Mutual Fund Summary Prospectus (497k)

October 28 2013 - 4:09PM

Edgar (US Regulatory)

|

|

|

|

|

|

|

|

|

|

|

CRM All Cap Value Fund

|

|

Summary Prospectus

|

|

|

|

|

Investor Shares CRMEX

|

|

October 28, 2013

|

|

|

|

|

Institutional Shares CRIEX

|

|

|

Before you invest, you may want to

review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at www.crmfunds.com/download_center.aspx. You may also obtain this

information at no cost by calling

800-CRM-2883

or by sending an email request to prospectus@crmllc.com. The Fund’s prospectus and statement of additional

information, both dated October 28, 2013, and the independent registered public accounting firm’s report and financial statements in the Fund’s annual report to shareholders dated June 30, 2013, are incorporated by reference into this

summary prospectus.

I

NVESTMENT

O

BJECTIVE

CRM All Cap Value Fund seeks long-term capital appreciation.

F

EES

AND

E

XPENSES

This table sets forth the fees and expenses that you may pay if you buy and hold shares of the Fund.

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

|

|

|

|

|

|

|

|

Investor

Shares

|

|

|

Institutional

Shares

|

|

|

Management Fees

|

|

|

0.95

|

%

|

|

|

0.95

|

%

|

|

Distribution

(12b-1)

Fees

|

|

|

None

|

|

|

|

None

|

|

|

Other Expenses

|

|

|

|

|

|

|

|

|

|

Shareholder Servicing Fee

|

|

|

0.25

|

%

|

|

|

None

|

|

|

Other Miscellaneous Expenses

|

|

|

0.29

|

%

|

|

|

0.29

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Total Other Expenses

|

|

|

0.54

|

%

|

|

|

0.29

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Acquired Fund Fees and Expenses

|

|

|

0.01

|

%

|

|

|

0.01

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Annual Fund Operating

Expenses

(1)

|

|

|

1.50

|

%

|

|

|

1.25

|

%

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Total Annual Fund Operating Expenses do not correlate to the ratio of

expenses to average net assets that is included in the Fund’s financial highlights, which reflects the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses.

|

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual

funds. The Example below shows what you would pay if you invested $10,000 over the various time periods indicated. The Example assumes that you reinvested all dividends and other distributions; the average annual return was 5%; the Fund’s total

operating expenses are charged and remain the same over the time periods; and you redeemed all of your investment at the end of each time period.

Although your actual costs may be higher or lower based on these assumptions, your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

|

3 Years

|

|

|

5 Years

|

|

|

10 Years

|

|

|

Investor Shares

|

|

$

|

153

|

|

|

$

|

474

|

|

|

$

|

818

|

|

|

$

|

1,791

|

|

|

Institutional Shares

|

|

$

|

127

|

|

|

$

|

397

|

|

|

$

|

686

|

|

|

$

|

1,511

|

|

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells

securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in

annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 113% of the average value of its portfolio.

1

P

RINCIPAL

I

NVESTMENT

S

TRATEGIES

The Fund, under normal circumstances, invests at least 80% of its assets in equity and equity related securities of U.S. and

non-U.S.

companies that are publicly

traded on a U.S. securities market. There are no limits on the market capitalizations of the companies in which the Fund may invest. For purposes of the 80% investment policy, equity and equity related securities include: common and preferred

stocks, securities convertible into common stock, and warrants on common stock.

The Adviser evaluates investment opportunities for the Fund using a proprietary value-oriented process that seeks to identify companies characterized by three attributes: change, neglect and relative

valuation. The Adviser seeks to identify those changes that are material to a company’s operations, outlook and prospects while also identifying companies that it believes have been neglected by other investors. The Adviser utilizes a primarily

qualitative research process focused on these attributes to identify and invest in relatively undervalued companies. These factors formulate the Adviser’s investment case for each company under consideration for investment. The Adviser’s

process is focused not only on building the investment case, but also on understanding how the case might deteriorate. The Adviser’s sell discipline is ultimately dependent upon the written investment case for the stock. A position generally

will be sold when one or more of the following occurs: (i) an established price target is approaching or is attained, implying the stock has reached an estimation of fair valuation; (ii) a factor in the initial investment thesis has deteriorated

causing the Adviser to reassess the potential for the company; or (iii) the Adviser identifies what it believes is a more promising investment opportunity. After a decision to sell is made, the investment generally is replaced by either a new idea

or existing holdings which the Adviser believes offers greater upside.

P

RINCIPAL

I

NVESTMENT

R

ISKS

It is possible to lose money by investing in the Fund. There is no guarantee

that the stock market or the stocks the Fund buys will increase in value. The following is a summary description of certain risks of investing in the Fund.

