UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 or 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023.

Commission File Number 000-55982

C21 INVESTMENTS INC.

(Translation of registrant’s name into English)

Suite 1900-855 West Georgia St

Vancouver BC, V6C 3H4

Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover Form 20-F or Form 40-F

Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Note: Regulation S-T Rule 101(b)(1) only permits the

submission in paper of a Form 6-K if submitted solely to provide an attached

annual report to security holders.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Note: Regulation S-T Rule 101(b)(7) only permits the

submission in paper of a Form 6-K if submitted to furnish a report or other

document that the registrant foreign private issuer must furnish and make public

under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the

rules of the home country exchange on which the registrant’s securities are

traded, as long as the report or other document is not a press release, is not

required to be and has not been distributed to the registrant’s security

holders, and, if discussing a material event, has already been the subject of a

Form 6-K submission or other Commission filing on EDGAR.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

C21 INVESTMENTS INC. |

| |

|

| Date: December 14, 2023 |

/s/

Michael Kidd |

| |

Michael Kidd |

| |

Chief Financial Officer |

-2-

INDEX TO EXHIBITS

| |

Interim Condensed Consolidated Financial Statements

For the three and nine months ended October 31, 2023 and 2022

(Expressed in U.S. Dollars)

|

Notice of Disclosure of Non-auditor Review of the Interim Condensed Consolidated Financial Statements for the Three and Nine Months Ended October 31, 2023 and 2022.

Pursuant to National Instrument 51-102 Continuous Disclosure Obligations, part 4, subsection 4.3(3)(a) issued by the Canadian Securities Administrators, if an auditor has not performed a review of the interim financial statements, they must be accompanied by a notice indicating that the interim financial statements have not been reviewed by an auditor.

The accompanying unaudited interim condensed consolidated financial statements of C21 Investments Inc. for the interim periods ended October 31, 2023 and 2022, have been prepared in accordance with accounting principles generally accepted in the United States of America and are the responsibility of the Company's management.

The Company's independent auditors, Marcum LLP, have not performed a review of these interim condensed consolidated financial statements.

December 14, 2023

C21 INVESTMENTS INC.

Interim Condensed Consolidated Balance Sheets

(Expressed in U.S. dollars)

| |

|

October 31,

2023 |

|

|

January 31,

2023 |

|

| |

|

$ |

|

|

$ |

|

| ASSETS |

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

| Cash |

|

1,905,089 |

|

|

1,891,772 |

|

| Receivables |

|

348,206 |

|

|

412,310 |

|

| Inventory |

|

2,839,054 |

|

|

4,173,573 |

|

| Prepaid expenses and deposits |

|

759,961 |

|

|

881,628 |

|

| Assets classified as held for sale |

|

1,291,741 |

|

|

1,383,089 |

|

| |

|

7,144,051 |

|

|

8,742,372 |

|

| Non-current assets |

|

|

|

|

|

|

| Property and equipment |

|

4,402,081 |

|

|

4,685,118 |

|

| Right-of-use assets |

|

7,994,603 |

|

|

8,385,533 |

|

| Intangible assets |

|

6,854,795 |

|

|

7,886,825 |

|

| Goodwill |

|

28,541,323 |

|

|

28,541,323 |

|

| Security deposit |

|

46,434 |

|

|

46,871 |

|

| Deferred tax asset |

|

23,362 |

|

|

23,362 |

|

| Total assets |

|

55,006,649 |

|

|

58,311,404 |

|

| |

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

| Accounts payable and accrued liabilities |

|

2,733,249 |

|

|

2,921,426 |

|

| Convertible promissory notes |

|

1,156,259 |

|

|

1,156,259 |

|

| Promissory note payable |

|

- |

|

|

2,026,667 |

|

| Income taxes payable |

|

8,495,058 |

|

|

7,736,858 |

|

| Deferred revenue |

|

306,265 |

|

|

94,068 |

|

| Lease liabilities - current portion |

|

459,262 |

|

|

398,723 |

|

| Liabilities classified as held for sale |

|

403,814 |

|

|

640,266 |

|

| |

|

13,553,907 |

|

|

14,974,267 |

|

| Non-current liabilities |

|

|

|

|

|

|

| Lease liabilities |

|

8,201,231 |

|

|

8,554,702 |

|

| Deposit liability |

|

75,000 |

|

|

175,000 |

|

| Derivative liability |

|

46,860 |

|

|

239,700 |

|

| Reclamation obligation |

|

50,681 |

|

|

52,659 |

|

| Total liabilities |

|

21,927,679 |

|

|

23,996,328 |

|

| |

|

|

|

|

|

|

| Commitments and contingencies (Notes 17 and 20) |

|

|

|

|

|

|

| Subsequent event (Note 23) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

| Common stock, no par value; unlimited shares authorized; 120,047,814 and 120,047,814 shares issued and outstanding as of October 31, 2023 and January 31, 2023, respectively |

|

105,462,393 |

|

|

105,445,792 |

|

| Commitment to issue shares |

|

628,141 |

|

|

628,141 |

|

| Accumulated other comprehensive loss |

|

(2,276,571 |

) |

|

(2,287,145 |

) |

| Deficit |

|

(70,734,993 |

) |

|

(69,471,712 |

) |

| Total shareholders' equity |

|

33,078,970 |

|

|

34,315,076 |

|

| Total liabilities and shareholders' equity |

|

55,006,649 |

|

|

58,311,404 |

|

Approved and authorized for issue on behalf of the Board of Directors:

|

/s/ "Bruce Macdonald"

|

Director

|

/s/ "Michael Kidd"

|

Director

|

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

C21 INVESTMENTS INC.

Interim Condensed Consolidated Statements of Income (Loss) and Comprehensive Income (Loss)

(Expressed in U.S. dollars, except number of shares)

| |

|

Three months ended

October 31, |

|

|

Nine months ended

October 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

6,882,078 |

|

|

7,207,404 |

|

|

21,736,388 |

|

|

21,855,358 |

|

| Cost of sales |

|

4,129,429 |

|

|

3,303,066 |

|

|

13,432,965 |

|

|

10,104,051 |

|

| Gross profit |

|

2,752,649 |

|

|

3,904,338 |

|

|

8,303,423 |

|

|

11,751,307 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative expenses |

|

2,532,967 |

|

|

2,528,779 |

|

|

7,317,939 |

|

|

7,156,869 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

219,682 |

|

|

1,375,559 |

|

|

985,484 |

|

|

4,594,438 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gain (loss) on change in fair value of derivative liability |

|

- |

|

|

127,813 |

|

|

(392,155 |

) |

|

757,313 |

|

| Gain on termination of sales-type lease and disposal of licenses |

|

- |

|

|

- |

|

|

467,750 |

|

|

- |

|

| Loss on disposal of assets |

|

(11,655 |

) |

|

- |

|

|

(11,655 |

) |

|

- |

|

| Impairment loss |

|

- |

|

|

- |

|

|

(372,227 |

) |

|

(20,726 |

) |

| Interest expense |

|

- |

|

|

(98,657 |

) |

|

(35,210 |

) |

|

(396,161 |

) |

| Other expense |

|

(2,145 |

) |

|

(13,173 |

) |

|

(24,894 |

) |

|

(10,273 |

) |

| Net income from continuing operations before income tax expense |

|

205,882 |

|

|

1,391,542 |

|

|

617,093 |

|

|

4,924,591 |

|

| Income tax expense |

|

(563,100 |

) |

|

(1,154,189 |

) |

|

(1,758,200 |

) |

|

(2,137,604 |

) |

| Net income (loss) from continuing operations after income tax expense |

|

(357,218 |

) |

|

237,353 |

|

|

(1,141,107 |

) |

|

2,786,987 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) from discontinued operations after income tax expense |

