UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

FOR THE QUARTERLY PERIOD ENDED JULY 31, 2010

OR

|

o

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

FOR THE TRANSITION FROM _______ TO ________.

COMMISSION FILE NUMBER 000-52861

BELLTOWER ENTERTAINMENT CORP

.

(Exact Name of Small Business Issuer as Specified in its Charter)

|

NEVADA

|

|

47-0926548

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

11684 VENTURA BOULEVARD, SUITE

684 STUDIO CITY, CA

|

|

91604

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

Issuer's telephone number: (877) 355-1388

|

N/A

|

|

(Former name, former address and former fiscal year,

if changed since last report.)

|

Indicate by check mark whether the registrant (1) has filed all reports required

to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Yes

x

No

o

Indicate by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting company. See

definitions of "large accelerated filer," "accelerated filer" and "smaller

reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated

filer

|

Accelerated

filer

|

Non-accelerated filer

(Do not check if a smaller reporting company)

|

Smaller reporting

company

|

|

o

|

o

|

o

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act). Yes

o

No

x

State the number of shares outstanding of each of the issuer's classes of common

equity, for the period covered by this report and as at the latest practicable

date:

At July 31, 2010, there were outstanding 47,296,924 shares of the

Registrant's Common Stock, $.0001 par value and as of the date hereof, there are

outstanding 47,646,924 shares of the Registrant's Common Stock, $.0001 par

value.

TRANSITIONAL SMALL BUSINESS DISCLOSURE FORMAT:

Yes

o

No

x

FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

BELLTOWER ENTERTAINMENT CORP.

INDEX TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

JULY 31, 2010

|

|

Page

|

|

Condensed Consolidated Financial Statements:

|

|

|

|

|

|

Condensed Consolidated Balance Sheets (unaudited)

|

F-1

|

|

|

|

|

Condensed Consolidated Statements of Operations (unaudited)

|

F-2

|

|

|

|

|

Condensed Consolidated Statements of Cash Flows (unaudited)

|

F-3

|

|

|

|

|

Notes to Condensed Consolidated Financial Statements (unaudited)

|

F-4

|

BELLTOWER ENTERTAINMENT CORP.

(FORMERLY BRITTON INTERNATIONAL, INC.)

CONSOLIDATED BALANCE SHEETS

|

|

|

July 31,

|

|

|

April 30,

|

|

|

|

|

2010

|

|

|

2010

|

|

|

ASSETS

|

|

(Unaudited)

|

|

|

(Audited)

|

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

Cash

|

|

$

|

26,194

|

|

|

$

|

45,674

|

|

|

Receivables - Other

|

|

|

100,188

|

|

|

|

1,465

|

|

|

Deposits

|

|

|

150,000

|

|

|

|

750,000

|

|

|

Prepaid expenses

|

|

|

2,000

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Current Assets

|

|

|

278,382

|

|

|

|

797,139

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed assets, net

|

|

|

9,449

|

|

|

|

6,725

|

|

|

Film costs

|

|

|

437,089

|

|

|

|

354,089

|

|

|

Investment

|

|

|

50,000

|

|

|

|

-

|

|

|

Goodwill

|

|

|

164,884

|

|

|

|

164,884

|

|

|

Intangible assets

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$

|

949,804

|

|

|

$

|

1,332,837

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

63,065

|

|

|

$

|

143,037

|

|

|

Loans payable

|

|

|

1,050,025

|

|

|

|

1,140,025

|

|

|

Due to related parties

|

|

|

-

|

|

|

|

-

|

|

|

Accrued liabilities

|

|

|

84,589

|

|

|

|

93,531

|

|

|

Accrued interest

|

|

|

5,000

|

|

|

|

16,236

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Current Liabilities

|

|

|

1,202,678

|

|

|

|

1,392,829

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares, 50,000,000 shares with par value $0.0001

|

|

|

|

|

|

|

|

|

|

authorized, and 47,296,924 issued and outstanding as of

|

|

|

|

|

|

|

|

|

|

July 31, 2010 and 37,231,424 as of April 30, 2010

|

|

|

1,607

|

|

|

|

1,607

|

|

|

Additional paid in capital

|

|

|

1,292,638

|

|

|

|

1,292,638

|

|

|

Retained deficit

|

|

|

(1,547,119

|

)

|

|

|

(1,354,237

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total Stockholders' Equity (Deficit)

|

|

|

(252,874

|

)

|

|

|

(59,992

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders' Equity (Deficit)

|

|

$

|

949,804

|

|

|

$

|

1,332,837

|

|

The accompanying notes are an integral part of these consolidated financial statements.

