0001563298

false

2022

FY

0001563298

2022-01-01

2022-12-31

0001563298

2022-12-31

0001563298

2023-03-22

0001563298

2021-12-31

0001563298

2021-01-01

2021-12-31

0001563298

us-gaap:PreferredStockMember

2020-12-31

0001563298

us-gaap:CommonStockMember

2020-12-31

0001563298

eawd:CommonStockSubscriptionsMember

2020-12-31

0001563298

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001563298

us-gaap:RetainedEarningsMember

2020-12-31

0001563298

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-12-31

0001563298

2020-12-31

0001563298

us-gaap:PreferredStockMember

2021-12-31

0001563298

us-gaap:CommonStockMember

2021-12-31

0001563298

eawd:CommonStockSubscriptionsMember

2021-12-31

0001563298

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001563298

us-gaap:RetainedEarningsMember

2021-12-31

0001563298

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001563298

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001563298

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001563298

eawd:CommonStockSubscriptionsMember

2021-01-01

2021-12-31

0001563298

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001563298

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001563298

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-01-01

2021-12-31

0001563298

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001563298

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001563298

eawd:CommonStockSubscriptionsMember

2022-01-01

2022-12-31

0001563298

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001563298

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001563298

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-12-31

0001563298

us-gaap:PreferredStockMember

2022-12-31

0001563298

us-gaap:CommonStockMember

2022-12-31

0001563298

eawd:CommonStockSubscriptionsMember

2022-12-31

0001563298

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001563298

us-gaap:RetainedEarningsMember

2022-12-31

0001563298

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001563298

us-gaap:OfficeEquipmentMember

2022-01-01

2022-12-31

0001563298

us-gaap:FurnitureAndFixturesMember

2022-01-01

2022-12-31

0001563298

us-gaap:AutomobilesMember

2022-01-01

2022-12-31

0001563298

us-gaap:MachineryAndEquipmentMember

2022-01-01

2022-12-31

0001563298

2012-12-01

2022-12-31

0001563298

us-gaap:OfficeEquipmentMember

2022-12-31

0001563298

us-gaap:OfficeEquipmentMember

2021-12-31

0001563298

us-gaap:FurnitureAndFixturesMember

2022-12-31

0001563298

us-gaap:FurnitureAndFixturesMember

2021-12-31

0001563298

eawd:FinancingLeaseEquipmentMember

2022-12-31

0001563298

eawd:FinancingLeaseEquipmentMember

2021-12-31

0001563298

us-gaap:MachineryAndEquipmentMember

2022-12-31

0001563298

us-gaap:MachineryAndEquipmentMember

2021-12-31

0001563298

us-gaap:AutomobilesMember

2022-12-31

0001563298

us-gaap:AutomobilesMember

2021-12-31

0001563298

eawd:VirhtechGmbhMember

eawd:RelatedPartyMember

2022-12-31

0001563298

eawd:VirhtechGmbhMember

eawd:RelatedPartyMember

2021-12-31

0001563298

us-gaap:ConvertibleDebtMember

2022-12-31

0001563298

us-gaap:ConvertibleDebtMember

2021-12-31

0001563298

us-gaap:ConvertibleDebtMember

2022-01-01

2022-12-31

0001563298

us-gaap:ConvertibleDebtMember

2021-01-01

2021-12-31

0001563298

us-gaap:ConvertibleDebtMember

2021-10-01

2021-10-21

0001563298

srt:MinimumMember

us-gaap:ConvertibleDebtMember

2021-10-01

2021-10-21

0001563298

srt:MaximumMember

us-gaap:ConvertibleDebtMember

2021-10-01

2021-10-21

0001563298

srt:MinimumMember

2022-01-01

2022-12-31

0001563298

srt:MaximumMember

2022-01-01

2022-12-31

0001563298

srt:MinimumMember

2021-01-01

2021-12-31

0001563298

srt:MaximumMember

2021-01-01

2021-12-31

0001563298

us-gaap:FairValueInputsLevel1Member

2022-12-31

0001563298

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001563298

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001563298

us-gaap:FairValueInputsLevel1Member

2021-12-31

0001563298

us-gaap:FairValueInputsLevel2Member

2021-12-31

0001563298

us-gaap:FairValueInputsLevel3Member

2021-12-31

0001563298

eawd:PropertySubjectToFinancingLeaseMember

2022-12-31

0001563298

eawd:PropertySubjectToFinancingLeaseMember

2021-12-31

0001563298

us-gaap:PropertySubjectToOperatingLeaseMember

2022-01-01

2022-12-31

0001563298

us-gaap:PropertySubjectToOperatingLeaseMember

2022-12-31

0001563298

us-gaap:PropertySubjectToOperatingLeaseMember

2021-01-01

2021-12-31

0001563298

eawd:OperatingLeaseLiabilitiesMember

2022-12-31

0001563298

eawd:FinanceLeaseLiabilityMember

2022-12-31

0001563298

eawd:OfficerRalphHofmeierMember

2022-12-31

0001563298

eawd:OfficerRalphHofmeierMember

2021-12-31

0001563298

eawd:OfficerIrmaVelazquezMember

2022-12-31

0001563298

eawd:OfficerIrmaVelazquezMember

2021-12-31

0001563298

2019-01-01

2019-12-31

0001563298

2019-12-31

0001563298

eawd:SecuritiesPurchaseAgreementMember

us-gaap:CommonStockMember

2022-02-01

2022-02-18

0001563298

eawd:SecuritiesPurchaseAgreementMember

us-gaap:CommonStockMember

2022-02-18

0001563298

eawd:CommonStockSubscriptionsMember

2022-01-01

2022-03-31

0001563298

eawd:CommonStockSubscriptionsMember

2022-04-01

2022-06-30

0001563298

us-gaap:InvestorMember

2022-01-26

0001563298

us-gaap:CommonStockMember

2022-01-26

0001563298

2022-03-31

0001563298

2022-03-01

2022-03-31

0001563298

us-gaap:CommonStockMember

eawd:SecuritiesPurchaseAgreementMember

2022-07-01

2022-09-30

0001563298

us-gaap:LineOfCreditMember

2022-01-01

2022-12-31

0001563298

us-gaap:ConvertibleDebtMember

2022-01-14

0001563298

2022-01-14

0001563298

2022-01-02

2022-01-14

0001563298

2022-02-01

2022-02-02

0001563298

2022-02-01

2022-02-03

0001563298

2022-04-26

2022-04-27

0001563298

2022-08-01

2022-08-11

0001563298

2022-09-01

2022-09-09

0001563298

2021-02-17

0001563298

us-gaap:LineOfCreditMember

2022-12-31

0001563298

eawd:HofmeierMember

2022-12-31

0001563298

eawd:VelazquezMember

2022-12-31

0001563298

eawd:EmploymentAgreements2022Member

2022-01-01

2022-12-31

0001563298

eawd:EmploymentAgreements2022Member

eawd:EmployeesMember

2022-08-04

0001563298

2022-11-01

2022-11-28

0001563298

us-gaap:SubsequentEventMember

2023-01-01

2023-01-25

0001563298

us-gaap:USTreasuryAndGovernmentMember

2022-01-01

2022-12-31

0001563298

us-gaap:USTreasuryAndGovernmentMember

2021-01-01

2021-12-31

0001563298

eawd:ForeignMember

2022-01-01

2022-12-31

0001563298

eawd:ForeignMember

2021-01-01

2021-12-31

0001563298

us-gaap:USTreasuryAndGovernmentMember

2022-12-31

0001563298

us-gaap:USTreasuryAndGovernmentMember

2021-12-31

0001563298

eawd:ForeignMember

2022-12-31

0001563298

eawd:ForeignMember

2021-12-31

0001563298

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

eawd:TysadcoPartnersLLCMember

2023-01-01

2023-01-10

0001563298

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

eawd:TysadcoPartnersLLCMember

2023-01-10

0001563298

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

eawd:GaryRodneyMember

2023-01-01

2023-01-18

0001563298

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

eawd:GaryRodneyMember

2023-01-18

0001563298

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

eawd:RalphHofmeierMember

2023-01-01

2023-01-18

0001563298

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

eawd:RalphHofmeierMember

2023-01-18

0001563298

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

eawd:TysadcoPartnersLLCMember

2023-01-01