|

(18,932 |

) |

|

11,154 |

|

|

(122,174 |

) |

|

(374,617 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

(376,150 |

) |

|

248,507 |

|

|

(1,263,281 |

) |

|

2,412,370 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cumulative translation adjustment |

|

6,590 |

|

|

305,354 |

|

|

10,574 |

|

|

88,967 |

|

| Comprehensive income (loss) |

|

(369,560 |

) |

|

553,861 |

|

|

(1,252,707 |

) |

|

2,501,337 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic income per share from continuing operations |

|

(0.00 |

) |

|

0.00 |

|

|

(0.01 |

) |

|

0.02 |

|

| Diluted income per share from continuing operations |

|

(0.00 |

) |

|

0.00 |

|

|

(0.01 |

) |

|

0.02 |

|

| Basic and diluted income (loss) per share from discontinued operations |

|

(0.00 |

) |

|

0.00 |

|

|

(0.00 |

) |

|

(0.00 |

) |

| Basic income per share |

|

(0.00 |

) |

|

0.00 |

|

|

(0.01 |

) |

|

0.02 |

|

| Diluted income per share |

|

(0.00 |

) |

|

0.00 |

|

|

(0.01 |

) |

|

0.02 |

|

| Weighted average number of common shares outstanding - basic |

|

120,047,814 |

|

|

120,047,814 |

|

|

120,047,814 |

|

|

120,047,814 |

|

| Weighted average number of common shares outstanding - diluted |

|

122,880,907 |

|

|

122,880,907 |

|

|

122,880,907 |

|

|

122,880,907 |

|

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

C21 INVESTMENTS INC.

Interim Condensed Consolidated Statements of Changes in Shareholders’ Equity

(Expressed in U.S. dollars, except number of shares)

| |

|

Number of

shares |

|

|

Common

stock |

|

|

Commitment

to issue

shares |

|

|

Accumulated

other

comprehensive

loss |

|

|

Deficit |

|

|

Total

shareholders'

equity |

|

| |

|

# |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| Balance, January 31, 2022 |

|

120,047,814 |

|

|

105,236,351 |

|

|

628,141 |

|

|

(2,370,967 |

) |

|

(69,764,923 |

) |

|

33,728,602 |

|

| Share-based compensation |

|

- |

|

|

188,638 |

|

|

- |

|

|

- |

|

|

- |

|

|

188,638 |

|

| Net income and other comprehensive loss for the period |

|

- |

|

|

- |

|

|

- |

|

|

88,967 |

|

|

2,412,370 |

|

|

2,501,337 |

|

| Balance, October 31, 2022 |

|

120,047,814 |

|

|

105,424,989 |

|

|

628,141 |

|

|

(2,282,000 |

) |

|

(67,352,553 |

) |

|

36,418,577 |

|

| Share-based compensation |

|

- |

|

|

20,803 |

|

|

- |

|

|

- |

|

|

- |

|

|

20,803 |

|

| Net loss and other comprehensive income for the period |

|

- |

|

|

- |

|

|

- |

|

|

(5,145 |

) |

|

(2,119,159 |

) |

|

(2,124,304 |

) |

| Balance, January 31, 2023 |

|

120,047,814 |

|

|

105,445,792 |

|

|

628,141 |

|

|

(2,287,145 |

) |

|

(69,471,712 |

) |

|

34,315,076 |

|

| Share-based compensation |

|

- |

|

|

16,601 |

|

|

- |

|

|

- |

|

|

- |

|

|

16,601 |

|

| Net loss and other comprehensive income for the period |

|

- |

|

|

- |

|

|

- |

|

|

10,574 |

|

|

(1,263,281 |

) |

|

(1,252,707 |

) |

| Balance, October 31, 2023 |

|

120,047,814 |

|

|

105,462,393 |

|

|

628,141 |

|

|

(2,276,571 |

) |

|

(70,734,993 |

) |

|

33,078,970 |

|

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

C21 INVESTMENTS INC.

Interim Condensed Consolidated Statements of Cash Flows

(Expressed in U.S. dollars)

