Filed Pursuant to Rule 433 Issuer Free

Writing Prospectus dated February 6, 2025 Relating to Preliminary Prospectus Supplement dated February 6, 2025 and Prospectus dated February 28, 2023 Registration No. 333-269804

Forward Looking Statements Forward

Looking Statements Certain information contained in this Presentation (together with oral statements made in connection herewith, this “Presentation”) may include “forward-looking statements” within the meaning of the

“safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to future operations of Eagle Financial Services, Inc. (the “Company,” “we,”

“us,” or “our”) and are generally identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,”

“expect,” “believe,” “seek,” “anticipate,” “target,” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These

forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of operating and financial measures or metrics and projections of growth, the results of the proposed balance sheet restructuring, market

opportunity and market share. Although the Company believes that its expectations with respect to the forward-looking statements are based upon reliable assumptions within the bounds of its knowledge of its business and operations, there can be no

assurance that actual results, performance or achievements of the Company will not differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements are

not intended to serve forward-looking must not be relied on by any prospective or current investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or

impossible to predict, are beyond the control of the Company and will differ from assumptions. These forward-looking statements are subject to forward-looking risks and uncertainties. Factors that could have a material adverse effect on the

operations and forward-looking of the Company forward-looking are not limited to those factors identified in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, subsequent quarterly reports on Form 10-Q, other

filings with the U.S. Securities and Exchange Commission (the “SEC”) and the preliminary prospectus supplement and accompanying base prospectus. If any of these risks or uncertainties materialize or our assumptions prove

incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that the Company is not aware of or that the Company currently believes are immaterial that could also

cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect the Company’s expectations, plans or forecasts of future events and views as of the date of this

Presentation. The Company anticipates that subsequent events and developments may cause its assessments to change; however, the Company has no obligation to update these forward-looking statements, unless required by law. Accordingly, you are

cautioned not to place undue reliance upon any such forward-looking statements in this Presentation when deciding whether to make any investment in the Company. Any forward-looking statements in this Presentation speak only as of the date on

which it is made and the Company undertakes no obligation to update or revise any forward-looking statements to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events,

except as required by law. Although all information included in this Presentation was obtained from sources believed to be reliable and in good faith, no representation or warranty, express or implied, is made as to its accuracy or completeness.

This Presentation contains preliminary information only, is subject to change at any time and is not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regarding your

investment in the Company. All forward-looking statements, express or implied, herein are qualified in their entirety by this cautionary statement. Use of Unaudited Pro Forma and Non-GAAP Financial Measures Annualized, pro forma, projected,

and estimated financial information included in this Presentation are used for illustrative purposes only, are not forecasts and may not necessarily reflect actual financial results the Company may achieve. This Presentation includes certain

non-GAAP measures, which provide meaningful supplemental information regarding the Company’s operational performance and to enhance investors’ overall understanding of such financial performance. These non-GAAP measures are provided in

addition to, and not as substitutes for, measures of our financial performance determined in accordance with GAAP. Our calculation of these non-GAAP measures may not be comparable to similarly titled measures of other companies due to potential

differences between companies in the method of calculation. As a result, the use of these non-GAAP measures has limitations and should not be considered superior to, in isolation from, or as a substitute for, related non-GAAP measures.

Reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found at the end of this Presentation. Preliminary Financial Information as of December 31, 2024 Numbers contained in this

Presentation as of and for the three month period or full year ended December 31, 2024 are preliminary and unaudited, and remain subject to further review, change and finalization. Such reviews and subsequent information could result in material

changes in accounting estimates and other financial information, particularly with respect to material estimates and assumptions used in preparing this preliminary information, including the Company's allowance for credit losses (“ACL”),

fair values and income taxes. As of the date of this Presentation, our independent registered public accounting form, Yount, Hyde & Barbour, P.C., has not completed its review procedures with respect to this preliminary financial information.

