SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

(RULE 14d-101)

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(d)(4)

OF THE SECURITIES ACT OF 1934

Almacenes Éxito S.A.

(Name of Subject

Company)

Casino, Guichard-Perrachon S.A.

(Name of Person Filing Statement)

Common Shares, par value of COP 3.33 per common

share

American Depositary Shares, each representing

eight common shares

(Title of Class of Securities)

02028M105*

(CUSIP Number of Class of Securities)

Pascal

Rivet

1,

Cours Antoine Guichard

42000

Saint-Étienne

France

+33

4 77 45 46 98

(Name, Address and Telephone

Number of Person Authorized to Receive Notices and Communications

on Behalf of the Person(s) Filing Statement)

With copies to:

John Vetterli

Karen Katri

White & Case LLP

1221 Avenue of the Americas

New York, New York 10020

(212) 819-8200

| ☒ | Check the box if the filing relates solely to preliminary

communications made before the commencement of a tender offer. |

* | The CUSIP number is for the American Depositary Shares relating

to the common shares. No CUSIP number exists for the underlying common shares, because such shares are not traded in the United States. |

This Schedule

14D-9 consists of a communication by the Casino Group, which is attached hereto as Exhibit 99.1, concerning an agreement that the Casino

Group and certain of its affiliates have entered into with Cama Commercial Group, Corp. (the

“Buyer”) that could result in the Buyer launching a tender offer for common shares of Almacenes Éxito S.A. (“Éxito”),

including common shares represented by American Depositary Shares.

Important Information

The tender offer described in this communication

has not yet commenced. This communication is provided for informational purposes only and does not constitute an offer to purchase or

the solicitation of an offer to sell any shares or other securities. If and at the time a tender offer is commenced, the Buyer has advised

us that it intends to file with the U.S. Securities and Exchange Commission (the “SEC”) a Tender Offer Statement on Schedule

TO containing an offer to purchase, a form of letter of transmittal and other documents relating to the tender offer, and Éxito

will file with the SEC a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer.

U.S. INVESTORS AND SECURITY HOLDERS ARE URGED

TO READ THE TENDER OFFER STATEMENT, OFFER TO PURCHASE, SOLICITATION/RECOMMENDATION STATEMENT AND ALL OTHER RELEVANT DOCUMENTS THAT WILL

BE FILED WITH THE SEC REGARDING THE PROPOSED TRANSACTION CAREFULLY BEFORE MAKING A DECISION CONCERNING THE TENDER OFFER AS THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE TENDER OFFER.

Such documents, and other documents filed with

the SEC by the Buyer and Éxito, may be obtained by U.S. shareholders without charge after they have been filed at the SEC’s

website at www.sec.gov. The offer to purchase and related materials may also be obtained (when available) for free by U.S. shareholders

by contacting the information agent for the tender offer that will be named in the Tender Offer Statement on Schedule TO.

This communication shall

not constitute a tender offer in any country or jurisdiction in which such offer would be considered unlawful or otherwise violate any

applicable laws or regulations.

Forward-Looking Statements

This communication contains

forward-looking statements related to a pre-agreement for the purchase of and the proposed tender offer for shares of Éxito. Words

such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,”

“may,” “plan,” “project,” “predict,” “should,” “would” and “will”

and variations of such words and similar expressions are intended to identify such forward-looking statements. Such statements are based

on the Casino Group’s expectations as of the date they were first made and involve risks and uncertainties that could cause actual

results to differ materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include,

among others, the outcome and timing of regulatory reviews and the timing of the launch and completion of the tender offer. Readers are

cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. Unless as otherwise stated

or required by applicable law, the Casino Group undertakes no obligation and does not intend to update these forward-looking statements,

whether as a result of new information, future events or otherwise.

Exhibit 99.1

Disposal of Casino’s

stake in Éxito Group

Paris, 16 October 2023

Casino Group announces that its Board of Directors

approved on Friday, 13 October 2023 the execution of a pre-agreement (“Pre-Agreement”) with Grupo Calleja, which owns the

leading grocery retailer group in El Salvador and operates under the Super Selectos brand (the “Buyer”) for the sale of Casino’s

total equity interest in Almacenes Éxito S.A. (“Éxito Group”), corresponding to 34.05 % of Éxito Group’s

capital stock, in tender offers to be launched by the Buyer in Colombia and in the United States of America for the acquisition of 100%

of the outstanding shares of Éxito Group (including shares represented by American Depositary Shares and Brazilian Depositary Receipts),

subject to the acquisition of at least 51% of the shares (“TO”).

Grupo Pão de Açucar (“GPA”),

a Brazilian subsidiary of Casino, which holds 13.31% of Éxito Group’s shares is also party to the Pre-Agreement and agreed

to sell its equity interest in the TO.

The price to be offered in the TO is US$ 1.175

billion for 100% of the outstanding shares, equivalent to 0.9053 USD per share, of which US$ 400 million (corresponding to EUR 380 million

on this date1) is for Casino Group’s direct equity interest and US$ 156 million (EUR 148 million) is for GPA’s

equity interest. The offer price will be paid by the Buyer in cash.

