false

0001750155

A1

0001750155

2024-08-08

2024-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 8, 2024

Charlotte’s

Web Holdings, Inc.

(Exact name of Registrant as Specified in Its Charter)

| British Columbia |

000-56364 |

98-1508633 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

|

700 Tech Court

Louisville, Colorado

|

80027 |

|

(Address of Principal Executive Offices)

|

(Zip Code) |

Registrant’s Telephone Number, Including

Area Code: (720) 617-7303

Not applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2.

below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of exchange on which registered |

| N/A |

N/A |

N/A |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 2.02 |

Results of Operations and Financial Condition. |

On August 8, 2024, Charlotte’s

Web Holdings, Inc. (the “Company”) issued an earnings release announcing its financial

results for the three months and six months ended June 30, 2024. A copy of the earnings release is furnished herewith as Exhibit

99.1 and incorporated in this Item 2.02 by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

The information in the press release attached

as Exhibit 99.1 is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific

reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

CHARLOTTE’S WEB HOLDINGS, INC. |

| |

|

|

|

| Date: August 8, 2024 |

|

By: |

/s/ Stephen Rogers |

| |

|

|

Stephen Rogers |

| |

|

|

Senior Vice President - General Counsel and Corporate Secretary |

| |

|

|

|

Exhibit 99.1

Charlotte’s Web Reports 2024 Second

Quarter

Financial Results

New DTC e-commerce platform launched

First sequential Q2 revenue growth since 2021

Additional expense reductions taken to improve

future cash flow

Louisville, Colo. August 8, 2024 - (TSX: CWEB,

OTCQX: CWBHF), Charlotte’s Web Holdings, Inc. (“Charlotte’s Web” or the “Company”), the market leader

in full-spectrum hemp extract wellness products, today reported financial results for the second quarter ended June 30, 2024.

“Our strategic turnaround initiatives and innovations

are yielding promising results towards a return to growth, despite lower revenue,” said Bill Morachnick, Chief Executive Officer

of Charlotte’s Web. “During the second quarter, we successfully migrated to our new e-commerce platform, which has enhanced

the consumer experience and provided more effective customer relationship management tools. The platform has been performing well. Our

retail business has also shown improvement, delivering the first sequential second-quarter growth since 2021, supported by distribution

gains, including with Walmart, as well as the successful launch of our new CBN Stay Asleep Gummies.”

In June, Charlotte’s Web launched

new CBD isolate topical products with Walmart in 827 Walmart stores across five states including California, Illinois, Florida, Texas,

and Pennsylvania. The new retail distribution at Walmart expands Charlotte’s Web CBD wellness presence at an affordable price point,

unlocking both value and accessibility.

"Following our first-quarter operating expense

reductions, we took additional measures after the close of the second quarter to further align with current revenue levels," said

Erika Lind, Chief Financial Officer. "These prudent reductions are designed to decrease future cash burn and position us for positive

cash flow as we return to growth. We expect a reduction in SG&A for 2024 of more than $20 million from 2023, effectively lowering

our cash burn in the second half of 2024. With our newly refined cost structure, we would be able to achieve cash flow breakeven at approximately

$65 million in annual net revenue."

DeFloria LLC (“DeFloria”) Update

DeFloria’s Phase 1 trial data processing is

nearly complete. DeFloria expects to include the Phase 1 data in its investigational new drug (IND) application with the U.S. Food and

Drug Administration (FDA) later this year. The Phase 1 clinical trial determined the dose range that will inform an IND opening Phase

2 clinical trial, which would follow a No Objection letter from the FDA. Charlotte’s Web is excited about the potential for a Phase

2 clinical trial program and updates on DeFloria’s progress will be provided as appropriate. DeFloria (see April 6, 2023 press release)

is a botanical drug development company developing a botanical drug utilizing patented hemp genetics from Charlotte’s Web.