2023-01-18

0001563298

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

eawd:TysadcoPartnersLLCMember

2023-01-18

0001563298

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

eawd:TysadcoPartnersLLCMember

2023-01-01

2023-01-30

0001563298

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

eawd:TysadcoPartnersLLCMember

2023-01-30

0001563298

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

eawd:TysadcoPartnersLLCMember

2023-02-01

2023-02-14

0001563298

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

eawd:TysadcoPartnersLLCMember

2023-02-14

0001563298

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

us-gaap:InvestorMember

2023-02-01

2023-02-14

0001563298

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

us-gaap:InvestorMember

2023-02-14

0001563298

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

us-gaap:InvestorMember

2023-02-01

2023-02-17

0001563298

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

us-gaap:InvestorMember

2023-02-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:EUR

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required

to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has

filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted

electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Indicate by checkmark whether the registrant has filed

a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting

under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the regular public accounting firm that prepared or issued its audit

report. ☐

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of December 31, 2022, the last business day of

the registrant’s most recently completed fiscal quarter, the aggregate market value of the common stock held by non-affiliates

of the registrant was $7,310,080 based on the closing

price of $0.036 for the registrant’s common stock as quoted on the OTC QB Market on that date. Shares of common stock held by

each director, each officer and each person who owns 10% or more of the outstanding common stock have been excluded from this

calculation in that such persons may be deemed to be affiliates. The determination of affiliate status is not necessarily

conclusive.

None.

Certain statements contained

in this Report may contain "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, but are not limited to,

statements regarding our Company and management’s expectations, hopes, beliefs, intentions, or strategies regarding the future,

including our financial condition and results of operations. In addition, any statements that refer to projections, forecasts, or other

characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,”

“believes,” “continue,” “could,” “estimates,” “expects,” “intends,”

“may,” “might,” “plans,” “possible,” “potential,” “predicts,”

“projects,” “seeks,” “should,” “will,” “would” and similar expressions, or

the negatives of such terms, may identify forward-looking statements, but the absence of these words does not mean that a statement is

not forward-looking.

Forward-looking statements

are subject to significant risks and uncertainties. Investors are cautioned against placing undue reliance on such statements. Actual

results may differ materially from those set forth in the forward-looking statements. Other important factors that we think could cause

our actual results to differ materially from expected results are summarized below, including the still ongoing impact of the current

outbreak of the novel coronavirus ("COVID-19"), on the U.S., regional and global economies, the U.S. sustainable energy market,

and the broader financial markets. The current outbreak of COVID-19 has also impacted, and is likely to continue to impact, directly or

indirectly, many of the other important factors below and the risks described in this Form 10-K and in our subsequent filings under the

Exchange Act. Other factors besides those listed could also adversely affect us. In addition, we cannot assess the impact of each factor

on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those

contained in any forward-looking statements. In particular, it is difficult to fully assess the impact of COVID-19 at this time due to,

among other factors, uncertainty regarding the severity and duration of the outbreak domestically and internationally, uncertainty regarding

the effectiveness of federal, state and local governments’ efforts to contain the spread of COVID-19 and respond to its direct and

indirect impact on the global economy and economic activity, including the timing of the successful distribution of an effective vaccine.

Statements regarding

the following subjects, among others, may be forward-looking:

Forward-looking statements

are based on beliefs, assumptions and expectations as of the date of this Form 10-K. Any forward-looking statement speaks only as

of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict those events or

how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking

statements after the date of this Form 10-K, whether as a result of new information, future events or otherwise.

The risks included here

are not exhaustive. Other sections of this Form 10-K may include additional factors that could adversely affect our business and financial

performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time and

it is not possible for management to predict all such risk factors, nor can it assess the impact of all such risk factors on our business

or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any

forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements

as a prediction of actual results.

PART I

ITEM 1. BUSINESS.

Company Overview

Energy and Water Development Corp. (the “Company”

or “EAWD”) was originally incorporated as a Delaware corporation named Wealthhound.com, Inc. in 2000 and was converted to

a Florida corporation under the name Eagle International Holdings Group Inc. on December 14, 2007.

On March 10, 2008, the Company changed its name to

Eurosport Active World Corporation and on March 17, 2008, the Company entered into an Agreement and Plan of Acquisition (the “Acquisition

Agreement”) with Inko Sport America, LLC (“ISA”), a privately-held Florida limited liability company wherein all of

the certified owners of ISA exchanged their ownership interests in ISA for shares of the Company. In connection with the closing of the

Acquisition Agreement, the Company adopted ISA’s business plan and the Company’s registered current directors

were elected to their positions. This transaction was accounted for as a recapitalization effected by a share exchange, wherein ISA was

considered the acquirer for accounting and financial reporting purposes. ISA was administratively dissolved in September 2010.

In September 2019, the Company changed its name to

Energy and Water Development Corp. to more accurately reflect the Company’s purpose and business sector and the Company has registered

its logo “EAWD” with the United States Patent and Trademark Office, the European Union Intellectual Property Office and the

World Intellectual Property Organization (WIPO) to secure its corporate identity.

To ensure the Company is positioned to service

its growing business in one of the EU’s most environmentally progressive countries, the Company has a branch registered to conduct

business in Germany and two wholly-owned German subsidiaries: Energy and Water Development Deutschland GmbH (“EAWD Deutschland”)

and EAWD Logistik GmbH (“EAWD Logistik”).

