false

2023

FY

0001043150

0

0

0

0001043150

2023-01-01

2023-12-31

0001043150

2023-06-30

0001043150

2024-12-23

0001043150

2023-10-01

2023-12-31

0001043150

2023-12-31

0001043150

2022-12-31

0001043150

us-gaap:SeriesDPreferredStockMember

2023-12-31

0001043150

us-gaap:SeriesDPreferredStockMember

2022-12-31

0001043150

2022-01-01

2022-12-31

0001043150

EEGI:PreferredStockSeriesDMember

2021-12-31

0001043150

us-gaap:CommonStockMember

2021-12-31

0001043150

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001043150

us-gaap:RetainedEarningsMember

2021-12-31

0001043150

2021-12-31

0001043150

EEGI:PreferredStockSeriesDMember

2022-12-31

0001043150

us-gaap:CommonStockMember

2022-12-31

0001043150

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001043150

us-gaap:RetainedEarningsMember

2022-12-31

0001043150

EEGI:PreferredStockSeriesDMember

2022-01-01

2022-12-31

0001043150

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001043150

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001043150

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001043150

EEGI:PreferredStockSeriesDMember

2023-01-01

2023-12-31

0001043150

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001043150

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0001043150

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001043150

EEGI:PreferredStockSeriesDMember

2023-12-31

0001043150

us-gaap:CommonStockMember

2023-12-31

0001043150

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001043150

us-gaap:RetainedEarningsMember

2023-12-31

0001043150

EEGI:NewDirectorAndManagementTeamMember

us-gaap:CommonStockMember

2022-11-06

2022-11-07

0001043150

EEGI:ConvertiblePreferredDSeriesStockMember

EEGI:KeaveneyMember

2022-05-01

2022-05-31

0001043150

us-gaap:CommonStockMember

EEGI:KeaveneyMember

2022-05-01

2022-05-31

0001043150

EEGI:ConvertibleSeriesCPreferredStockMember

2023-12-31

0001043150

EEGI:ConvertibleSeriesDPreferredStockMember

2023-12-31

0001043150

EEGI:ConvertibleSeriesCPreferredStockMember

2022-12-31

0001043150

EEGI:ConvertibleSeriesDPreferredStockMember

2022-12-31

0001043150

EEGI:ChiChingHungMember

2023-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the year ended December 31, 2023

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to _____________

Commission file number: 000-53212

| Eline

Entertainment Group, Inc. |

| (Exact name of registrant as specified in its charter) |

| Wyoming |

|

88-0429856 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

1113,

Tower 2, Lippo Centre, 89 Queensway,

Admiralty, Hong

Kong 0000

(Address of principal executive offices) (Zip Code)

+852 3703 6155

(Registrant’s telephone number, including area

code)

N/A

(Former name, former address and former fiscal year,

if changed since last report)

Securities registered pursuant to Section 12(b) of

the Exchange Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| None |

|

EEGI |

|

N/A |

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required

to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1)

has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. ☐ Yes ☒ No

Indicate by check mark whether the registrant has

submitted electronically and every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☐

Yes ☒ No

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has

filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting

under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its

audit report. ☐

If securities are registered pursuant to Section 12(b)

of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of

an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error

corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a

shell company (as defined in Rule 12b-2 of the Act). ☒ Yes ☐ No

As of June 30, 2023 (last business day of the

registrant’s most recently completed second fiscal quarter), based upon the last reported trade on that date ($0.0007), the aggregate

market value of the voting and non-voting common equity held by non-affiliates (for this purpose, all outstanding and issued common stock

minus stock held by the officers, directors and known holders of 10% or more of the Company’s common stock) was $8,524,529,727.

The number of shares of the registrant's common stock outstanding on December

23, 2024 was 8,524,529,727.

ELINE ENTERTAINMENT GROUP, INC.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

Use of Certain Defined Terms

Except as otherwise indicated by the context, references

in this report to “Eline Entertainment Group, Inc.”, “we,” “us,” “our,” “our Company”.

Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933,

as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking

statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,”

“should,” “would,” “may,” “seek,” “plan,” “might,” “will,”

“expect,” “anticipate,” “predict,” “project,” “forecast,” “potential,”

“continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are

based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known

and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to

be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties.

Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or

that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these

forward-looking statements. These forward-looking statements are found at various places throughout this Annual Report on Form 10-K and

include information concerning possible or assumed future results of our operations, including statements about potential acquisition

or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding

future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that

are not historical facts.

These forward-looking statements represent our intentions,

plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those

factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those

forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements

might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue

reliance on these forward-looking statements, which speak only as of the date of the Annual Report on Form 10-K. All subsequent written

and oral forward-looking statements concerning other matters addressed in this Annual Report on Form 10-K and attributable to us or any

person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Annual

Report on Form 10-K.

Except to the extent required by law, we undertake

no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events,

conditions, circumstances or assumptions underlying such statements, or otherwise.

PART I

ITEM 1. BUSINESS

Business Overview

Eline Entertainment Group, Inc. (OTC “EEGI”)

was incorporated under the laws of the State of Nevada on June 12, 1997, as Rapid Retrieval Systems, Inc. On April 25, 2001, the Company

filed an amendment to its Articles of Incorporation and changed its name to Eline Entertainment Group, Inc. In 2017, the Company converted

out of the State of Nevada and domiciled in the State of Wyoming.

Eline Entertainment Group, Inc., Inc. operated as

food service business specializing in sports and entertainment production and distribution. Business

operations for Eline Entertainment Group, Inc. were abandoned by former management and a custodianship action, as described in the subsequent

paragraph, was commenced in 2022.

On May 11, 2022,

the First Judicial District Court of Laramie, Wyoming granted the Application for Appointment of Custodian as a result of the absence

of a functioning board of directors and the revocation of the Company’s charter. The order appointed Rhonda Keaveney (the “Custodian”)

custodian with the right to appoint officers and directors, negotiate and compromise debt, execute contracts, issue stock, and authorize

new classes of stock.

The court awarded custodianship to the Custodian based

on the absence of a functioning board of directors, revocation of the company’s charter, and abandonment of the business. At this

time, the Custodian appointed Rhonda Keaveney as our sole individual serving as director, officer, and executive officer.

The Custodian attempted to contact the Company’s

officers and directors through letters, emails, and phone calls, with no success.