| |

|

Nine months ended

October 31, |

|

| |

|

2023 |

|

|

2022 |

|

| |

|

$ |

|

|

$ |

|

| OPERATING ACTIVITIES |

|

|

|

|

|

|

| Net income from continuing operations after income tax expense |

|

(1,141,107) |

|

|

2,786,987 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

| Amortization of right-of-use assets |

|

390,930 |

|

|

364,727 |

|

| Deferred income tax recovery |

|

- |

|

|

(540,556 |

) |

| Depreciation and amortization |

|

1,049,408 |

|

|

1,142,619 |

|

| Foreign exchange gain |

|

(1,541 |

) |

|

(27,543 |

) |

| Loss (gain) on change in fair value of derivative liability |

|

392,155 |

|

|

(757,313 |

) |

| Gain on termination of sales-type lease and disposal of licenses |

|

(467,750 |

) |

|

- |

|

| Loss on disposal of assets |

|

11,655 |

|

|

- |

|

| Impairment loss |

|

372,227 |

|

|

20,726 |

|

| Interest expense |

|

35,210 |

|

|

422,288 |

|

| Share-based compensation |

|

16,601 |

|

|

188,638 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

| Receivables |

|

64,104 |

|

|

(50,417 |

) |

| Inventory |

|

1,698,374 |

|

|

(1,256,521 |

) |

| Prepaid expenses and deposits |

|

121,667 |

|

|

332,022 |

|

| Accounts payable and accrued liabilities |

|

(475,594 |

) |

|

(309,366 |

) |

| Income taxes payable |

|

758,200 |

|

|

2,678,160 |

|

| Deferred revenue |

|

212,197 |

|

|

- |

|

| Lease liabilities |

|

(292,932 |

) |

|

(238,919 |

) |

| Cash provided by operating activities of continuing operations |

|

2,743,804 |

|

|

4,755,532 |

|

| Cash provided by (used in) operating activities of discontinued operations |

|

59,644 |

|

|

(55,934 |

) |

| |

|

|

|

|

|

|

| INVESTING ACTIVITIES |

|

|

|

|

|

|

| Purchases of property and equipment |

|

(503,328 |

) |

|

(433,214 |

) |

| Proceeds from termination of sales-type lease and disposal of licenses |

|

400,000 |

|

|

- |

|

| Cash used in investing activities of continuing operations |

|

(103,328 |

) |

|

(433,214 |

) |

| Cash provided by investing activities of discontinued operations |

|

- |

|

|

51,357 |

|

| |

|

|

|

|

|

|

| FINANCING ACTIVITIES |

|

|

|

|

|

|

| Settlement of earn out shares |

|

(575,136 |

) |

|

- |

|

| Principal repayments on promissory note payable |

|

(2,026,667 |

) |

|

(4,560,000 |

) |

| Repayments of convertible promissory notes |

|

- |

|

|

(40,000 |

) |

| Interest paid in cash |

|

(51,562 |

) |

|

(432,954 |

) |

| Cash used in financing activities of continuing operations |

|

(2,653,365 |

) |

|

(5,032,954 |

) |

| Cash used in financing activities of discontinued operations |

|

(34,163 |

) |

|

(46,762 |

) |

| |

|

|

|

|

|

|

| Effect of foreign exchange on cash |

|

725 |

|

|

3,784 |

|

| Change in cash during the period |

|

13,317 |

|

|

(758,191 |

) |

| Cash beginning of period |

|

1,891,772 |

|

|

3,067,983 |

|

| Cash end of period |

|

1,905,089 |

|

|

2,309,792 |

|

| |

|

|

|

|

|

|

| Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

| Interest paid in cash |

|

51,562 |

|

|

431,354 |

|

| Income taxes paid in cash |

|

1,000,000 |

|

|

- |

|

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

1. NATURE OF OPERATIONS

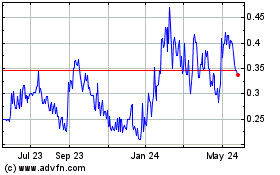

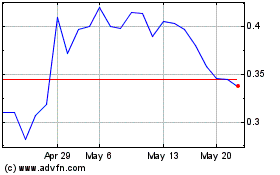

C21 Investments Inc. (the "Company" or "C21") was incorporated January 15, 1987, under the Company Act of British Columbia. The Company is a publicly traded company with its registered office is 170-601 West Cordova Street, Vancouver, BC, V6B 1G1. The Company is listed on the Canadian Securities Exchange ("CSE") under the symbol CXXI and on the OTCQB® Venture Market under the symbol CXXIF.

The Company is a cannabis operator in the USA. The Company initially operated in two segments: recreational cannabis in Oregon, USA and recreational and medical cannabis in Nevada, USA. During the year ended January 31, 2022, the Company made the strategic decision to exit operations in Oregon. Operating results of the Oregon segment are presented as discontinued operations. The Nevada segment remains engaged in the cultivation of and manufacturing of cannabis flower products, vape products and extract products for wholesale and retail sales.

As at October 31, 2023, the Company had a working capital deficit of $6,409,856 (January 31, 2023 - $6,231,895) and an accumulated deficit of $70,734,993 (January 31, 2023 - $69,471,712). However, for the nine months ended October 31, 2023, the Company generated positive operating cash flows from continuing operations.

At the federal level, however, cannabis currently remains a Schedule I controlled substance under the Federal Controlled Substances Act of 1970. Under U.S. federal law, a Schedule I drug or substance has a high potential for abuse, no accepted medical use in the United States, and a lack of accepted safety for the use of the drug under medical supervision. As such, even in those states in which marijuana is legalized under state law, the manufacture, importation, possession, use or distribution of cannabis remains illegal under U.S. federal law. This has created a dichotomy between state and federal law, whereby many states have elected to regulate and remove state-level penalties regarding a substance which is still illegal at the federal level. There remains uncertainty about the US federal government's position on cannabis with respect to cannabis-legal status. A change in its enforcement policies could impact the ability of the Company to continue as a going concern.

2. BASIS OF PREPARATION

a) Basis of presentation

These unaudited interim condensed consolidated financial statements for the three and nine months ended October 31, 2023 and 2022 ("consolidated financial statements") are prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP"). These consolidated financial statements have been prepared on an accrual basis and are based on historical costs, except for certain financial instruments classified as fair value through profit or loss.

b) Functional and reporting currency

The functional currency of C21 Investments Inc. is Canadian dollars ("C$"), and the functional currency of the Company's subsidiaries is U.S. dollars. C21 has determined that the U.S. dollar ("USD") is the most relevant and appropriate reporting currency as the Company's operations are conducted in U.S. dollars and its financial results are prepared and reviewed internally by management in U.S. dollars. The consolidated financial statements are presented in U.S. dollars unless otherwise noted.

c) Basis of consolidation

The consolidated financial statements incorporate the accounts of the Company and all the entities in which the Company has a controlling voting interest and is deemed to be the primary beneficiary. All consolidated entities were under common control during the entirety of the periods for which their respective results of operations were included in the consolidated statements from the date of acquisition. All intercompany balances and transactions are eliminated upon consolidation.

2. BASIS OF PREPARATION (continued)

A summary of the Company's subsidiaries included in these consolidated financial statements as at October 31, 2023 is as follows:

|

Name of subsidiary (1)

|

Principal activity

|

|

320204 US Holdings Corp.

|

Holding Company

|

|

320204 Oregon Holdings Corp.

|

Holding Company

|

|

320204 Nevada Holdings Corp.

|

Holding Company

|

|

320204 Re Holdings, LLC

|

Holding Company

|

|

Eco Firma Farms LLC (2)

|

Cannabis producer

|

|

Silver State Cultivation LLC

|

Cannabis producer

|

|

Silver State Relief LLC

|

Cannabis retailer

|

|

Swell Companies LTD (2)

|

Cannabis processor, distributor

|

|

Megawood Enterprises Inc. (2)

|

Cannabis retailer

|

|

Phantom Venture Group, LLC (2)

|

Holding Company

|

|

Phantom Brands, LLC (2)

|

Holding Company

|

|

Phantom Distribution, LLC (2)

|

Cannabis distributor

|

|

63353 Bend, LLC (2)

|

Cannabis producer

|

|

20727-4 Bend, LLC (2)

|

Cannabis processor

|

|

4964 BFH, LLC (2)

|

Cannabis producer

|

|

Workforce Concepts 21, Inc.

|

Payroll and benefits services

|

(1) All subsidiaries of the Company were incorporated in the USA, are wholly owned and have USD as their functional currency.

(2) Operations have been discontinued and results are included in discontinued operations.

d) Reclassification of comparative figures

The Company has reclassified certain items on the interim condensed consolidated statements of cash flows for the nine months ended October 31, 2022 to conform with current period presentation. A summary of the reclassifications is as follows:

|

Former classification

|

Reclassified to

|

Amount

reclassified

|

|

|

|

$

|

|

Depreciation and amortization

|

Changes in inventory

|

363,855

|

|

Changes in lease liabilities

|

Amortization of right-of-use assets

|

364,727

|

|

Changes in accounts payable and accrued liabilities

|

Interest expense

|

396,161

|

3. SIGNIFICANT ACCOUNTING POLICIES

The Company's significant accounting policies are fully described in Note 3 to the consolidated financial statements for the years ended January 31, 2023 and 2022. There have been no material changes to the Company's significant accounting policies.

a) Significant accounting estimates and assumptions

The preparation of the Company's consolidated financial statements in conformity with U.S. GAAP requires management to make judgments, estimates and assumptions that affect the reported amounts of assets, liabilities and contingent liabilities at the date of the financial statements and reported amounts of revenues and expenses during the reporting period. Estimates and assumptions are continuously evaluated and are based on management's experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. Actual results may differ from those estimates and judgments.