Federal Regulatory Update

Encouraging progress continues regarding The Hemp

Derived Consumer Protection and Market Stabilization Act of 2023 (H.R. 1629), and Hemp Access and Consumer Safety Act (S. 2451). The proposed

legislation seeks to regulate hemp extract products under the FDA’s existing dietary supplement regulatory framework. Charlotte’s

Web has been actively supporting industry stakeholders, including the Coalition for Access Now and the industry working group ONE HEMP,

to advocate for this critical legislation. Together, these groups are actively engaged in providing comments and assistance on these bills.

Finalized drafts are expected to be introduced this calendar year, including FDA technical assistance, which will commence the official

legislative process leading to committee hearings. Charlotte’s Web remains committed to supporting this legislative effort and is

optimistic about the positive impact these regulations could have on the hemp and CBD industries.

The proposed bills are poised to establish comprehensive

FDA regulations for food and beverage (F&B) products and dietary supplements, specifically targeting non-intoxicating CBD products.

By creating a clear regulatory pathway, these measures would ensure consistent oversight and consumer protection for non-intoxicating

CBD products in the marketplace.

Financial Review - Q2 2024

The following table sets forth selected financial information for the

periods indicated.

| |

|

Three Months Ended, June 30, |

| U.S. $ millions, except per share data |

|

2024 |

|

2023 |

| |

|

|

|

|

| Revenue |

|

$12.3 |

|

$16.0 |

| Cost of goods sold |

|

9.7 |

|

7.1 |

| Gross profit |

|

2.6 |

|

8.9 |

| |

|

|

|

|

| Selling, general and administrative expenses |

|

14.7 |

|

19.6 |

| Operating loss |

|

(12.1) |

|

(10.7) |

| |

|

|

|

|

| Other income (expense), net |

|

- |

|

(1.4) |

| Change in fair value of financial instruments |

|

1.1 |

|

14.9 |

| |

|

|

|

|

| Net income (loss) |

|

$(11.0) |

|

$2.8 |

| Net loss per common share, basic and diluted |

|

$(0.07) |

|

$0.02 |

Consolidated net revenue for the second quarter ended

June 30, 2024, was $12.3 million, as compared to $16.0 million in the second quarter of 2023, with both retail and e-commerce revenues

lower year-over-year. Overall, CBD industry growth in 2024 has been stymied by ongoing headwinds in the category, including regulatory

ambiguities at the federal and state levels and associated competitive alternatives causing retailer and consumer confusion.

Gross profit was reduced to $2.6 million, or 21.0%

of revenue, due to a non-cash inventory provision of $3.8 million taken in the quarter related to a one-time wholesale hemp biomass transaction.

Excluding inventory provisions, Adjusted Gross Margin1 was 52.2% for Q2 2024, versus Adjusted Gross Margin of 56.5% in Q2 2023.

The decrease reflected the lower revenue in Q2 2024 as well as the Q1 2024 price reductions implemented on all oil tinctures. This was

partially offset by improved production costs.

| |

|

Three Months Ended |

|

|

|

Segmented Net Revenue |

|

June 30, |

|

|

| |

2024 |

|

2023 |

|

% Decrease |

| Direct-to-consumer ("DTC”) net revenue |

|

$7.8 |

|

$10.7 |

|

(27.1) % |

| Business-to-business ("B2B”) net revenue |

|

$4.4 |

|

$5.3 |

|

(16.6) % |

Direct-to-consumer

net revenue through the Company’s web store was $7.8 million, a decrease of $2.9 million as compared to $10.7 million in

Q2 2023, primarily as a result of lower online traffic and new consumer acquisitions. In June 2024, the Company migrated to a new e-commerce

platform which provides improved software integrations, advanced target marketing tools, and superior customer relationship management

capabilities. The new platform aims to provide a more engaging consumer experience and guide consumers to find the right products. On

a quarter-over-quarter basis DTC net revenue increased 0.6% compared to the first quarter of 2024.