Industry and Market Data This Presentation includes statistical and other industry and market data that we obtained from government reports and other third-party sources. Our internal data, estimates and forecasts are based on

information obtained from government reports, trade and business organizations and other contacts in the markets in which we operate and our management’s understanding of industry conditions. Although we believe that this information

(including the industry publications and third-party research, surveys and studies) is accurate and reliable, we have not independently verified such information, and no representations or warranties are made by us of our affiliates as to the

accuracy of any such statements or projections. In addition, estimates, forecasts, and assumptions are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. Forward-looking information obtained from these sources

is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this Presentation. These and other factors could cause our results to differ materially from those expressed in our estimates

and beliefs and in the estimates prepared by independent parties. Trademarks and Trade Names The Company owns or has rights to various trademarks, service marks and trade names that it uses in connection with the operation of its

business. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that the Company will not

assert, to the fullest extent under applicable law, its rights to these trademarks, service marks and trade names under applicable law. Other service marks, trademarks and trade names referred to in this Presentation, if any, are the property of

their respective owners. Registration Statement; No Advice This Presentation is not an offer to sell securities, nor is it a solicitation of an offer to buy securities, in any locality, state, country or other jurisdiction where such distribution,

publication, availability or use would be contrary to law or regulation or which would require any registration or licensing within such jurisdiction. Neither the SEC nor any other regulatory body has approved or disapproved of the securities of the

Company or passed upon the accuracy or adequacy of this Presentation. Any representation to the contrary is a criminal offense. Except as otherwise indicated, this Presentation speaks as to the date hereof. The delivery of this Presentation shall

not, under any circumstances, create any implication that there has been no change in the affairs of the Company after the date hereof. The Company has filed a shelf registration statement on Form S-3 (File No. 333-269804) (including a base

prospectus) and related preliminary prospectus supplement dated February 6, 2025 with the SEC for the offering to which this communication relates. The sale of shares of common stock in the proposed underwritten public offering is being made

pursuant to such prospectus supplement and accompanying base prospectus. Before you invest, you should read the prospectus in that registration statement the related prospectus supplement and other documents that the Company has filed with the SEC

for more complete information about the Company and the offering. You may get these documents for free by visiting the SEC's website at www.sec.gov. Alternatively, the Company, the underwriters or any dealers participating in the offering will

arrange to send you the base prospectus and the related preliminary prospectus supplement if you request it by calling Keefe, Bruyette & Woods, Inc. toll free at (800) 966-1559 or emailing USCapitalMarkets@kbw.com. Nothing herein should be

construed as legal, financial, tax or other advice. You should consult your own advisers concerning any legal, financial, tax or other considerations concerning the opportunity described herein. The general explanations included in this Presentation

cannot address, and are not intended to address, your specific investment objectives, financial situations or financial needs.

Table of Contents Introduction Detailed

Financial Review Appendix

Common Stock Offering Summary Issuer

Exchange / Ticker Base Offering Size Overallotment Option Lock-Up Sole Bookrunner Lead Manager Eagle Financial Services, Inc. OTCQX (NASDAQ Post-Offering) / EFSI $50.0 Million (100% Primary) 15% (100% Primary) 90 Days for the Company, Directors,

Officers & Certain Shareholders Keefe, Bruyette & Woods D.A. Davidson & Co. Expected Pricing Date February 6, 2025 Use of Proceeds General corporate purposes, which may include balance sheet restructuring through the repositioning of our

available-for-sale securities portfolio, to support our capital ratios and our continued growth

1. Introduction

Company Overview The EFSI Story 2024

Financial Highlights WASHINGTON DC Arlington Annapolis Baltimore MARYLAND 95 81 EFSI Branches (13) EFSI LPO (2) VIRGINIA Berryville Winchester Eagle Financial Services, Inc. is the parent company for Bank of Clarke, was established over 140 years

ago Commercial focused banking institution operating in several of the country’s most attractive markets Deep management team with experience running larger financial institutions Diversified revenue sources driven primarily by wealth division