The Business

We are an engineering services company formed as an outsourcing green tech

platform, focused on sustainable water and energy solutions.

| |

· |

EAWD builds water and energy systems out of existing, proven technologies, utilizing our patent pending systems configuration and our technical know-how

to customize solutions to meet our clients’ needs. To date, two water systems have been sold and deployed in Mexico and Germany. |

| |

· |

Using its patent pending design, EAWD is working to design, build, and operate Off-Grid EV Charging Stations in Germany. |

| |

· |

EAWD commercializes proven technologies for the sustainable generation of energy and water. The first unit has been built and tested in Germany and the Company is working to fulfill additional orders. |

| |

· |

EAWD is a United Nations “accredited vendor” and offers design, construction, maintenance and specialty consulting services to private companies, government entities and non-government organizations (NGOs) for the sustainable supply of energy and water. |

In view of the increased world-wide demand for water

and energy, our business goals are focused on self-sufficient energy supplied water generation and green energy production. To accomplish

this, we set out to establish an outsourcing green tech platform to commercialize the Company’s state-of-the-art technologies while

providing engineering and technical consultation services to design the most sustainable technological solutions that can provide water

and energy. We also intend to secure all required technical, maintenance, education, and training related to the identified technology

solutions. To this end the Company has sought potential collaboration with green tech research and development centers in Europe and has

established its operating subsidiaries in Hamburg Germany, where we have started to assemble our patent-pending innovative off-grid, self-sufficient

energy supply atmosphere water generation (“AWG”) systems (EAWD Off-Grid AWG Systems). EAWD Deutschland and EAWD Logistik

operate in Hamburg, Germany to meet the increasing demands of water and energy generation projects around the world as well as to operate

the solar powered EAWD Off-Grid EV Charging Stations, EAWD’s newest product, in Germany.

The green tech industry is constantly evolving due

to ongoing and increasing water scarcity as well as increased energy needs in the world. Therefore, we believe that by designing

sustainable and renewable solutions to these problems, EAWD will become an essential component of a rapidly growing industry with many

new markets.

The green tech industry is complex because it still

requires increased promotion and public education about its potential. Furthermore, regulations in each country are different and, in

many cases, several segments are regulated by both national and local (state, provincial, municipal) governments. EAWD’s approach

seeks to assist businesses with the growth and development of their general operations by ensuring the efficient, profitable, and sustainable

supply/generation of water and energy allowing our potential customers to focus on their business while adopting strategies of sustainability.

Using our own EAWD Off-Grid AWG Systems, EAWD Off-Grid EV Charging Stations, EAWD Off-Grid Power Systems, EAWD Off-Grid Water Purification

Systems, and other identified technology, products, and services licensed or purchased from third party sources, we are delivering and

installing a product set that suits the green technology water and/or energy needs of our customers. By using the state-of-the art technological

solutions and technologies identified, designed, and provided by EAWD and its collaborators, we believe that our potential clients will

be free to focus on the performance of their operations as well as with the water and energy consumption or generation regulations within

their industry. Our clients may be businesses seeking to upgrade their business processes, NGOs or governmental entities seeking to apply

green technology solutions for the water and energy they supply to their constituencies.

We continue to be a development stage company. The

Company presently assembles its EAWD Off-Grid AWG Systems and EAWD Off-Grid EV Charging Stations at its workshop in Germany and outsources

most of its engineering and technical services as well as services relating to the promotion, selling, and distribution of its products.

We presently have only nine employees: Ms. Velazquez, our Chief Executive Officer, Vice-Chairman of the Board of Directors, and a significant

stockholder, Mr. Hofmeier, our Chief Technology Officer, Chairman of the Board of Directors, and a significant stockholder, two engineers,

two technicians, one accountant assistant, and two assemblers. Ms. Velazquez and Mr. Hofmeier are married.

We seek to focus on three main aspects of the water

and energy business: (1) generation, (2) supply, and (3) maintenance. We seek to assist private companies, government entities and municipalities,

and NGOs to build profitable and sustainable supplies/generation capabilities of water and energy as required by selling them the required

technology or technical service to enhance their productivity/operability. With its outsourced technical arm and its commission-based

global network of distributors, the Company expects to create sustainable added value to each project it takes on while generating revenue

from the sale of own EAWD Off-Grid AWG Systems, EAWD Off-Grid EV Charging Stations, EAWD Off-Grid Power Systems, and EAWD Off-Grid Water

Purification Systems, royalties from the commercialization of energy and water in certain cases, and the licensing of our innovated technologies;

as well as from its engineering, technical consulting, and project management services.

The following table depicts the Company’s service and product offerings

to its clients.

We plan to provide customized technology solutions

and technical services, based upon client need and preference, which may include any or all of the following:

| |

· |

water and energy generation |

| |

· |

off-grid electric vehicle charging stations |

| |

· |

technical assistance |

| |

· |

strategic and financial partnering |

| |

· |

project management |

The Company also plans to focus on addressing areas

of the industry which concentrate on new technological and engineering concepts relating to water and energy generation and those related

components that assist in advancing the green tech industry. These include:

| |

· |

advancement of EAWD Off-Grid AWG Systems |

| |

· |

development of techniques to attain self-sufficient supply of energy |

| |

· |

advancement of new ideas on energy generation, storage and management implementation |

| |

· |

designing, prototyping, and arranging the manufacture of new water and energy generation systems |

| |

· |

designing and prototyping off-grid self-sufficient power systems |

| |

· |

designing and prototyping solar powered charging stations for electric vehicles |

Our Vision

The size of the global market for atmospheric water

generators was estimated at USD 959.85 million in 2020, reached USD 1,074.01 million in 2021, and at a compound annual growth rate (CAGR)

of 14.75%, is expected to reach USD 2,515.19 million by 2027. (Source: Atmospheric Water Generator Market 2022 Report published by 360i

Research)

The main market dynamics to consider are the growing

numbers of AWGs across various end-use verticals and versus the high energy consumption, production cost, and high carbon footprint of

such technology. Our research and development activities in AWG technology have led us to develop novel technologies that overcome these

negative dynamics (such as our EAWD Off-Grid AWG Systems).

The mission of EAWD is to provide sustainable water

generation systems based on high efficiency, renewable sources and to provide off-grid self-sufficient energy supply solutions. Through

a combination of the best design and configuration of state-of-the-art technology-assisted solutions, EAWD has created a completely self-sufficient

off the grid energy generation and water production system, which can be simultaneously used to meet potable water requirements and the

electrical energy needs of the industrial sector.

EAWD promotes and commercializes its green technology

solutions via commission-based distributers and agents worldwide.

Through our BlueTech Alliance for Water Generation,

established in December 2020, we have state-of-the-art technology partners, technology transfer agreements, and technology representation

agreements in place relating to aspects of renewable energy and water supply. These unique key relationships offer important selling features

and capabilities that differentiated EAWD from its competitors.

