Avidbank Holdings, Inc. ("the Company") (OTCBB: AVBH), sole

owner of Avidbank ("the Bank"), an independent full-service

commercial bank serving businesses and consumers in Northern

California, announced unaudited net income of $408,000 for the

first quarter of 2014 compared to $514,000 for the same period in

2013.

First Quarter 2014 Financial

Highlights

- Net income was $408,000 for the first

quarter of 2014, compared to $514,000 for the first quarter of

2013

- Diluted earnings per common share were

$0.09 for the first quarter of 2014, compared to $0.16 for the

first quarter of 2013

- Total assets increased by 13% over the

past twelve months, ending the first quarter at $473 million

- Total loans outstanding increased by 5%

from the prior year, ending the first quarter at $254 million

- Total deposits increased by 12% from a

year ago, ending the first quarter at $422 million

- The Bank continues to be well

capitalized with a Tier 1 Leverage Ratio of 9.7% and a Total Risk

Based Capital Ratio of 14.1%

Mark D. Mordell, Chairman and Chief Executive Officer, stated,

“We continued to execute our strategic plan and build lending

infrastructure in the first quarter of 2014 and we are starting to

see the results of our investments. Our team originated over $40

million in new commitments that resulted in over $20 million in new

loan outstandings for the quarter. At the same time, we experienced

over $20 million in anticipated construction loan payoffs causing a

slight decrease in our loans outstanding. We are continuing to

attract top talent as we have hired another senior commercial

relationship manager with a network that spans from San Francisco

to San Jose, as well as an experienced cash management sales

officer to enhance our offerings to the business community. These

efforts, along with last year's increase in lending staff, are

starting to have a positive impact on our business development

opportunities. We believe these investments will enhance the Bank's

long term profitability.”

“Deposits declined by $28 million as several large accounts with

expected seasonality drew down on the balances they had accumulated

at the end of 2013. The reductions do not reflect the closure of

any major relationships. Our credit quality remains strong with no

charge-offs to date in 2014 as we continue to maintain our high

lending standards,” noted Mr. Mordell.

Results for the quarter ended March 31,

2014

For the three months ended March 31, 2014, net interest income

after provision for loan losses was $3.6 million, a decrease of

$231,000 or 6% compared to the first quarter of 2013. The decrease

in net interest income was primarily the result of a decline in

loan yields due to the low interest rate environment being

experienced nationwide. Average earning assets were $451 million in

the first quarter of 2014, a 13% increase over the first quarter of

the prior year. Earning assets increased due to growth in overnight

fed funds resulting from higher deposits. Net interest margin was

3.32% for the first quarter of 2014, compared to 3.93% for the

first quarter of 2013. Net interest margin declined due to lower

loan yields and the above mentioned increase in overnight funds. No

provision for loan losses was taken in the first quarter of 2014 or

2013.

Non-interest income, excluding gains on sales of securities, was

$278,000 in the first quarter of 2014, an increase of $153,000 or

122% over the first quarter of 2013. The increase was due to

increases in service charges and other fee generation activities as

well as an increase in earnings on bank owned life insurance.

Non-interest expense grew by $133,000 in the first quarter of

2014 to $3.2 million compared to $3.1 million for the first quarter

of 2013. This growth was due to the investments in loan production

personnel and facilities mentioned previously.

About Avidbank

Avidbank Holdings, Inc., headquartered in Palo Alto, California,

offers innovative financial solutions and services. We specialize

in the following markets: commercial & industrial, corporate

finance, asset-based lending, real estate construction and

commercial real estate lending, and real estate bridge financing.

Avidbank advances the success of our clients by providing them with

financial opportunities and serving them as we wish to be served –

with mutual effort, ingenuity and trust – creating long-term

banking relationships.

Forward-Looking Statement:

This news release contains statements that are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements are based on current

expectations, estimates and projections about Avidbank's business

based, in part, on assumptions made by management. These statements

are not guarantees of future performance and involve risks,

uncertainties and assumptions that are difficult to predict.

Therefore, actual outcomes and results may differ materially from

what is expressed or forecasted in such forward-looking statements

due to numerous factors, including those described above and the

following: Avidbank's timely implementation of new products and

services, technological changes, changes in consumer spending and

savings habits and other risks discussed from time to time in

Avidbank's reports and filings with banking regulatory agencies. In

addition, such statements could be affected by general industry and

market conditions and growth rates, and general domestic and

international economic conditions. Such forward-looking statements

speak only as of the date on which they are made, and Avidbank does

not undertake any obligation to update any forward-looking

statement to reflect events or circumstances after the date of this

release.