Business-to-business retail net revenue was $4.4

million, as compared to $5.3 million in Q2 2023. The $0.9 million decrease was primarily due to the reductions in retail shelf space allocated

to the CBD category between the comparable periods. Inflationary impact on discretionary consumer spending activity and product mix shift

away from higher-priced tinctures were additional contributing factors. Despite declines in the overall CBD category this year, Charlotte’s

Web has been outperforming the category at retail according to data from SPINS LLC and holds the leading brand position in trust and loyalty

according to the latest surveys by The Brightfield Group.

B2B net revenue increased 8.8% quarter-over-quarter

compared to the first quarter of 2024. During the second quarter of 2024, Charlotte’s Web rolled out its new CBN 'Stay Asleep' gummies

to retailers. The Company also added Walmart as a retail partner. The distribution improvements in the first half of 2024, combined with

CBN Stay Asleep gummy retail placements, increased overall retail distribution in the Natural channel by 10% year-over-year.

SG&A Expenses

Total selling, general, and administrative (“SG&A”)

expenses in the quarter were $14.7 million, a 25.0% improvement versus $19.6 million in Q2 2023. The improvement reflects actions taken

during the first quarter of 2024 to reduce operating expenses to better align SG&A against revenue levels. Additional expense reductions

were made subsequent to the close of the second quarter of 2024. As a result of the operating expense reductions, efficiency improvements,

and stringent cost controls, the Company expects operating expenses for 2024 to be more than $20 million lower than 2023.

Net Income and Adjusted EBITDA1

Charlotte’s Web reported a net loss of $11.0

million, or ($0.07) per share basic and diluted, for the second quarter of 2024, as compared to net income of $2.8 million, or $0.02 per

share basic and diluted, for the second quarter of 2023. The positive net income in Q2 2023 reflects a $10.7 million gain due

to the Company jointly forming an entity, DeFloria LLC, with AJNA Biosciences and a subsidiary of British American Tobacco. DeFloria was

established to pursue FDA approval for a novel botanical drug to target a neurological condition, with the botanical drug being developed

from certain proprietary hemp genetics of the Company. The initial investment was measured at fair value and is remeasured at each reporting

date, with changes recognized in the fair value of financial instruments.

Adjusted EBITDA1 loss for the second quarter

of 2024 was $5.2 million, compared to Adjusted EBITDA of $3.7 million in the second quarter of 2023.

Cash Flow and Balance Sheet

Net cash used for operations for the three months

ended June 30, 2024, was $4.7 million as compared to $1.0 million cash provided in Q2 2023. There were $1.3 million of capital expenditures

during the quarter but no payments for MLB© license and media rights assets. The comparable three-month period in 2023

included capital expenditures of $0.1 million, $2.0 million for MLB payments, and the receipt of a $4.2 million IRS Employee Retention

Credit.

The Company’s cash and working capital as of

June 30, 2024, were $32.5 million and $38.5 million, respectively, compared to $47.8 million and $54.5 million at December 31, 2023, respectively.

Consolidated Financial Statements and Management’s

Discussion and Analysis

The Company’s unaudited consolidated financial

statements and accompanying notes for the three and six months ended June 30, 2024, and 2023, and related management’s discussion

and analysis of financial condition and results of operations (“MD&A”), are reported in the Company’s 10-Q filing

on the Securities and Exchange Commission website at www.sec.gov and on SEDAR+ at www.sedarplus.ca and will be available on the Investor

Relations section of the Company’s website at https://investors.charlottesweb.com.

Conference Call

Management will host a conference call to discuss

the Company’s 2024 second quarter at 11:00 A.M. ET on August 8, 2024.

There are three ways to join the call:

| • | Register

and enter your phone number at https://emportal.ink/4cfgOMf

to receive an instant automated call back, or |

| • | Dial 1-416-764-8659 or 1-888-664-6392 approximately

10 minutes before the conference call, or |

| • | Listen

to the live webcast online. |

Earnings Call Replay

A recording of the call will be available through

August 15, 2024. To listen to a replay of the earnings call please dial 1-416-764-8677 or 1-888-390-0541 and provide conference

replay ID 582110#. A webcast of the call will also be accessible through the investor relations section

of the Company’s website for an extended period of time.