Areas requiring a significant degree of estimation and judgment relate to the determination of recoverability of goodwill, recoverability of intangible assets, fair value less costs to sell of assets classified as held for sale, estimates used in valuation and costing of inventory, impairment of long-lived assets and inventory, fair value measurements, useful lives, depreciation and amortization of property, equipment and intangible assets, the recoverability and measurement of deferred tax assets and liabilities, share-based compensation, and fair value of derivative liability.

3. SIGNIFICANT ACCOUNTING POLICIES (continued)

b) Recently issued accounting pronouncements

Recent accounting pronouncements issued by the FASB, the American Institute of Certified Public Accountants ("AICPA") and the U.S. Securities and Exchange Commission ("SEC") did not or are not believed by management to have a material effect on the Company's present or future financial statements.

4. DISCONTINUED OPERATIONS

a) Sales-type lease and disposal of licenses

In January 2022, the Company entered into a lease-to-own arrangement with a lessee for certain licenses, land and equipment in Oregon, USA, representing its outdoor growing operation. The Company determined that the arrangement should be accounted for as a sales-type lease and concluded that it is not probable that all required payments will be made such that title will transfer at the end of the term. As such, in accordance with ASC 842, the land and equipment are not derecognized, and payments received are recorded as a deposit liability until such time that collectability becomes probable.

During the nine months ended October 31, 2023, the Company executed a settlement agreement to terminate the lease-to-own arrangement. In the period preceding the settlement agreement date, the Company collected a cumulative $100,000 in connection with the lease-to-own arrangement and $75,000 for a separate sale of three licenses in Bend, Oregon (contingent upon State regulatory approval) to the same lessee, which were recorded as a deposit liability. Under the settlement agreement, the Company agreed to transfer certain licenses with a carrying value of $32,250, in exchange for $400,000, which was paid by the lessee. In addition, the Company retained the cumulative $100,000 lease-to-own arrangement payments made to date. As a result, the Company recognized a gain on termination of sales-type lease and disposal of licenses of $467,750. The remaining deposit liability of $75,000 (January 31, 2023 - $175,000) relates to the separate sale of licenses in Bend, Oregon, which remain pending State regulatory approval.

b) Oregon reporting unit

As a result of non-profitable operations in the Oregon reporting unit, the Company began to wind down operations in Oregon beginning in the year ended January 31, 2021. By January 31, 2022, the Company made the decision to cease all growing, manufacturing, and processing activities in Bend, Oregon. As the Oregon reporting unit comprises the assets of multiple components in distinct geographic locations, management anticipates completing the sale on a piecemeal basis. Management is engaged in an active program to seek buyers for the major classes of assets and liabilities in Oregon in order to complete a sale.

By April 2023, the Company had terminated all operating lease agreements in Oregon and paid a settlement payment of $151,350. As a result, security deposits with a carrying amount of $43,796 were written off and the Company recognized a loss on lease termination of $13,419.

Long-term debt comprises equipment and vehicle loans and a building mortgage. The mortgage was entered into on February 1, 2015 and matures on February 1, 2035 (20 years). The mortgage bears interest at a fixed rate of 4.5% with payments made monthly. The equipment and vehicle loans had interest rates ranging from 5.59% to 19.9% and were repaid in March 2022. During the three and nine months ended October 31, 2023, other expenses included interest expense incurred on long-term debt of $4,594 and $14,009 (2022 - $4,892 and $15,343), respectively. During the nine months ended October 31, 2023, an amount of $34,163 (2022 - $34,163) was repaid in connection with the long-term debt.

4. DISCONTINUED OPERATIONS (continued)

A summary of major classes of assets and liabilities of the discontinued Oregon operation that are classified as held for sale in the interim condensed consolidated balance sheets is as follows:

| |

|

October 31,

2023 |

|

|

January 31,

2023 |

|

| |

|

$ |

|

|

$ |

|

| Carrying amounts of the major classes of assets included in discontinued operations: |

|

|

|

|

|

|

| Receivables |

|

- |

|

|

15,522 |

|

| Prepaid expenses and deposits |

|

9,146 |

|

|

84,972 |

|

| Deferred tax asset |

|

143,078 |

|

|

143,078 |

|

| Property and equipment |

|

1,139,517 |

|

|

1,139,517 |

|

| Total assets classified as held for sale |

|

1,291,741 |

|

|

1,383,089 |

|

| |

|

|

|

|

|

|

| Carrying amounts of the major classes of liabilities included in discontinued operations: |

|

|

|

|

|

|

| Lease liabilities |

|

- |

|

|

216,298 |

|

| Long-term debt |

|

403,814 |

|

|

423,968 |

|

| Total liabilities classified as held for sale |

|

403,814 |

|

|

640,266 |

|

A summary of the Company's net loss from discontinued operations is as follows:

| |

|

Three months ended

October 31, |

|

|

Nine months ended

October 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| Revenue |

|

- |

|

|

- |

|

|

- |

|

|

357,540 |

|

| Cost of sales |

|

- |

|

|

(3,311 |

) |

|

- |

|

|

473,894 |

|

| Gross loss |

|

- |

|

|

(3,311 |

) |

|

- |

|

|

(116,354 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative expenses |

|

14,338 |

|

|

119,402 |

|

|

94,746 |

|

|

424,655 |

|

| Impairment loss |

|

- |

|

|

- |

|

|

- |

|

|

61,937 |

|

| Provision for expected credit losses |

|

- |

|

|

- |

|

|

- |

|

|

35,359 |

|

| Loss on lease termination |

|

- |

|

|

- |

|

|

13,419 |

|

|

- |

|

| Other expenses |

|

4,594 |

|

|

4,892 |

|

|

14,009 |

|

|

2,042 |

|

| Net loss from discontinued operations before income tax expense |

|

(18,932 |

) |

|

(120,983 |

) |

|

(122,174 |

) |

|

(640,347 |

) |

| Income tax recovery |

|

- |

|

|

132,137 |

|

|

- |

|

|

265,730 |

|

| Net income (loss) from discontinued operations after income tax expense |

|

(18,932 |

) |

|

11,154 |

|

|

(122,174 |

) |

|

(374,617 |

) |

A summary of the Company's cash flows from discontinued operations for the nine months ended October 31, 2023 and 2022 is as follows:

| |

|

2023 |

|

|

2022 |

|

| |

|

$ |

|

|

$ |

|

| Net cash provided by (used in) operating activities of discontinued operations |

|

59,644 |

|

|

(55,934 |

) |

| Net cash provided by investing activities of discontinued operations |

|

- |

|

|

51,357 |

|

| Net cash used in financing activities of discontinued operations |

|

(34,163 |

) |

|

(46,762 |

) |

5. RECEIVABLES

A summary of the Company's receivables is as follows:

| |

|

October 31,

2023 |

|

|

January 31,

2023 |

|

| |

|

$ |

|

|

$ |

|

| Taxes receivable |

|

10,734 |

|

|

10,834 |

|

| Trade receivables |

|

337,472 |

|

|

401,476 |

|

| |

|

348,206 |

|

|

412,310 |

|

There was no provision for expected credit losses on trade receivables as at October 31, 2023 and January 31, 2023.