BELLTOWER ENTERTAINMENT CORP.

(FORMERLY BRITTON INTERNATIONAL, INC.)

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

|

|

|

For the Three Months Ended July 31,

|

|

|

|

|

2010

|

|

|

2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

General, selling and

|

|

|

|

|

|

|

|

|

|

administrative expenses

|

|

|

181,184

|

|

|

|

52,523

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from operations

|

|

|

(181,184

|

)

|

|

|

(52,523

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Nonoperating income ( expense )

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

45

|

|

|

|

-

|

|

|

Interest expense

|

|

|

(11,743

|

)

|

|

|

(797

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total nonoperating income ( expenses )

|

|

|

(11,698

|

)

|

|

|

(797

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

(192,882

|

)

|

|

|

(53,320

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share:

|

|

|

|

|

|

|

|

|

|

Basic and Diluted

|

|

$

|

(0.0041

|

)

|

|

$

|

(0.0014

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding:

|

|

|

|

|

|

|

|

|

|

Basic and Diluted

|

|

|

47,296,924

|

|

|

|

37,696,098

|

|

The accompanying notes are an integral part of these consolidated financial statements.

BELLTOWER ENTERTAINMENT CORP.

(FORMERLY BRITTON INTERNATIONAL, INC.)

CONSOLIDATED STATEMENTS OF CASH FLOW

(UNAUDITED)

|

|

|

For the three month periods ended July 31,

|

|

|

|

|

2010

|

|

|

2009

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(192,882

|

)

|

|

$

|

(53,320

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net loss to net cash

|

|

|

|

|

|

|

|

|

|

used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

1,035

|

|

|

|

827

|

|

|

Impairment of intangible asset

|

|

|

-

|

|

|

|

(24,127

|

)

|

|

(Increase) / decrease in current assets:

|

|

|

|

|

|

|

-

|

|

|

Film costs

|

|

|

(83,000

|

)

|

|

|

|

|

|

Prepaid expenses

|

|

|

(2,000

|

)

|

|

|

(4,487

|

)

|

|

Other receivables

|

|

|

(99,680

|

)

|

|

|

3,418

|

|

|

Deposit

|

|

|

600,000

|

|

|

|

|

|

|

Increase / (decrease) in current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

|

(79,971

|

)

|

|

|

-

|

|

|

Accrued interest

|

|

|

(19,222

|

)

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Adjustments

|

|

|

317,162

|

|

|

|

(24,368

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities

|

|

|

124,280

|

|

|

|

(77,689

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Investment in Women's Health House

|

|

|

(50,000

|

)

|

|

|

-

|

|

|

Purchase of fixed assets

|

|

|

(3,760

|

)

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in investing activities

|

|

|

(53,760

|

)

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment of loan payable

|

|

|

(90,000

|

)

|

|

|

|

|

|

Proceeds from loans

|

|

|

-

|

|

|

|

40,000

|

|

|

Proceeds from related party loans

|

|

|

-

|

|

|

|

28,961

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) financing activities

|

|

|

(90,000

|

)

|

|

|

68,961

|

|

|

|

|

|

|

|

|

|

|

|

|

Net decrease in cash

|

|

|

(19,480

|

)

|

|

|

(8,728

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash, beginning of year

|

|

|

45,674

|

|

|

|

9,724

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, end of year

|

|

$

|

26,194

|

|

|

$

|

996

|

|

The accompanying notes are an integral part of these consolidated financial statements.

BELLTOWER ENTERTAINMENT CORP.

Notes to Consolidated Financial Statements

July 31, 2010

Note 1 – Nature of Operations

Belltower Entertainment Corp. (“Belltower”, “We”, or the “Company”) was incorporated in the State of Nevada on August 1, 2003.

On September 5, 2008, the Company acquired all of the issued and outstanding stock of Calico Entertainment Group, Inc. in exchange for 1,725,000 (reverse split adjusted) newly issued shares of Belltower. Upon completion of the transaction the shareholders of Calico owned approximately 5% of the issued and outstanding shares of Belltower.

On April 28, 2008 a corporation was formed under the laws of the State of Nevada called Belltower Entertainment Corp. and on September 15, 2008, Britton International Inc. acquired one hundred shares of its common stock for cash. As such, Belltower Entertainment Corp. became a wholly-owned subsidiary of Britton.

On September 24, 2008, Belltower was merged with and into Britton. As a result of the merger, the corporate name of Britton was changed to “Belltower Entertainment Corp.”

Our fiscal year end is April 30th.

