false

0001477009

0001477009

2024-11-08

2024-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 8, 2024

TREES CORPORATION

(Exact Name of Registrant as Specified in Charter)

| Colorado |

|

000-54457 |

|

90-1072649 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

215 Union Boulevard, Suite 415

Lakewood, Colorado |

|

80228 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (303) 759-1300

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

Senior Secured Working Capital

On November 8, 2024 (“Effective Date”),

TREES Corporation (the “Company”) entered into a Senior Secured Promissory Note with TCM Tactical Opportunities Fund II LP

and/or affiliates thereof (“Holder”) in the principal amount of $1,250,000 (the “Note”). The Note bears interest

at the rate of 12% per annum and matures on September 15, 2026. The Note is pari passu to any amount(s) that may become due

and payable under that certain Senior Secured Promissory Note issued to Holder on June 15, 2024 as well as Senior Secured Convertible

Promissory Notes issued to Holder and certain other investors on December 15, 2023 (collectively, “Prior Notes”). In the event

of liquidation, the Note is elevated in right of payment ahead of the Prior Notes as well as any existing Company debts, and payment of

the Note is pari passu in respect of payment of the Prior Notes. The Note contains a liquidation preference equal to 1.5 times

the principal amount, payable upon the earlier of the maturity date, the date of repayment as permitted in the Note, or a ‘change

in control’ (as defined therein).

Holder is a senior secured lender of the Company

and the lead investor in connection with the Prior Notes. Reference is made to the Form 8-Ks of the Company filed on June 14, 2024 and

December 21, 2023 for a more complete description of the transaction relating to the Prior Notes.

On November 8, 2024, the Company granted to Holder

2,500,000 warrants (“Warrants”) to purchase the Company’s common stock at an exercise price equal to the product of

(i) the average of the per share price of the common stock for the ten (10) trading days immediately preceding the Effective Date as reported

on the OTCQB multiplied by (ii) 1.25 (“Exercise Price”). These warrants expire on November 15, 2029.

Also on November 8, 2024, the Company reduced

the exercise price of 6,545,149 warrants previously granted to Holder and/or affiliates thereof to the Exercise Price; and extended the

expiration date thereof to November 15, 2029.

Amendments to Headgate Agreements

On November 8, 2024, the Company entered into

a Second Modification to Asset Purchase Agreement (“Second Modification”) with Headgate III, LLC (“Headgate”),

pursuant to which the Company paid to Headgate the sum of $802,500 (“Payment”) in full satisfaction of all amounts due from

the Company to Headgate under the original Asset Purchase Agreement dated October 28, 2022, as amended on December 6, 2023, by and among

the Company, Green Man Colorado LLC, and GMC, LLC (from whom right to the Payment was assigned to Headgate).

Also on November 8, 2024, in connection with the

Second Modification, the Company (through a wholly-owned subsidiary) and Headgate entered into a Modification of First Amendment to Commercial

Lease Agreement pursuant to which, in partial consideration for the completion of the Payment (as described above), the provisions of

the original lease dated November 23, 2022 between the Company’s subsidiary and Headgate, as amended on December 6, 2023, wherein

the Company had agreed to a ‘confession of judgment’ or similar pre-litigation arrangement (in the event of default of the

Payment), is terminated, null and void, and of no further force or effect.

The foregoing descriptions of the above agreements

do not purport to be complete and are qualified in their entirety by reference to the full texts thereof, which are annexed hereto as

Exhibits 10.1, 10.2, 10.3, 10.4 and 10.5, and incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 of this

Current Report on Form 8-K regarding the Note is incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

Dated: November 15, 2024

| |

By: |

/s/ Adam Hershey |

| |

Name: |

Adam Hershey |

| |

Title: |

Interim Chief Executive Officer |

3

Exhibit 10.1

NEITHER

THE ISSUANCE NOR SALE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED,

OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF

(A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES FILED PURSUANT TO THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION

OF COUNSEL IN FORM AND SUBSTANCE SATISFACTORY TO THE BORROWER THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD PURSUANT

TO RULE 144 OR RULE 144A UNDER SAID ACT.

| Principal Amount:

$1,250,000 |

Issue

Date: November 8, 2024 |

SENIOR

SECURED PROMISSORY NOTE

FOR

VALUE RECEIVED, TREES CORPORATION, a Colorado corporation (hereinafter called the “Borrower”), hereby promises

to pay to the order of TCM Tactical Opportunities Fund II LP, or its registered assigns (the “Holder”) up to the principal

sum of $1,250,000 (ONE MILLION TWO HUNDRED FIFTY THOUSAND DOLLARS) (the “Principal Amount”), together with interest

at the rate of twelve percent (12%) per annum on the aggregate and then outstanding Principal Amount of this Note, at maturity or upon

acceleration or otherwise, as set forth herein (this “Note”).

Borrower

shall be entitled, at any time prior to the Maturity Date, to request from Holder in writing in the manner set forth in Exhibit A,

and Holder commits to lend to Borrower upon request pursuant to the provisions of this Note, up to the Principal Amount.

The

maturity date of this Note shall be on September 15, 2026 (the “Maturity Date”), and is the date upon which the Principal

Amount, as well as all accrued and unpaid interest and other fees, shall be due and payable.

Interest

on the outstanding Principal Amount shall be paid quarterly in arrears commencing March 15, 2025.

Any

amount of principal or interest on this Note, which is not paid by the Maturity Date, shall bear interest at the rate of the lesser of

(i) eighteen percent (18%) per annum or (ii) the maximum amount allowed by law, from the due date thereof until the same is paid (“Default

Interest”).

The

Borrower shall have the right to prepay all or any portion of this Note. The following procedure shall apply in connection with any such

prepayment. The Borrower shall first provide notice of its intention to prepay all or any portion of this Note (“Prepayment Notice”).

All

payments due hereunder in accordance with the terms hereof) shall be made in lawful money of the United States of America. All payments

shall be made at such address as the Holder shall hereafter give to the Borrower by written notice made in accordance with the provisions

of this Note. Whenever any amount expressed to be due by the terms of this Note is due on any day which is not a business day, the same

shall instead be due on the next succeeding day which is a business day and, in the case of any interest payment date which is not the

date on which this Note is paid in full, the extension of the due date thereof shall not be taken into account for purposes of determining

the amount of interest due on such date. As used in this Note, the term “business day” shall mean any day other than a Saturday,

Sunday or a day on which commercial banks in the city of New York, New York are authorized or required by law or executive order to remain

closed.