The Company plans to generate revenue from the sale

of EAWD Off-Grid AWG Systems, the development, sale, and operation of the EAWD Off-Grid EV Charging Stations, sale of EAWD Off-Grid Power

Systems, and EAWD Off-Grid Water Purification Systems, royalties from the commercialization of energy and water in certain cases, and

the licensing of our innovated technologies; as well as from its engineering, technical consulting, and project management services.

Our Products

The technological solutions offered by our Company are the following:

EAWD Off-Grid AWG Systems

Today, atmospheric water generators (AWGs) are standard

equipment in many places; however, operating AWGs requires high amounts of energy that is often not available in the places where they

are needed most, making the price for the generated water very high. Our innovative EAWD Off-Grid AWG Systems are designed to have

an internal power supply and ability to generate power. Our EAWD Off-Grid AWG Systems produce sufficient quantities of potable water

even in very dry and hot climate conditions and can be scaled to almost any size, community, and/or population. Presently, AWGs are largely

used in Asian and African countries. The majority of manufacturers of AWGs, which rely on dehumidifying, are located in China. Almost

every U.S. based AWG brand is also supplied by manufacturers in China.

By contrast, EAWD uses a proven German technology

for condensate water from the air based on A/C technology. We believe that this method allows higher, more efficient, sustainable

performance and a larger quantity of water generation because of its internal power supply and because it does not require high humidity

to function. EAWD has licensed the rights to use this German AWG technology for ninety-nine years; however, thanks to our continued research

and development efforts, the Company has designed a new, innovative and more efficient configuration that allows the substantial amount

of energy required to operate the equipment to be supplied by the equipment itself. Our EAWD Off-Grid AWG Systems line is different in

size from the standard AWG line. Our EAWD Off-Grid AWG Systems are energy self-sufficient and can condense large amounts of water out

of the atmosphere and we believe they could be a solution in countries around the world that deal with issues of water scarcity.

Our EAWD Off-Grid AWG System with an internal

power supply, works by first “inhaling” large volumes of air, then cooling the air down to the dew point, and finally collecting,

filtering, and mineralizing the resulting condensed water. Through this process, pure drinking water is created that meets the quality

standards of the World Health Organization (WHO). In regions with high temperatures and high humidity levels, a single system can

generate more than 300,000 liters of water per day. Our EAWD Off-Grid AWG Systems line starts at 2,640 gallons/day and can expand the

water supply to one acre-feet/day, which we believe, in effect, is essentially the ability to produce an unlimited supply of water. As

a certified vendor of the United Nations (UN) Global Marketplace, EAWD is introducing the EAWD Off-Grid AWG and Power Systems to the UN

with the hopes of initially supplying the equipment to large cluster of agencies established in key locations for humanitarian response

as well as refugee camps around the world in need of fresh water.

EAWD Off-Grid Water Purification Systems

EAWD also seeks to respond to the growing

need for drinking water by proposing a water purification solution utilizing solar, photovoltaic energy and, when applicable, a mini-windmill

or other alternate source of renewable energy. The design of the system is ready to be built and delivered on demand.

Generally, drinking water is produced by

passing sea water, lake water, river water, or stagnant water through several stages of purification and treatment until it is rendered

drinkable in accordance with WHO standards. In the case of sea or stagnant water, we recommend a treatment via reverse osmosis membranes,

which permits the retention of dissolved solids and results in obtaining water of drinking quality. If the water being treated emanates

from lakes or rivers, we recommend treatment via an ultrafiltration membrane which functions by retaining suspended materials such as

colloids, viruses and bacteria. The systems proposed by EAWD are containerized and contain all the equipment necessary to function autonomously,

in part due to an automatic cleansing system that can be accessed remotely via satellite or the internet. Moreover, the machines use available

renewable energy sources such as solar or wind to function.

EAWD Off-Grid EV Charging Stations

The global electric vehicle market was valued

at $162.34 billion in 2019, and is projected to reach $802.81 billion by 2027, registering a CAGR of 22.6%. Asia-Pacific was the highest

revenue contributor, accounting for $84.84 billion in 2019, and is estimated to reach $357.81 billion by 2027, with a CAGR of 20.1%. North

America is estimated to reach $194.20 billion by 2027, at a significant CAGR of 27.5%. Asia- Pacific and Europe collectively accounted

for around 74.8% share in 2019, with the former constituting around 52.3% share. North America and Europe are expected to witness considerable

CAGRs of 27.5% and 25.3%, respectively, during the forecast period. The cumulative share of these two segments was 40.1% in 2019, and

is anticipated to reach 51.0% by 2027. (Source: Electric Vehicle Fluids Market Global Forecast to 2030 2021 Report from Markets and Markets.)

There is also an increasing consensus among European

truck manufacturers and industry stakeholders that battery electric trucks (BETs) will play a dominant role in the decarbonization of

the road freight sector. Most truck makers including Daimler, DAF, MAN, Scania and Volvo are now focusing on bringing BETs to the mass

market for all vehicle segments, including long-haul, starting from 2024. For this, a network of public high-power and overnight charging

points needs to be rolled out across Europe no later than 2024.

Based on our patent-pending Off-Grid Power System,

EAWD has developed an innovative design and configuration of off-grid charging stations for BETs and electric vehicles in Germany. Our

product is the first off-grid solution available in Europe for charging the BETs and electric passenger vehicles that are currently on

the roads of Europe. EAWD plans to establish up to 1,700 charging stations throughout the USA, Mexico and Germany starting with 40 locations

scheduled to be deployed in the fourth quarter of 2024.

EAWD Off-Grid Power Systems

Today, batteries for stationary storage have

become a commodity, but in order to reduce the duration, complexity and cost of the installation, and to increase its capacity or relocate

a system over time as well as to reduce its carbon footprint and environmental impact, we offer a complete Electrical Energy Storage System

(EESS) and Energy Management System (EMS) for a wide range of customers and applications, including microgrids and EV fast charging stations.

A highly capable energy management system which secures the efficient energy supply and storage of energy. Example: with elements such

as software and Battery Management System (BMS) our systems can allow controlled and optimized battery cell management.

This product portfolio includes systems and complete

services for solar power generation in the building envelope. A high-quality frameless glass solar panel with a super-matte surface, which

secures a high-performance energy source.

In contrast to classic solar systems on the roof,

EAWD combines the highest standards of aesthetics with high efficiency energy generation. With these solutions, EAWD supports its customers

on their way to CO2 neutrality and the search for alternative renewable energies.