Source: Company Documents; unaudited data as of or for the twelve months ended 12/31/24; Q4 ’24 NIM as of and for the three months ended 12/31/24 Note: Nonperforming assets defined as nonaccrual loans, OREO, and repossessed assets; core

deposits defined as total deposits less deposits greater than $250,000, brokered deposits, CDARS and Edward Jones demand deposits See appendix for reconciliation of non-GAAP metrics Gross loans includes held for investment and held for sale

loans

Opened branch in Loudoun County, VA

WASHINGTON DC Arlington Annapolis Baltimore MARYLAND 95 81 Bank of Clarke opened for business Eagle Financial Services, Inc. was incorporated First expansion out of Clarke County and into Winchester City, VA and Frederick County, VA markets Expanded

footprint in Northern Virginia: opened branch in Leesburg, VA and in Ashburn, VA Brandon Lorey began role as President and CEO of Eagle Financial Services, Inc. LaVictoire Finance began operating under EFSI, offering high-end marine financing for

maritime customers Opened LPO in McLean, VA Opened LPO in Frederick, MD Hired SBA, Government Contracting, and mortgage teams to expand lending offerings Raised $30 million of subordinated debt Hired a team of trust and wealth management

professionals and opened a full-service branch in Warrenton, VA Sold LaVictoire Finance to Axos Financial History of Asset Growth ($M) History of Growth 2024 1881 1991 1992 2015 2019 2020 2021 2022- 2023 2014 CAGR: 11% WASHINGTON DC Arlington

Annapolis Baltimore 95 81 EFSI Branches (13) EFSI LPO (2) VIRGINIA Berryville Winchester ` EFSI Branches (12) VIRGINIA Berryville Winchester MARYLAND 2011 Source: Company documents; annual data as 12/31 each year ended Completed sale leaseback of

Winchester branch for $3.9 million pre-tax gain 2024

Experienced Leadership Team Attractive

Markets of Operation Deep management team with community and regional banking experience in the Mid Atlantic Insider ownership of 12% as of 9/30/24 aligns shareholder interest with decision making Operate in 2 of the top 10 highest household income

counties in the United States Leverage funding base in legacy markets with robust lending opportunities in high growth Virginia counties Disciplined Organic Growth Organic growth focus by attracting and retaining elite banking professionals Strong

growth with a 16% asset CAGR since 2019 while maintaining strong asset quality metrics $370 million bank loan originations in 2022; $305 million in bank loan originations in 2023; $230 million in bank loan originations in 2024 (1) Investment

Highlights Experienced Leadership Team Attractive Markets of Operation Disciplined Organic Growth Diversified Loan Portfolio Scalable Operating Model Attractive Core Deposit Franchise Diversified Loan Portfolio Scalable Operating Model Attractive

Core Deposit Franchise 82% core deposits (2); 2.16% Q4 ’24 cost of deposits 26% non interest-bearing deposits vs. 22% for peers Commercial lending strategy with a focus on generating deposits from all borrowers Portfolio is diversified between

C&I, owner-occupied CRE, investment CRE and consumer; CRE ratio of 249% Invested in technology, infrastructure and people for future growth and profitability enhancement Operating leverage will be realized with further scale Source: Company

Documents, US Census; Data as of 12/31/24, unless otherwise indicated Note: Peer group includes major exchange traded banks headquartered in NC, VA, WV, SC, GA, AL, FL, MS, AR, and TN with total assets between $1.5 billion - $5 billion Excluding

LaVictoire finance loan originations Core deposits exclude deposits over $250K, brokered deposits, certificate of deposits account registry service and demand deposits from Edward Jones

Seasoned Management Team Experienced and

Balanced Board Management Team & Board of Directors Brandon Lorey President, Chief Executive Officer & Director Age: 56 Years in Banking: 35 EFSI Experience: 6 Kathleen Chappell Executive VP and Chief Financial Officer Age: 57 Years in