Market Risk.

Stock markets are volatile and can decline significantly in response to adverse issuer, industry, regulatory, market or economic

developments. Different parts of the U.S. market and different markets around the world can react differently to these developments. When market prices fall, the value of your investment will go down. The financial crisis that began in 2008 has

caused a significant decline in the value and liquidity of many securities of issuers worldwide. Some governmental and

non-governmental

issuers (notably in Europe) have defaulted on, or been forced to

restructure, their debts, and many other issuers have faced difficulties obtaining credit. These market conditions may continue, worsen or spread, including in the U.S., Europe and beyond. Further defaults or restructurings by governments and others

of their debt could have additional adverse effects on economies, financial markets and asset valuations around the world. In response to the crisis, the U.S. and other governments and the Federal Reserve and certain foreign central banks have taken

steps to support financial markets. The withdrawal of this support, failure of efforts in response to the crisis, or investor perception that these efforts are not succeeding could negatively affect financial markets generally as well as the value

and liquidity of certain securities. Whether or not the Fund invests in securities of issuers located in or with significant exposure to countries experiencing economic and financial difficulties, these events could negatively affect the value and

liquidity of the Fund’s investments. The Fund may experience a substantial or complete loss on any individual security. In addition, policy and legislative changes in the U.S. and in other countries are changing many aspects of financial

regulation. The impact of these changes on the markets, and the practical implications for market participants, may not be fully known for some time.

Company Risk.

The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform

differently from the market as a whole. This may result from a wide variety of factors that affect particular companies or industries, including changes in market demand for particular goods and services, increases in costs of supply, changes in

management, increased competition and changes in regulatory environment.

Value Investing Risk.

Value stocks can perform differently from the market as a whole and other types of stocks and can continue to be undervalued by the market for long periods of time. The

Adviser may be incorrect when it determines that a stock is undervalued by the market.

Portfolio Selection Risk.

The value of your investment may decrease if the Adviser’s judgment about the attractiveness, value of, or market trends affecting a particular security, industry or

sector, country or region, or about market movements, is incorrect.

Risks of Small and Mid Cap Companies.

Compared to mutual funds that focus exclusively on large capitalization companies, the Fund may be more

volatile because it also invests in small and/or mid capitalization companies. Small and mid capitalization companies are more likely to have more limited product lines, fewer capital resources and less depth of management than larger companies.

Securities of smaller companies may have limited liquidity and may be difficult to value or to sell at an advantageous time or without a substantial drop in price.

2

Risks of Foreign Investments.

Investing in foreign securities involves special risks that can

increase the potential for losses. These risks may include nationalization or expropriation of assets, illiquid foreign securities markets, confiscatory taxation, foreign withholding taxes, imposition of currency controls or restrictions, natural

disasters and political, economic or social instability. Because many foreign markets are smaller, less liquid and more volatile, the Fund may not be able to sell portfolio securities at times, in amounts and at prices it considers reasonable. In

some foreign countries, less information is available about issuers and markets. Foreign markets may offer less protection to investors. Foreign stocks can fluctuate more widely in price than comparable U.S. stocks, and they may also be less liquid.

Currency fluctuations could erase investment gains or add to investment losses.

Focus Risk.

To the extent that the Fund invests in a smaller number of issuers or emphasizes investments in particular industries or market sectors, the Fund will be subject to a greater degree to

any market price movements, regulatory or technological changes, economic conditions or other developments affecting those issuers or companies in those industries or market sectors.

Portfolio Turnover Risk.

If the Fund does a lot of trading, it may incur additional operating expenses, which would

reduce performance, and could cause shareowners to incur a higher level of costs, as well as taxable income or capital gains.

Expense Risk.

Your actual costs of investing in the Fund may be higher than the expenses shown in “Annual Fund Operating Expenses” for a

variety of reasons. For example, expense ratios may be higher than those shown if overall net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

These and other risks are discussed in more detail later in the Fund’s

prospectus or in the statement of additional information.

An

investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

P

ERFORMANCE

I

NFORMATION

The bar chart and the average annual total return

table below illustrate the risks and volatility of an investment in the Fund. The bar chart shows changes in the Fund’s performance from calendar year to calendar year for Institutional Shares. The table shows how the Fund’s average

annual total returns for one year, five years and since inception, both before and after taxes, compare with those of the Russell 3000 Value Index and the Russell 3000 Index, two broad-based measures of market performance. Total returns would have

been lower had certain fees and expenses not been waived. The Fund makes updated performance information available at the Fund’s website, www.crmfunds.com/performance_daily.aspx, or at the following telephone number: 800-CRM-2883. Of course,

the Fund’s past performance, both before and after taxes, does not necessarily indicate how the Fund will perform in the future.