Small Cap

Compliance, LLC (“SCC”) is a shareholder in the Company and Rhonda Keaveney is the sole member of SCC. Rhonda Keaveney

applied to the Court for an Order appointing her as the Custodian. This application was for the purpose of reinstating EEGI’s corporate

charter to do business and restoring value to the Company for the benefit of the stockholders.

The Custodian performed the following actions in its capacity as custodian:

| |

· |

Funded any expenses of the company including paying off outstanding liabilities |

| |

· |

Brought the Company back into compliance with the Wyoming Secretary of State, resident agent, transfer agent |

| |

· |

Appointed officers and directors, held a shareholders meeting, and audited financial reports |

The Custodian paid the following expenses on behalf

of the company:

| |

· |

Wyoming Secretary of State for reinstatement of the Company, $188 |

| |

· |

Transfer agent, Signature Stock Transfer, Inc., $850 |

| |

· |

Amended and Restated Articles of Incorporation for the Company, $175 |

| |

· |

Audit expenses, $17,500 |

Upon appointment as the Custodian of EEGI and under

its duties stipulated by the Wyoming court, the Custodian took initiative to organize the business of the issuer. As Custodian, the duties

were to conduct daily business, hold shareholder meetings, appoint officers and directors, reinstate the company with the Wyoming Secretary

of State. The Custodian also had authority to enter into contracts and find a suitable merger candidate. Ms. Keaveney was compensated

for her role as custodian in the amount 1 share of Convertible Preferred D Series Stock and 10,000,000 shares of restricted common stock

issued in the name of Small Cap Compliance, LLC. The Custodian did not receive any additional compensation, in the form of cash or stock,

for custodian services. The custodianship was terminated. See Order Discharging and Dismissing the Receivership dated July 29, 2022 filed

as Exhibit 10.1.

On November 7, 2022, the registrant’s majority

shareholder, Small Cap Compliance, LLC, entered into a Stock Purchase Agreement (the “Agreement”) with Chi Ching Hung. As

per the terms of the Agreement, Small Cap Compliance, LLC sold its control block of stock, 1 Convertible Series D Preferred Stock to Chi

Ching Hung and the Company issued 250,000,000 shares of Restricted Common Stock for the purchase price of $250,000.

On November

25, 2022, a change in control of the Company occurred by virtue of the Company's largest shareholder, Small Cap Compliance, LLC, selling

1 share of the Convertible Series D Preferred Stock and the Company issuing 250,000,000 shares of Restricted Common Stock to Chi Ching

Hung. Such shares represent 100% of the Company's total issued and outstanding shares of Convertible Series D Preferred Stock and .03%

of the Company’s total issued and outstanding shares of Restricted Common Stock. As part of the sale of the shares, Ms. Keaveney,

owner of Small Cap Compliance, LLC, arranged with Ms. Hung prior to resigning as the sole Officer and member of the Company's Board of

Directors and to appoint new officers and directors of the Company.

Eline Entertainment Group, Inc. is a developmental

stage company, incorporated under the laws of the State of Nevada on June 12, 1997. Our plan of business has not been implemented but

will involves mergers and acquisitions of operating companies

Since May 2022, the Company’s operations consist

of a search for a merger, acquisition, reverse merger or a business transaction opportunity with an operating business or other financial

transaction; however, there can be no assurance that this plan will be successfully implemented. Until a transaction is effectuated,

the Company does not expect to have significant operations. At this time, the Company has no arrangements or understandings with respect

to any potential merger, acquisition, reverse merger or business combination candidate pursuant to which the Company may become an operating

company.

Opportunities may come to the Company’s attention

from various sources, including our management, our stockholders, professional advisors, securities broker dealers, venture capitalists

and private equity funds, members of the financial community and others who may present unsolicited proposals. At this time, the Company

has no plans, understandings, agreements, or commitments with any individual or entity to act as a finder in regard to any business opportunities.

While it is not currently anticipated that the Company will engage unaffiliated professional firms specializing in business acquisitions,

reorganizations or other such transactions, such firms may be retained if such arrangements are deemed to be in the best interest of the

Company. Compensation to a finder or business acquisition firm may take various forms, including one-time cash payments, payments involving

issuance of securities (including those of the Company), or any combination of these or other compensation arrangements. Consequently,

the Company is currently unable to predict the cost of utilizing such services.

The Company has not restricted its search to any particular

business, industry, or geographical location. In evaluating a potential transaction, the Company analyzes all available factors and make

a determination based on a composite of available facts, without reliance on any single factor.

It is not possible at this time to predict the

nature of a transaction in which the Company may participate. Specific business opportunities would be reviewed as well as the respective

needs and desires of the Company and the legal structure or method deemed by management to be suitable would be selected. In implementing

a structure for a particular transaction, the Company may become a party to a merger, consolidation, reorganization, tender offer, joint

venture, license, purchase and sale of assets, or purchase and sale of stock, or other arrangement the exact nature of which cannot now

be predicted. Additionally, the Company may act directly or indirectly through an interest in a partnership, corporation or other form

of organization. Implementing such structure may require the merger, consolidation, or reorganization of the Company with other business

organizations and there is no assurance that the Company would be the surviving entity. In addition, our present management and stockholders

may not have control of a majority of the voting shares of the Company following reorganization or other financial transaction. As part

of such a transaction, some or all of the Company’s existing directors may resign and new directors may be appointed. The Company’s

operations following the consummation of a transaction will be dependent on the nature of the transaction. There may also be various risks

inherent in the transaction, the nature and magnitude of which cannot be predicted.

The Company may also be subject to increased governmental

regulation following a transaction; however, it is not possible at this time to predict the nature or magnitude of such increased

regulation, if any.

The Company expects to continue to incur moderate

losses each quarter until a transaction considered appropriate by management is effectuate.

At present financial revenue has not yet been realized.

The Company hopes to raise capital in order to fund the acquisitions.

All statements involving our business plan are forward

looking statements and have not been implemented as of this filing.

The Company

is moving in a new direction, statements made relating to our business plan are forward looking statements and we have no history of performance.

Current management does not have any experience in acquisition of companies but is actively looking for a suitable person to incorporate

into the management team.

The analysis will be undertaken by or under the supervision

of our management. As of the date of this filing, we have not entered into definitive agreements. In our continued efforts to analyze

potential business plan, we intend to consider the following factors:

| |

· |

Potential for growth, indicated by anticipated market expansion or new technology; |

| |

· |

Competitive position as compared to other businesses of similar size and experience within our contemplated segment as well as within the industry as a whole; |

| |

· |

Strength and diversity of management, and the accessibility of required management expertise, personnel, services, professional assistance and other required items; |

| |

· |

Capital requirements and anticipated availability of required funds, to be provided by the Company or from operations, through the sale of additional securities or convertible debt, through joint ventures or similar arrangements or from other sources; |

| |

· |

The extent to which the business opportunity can be advanced in our contemplated marketplace; and |

| |

· |

Other relevant factors |

In applying the foregoing criteria, management will

attempt to analyze all factors and circumstances and make a determination based upon reasonable investigative measures and available data.