Banking: 35 EFSI Experience: 16 Joe Zmitrovich President of Bank of Clarke and Chief Banking Officer Age: 54 Years in Banking: 32 EFSI Experience: 8 Kaley Crosen Executive VP and Chief Human Resources Officer Age: 59 Years in Banking: 38 EFSI

Experience: 27 Aaron Poffinberger Executive VP and Chief Operating Officer Age: 42 Years in Banking: 20 EFSI Experience: 10 James George II Executive VP and Chief Credit Officer Age: 64 Years in Banking: 42 EFSI Experience: 11 Board Member (Age)

Years on Board Experience Thomas T. Gilpin (72) Chairman 40 Years President, Lenoir Company Robert W. Smalley, Jr. (73) Vice Chairman 36 Years President, Smalley Package Co., Inc. Cary C. Nelson (50) Director 7 Years President, H. N. Funkhouser

& Co. Mary Bruce Glaize (69) Director 27 Years Founder and Trustee Emerita of Volunteer Shenandoah Valley Discovery Museum Scott M. Hamberger (53) Director 9 Years Former President & CEO, Integrus Holdings, Inc. John R. Milleson (68)

Director 26 Years Retired President & CEO, EFSI & Bank of Clarke Douglas C. Rinker (65) Director 19 Years Chairman, Winchester Equipment Co. John D. Stokely, Jr. (72) Director 19 Years Retired President, Cavalier Land Development Corp. Dr.

Edward Hill III (60) Director 3 Years Physician executive, entrepreneur, investor Tatiana C. Matthews (68) Director 3 Years Co-Founder, President, Chairman, The Matthews Group, Inc. ~12% Insider Ownership Brandon C. Lorey (56)* Director 6 Years

President and Chief Executive Officer of EFSI Data as of 9/30/24 *Denotes non-independent board member Nick Smith Executive VP Corporate Strategy and Investor Relations Age: 31 Years in Banking: 9 EFSI Experience: 1

Our Markets Winchester, VA MSA The

oldest city in Virginia west of the Blue Ridge mountains; founded in 1744 #9 small metro area for business and careers in America (Forbes, 2024) Major industries include education, health services, manufacturing and distribution Home to a

“Best Regional Hospital” in the Shenandoah Valley, which is ranked 7th in Virginia in 2024 (US News) The MSA has a 6.1% projected population growth from ’25 – ’30 and $97,307 projected median household income in

’30 Diverse range of commercial focuses, including government services, national defense, management consulting and telecommunication Fairfax County is home to 10 Fortune 500 companies (Fortune, 2023) 38 of the top 100 global defense companies

operate in Fairfax County (Defense News, 2022) Loudoun County is home to largest and fastest-growing data center hub in the world, with industry leaders like Amazon, Google, and Salesforce using its digital infrastructure (Loudoun County Economic

Development, 2024) Major Employers Major Employers Sources: City of Winchester, Virginia, Forbes, citytowninfo.com, US News, Frederick County Economic Development Authority, S&P Capital IQ Pro, WTOP News, smartasset.com, Loudoun County Economic

Development, Fairfax News, Defense News, Fairfax County Economic Development Authority Loudoun and Fairfax Counties, VA

Dominant Market Share in Our Core

Markets Winchester, VA MSA Historical Growth in Winchester Deposits ($M) Loudoun County, VA EFSI 10-Year CAGR: 10% Source: S&P Capital IQ Pro; Deposit data as of 6/30/24 or as of 6/30 of each respective year Community banks defined as banks

under $10 billion in assets Winchester MSA 10-Year CAGR represents the deposit growth in the Winchester MSA market for all banks from 2014 to 2024 11.3% Rank: 3 EFSI Deposit Market Share & Rank 13.9% Rank: 3 18.4% Rank: 2 Winchester MSA 10-Year

CAGR: 5% (2)