About Charlotte’s Web Holdings, Inc.

Charlotte's Web Holdings, Inc., a Certified B Corporation

headquartered in Louisville, Colorado, is the market leader in innovative hemp extract wellness products that include Charlotte’s

Web whole-plant full-spectrum CBD extracts as well as broad-spectrum CBD certified NSF for Sport®. Charlotte’s Web is the official

CBD of Major League Baseball©, Angel City Football Club and the Premier Lacrosse League. Charlotte's Web branded premium quality

products start with proprietary hemp genetics that are North American farm-grown using organic and regenerative cultivation practices.

The Company's hemp extracts have naturally occurring botanical compounds including cannabidiol ("CBD"), CBN, CBC, CBG, terpenes,

flavonoids, and other beneficial compounds. Charlotte’s Web product categories include CBD oil tinctures (liquid products), CBD

gummies (sleep, calming, exercise recovery, immunity), CBN gummies, CBD capsules, CBD topical creams, and lotions, as well as CBD pet

products for dogs. Through its substantially vertically integrated business model, Charlotte’s Web maintains stringent control

over product quality and consistency with analytic testing from soil to shelf for quality assurance. Charlotte’s Web products are

distributed to retailers and healthcare practitioners throughout the U.S.A. and online through the Company's website at www.charlottesweb.com.

Subscribe

to Charlotte's Web investor news.

© Major League Baseball trademarks and

copyrights are used with permission of Major League Baseball. Visit MLB.com.

Forward-Looking Information

Certain information provided herein constitutes

forward-looking statements or information (collectively, "forward-looking statements") within the meaning of applicable securities

laws. Forward-looking statements are typically identified by words such as "may", "will", "should", "could",

"anticipate", "expect", "project", "estimate", "forecast", "plan", "intend",

"target", "believe" and similar words suggesting future outcomes or statements regarding an outlook. Forward-looking

statements are not guarantees of future performance and readers are cautioned against placing undue reliance on forward-looking statements.

This press release includes forward-looking statements. By their nature, these statements involve a variety of assumptions, known and

unknown risks and uncertainties, and other factors which may cause actual results, levels of activity, and achievements to differ materially

from those expressed or implied by such statements. The forward-looking statements contained in this press release are based on certain

assumptions and analysis by management of the Company in light of its experience and perception of historical trends, current conditions

and expected future development and other factors that it believes are appropriate and reasonable.

Specifically, this press release contains forward-looking

statements relating to, but not limited to: organizational changes, marketing plans and operational platform upgrades, and the impact

of these initiatives, operational efficiencies, cash flow, revenue and e-commerce monetization; expectations relating to IT upgrades,

marketing optimization and operational integrations; product expansion activities and the corresponding results thereof; sales volume

and gross margin expectations; anticipated timing for, and business impact of, in-house manufacturing of topical and gummy products;

the impact of the Company’s product innovations on product development; regulatory developments and the impact of developments

on both consumer action and the Company's opportunities and operations; activities relating to, and sponsorship of, legislation to advance

regulatory framework; the impact of insourcing on operating margins, capital expenditures and R&D; anticipated consumer trends and

corresponding product innovation; anticipated future financial results, including expectations regarding targeted reduction in SG&A

costs; improvements in cash flow; sufficient working capital; the impact of the Company’s partnership with the MLB on the Company's

exposure and sales; the Company’s ability to increase online traffic and demographic exposure through new products and marketing;

and the impact of certain activities on the Company's business and financial condition and anticipated trajectory.