ARTICLE

I

SENIORITY

1.1

Seniority. This Note shall rank pari passu with that certain Amended and Restated Senior Secured Promissory Note, issued

by Borrower to Holder on December 15, 2023 and the Senior Secured Promissory Note, issued by Borrower to Holder on June 15, 2024. Borrower

shall not make any interest payments with respect to Borrower Debt that is junior to this Note. “Borrower Debt” means

any indebtedness now or during the term hereof for borrowed money of any kind whether evidenced by notes, debentures, bonds or similar

instruments, and any guaranty of any of the foregoing, excluding (i) any other Notes issued in the Offering pursuant to the Purchase

Agreement, (ii) accounts payable and trade debt and/or related cost, expenditures or payments incurred in the day-to-day operations of

the business of the Borrower, (iii) operating, real estate and/or capex or similar leases, (iv) royalties existing as of the date hereof

or ordinary course of business operating licenses and (vi) any other indebtedness for borrowed money incurred upon the written consent

of the Holder.

1.2

Borrower Covenant. Borrower agrees that so long as any of the obligations evidenced hereby remain outstanding it will not become

obligated or a guarantor with respect to any Borrower Debt that is not, by its terms, junior in right of payment to the obligations hereunder;

provided however that nothing herein shall prohibit the Borrower from repaying or refinancing any or all of its notes ranking pari

passu with this Note.

ARTICLE

II

LIQUIDATION PREFERENCE; WARRANTS

2.1

Holder Liquidation Preference. The outstanding Principal on this Note shall be payable in accordance with this Section 2.1. In

addition to interest and other fees as set forth herein, upon the earlier of (i) the Maturity Date, (ii) the date of repayment as allowed

under this Note, or (iii) a ‘change in control’ (as defined below), Borrower shall pay to Holder an amount equal to the Principal

Amount multiplied by 1.5.

For

purposes hereof, a ‘change in control’ shall mean, in respect of Borrower, (A) the sale of greater than 50% of its issued

and outstanding capital stock; (B) a sale of all or substantially all of its assets; or (C) a merger wherein Borrower is merged with

or into a unrelated third party and Borrower is not the surviving entity.

2.2

Warrants. Upon the signing of this Note, Holder shall be granted warrants to purchase 2,500,000 shares of common stock, par value

$.001 per share, of Borrower, pursuant to a Warrant Agreement executed and delivered of even date herewith.

ARTICLE

III

EVENTS

OF DEFAULT; REMEDIES

3.1

Events of Default. The occurrence of any of the following events of default shall each be an “Event of Default”:

(a)

Failure to Pay Principal or Interest. The Borrower fails to pay the Principal Amount hereof or interest thereon when due on this

Note, whether at the Maturity Date, upon acceleration, or otherwise, and such failure continues for a period of ten (10) business days

after written notice thereof to the Borrower from the Holder.

(b)

Breach of Covenants. The Borrower breaches any covenant or other term or condition contained in this Note or in any other document

entered into between the Holder and Borrower in any material respect, and such breach continues for a period of thirty (30) days after

written notice thereof to the Borrower from the Holder.

(c)

Breach of Representations and Warranties. Any representation or warranty of the Borrower made herein or in any agreement, statement

or certificate given in writing pursuant hereto or in connection herewith, shall be false or misleading in any material respect when

made and the breach of which has (or with the passage of time will have) a material adverse effect on the rights of the Holder with respect

to this Note, provided that Holder shall provide Borrower with five (5) days advance notice that Holder intends to declare that such

representation or warranty was breached by the Borrower.

(d)

Receiver or Trustee. The Borrower or any subsidiary of the Borrower shall make an assignment for the benefit of creditors, or

apply for or consent to the appointment of a receiver or trustee for it or for a substantial part of its property or business, or such

a receiver or trustee shall otherwise be appointed.

(e)

Bankruptcy. Bankruptcy, insolvency, reorganization or liquidation proceedings or other proceedings, voluntary or involuntary,

for relief under any bankruptcy law or any law for the relief of debtors shall be instituted by or against the Borrower or any subsidiary

of the Borrower, which proceedings are not dismissed within ninety (90) days after institution.

(f)

Liquidation. The Borrower commences any dissolution, liquidation or winding up of Borrower.

3.2

Remedies. If an Event of Default shall occur, then the Holder, provided it receives the consent of the Lead Investor (except in

connection with an Event of Default resulting from Borrower’s failure to pay the Principal Amount hereof or interest thereon at

the Maturity Date for which no consent is required), by written notice to the Borrower, may (i) declare the obligations due hereunder

to be immediately due and payable, whereupon the sum of (x) the outstanding Principal Amount of this Note and (y) the interest and other

amounts outstanding hereunder shall become and shall be forthwith due and payable, without diligence, presentment, demand, protest or

other notice of any kind, all of which are hereby expressly waived, and (ii) exercise any and all of its other rights under applicable

law and/or hereunder. Any payment pursuant to this Section 3.2 shall be applied first to the Interest owed under this Note, second, to

any other obligations (other than principal) owed hereunder and lastly to the principal balance of this Note.

Notwithstanding

anything contained in this Section 3.2 or otherwise, Borrower and Holder expressly agree that the obligations under this Note shall be

senior to, and shall be paid ahead of, any amount(s) that may become due and payable under those certain Amended and Restated Senior

Secured Convertible Promissory Notes issued on December 15, 2023 by Borrower in favor of Holder and certain other investors (the “December

2023 Notes”). For purposes of clarity, in the event of liquidation, this Note shall be elevated in right of payment ahead of the

December 2023 Notes as well as any existing Borrower debts, and payment of this Note shall be pari passu in respect of payment

of that certain Amended and Restated Senior Secured Promissory Note, issued by Borrower in favor of Holder on December 15, 2023 in the

principal amount of $500,000 and the Senior Secured Promissory Note, issued by Borrower in favor of Holder on June 15, 2024 in the principal

amount of $500,000.

ARTICLE

IV

MISCELLANEOUS

4.1

Failure or Indulgence Not Waiver. No failure or delay on the part of the Holder in the exercise of any power, right or privilege

hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of any such power, right or privilege preclude

other or further exercise thereof or of any other right, power or privileges.

4.2

Notices. Any notices, consents, waivers or other communications required or permitted to be given hereunder must be in writing

and will be deemed to have been given (i) upon receipt, when delivered personally or via email to the email address designated below;

(ii) three days after being sent by U.S. certified mail, return receipt requested; or (iii) one day after deposit with a nationally recognized

overnight delivery service, in each case properly addressed to the party to receive the same. The addresses for such communications shall

be:

If

to the Borrower, to:

TREES

Corporation

215

Union Boulevard, Suite 415

Lakewood,

CO 80228

Attention:

David R. Fishkin, General Counsel

dfishkin@treescann.com

If

to the Holder, to:

TCM

Tactical Opportunities Fund II, LP

4

International Drive, Suite 230

Rye

Brook, NY 10573

Attention:

Douglas Troob

dtroob@troobcapital.com

4.3

Amendments. Except for the Borrower’s obligations to repay the outstanding Principal Amount and any accrued and unpaid interest,

the terms of this Note may be modified with the written consent of the

Borrower and the Holder.