Due to our limited capital available for investigation, we may not discover or adequately evaluate adverse facts about the opportunity

to be acquired. Additionally, we will be competing against other entities that may have greater financial, technical, and managerial capabilities

for identifying and completing our business plan.

We are unable to predict when we will, if ever, identify

and implement a business plan. We anticipate that proposed business plan would be made available to us through personal contacts of our

directors, officers and principal stockholders, professional advisors, broker-dealers, venture capitalists, members of the financial community

and others who may present unsolicited proposals. In certain cases, we may agree to pay a finder’s fee or to otherwise compensate

the persons who introduce the Company to business opportunities in which we participate.

We expect that our due diligence will encompass, among

other things, meetings with incumbent management of the target business and inspection of its facilities, as necessary, as well as a review

of financial and other information, which is made available to the Company. This due diligence review will be conducted either by our

management or by third parties we may engage. We anticipate that we may rely on the issuance of our common stock in lieu of cash payments

for services or expenses related to any analysis.

We may incur time and costs required to select and

evaluate our business structure and complete our business plan, which cannot presently be determined with any degree of certainty. Any

costs incurred with respect to the indemnification and evaluation of a prospective business that is not ultimately completed may result

in a loss to the Company. These fees may include legal costs, accounting costs, finder’s fees, consultant’s fees and other

related expenses. We have no present arrangements for any of these types of fees.

We anticipate that the investigation of specific business

opportunities and the negotiation, drafting and execution of relevant agreements, disclosure documents and other instruments will require

substantial management time and attention and substantial cost for accountants, attorneys, consultants, and others. Costs may be incurred

in the investigation process, which may not be recoverable. Furthermore, even if an agreement is reached for the participation in a specific

business opportunity, the failure to consummate that transaction may result in a loss to the Company of the related costs incurred.

As of the time of this filing, the Company has not

implemented a business combination. Our business plan is to merge with, or acquire, an operating entity that offers product or service

growth potential. We are actively looking for a suitable merger candidate and evaluating potential target companies that align with our

business plan. This will require review of financials, products and management of the merger candidate. We anticipate the review process

could take up to 30 days after a viable candidate is located.

Competition

Eline Entertainment Group, Inc. is in direct competition

with many other entities in its efforts to locate a suitable transaction. Included in the competition are business development companies,

special purpose acquisition companies (“SPACs”), venture capital firms, small business investment companies, venture capital

affiliates of industrial and financial companies, broker-dealers and investment bankers, management consultant firms and private individual

investors. Many of these entities possess greater financial resources and are able to assume greater risks than those which Eline Entertainment

Group, Inc. could consider. Many of these competing entities also possess significantly greater experience and contacts than Eline Entertainment

Group, Inc.’s management. Moreover, the Company also competes with numerous other companies similar to it for such opportunities.

Effect of Existing or Probable Governmental

Regulations on the Business

With our Form 10 being effective, we are subject to

the Exchange Act and the Sarbanes-Oxley Act of 2002. Under the Exchange Act, we are required to file with the SEC annual reports on Form

10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. The Sarbanes-Oxley Act creates a strong and independent accounting

oversight board to oversee the conduct of auditors of public companies and to strengthen auditor independence. It also (1) requires steps

be taken to enhance the direct responsibility of senior members of management for financial reporting and for the quality of financial

disclosures made by public companies; (2) establishes clear statutory rules to limit, and to expose to public view, possible conflicts

of interest affecting securities analysts; (3) creates guidelines for audit committee members’ appointment, and compensation and

oversight of the work of public companies’ auditors; (4) prohibits certain insider trading during pension fund blackout periods;

and (5) establishes a federal crime of securities fraud, among other provisions.

We are also be subject to Section 14(a) of the Exchange

Act, which requires all companies with securities registered pursuant to Section 12(g) of the Exchange Act to comply with the rules and

regulations of the SEC regarding proxy solicitations, as outlined in Regulation 14A. Matters submitted to our stockholders at a special

or annual meeting thereof or pursuant to a written consent require us to provide our stockholders with the information outlined in Schedules

14A or 14C of Regulation 14A. Preliminary copies of this information must be submitted to the SEC at least 10 days prior to the date that

definitive copies of this information are provided to our stockholders.

Employees

As

of December 31, 2023, we had two officers, two directors and no

employees. We anticipate that we will begin to fill out our management team as and when we raise capital to begin implementing our business

plan. In the interim, we will utilize independent consultants to assist with accounting and administrative matters. We currently have

no employment agreements and believe our consulting relationships are satisfactory. We plan to continue to hire independent consultants

from time to time on an as-needed basis.

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule

12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable to a “smaller reporting company”

as defined in Item 10(f)(1) of Regulation S-K.

ITEM 1C. CYBERSECURITY

The Company currently manages its cybersecurity

risk through a variety of practices that are applicable to all users of our information technology and information assets, including our

officers and directors, contractors, and vendors. The Company uses a combination of technology and monitoring to promote security awareness

and prevent security incidents, including network and passwords protocols, third party firewalls, and antivirus protections. Our Board

of Directors performs an annual review of our cybersecurity program, including management’s actions to identify and detect threats.

We have not experienced any material cybersecurity

incidents or identified any material cybersecurity threats that have affected or are reasonably likely to materially affect us, our business

strategy, results of operations or financial condition.

ITEM 2. PROPERTIES

The Company does not own any real estate or other

properties and has not entered into any long-term lease or rental agreements for property.

ITEM 3. LEGAL PROCEEDINGS

There are no pending legal proceedings to which the

Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5%

of any class of voting securities of the Company, or stockholder is a party adverse to the Company or has a material interest adverse

to the Company.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY,

RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

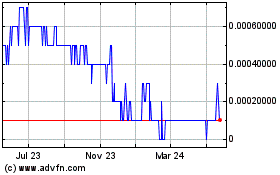

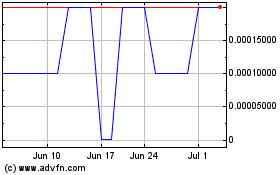

Our common stock is currently quoted on the OTC market

"Pink Sheets" under the symbol EEGI and there is limited liquidity in the public trading market for the class of common equity.