On September 15, 2008 a corporation was formed under the laws of the Sate of Nevada named 3A Productions Corp. and on September 15, 2008, Belltower Entertainment Corp. acquired one hundred shares of its common stock (100% of the issued and outstanding shares on that date). As such, 3A Productions Corp. became a wholly-owned subsidiary of Belltower Entertainment Corp.

On September 19, 2008 a corporation was formed under the laws of the Sate of California named Y2K Productions, Inc. and on September 19, 2008, Belltower Entertainment Corp. acquired one hundred shares of its common stock (100% of the issued and outstanding shares on that date). As such, Y2K Productions Inc. became a wholly-owned subsidiary of Belltower Entertainment Corp.

On August 19, 2009 a Limited Liability Company (LLC) was formed under the laws of the State of Nevada and named 19th Hole Productions, LLC. Belltower Entertainment Corp. is the sole member of the LLC and as such is a wholly owned subsidiary.

Belltower Entertainment Corp., through its wholly owned subsidiaries, Calico Entertainment Group, Y2K Productions, Inc. 19th Hole Productions, LLC and 3A Productions Corp. is a producer and distributor of feature length motion pictures.

Note 2 – Summary of Significant Accounting Policies

This summary of significant accounting policies is presented to assist in understanding Belltower Entertainment Corp.’s financial statements. The financial statements and notes are representations of the Company’s management, who are responsible for their integrity and objectivity. These accounting policies conform to generally accepted accounting principles in the United States of America and have been consistently applied in the preparation of the financial statements.

The financial statements reflect the following significant accounting policies:

Revenue Recognition

Revenues are recognized in accordance with AICPA Statement of Position (SOP) 00-2, "Accounting by Producers or Distributors of Films". Under SOP 00-2, revenue from the sale or licensing of a film should be recognized only when all five of the following conditions are met:

1. Persuasive evidence of a sale or licensing arrangement with a customer exists.

2. The film is complete and has been delivered or is available for immediate and unconditional delivery (in accordance with the terms of the arrangement).

3. The license period has begun and the customer can begin its exploitation, exhibition, or sale.

4. The fee is fixed or determinable.

5. Collection of the fee is reasonably assured.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

Basic and Diluted Earnings per Share (EPS)

Basic EPS is computed by dividing income available to common shareholders by the weighted average number of common shares outstanding for the period. Diluted EPS is computed similar to basic net income per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if all the potential common shares, warrants and stock options had been issued and if the additional common shares were dilutive. Diluted net earnings per share are based on the assumption that all dilutive convertible shares and stock options were converted or exercised. Dilution is computed by applying the treasury stock method. Under this method, options and warrants are assumed to be exercised at the beginning of the period (or at the time of issuance, if later), and as if funds obtained thereby were used to purchase common stock at the average market price during the period.

Comprehensive Income

The Company has adopted Statement of Financial Accounting Standards (SFAS) No. 130, "Reporting Comprehensive Income"

(codified in FASB ASC Topic 220). FASB ASC Topic 220

requires that the components and total amounts of comprehensive income be displayed in the financial statements. Comprehensive income includes net income and all changes in equity during a period that arises from non-owner sources, such as foreign currency items and unrealized gains and losses on certain investments in equity securities. Comprehensive loss for the periods shown equals the net loss for the period plus the effect of foreign currency translation.

Income Taxes

The Company utilizes SFAS No. 109, “Accounting for Income Taxes,” (codified in FASB ASC Topic 740), which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that were included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

The Company adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes, (codified in FASB ASC Topic 740) on January 1, 2007. As a result of the implementation of FIN 48, the Company made a comprehensive review of its portfolio of tax positions in accordance with recognition standards established by FIN 48. As a result of the implementation of Interpretation 48, the Company recognized no material adjustments to liabilities or stockholders’ equity. When tax returns are filed, it is likely that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately sustained. The benefit of a tax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50 percent likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described above is reflected as a liability for unrecognized tax benefits in the accompanying balance sheets along with any associated interest and penalties that would be payable to the taxing authorities upon examination. Interest associated with unrecognized tax benefits are classified as interest expense and penalties are classified in selling, general and administrative expenses in the statements of income. The adoption of FIN 48 did not have a material impact on the Company’s financial statements.

At July 31, 2010 and April 30, 2010, the Company had not taken any significant uncertain tax position on its tax return for 2009 and prior years or in computing its tax provision for 2010

.

Fair Value of Financial Instruments

For certain of the Company’s financial instruments, including cash and cash equivalents, restricted cash, accounts receivable, accounts payable, accrued liabilities and short-term debt, the carrying amounts approximate their fair values due to their short maturities.