4.4

Assignability. This Note shall be binding upon the Borrower and its successors and assigns, and shall inure to the benefit of

the Holder and its successors and assigns. This Note may not be transferred unless the Holder delivers to the Borrower a written opinion

of legal counsel or otherwise satisfies the Borrower with respect to the compliance of such transfer with applicable securities laws

and the transferee agrees to be bound by all of the provisions of this Note. Each transferee of this Note must be an “accredited

investor” (as defined in Rule 501(a) of the Securities Act).

4.5

Costs and Expenses. The Parties shall pay their own respective costs and expenses. After the occurrence of an Event of Default,

Borrower agrees to pay Holder for all reasonable out-of-pocket costs and expenses, including reasonable attorneys’ fees, incurred

by Holder in connection with the enforcement of this Note.

4.6

Governing Law. All questions concerning the construction, validity, enforcement and interpretation of this Note shall be governed

by and construed and enforced in accordance with the internal laws of the State of Colorado, without regard to the principles of conflict

of laws thereof.

4.7

Exclusive Jurisdiction. Each party agrees that all legal proceedings concerning the interpretation, enforcement and defense of

the transactions contemplated by this Note (whether brought against a party hereto or its respective affiliates, directors, officers,

shareholders, employees or agents) shall only be commenced in the state and federal courts sitting in Denver County, State of Colorado

(the “Colorado Courts”). Each party hereto hereby irrevocably submits to the exclusive jurisdiction of the Colorado

Courts for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated hereby or discussed

herein (including with respect to the enforcement of this Note), and hereby irrevocably waives, and agrees not to assert in any suit,

action or proceeding, any claim that it is not personally subject to the jurisdiction of such Colorado Courts, or such Colorado Courts

are improper or inconvenient venue for such proceeding. Each party hereby irrevocably waives personal service of process and consents

to process being served in any such suit, action or proceeding by mailing a copy thereof via registered or certified mail or overnight

delivery (with evidence of delivery) to such party at the address in effect for notices to it under this Note and agrees that such service

shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any

way any right to serve process in any other manner permitted by applicable law. Each party hereto hereby irrevocably waives, to the fullest

extent permitted by applicable law, any and all right to trial by jury in any legal proceeding arising out of or relating to this Note

or the transactions contemplated hereby.

4.8

JURY TRIAL WAIVER. THE BORROWER AND THE HOLDER HEREBY WAIVE A

TRIAL BY JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM BROUGHT BY EITHER OF THE PARTIES HERETO AGAINST THE OTHER IN RESPECT OF ANY MATTER

ARISING OUT OF OR IN CONNECTION WITH THIS NOTE.

4.9

Usury. If it shall be found that any interest or other amount deemed interest due hereunder violates the applicable law governing

usury, the applicable rate of interest due hereunder shall automatically be lowered to equal the maximum rate of interest permitted under

applicable law.

**

signature page to follow **

IN

WITNESS WHEREOF, Borrower has caused this Note to be signed in its name by its duly authorized officer on the Issue Date.

|

TREES Corporation |

| |

|

|

By: |

|

|

|

Name: |

Adam Hershey |

|

|

Title: |

Interim Chief Executive Officer |

EXHIBIT

A

Notice

of Request for Funds

The

undersigned hereby elects to request $___________ principal amount of the Note dated as of June 15, 2024 (the “Note”) issued

by TREES Corporation, a Colorado corporation (the “Borrower”), and requests that the amount above be deposited in the following

account:

| |

Sincerely, |

| |

|

| |

TREES

Corporation |

| |

|

| |

By: |

|

| |

|

Name: |

Adam

Hershey |

| |

|

Title: |

Interim

Chief Executive Officer |

Exhibit 10.2

NEITHER THIS WARRANT NOR

THE SECURITIES FOR WHICH THIS WARRANT IS EXERCISABLE HAVE BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES

COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES

ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT

AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS AS EVIDENCED BY A LEGAL OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE

FORM AND SUBSTANCE OF WHICH SHALL BE REASONABLY ACCEPTABLE TO THE COMPANY.

TREES CORPORATION

WARRANT TO PURCHASE SHARES

OF COMMON STOCK

Effective Date: November

8, 2024

Expiration Date: November

15, 2029

No. TCORPW-1

TREES CORPORATION,

a Colorado corporation (the “Company”), for value received, hereby certifies that TCM Tactical Opportunities Fund II

LP, or its registered assigns (the “Holder”), is entitled to purchase from the Company, at the Exercise Price, 2,500,000

shares of the duly authorized, validly issued, fully paid and nonassessable shares the Company’s common stock with a par value of

$0.001 (“Common Stock”), at any time or from time to time prior to 11:59 P.M., New York City time, on the Expiration

Date, all subject to the terms, conditions and adjustments set forth below.

This Warrant

is one of a series of warrants of like tenor that have been issued in connection with the Company’s private offering solely to accredited

investors of senior secured convertible promissory notes and warrants in accordance with, and subject to, the terms and conditions described

in the Securities Purchase Agreement between the Holder and the Company, as the same may be amended and supplemented from time to time

(the “Purchase Agreement”). This Warrant is entitled to the benefits of the Purchase Agreement and is also subject

to the obligations imposed by the Purchase Agreement, including as it relates to any restrictions on transfer of ownership of this Warrant.

Capitalized terms used herein and not otherwise

defined herein shall have the meanings assigned such terms in the Purchase Agreement.

1. Definitions.

As used herein, unless the context otherwise requires, the following terms shall have the meanings indicated:

“Acquisition”

shall mean any sale or other disposition of all or substantially all of the assets of the Company, or any reorganization, consolidation,

or merger of the Company where the holders of the Company’s securities before the transaction beneficially own less than thirty

percent (30%) of the outstanding voting securities of the surviving entity after the transaction.

“Business

Day” shall mean any day other than a Saturday or a Sunday or a day on which commercial banking institutions in the City of New

York are authorized by law to be closed. Any reference to “days” (unless Business Days are specified) shall mean calendar

days. In any circumstance where a date of determination under this Warrant falls on a date that is not a Business Day, it shall be deemed

to be the next Business Day.