6. INVENTORY

A summary of the Company's inventory is as follows:

| |

|

October 31,

2023 |

|

|

January 31,

2023 |

|

| |

|

$ |

|

|

$ |

|

| Finished goods |

|

1,406,549 |

|

|

1,556,353 |

|

| Work in process |

|

1,199,851 |

|

|

2,494,455 |

|

| Raw materials |

|

232,654 |

|

|

122,765 |

|

| |

|

2,839,054 |

|

|

4,173,573 |

|

7. PROPERTY AND EQUIPMENT AND RIGHT-OF-USE ASSETS

a) Property and equipment

A summary of the Company's property and equipment is as follows:

| |

|

October 31,

2023 |

|

|

January 31,

2023 |

|

| |

|

$ |

|

|

$ |

|

| Land |

|

1,330,000 |

|

|

1,330,000 |

|

| Leasehold improvements |

|

2,024,882 |

|

|

1,775,896 |

|

| Furniture and fixtures |

|

361,579 |

|

|

468,696 |

|

| Computer equipment |

|

6,659 |

|

|

6,659 |

|

| Machinery and equipment |

|

2,394,286 |

|

|

2,450,919 |

|

| |

|

6,117,406 |

|

|

6,032,170 |

|

| Less: accumulated depreciation |

|

(1,715,325 |

) |

|

(1,347,052 |

) |

| |

|

4,402,081 |

|

|

4,685,118 |

|

Total depreciation expense for the three and nine months ended October 31, 2023 was $143,670 and $413,484 (2022 - $134,988 and $398,603), respectively. During the three and nine months ended October 31, 2023, $118,590 and $357,056 (2022 - $120,382 and $351,816), respectively, of the total depreciation expense was allocated to inventory. During the three and nine months ended October 31, 2023, the Company recorded impairment of property and equipment of $nil and $372,227 (2022 - $nil and $61,937), respectively.

b) Right-of-use assets

The Company's right-of-use assets result from its operating leases (Note 12) and consist of land and buildings used in the cultivation, processing, and warehousing of its products.

8. INTANGIBLE ASSETS AND GOODWILL

a) Intangible assets

A summary of the Company's intangible assets subject to amortization is as follows:

| |

|

October 31,

2023 |

|

|

January 31,

2023 |

|

| |

|

$ |

|

|

$ |

|

| Licenses |

|

12,102,521 |

|

|

12,167,021 |

|

| Brands |

|

644,800 |

|

|

644,800 |

|

| Customer relationships |

|

1,540,447 |

|

|

1,540,447 |

|

| |

|

14,287,768 |

|

|

14,352,268 |

|

| Less: accumulated amortization |

|

(7,432,973 |

) |

|

(6,465,443 |

) |

| |

|

6,854,795 |

|

|

7,886,825 |

|

During the three and nine months ended October 31, 2023, the Company recognized amortization expense on intangible assets of $332,722 and $999,779 (2022 - $334,334 and $1,003,002), respectively. Of the total amortization expense, $2,266 and $6,799 (2022 - $2,266 and $6,799), respectively, was allocated to inventory.

During the nine months ended October 31, 2023, the Company disposed of three licenses in Oregon with a cost of $64,500 and accumulated amortization of $32,250 (Note 4).

b) Goodwill

As at October 31, 2023 and January 31, 2023, the Company had goodwill of $28,541,323 and $28,541,323, respectively, which was allocated to the Nevada reporting unit. There was no impairment on goodwill identified during the nine months ended October 31, 2023 and 2022.

9. SECURITY DEPOSIT

Non-current assets include a security deposit with the Alberta Energy Regulator ("AER") under the AER's Liability Management programs to cover potential liabilities relating to its wells. The required security deposit with the AER is determined based on a monthly licensee management rating assessment. As at October 31, 2023, the security deposit had a balance of $46,434 (January 31, 2023 - $46,871).

10. ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

A summary of the Company's accounts payable and accrued liabilities is as follows:

| |

|

October 31,

2023 |

|

|

January 31,

2023 |

|

| |

|

$ |

|

|

$ |

|

| Accounts payable |

|

1,506,999 |

|

|

1,842,089 |

|

| Accrued liabilities |

|

613,750 |

|

|

450,485 |

|

| EFF settlement accrual (Note 20) |

|

612,500 |

|

|

612,500 |

|

| Interest payable |

|

- |

|

|

16,352 |

|

| |

|

2,733,249 |

|

|

2,921,426 |

|

11. PROMISSORY NOTES

Transaction costs related to the issuance of convertible promissory notes are apportioned to their respective financial liability and equity components (if applicable) in proportion to the allocation of proceeds as a reduction to the carrying amount of each component.

When valuing the financial liability component of the promissory notes, the Company used specific interest rates assuming no conversion features existed. The resulting liability component is accreted to its face value over the convertible note's term until its maturity date.

a) Convertible promissory notes

A summary of the Company's convertible promissory notes denominated in USD is as follows:

| |

|

June 13, 2018

issuance |

|

| |

|

$ |

|

| Balance, January 31, 2022 |

|

1,281,442 |

|

| Payment |

|

(41,600 |

) |

| Interest expense |

|

1,600 |

|

| Effect of foreign exchange |

|

(85,183 |

) |

| Balance, October 31, 2023 and January 31, 2023 |

|

1,156,259 |

|

On June 13, 2018, the Company issued convertible promissory notes to the vendors that sold Eco Firma Farms, LLC ("EFF") to the Company in the aggregate principal amount of $2,000,000. The convertible promissory notes were convertible at $1.00 per share. The convertible promissory notes accrue interest at a rate of 4% per annum, compounded annually, and were fully due and payable on June 13, 2021. The Company is in an ongoing dispute with the vendors over repayment (Note 20). On issuance, the Company determined the conversion feature was a derivative liability as the convertible promissory notes were exercisable in USD while the functional currency of the Company is Canadian dollars. The conversion feature expired on June 13, 2021 and as such the fair value of the conversion feature as at October 31, 2023 was $nil (January 31, 2023 - $nil).

b) Promissory note payable

A summary of the Company's promissory note payable denominated in USD is as follows:

| |

|

$ |

|

| Balance, January 31, 2022 |

|

8,106,667 |

|

| Repayments |

|

(6,080,000 |

) |

| Balance, January 31, 2023 |

|

2,026,667 |

|

| Repayments |

|

(2,026,667 |

) |

| Balance, October 31, 2023 |

|

- |

|

On January 1, 2019, the Company issued a promissory note to Mr. Newman, who sold Silver State to the Company in the principal amount of $30,000,000. The promissory note is payable in the following principal instalments: $3,000,000 on April 1, 2019, $6,000,000 on each of July 1, 2019, October 1, 2019, January 1, 2020, and April 1, 2020, and $3,000,000 on July 1, 2020. The promissory note accrues interest at a rate of 10% per annum. The promissory note is secured by all of the outstanding membership interests, and a security interest in all of the assets, of Silver State.

On July 1, 2019, the terms of the promissory note payable for the acquisition of Silver State were amended to call for immediate payment of $2,000,000 plus accrued interest on July 1, 2019 followed by payments of $800,000 plus accrued interest on the first of each of August, September, October, November, and December 2019.

