and specifying the increased or decreased Liquidation Preference following such adjustment.

| | Page 5 of 6

Aqua Power Systems Inc.

Certificate of Designations of Series A Convertible Preferred Stock | |

(g) With

respect to any notice to a Holder required to be provided hereunder, such notice shall be mailed to the registered address of

such Holder, and neither failure to mail such notice, nor any defect therein or in the mailing thereof, to any particular Holder

shall affect the sufficiency of the notice or the validity of the proceedings referred to in such notice with respect to the other

Holders or affect the legality or validity of any redemption, conversion, distribution, rights, warrant, reclassification, consolidation,

merger, conveyance, transfer, dissolution, liquidation, winding-up or other action, or the vote upon any action with respect to

which the Holders are entitled to vote. All notice periods referred to herein shall commence on the date of the mailing of the

applicable notice. Any notice which was mailed in the manner herein provided shall be conclusively presumed to have been duly

given whether or not the Holder receives the notice.

IN

WITNESS WHEREOF, the Company has caused this statement to be duly executed by its Chief Executive Officer this 1st

day of September 2015.

| |

AQUA POWER SYSTEMS INC. |

| |

|

| |

|

| |

By: |

| |

Tadashi Ishikawa – President

and Director |

| |

|

| |

|

| | Page 6 of 6

Aqua Power Systems Inc.

Certificate of Designations of Series A Convertible Preferred Stock | |

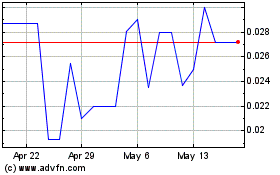

Aqua Power Systems (PK) (USOTC:APSI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Aqua Power Systems (PK) (USOTC:APSI)

Historical Stock Chart

From Jan 2024 to Jan 2025