“Common

Stock” shall have the meaning assigned to it in the introduction to this Warrant, such term to include any stock into which

such Common Stock shall have been changed or any stock resulting from any reclassification of such Common Stock, and all other stock of

any class or classes (however designated) of the Company the holders of which have the right, without limitation as to amount, either

to all or to a share of the balance of current dividends and liquidating dividends after the payment of dividends and distributions on

any shares entitled to preference.

“Company”

shall have the meaning assigned to it in the introduction to this Warrant, such term to include any corporation or other entity which

shall succeed to or assume the obligations of the Company hereunder in compliance with Section 4.

“Exchange

Act” shall mean the Securities Exchange Act of 1934, as amended from time to time, and the rules and regulations thereunder,

or any successor statute.

“Exercise

Price” in respect of any Warrant Share shall mean the product of (i) the average of the per share price of the Common Stock

for the ten (10) trading days immediately preceding the Effective Date as reported on the OTCQB multiplied by (ii) 1.25, subject

to adjustment and readjustment from time to time as provided in Section 3, and, as so adjusted or readjusted, shall remain in effect until

a further adjustment or readjustment thereof is required by Section 3.

“Expiration

Date” shall mean the date set forth on the first page hereto, subject to Section 4.

“Person”

shall mean any individual, firm, partnership, corporation, trust, joint venture, association, joint stock company, limited liability company,

unincorporated organization or any other entity or organization, including a government or agency or political subdivision thereof, and

shall include any successor (by merger or otherwise) of such entity.

“Securities

Act” shall mean the Securities Act of 1933, as amended from time to time, and the rules and regulations thereunder, or any successor

statute.

“Warrant

Shares” shall mean the number of shares of Common Stock that can be purchased upon exercise of this Warrant.

2.

Exercise of Warrant.

2.1

Manner of Exercise; Payment of the Exercise Price.

(a) This

Warrant may be exercised by the Holder hereof, in whole or in part, at any time or from time to time prior to the Expiration Date, by

surrendering to the Company at its principal office, this Warrant, with the form of Election to Purchase Shares attached hereto as Exhibit

A, duly executed by the Holder and accompanied by payment of the Exercise Price for the number of shares of Common Stock specified

in such form.

(b) Payment

of the Exercise Price shall be made in United States currency by cash or delivery of a check payable to the order of the Company or by

wire transfer to the Company.

2.2 When

Exercise Effective. Each exercise of this Warrant shall be deemed to have been effected immediately prior to the close of business

on the Business Day on which this Warrant shall have been surrendered to, and the Exercise Price shall have been received by, the Company

and at such time the Person or Persons in whose name or names any certificate or certificates for shares of Common Stock shall be issuable

upon such exercise shall be deemed to have become the holder or holders of record thereof for all purposes.

2.3

Delivery of Stock Certificates, Etc.; Charges, Taxes and Expenses.

(a) As

soon as practicable after each exercise of this Warrant, in whole or in part, the Company shall cause to be issued in such denominations

as may be requested by the Holder in the Election to Purchase Shares, in the name of and delivered to the Holder or, subject to applicable

securities laws, as the Holder may direct, the following:

(i) a

certificate or certificates for the number of Warrant Shares to which the Holder shall be entitled upon such exercise plus, if applicable,

in lieu of issuance of any fractional share to which the Holder would otherwise be entitled, a Company check pursuant to Section 7.5,

and

(ii) in

case such exercise is for less than all of the Warrant Shares a new Warrant or Warrants of like tenor, covering the balance of the Warrant

Shares.

(b) Issuance

of Warrant Shares upon the exercise of this Warrant shall be made without charge to the Holder hereof for any issue tax or other incidental

expense, in respect of the issuance of such certificates, all of which such taxes and expenses shall be paid by the Company; provided,

however, the Holder shall pay any applicable transfer or similar tax resulting from the issuance of Warrant Shares to any Person

other than the Holder.

3. Adjustment

to Exercise Price and Warrant Shares Upon Stock Dividends, Splits or Combination of Common Stock. In the event that the Company shall

(a) issue additional shares of the Common Stock to those issued and outstanding as of the date hereof, either as a dividend or other distribution

on the outstanding Common Stock, or otherwise (b) subdivide its outstanding shares of Common Stock, or (c) combine its outstanding shares

of Common Stock into a smaller number of shares of Common Stock, then, in each such event, the Exercise Price shall, simultaneously with

the happening of such event, be adjusted by multiplying the then Exercise Price by a fraction, the numerator of which shall be the number

of shares of Common Stock outstanding immediately prior to such event and the denominator of which shall be the number of shares of Common

Stock outstanding immediately after such event, and the product so obtained shall thereafter be the Exercise Price then in effect. The

Exercise Price, as so adjusted, shall be readjusted in the same manner upon the happening of any successive event or events described

herein in this Section 3. The number of Warrant Shares that the Holder shall thereafter, be entitled to receive on the exercise hereof

as provided in Section 2, shall be adjusted to a number determined by multiplying the number of Warrant Shares that would otherwise (but

for the provisions of this Section 3) be issuable on such exercise by a fraction of which the numerator is the Exercise Price that would

otherwise (but for the provisions of this Section 3) be in effect, and the denominator is the Exercise Price in effect on the date of

such exercise.

4. Acquisition

of Company. In the event of a proposed Acquisition of the Company, the Company shall provide the Holder with all information with

respect to the Acquisition that is otherwise provided to shareholders of the Company at such time and from time to time during the pendency

of the Acquisition, including (but not limited to) the proposed closing date (the “Proposed Closing Date”) and the

proposed price to be paid in the proposed Acquisition. The Company shall provide the Holder with such information no less than fifteen

(15) days prior to the Proposed Closing Date. The Holder shall have the right to exercise this Warrant in accordance with Section 2 no

less than five (5) days prior to the closing date with respect to the proposed Acquisition; if the Warrant is not exercised on or before

the fifth (5th) day preceding the closing date with respect to the proposed Acquisition, then the Warrant shall expire upon

the occurrence of the closing of the Acquisition.

5. Certificate

as to Adjustments. In each case of any adjustment or readjustment pursuant to Section 3, the Company at its expense shall promptly

compute such adjustment or readjustment in accordance with the terms of this Warrant and prepare a certificate, signed by the Chief Financial

Officer, or Corporate Secretary of the Company, setting forth such adjustment or readjustment (including but not limited to the Exercise

Price and number of Warrant Shares purchasable hereunder after giving effect to such adjustment or readjustment) and showing in reasonable

detail the method of calculation thereof. Such certificate shall constitute an amendment to this Warrant and shall be delivered to the

Holder in the manner provided in Section 8. Upon request of the Holder, the Company shall issue a new Warrant that reflects the terms

of any such adjustment or readjustment reflected in any such certificate issued hereunder.