ASC Topic 820, “Fair Value Measurements and Disclosures,” requires disclosure of the fair value of financial instruments held by the Company. ASC Topic 825, “Financial Instruments,” defines fair value, and establishes a three-level valuation hierarchy for disclosures of fair value measurement that enhances disclosure requirements for fair value measures. The carrying amounts reported in the consolidated balance sheets for receivables and current liabilities each qualify as financial instruments and are a reasonable estimate of their fair values because of the short period of time between the origination of such instruments and their expected realization and their current market rate of interest. The three levels of valuation hierarchy are defined as follows:

Level 1 inputs to the valuation methodology are quoted prices for identical assets or liabilities in active markets.

Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument.

Level 3 inputs to the valuation methodology are unobservable and significant to the fair value measurement.

The Company analyzes all financial instruments with features of both liabilities and equity under ASC 480, “Distinguishing Liabilities from Equity,” and ASC 815.

As of July 31, 2010 and April 30. 2010, the Company did not identify any assets and liabilities that are required to be presented on the balance sheet at fair value.

Goodwill

Goodwill represents the excess of the purchase price over the fair value of the identifiable assets and liabilities acquired as a result of the Company’s acquisitions of interests in its subsidiaries. Under SFAS No. 142, “Goodwill and Other Intangible Assets (“SFAS 142”) (codified in FASB ASC Topic 350), goodwill is no longer amortized, but tested for impairment upon first adoption and annually, thereafter, or more frequently if events or changes in circumstances indicate that it might be impaired.

Start-up Costs

The Company has adopted Statement of Position No. 98-5 ("SOP 98-5"), "Reporting the Costs of Start-Up Activities." SOP 98-5 requires that all non-governmental entities expense the cost of start-up activities, including organizational costs as those costs are incurred.

Currency

The majority of the Company's cash flows are in United States dollars. Accordingly, the US dollar is the Company’s functional currency.

Property, plant and equipment

Property and equipment are stated at cost. Expenditures for maintenance and repairs are charged to earnings as incurred; additions, renewals and betterments are capitalized. When property and equipment are retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the respective accounts, and any gain or loss is included in operations. Depreciation of property and equipment is provided using the straight-line method for substantially all assets with estimated lives of:

Equipment 3 -5 years

Furniture & Fixtures 5 -10 years

Motor Vehicles 5 years

As of July 31, 2010 and April 30, 2010 property, plant and equipment consisted of the following:

|

|

|

July 31, 2010

|

|

|

April 30, 2010

|

|

|

Furniture and fixtures

|

|

$

|

1,405

|

|

|

$

|

1,405

|

|

|

Office equipment

|

|

|

15,810

|

|

|

|

12,050

|

|

|

Leasehold improvements

|

|

|

6,415

|

|

|

|

6,415

|

|

|

|

|

|

23,630

|

|

|

|

19,870

|

|

|

Accumulated depreciation

|

|

|

(14,181

|

)

|

|

|

(13,145

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

9,449

|

|

|

$

|

6,725

|

|

Depreciation expense for the three months ended July 31, 2010 and 2009 was $1,035 and $827, respectively.

Intangible assets

The Company has the following intangible assets as of July 31, 2010 and April 30, 2010:

|

|

|

July 31, 2010

|

|

|

April 30, 2010

|

|

|

Goodwill

|

|

$

|

164,884

|

|

|

$

|

164,884

|

|

|

Film revenue interest

|

|

|

-

|

|

|

|

-

|

|

|

Logo design

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

174,884

|

|

|

$

|

174,884

|

|

See Footnote 4 for further details.

Film Costs

Film costs include all direct costs incurred in the physical production of a film, such as the

costs of story and scenario (film rights to books, stage plays, or original screenplays); compensation of cast, directors, producers, and extras; costs of set construction, operations, and wardrobe; costs of sound synchronization; costs of rental facilities on location; and postproduction costs (music, special effects, and editing). They can also include allocations of

production overhead and capitalized interest costs. Film costs are capitalized until the production is completed. The costs are then amortized according to the individual-film-forecast method.

Principles of Consolidation

The consolidated financial statements include the accounts of Belltower and its wholly owned subsidiaries Calico Entertainment Group, Inc., 3A Productions Corp. and Y2K Productions, Inc. All material intercompany accounts, transactions and profits have been eliminated in consolidation.

Risks and Uncertainties

The Company is subject to substantial business risks and uncertainties inherent in starting a new business. There is no assurance that the Company will be able to generate sufficient revenues or obtain sufficient funds necessary for launching a new business venture.

Reclassification

Certain prior year accounts have been reclassified to conform to the current year’s presentation.