The material factors and assumptions used to develop

the forward-looking statements herein include, but are not limited to: regulatory regime changes; anticipated product development and

sales; the success of sales and marketing activities; product development and production expectations; outcomes from R&D activities;

the Company's ability to deal with adverse growing conditions in a timely and cost-effective manner; the availability of qualified and

cost-effective human resources; compliance with contractual and regulatory obligations and requirements; availability of adequate liquidity

and capital to support operations and business plans; and expectations around consumer product demand. In addition, the forward-looking

statements are subject to risks and uncertainties pertaining to, among other things: supply and distribution chains; the market for the

Company's products; revenue fluctuations; regulatory changes; loss of customers and retail partners; retention and availability of talent;

competing products; share price volatility; loss of proprietary information; product acceptance; internet and system infrastructure functionality;

information technology security; available capital to fund operations and business plans; crop risk; economic and political considerations;

and including but not limited to those risks and uncertainties discussed under the heading "Risk Factors" in the Company’s

Annual Report on Form 10-K for the year ending December 31, 2023, and other risk factors contained in other filings with the Securities

and Exchange Commission available on www.sec.gov and filings with Canadian securities regulatory

authorities available on www.sedarplus.ca. The impact of any one risk, uncertainty, or factor

on a particular forward-looking statement is not determinable with certainty as these are interdependent, and the Company's future course

of action depends on management's assessment of all information available at the relevant time.

Any forward-looking statement in this press release

is based only on information currently available to the Company and speaks only as of the date on which it is made. Except as required

by applicable law, the Company assumes no obligation to publicly update any forward-looking statement, whether as a result of new information,

future events, or otherwise. All forward-looking statements, whether written or oral, attributable to the Company or persons acting on

the Company's behalf, are expressly qualified in their entirety by these cautionary statements.

| (1) | Non-GAAP Measures: The press release contains non-GAAP measures, including EBITDA and Adjusted EBITDA.

Please refer to the section in the tables captioned “Non-GAAP Measures” below for additional information and a reconciliation

to GAAP for all Non-GAAP metrics. |

For further information contact

Erika Lind

Chief Financial Officer

(720) 388-6505

Erika.Lind@CharlottesWeb.com

Cory Pala

Director of Investor Relations

(720) 484-8930

Cory.Pala@CharlottesWeb.com

| |

June 30, |

|

December 31, |

| |

2024 (unaudited) |

|

2023 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ 32,531 |

|

$ 47,820 |

| Accounts receivable, net |

1,869 |

|

1,950 |

| Inventories, net |

18,673 |

|

21,538 |

| Prepaid expenses and other current assets |

3,857 |

|

6,864 |

| Total current assets |

56,930 |

|

78,172 |

| Property and equipment, net |

28,198 |

|

27,513 |

| License and media rights |

16,590 |

|

17,070 |

| Operating lease right-of-use assets, net |

13,740 |

|

14,601 |

| Investment in unconsolidated entity |

11,200 |

|

11,000 |

| SBH purchase option and other derivative assets |

1,436 |

|

2,602 |

| Intangible assets, net |

1,166 |

|

887 |

| Other long-term assets |

534 |

|

703 |

| Total assets |

$ 129,794 |

|

$ 152,548 |

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ 4,350 |

|

$ 2,860 |

| Accrued and other current liabilities |

6,669 |

|

8,682 |

| Lease obligations - current |

2,376 |

|

2,252 |

| License and media rights payable - current |

5,072 |

|

9,852 |

| Total current liabilities |

18,467 |

|

23,646 |

| Convertible debenture |

43,455 |

|

42,528 |

| Lease obligations |

14,456 |

|

15,655 |

| License and media rights payable |

14,093 |

|

11,338 |

| Derivatives and other long-term liabilities |

3,495 |

|

3,823 |

| Total liabilities |

93,966 |

|

96,990 |

| Commitments and contingencies |

|

|

|

| Shareholders’ equity: |

|

|

|

| Common shares, nil par value; unlimited shares authorized; 157,495,042 and 154,332,366 shares issued and outstanding as of June 30, 2024 and December 31, 2023 |