Regardless of any

adjustment or readjustment in the Exercise Price or the number of Warrant Shares or other securities actually purchasable under the Warrant

(or the issuance of any certificate with respect thereto pursuant to this Section 5), any Warrant may continue to express the Exercise

Price and the number of Warrant Shares purchasable under the Warrant as the price and number of shares were expressed on the Warrant when

initially issued, subject to the Holder’s rights hereunder to exchange the Warrant for a new Warrant that reflects the terms of

any such adjustment or readjustment.

6. Reservation

of Stock, Etc. The Company shall at all times reserve and keep available, solely for issuance and delivery upon exercise of the Warrants,

100% of the number of Warrant Shares from time to time issuable upon exercise of all Warrants at the time outstanding. All Warrant Shares

issuable upon exercise of any Warrants shall be duly authorized and, when issued upon such exercise, shall be validly issued and, in the

case of shares, fully paid and nonassessable with no liability on the part of the holders thereof, and, in the case of all securities,

shall be free from all taxes, liens, security interests, encumbrances, preemptive rights and charges, except for the payment of applicable

transfer or similar taxes by the Holder upon issuance to a Person other than the Holder. Subsequent to the Expiration Date, no shares

of stock need be reserved in respect of any unexercised portion of this Warrant.

7.

Registration and Transfer of Warrants, Etc.

7.1 Warrant

Register; Ownership of Warrants. Each Warrant issued by the Company shall be numbered and shall be registered in a warrant register

(the “Warrant Register”) as it is issued and transferred, which Warrant Register shall be maintained by the Company

at its principal office or, at the Company’s election and expense, by a warrant agent or the Company’s Transfer Agent. The

Company shall be entitled to treat the registered Holder of any Warrant on the Warrant Register as the owner in fact thereof for all purposes

and shall not be bound to recognize any equitable or other claim to or interest in such Warrant on the part of any other Person, and shall

not be affected by any notice to the contrary, except that, if and when any Warrant is properly assigned in blank, the Company may (but

shall not be obligated to) treat the bearer thereof as the owner of such Warrant for all purposes. A Warrant, if properly assigned, may

be exercised by a new holder without a new Warrant first having been issued.

7.2

Transfer of Warrants and Compliance with Securities Laws.

(a) Neither

this Warrant nor any interest therein may be transferred or assigned in whole or in part without compliance with all applicable federal

and state securities laws by the Holder and the transferee or assignee thereof. Subject to such compliance, this Warrant and all rights

hereunder are transferable in whole or in part, without charge to the Holder hereof, upon surrender of this Warrant with a properly executed

Form of Assignment, attached hereto as Exhibit B, at the principal office of the Company. Upon any partial transfer, the Company

shall at its expense issue and deliver to the Holder a new Warrant of like tenor, in the name of the Holder, which shall be exercisable

for such number of shares of Common Stock with respect to which rights under this Warrant were not so transferred and to the transferee

a new Warrant of like tenor, in the name of the transferee, which shall be exercisable for such number of shares of Common Stock with

respect to which rights under this Warrant were so transferred.

(b) The

Holder, by acceptance of this Warrant, acknowledges that neither this Warrant nor the Warrant Shares have been registered under the Securities

Act and represents and warrants to the Company that this Warrant is being acquired for investment and not for distribution or resale,

solely for Holder’s own account and not as a nominee for any other person, and that Holder will not offer, sell, pledge or otherwise

transfer this Warrant or any Warrant Shares except (i) in compliance with the requirements for an available exemption from the Securities

Act and any applicable state securities laws, or (ii) pursuant to an effective registration statement or qualification under the Securities

Act and any applicable state securities laws.

7.3 Registration

Rights. The Holder shall be entitled to the rights and subject to the obligations set forth in Article IV of the Purchase Agreement.

7.4 Replacement

of Warrants. On receipt by the Company of evidence reasonably satisfactory to the Company of the loss, theft, destruction or mutilation

of this Warrant and, in the case of any such loss, theft or destruction of this Warrant, on delivery of an indemnity agreement reasonably

satisfactory in form and amount to the Company or, in the case of any such mutilation, on surrender of such Warrant to the Company at

its principal office and cancellation thereof, the Company at its expense shall execute and deliver, in lieu thereof, a new Warrant of

like tenor.

7.5 Fractional

Shares. Notwithstanding any adjustment pursuant to Section 3, if the Common Stock shall be listed on a national securities exchange,

the Company then shall not be required to issue fractions of shares upon exercise of this Warrant or to distribute certificates which

evidence fractional shares. In lieu of fractional shares, the Company then shall make payment to the Holder of an amount in cash equal

to such fraction multiplied by the closing bid price on the principal trading market of a share of Common Stock on the date of exercise

of this Warrant.

8. Notices.

Any notices, consents, waivers or other communications required or permitted to be given hereunder must be in writing and will be deemed

to have been given (i) upon receipt, when delivered personally or via email to the email address designated below; (ii) three days after

being sent by U.S. certified mail, return receipt requested; or (iii) one day after deposit with a nationally recognized overnight delivery

service, in each case properly addressed to the party to receive the same. The addresses for such communications shall be:

If to the Company:

TREES Corporation

215 Union Boulevard, Suite 415

Lakewood, CO 80228

Attention: David R. Fishkin, General Counsel

dfishkin@treescann.com

If to the Holder:

TCM Tactical

Opportunities Fund II, LP

4 International Drive, Suite 230

Rye Brook, NY 10573

Attention: Douglas Troob

dtroob@troobcapital.com

Each party shall

provide five (5) days’ prior written notice to the other party of any change in address. Notwithstanding the foregoing, the exercise

of this Warrant shall be effective in the manner provided in Section 2.

9. Amendments.

This Warrant and any term hereof may not be amended, modified, supplemented or terminated, and waivers or consents to departures from

the provisions hereof may not be given, except by written instrument duly executed by the party against which enforcement of such amendment,

modification, supplement, termination or consent to departure is sought.

10. Descriptive

Headings, Etc. The headings in this Warrant are for convenience of reference only and shall not limit or otherwise affect the meaning

of terms contained herein. Unless the context of this Warrant otherwise requires: (a) words of any gender shall be deemed to include each

other gender; (b) words using the singular or plural number shall also include the plural or singular number, respectively; (c) the words

“hereof”, “herein” and “hereunder” and words of similar import when used in this Warrant shall refer

to this Warrant as a whole and not to any particular provision of this Warrant, and Section and paragraph references are to the Sections

and paragraphs of this Warrant unless otherwise specified; (d) the word “including” and words of similar import when used

in this Warrant shall mean “including, without limitation,” unless otherwise specified; (e) “or” is not exclusive;

and (f) provisions apply to successive events and transactions.