Metro(1) vs. Community Markets Loans

and Deposits by Market Loans Deposits Current Balances by Market Dollars in millions Source: Company documents, US Census; data as of 12/31/14 and as of 12/31/24 Metro defined as a county with a population of over 250,000 at 2025 census estimates;

Purcellville, VA and Leesburg, VA included in community markets as “Loudoun County (West)” Excludes $213 million of Marine Finance loans, $211 million of Mortgage loans, $25 million of triad loans, $22 million of Government loans, and $4

million of BHG loans not classified in a metro or community market $504 $470 Metro Markets Community Markets Metro Markets Community Markets $991 (2) $1,575

Market Expansion Opportunities

’25 – ’30E Projected Population Growth (%) ’30E Projected Median Household Income ($) Source: S&P Capital IQ Pro; Demographic data as of 6/30/24 Note: Market opportunities are by county, unless otherwise specified =

Current Market = LPO Market = Prospective Market EFSI Branches (13) EFSI LPO (2) Frederick, VA Clarke, VA Fauquier, VA Loudoun, VA Frederick, MD Fairfax, VA Prince William, VA Alexandria, VA (City) Arlington, VA Stafford, VA Montgomery, MD

Washington, DC

Creating Scarcity Value Source:

S&P Capital IQ Pro; Data as of 9/30/24 Includes all banks headquartered in VA and MD, excludes merger targets Virginia and Maryland Banks by Asset Size (1)

Strategic Objectives Maintain focus on

strong, profitable organic growth without compromising credit quality Increase operating revenue, manage down NIE/AA to peer levels, maximize operating earnings and grow tangible book value Increase utilization of technology to drive revenue and

lower expenses Expand into new markets by hiring top-tier commercial bankers Defend our cost of funds and further grow our core deposit franchise Invest in our people and systems to improve the customer experience and preserve the “customer

first” value system Evaluate strategic acquisition opportunities Growth-focused, high-performing bank to create value for our shareholders, customers and employees Increase operating revenue, maximize operating earnings, manage down NIE/AA and

grow tangible book value Be the employer of choice in the communities we serve Provide a premier digital experience across all products and services Be the market leader for commercial and small businesses in the markets we serve Evaluate strategic

acquisition opportunities Prudently manage capital between balance sheet growth and return to shareholders Near Term 2025 Long Term 2026 and beyond

2. Detailed Financial

Review

Gross Loans ($M) (1) Balance Sheet

Growth Total Assets ($M) Total Deposits ($M) Source: Company documents; annual data as of 12/31 each year ended (1)Gross loans includes held for investment and held for sale loans CAGR: 16% CAGR: 18% CAGR: 15%

Operating Leverage Assets / Full-Time

Employees ($M) Deposits / Branch ($M) Revenue and NIE ($M) Full-Time Employees 175 195 221 241 241 Branches 12 12 12 13 13 Source: Company documents; data as of or for the year ended each period Revenue defined as net interest income plus

noninterest income; total is net of interest expense 231 13

Demand Deposit CAGR: 9% Core Deposit

Portfolio Cost of Deposits (%) Deposit Composition Over Time ($M) Deposit Composition Core deposits (3) continue to fuel our organic loan growth Continued focus on commercial deposits; recently expanded treasury management product suite Implementing

niche deposit gathering opportunities Bankers are incentivized to grow core deposits Minimal dependence on brokered deposits (4.5% of total deposits) Source: Company documents; data as of or for the three months ended 12/31/24, unless otherwise

indicated; annual data as of 12/31 each year ended; quarterly data as of or for the three months ended each period Note: Jumbo time deposits defined as all time deposits greater than $250,000 Note: Brokered deposits include $42 million NOW accounts

and $30 million retail time deposits Tightening cycle deposit beta defined as the change in cost of interest-bearing and total deposits divided by the change in upper fed funds target range between and Q4 ‘21 and Q3 ’24 Core deposits

exclude deposits over $250K, brokered deposits, certificate of deposits account registry service and demand deposits from Edward Jones $772 $1,013 $1,177 $1,264 Q4 ’24 Cost of Deposits: 2.16% Q4 ’24 Total Deposits: $1.6B Tightening Cycle