The price per share will be reduced by any extraordinary

distribution of dividends or any other distribution, payment, transfer of assets or similar transaction made by Éxito Group, except

for the ordinary dividends, between the date of the Pre-Agreement and the date that the TO documents are filed with the Financial Superintendency

of Colombia (“SFC”).

The launching of the TO is subject to the SFC’s

approval and the necessary filings before the U.S. Securities and Exchange Commission. The TO is expected to close around year end.

About Grupo Calleja: Grupo Calleja

is the leading food retailer in El Salvador and operates under its banner Super Selectos. With 110 stores and a market share of circa

60%, Super Selectos is one of the largest companies in El Salvador and employs over 12 thousand collaborators in its operations.

While retail is the group’s primary focus,

it also has investments in real estate, technology, energy, and other sectors. With over 70 years of experience, Grupo Calleja is committed

to growing its business sustainably in the future.

This communication is for informational purposes

only under the current applicable laws and regulations, and is neither an offer to sell nor a solicitation of an offer to buy the securities

described herein, nor shall there be any sale of these securities in any jurisdiction in which such an offer, solicitation or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

| 1 |

USD/EUR exchange rate of 1.0524 as of 13 October 2023 (ECB) |

Monday 16 October 2023 ▪ 1

Forward-Looking Statements

This communication contains forward-looking

statements related to a pre-agreement for the purchase of and the proposed tender offer for shares of Éxito Group. Words such as

“anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,”

“may,” “plan,” “project,” “predict,” “should,” “would” and “will”

and variations of such words and similar expressions are intended to identify such forward-looking statements. Such statements are based

on Casino Group’s expectations as of the date they were first made and involve risks and uncertainties that could cause actual results

to differ materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include, among others,

the outcome and timing of regulatory reviews and the timing of the launch and completion of the tender offer. Readers are cautioned not

to place undue reliance on these forward-looking statements, which speak only as of their dates. Unless as otherwise stated or required

by applicable law, Casino Group undertakes no obligation and does not intend to update these forward-looking statements, whether as a

result of new information, future events or otherwise.

Important Information for U.S. Investors

The tender offer described in this communication

has not yet commenced. This communication is provided for informational purposes only and does not constitute an offer to purchase or

the solicitation of an offer to sell any shares or other securities. If and at the time a tender offer is commenced, the Buyer has advised

us that it intends to file with the U.S. Securities and Exchange Commission (the “SEC”) a Tender Offer Statement on Schedule

TO containing an offer to purchase, a form of letter of transmittal and other documents relating to the tender offer, and Éxito

Group will file with the SEC a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer.

U.S. INVESTORS AND SECURITY HOLDERS ARE

URGED TO READ THE TENDER OFFER STATEMENT, OFFER TO PURCHASE, SOLICITATION/RECOMMENDATION STATEMENT AND ALL OTHER RELEVANT DOCUMENTS THAT

WILL BE FILED WITH THE SEC REGARDING THE PROPOSED TRANSACTION CAREFULLY BEFORE MAKING A DECISION CONCERNING THE TENDER OFFER AS THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE TENDER OFFER.

Such documents, and other documents filed with

the SEC by the Buyer and Éxito Group, may be obtained by U.S. shareholders without charge after they have been filed at the SEC’s

website at www.sec.gov. The offer to purchase and related materials may also be obtained (when available) for free by U.S. shareholders

by contacting the information agent for the tender offer that will be named in the Tender Offer Statement on Schedule TO.

Pursuant to the European Commission’s Implementing

Regulation (EU) 2016/1055 of 29 June 2016, relating to the technical procedures for the publication and deferral of inside information,

this press release was communicated to Casino’s authorized distributor for release on 16 October 2023 at 07:30 CET.

* * *

ANALYSTS AND INVESTORS CONTACTS

Christopher WELTON - cwelton.exterieur@groupe-casino.fr

- Tel: +33 (0)1 53 65 64 17

or

IR_Casino@groupe-casino.fr - Tel: +33 (0)1 53 65

24 17

PRESS CONTACTS

Groupe Casino – Communications Director

Nicolas BOUDOT - nboudot@groupe-casino.fr

- Tel: + 33 (0)6 79 61 40 99

or

directiondelacommunication@groupe-casino.fr

- Tel: + 33(0)1 53 65 24 78

Agence IMAGE 7

Karine Allouis -

kallouis@image7.fr - Tel: +33 (0)6 11 59 23 26

Laurent Poinsot -

lpoinsot@image7.fr - Tel: + 33(0)6 80 11 73 52

Franck Pasquier -

fpasquier@image7.fr - Tel: + 33(0)6 73 62 57 99

Monday 16 October 2023 ▪ 2

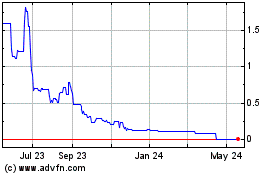

Casino Guichard Perrachon (CE) (USOTC:CGUSY)

Historical Stock Chart

From Jan 2025 to Feb 2025

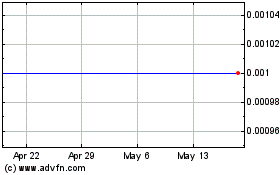

Casino Guichard Perrachon (CE) (USOTC:CGUSY)

Historical Stock Chart

From Feb 2024 to Feb 2025