Note 3 – Going Concern

Generally accepted accounting principles in the United States of America contemplate the continuation of the Company as a going concern. However, the Company has accumulated operation losses since its inception and currently has limited business operations, which raises substantial doubt about the Company’s ability to continue as a going concern. The continuation of the Company is dependent on further financial support of investors and management. Once the Company has established a new business unit, the Company intends to attempt to acquire additional operating capital through equity offerings to the public to fund its business plan but there is no assurance that equity or debt offerings will be successful in raising sufficient funds to assure the eventual profitability of the Company.

Note 4 – Intangible Assets

The Company applies criteria specified in SFAS No. 141(R), “Business Combinations” (codified in FASB ASC Topic 805) to determine whether an intangible asset should be recognized separately from goodwill. Intangible assets acquired through business acquisitions are recognized as assets separate from goodwill if they satisfy either the “contractual-legal” or “separability” criterion. Per SFAS 142, (codified in FASB ASC Topic 350), intangible assets with definite lives are amortized over their estimated useful life and reviewed for impairment in accordance with SFAS No. 144, “Accounting for the Impairment or Disposal of Long-lived Assets” (codified in FASB ASC Topic 360). Intangible assets, such as purchased technology, trademark, customer list, user base and non-compete agreements, arising from the acquisitions of subsidiaries and variable interest entities are recognized and measured at fair value upon acquisition. Intangible assets are amortized over their estimated useful lives from one to ten years. The Company reviews the amortization methods and estimated useful lives of intangible assets at least annually or when events or changes in circumstances indicate that assets may be impaired. The recoverability of an intangible asset to be held and used is evaluated by comparing the carrying amount of the intangible to its future net undiscounted cash flows. If the intangible is considered impaired, the impairment loss is measured as the amount by which the carrying amount of the intangible exceeds the fair value of the intangible, calculated using a discounted future cash flow analysis. The Company uses estimates and judgments in its impairment tests, and if different estimates or judgments had been utilized, the timing or the amount of the impairment charges could be different.

The cost for the film revenue interest rights are amortized using the individual-film-forecast method which takes the proportion that current year’s revenues bear to management’s estimates of the ultimate revenue at the beginning of the year expected to be recognized from exploitation, exhibition or sale of such film over a period not to exceed ten years from the date of initial release. The Company’s management regularly reviews and revises when necessary its ultimate revenue estimates, which may result in a change in the rate of amortization of the film cost and/or write-down of all or a portion of the unamortized costs of the film rights to estimated fair value. The Company’s management estimates the ultimate revenue based on experience with similar titles or title genre, the general public appeal of the cast, actual performance (when available) at the box office or in markets currently being exploited, and other factors such as the quality and acceptance of motion pictures or programs that competitors release into the marketplace at or near the same time, critical reviews, general economic conditions and other tangible and intangible factors, many of which we do not control and which may change. In the normal course of our business, some films and titles are more successful than anticipated and some are less successful. Accordingly, we update our estimates of ultimate revenue based upon the actual results achieved or new information as to anticipated revenue performance such as (for home video revenues) initial orders and demand from retail stores when it becomes available. An increase in the ultimate revenue will generally result in a lower amortization rate while a decrease in the ultimate revenue will generally result in a higher amortization rate and periodically results in an impairment requiring a write down of the film cost to the title’s fair value. These write downs are included in amortization expense within direct operating expenses in our consolidated statements of operations. To date no revenue has been received on this film revenue right.

As of July 31, 2010 and April 30, 2010 intangible assets consist of the following:

|

|

|

July 31, 2010

|

|

|

April 30, 2010

|

|

|

Goodwill

|

|

$

|

164,884

|

|

|

$

|

164,884

|

|

|

Film revenue interest

|

|

|

-

|

|

|

|

-

|

|

|

Logo design

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

174,884

|

|

|

$

|

174,884

|

|

Note 5 – Deposit

On April 22, 2010 the Company entered into an agreement with William Morris Endeavor for the services of Forest Whitaker related to our project “Little Treasure”. To secure the services of Mr. Whitaker the Company deposited into an Escrow account the amount of $750,000. The balance at July 31, 2010 and April 30, 2010 was $750,000 and $150,000, respectively.

Note 6 – Loans Payable

As of April 30, 2010 the Company has the following loans outstanding:

Loan with a financial institution in the amount of $1,000,000, unsecured, guaranteed by an officer of the Company. The loan is due and payable on March 24, 2011 and interest is due monthly at the rate of 4.25% per annum.

Loan with an individual in the amount of $50,000, due on March 31, 2010. Interest due per agreement of $5,000. As of July 31, 2010 this loan is in default and management of the Company is negotiating new terms.