IB Deposit Beta: 53.7% (2) $1,506 $1,575 Tightening Cycle Total Deposit Beta: 39.7% (2)

Loan Portfolio Loan Composition 2019

2024 C&D: 50% CRE: 198% C&D: 45% CRE: 249% Continued focus on providing credit to small- and medium-sized businesses Granular loan portfolio with average loan size of $280k Currently prioritizing C&I over owner-occupied lending No shared

national credit exposure and limited exposure to purchased and participated loans 14 commercial bankers throughout our footprint Continue to build out SBA, mortgage and government contracting Loan Originations ($M) Dollars in millions Source:

Company documents; annual data as of 12/31 each year ended; Loan composition, CRE and C&D ratios bank level Gross loans & leases includes loans held for sale Non owner-occupied CRE includes farmland loans Consumer and C&I total includes

marine loans Number of Lenders 8 12 16 15 $472 $619 $678 $195 $486 16 14 $230 (2) (3) (3) (1)

Loan Portfolio Detail C&I and

Owner-Occupied CRE (%) Investment CRE (%) Total C&I and OOCRE Loans: $508 million C&I and OOCRE Loans / Total Loans: 34.6% Largest C&I and OOCRE Loan: $13.1 million Average C&I and OOCRE Loan Size: $406k Average Loan to Value: 33.9%

Total Investment CRE Loans: $369 million Investment CRE Loans / Total Loans: 25.2% Largest Investment CRE Loan Size: $12.8 million Average Investment CRE Loan Size: $1.3 million Average Loan to Value: 45.4% Source: Company documents; data as of

12/31/24 Note: Commercial and industrial loans include commercial and industrial, and owner-occupied commercial real estate; investment commercial real estate loans include non owner-occupied commercial real estate and multifamily loans

Asset Quality Nonperforming Assets by

Type ($M) Reserves / Loans (%) (0.05%) 0.18% (0.09%) (0.02%) (0.05%) Comprehensive and conservative underwriting process Highly experienced bankers incentivized with equity ownership Commitment to a diverse loan portfolio while maintaining strong

asset quality metrics Proactive approach to managing problem credits CECL was implemented on 1/1/23 with an additional one-time reserve of $2.1M Source: Company documents; annual data as or for the twelve months ended 12/31 each year ended Note:

Nonperforming assets defined as nonaccrual loans and OREO; core deposits defined as total deposits less deposits greater than $250,000, brokered deposits, CDARS and Edward Jones demand deposits Two CRE loans totaling $3.6 million became nonaccrual

in 2023; these relationships are no longer with the bank and resulted in no losses to the bank $2.2 $2.4 $5.4 $2.7 $2.3 NCOs / Avg. Loans $6.0 0.03% $2.6 0.14% (1)

$21.6 (3) Noninterest Income

Highlights Noninterest Income Sources ($M) Diversified Revenue Sources Recent expansion of Wealth Management division with several new hires in 2021, 2022 and January 2025 12 professionals dedicated to Wealth Management services Investment

Management Personal Managed Portfolios Institutional Managed Portfolios Trust services and estate planning Investments in Bank Owned Life Insurance in 2022 ($24M) and 2023 ($30M) SBA lending team hired in February 2022 Secondary mortgage department

built out in 2020 and began selling loans in Q2 2021 Wealth Assets Under Management ($M) Source: Company documents; data as of or for the year ended each period Note: Other fee income includes gain (loss) on sale of AFS securities, gain (loss) on

sale of bank premises & equipment and other operating income 2021 gain on sale of loans includes $1.0 million of marine loans and $636k of mortgage loans 2022 gain on sale of loans includes $557k of marine loans, $840k of marine loan servicing

rights, $303k of mortgage loans, and $175k of SBA loans 2024 other income includes $3.9 million gain on sale leaseback; BOLI income in 2024 includes two BOLI death benefits $7.8 $8.6 $11.3 (1) $13.3 (2) $14.7