1 |

|

1 |

| Additional paid-in capital |

328,241 |

|

327,280 |

| Accumulated deficit |

(292,414) |

|

(271,723) |

| Total shareholders’ equity |

35,828 |

|

55,558 |

| Total liabilities and shareholders’ equity |

$ 129,794 |

|

$ 152,548 |

| |

Three Months

Ended June 30,

(unaudited) |

|

Six Months

Ended June 30,

(unaudited) |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenue |

$ 12,289 |

|

$ 16,006 |

|

$ 24,413 |

|

$ 33,016 |

| Cost of goods sold |

9,707 |

|

7,088 |

|

14,920 |

|

14,181 |

| Gross profit |

2,582 |

|

8,918 |

|

9,493 |

|

18,835 |

| |

|

|

|

|

|

|

|

| Selling, general and administrative expenses |

14,727 |

|

19,627 |

|

30,007 |

|

37,140 |

| Operating loss |

(12,145) |

|

(10,709) |

|

(20,514) |

|

(18,305) |

| |

|

|

|

|

|

|

|

| Gain on initial investment in unconsolidated entity |

- |

|

10,700 |

|

- |

|

10,700 |

| Change in fair value of financial instruments |

1,140 |

|

4,229 |

|

(720) |

|

9,612 |

| Other income (expense), net |

(6) |

|

(1,376) |

|

605 |

|

(2,074) |

| Income (loss) before provision for income taxes |

(11,011) |

|

2,844 |

|

(20,629) |

|

(67) |

| Income tax benefit (expense) |

(46) |

|

- |

|

(62) |

|

- |

| Net income (loss) |

$ (11,057) |

|

$ 2,844 |

|

$ (20,691) |

|

$ (67) |

| |

|

|

|

|

|

|

|

| Per common share amounts |

|

|

|

|

|

|

|

| Net income (loss) per common share, basic |

$ (0.07) |

|

$ 0.02 |

|

$ (0.13) |

|

$ - |

| Net income (loss) per common share, diluted |

$ (0.07) |

|

$ 0.02 |

|

$ (0.13) |

|

$ - |

| |

Common Shares |

|

Additional

Paid-in

Capital |

|

Accumulated

Deficit |

|

Total

Shareholders’

Equity |

| |

Shares |

|

Amount |

|

|

|

| Balance - December 31, 2023 |

154,332,366 |

|

$ 1 |

|

$ 327,280 |

|

$ (271,723) |

|

$ 55,558 |

| Common shares issued upon vesting of restricted share units, net of withholding |

2,895,489 |

|

- |

|

(98) |

|

- |

|

(98) |

| Share-based compensation |

- |

|

- |

|

842 |

|

- |

|

842 |

| Net income (loss) |

|

|

- |

|

|

|

(9,634) |

|

(9,634) |

| Balance - March 31, 2024 |

157,227,855 |

|

$ 1 |

|

$ 328,024 |

|

$ (281,357) |

|

$ 46,668 |

| Common shares issued upon vesting of restricted share units, net of withholding |

267,187 |

|

- |

|

(20) |

|

- |

|

(20) |

| Share-based compensation |

- |

|

- |

|

237 |

|

- |

|

237 |

| Net income (loss) |

- |

|

- |

|

- |

|

(11,057) |

|

(11,057) |

| Balance - June 30, 2024 |

157,495,042 |

|

$ 1 |

|

$ 328,241 |

|

$ (292,414) |

|

$ 35,828 |

| |

|

|

|

|

|

|

|

|

|

| Balance - December 31, 2022 |

152,135,026 |

|

$ 1 |

|

$ 325,431 |

|

$ (247,927) |

|

$ 77,505 |

| Common shares issued upon vesting of restricted share units, net of withholding |

297,888 |

|

- |

|

(69) |

|

- |

|

(69) |

| Share-based compensation |

- |

|

- |

|

375 |

|

- |

|

375 |

| Net income (loss) |

- |

|

- |

|

- |

|

(2,912) |

|

(2,912) |

| Balance - March 31, 2023 |

152,432,914 |

|

$ 1 |

|

$ 325,737 |

|

$ (250,839) |

|

$ 74,899 |

| Common shares issued upon vesting of restricted share units, net of withholding |