Current Projects

COVID-19 is an incomparable global public health emergency

that has affected almost every industry and has caused the worst global economic contraction of the past 80 years (IMF) and the current

war in Ukraine has also caused significant changes in consumer behavior and purchasing patterns, supply chain routing, the dynamics of

current market forces, and government oversight and intervention. As a consequence of the foregoing, the following projects have been

delayed; however the Company continues to make progress on their fulfillment:

Germany

The Company has leased 24,000 sq. mi of land in

Kassel, Germany, where it is establishing the first large off-grid charging station location for electric trucks and passenger vehicles

in Germany and Europe. With enough solar panels installed, each charging station is proposed to generate at least five MWh of solar energy

per day and have a total capacity of at least one MWp. More than 2,400 MWh of energy storage capacity will be used in lithium battery

systems (LFP), to ensure the continuous use and availability of energy. The system is low voltage AC coupled, which will ensure easy

integration and expansion of the system in the future. The different elements of EAWD’s system form a “micro grid”

that is isolated and independent from the public power grid. It will have a capacity up to one MW of instant and continuous power. The

charging points will be of 300 KW of power, with the capacity to charge two trucks simultaneously of 150 KW each, of course it will also

be able to charge any other electric vehicle since it has the most common and standard connections/adapters in Europe.

The Company has completed the manufacture and installation

of the first of forty planned solar powered EAWD Off-Grid EV Charging Stations for electric long-haul trucks in Hamburg, Germany. Our

charging stations are the first off-grid charging station available for these e-trucks in Europe and the Company plans to contract with

companies that own these electric long-haul trucks to provide fleet charging as well as to install them in public places for per-use fees.

A solar powered EAWD Off-Grid AWG System has also

been built in Hamburg, Germany and the Company plans to use it to showcase the system’s ability to generate water for large projects

throughout Germany where it is expected to produce up to two million gallons of water per day. The Company expects these systems to be

operated throughout Germany, the United States of America, Mexico and Latin America.

Mexico

In 2020, our Mexican distributor placed a USD $550,000 initial order for a solar powered EAWD Off-Grid AWG System which was built in Germany

and delivered to the customer in accordance with the purchase agreement. The Company is currently negotiating the purchase of three additional

units by the same customer. The foregoing description of the purchase contract does not purport to be complete and is qualified in its

entirety by reference to the copy of such contract filed as Exhibit 10.4 to this report on Form 10-K.

South Africa

On May 8, 2019, the Company signed a sales contract

for the sale of a solar powered EAWD Off-Grid AWG System to a South African customer

for a purchase price of $2,800,000. The build out of the equipment began in the fourth quarter of 2019, however because of delays due

to COVID-19 and the global supply chain, the expected completion date has been pushed to late 2023. The foregoing description of the purchase

contract does not purport to be complete and is qualified in its entirety by reference to the copy of such contract filed as Exhibit 10.3

to this report on Form 10-K.

Worldwide Business Relationships

EAWD has commission-based independent agents

and distributors strategically placed around the world in Germany, Mexico, United States, India, Canada, Australia, Colombia, Nepal, Kenya,

Morocco, and Thailand to promote and sell EAWD’s technology solutions.

We believe that this worldwide presence through

our agents and distributors will provide us access to the most important markets in need of water, energy, and energy management solutions.

Competition

The

market witnesses the presence of a diversified array of large and small scale manufacturers resulting in a significant level of competition

in the global market. The competition in the market, both in the residential and commercial sectors, is projected to grow in intensity

and is characterized by the demand for advanced and reliable atmospheric water generator units. Rising demand for industrial-size eAWGs,

particularly in regions facing water shortages, is expected to create opportunities for new market players such as EAWD through 2027.

Moreover, current research that is focused on increasing overall product efficiency in the industry is anticipated to open new avenues

for market players over the coming years. According to an atmospheric water generator market size report [published by Grand View Research

in 2020], some of the prominent players in the atmospheric water generator (AWG) market include: Akvo Atmospheric Water Systems Pvt. Ltd.,

Dew Point Manufacturing, Saisons Trade & Industry Private Limited, Water Maker India Pvt. Ltd., Planets Water, Water Technologies

International, Inc. (WTII), Drinkable Air, Hendrx Water, Atlantis Solar, GENAQ Technologies S.L., Air2Water

LLC, EcoloBlue, Inc and Watergen. On some level, each of these companies faces the two

main industry challenges: carbon footprint and high-power requirement.

We compete by providing innovative

systems assembled with state-of-the-art technologies and that contain self-sufficient power supplies, which make them more sustainable

and profitable than the traditional solutions. We also set ourselves apart by providing services that are valued by our customers such

as reliable sales relationships, product innovations, and responses to changing market/business needs.

Corporate Information

We were incorporated in Florida

in 2008 and have operations based in Hamburg, Germany.

Our website is www.energy-water.com.

Our website and the information contained therein, or connected thereto, are not intended to be incorporated into this report on Form

10-K.

Our principal executive offices

are located at 7901 4th Street N STE #4174, St Petersburg, Florida. Our telephone number is 727-677-9408, and our website is www.energy-water.com.

Our operations in Germany are located at the office address Ballindamm 3, 20095 Hamburg. Our Telephone number is +49 40 809 08 1354.

The transfer agent for our common stock is Worldwide

Stock Transfer, LLC, located at One University Plaza, Suite 505, Hackensack, NJ 07601, Phone: (201) 820-2008, Fax: (201) 820-2010. We

intend to engage Worldwide Stock Transfer, LLC as transfer agent for the Warrants as well.

Government Regulation

The manufacturing, processing,

testing, packaging, labeling, and advertising of the technologies that we sell may be subject to regulation by one or more U.S. federal

agencies, including the Food and Drug Administration, the Federal Trade Commission, the U.S. Department of Agriculture, the Environmental

Protection Agency, and by the standards provided by the U.S. Department of Health and Human Services and the World Health Organization

for drinking water. Our operations may also be regulated by various agencies of states, localities, and foreign countries in which consumers

reside. Currently, the technologies we intend to use in our solutions and our services are not subject to any governmental regulation

in the United States although it is possible that the FDA may choose to regulate the quality of water produced from atmospheric water

generating machines in the near future.

Since the Company may

be subject to a wide range of regulation covering every aspect of our business as mentioned above, we cannot predict the nature of any

future U.S. laws, regulations, interpretations or applications, nor can we determine what effect additional governmental regulations or

administrative orders, when and if promulgated, would have on the business in the future. Although the regulation of water is less restrictive

than that of drugs and food additives, we cannot offer assurance that the current statutory scheme and regulations applicable to water

will remain less restrictive. Further, we cannot assure you that, under existing laws and regulations, or if more stringent statutes are

enacted, regulations are promulgated, or enforcement policies are adopted, we are or will be in compliance with these new statutes, regulations

or enforcement policies without incurring material expenses or adjusting our business strategy. Any laws, regulations, enforcement policies,

interpretations or applications applicable to our business could require the reformulation of products, all of which are supplied by third

parties, to meet new standards or the recall or discontinuance of certain products not capable of reformulation, additional record keeping,

expanded documentation of the properties of certain products, expanded or different labeling or scientific substantiation.