|

|

|

|

Best Quarter During

the Period Covered

in the Bar Chart

|

|

Worst Quarter During

the Period Covered

in the Bar Chart

|

|

17.89%

|

|

(23.47)%

|

For the quarter ended

June 30, 2009

|

|

For the quarter ended

December 31, 2008

|

3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Annual

Total Returns as of

December 31,

2012

|

|

1 Year

|

|

|

5 Years

|

|

|

Since Inception

(October 24, 2006)

|

|

|

Institutional Shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before Taxes

|

|

|

18.51

|

%

|

|

|

1.24

|

%

|

|

|

2.18

|

%

|

|

After Taxes on Distributions

|

|

|

18.25

|

%

|

|

|

1.11

|

%

|

|

|

1.97

|

%

|

|

After Taxes on Distributions and Sale of

Shares

|

|

|

12.38

|

%

|

|

|

1.04

|

%

|

|

|

1.81

|

%

|

|

Investor Shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before Taxes

|

|

|

18.13

|

%

|

|

|

0.98

|

%

|

|

|

1.91

|

%

|

|

Russell 3000 Value Index

(reflects no deduction for fees, expenses or taxes)

|

|

|

17.55

|

%

|

|

|

0.83

|

%

|

|

|

1.26

|

%

|

|

Russell 3000 Index

(reflects no deduction for fees, expenses or taxes)

|

|

|

16.42

|

%

|

|

|

2.04

|

%

|

|

|

3.06

|

%

|

After-tax

returns are calculated using the historical highest individual federal marginal income tax rates and do

not reflect the impact of state and local taxes. Actual

after-tax

returns will depend on your tax situation, may differ from those shown and are not relevant if you hold your shares through

tax-deferred

arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown only for Institutional Shares. After-tax returns for Investor Shares will vary.

I

NVESTMENT

A

DVISER

Cramer Rosenthal McGlynn, LLC

P

ORTFOLIO

M

ANAGERS

Jay B. Abramson, Michael J. Caputo, Jeffrey B. Reich, MD and Robert “Chip” L. Rewey III, CFA jointly lead the team responsible for the

day-to-day

management of the Fund. Messrs. Abramson, Caputo and Rewey have served as portfolio managers of the Fund since 2010. Mr. Reich has served as a portfolio manager of

the Fund since 2012.

P

URCHASE

AND

S

ALE

OF

F

UND

S

HARES

You may purchase or redeem shares of the Fund each day the New York Stock Exchange is open at the Fund’s net asset value next determined after receipt of your request in good order.

The minimum initial investment in the Fund is $2,500 ($2,000 for individual

retirement accounts or automatic investment plans) for Investor Shares and $1,000,000 for Institutional Shares. The minimum additional investment for direct investors in the Fund’s Investor Shares is $100. Your financial intermediary may impose

higher investment minimums. There is no minimum amount for additional investments in Institutional Shares.

You may purchase or redeem Fund shares by contacting your financial intermediary or, if you hold your shares directly with the Fund, by contacting the Fund

|

|

|

|

|

Regular Mail

|

|

Overnight Mail

|

|

CRM Funds

|

|

CRM Funds

|

|

c/o BNY Mellon

|

|

c/o BNY Mellon

|

|

Investment Servicing (US) Inc.

|

|

Investment Servicing (US) Inc.

|

|

P.O. Box 9812

|

|

4400 Computer Drive

|

|

Providence, RI 02940

|

|

Westborough, MA 01581

|

|

|

(ii)

|

by telephone at 800-CRM-2883

|

T

AX

I

NFORMATION

The Fund’s distributions are generally taxable as ordinary income, qualified dividend income, or capital gains, and it is generally a taxable event

for you if you redeem, sell or exchange Fund shares, except when your investment in the Fund is made through an individual retirement account, 401(k) or other tax-advantaged account.

P

AYMENTS

TO

B

ROKER

-

DEALERS

AND

O

THER

F

INANCIAL

I

NTERMEDIARIES

If you purchase shares of the Fund through a broker-dealer or other

financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other

intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

4

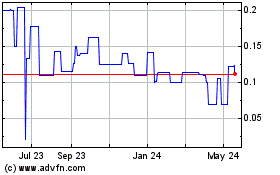

Avricore Health (QB) (USOTC:AVCRF)

Historical Stock Chart

From Jan 2025 to Feb 2025

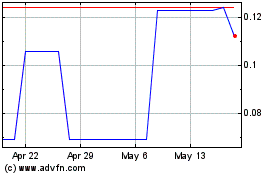

Avricore Health (QB) (USOTC:AVCRF)

Historical Stock Chart

From Feb 2024 to Feb 2025