Avidbank Holdings, Inc.

Balance Sheet ($000, except share and per

share amounts)

(Unaudited)

Assets

3/31/2014

12/31/2013

3/31/2013

Cash and due from banks $ 15,427 $ 16,905 $ 11,381 Fed funds sold

127,785 151,940

102,070 Total cash and cash equivalents 143,212 168,845

113,451 Investment securities - available for sale 58,397

58,983 54,767 Loans, net of deferred loan fees 254,375

257,434 242,225 Allowance for loan losses (4,795 )

(4,788 ) (4,736 ) Loans, net of allowance for

loan losses 249,580 252,646 237,489 Bank owned life

insurance 11,694 11,607 3,445 Premises and equipment, net 1,287

1,175 1,334 Accrued interest receivable & other assets

8,950 7,420 6,756

Total assets $ 473,120 $ 500,676 $

417,242

Liabilities

Non-interest-bearing demand deposits $ 151,538 $ 158,364 $ 101,386

Interest bearing transaction accounts 18,041 18,991 15,990 Money

market and savings accounts 205,237 222,324 197,639 Time deposits

47,250 50,625

60,931 Total deposits 422,066 450,304 375,946 Other

liabilities 2,209 2,340

2,884 Total liabilities 424,275 452,644 378,830

Shareholders'

equity

Preferred stock - - 5,963 Common stock/additional paid-in capital

44,774 44,531 29,647 Retained earnings 3,877 3,469 1,598

Accumulated other comprehensive income 194

32 1,204 Total shareholders'

equity 48,845 48,032 38,412 Total liabilities and

shareholders' equity $ 473,120 $ 500,676

$ 417,242 Bank Capital ratios Tier 1 leverage

ratio 9.72 % 9.66 % 8.87 % Tier 1 risk-based capital ratio 12.89 %

12.45 % 11.01 % Total risk-based capital ratio 14.14 % 13.70 %

12.26 % Book value per common share $ 11.34 $ 11.21 $ 12.37

Total shares outstanding 4,308,756 4,283,494 2,623,852

Other Ratios

Non-interest bearing/total deposits

35.9

%

35.2

%

27.0

%

Loan to deposit ratio

60.3

%

57.2

%

64.4

%

Allowance/Total loans

1.88

%

1.85

%

1.96

%

Avidbank Holdings, Inc.

Condensed Statements of Income

($000, except share and per share

amounts)(Unaudited)

Quarter Ended

3/31/2014

3/31/2013

Interest and fees on loans $ 3,412 $ 3,722 Interest on investment

securities 375 404 Other interest income 88

54 Total interest income 3,875 4,180 Interest expense

244 318 Net interest income

3,631 3,862 Provision for loan losses -

-

Net interest income after provision for

loan losses

3,631 3,862 Service charges, fees and other income 278 125

Gain on sale of investment securities -

- Total non-interest income 278 125 Compensation and

benefit expenses 2,052 1,838 Occupancy and equipment expenses 569

567 Other operating expenses 608 691

Total non-interest expense 3,229 3,096 Income before

income taxes 680 891 Provision for income taxes 272

377 Net income $ 408 $ 514

Preferred dividends & warrant amortization

- 84

Net income applicable to common

shareholders

$ 408 $ 430 Basic earnings per

share $ 0.10 $ 0.16 Diluted earnings per share $ 0.09 $ 0.16

Average shares outstanding 4,294,697 2,616,099 Average fully

diluted shares 4,374,997 2,695,340 Total shares outstanding at

period end 4,308,756 2,623,852 Annualized returns: Return on

average assets 0.34 % 0.49 % Return on average common equity 3.35 %

6.37 % Net interest margin 3.32 % 3.93 % Cost of funds 0.22

% 0.34 % Efficiency ratio 82.6 % 77.7 %

Avidbank Holdings, Inc.Steve Leen, 650-843-2204Executive Vice

President and Chief Financial

Officersleen@avidbank.comavidbank.com

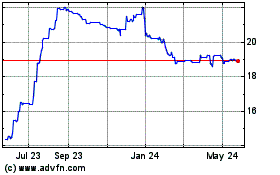

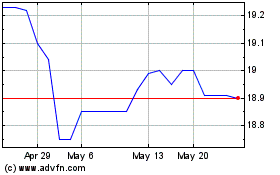

Avidbank (PK) (USOTC:AVBH)

Historical Stock Chart

From Nov 2024 to Dec 2024

Avidbank (PK) (USOTC:AVBH)

Historical Stock Chart

From Dec 2023 to Dec 2024