Earnings, Book Value and Dividends

Earnings per Share ($) Net Income ($M) Dividend per Share ($) Tangible Book Value per Share ($)(1) Source: Company documents; data as of or for the year ended each period See appendix for reconciliation of non-GAAP metrics Core income defined as net

income after taxes and before extraordinary items, less net income attributable to noncontrolling interest, gain on the sale of held to maturity and available for sale securities, amortization of intangibles, goodwill and nonrecurring items (1) (2)

(1) (2)

Yield and Cost Analysis Source:

Company documents; annual data for the twelve months ended ended each year; quarterly data for the three months ended each quarter

Profitability Metrics Return on

Average Assets (ROAA)(%) NII / AA and NIE / AA (%) Return on Average Equity (ROAE) (%) Core Efficiency Ratio (%) (1) NII / Revenue 19.7% 19.3% 21.5% 21.3% 22.7% Source: Company documents; data for the year ended each period; quarterly data for each

quarter ended, respectively Note: EFSI had no intangible assets or preferred equity as of 12/31/24 (1)See appendix for reconciliation of non-GAAP metrics Core income defined as net income after taxes and before extraordinary items, less net income

attributable to noncontrolling interest, gain on the sale of held to maturity and available for sale securities, amortization of intangibles, goodwill and nonrecurring items (1) (1) (2) (2) 28.5% 21.9% 26.1% 38.6%

Potential Securities Repositioning

Potential Transaction Assumptions (1) Securities Portfolio Composition Potential Securities Sold: ~$78 million Pre-Tax Loss: ~$10.0 million Average Yield on Securities Sold: ~1.73% Securities to be Reinvested: ~$68 million @ Assumed ~4.75% Weighted

Average Life: ~3.8 years Effective Duration: ~2.5 years Source: Company documents; Securities portfolio data as of 12/31/24 (1)Estimated market prices as of 1/29/25 and may not represent executable levels Management is considering a partial

restructuring of its low-yielding AFS securities portfolio following the capital raise Illustrative securities restructuring results in: No impact to TBVPS Improvement to NIM and ROAA Shorter duration securities portfolio Stronger liquidity

management and TBVPS generation Repositioning Rationale Weighted Average Life of Securities Portfolio: 6.1 years

Potential Repositioning Accelerates

Profitability Net Interest Margin (%) (1)(2) Core ROAA (%) (1) Source: Company documents; data for the twelve months ended 12/31/24, unless otherwise noted Note: Assumes 21% tax rate for illustrative purposes Note: Illustrative pro forma adjustments

include the base $50 million common equity raise plus the $7.5 million overallotment option less customary offering related expenses; net proceeds are held in cash with an assumed yield of 4.25%; additionally, assumes sale of approximately $78

million AFS securities at a ~1.73% yield for a $10.0 million pre-tax loss ($7.9 million after-tax), & reinvestment of approximately $68 million repositioned into securities at a ~4.75% yield; estimated market prices as of 1/29/25 and may not

represent executable levels See appendix for illustrations of pro forma calculations As for the three months ended 12/31/24; annualized Core Net Income ($M) (1) Core Earnings Per Share (1) Tangible Book Value Per Share (1) Net Interest Income (FTE)

($M) (1)

Bank Level Leverage Ratio (%) Tangible

Common Equity / Tangible Assets (%) Capital Ratios CET1 Ratio (%) Total Risk-Based Capital Ratio (%) Source: Company documents; data as of 12/31 each year ended See appendix for reconciliation of non-GAAP metrics Illustrative pro forma adjustments

include the base $50 million common equity raise plus the $7.5 million overallotment option less customary offering related expenses; additionally, assumes sale of approximately $78 million AFS securities at a ~1.73% yield for a $10.0 million

pre-tax loss ($7.9 million after-tax), & reinvestment of approximately $68 million repositioned into securities at a ~4.75% yield; estimated market prices as of 1/29/25 and may not represent executable levels; see appendix for illustrations of

pro forma calculations (1) Pro Forma (2) 8.4% Pro Forma (2) 10.4% Pro Forma (2) 11.5% Pro Forma (2) 14.4% (2) (2) (2) (2)