Effective November 21, 2019 and June 25, 2020, Mr. Newman and the Company agreed to further amend the terms of the promissory note due to Mr. Newman. The December 1, 2019 principal payment of $800,000 was cancelled and the monthly principal payments thereafter were reduced to $600,000 per month. Further, the annual interest rate on the note was reduced from 10% to 9.5%. The remaining balance on the promissory note is due and payable on January 1, 2021. This modification did not result in any profit or loss.

11. PROMISSORY NOTES (continued)

On November 19, 2020, the Company announced an agreement with Mr. Newman that the remaining $15,200,000 principal outstanding on his promissory note, due to mature on January 1, 2021, was amended with lower monthly payments amortized over a 30-month period. Commencing December 1, 2020, the monthly payments are $506,667 plus interest. The interest rate at 9.5% was unchanged.

For the three and nine months ended October 31, 2023, interest expense was $nil and $35,210 (2022 - $97,058 and $394,561), respectively. Interest paid during the three and nine months ended October 31, 2023 was $nil and $51,562 (2022 - $109,322 and $431,354), respectively.

12. LEASE LIABILITIES

The Company's leases consist of land and buildings used in the cultivation, processing, and warehousing of its products. All leases were classified as operating leases in accordance with ASC 842.

A summary of the Company's active leases under contract as at October 31, 2023 is as follows:

|

Entity Name/Lessee

|

Asset

|

Original lease

term

|

Type

|

|

Silver State Cultivation LLC

|

Land/ Building

|

12

|

Operating lease

|

|

Silver State Relief LLC (Sparks)

|

Land/ Building

|

12

|

Operating lease

|

|

Silver State Relief LLC (Fernley)

|

Land/ Building

|

12

|

Operating lease

|

For the three and nine months ended October 31, 2023, the Company incurred operating lease costs in continuing operations of $350,936 and $1,052,808 (2022 - $350,936 and $1,052,808), respectively. Of this amount, $203,092 and $609,276 (2022 - $203,092 and $609,276), respectively, was allocated to inventory.

A summary of the Company's weighted average discount rate used in calculating lease liabilities and weighted average remaining lease term is as follows:

| |

|

October 31,

2023 |

|

|

January 31,

2023

|

|

| Weighted average discount rate |

|

10% |

|

|

10% |

|

| Weighted average remaining lease term (years) |

|

9.09 |

|

|

9.63 |

|

A summary of the maturity of contractual undiscounted liabilities associated with the Company's operating leases as at October 31, 2023 is as follows:

| Year ending January 31, |

|

$ |

|

| 2024 |

|

321,453 |

|

| 2025 |

|

1,314,551 |

|

| 2026 |

|

1,353,987 |

|

| 2027 |

|

1,394,607 |

|

| 2028 |

|

1,436,445 |

|

| Thereafter |

|

7,712,494 |

|

| Total undiscounted lease liabilities |

|

13,533,537 |

|

| Interest on lease liabilities |

|

(4,873,044 |

) |

| Total present value of minimum lease payments |

|

8,660,493 |

|

| Current portion of lease liability |

|

459,262 |

|

| Lease liabilities |

|

8,201,231 |

|

As at October 31, 2023, the Company has total undiscounted lease liabilities of $13,533,537 (January 31, 2023 - $14,488,346) pertaining to lease liabilities in continuing operations and total undiscounted lease liabilities of $nil (January 31, 2023 - $228,192) which are classified as held for sale.

13. DERIVATIVE LIABILITY

A summary of the Company's derivative liability is as follows:

| |

|

Earn out

shares |

|

| |

|

$ |

|

| Balance, January 31, 2022 |

|

1,006,368 |

|

| Fair value adjustment on derivative liability |

|

(742,483 |

) |

| Effect of foreign exchange |

|

(24,185 |

) |

| Balance, January 31, 2023 |

|

239,700 |

|

| Fair value adjustment on derivative liability |

|

392,155 |

|

| Settlement of earn out shares |

|

(575,136 |

) |

| Effect of foreign exchange |

|

(9,859 |

) |

| Balance, October 31, 2023 |

|

46,860 |

|

Upon the May 24, 2019 acquisition of Swell Companies, the vendors can earn up to 6,000,000 'earn out' shares over a period of seven years. The conditions were based on the Company's common shares exceeding certain share prices during the period. Additionally, the 50% of the earn out shares are earned upon a change of control of the Company. The fair value of the derivative liability is derived using a Monte Carlo simulation.

In February 2023, the Company settled the obligation to issue 4,792,800 common shares by making cash payments of $575,136. As at October 31, 2023, the total number of remaining earn out shares is 1,207,200 (January 31, 2023 - 6,000,000).

14. SHARE CAPITAL

Share capital consists of one class of fully paid common shares, with no par value. The Company is authorized to issue an unlimited number of common shares. All shares are equally eligible to receive dividends and repayment of capital and represent one vote at the Company's shareholders' meetings.

A summary of the Company's share capital is as follows:

| |

|

Number of

shares |

|

|

Common

stock |

|

| |

|

# |

|

|

$ |

|

| Balance, January 31, 2022 |

|

120,047,814 |

|

|

105,236,351 |

|

| Share-based compensation |

|

- |

|

|

209,441 |

|

| Balance, January 31, 2023 |

|

120,047,814 |

|

|

105,445,792 |

|

| Share-based compensation |

|

- |

|

|

16,601 |

|

| Balance, October 31, 2023 |

|

120,047,814 |

|

|

105,462,393 |

|

a) Commitment to issue shares

In connection with the acquisition of EFF on June 13, 2018, the Company issued a promissory note payable to deliver 1,977,500 shares to the vendors of EFF in the amount of $1,905,635, without interest, any time after October 15, 2018. As at October 31, 2023, shares issued pursuant to this commitment total 1,184,407 shares (January 31, 2023 - 1,184,407 shares).

b) Warrants

A summary of the Company's warrant activity is as follows:

| |

|

Number of

warrants |

|

|

Weighted

average

exercise price |

|

|

Weighted

average

remaining life |

|

| |

|

# |

|

|

C$ |

|

|

Years |

|

| Balance, January 31, 2022 |

|

3,240,000 |

|

|

1.18 |

|

|

2.10 |

|

| Balance, January 31, 2023 |

|

3,240,000 |

|

|

1.18 |

|

|

1.10 |

|

| Balance, October 31, 2023 |

|

3,240,000 |

|

|

1.18 |

|

|

0.35 |

|

14. SHARE CAPITAL (continued)

A summary of the Company's outstanding and exercisable warrants as at October 31, 2023, is as follows:

| Expiry date |

|

Exercise price |

|

|

Number of

warrants

outstanding |

|

| |

|

C$ |

|

|

# |

|

| December 31, 2023 |

|

1.00 |

|

|

632,400 |

|

| January 30, 2024 |

|

1.00 |

|

|

1,407,600 |

|

| May 24, 2024 |

|

1.50 |

|

|

1,200,000 |

|

| |

|

|

|

|

3,240,000 |

|

As at October 31, 2023 and January 31, 2023, outstanding and exercisable warrants had intrinsic values of $nil and $nil, respectively.

c) Stock options

The Company is authorized to grant options to executive officers and directors, employees, and consultants, enabling them to acquire up to 10% of the issued and outstanding common shares of the Company. The exercise price of each option equals the market price of the Company's shares as calculated on the date of grant. The options can be granted for a maximum term of 10 years. Vesting is determined by the Board of Directors.