Although our stock is quoted on OTC markets, the existence of limited or sporadic quotations should not of itself be deemed to constitute

an established public trading market. There is no established public trading market for our shares. For the periods indicated, the following

table sets forth the high and low bid prices per share of common stock. The below prices represent inter-dealer quotations without retail

markup, markdown, or commission and may not necessarily represent actual transactions.

| |

|

Price Range |

|

| Period |

|

High ($) |

|

|

Low ($) |

|

| Year ended December 31, 2023 |

|

|

|

|

|

|

| First Quarter |

|

|

0.0007 |

|

|

|

0.0002 |

|

| Second Quarter |

|

|

0.0007 |

|

|

|

0.0002 |

|

| Third Quarter |

|

|

0.0007 |

|

|

|

0.0002 |

|

| Fourth Quarter |

|

|

0.0005 |

|

|

|

0.0001 |

|

| Year Ended December 31, 2022 |

|

|

|

|

|

|

|

|

| First Quarter |

|

|

0.0014 |

|

|

|

0.0010 |

|

| Second Quarter |

|

|

0.0099 |

|

|

|

0.0071 |

|

| Third Quarter |

|

|

0.0047 |

|

|

|

0.0040 |

|

| Fourth Quarter |

|

|

0.0032 |

|

|

|

0.0026 |

|

As of December 11, 2024, there are approximately 93

holders of an aggregate of 8,524,529,727 shares of our Common Stock issued and outstanding.

We have not paid any cash dividends to date and do

not anticipate or contemplate paying dividends in the foreseeable future. It is the president intention of management to utilize all available

funds for the development of the Registrant’s business.

| |

(d) |

Securities authorized for issuance under equity compensation plans. |

None.

ITEM 6. RESERVED

Not applicable to a “smaller reporting company”

as defined in Rule 12b-2 of the Exchange Act.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Management’s Discussion and Analysis

of Financial Condition and Results of Operations is intended to provide a reader of our financial statements with a narrative from the

perspective of our management on our financial condition, results of operations, liquidity, and certain other factors that may affect

our future results. The following discussion and analysis should be read in conjunction with our audited consolidated financial statements

and the accompanying notes thereto included in “Item 8. Financial Statements and Supplementary Data.” In addition to historical

financial information, the following discussion and analysis contains forward-looking statements that involve risks, uncertainties and

assumptions. See “Forward-Looking Statements.” Our results and the timing of selected events may differ materially from those

anticipated in these forward-looking statements as a result of many factors.

Business Overview

Our business plan includes

mergers and acquisitions of operating companies. We are tentatively looking for capital or different target companies in same industry

for acquisition for our business plan. Our business is not yet operational.

Recent Developments

On November 25, 2022, a change in control of the Company

occurred by virtue of the Company's largest shareholder, Small Cap Compliance, LLC, selling 1 share of the Convertible Series D Preferred

Stock and the Company issuing 250,000,000 shares of Restricted Common Stock to Chi Ching Hung. Such shares represent 100% of the Company's

total issued and outstanding shares of Convertible Series D Preferred Stock and approximately 3% of the Company’s total issued and

outstanding shares of Restricted Common Stock. As part of the sale of the shares, Ms. Keaveney, owner of Small Cap Compliance, LLC, arranged

with Ms. Hung prior to resigning as the sole Officer and member of the Company's Board of Directors and to appoint new officers and directors

of the Company.

Going Concern

Our auditor has indicated in their reports on our

financial statements for the fiscal years ended December 31, 2023, that conditions exist that raise substantial doubt about our ability

to continue as a going concern due to our recurring losses from operations, deficit in equity, and the need to raise additional capital

to fund operations. A “going concern” opinion could impair our ability to finance our operations through the sale of debt

or equity securities.

Results of Operations - Years ended December

31, 2023 and 2022

Revenue

We had no revenues from operations for the years ended December 31, 2023

and 2022.

General and Administrative Expense

General and Administrative Expenses were $53,931 for

the year ended December 31, 2023 compared to $21,214 for the year ended December 31, 2022, an increase of $32,717. The increase resulted

from expenses incurred as a SEC reporting company. Professional fess such as auditor fees of $34,700 and consulting fees of $16,000 for

the years ended December 31, 2023 increased compared to the same period in 2022.

Net Loss

We had a net loss of $53,931 for the year ended December 31, 2023 compared

to $21,214 for the year ended December 31, 2022.

Capital Resources and Liquidity - At December

31, 2023 and 2022

Cash Used in Operating Activities

For the years ended December 31, 2023 and 2022, the

Company had cash used in operating activities in the amount of $26,035 and $2,501, respectively, which were primarily due to net loss

for the year with an increase in accounts payable and accrued expenses for the year ended December 31. 2023.

Cash Used in Investing Activities

For the years ended December 31, 2023 and 2022, the

Company did not have any investing activities.

Cash Provided by Financing Activities

For the years ended December 31, 2023 and 2022, the

Company realized cash provided by financing activities in the amount of $26,035 and $2,501, respectively, which consisted of advances

from our CEO for working capital purposes.

As of December 31, 2023 and 2022, we had no cash balances.

Our auditors have issued a “going concern”

opinion, meaning that there is substantial doubt if we can continue as an on-going business for the next twelve months unless we obtain

additional capital. No substantial revenues are anticipated until we have implemented our plan of operations.

The Company requires additional funding to meet its

ongoing obligations and to fund anticipated operating losses. Our auditor has expressed substantial doubt about our ability to continue

as a going concern. The ability of the Company to continue as a going concern is dependent on raising capital to fund its initial business

plan and ultimately to attain profitable operations. These financial statements do not include any adjustments relating to the recoverability

and classification of recorded asset amounts, or amounts and classification of liabilities that might result from this uncertainty.

We expect to incur marketing and professional and

administrative expenses as well expenses associated with maintaining our filings with the Commission. We will require additional funds

during this time and will seek to raise the necessary additional capital. If we are unable to obtain additional financing, we may be required

to reduce the scope of our business development activities, which could harm our business plans, financial condition and operating results.

Additional funding may not be available on favorable terms, if at all. The Company intends to continue to fund its business by way of

equity or debt financing and advances from related parties. Any inability to raise capital as needed would have a material adverse effect

on our business, financial condition and results of operations.

If we cannot raise additional funds, we will have

to cease business operations. As a result, investors in the Company’s common stock would lose all of their investment.