Employees

As of December 31, 2022,

we had four full-time employees. Over time, we will be required to hire employees or continue to engage independent contractors in order

to execute the projects necessary to grow and develop the business. These decisions will be made by our officers and directors, if and

when appropriate. We work with 34 commission-based agents and distributors to promote and sell the Company’s technology solutions.

These agents and distributors are independent contractors with whom we have contractual relationships and are compensated solely based

on commission.

JOBS Act and the Implications of Being an Emerging

Growth Company

We are an “emerging

growth company” as defined in Section 2(a)(19) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of

2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting requirements

that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not

being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley

Act”), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions

from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute

payments not previously approved. We elected to take advantage of all of these exemptions.

In addition, Section 107

of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided

in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards, and delay compliance with new or revised

accounting standards until those standards are applicable to private companies. We have elected to take advantage of the benefits of this

extended transition period.

We will be an emerging growth

company until the last day of the first fiscal year following the fifth anniversary of our first common equity offering, although we will

lose that status earlier if our annual revenues exceed $1.0 billion, if we issue more than $1.0 billion in non-convertible debt in any

three-year period or if we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of

1934, as amended (the “Exchange Act”). We will qualify as a “large accelerated filer” as of the first day

of the first fiscal year after we have (i) more than $700,000,000 in outstanding common equity held by our non-affiliates as of the last

day of our most recently completed second fiscal quarter; (ii) been a public company for at least 12 months; and (iii) filed at least

one annual report with the SEC. The value of our outstanding common equity will be measured each year on the last day of our second fiscal

quarter.

COVID-19 Pandemic Update

and the War in Ukraine

The outbreak of Coronavirus (COVID-19) has caused

significant disruptions to national and global economies and government activities. However, during this time, we have continued to conduct

our operations to the fullest extent possible, while responding to the outbreak with actions that include:

| |

● |

coordinating closely with our suppliers and customers; |

| |

● |

instituting various aspects of our business continuity programs; and |

| |

● |

planning for and working aggressively to mitigate disruptions that may occur. |

COVID-19 is an incomparable

global public health emergency that has affected almost every industry and has caused the worst global economic contraction of the past

80 years (IMF) and the current war in Ukraine has also caused significant changes in consumer behavior and purchasing patterns, supply

chain routing, the dynamics of current market forces, and government oversight and intervention.. Disruptive activities could include

the temporary closure of our manufacturing facilities and those used in our supply chain processes, restrictions on the export or shipment

of our products, significant cutback of ocean container delivery from Germany, business closures in impacted areas, and restrictions on

our employees’ and consultants’ ability to travel and to meet with customers. The extent to which COVID-19 or the war in Ukraine

impacts our results will depend on future developments, which still uncertain and cannot be predicted, including new information which

may emerge concerning the severity of the current conflict as well as virus variants and the actions to contain it or treat its impact,

among others. COVID-19 and the war in Ukraine could also continue to result in social, economic and labor instability in the countries

in which we or our customers and suppliers operate.

If workers at one or more

of our offices or the offices of our suppliers or manufacturers become ill or are quarantined and in either or both events are therefore

unable to work, our operations could be subject to disruption. Further, if our manufacturers become unable to obtain necessary raw materials

or components, we may incur higher supply costs or our manufacturers may be required to reduce production levels, either of which may

negatively affect our financial condition or results of operations.

In light of these challenges, the Company is focusing

its efforts on supporting key areas of our business that will help us to stabilize in the new environment and strategize for what comes

next. Those key areas are: crisis management and response, workforce, operation and supply chain, finance and liquidity, tax, trade and

regulatory, as well as strategy and brand.

Intellectual Property

We rely on a combination of trademarks, copyrights,

trade secrets and patents and contractual provisions, to protect our proprietary technology and our brands.

| · | The Company has registered its logo as a trademark with the United States

Patent and Trademark Office (USPTO, the European Union Intellectual Property Office and the World Intellectual Property Organization (WIPO)

to secure its corporate identity. |

| · | The Company has filed an application to patent its EAWD Off-Grid AWG Systems

with the USPTO and WIPO. |

| · | The Company has filed an application to patent its EAWD Off Grid Self Sufficient

Electric Vehicle Charging Station with the USPTO and WIPO. |

ITEM 1A. RISK FACTORS.

As a Smaller Reporting Company, the

Company is not required to include the disclosure required under this Item 1A.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not applicable.

ITEM 2. PROPERTIES.

Our registered office is

located at 7901 4th Street N STE #4174, St. Petersburg, Florida 33702. Our telephone number is +1 (727) 677-9408. Office

services are contracted for on a month-to-month basis in this address. Since October 2020, the Company had an official registered Branch,

which became an officially registered subsidiary in Hamburg Germany; the office address Bellindam 3, 20095 Hamburg. Our Telephone

number is +49 40 809 08 1354.

We do not own any real property.

We may procure additional space as we add employees and expand geographically. We believe that our current facilities are adequate to

meet our needs for the immediate future and that, should it be needed, suitable additional space will be available to accommodate expansion

of our operations.

ITEM 3. LEGAL PROCEEDINGS.

EAWD vs Packard

and Co-Defendant Nick Norwood - Case number 18-031011 CA-01 Miami-Dade County Circuit Court. The Company is demanding

proof of payment for shares issued in 2008.

EAWD vs Nerve Smart Systems ApS (“Nerve”)

Case number BS-15264/2022– The Court of Roskilde, Denmark. On April 2022, the Company filed a claim against Nerve demanding

the return of amounts paid by the Company for a Battery Energy Storage System that was never delivered by Nerve to the Company, and therefore

Nerve did not meet the requirements and specifications of the contract with the Company. The Company is confident there will be a positive

outcome. This matter is not expected to be resolved prior to 2024 due to the long waiting times of the Danish court System.

EAWD vs NPP Niethammer, Posewang & Partner

GmbH Wirtschaftsprüfungsgesellschaft Steuerberatungsgesellschaft (“NPP”) – Case number 322

O 159/22 – On November 28, 2022, by court settlement, the legal dispute again NPP

was settled. The subject matter of the legal dispute was NPP’s fee claims against the Company in the amount of EUR 45,500, which

is approximately $48,160, plus interest. On November 28, 2022, the Company agreed to pay NPP an amount of EUR 22,749, which is approximately

$23,214. The costs of the legal dispute were set off against each other in the settlement. There is still an outstanding fee claim against

the Company according to an invoice dated January 25, 2023 in the amount of EUR 4,986, which is approximately $5,277.