A summary of the Company's stock option activity is as follows:

| |

|

Number of

options |

|

|

Weighted

average

exercise price |

|

|

Weighted

average

remaining life |

|

| |

|

# |

|

|

C$ |

|

|

Years |

|

| Balance, January 31, 2022 |

|

5,615,000 |

|

|

0.84 |

|

|

1.45 |

|

| Granted |

|

600,000 |

|

|

0.70 |

|

|

3.00 |

|

| Expired/forfeited |

|

(1,405,000 |

) |

|

1.25 |

|

|

0.56 |

|

| Balance, January 31, 2023 |

|

4,810,000 |

|

|

0.75 |

|

|

0.86 |

|

| Expired/forfeited |

|

(3,560,000 |

) |

|

0.70 |

|

|

- |

|

| Balance, October 31, 2023 |

|

1,250,000 |

|

|

0.75 |

|

|

0.27 |

|

A summary of the Company's stock options outstanding and exercisable as at October 31, 2023, is as follows:

| Expiry date |

|

Exercise price |

|

|

Number of

options

outstanding |

|

|

Number of

options

exercisable |

|

| |

|

C$ |

|

|

# |

|

|

# |

|

| January 28, 2024 |

|

1.50 |

|

|

150,000 |

|

|

150,000 |

|

| October 9, 2024 |

|

1.00 |

|

|

500,000 |

|

|

500,000 |

|

| February 10, 2025 |

|

0.70 |

|

|

600,000 |

|

|

399,999 |

|

| |

|

|

|

|

1,250,000 |

|

|

1,049,999 |

|

As at October 31, 2023 and January 31, 2023, outstanding and exercisable stock options had intrinsic values of $nil and $nil, respectively.

During the three and nine months ended October 31, 2023, the Company recorded a share-based compensation of $5,499 and $16,601 (2022 - $31,788 and $188,638), respectively.

14. SHARE CAPITAL (continued)

During the nine months ended October 31, 2023, there were no stock options granted. During the nine months ended October 31, 2022, the Company used the following assumptions in the Black-Scholes option pricing model:

| |

|

2022 |

|

| Stock price |

|

C$0.61 |

|

| Exercise price |

|

C$0.70 |

|

| Risk-free rate |

|

1.60% |

|

| Expected life of options |

|

3 years |

|

| Annualized volatility |

|

80% |

|

| Dividend rate |

|

0% |

|

The Company has computed the fair value of options granted using the Black-Scholes option pricing model. The expected term used for options issued to non-employees is the contractual life and the expected term used for options issued to employees and directors is the estimated period of time that options granted are expected to be outstanding. The Company utilizes the "simplified" method to develop an estimate of the expected term of "plain vanilla" employee option grants. The Company is utilizing an expected volatility figure based on a review of the historical volatilities, over a period of time, equivalent to the expected life of the instrument being valued, of similarly positioned public companies within its industry. The risk-free interest rate was determined from the implied yields from U.S. Treasury zero-coupon bonds with a remaining term consistent with the expected term of the instrument being valued.

15. SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

A summary of the Company's selling, general and administration expenses is as follows:

| |

|

Three months ended

October 31, |

|

|

Nine months ended

October 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| Accounting and legal |

|

278,929 |

|

|

347,618 |

|

|

735,141 |

|

|

581,275 |

|

| Depreciation and amortization |

|

355,536 |

|

|

341,782 |

|

|

1,049,408 |

|

|

1,024,354 |

|

| License fees, taxes, and insurance |

|

398,688 |

|

|

377,057 |

|

|

1,236,314 |

|

|

1,231,435 |

|

| Office facilities and administrative |

|

105,971 |

|

|

84,202 |

|

|

282,646 |

|

|

279,223 |

|

| Operating lease costs |

|

147,844 |

|

|

147,844 |

|

|

443,532 |

|

|

443,532 |

|

| Other expenses |

|

206,056 |

|

|

236,395 |

|

|

781,170 |

|

|

558,830 |

|

| Professional fees and consulting |

|

186,842 |

|

|

240,138 |

|

|

410,949 |

|

|

645,687 |

|

| Salaries and wages |

|

810,821 |

|

|

676,467 |

|

|

2,256,369 |

|

|

2,080,531 |

|

| Sales, marketing, and promotion |

|

17,465 |

|

|

26,366 |

|

|

51,870 |

|

|

65,464 |

|

| Share-based compensation |

|

5,499 |

|

|

31,788 |

|

|

16,601 |

|

|

188,638 |

|

| Shareholder communications |

|

6,354 |

|

|

4,352 |

|

|

12,971 |

|

|

14,144 |

|

| Travel and entertainment |

|

12,962 |

|

|

14,770 |

|

|

40,968 |

|

|

43,756 |

|

| |

|

2,532,967 |

|

|

2,528,779 |

|

|

7,317,939 |

|

|

7,156,869 |

|

16. SEGMENTED INFORMATION

The Company defines its major geographic operating segments as Oregon and Nevada. Due to the jurisdictional cannabis compliance issues ever-present in the industry, each state operation is by nature operationally segmented.

Key decision makers primarily review revenue, cost of sales expense, and gross margin as the primary indicators of segment performance. As the Company continues to expand via acquisition, the segmented information will expand based on management's agreed upon allocation of costs beyond gross margin.

16. SEGMENTED INFORMATION (continued)

A summary of the Company's segmented operational activity and balances from continuing operations for the nine months ended October 31, 2023 is as follows:

| |

|

Nevada |

|

|

Corporate |

|

|

Total |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

| Total revenue |

|

21,736,388 |

|

|

- |

|

|

21,736,388 |

|

| Gross profit |

|

8,303,423 |

|

|

- |

|

|

8,303,423 |

|

| Operating income (expenses): |

|

|

|

|

|

|

|

|

|

| General and administration |

|

(3,621,592 |

) |

|

(2,134,936 |

) |

|

(5,756,528 |

) |

| Sales, marketing, and promotion |

|

(51,870 |

) |

|

- |

|

|

(51,870 |

) |

| Operating lease cost |

|

(443,532 |

) |

|

- |

|

|

(443,532 |

) |

| Depreciation and amortization |

|

(979,631 |

) |

|

(69,777 |

) |

|

(1,049,408 |

) |

| Share-based compensation |

|

- |

|

|

(16,601 |

) |

|

(16,601 |

) |

| Impairment loss |

|

(372,227 |

) |

|

- |

|

|

(372,227 |

) |

| Gain on termination of sales-type lease and disposal of licenses |

|

- |

|

|

467,750 |

|

|

467,750 |

|

| Interest expense and others |

|

(36,330 |

) |

|

(427,584 |

) |

|

(463,914 |

) |

| Net income (loss) from continuing operations before income tax expense |

|

2,798,241 |

|

|

(2,181,148 |

) |

|

617,093 |

|

Segmented information pertaining to discontinued operations is contained within Note 4.