Note 7 – Income Taxes

The Company is subject to federal income taxes in the US. The Company has had no net income from its US operations and therefore has not paid nor has any income taxes owing in the US.

Deferred income taxes arise from temporary timing differences in the recognition of income and expenses for financial reporting and tax purposes. The Company's deferred tax assets consist entirely of the benefit from net operating loss carry-forwards. The Company's deferred tax assets are offset by a valuation allowance due to the uncertainty of the realization of the net operating loss carry-forwards. Net operating loss carry-forwards may be further limited by a change in company ownership and other provisions of the tax laws.

The Company's deferred tax assets, valuation allowance, and change in valuation allowance are as follows (“NOL” denotes Net Operating Loss):

|

|

|

Estimated

|

|

|

|

|

|

Estimated

|

|

|

|

|

|

|

|

|

Year

|

|

NOL

|

|

|

|

|

|

Tax

|

|

|

|

|

|

|

|

|

Ending

|

|

Carry -

|

|

|

NOL

|

|

|

Benefit

|

|

|

Valuation

|

|

|

Net Tax

|

|

|

April 30,

|

|

forward

|

|

|

Expires

|

|

|

From NOL

|

|

|

Allowance

|

|

|

Benefit

|

|

|

2004

|

|

$

|

(4,737

|

)

|

|

|

2024

|

|

|

$

|

711

|

|

|

$

|

(711

|

)

|

|

$

|

-

|

|

|

2005

|

|

|

(8,925

|

)

|

|

|

2025

|

|

|

|

1,339

|

|

|

|

(1,339

|

)

|

|

|

-

|

|

|

2006

|

|

|

(44,040

|

)

|

|

|

2026

|

|

|

|

6,606

|

|

|

|

(6,606

|

)

|

|

|

-

|

|

|

2007

|

|

|

(72,633

|

)

|

|

|

2027

|

|

|

|

10,895

|

|

|

|

(10,895

|

)

|

|

|

-

|

|

|

2008

|

|

|

(53,105

|

)

|

|

|

2028

|

|

|

|

7,966

|

|

|

|

(7,966

|

)

|

|

|

-

|

|

|

2009

|

|

|

(310,688

|

)

|

|

|

2029

|

|

|

|

46,603

|

|

|

|

(46,603

|

)

|

|

|

-

|

|

|

2010

|

|

|

(860,107

|

)

|

|

|

2030

|

|

|

|

129,016

|

|

|

|

(129,016

|

)

|

|

|

-

|

|

|

2011

|

|

|

(192,882

|

)

|

|

|

2031

|

|

|

|

28,932

|

|

|

|

(28,932

|

)

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

(1,547,117

|

)

|

|

|

|

|

|

$

|

232,069

|

|

|

$

|

(232,069

|

)

|

|

$

|

-

|

|

The total combined valuation allowance for the year as of July 31, 2010 and April 30, 2010 is $(232,069) and $(203,137), respectively.

Note 8 Investment

During the quarter ended July 31, 2010 the Company invested $50,000 for a 10% interest in Women’s Health House (WHH). Through this investment Belltower will receive revenue profit participation from products that WHH has and will acquire revenue interests in through direct response television marketing campaigns targeted primarily at health and beauty products for the female consumer.

The Company will record the amount as a long-term investment.

Note 9 – Subsequent Events

Pursuant to Financial Accounting Standards Board Accounting Standards Codification 855-10, we have evaluated all events or transactions that occurred from August 1, 2010 through the filing with the SEC.

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS

Belltower Entertainment Corp, formerly Britton International Inc.

(sometimes the "Company") is a Nevada corporation incorporated on August 1,

2003. On September 5, 2008, we acquired all of the outstanding shares of capital

stock of Calico Entertainment Group, Inc. ("Calico") from the shareholders of

Calico and the Company (directly or through Calico) is currently engaged in the

production, as an independent filmmaker, and in distribution of feature length

and shorter length movies.

The Company believes that the entertainment industry is experiencing major

market expansion along with major structural and technological change. Although

the industry is dominated by the major studios, the Company believes that there

is still opportunity for independent filmmakers in the domestic and foreign

markets.

We currently own a 20% revenue interest in an original literary composition

and completed film project called "Stuck" that we acquired from Prodigy Pictures

Inc. in 2007; said revenue interest is subject to the repayment of prior

financing on the film from the net proceeds from distribution. Our interest and

participation in the investment is passive and we will be relying upon Prodigy

Pictures Inc. to monitor the investment. Prodigy Pictures Inc. currently owns a

40% revenue interest in the film and owns approximately 2% of our issued and

outstanding common stock.We own a ten (10%) percent revenue profit participation in Women's Health House, an investment member in a limited liability company, a direct response television marketing investment company.

