COSTAS INC. (CSSI) Announces push to Target New FINTEC Acquisitions

June 20 2017 - 11:05AM

InvestorsHub NewsWire

LAS VEGAS NV - June 20, 2017 -

InvestorsHub NewsWire - Clifford

Redekop, the newly appointed CEO of COSTAS, INC (CSSI), as a first order of

business is busy re-focusing on the “Bitcoin trading platform”

direction the company embarked on from

inception.

Mr. Redekop stated, “Costas was an

early entry into the FINTEC industry primarily looking for

acquisitions based around Bitcoin, so we have a very strong

understanding of where FINTEC has been and where it is going in the

future.”

“We are focusing our efforts to move

with the current advances and bring blockchain technology into

specific transactional online businesses, and become the crossroads

of companies who can utilize a one-stop tool for acquisition of

customers, and do business with them seamlessly across multiple

advanced technology platforms,” he

continued.

Mr. Redekop also stated, “We are

currently in the process of targeting specific online casino

management systems out of Europe and Asia who were early leaders in

FINTEC as a result of their gaming software platforms utilizing

multiple payment systems integrated into one online shop.

Online gaming has shown a strong early acceptance of Bitcoin, and

thus the introduction of full blockchain technology will streamline

the Casino’s ability to reduce fraud, which is a major hit to the

bottom line.”

Most of the growth in the online

gambling industries has been gained in mobile games and

platforms.

According to KEN Research, the U.S.

FinTech market size will be $8 trillion by 2020.

FinTech investments in the US rose

from $1.6 billion USD in 2010 to $3.4 billion USD in 2013. 2014 and

2015 saw a dramatic rise on the investments front. In the year

2014, US investments almost tripled from $3.4 billion USD to around

$9.9 billion USD, whereas investments grew even further in 2015.

The highest proportion of investments was attracted by the Payments

sector followed by the lending space in 2015. The FinTech market

has increased in terms of the transactional value from 2010 to 2015

at a CAGR of over 20%

In the USA, advanced payment

security, faster checkout, loyalty rewards and customer ease have

been the major factors driving the mobile wallets market. However,

delay in adoption of the required infrastructure, such as NFC

terminal, by retail merchants have prevented mobile wallets from

achieving mainstream adoption. Dwolla, Venmo and Chase QuickPay

were the pioneers in the space of P2P money transfers. P2P transfer

systems have become increasingly prudent for customers in the US

due to absence of a common network for all financial institutions.

Peer-to-peer payment apps have made it highly convenient for

customers to transfer money, and their services usually are

accompanied with very nominal charges, or even free of

cost.

“Europe differs from the USA in that

online retailers, particularly in the Casino Management business,

have been well ahead of the curve having advanced with the e-wallet

online gambling space since 2008, when the USA created laws that

caused the gaming companies to fully vacate the online casino

business. This gives us a better position on the FINTEC

curve, utilizing a European centric team for acquisitions in the

space,” Mr. Redekop concluded.

About COSTAS (CSSI): http://www.otcmarkets.com/stock/CSSI/profile

COSTAS INC. is a publicly

traded company on the OTC Markets under the symbol ‘CSSI’. Costas Inc. invests

in early stage Digital Currency projects. We believe strongly in

the growth of Distributed Asset Technology and its integration into

Financial Technologies (FINTech). Distributed Networks are the next

massive internet investment market, as social media was 10 years

ago. Costas Inc. strongly believes that a Distributed Asset

Technology product will be the next Facebook or Twitter. The

current US market of FINTech is approximately $1.24

Trillion.

FORWARD LOOKING

STATEMENTS:

This press release and the

statements of representatives of Costas, Inc. (the "Company")

related thereto contain, or may contain, among other things,

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. All statements, other

than statements of historical fact included herein are

"forward-looking statements," including any other statements of

non-historical information. These forward-looking statements are

subject to significant known and unknown risks and uncertainties

and are often identified by the use of forward-looking terminology

such as "guidance," "projects," "may," "could," "would," "should,"

"believes," "expects," "anticipates," "estimates," "intends,"

"plans," "ultimately" or similar expressions. All forward-looking

statements involve material assumptions, risks and uncertainties,

and the expectations contained in such statements may prove to be

incorrect. Investors should not place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. The Company's actual results (including, without

limitation, Costas’ ability to advance its business, generate

revenue and profit and operate as a public company) could differ

materially from those stated or anticipated in these

forward-looking statements as a result of a variety of factors,

including factors and risks discussed in the periodic reports that

the Company files with OTC Markets (Pink Sheets). All

forward-looking statements attributable to the Company or persons

acting on its behalf are expressly qualified in their entirety by

these factors. The Company undertakes no duty to update these

forward-looking statements except as required by

law.

For further information

contact:

media@iamcorp.eu

Peter Nicosia

President, Bull In

Advantage, LLC

585-703-6565

info@bluehorseshoestocks.com

bullinadvantage@aol.com

Skype: StockSumo

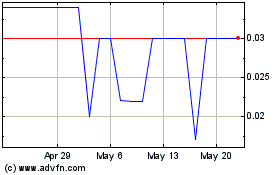

Costas (PK) (USOTC:CSSI)

Historical Stock Chart

From Jan 2025 to Feb 2025

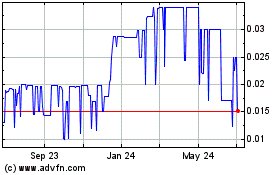

Costas (PK) (USOTC:CSSI)

Historical Stock Chart

From Feb 2024 to Feb 2025