Off Balance Sheet Arrangements

There are no off-balance sheet arrangements currently

contemplated by management or in place that are reasonably likely to have a current or future effect on the business, financial condition,

changes in financial condition, revenue or expenses, result of operations, liquidity, capital expenditures and/or capital resources.

Recent Accounting Pronouncements

The Company has implemented all new accounting pronouncements

that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements

that have been issued that might have a material impact on its financial position or results of operations.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES

ABOUT MARKET RISK

Not applicable to a “smaller reporting company”

as defined in Rule 12b-2 of the Exchange Act.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY

DATA

The full text of the Company’s financial statements

for the years ended December 31, 2023 and 2022, begins on page F-1 of this Annual Report on Form 10-K.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

ON ACCOUNTING AND FINANCIAL DISCLOSURES

| Dismissal of Independent Registered Public Accounting Firm. |

On May 3, 2024, the Securities

and Exchange Commission (the “Commission”) entered an order instituting settled administrative and cease-and-desist proceedings

against Borgers and its sole audit partner, Benjamin F. Borgers CPA, permanently barring Mr. Borgers and Borgers (collectively, “BF

Borgers”) from appearing or practicing before the Commission as an accountant (the “Order”). As a result of the Order,

BF Borgers may no longer serve as Eline Entertainment Group, Inc. (the “Company”) independent registered public accounting

firm, nor can BF Borgers issue any audit reports included in Commission filings or provide consents with respect to audit reports.

In light of the Order,

the Board of Directors of the Company on June 28, 2024, unanimously approved to dismiss BF Borgers as the Company’s independent

registered public accounting firm. BF Borgers was dismissed as the Company’s independent registered public accounting firm on June

28, 2024.

BF Borgers’ reports on the financial statements

of the Company as of and for the fiscal years ended December 31, 2022 and 2021, did

not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting

principles.

During the fiscal years ended December

31, 2022 and 2021, and through June 28, 2024 (the date of BF Borgers’ dismissal), there were no disagreements with BF Borgers

on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which if not resolved

to BF Borgers’ satisfaction would have caused it to make reference thereto in connection with its reports on the financial statements

for such year. During the fiscal years ended December 31, 2022 and 2021, and through

June 28, 2024, there were no events of the type described in Item 304(a)(1)(v) of Regulation S-K.

In the May 3, 2024 “Staff Statement on the

Issuer Disclosure and Reporting Obligations in Light of Rule 102(e) Order Against BF Borgers CPA PC,” the Commission advised registrants

that they may indicate in their Commission filing that their prior auditor is no longer permitted to appear or practice before the Commission,

in lieu of including a letter from BF Borgers stating whether it agrees with our disclosures under Item 304 of Regulation S-K. In light

of the Order and the staff statement, we are not requesting BF Borgers to furnish the Company with such letter.

Engagement of New Independent Registered Public

Accounting Firm.

Effective June 28, 2024, the Company engaged Beckles

& Co., Inc. (“Beckles & Co.”) as the Company’s new independent registered public accounting firm. The decision

to change accountants was approved by the Company’s Board of Directors. The Company does not have an audit committee at this time.

During the two most recent fiscal years ended

December 31, 2023 and December 31, 2022 and during the subsequent interim period from January 1, 2023 through June 28, 2024, neither the

Company nor anyone on its behalf consulted Beckles & Co. regarding either (i) the application of accounting principles to a specified

transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements,

and neither a written report nor oral advice was provided to the Company that Beckles & Co. concluded was an important factor considered

by the Company in reaching a decision as to any accounting, auditing or financial reporting issue, or (ii) any matter that was either

the subject of a “disagreement” or a “reportable event”, each as defined in Regulation S-K Item 304(a)(1)(iv)

and 304(a)(1)(v), respectively.

ITEM 9A. CONTROLS AND PROCEDURES

a) Evaluation of Disclosure Controls and Procedures

We conducted an evaluation, under the supervision

and with the participation of our management, of the effectiveness of the design and operation of our disclosure controls and procedures.

The term “disclosure controls and procedures,” as defined in Rules 13a-15(e) and 15d-15(e) under the Securities and Exchange

Act of 1934, as amended (“Exchange Act”), means controls and other procedures of a company that are designed to ensure that

information required to be disclosed by the company in the reports it files or submits under the Exchange Act is recorded, processed,

summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure

controls and procedures also include, without limitation, controls and procedures designed to ensure that information required to be

disclosed by a company in the reports that it files or submits under the Exchange Act is accumulated and communicated to the company’s

management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate,

to allow timely decisions regarding required disclosure. Based on that evaluation, our Chief Executive Officer and Chief Financial Officer

concluded that, as of December 31, 2023, our disclosure controls and procedures were not effective at the reasonable assurance level.

b) Management’s Report on Internal Control

Over Financial Reporting.

Our management is responsible for establishing and

maintaining adequate internal control over financial reporting as defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange

Act of 1934. Our internal control over financial reporting is a process designed by, or under the supervision of, our CEO and CFO, or

persons performing similar functions, and effected by our board of directors, management and other personnel, to provide reasonable assurance

regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with

accounting principles generally accepted in the United States of America (GAAP). Our internal control over financial reporting includes

those policies and procedures that: (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect

the transactions and disposition of the assets of our company; (ii) provide reasonable assurance that transactions are recorded as necessary

to permit preparation of financial statements in accordance with GAAP and that receipts and expenditures of our company are being made

only in accordance with authorization of management and directors of our company; and (iii) provide reasonable assurance regarding prevention

or timely detection of unauthorized acquisition, use, or disposition of our assets that could have a material effect on the financial

statements.

Our management, including our principal executive

officer and principal financial officer, assessed the effectiveness of our internal control over financial reporting at December 31,

2023. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway

Commission (COSO) in Internal Control—Integrated Framework (2013). Based on that assessment under those criteria, management has

determined that, as of December 31, 2023, our internal control over financial reporting was not effective.

Our internal controls are not effective for the following

reasons: (1) lack of a functioning audit committee and lack of a majority of outside directors on the Company’s board of directors,

resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; (2) inadequate segregation

of duties consistent with control objectives; (3) insufficient written policies and procedures for accounting and financial reporting

with respect to the requirements and application of US GAAP and SEC disclosure requirements; and (4) ineffective controls over period

end financial disclosure and reporting processes. The aforementioned material weaknesses were identified by the Company’s Chief

Financial Officer in connection with the review of our financial statements as of December 31, 2023 and communicated the matters to our

management.