392,204 |

|

- |

|

(6) |

|

- |

|

(6) |

| Share-based compensation |

- |

|

- |

|

624 |

|

- |

|

624 |

| Net income (loss) |

- |

|

- |

|

- |

|

2,844 |

|

2,844 |

| Balance - June 30, 2023 |

152,825,118 |

|

$ 1 |

|

$ 326,355 |

|

$ (247,995) |

|

$ 78,361 |

| |

Six

Months

Ended June 30,

(unaudited) |

| |

2024 |

|

2023 |

| |

|

|

|

| Cash flows from operating activities: |

|

|

|

| Net loss |

$ (20,691) |

|

$ (67) |

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

| Depreciation and amortization |

4,982 |

|

7,769 |

| Inventory provision |

3,926 |

|

320 |

| Convertible debenture accrued interest |

1,931 |

|

1,954 |

| Share-based compensation |

1,079 |

|

999 |

| Changes in right-of-use assets |

908 |

|

976 |

| Change in fair value of financial instruments |

720 |

|

(9,612) |

| Gain on investment in unconsolidated entity |

- |

|

(10,700) |

| (Gain)/loss on foreign currency transaction |

(1,430) |

|

979 |

| Other |

238 |

|

957 |

| Changes in operating assets and liabilities: |

|

|

|

| Accounts receivable, net |

(154) |

|

(1,104) |

| Inventories, net |

(1,025) |

|

2,878 |

| Prepaid expenses and other current assets |

1,732 |

|

764 |

| Accounts payable, accrued and other liabilities |

(286) |

|

183 |

| Operating lease obligations |

(1,121) |

|

(1,436) |

| License and media rights |

(2,500) |

|

(4,000) |

| Income taxes receivable |

- |

|

4,261 |

| Other operating assets and liabilities, net |

(192) |

|

(130) |

| Net cash used in operating activities |

(11,883) |

|

(5,009) |

| Cash flows from investing activities: |

|

|

|

| Purchases of property and equipment and intangible assets |

(3,316) |

|

(187) |

| Proceeds from sale of assets |

28 |

|

36 |

| Net cash used in investing activities |

(3,288) |

|

(151) |

| Cash flows from financing activities: |

|

|

|

| Other financing activities |

(118) |

|

(75) |

| Net cash used in financing activities |

(118) |

|

(75) |

| Net decrease in cash and cash equivalents |

(15,289) |

|

(5,235) |

| Cash and cash equivalents - beginning of period |

47,820 |

|

66,963 |

| Cash and cash equivalents - end of period |

$ 32,531 |

|

$ 61,728 |

| Non-cash activities: |

|

|

|

| Non-cash purchase of property and equipment and intangible assets |

(269) |

|

(163) |

| Non-cash issuance of note receivable |

- |

|

(156) |

(1) Non-GAAP Measures - Adjusted Gross Profit, EBITDA and

Adjusted EBITDA

Earnings before interest, taxes, depreciation,

and amortization (“EBITDA”) is not a recognized performance measure under U.S. GAAP. The term EBITDA consists of net

income (loss) and excludes interest, taxes, depreciation, and amortization. Adjusted EBITDA also excludes other non-cash items such

as changes in fair value of financial instruments (Mark-to-Market), Share-based compensation, and impairment of assets. These non-GAAP

financial measures should be considered supplemental to, and not a substitute for, our reported financial results prepared in accordance

with GAAP. The non-GAAP financial measures do not have a standardized meaning prescribed under U.S. GAAP and therefore may not be

comparable to similar measures presented by other issuers. The primary purpose of using non-GAAP financial measures is to provide

supplemental information that we believe may be useful to investors and to enable investors to evaluate our results in the same way we