11. Governing

Law. This Warrant shall be governed by, and construed in accordance with, the laws of the State of Colorado (without giving effect

to the conflict of laws principles thereof).

12. Judicial

Proceedings. Any legal action, suit or proceeding brought against the Company with respect to this Warrant may be brought in any court

located in Denver County, State of Colorado, and by execution and delivery of this Warrant, the Company hereby irrevocably and unconditionally

waives any claim (by way of motion, as a defense or otherwise) of improper venue, that it is not subject personally to the jurisdiction

of such court, that such courts are an inconvenient forum or that this Warrant or its subject matter may not be enforced in or by such

court.

[Signature Page Follows]

IN WITNESS WHEREOF, the

Company has caused this Warrant to be issued as of the Effective Date.

| |

TREES CORPORATION |

| |

|

| |

By: |

|

| |

|

Name: |

Adam Hershey |

| |

|

Title: |

Interim Chief Executive Officer |

EXHIBIT A

TREES CORPORATION

ELECTION TO PURCHASE SHARES

The undersigned hereby irrevocably elects to

purchase shares of Common Stock, (“Common Stock”), of TREES CORPORATION (the “Company”) by

exercising the warrant (the “Warrant”) dated ___ __, 20__ and issued to the undersigned, and hereby makes payment

of $__ therefor. The undersigned hereby requests that the certificate(s) for such shares and payment for fractional shares be issued

and made as follows:

ISSUE/PAY TO:

(NAME)

(ADDRESS, INCLUDING ZIP CODE)

(SOCIAL SECURITY OR OTHER IDENTIFYING

NUMBER)

DELIVER TO:

(NAME)

(ADDRESS, INCLUDING ZIP CODE)

If the number

of shares of Common Stock purchased hereby is less than the number of shares of Common Stock covered by the Warrant, the undersigned requests

that a new Warrant representing the number of shares of Common Stock not so purchased be issued and delivered as follows:

ISSUE/PAY TO:

(NAME)

(ADDRESS, INCLUDING ZIP CODE)

(SOCIAL SECURITY OR OTHER IDENTIFYING

NUMBER)

DELIVER TO:

(NAME)

(ADDRESS, INCLUDING ZIP CODE)

In order to

induce the Company to give instructions to its transfer agent to issue the shares of Common Stock being purchased upon exercise of the

Warrant, the undersigned hereby represents and warrants that the undersigned is an “accredited investor” as that term is defined

in Regulation D under the Securities Act of 1933, as amended.

[Signature page follows]

| * | If other than the Holder specified on the Warrant delivered

with this Election to Purchase Shares, the transfer is subject to compliance with applicable securities laws and the payment by the Holder

of any applicable transfer or similar taxes. |

[Signature Page to Election

to Purchase Shares]

|

Individual(s):

|

|

|

| |

|

|

| |

|

|

|

Signature (exactly as name appears on stock certificate(s) tendered)

|

|

Signature of spouse, joint tenant, tenant in common, or other required signature |

| |

|

|

| |

|

|

| Print or type name |

|

Print or type name |

| |

|

|

|

Entity:

|

|

|

| |

|

|

| |

|

|

| Print or type name of entity (exactly as name appears on stock certificate(s) tendered) |

|

|

| |

|

|

| By: |

|

|

|

| |

|

|

| Name: |

|

|

|

| |

|

|

|

Title: |

|

|

|

(Unless waived by the Company, all signatures must be

guaranteed by an eligible guarantor institution that is a member of a recognized medallion signature guarantee program.)

EXHIBIT B

ASSIGNMENT

FOR VALUE

RECEIVED, and subject to compliance with applicable securities laws and payment of any applicable transfer taxes, the undersigned

hereby sells, assigns, and transfers unto the Assignee named below all of the rights of the undersigned to purchase Common Stock of TREES

CORPORATION (the “Company”) represented by the Warrant dated

______________, with respect to the number of shares

of Common Stock set forth below:

| Name of Assignee |

|

Address |

|

No. of

Warrant Shares |

and does hereby irrevocably

constitute and appoint any officer of the Company to make such transfer on the books of the Company maintained for that purpose, with

full power of substitution in the premises.

(Unless waived by the Company,

all signatures must be guaranteed by an eligible guarantor institution that is a member of a recognized medallion signature guaranty program.)

Exhibit 10.3

|

Trees Corporation

215 Union Boulevard, Suite 415

Lakewood, CO 80228 |

November 8, 2024

TCM Tactical Opportunities Fund II LP

777 Westchester Avenue, Suite 203

White Plains, NY 10604

Attention: Peter Troob

| Re: | TREES Corporation – Modification to Warrants |

Dear Mr. Troob:

Reference is made to those certain warrants to

purchase shares of common stock, par value $0.01 per share (“Common Stock”), of TREES Corporation, a Colorado corporation,

presently held by TCM Tactical Opportunities Fund II LP and/or certain affiliates thereof (collectively, “TCM”), as more particularly

set forth on Schedule A annexed hereto (“Warrants”). The purpose of this letter agreement is to amend certain terms

of the Warrants as set forth herein, as follows:

| 1. | Exercise Price. The Exercise Price for all Warrants is hereby amended to be the product of (i) the average of the per share

price of the Common Stock for the ten (10) trading days immediately preceding the date of this letter agreement as reported on the OTCQB

multiplied by (ii) 1.25. |

| 2. | Expiration Date. The Expiration Date for all Warrants shall be extended to November 15, 2029. |

| 3. | Remaining Terms. All remaining terms and conditions of the Warrants not otherwise amended pursuant to this letter agreement

shall remain in full force and effect in accordance with their respective terms. |

| 4. | Governing Law. This letter agreement shall be governed by, and construed in accordance with, the laws of the State of Colorado

(without giving effect to the conflict of laws principles thereof). |

| |

Very truly yours, |

| |

|

| |

TREES Corporation |

| |

|

| |

By: |

|

| |

|

Adam Hershey |

| |

|

Interim Chief Executive Officer |

SCHEDULE A

Schedule of Warrants

| Holder | |

Number of

Warrants | |

Date of Grant | |

Original

Exercise Price |

| TCM Tactical Opportunities Fund II LP | |

| 4,912,349 | | |

| September 15, 2022 | | |

$ | 0.70 | |

| Context TCM Series Fund LP – Tactical Opportunities Series | |

| 1,039,942 | | |

| April 20, 2021 | | |

$ | 0.56 | |

| Context TCM Series Fund LP – Tactical Opportunities Series | |

| 592,858 | | |

| April 20, 2021 | | |

$ | 0.56 | |

Exhibit 10.4

SECOND

MODIFICATION TO ASSET PURCHASE AGREEMENT

THIS

SECOND MODIFICATION TO ASSET PURCHASE AGREEMENT (the “Agreement”) is entered into as of November 8, 2024 (“Effective

Date”), by and among HEADGATE III, LLC, a Colorado limited liability company, or its assigns (“Headgate”), GREEN MAN

COLORADO, LLC, a Colorado limited liability company (“Green Man”) TREES Corporation, a Colorado corporation (“Trees”).