Management believes that the material weaknesses

set forth in items (2), (3) and (4) above did not have an effect on the Company’s financial results. However, management believes

that the lack of a functioning audit committee and lack of a majority of outside directors on the Company’s board of directors,

resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures can result in the

Company’s determination to its financial statements for the future years.

We are committed to improving our financial organization.

As part of this commitment, we intend to create a position to segregate duties consistent with control objectives and will increase our

personnel resources and technical accounting expertise within the accounting function when funds are available to the Company: i) Appointing

one or more outside directors to our board of directors who shall be appointed to the audit committee of the Company resulting in a fully

functioning audit committee who will undertake the oversight in the establishment and monitoring of required internal controls and procedures;

and ii) Preparing and implementing sufficient written policies and checklists which will set forth procedures for accounting and financial

reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements.

Pursuant to Regulation S-K Item 308(b), this Annual

Report on Form 10-K does not include an attestation report of our company’s registered public accounting firm regarding internal

control over financial reporting.

Because of its inherent limitations, internal control

over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods

are subject to the risk that controls may become inadequate because of changes in conditions or that the degree of compliance with the

policies or procedures may deteriorate. A control system, no matter how well designed and operated can provide only reasonable, but not

absolute, assurance that the control system’s objectives will be met. The design of a control system must reflect the fact that

there are resource constraints, and the benefits of controls must be considered relative to their cost.

c) Changes in Internal Control over Financial Reporting

During the year ended December 31, 2023, there were

no other changes in our internal controls over financial reporting, which were identified in connection with our management’s evaluation

required by paragraph (d) of rules 13a-15 and 15d-15 under the Exchange Act, that materially affected, or is reasonably likely to have

a material effect on our internal control over financial reporting.

ITEM 9B. OTHER INFORMATION

During the quarter ended December 31, 2023, no director or officer adopted or terminated any Rule 10b5-1

trading arrangement or non-Rule 10b5-1 trading arrangement, as each term is defined in Item 408(a) of Regulation S-K.

ITEM 9C. Disclosure Regarding

Foreign Jurisdictions that Prevent Inspections

Not Applicable.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE

GOVERNANCE

Our executive officers and director are as follows:

| Name |

|

Age |

|

Position |

| Chi Ching Hung |

|

54 |

|

Chairwoman and director |

| Shing Hei Lee |

|

30 |

|

CEO, CFO, President, Treasurer, Director |

| Timothy Chee Yau Lam |

|

38 |

|

Secretary |

Chi Ching Hung

Ms. Hung specializes in capital operation, asset management,

business management, and project mergers and acquisitions, etc. She held positions as Chairman of the Board of Directors of and Chief

Executive Officer of various Hong Kong-listed companies. In 2003, she obtained her bachelor degree in business administration from James

Cook University in Australia and a Ph.D. from International American University. Since 1997, Ms. Hung founded Hong's Asset Management

Co., Ltd., whose main business involves real estate, jewelry, investment, finance, funds, health drinks, energy, telecommunications, etc.

which invested in a smart home technology company and led its launch into the market.

Shing Hei Lee

Mr. Lee, has extensive knowledge in finance,

economics and capital markets. From April 2018 to present, Mr. Lee has acted as a representative and equity capital markets associate

at Head & Shoulders Securities Limited in Hong Kong, with a primary focus on negotiating and originating IPOs, follow-on equity offering

deals and client introduction for brokerage services. Mr. Lee has managed and executed over 50 capital markets deals, including IPO

placements, follow-on offering placements, and private equity transactions at Head & Shoulders Securities Limited. Mr. Lee holds a

Masters of Arts, with honors, in Economics with Finance obtained from The University of Edinburgh in 2017.

Timothy Chee Yau Lam

Mr. Lam was admitted as a lawyer in New South Wales,

Australia in 2007. He is also admitted and a qualified lawyer in New Zealand and Hong Kong. Since 2019, he has been a Partner in a Hong

Kong law firm and has experience across multiple jurisdictions including USA, Hong Kong, Australia, China, New Zealand, Thailand, Cayman

Islands and the BVI. Timothy has worked in both domestic and international firms in Australia and Hong Kong.

Timothy has a Bachelors in Arts (Philosophy), Bachelors

in Law, Masters in Law (Corporate and Finance), Masters in Industrial Property, Masters in Applied Law (Commercial Litigation), Masters

in Strategic Public Relations, Masters in Buddhist Studies and a Masters in Buddhist Counselling.

Timothy has advised and acted for multiple listed

companies in Hong Kong and Australia. He has also advised listed company board members on their obligations and has also advised high

level corporate and governmental staff as to their duties in their roles.

Timothy is a Member of the Hong Kong Law Society,

a Member of the NSW Law Society, a Governor to the Board of the Children’s Cancer Foundation and a Fellow of the Hong Kong Institute

of Directors. He has acted on multiple boards in private companies in Australia and Hong Kong.

Director Independence

Our board of directors is currently composed of two

members who do not qualify as independent directors in accordance with the published listing requirements of the NASDAQ Global Market.

The NASDAQ independence definition includes a series of objective tests, such as that the director is not, and has not been for at least

three years, one of our employees and that neither the director, nor any of his family members has engaged in various types of business

dealings with us. In addition, our board of directors has not made a subjective determination as to each director that no relationship

exists which, in the opinion of our board of directors, would interfere with the exercise of independent judgment in carrying out the

responsibilities of a director, though such subjective determination is required by the NASDAQ rules. Had our board of directors made

these determinations, our board of directors would have reviewed and discussed information provided by the directors and us with regard

to each director’s business and personal activities and relationships as they may relate to us and our management.

Involvement in Legal Proceedings

To our knowledge, there have been no material legal

proceedings during the last ten years that would require disclosure under the federal securities laws that are material to an evaluation

of the ability or integrity of any of our directors or executive officers.

Potential Conflicts of Interest

We are not aware of any current or potential conflicts

of interest with our directors or executive officers, other business interests and their involvement with the Company

ITEM 11. EXECUTIVE COMPENSATION

For each of the years ended December 31, 2023, and 2022 there was no direct

compensation awarded to, earned by, or paid by us to any of our executive officers and directors.

Employment Contracts

The Company has not entered into any employment agreements

with its officer and director.

Stock Awards Plan

The Company has not adopted a Stock Awards Plan, but

may do so in the future. The terms of any such plan have not been determined.