Due to the nature of the

Company's business, the Company may at times be subject to claims and legal actions. The Company accrues liabilities when it is probable

that future costs will be incurred, and such costs can be reasonably estimated. Such accruals are based on developments to date and the

Company’s estimates of the outcomes of these matters. Except as set forth above, as of December 31, 2022 we are not currently subject

to any legal proceedings, nor to the knowledge of management are any legal proceedings threatened that are likely to have a material adverse

effect on our financial position, results of operations or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

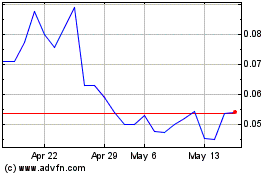

Our common stock is currently

quoted on the OTCQB tier of the OTC Market under the symbol “EAWD” There is currently a limited market for our common stock

and the volume of our common stock traded on any day may vary significantly from one day to another. Trading in stock quoted on the OTC

Market’s OTCQB is often thin and characterized by wide fluctuations in trading prices due to many factors that may have little to

do with our operations or business prospects. The availability of buyers and sellers represented by this volatility could lead to a market

price for our common stock that is unrelated to operating performance. Moreover, the OTC Market’s OTCQB is not a stock exchange,

and trading of securities quoted on the OTC Market’s OTCQB is often more sporadic than the trading of securities listed on a stock

exchange like NASDAQ. There is no assurance that there will be a sufficient market in our stock, in which case it could be difficult for

our stockholders to resell their shares.

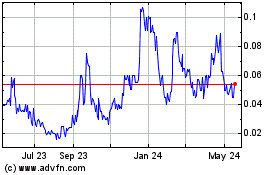

On March 28, 2023 , the closing

price of our common stock was $0.04 per share as reported on the OTC QB Market maintained by OTC Markets Group, Inc.

The

following table sets forth for the respective periods indicated the prices of our common stock in this market as reported and summarized

by the OTC Markets. Such prices are based on inter-dealer bid and asked prices, without markup, markdown, commissions, or adjustments

and may not represent actual transactions.

| |

|

HIGH |

|

|

LOW |

|

| Fiscal Year 2022: |

|

|

|

|

|

|

| First Quarter |

|

$ |

0.45 |

|

|

$ |

0.15 |

|

| Second Quarter |

|

$ |

0.25 |

|

|

$ |

0.16 |

|

| Third Quarter |

|

$ |

0.21 |

|

|

$ |

0.05 |

|

| Fourth Quarter |

|

$ |

0.08 |

|

|

$ |

0.02 |

|

| |

|

|

|

|

|

|

|

|

| Fiscal Year 2021: |

|

|

|

|

|

|

|

|

| First Quarter |

|

$ |

0.76 |

|

|

$ |

0.15 |

|

| Second Quarter |

|

$ |

0.45 |

|

|

$ |

0.17 |

|

| Third Quarter |

|

$ |

0.59 |

|

|

$ |

0.05 |

|

| Fourth Quarter |

|

$ |

1.00 |

|

|

$ |

0.0001 |

|

Penny Stock

The SEC has adopted rules

that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with

a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system,

provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system.

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document

prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings

and secondary trading; (b) contains a description of the broker’s or dealer’s duties to the customer and of the rights and

remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains

a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread

between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant

terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such

form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must

provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b)

the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices

apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement

showing the market value of each penny stock held in the customer’s account.

In addition, the penny stock

rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special

written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment

of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy

of a written suitability statement.

These disclosure requirements

may have the effect of reducing the trading activity for our common stock. Therefore, shareholders may have difficulty selling our securities.

Holders

As of December 31, 2022,

we had 846 record holders of our common stock, holding 182,934,483 shares of common stock. The number of record holders was determined

from the records of our transfer agent and does not include beneficial owners of common stock whose shares are held in the names of bank,

brokers and other nominees.

Dividends

We have never declared nor paid any cash dividends

on our common stock, and currently intend to retain all of our cash and any earnings for use in our business and, therefore, do not anticipate

paying any cash dividends in the foreseeable future. Any future determination to pay cash dividends on our common stock will be at the

discretion of the Board of Directors and will be dependent upon our consolidated financial condition, results of operations, capital requirements

and such other factors as the Board of Directors deems relevant.

Securities authorized for issuance under equity

compensation plans

Reference is made to “Item

12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters—Securities Authorized for Issuance

under Equity Compensation Plans” for the information required by this item.

Recent

Sales of Unregistered Securities

During the fiscal years ended

December 31, 2022 and 2021, the Company issued $178,000 and $404,000 in convertible debentures, respectively. The holders of certain of

such instruments had the option to convert these convertible debentures into the Company’s common stock at conversion prices ranging

from $0.01 to $0.20.

During 2022 and 2021, holders

of convertible debentures exercised their conversion options on convertible debentures amounting to $50,000 and $270,000, respectively

in exchange for 540,716 and 4,671,167 shares of common stock, respectively.

During the year ended December

31, 2022, the Company engaged in the following equity events:

Sale of Common Stock and

Subscriptions

On February 18, 2022, the Company received a deposit in the amount of $300,000

for 1,875,000 common shares to be issued pursuant to a securities purchase agreement. These common shares were issued on July 4, 2022.

From January 1, 2022 through

March 31, 2022, the Company has issued 14,953,000 common shares related to subscriptions outstanding at December 31, 2021 for

total cash consideration of $747,650.

From April 1, 2022 through

June 30, 2022, the Company has issued 8,527,947 common shares related to subscriptions outstanding at March 31, 2022 for total

cash consideration of $437,450.

Shares issued pursuant

to ELOC

On January 26, 2022 the

Company entered into a two year equity line of credit (“ELOC”) with an investor to provide up to $5 million. As of March

31, 2022, 500,000 common shares had been issued pursuant to this agreement as the commitment fee at a fair value of $80,000.

On

January 26, 2022, the Company entered into a Securities Purchase Agreement with an investor. As of March 31, 2022, 2,000,000 common

shares were issued pursuant to this agreement for a purchase price of $300,000. In the third quarter of 2022, an additional 4,023,368 common

shares were issued pursuant to ELOC for a purchase price of $450,000.

In

the fourth quarter of 2022, the Company issued an additional 5,064,421 shares of the Company’s common stock pursuant to the ELOC

for total cash consideration of $187,000.

Shares issued upon conversion

of convertible debt

On January 14, 2022, the

Company completed a conversion of our outstanding convertible debt by exchanging $53,222 cash for retiring $50,000 in convertible

debt along with $3,222 in interest for a total of 575,558 common shares.

Shares issued for services

On February 2, 2022, the

Company issued 20,000 shares of the Company’s common stock to a vendor for services valued at $3,600.

On February 3, 2022, the

Company issued 500,000 shares of the Company’s common stock to a vendor for services valued at $85,000.

On April 27, 2022, the Company

issued 227,273 shares of the Company’s common stock to a vendor for services valued at $50,000.

On August 11, 2022, the Company

issued 600,000 shares of the Company’s common stock to a vendor for services valued at $79,500.

On September 9, 2022, the

Company issued 227,273 shares of the Company’s common stock to a vendor for services valued at $50,000.