Headgate, Green Man and Trees are sometimes referred to individually as a “Party” and collectively as the “Parties.”

Recitals

WHEREAS,

on October 28, 2022 Trees through its subsidiary Green Man entered into an Asset Purchase Agreement (“APA”) with GMC, LLC,

a Colorado limited liability company (“GMC”) and its subsidiaries for the acquisition of licenses to legally sell recreational

marijuana in Colorado; as amended pursuant to the Modification to Asset Purchase Agreement dated as of December 6, 2023 (“APA First

Modification”).

WHEREAS,

Article II, subsection 2.2 (b) (iii) of the APA (the “Payment”) states: “An amount equal to $83,333.33 per month commencing

on the 12-month anniversary of the Closing and continuing each month thereafter for a total of 18 months, for a total additional consideration

of $1,500,000.”

WHEREAS,

on November 23, 2022 Green Man entered into a commercial lease agreement with Headgate for the property commonly known as 7289 East

Hampden Avenue, Denver, CO 80224 (the “Lease”)

WHEREAS,

contemporaneously with this Agreement Green Man and Headgate are modifying the Lease with a Modification to First Amendment to Commercial

Lease Agreement. (“Modification Amendment”)

WHEREAS,

on December 8, 2022 Headgate and GMC entered into a Settlement Agreement and Mutual Release (“Settlement Agreement”).

WHEREAS,

as a part of the Settlement Agreement, (see, Section 3, subsection 3.2, (iii)) Headgate in part was assigned the Payment by GMC along

with its rights to the Payment.

WHEREAS,

Trees acknowledges that Headgate is the beneficiary of the Payment in the APA.

WHEREAS,

The Parties entered into a modification of the Payment on December 6, 2023.

WHEREAS,

Trees wishes to make a second modification to the Payment and Headgate is willing to modify the Payment.

NOW

THEREFORE, the Parties agree as follows:

Agreement

| 1. | No

Impact on the Parties’ Other Rights or Obligations. Apart from modifying the Payment

described above, this Agreement shall have no other impact on the preexisting rights or obligations

of the Parties as set forth in the APA or Settlement Agreement, as amended or as otherwise. |

| 2. | Payment.

Trees wishes to make a onetime payment (“Lump Sum Payment”), that would satisfy

the Payment described above. Headgate, in consideration of receiving the Lump Sum Payment

rather than payments pursuant to the existing payment schedule, is willing to provide an

additional discount of the Payment to Trees notwithstanding the discount specified in the

APA First Modification. Therefore, the Parties agree to a Lump Sum Payment equal to $802,500.00.

The Lump Sum Payment shall be made to Headgate no later than 4 p.m. MST, November 8, 2024.

Upon payment of the Lump Sum Payment, Trees shall have satisfied in full their obligation

under the Payment, and neither Trees, Green Man nor any of their respective affiliates, directors,

officers, employees or agents shall have any further liability to Headgate or any affiliate

thereof under the APA, or First Modification. |

| a. | If

Trees fails, to make the Lump Sum Payment by 4 p.m. MST November 8, 2024, then Trees shall

have the option to pay the Lump Sum Payment by 4 p.m. November 12, 2024. If Trees makes the

Lump Sum Payment between the original deadline and the November 12 deadline, then Trees shall

also include an inconvenience fee of $20,000.00 in addition to the Lump Sum Payment. If Trees

Fails to make the Lump Sum Payment in accordance with the time frames above or fails to make

the inconvenience fee in accordance with the schedule above, this Agreement shall be null

and void and shall have no effect on any previous agreements. |

| 4. | Independent

Legal Advice. The Parties have received, or have had the opportunity to receive, independent

legal advice regarding the terms and conditions of this Agreement, as well the advisability

of entering into and executing this Agreement, and the Parties are fully informed as to its

contents. |

| 5. | Entire

Agreement. This Agreement constitutes the full and complete understanding of the Parties

with respect to the subject matter contained in the Agreement. No addition, deletion or amendment

of this Agreement shall have any force or effect, except as mutually agreed to in a writing

signed by all Parties to this Agreement. The Parties acknowledge that no promise, inducement

or agreement not expressed herein has been made, and that the terms of this Agreement are

contractual and not a mere recital. |

| 6. | No

Construction against Drafter. All Parties have negotiated and cooperated in the drafting

and preparation of this Agreement. Hence, this Agreement shall not be construed against any

party. |

| 7. | Counterparts.

This Agreement may be executed in multiple copies and/or counterparts, each of which

shall be deemed the original and which when taken together shall be considered to be one

binding original document. Facsimile or other electronic means of disseminating signatures

on this Agreement shall be treated as original signatures. |

| 8. | Choice

of Law; Venue. This Agreement shall be construed, interpreted, and enforced in accordance

with the laws of the State of Colorado, without regard to conflicts or choice-of-law principles.

Any dispute regarding this Agreement shall be litigated in the courts of the State of Colorado. |

| 9. | Notice.

Any notice required by this Agreement shall be provided via email at the email address set

forth below, with a copy provided via hand delivery or sent via overnight mail (unless the

receiving party as sooner confirmed receipt of the notification sent via email). |

If

to Headgate:

Att.

Chris Shopneck

155

Madison St.

Denver,

CO 80206

Pinetreefinancialpartners@gmail.com

If

to Trees:

Att.