Director Compensation

The Board of Directors of the Company has not adopted

a stock option plan. The Company has no plans to adopt it but may choose to do so in the future. If such a plan is adopted, this may be

administered by the board or a committee appointed by the board (the “Committee”). The committee would have the power to modify,

extend or renew outstanding options and to authorize the grant of new options in substitution therefore, provided that any such action

may not impair any rights under any option previously granted. The Company may develop an incentive-based stock option plan for its officers

and directors and may reserve up to 10% of its outstanding shares of common stock for that purpose.

Board Committees

We have not formed an Audit Committee, Compensation

Committee or Nominating and Corporate Governance Committee as of the filing of this Annual Report. Our Board of Directors performs the

principal functions of an Audit Committee. We currently do not have an audit committee financial expert on our Board of Directors. We

believe that an audit committee financial expert is not required because the cost of hiring an audit committee financial expert to act

as one of our directors and to be a member of an Audit Committee outweighs the benefits of having an audit committee financial expert

at this time.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth certain information

with respect to the beneficial ownership of our voting securities by (i) each director and named executive officer, (ii) all executive

officers and directors as a group; and (iii) each shareholder known to be the beneficial owner of 5% or more of the outstanding common

stock of the Company as of December 31, 2023.

Beneficial ownership is determined in accordance with

the rules of the SEC. Generally, a person is considered to beneficially own securities: (i) over which such person, directly or indirectly,

exercises sole or shared voting or investment power, and (ii) of which such person has the right to acquire beneficial ownership at any

time within 60 days (such as through exercise of stock options or warrants). For purposes of computing the percentage of outstanding shares

held by each person or group of persons, any shares that such person or persons has the right to acquire within 60 days of December 31,

2023 are deemed to be outstanding, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other

person. The inclusion herein of any shares listed as beneficially owned does not constitute an admission of beneficial ownership.

| | |

Amount and Nature of Beneficial Ownership Common Stock (2) | |

| Name and Address of Beneficial Owner (1) | |

Number of

Shares

Beneficially

Owned | | |

Percentage

Ownership of

Shares of

Common Stock | |

| Chi Ching Hung | |

250,000,000 | | |

2.932% | |

| Shing Hei Lee | |

0 | | |

0% | |

| | |

Amount and Nature of Beneficial Ownership Preferred Stock (3) | |

| Name and Address of Beneficial Owner (1) | |

Number of

Shares

Beneficially

Owned | | |

Percentage

Ownership of

Shares of

Common Stock | |

| Chi Ching Hung | |

1 | | |

100% | |

| (1) |

Except as otherwise set forth above, the address of each beneficial owner is c/o Eline Entertainment Group, Inc., 1107, Lippo Centre Tower 1, 89 Queensway, Admiralty, Hong Kong |

| |

|

| (2) |

Based on 8,524,529,727 shares of common stock issued and outstanding as of December 31, 2023. |

| |

|

| (3) |

Based on 1 shares of preferred stock issued and outstanding as of December 31, 2023. |

ITEM 13. CERTAIN RELATIONSHIP AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE.

Regulation S-K, Item 4, Section C require disclosure

of promoters and certain control persons for registrants that are filing a registration statement on Form 10 under the Exchange Act and

that had a promoter at any time during the past five fiscal years shall:

| |

(i) |

State the names of the promoter(s), the nature and amount of anything of value (including money, property, contracts, options or rights of any kind) received or to be received by each promoter, directly or indirectly, from the registrant and the nature and amount of any assets, services or other consideration therefore received or to be received by the registrant; and |

| |

|

|

| |

(ii) |

As to any assets acquired or to be acquired by the registrant from a promoter, state the amount at which the assets were acquired or are to be acquired and the principle followed or to be followed in determining such amount, and identify the persons making the determination and their relationship, if any, with the registrant or any promoter. If the assets were acquired by the promoter within two years prior to their transfer to the registrant, also state the cost thereof to the promoter. |

Small Cap Compliance, LLC or Rhonda

Keaveney is considered a promoter(s) under the meaning of Securities Act Rule 405. Small

Cap Compliance, LLC (“SCC”) is a shareholder in the Company and Rhonda Keaveney is the sole member of SCC. Ms. Keaveney

was appointed custodian of the Company and under its duties stipulated by the Nevada court where she took initiative to organize the business

of the issuer. As custodian, her duties were to conduct daily business, hold shareholder meetings, appoint officers and directors, reinstate

the company with the Nevada Secretary of State. The custodian also had authority to enter into contracts and find a suitable merger candidate.

In addition, Ms. Rhonda was compensated for his role as custodian and paid outstanding bills to creditors on behalf of the company. The

custodian has not, and will not, receive any additional compensation, in the form of cash or stock, for custodian services. The custodianship

was discharged accordingly.

Under Regulation S-K Item 404(c)(2) Registrants

shall provide the disclosure required by paragraphs (c)(1)(i) and (c)(1)(ii) of this Item as to any person who acquired control of a registrant

that is a shell company, or any person that is part of a group, consisting of two or more persons that agree to act together for the purpose

of acquiring, holding, voting or disposing of equity securities of a registrant, that acquired control of a registrant that is a shell

company.

Ms. Chi Ching Hung is considered to be control

person of the Company as of November 7, 2022. Ms. Hung purchased 250,000,000 shares of the Company’s Restricted Common Stock and

1 share of Convertible Series D Preferred Stock. These shares represent the controlling block

of stock and were purchased from Small Cap Compliance, LLC for $250,000.

Transactions with Related Persons

Ms. Chi Ching Hung, majority shareholder and a director

the Company, have advanced working capital to pay expenses of the Company. The advances are due on demand and non-interest bearing. The

outstanding amount due to related parties was $2,501 and $nil as of December 31, 2023 and 2022.