A summary of the Company's segmented operational activity and balances from continuing operations for the nine months ended October 31, 2022 is as follows:

| |

|

Nevada |

|

|

Corporate |

|

|

Total |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

| Total revenue |

|

21,855,358 |

|

|

- |

|

|

21,855,358 |

|

| Gross profit |

|

11,751,307 |

|

|

- |

|

|

11,751,307 |

|

| Operating income (expenses): |

|

|

|

|

|

|

|

|

|

| General and administration |

|

(3,199,334 |

) |

|

(2,235,547 |

) |

|

(5,434,881 |

) |

| Sales, marketing, and promotion |

|

(65,464 |

) |

|

- |

|

|

(65,464 |

) |

| Operating lease cost |

|

(443,532 |

) |

|

- |

|

|

(443,532 |

) |

| Provision for expected credit losses |

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

(953,152 |

) |

|

(71,202 |

) |

|

(1,024,354 |

) |

| Share-based compensation |

|

- |

|

|

(188,638 |

) |

|

(188,638 |

) |

| Impairment loss |

|

- |

|

|

(20,726 |

) |

|

(20,726 |

) |

| Interest expense and others |

|

(12,103 |

) |

|

362,982 |

|

|

350,879 |

|

| Net income (loss) from continuing operations before income tax expense |

|

7,077,722 |

|

|

(2,153,131 |

) |

|

4,924,591 |

|

Segmented information pertaining to discontinued operations is contained within Note 4.

Entity-wide disclosures

All revenue for the three and nine months ended October 31, 2023 and 2022 was earned in the United States.

For the three and nine months ended October 31, 2023 and 2022, no customer represented more than 10% of the Company's net revenue. As at October 31, 2023 and January 31, 2023, no customer represented more than 10% of the Company's receivables.

16. SEGMENTED INFORMATION (continued)

A summary of the Company's the long-lived tangible assets disaggregation by geographic area is as follows:

| |

|

October 31,

2023 |

|

|

January 31,

2023 |

|

| |

|

$ |

|

|

$ |

|

| Nevada |

|

11,066,684 |

|

|

11,321,662 |

|

| Discontinued operations (Oregon) |

|

1,330,000 |

|

|

1,748,286 |

|

| Other |

|

- |

|

|

703 |

|

| |

|

12,396,684 |

|

|

13,070,651 |

|

17. COMMITMENTS

The Company and its subsidiaries are committed under lease agreements with third parties and related parties, for land, office space, and equipment in Nevada and Oregon. A summary of the Company's future minimum payments as at October 31, 2023 is as follows:

| Year ending January 31, |

|

Third

parties |

|

|

Related

parties |

|

|

Total |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

| 2024 |

|

88,536 |

|

|

244,304 |

|

|

332,840 |

|

| 2025 |

|

361,043 |

|

|

999,058 |

|

|

1,360,101 |

|

| 2026 |

|

370,508 |

|

|

1,029,030 |

|

|

1,399,538 |

|

| 2027 |

|

380,256 |

|

|

1,059,901 |

|

|

1,440,157 |

|

| 2028 |

|

390,298 |

|

|

1,091,698 |

|

|

1,481,996 |

|

| Thereafter |

|

2,173,650 |

|

|

5,861,496 |

|

|

8,035,146 |

|

| |

|

3,764,291 |

|

|

10,285,487 |

|

|

14,049,778 |

|

18. RELATED PARTY TRANSACTIONS

A summary of the Company's related balances included in accounts payable and accrued liabilities, and promissory note payable is as follows:

| |

|

October 31,

2023 |

|

|

January 31,

2023 |

|

| |

|

$ |

|

|

$ |

|

| Due to the President and CEO |

|

- |

|

|

2,043,019 |

|

| Lease liabilities due to a company controlled by the CEO |

|

5,023,085 |

|

|

8,953,425 |

|

| Due to the CFO |

|

575 |

|

|

692 |

|

| |

|

5,023,660 |

|

|

10,997,136 |

|

As at January 31, 2023, Due to the President and CEO included the promissory note that was repaid during the nine months ended October 31, 2023. As at October 31, 2023 and January 31, 2023, Due to the CFO consists of reimbursable expenses incurred in the normal course of business.

18. RELATED PARTY TRANSACTIONS (continued)

A summary of the Company's transactions with related parties including key management personnel is as follows:

| |

|

Three months ended

October 31, |

|

|

Nine months ended

October 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| Consulting fees paid to a director |

|

- |

|

|

75,000 |

|

|

20,000 |

|

|

95,000 |

|

| Amounts paid to CEO or companies controlled by CEO for leases |

|

203,693 |

|

|

309,000 |

|

|

814,771 |

|

|

927,000 |

|

| Amounts paid to CEO or companies controlled by CEO for repayments of promissory note |

|

- |

|

|

1,629,322 |

|

|

2,078,229 |

|

|

4,991,354 |

|

| Amounts paid to CEO or companies controlled by CEO for remuneration |

|

53,845 |

|

|

53,846 |

|

|

153,846 |

|

|

153,846 |

|

| Salary paid to directors and officers |

|

117,520 |

|

|

104,268 |

|

|

319,676 |

|

|

304,599 |

|

| Share-based compensation |

|

5,499 |

|

|

21,108 |

|

|

16,601 |

|

|

132,990 |

|

| |

|

380,557 |

|

|

2,192,544 |

|

|

3,403,123 |

|

|

6,604,789 |

|

On June 5, 2023, the company controlled by the CEO sold its interest in the Silver State Relief LLC (Sparks) property. The Company continues to lease this facility from a third party.

On August 19, 2023, the company controlled by the CEO sold its interest in the Silver State Relief LLC (Fernley) property. The Company continues to lease this facility from a third party.

19. EARNINGS PER SHARE

A summary of the Company's calculation of basic and diluted earnings per share for the nine months ended October 31, 2023 and 2022 is as follows:

| |

|

2023 |

|

|

2022 |

|

| Net income (loss) from continuing operations after income taxes |

|

(1,141,107) |

|

|

2,786,987 |

|

| Net loss from discontinued operations after income taxes |

|

(122,174) |

|

|

(374,617) |

|

| Net income (loss) |

|

(1,263,281 |

) |

|

2,412,370 |

|

| |

|

|

|

|

|

|

| Weighted average number of common shares outstanding |

|

120,047,814 |

|

|

120,047,814 |

|

| Dilutive effect of warrants and stock options outstanding |

|

2,833,093 |

|

|

2,833,093 |

|

| Diluted weighted average number of common shares outstanding |

|

122,880,907 |

|

|

122,880,907 |

|

| |

|

|

|

|

|

|

| Basic income (loss) per share, continuing operations |

|

(0.01 |

) |

|

0.02 |

|

| Diluted income (loss) per share, continuing operations |

|

(0.01 |

) |

|

0.02 |

|

| |

|

|

|

|

|

|

| Basic loss per share, discontinued operations |

|

(0.00 |

) |

|

(0.00 |

) |

| Diluted loss per share, discontinued operations |

|

(0.00 |

) |

|

(0.00 |

) |

| |

|

|

|

|

|

|

| Basic income (loss) per share |

|

(0.01 |

) |

|

0.02 |

|

| Diluted income (loss) per share |

|

(0.01 |

) |

|

0.02 |

|