We currently own a 10% interest in Women's Health House. Through through this investment we will receive revenue interest in direct response television marketing campaigns.

In addition, we are in the process of developing a production slate of future projects. We are in pre-production for a film project currently known as "Little Treasure," a family comedy and we also developing a film project currently known as "Smokescreen," an action-adventure story about marijuana smuggling based upon a Robert Sabbag novel of the same name. Further, we are currently negotiating for other potential feature film projects. We anticipate that any selection of a film project and our participation in the venture may be complex and extremely risky. Further, there can be no assurance that any of our production slate will be completed or if completed, successful. Due to current general economic condition and the shortages of available capital, there is no assurance that we will be able to identify and evaluate other suitable film projects.

We intend to use outside financing wherever it is possible for our film

projects. This ability will allow the Company to attract higher quality

independent projects. Typically a single purpose entity specific to the film

project is established to produce and finance the film. We have formed Y2K

Productions, Inc., 19th Hole Productions, LLC and 3A Productions Corp, to serve

as these entities. We are in the process of forming Little Treasure Productions,

LLC for the production of "Little Treasure." The entity, with the Company or

Calico, then contracts with the financing parties and the owners of the film

project. We will be competing,

however, withother established and well-

financed entities. Our competitive advantage is that we will be able to provide

the targeted independent project with less production restrictions and a

larger ownership

in the completed project. We further have had preliminary

negotiations, at a favorable cost, with established production facilities in

Canada and China. There is no assurance that these negotiations will result in

enhancing or increasing our competitive advantage, if any, or result in us

utilizing the production facility or completing a film project.

Generally.

Our general and administrative expenses increased by $128,661 during the three months ended July 31, 2010 as compared to the three months ended July 31, 2009. During this period we had increased wages due to the accrual of salaries for CEO and CFO. Set forth below is the three month comparative summary for the three months thereon indicated:

|

|

|

For the Three Months Ended July 31,

|

|

|

|

|

2010

|

|

|

2009

|

|

|

General and

|

|

|

|

|

|

|

|

administrative expenses

|

|

$

|

181,184

|

|

|

$

|

52,523

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from operations

|

|

|

(181,184

|

)

|

|

|

(52,523

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total nonoperating income ( expenses )

|

|

|

(11,698

|

)

|

|

|

(797

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(192,882

|

)

|

|

$

|

(53,320

|

)

|

Our total nonoperating expenses increased by $10,901 for the three months ended July 31, 2010 compared to the three months ended July 31, 2009 due to an increase in interest expense of $10,946. This interest expense increased as we borrowed funds allocated for pre-production costs.

Liquidity

As of July 31, 2010, we had total assets of $949,804 and total liabilities of $1,202,678 and we had a negative net worth of ($252,874). As of April 30, 2010, we had total assets of $1,332,837 and total liabilities of $1,392,829 and we had a negative net worth of ($59,992).

As of July 31, 2010 we had a cash balance of $26,194, as of April 30, 2010 we had $45,674.

We have had no revenues from May 1, 2010 through July 31, 2010. We have an accumulated deficit from inception through April 30, 2010 of $1,354,237 and as of July 31, 2010 of $1,547,119.

The Company has a $50,000 note payable to an individual that was due March 31, 2010. The Company is currently negotiating new payment terms.

As of July 31, 2010 management has a going concern determination based on its lack of revenue, negative working capital and notes payable liability.

It is management expectation that its first production will commence in 2011.

ITEM 3. EVALUATION OF DISCLOSURE ON CONTROLS AND PROCEDURES.

Based on an evaluation of our disclosure controls and procedures as of the end

of the period covered by this Form 10Q (and the financial statements contained

in the report), our president and treasurer have determined that our current

disclosure controls and procedures are effective.

There have not been any changes in our internal control over financial reporting

(as such term is defined in Rule 13a-15(f) under the Exchange Act) or any other

factors during the quarter covered by this report, that have materially

affected, or are reasonably likely to materially affect our internal control

over financial reporting.

ITEM 4(T). CONTROLS AND PROCEDURES.