The Company issued 10,000,000 shares of restricted

common stock and 1 share of Convertible Preferred D Series Stock to Ms. Keaveney in the name of Small Cap Compliance, LLC, for expense

reimbursement and services compensation in the amount of $18,713 as custodian of the Company.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Independent Auditors’ Fees

The following table represents fees billed for each of the years ended

December 31, 2023 and 2022, for professional audit services rendered by our independent registered public accounting firm:

| | |

December 31, 2023 | | |

December 31, 2022 | |

| | |

| | |

| |

| Audit fees | |

$ | 20,000 | | |

$ | 17,500 | |

| Audit-related fees | |

| | | |

| – | |

| Tax fees | |

| | | |

| – | |

| All other fees | |

| | | |

| – | |

| Total | |

$ | 20,000 | | |

$ | 17,500 | |

| |

(1) |

Audit Fees consist of the aggregate fees billed for professional services rendered for the audit of our annual financial statements and the reviews of the financial statements included in our Forms 10-Q and for any other services that were normally provided in connection with our statutory and regulatory filings or engagements. |

| |

(2) |

Audit-related fees consist of fees for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements. |

| |

(3) |

Tax fees consist of fees for professional services rendered for tax compliance, tax advice and tax planning. |

| |

(4) |

All other fees consist of fees for products and services provided, other than for the services reported under the headings “Audit Fees,” “Audit Related Fees” and “Tax Fees.” The Company has adopted a policy regarding the services of its independent auditors under which our independent accounting firm is not allowed to perform any service which may have the effect of jeopardizing the registered public accountant’s independence. Without limiting the foregoing, the independent accounting firm shall not be retained to perform the following: |

| |

· |

Bookkeeping or other services related to the accounting records or financial statements |

| |

· |

Financial information systems design and implementation |

| |

· |

Appraisal or valuation services, fairness opinions or contribution-in-kind reports |

| |

· |

Actuarial services |

| |

· |

Internal audit outsourcing services |

| |

· |

Management functions |

| |

· |

Broker-dealer, investment adviser or investment banking services |

| |

· |

Legal services |

| |

· |

Expert services unrelated to the audit |

Pre-Approval Policies and Procedures

The SEC requires that before our independent registered

public accounting firm is engaged by us to render any auditing or permitted non-audit related service, the engagement be either: (i) approved

by our Audit Committee or (ii) entered into pursuant to pre-approval policies and procedures established by the Audit Committee, provided

that the policies and procedures are detailed as to the particular service, the Audit Committee is informed of each service, and such

policies and procedures do not include delegation of the Audit Committee’s responsibilities to management.

We do not have an Audit Committee. Our Board pre-approves

all services provided by our independent registered public accounting firm.

PART IV

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

Please see the “Exhibit Index,” which

is incorporated herein by reference, following the signature page for a list of our exhibits.

ITEM 16. 10-K SUMMARY

As permitted, the registrant has elected not to supply

a summary of information required by Form 10-K.

EXHIBIT INDEX

| 3.1 |

|

Articles of Domestication* |

| |

|

|

| 3.2 |

|

By-Laws of Eline Entertainment Group, Inc.* |

| |

|

|

| 3.3 |

|

Articles of Conversion for Eline Entertainment Group, Inc. filed May 24, 2017* |

| |

|

|

| 3.4 |

|

Articles of Amendment for Eline Entertainment Group, Inc. filed May 24, 2022* |

| |

|

|

| 10.1 |

|

Court

Custodial Orders to Appoint and Discharge Custodianship

|

| 10.2 |

|

Custodianships

for Colorado, Wyoming, and Florida*

|

| 10.3 |

|

Stock Purchase Agreement, between the Small Cap Compliance, LLC and Chi Ching Hung dated November 7, 2022. |

| |

|

|

| 31.1 |

|

Certification of Chief Executive Officer pursuant to Rule 13(a)-14(a)/15(d)-14(a) of the Securities Act of 1934 |

| |

|

|

| 31.2 |

|

Certification of Chief Financial Officer pursuant to Rule 13(a)-14(a)/15(d)-14(a) of the Securities Act of 1934 |

| |

|

|

| 32.1 |

|

Certification of Chief Executive Officer Executive Officer under Section 1350 as Adopted pursuant Section 906 of the Sarbanes-Oxley Act of 2002 |

| |

|

|

| 32.2 |

|

Certification of Chief Financial Officer under Section 1350 as Adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| |

|

|

| 101.INS |

|

Inline XBRL Instance Document (the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document) |

| 101.SCH |

|

Inline XBRL Taxonomy Extension Schema Document |

| 101.CAL |

|

Inline XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF |

|

Inline XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB |

|

Inline XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE |

|

Inline XBRL Taxonomy Extension Presentation Linkbase Document |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

Eline Entertainment Group, Inc. |

| |

(Registrant) |

| |

|

|

| Date: December 23, 2024 |

By: |

/s/ Shing Hei Lee |

| |

|

Shing Hei Lee |

| |

|

Chief Executive Officer |

| |

|

Chief Financial Officer |

Index to Financial Statements

Report

of Independent Registered Public Accounting

Firm

To the shareholders and the board of directors

of Eline Entertainment Group, Inc.

Opinion on the Financial Statements

We have audited the accompanying balance sheets

of Eline Entertainment Group, Inc. as of December 31, 2023 and 2022, the related statements of operations, stockholders' equity (deficit),

and cash flows for the years then ended, and the related notes (collectively referred to as the "financial statements"). In

our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31,

2023 and 2022, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles

generally accepted in the United States.

Substantial Doubt about the Company’s

Ability to Continue as a Going Concern

The accompanying financial statements have been

prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company has

suffered recurring losses from operations and has a significant accumulated deficit. In addition, the Company continues to experience

negative cash flows from operations. These factors raise substantial doubt about the Company's ability to continue as a going concern.

Management's plans in regard to these matters are also described in Note 3. The financial statements do not include any adjustments that

might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility

of the Company's management. Our responsibility is to express an opinion on the Company's financial statements based on our audit. We

are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are

required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and

regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the

standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial

statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged

to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding

of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s

internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess

the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond

to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating

the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below

are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to

the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our

especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion

on the financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate

opinions on the critical audit matters or on the accounts or disclosures to which they relate.

No matters identified in the audit were considered

to be critical audit matters.

/S/ Beckles & Co, Inc.

Beckles & Co, Inc. (PCAOB ID 7116)

We have served as the Company's auditor since

2024

West Palm Beach, FL

December 23, 2024

Eline Entertainment Group, Inc.

BALANCE SHEETS

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Assets | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash | |

$ | – | | |

$ | – | |

| Total Current Assets | |

| – | | |

| – | |

| Total Assets | |

| – | | |

| – | |

| | |

| | | |

| | |

| Liabilities and Stockholders' Deficit | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable and accrued expenses | |

| 27,896 | | |

| – | |

| Due to related party | |

| 28,536 | | |

| 2,501 | |

| Total Current Liabilities | |

| 56,432 | | |

| 2,501 | |

| Total Liabilities | |

| 56,432 | | |

| 2,501 | |

| | |

| | | |

| | |

| Commitment & contingencies | |

| – | | |

| – | |