do. We also present the non-GAAP financial measures because we believe they assist investors in comparing our performance across reporting

periods on a consistent basis, as well as comparing our results against the results of other companies, by excluding items that we do

not believe are indicative of our core operating performance. Specifically, we use these non-GAAP measures as measures of operating performance;

to prepare our annual operating budget; to allocate resources to enhance the financial performance of our business; to evaluate the effectiveness

of our business strategies; to provide consistency and comparability with past financial performance; to facilitate a comparison of our

results with those of other companies, many of which use similar non-GAAP financial measures to supplement their GAAP results; and in

communications with our board of directors concerning our financial performance. Investors should be aware, however, that not all companies

define these non-GAAP measures consistently.

| (1) | Adjusted Gross Profit, EBITDA and Adjusted EBITDA are non-GAAP financial measures with reconciliations

provided in the tables below. |

Adjusted Gross Profit for

the three and six months ended June 30, 2024, and 2023 is as follows:

| Charlotte's Web Holdings, Inc. |

| Statement of Adjusted Gross Profit |

| (In Millions) |

| |

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 30, |

|

June 30, |

| |

|

(unaudited) |

|

(unaudited) |

| U.S. $ millions |

|

2024 |

2023 |

|

2024 |

2023 |

| |

|

|

|

|

|

|

| Total revenue |

|

$12,289 |

$16,006 |

|

$ 24,413 |

$ 33,016 |

| Cost of goods sold |

|

9,707 |

$7,008 |

|

14,920 |

14,181 |

| Gross profit before inventory provision |

|

2,582 |

$8,918 |

|

9,493 |

18,835 |

| Inventory provision, net |

|

3,830 |

$127 |

|

3,926 |

320 |

| Adjusted gross profit |

|

$6,412 |

$9,045 |

|

$13,419 |

$19,155 |

| Adjusted gross margin % |

|

52.2% |

56.5% |

|

55.0% |

58.0% |

Adjusted EBITDA for the three

and six months ended June 30, 2024, and 2023 is as follows:

| Charlotte's Web Holdings, Inc. |

| Statement of Adjusted EBITDA |

| (In Thousands) |

| |

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 30, |

|

June 30, |

| |

|

(unaudited) |

|

(unaudited) |

| U.S. $ Thousands |

|

2024 |

2023 |

|

2024 |

2023 |

| |

|

|

|

|

|

|

| Net income (loss) |

|

$ (11,057) |

$ 2,844 |

|

$ (20,691) |

$ (67) |

| |

|

|

|

|

|

|

| Depreciation of property and equipment and amortization of intangibles |

|

2,489 |

3,977 |

|

4,982 |

7,769 |

| Interest expense |

|

493 |

348 |

|

980 |

1,147 |

| Income tax expense |

|

(46) |

- |

|

(62) |

- |

| EBITDA |

|

(8,121) |

7,169 |

|

(14,791) |

8,849 |

| |

|

|

|

|

|

|

| Stock Comp |

|

237 |

624 |

|

1,079 |

999 |

| Mark-to-market financial instruments |

(1,140) |

(4,229) |

|

720 |

(9,612) |

| Inventory Provision |

|

3,830 |

127 |

|

3,926 |

320 |

| |

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ (5,194) |

$ 3,691 |

|

$ (9,066) |

$ 556 |

| |

|

|

|

|

|

|

11

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

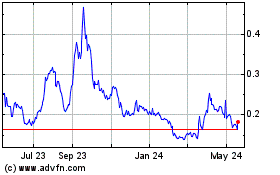

Charlottes Web (QX) (USOTC:CWBHF)

Historical Stock Chart

From Oct 2024 to Nov 2024

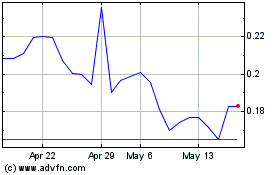

Charlottes Web (QX) (USOTC:CWBHF)

Historical Stock Chart

From Nov 2023 to Nov 2024