Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 13 2025 - 2:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

February 13, 2025

Commission File Number: 001-38159

BRITISH AMERICAN TOBACCO P.L.C.

(Translation of registrant’s name into English)

Globe House

4 Temple Place

London WC2R 2PG

United Kingdom

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

This report includes materials as exhibits that have been published and made available by British American Tobacco p.l.c. as of February 13, 2025.

EXHIBIT INDEX

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| |

British American Tobacco p.l.c.

|

|

| |

|

|

|

| |

|

|

|

|

|

By:

|

/s/ Nancy Jiang

|

|

| |

|

Name:

|

Nancy Jiang |

|

| |

|

Title:

|

Senior Assistant Company Secretary

|

|

| |

|

|

|

Date: February 13, 2025

Exhibit 1

British American Tobacco p.l.c. (the “Company”)

13 February 2025

Share Buyback Programme

Further to the share buyback programme announcement on 18 March 2024 (“the Programme”), the Company announces that it has entered into a non-discretionary agreement with UBS AG

London Branch (“UBS”) to purchase ordinary shares of the Company (“Shares”) during the period commencing on 13 February 2025 and ending at the close of business on 30 April 2025 (the “Purchase Period”).

UBS will make its trading decisions in relation to the Company’s Shares independently of, and uninfluenced by, the Company.

The purpose of the Programme is to reduce the share capital of the Company. The Shares repurchased will be cancelled. The maximum number of Shares permitted to be purchased by the

Company under the Programme, pursuant to the authority granted by its shareholders at the Company's 2024 AGM, is 223,642,156 Shares (less the number of Shares subsequently purchased by the Company under the Programme since that authority was

granted).

Any purchases of Shares by the Company in relation to this announcement will be undertaken within certain pre-set parameters, and in accordance with both the Company’s general

authority to repurchase shares granted by its shareholders at the Company's 2024 AGM, or by any subsequent authorisation conferred by the Company's shareholders at a general meeting of the Company held during the Purchase Period, the Market Abuse

Regulation 596/2014 and the Commission Delegated Regulation (2016/1052), in each case as such legislation forms part of domestic law by virtue of section 3 of the European Union (Withdrawal) Act 2018 (as amended) and Chapter 12 of the Financial

Conduct Authority's Listing Rules.

The maximum price which may be paid for a Share is an amount (exclusive of taxes and expenses) equal to the higher of:

|

– |

105 per cent of the average market value of a Share as derived from the LSE's Daily Official List for the five business days immediately preceding the day on which the Share is purchased, in

accordance with Listing Rule 9.6.1 of the Listing Rules published pursuant to Part 6 of the Financial Services and Markets Act 2000 ("FSMA") (the "Listing Rules"); and

|

|

– |

the higher of (i) the price of the last independent trade and (ii) the highest current independent purchase bid on the trading venue where

the purchase is carried out, including when the shares are traded on different trading venues, in accordance with Article 3(2) of the UK Safe Harbour Regulation.

|

Enquiries:

Investor Relations

Victoria Buxton: +44 (0)20 7845 2012 | IR_team@bat.com

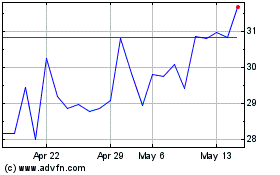

British American Tobacco (PK) (USOTC:BTAFF)

Historical Stock Chart

From Feb 2025 to Mar 2025

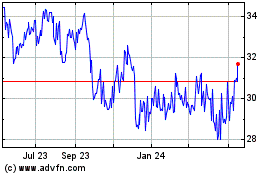

British American Tobacco (PK) (USOTC:BTAFF)

Historical Stock Chart

From Mar 2024 to Mar 2025