Internal control over financial reporting refers to the process designed by, or

under the supervision of, our Chief Executive Officer and Chief Financial

Officer, and effected by our Board of Directors, management and other personnel,

to provide reasonable assurance regarding the reliability of financial reporting

and the preparation of financial statements for external purposes in accordance

with generally accepted accounting principles, and includes those policies an

procedures that:

|

o

|

Pertain to the maintenance of records that in reasonable detail

accurately and fairly reflect the transactions and dispositions of our

assets;

|

|

|

|

|

o

|

Provide reasonable assurance that transactions are recorded as

necessary to permit preparation of financial statements in accordance

with generally accepted accounting principles, and that our receipts

and expenditures are being made only in accordance with authorization

of our management and directors; and

|

|

|

|

|

o

|

Provide reasonable assurance regarding prevention or timely detection

of unauthorized acquisitions, use or disposition of our assets that

could have a material effect on the financial statements.

|

Internal control over financial reporting cannot provide absolute assurance of achieving financial reporting objectives because of its inherent limitations. It is a process that involves human diligence and compliance and is subject to lapses in judgment and breakdowns resulting from human failures. It also can becircumvented by collusion or improper management override.

Because of such limitations,there is a risk that material misstatements may not be prevented or detected on a timely basis by internal control over financial reporting. However, these inherent limitations are known features of the financial reporting process. Therefore,it is possibl to design into the process certain safeguards to reduce, though not eliminate, this risk. Management is responsible for establishing and maintaining adequate internal control over our financial reporting. To avoid segregation of duties due to management accounting size, management has engaged an outside CPA to assist in the financial reporting.

Management has used the framework set forth in the report entitled Internal Control - Integrated Framework published by the Committee of Sponsoring Organizations of the Treadway Commission, known as COSO, to evaluate the effectiveness of our internal control over financial reporting.

Management has concluded that our internal control over financial reporting was effective as of the quarter ended July 31, 2010.

The Company was not an "accelerated filer" for the 2009 fiscal year because it is qualified as a "small business issuer". Hence, under current law, the internal controls certification and attestation requirements of Section 404 of the Sarbanes-Oxley act will not apply to the Company.

PART II

OTHER INFORMATION

ITEM 1 - LEGAL PROCEEDINGS

.................................................

NONE

ITEM 1A - RISK FACTORS.

There has been no material change in the risk factors previously disclosed.

ITEM 2 - UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

For the quarter ending July 31, 2010, we sold and issued an aggregate of

3,220,000 shares of common stock at $0.10 per share. The sale and issuance of

the shares was exempt from registration under the Securities Act of 1933,

as amended, by virtue of section 4(2) as a transaction not involving a public

offering. Each of the shareholders had acquired the shares for investment

and not with a view to distribution to the public. All of these shares had been

issued for investment purposes in a "private transaction" and were "restricted"

shares as defined in Rule 144 under the Securities Act of 1933, as amended.

ITEM 3 - DEFAULTS UPON SENIOR SECURITIES

...................................None

ITEM 4 - SUBMISSION OF MATTER TO A VOTE OF SECURITY HOLDERS

................None

ITEM 5 - OTHER INFORMATION

As at the close of business on July 31, 2010, Nina Yang resigned as an officer and director of the company. The resignation was not the result of any disagreement with the company on any matter relating to our operations, policies or practices. Nina Yang will continue to serve as a producer for the feature film “Little Treasure” currently to commence production in 2011. Donald K. Bell, our former president and a currently a member of our board of directors will serve as President and Chief Executive Officer until an industry successor is duly retained.

ITEM 6 - EXHIBITS AND REPORTS ON FORM 8-K

There were no 8-K's filed during the reporting period.

The following exhibits are filed with this report:

|

31.1

|

Rule 13a-14(a)/15d-14(a) - Certification of Chief Executive Officer.

|

|

31.2

|

Rule 13a-14(a)/15d-14(a) - Certification of Chief Financial Officer.

|

|

32.1

|

Section 1350 Certification - Chief Executive Officer.

|

|

32.1

|

Section 1350 Certification - Chief Financial Officer.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

|

|

BELLTOWER ENTERTAINMENT CORP.

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: September 20, 2010

|

By:

|

/s/

Donald K. Bell

|

|

|

|

|

Donald K. Bell

|

|

|

|

|

Director, President and Chief Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: September 20, 2010

|

By:

|

/s/ Lawrence Lichter

|

|

|

|

|

Lawrence Lichter

|

|

|

|

|

Treasurer and Chief Financial Officer

|

|

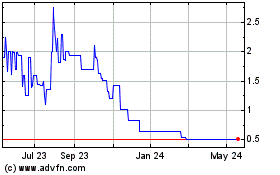

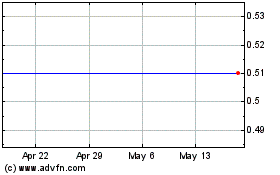

GTFN (PK) (USOTC:BTOW)

Historical Stock Chart

From Feb 2025 to Mar 2025

GTFN (PK) (USOTC:BTOW)

Historical Stock Chart

From Mar 2024 to Mar 2025