The

sale and the issuance of the foregoing securities were offered and sold in reliance upon exemptions from registration pursuant to Section

4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) and Rule 506 of Regulation D promulgated under the

Securities Act (“Regulation D”). We made this determination based on the representations of each recipient, as applicable,

which included, in pertinent part, that each such investor was either (a) an “accredited investor” within the meaning of Rule

501 of Regulation D or (b) a “qualified institutional buyer” within the meaning of Rule 144A under the Securities Act and

upon such further representations from each investor that (i) such investor acquired the securities for his, her or its own account for

investment and not for the account of any other person and not with a view to or for distribution, assignment or resale in connection

with any distribution within the meaning of the Securities Act, (ii) such investor agreed not to sell or otherwise transfer the purchased

securities unless they are registered under the Securities Act and any applicable state securities laws, or an exemption or exemptions

from such registration are available, (iii) such investor had knowledge and experience in financial and business matters such that he,

she or it was capable of evaluating the merits and risks of an investment in us, (iv) such investor had access to all of our documents,

records, and books pertaining to the investment and was provided the opportunity to ask questions and receive answers regarding the terms

and conditions of the offering and to obtain any additional information which we possessed or were able to acquire without unreasonable

effort and expense, and (v) such investor had no need for the liquidity in its investment in us and could afford the complete loss of

such investment. In addition, there was no general solicitation or advertising for such securities issued in reliance upon these exemptions.

ITEM 6. [RESERVED]

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS.

Introductory

Statement

The following discussion

and analysis of the results of operations and financial condition for the fiscal years ended December 31, 2022 and 2021 should be

read in conjunction with our financial statements and the notes to those financial statements that are included elsewhere in this

Report. This discussion contains forward-looking statements and information relating to our business that reflect our current views

and assumptions with respect to future events and are subject to risks and uncertainties that may cause our or our industry’s actual

results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance

or achievements expressed or implied by these forward-looking statements.

These forward-looking

statements speak only as of the date of this report. Although we believe that the expectations reflected in the forward-looking statements

are reasonable, we cannot guarantee future results, levels of activity, or achievements. Except as required by applicable law, including

the securities laws of the United States, we expressly disclaim any obligation or undertaking to disseminate any update or revisions

of any of the forward-looking statements to reflect any change in our expectations with regard thereto or to conform these statements

to actual results.

Addressing Challenges

Post-COVID-19 and the Current War in Ukraine

COVID-19 is an incomparable

global public health emergency that has affected almost every industry and has caused the worst global economic contraction of the past

80 years (IMF) and the current war in Ukraine has also caused significant changes in consumer behavior and purchasing patterns, supply

chain routing, the dynamics of current market forces, and government oversight and intervention. Disruptive activities could include the

temporary closure of our manufacturing facilities and those used in our supply chain processes, restrictions on the export or shipment

of our products, significant cutback of ocean container delivery from Germany, business closures in impacted areas, and restrictions on

our employees’ and consultants’ ability to travel and to meet with customers. The extent to which COVID-19 or the war in Ukraine

impacts our results will depend on future developments, which still uncertain and cannot be predicted, including new information which

may emerge concerning the severity of the current conflict as well as virus variants and the actions to contain it or treat its impact,

among others. COVID-19 and the war in Ukraine could also continue to result in social, economic and labor instability in the countries

in which we or our customers and suppliers operate.

If workers at one or more

of our offices or the offices of our suppliers or manufacturers become ill or are quarantined and in either or both events are therefore

unable to work, our operations could be subject to disruption. Further, if our manufacturers become unable to obtain necessary raw materials

or components, we may incur higher supply costs or our manufacturers may be required to reduce production levels, either of which may

negatively affect our financial condition or results of operations.

In light of these challenges,

the Company is focusing its efforts on supporting key areas of our business that will help us to stabilize in the new environment and

strategize for what comes next. Those key areas are: crisis management and response, workforce, operation and supply chain, finance and

liquidity, tax, trade and regulatory, as well as strategy and brand.

Critical

Accounting Policies and Estimates

Our financial statements

have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these

financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities and

expenses. Note 2 of the Notes to Financial Statements describes the significant accounting policies used in the preparation of the financial

statements. Certain of these significant accounting policies are considered to be critical accounting policies, as defined below.

A critical accounting policy

is defined as one that is both material to the presentation of our financial statements and requires management to make difficult, subjective

or complex judgments that could have a material effect on our financial condition and results of operations. Specifically, critical accounting

estimates have the following attributes: 1) we are required to make assumptions about matters that are highly uncertain at the time of

the estimate; and 2) different estimates we could reasonably have used, or changes in the estimate that are reasonably likely to occur,

would have a material effect on our financial condition or results of operations.

Estimates and assumptions

about future events and their effects cannot be determined with certainty. We base our estimates on historical experience and on various

other assumptions believed to be applicable and reasonable under the circumstances. These estimates may change as new events occur, as

additional information is obtained and as our operating environment changes. These changes have historically been minor and have been

included in the financial statements as soon as they became known. Based on a critical assessment of our accounting policies and the underlying

judgments and uncertainties affecting the application of those policies, management believes that our financial statements are fairly

stated in accordance with accounting principles generally accepted in the United States and present a meaningful presentation of our financial

condition and results of operations. We believe the following critical accounting policies reflect our more significant estimates and

assumptions used in the preparation of our financial statements:

Risks and

Uncertainties – The Company’s business could be impacted by price pressure on its product manufacturing, acceptance

of its products in the marketplace, new competitors, changes in federal and/or state legislation and other factors and new technology.

If the Company is unsuccessful in securing adequate liquidity, its plans may be curtailed. Adverse changes in these areas could negatively

impact the Company’s financial position, results of operations and cash flows.

Basis of Presentation

The consolidated financial

statements include the accounts of Energy and Water Development Corp and have been prepared in accordance with accounting principles generally

accepted in the United States of America and the rules of the Securities and Exchange Commission. In the opinion of management, all adjustments,

consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the results of operations for

the periods presented have been reflected herein.

Use of Estimates

The preparation of financial

statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at

the date of the financial statements and the reported amounts of expenses during the reporting periods. Actual results could differ from

those estimates. Estimates which are particularly significant to the financial statements include estimates relating to the determination

of impairment of assets, assessment of going concern, the useful life of property and equipment, the determination of the fair value of

stock-based compensation, and the recoverability of deferred income tax assets.

Leases

Effective January 1, 2019,

the Company adopted ASC 842- Leases (“ASC 842”). The lease standard provided a number of optional practical expedients in

transition. The Company elected the package of practical expedients. As such, the Company did not have to reassess whether expired or

existing contracts are or contain a lease; did not have to reassess the lease classifications or reassess the initial direct costs associated

with expired or existing leases. The lease standard also provides practical expedients for an entity’s ongoing accounting. The Company

elected the short-term lease recognition exemption under which the Company will not recognize right-of-use (“ROU”) assets

or lease liabilities, and this includes not recognizing ROU assets or lease liabilities for existing short-term leases. The Company elected