RedChip Research Issues Research Update on China Bilingual

December 15 2011 - 8:10AM

RedChip Research™, a division of RedChip Companies, Inc., today

announced it has issued a research update on China Bilingual

Technology & Education Group, Inc. (OTCBB:CBLY) an education

company that owns and operates high-quality, K-12 private boarding

schools in the People's Republic of China.

To receive a complimentary copy of the RedChip Research Report

for CBLY, please visit:

http://www.redchip.com/about/aboutmain.asp?rid=391

To learn more about China Bilingual Technology & Education

Group, Inc. visit

http://www.redchip.com/visibility/investor.asp?symbol=CBLY

About RedChip Companies, Inc.

RedChip Companies is an international, small-cap research and

financial public relations firm headquartered in Orlando, Florida;

with affiliate offices in Beijing, China; Paris, France; and Seoul,

Korea. RedChip delivers concrete, measurable results for its

clients through its extensive national and international network of

small-cap institutional and retail investors. RedChip has developed

the most comprehensive platform of products and services for

small-cap companies, including: RedChip Research™, Traditional

Investor Relations, Digital Investor Relations, Institutional and

Retail Conferences, RedChip Small-Cap TV™, Shareholder

Intelligence, Social Media and Blogging Services, Webcasts, and

RedChip Radio™. To learn more about RedChip's products and

services please visit:

http://www.redchip.com/visibility/productsandservices.asp.

"Discovering Tomorrow's Blue Chips Today"™

The RedChip Companies, Inc. logo is available at

http://www.globenewswire.com/newsroom/prs/?pkgid=2761

Disclosure

None of the reports issued by RedChip Companies, Inc.,

constitutes a recommendation for any investor to purchase or sell

any particular security nor do they constitute investment advice.

RedChip certifies that no part of the analysts' compensation was,

is, or will be, directly or indirectly, related to the specific

recommendation or views expressed by the analyst in the report. Any

investor should determine whether a particular security is suitable

based on the investor's objectives, other securities holdings,

financial situation needs, and tax status. RedChip Companies, Inc.,

employees and affiliates may have positions and affect transactions

in the securities or options of the issuers mentioned herein. All

materials are subject to change without notice. Information is

obtained from sources believed to be reliable, but its accuracy and

completeness are not guaranteed. China Bilingual Technology &

Education Group Inc. ("CBLY") is a client of RedChip Companies,

Inc. and of RedChip Visibility, a division of RedChip Companies.

RedChip Visibility Program services included the preparation of the

equity research report(s). The equity research report(s) were

prepared for informational purposes only and were paid for by the

company portrayed in the report. Information contained in the

equity research report(s) is obtained from sources believed to be

reliable, but its accuracy and completeness are not guaranteed. The

equity research report(s) are not a recommendation of a

solicitation to purchase or sell any security, nor do they

constitute investment advice. RedChip Companies, Inc., is currently

engaged by this company to provide investor awareness services.

Investor awareness services and programs are designed to help

small-cap companies communicate their investment characteristics.

CBLY agreed to pay RedChip Companies, Inc., a fee of $5,000 in cash

per month for RedChip Visibility Program and investor relations

services, to be increased to $7,500 in cash per month thereafter

when the company's stock price reaches or exceeds $3.00 for three

consecutive trading days, $10,000 in cash per month thereafter when

the company's stock price reaches or exceeds $4.00 for three

consecutive trading days and the average one month day closing

price maintains $3.00, and 50,000 shares of restricted common stock

when the company becomes listed on the NYSE Amex or the Nasdaq

Capital Market. The initial term of the agreement is six (6) month,

subject to earlier termination by CBLY if the market price of

CBLY's common stock does not reach $2.00 per share within the first

month. Previously, CBLY paid RedChip Visibility, a division of

RedChip Companies, Inc., $30,000 for twelve (12) months of RedChip

Visibility Program services. CBLY also previously agreed to pay

RedChip Companies, Inc., a fee of $20,000 in cash per month for the

first six (6) months of investor relations services, and

thereafter, $10,000 in cash per month for the next six (6) months

of investor relations services. In addition, the company previously

agreed to pay RedChip Companies, Inc., 200,000 shares of restricted

common stock when the company becomes listed on the Nasdaq Capital

Market, and an additional 50,000 shares of restricted common stock

when CBLY's stock price reaches $5.00 for 45 days. RedChip

Companies, Inc. invested in the issuer and owns 500,000 shares of

the issuer's common stock that was registered. These shares may be

sold during the time it represents the company for investor

relations activities. RedChip may sell anywhere from 5,000 shares

to 200,000 shares during any two-month period of its investor

relations activities, depending upon the liquidity of the stock.

RedChip Companies, Inc., employees and affiliates may maintain

positions and buy and sell the securities or options of the issuers

mentioned herein.

CONTACT: RedChip Companies Inc.

1-800-REDCHIP (733-2447)

research@redchip.com

http://www.redchip.com

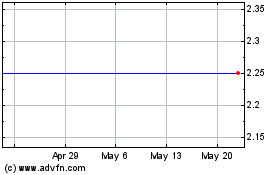

Capstone Technologies (PK) (USOTC:CATG)

Historical Stock Chart

From Jan 2025 to Feb 2025

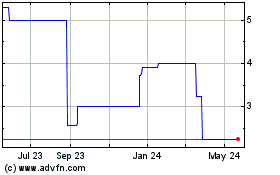

Capstone Technologies (PK) (USOTC:CATG)

Historical Stock Chart

From Feb 2024 to Feb 2025