David R. Fishkin, General Counsel

215

Union Boulevard, Suite 415

Lakewood,

Colorado 80228

dfishkin@treescann.com

| 10. | If

Any Portion Not Enforceable. If any portion or term of this Agreement is held unenforceable

by a court of competent jurisdiction, the remainder of this Agreement shall not be affected

and shall remain fully in force and enforceable. |

[Signature

page follows immediately]

IN WITNESS

WHEREOF, the parties have executed this Agreement as of the day and year first above written.

| HEADGATE III, LLC |

|

Trees Corporation |

| a Colorado limited liability company |

|

a Colorado corporation |

| By: Singletree Financial Partners, LLC |

|

By: |

|

| a Colorado limited liability company |

|

|

Adam Hershey |

| Managing Member of HEADGATE III, LLC |

|

Interim CEO |

| |

GREEN MAN COLORADO, LLC |

| |

|

| |

a Colorado limited liability company |

| By: |

|

|

By: |

|

| |

William Andrew Shopneck |

|

|

Adam Hershey, Interim CEO |

| |

Managing Member of |

|

|

|

Singletree

Financial Partners, LLC

| By: |

|

|

| |

Christopher Clark Shopneck |

|

| |

Managing Member of |

|

| |

Singletree Financial Partners, LLC |

|

Exhibit 10.5

MODIFICATION OF FIRST AMENDMENT TO COMMERCIAL

LEASE AGREEMENT

This MODIFICATION OF FIRST AMENDMENT TO COMMERCIAL

LEASE AGREEMENT (this “Modification to Amendment”) is made effective as of November 8, 2024, by and between HEADGATE III,

LLC, a Colorado limited liability company (“Landlord”) and Green Man Colorado, LLC, a Colorado limited liability company (“Tenant”)

together the (“Parties”) pursuant to the following terms:

RECITALS

| A. | The Landlord and Tenant are parties to a Commercial Lease Agreement dated effective as of November 23, 2022 (the “Lease”)

for the Leased Premises. |

| B. | On December 6, 2023, Landlord and Tenant individually and through their parent company Trees corporation, a Colorado corporation,

(“Trees”) entered into a MODIFICATION TO ASSET PURCHASE AGREEMENT (“Agreement”). |

| C. | In conjunction with that Agreement Landlord and Tenant, amended the Lease under the FIRST AMENDMENT TO COMMERCIAL LEASE (“First

Amendment”) and created a new Section 38 of the Lease (“Section 38”). |

| D. | On, November 8, 2024, Landlord and Tenant individually and through their parent company Trees corporation, a Colorado corporation,

(“Trees”) Entered into a SECOND MODIFICATION TO ASSET PURCHASE AGREEMENT (“Second Agreement”) |

| E. | In conjunction with the successful completion of the Second Agreement, Landlord and Tenant agree to terminate section 38 of the Lease. |

NOW THEREFORE, for good and valuable consideration,

the receipt and sufficiency of which is hereby acknowledged, Landlord and Tenant hereby enter into this Amendment as follows:

AGREEMENT

| 1. | In accordance with Section 2 subsection (d) of the First Amendment, this is notice that Trees has completed the payment of the Judgment

Agreement and Section 38 shall hereby be terminated, null and void, and of no further force or effect; and neither Headgate nor any affiliate

thereof shall take any action in the future to enforce, file or otherwise prosecute the Judgement Agreement (as such term is defined in

the First Agreement). |

| 2. | The termination of Section 38 is conditioned on the Parties successful execution of the Second Agreement. |

| 3. | In the event Tenant and or Trees default on the Second Agreement then this Modification to Amendment shall be null and void, and Section

38 of the Lease shall still be in effect. |

| 4. | Conflict. Except as modified by this Modification to Amendment, the terms and conditions of the Lease shall remain in full

force and effect. Landlord shall not be obligated to further amend the Lease after the date of this Amendment. In the event of any conflict

between the terms of the Lease and the terms of this Amendment, the terms of this Amendment shall control. |

| 5. | Capitalized Terms. Capitalized terms not otherwise defined in this Modification to Amendment shall have the meanings set forth

in the Lease. |

| 6. | Counterparts. This Modification to Amendment may be executed in counterparts, each of which shall be treated as an original,

but all of which shall together constitute one document. Photocopies and facsimile copies of the parties’ signatures shall be treated

as originals. |

| 7. | No Waiver. No term of the Lease or this Modification to Amendment may be varied, changed, modified, waived or terminated orally

or by conduct or inaction, but only by an instrument in writing signed by any of the parties against whom the enforcement of the variation,

change, modification, waiver, or termination is sought. Delay in seeking to enforce any provision herein shall not constitute or operate

as a waiver of any breach of any provision hereof, nor shall such delay, or failure to act, operate as a waiver to seek enforcement of

any provision hereof at any future time. |

| 8. | General Provisions. The following terms shall apply to the enforcement and interpretation of this Modification to Amendment: |

| a. | This Modification to Amendment shall be binding upon and inure to the benefit of the parties’ successors and permitted assigns. |

| b. | This Modification to Amendment shall be governed, construed, and enforced in accordance with the laws of the State of Colorado without

giving effect to principles of conflicts or choice of laws thereof. |

| c. | The Parties represent that they have full authority and are competent to execute this Modification to Amendment. |

| d. | The Parties have had a reasonable time to consider the terms of this Modification to Amendment and an opportunity to consult with

independent legal counsel and an interpreter to review this Modification to Amendment and to revise any provision of this Modification

to Amendment with the assistance of counsel. Therefore, any ambiguity contained in this Modification to Amendment shall not be construed

against the drafting party, and the Parties shall be deemed to have understood the terms contained in this Modification to Amendment. |

| e. | The Parties have voluntarily executed this Modification to Amendment without being pressured or influenced by any statement or representation

of any person. |

| f. | The Parties each agree to undertake such other acts and execute and deliver such other documents as may be reasonably appropriate

or necessary to affect the purpose and intent of this Modification to Amendment. |

| g. | There are no oral promises, conditions, representations, understandings, interpretations or terms of any kind as conditions or inducements

to the execution hereof or in effect between the Parties. |

| h. | The captions of the Sections hereof are for convenience only and shall not govern or influence the interpretation hereof. |

| i. | Tenant acknowledges that, as of the date of this Modification to Amendment, Landlord has fulfilled all of its duties and obligations

under the Lease, and that Landlord is not otherwise in default under the Lease. |

[Signature page follows immediately]

IN WITNESS WHEREOF, the parties hereto

have executed this Modification to Amendment effective the date and year first above written.

| LANDLORD: |

TENANT: |

| |

|

| HEADGATE III, LLC |

Green Man Colorado, LLC |

| a Colorado limited liability company |

a Colorado limited liability company |

| |

|

| By: Singletree Financial Partners, LLC |

By: |

|

| a Colorado limited liability company |

|

Adam Hershey |

| Managing Member of HEADGATE III, LLC |

|

CEO |

| By: |

|

|

|

William Andrew Shopneck |

|

| |

Managing Member of Singletree Financial Partners, LLC |

|

| By: |

|

|

| |

Christopher Clark Shopneck |

|

| |

Managing Member of Singletree Financial Partners, LLC |

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

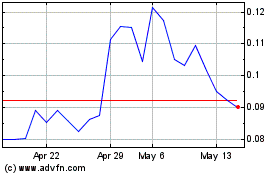

TREES (QB) (USOTC:CANN)

Historical Stock Chart

From Dec 2024 to Jan 2025

TREES (QB) (USOTC:CANN)

Historical Stock Chart

From Jan 2024 to Jan 2025