3. Appendix

Certificate of Deposit Maturity

Schedule Source: Company documents; data as of 12/31/24 Dollars in thousands 4.18% $481 million in Certificate of Deposits Accounts as of 12/31/24 Weighted Average Cost of 4.53% 4.71% 4.59% 4.26% 3.78% 3.47% 2.98% 3.54% 4.61% Weighted Avg.

Cost:

Loan Concentration Ratios Bank CRE

Ratio Over time (%) Bank C&D Ratio Over time (%) Source: Company documents; annual data as of 12/31 each year ended Note: Illustrative pro forma adjustments include the base $50 million common equity raise plus the $7.5 million overallotment

option less customary offering related expenses; additionally, assumes sale of approximately $78 million AFS securities at a ~1.73% yield for a $10.0 million pre-tax loss ($7.9 million after-tax), & reinvestment of approximately $68 million

repositioned into securities at a ~4.75% yield; estimated market prices as of 1/29/25 and may not represent executable levels; see appendix for illustrations of pro forma calculations

Funding and Sources of Liquidity

Source: Company documents; data as of 12/31/24 $1.5 million of cash at the holding company as of December 31, 2024 Dividend capacity from the bank to the holding company of $34.4 million as of December 31, 2024 Unused lines of credit to purchase

federal funds from correspondent banks totaling $78 million $254 million remaining credit availability at FHLB as of December 31, 2024 Total lendable collateral value pledged of $351 million as of December 31, 2024 No holding company lines of credit

or revolving lines 12% total wholesale borrowings to total assets ratio as of December 31, 2024; policy threshold is 25% 3.8% total brokered deposits to total assets ratio as of December 31, 2024; policy threshold is 10% $29.5 million of

subordinated debt as of December 31, 2024

Historical Financials Source: Company

documents Dollars in millions Note: Numbers may not match due to rounding See appendix for reconciliation of non-GAAP metrics; PTPP income defined as pre-tax, pre-provision income Gross loans includes held for investment and held for sale loans EFSI

recorded no intangible assets or preferred equity in 2024

Non-GAAP Reconciliation Source:

Company documents Note: Numbers may not match due to rounding PTPP income defined as pre-tax, pre-provision income (1)

Non-GAAP Reconciliation Source:

Company documents Note: Core net income additions and exclusions assume 21% tax rate for illustrative purposes Note: Quarterly ratios shown on an annualized basis Note: Calculations may not match due to rounding

Pro Forma Profitability Reconciliation

Source: Company documents; 2024 data as of the twelve months ended 12/31/24; Q4 ’24 data for the three months ended 12/31/24, ratios annualized Note: Assumes 21% tax rate for illustrative purposes Note: Net interest income shown on a fully tax

equivalent basis Note: Illustrative pro forma adjustments include the base $50 million common equity raise plus the $7.5 million overallotment option less customary offering related expenses; net proceeds are held in cash with an assumed yield of

4.25%; Additionally, assumes sale of approximately $78 million AFS securities at a ~1.73% yield for a $10.0 million pre-tax loss ($7.9 million after-tax), & reinvestment of approximately $68 million repositioned into securities at a ~4.75%

yield; Estimated market prices as of 1/29/25 and may not represent executable levels (1)Pre-tax adjustment (1) (1) (1) (1)

Pro Forma Capital Reconciliation

Source: Company documents; 2024 data as of 12/31/24 Note: Assumes 21% tax rate for illustrative purposes Note: Illustrative pro forma adjustments include the base $50 million common equity raise plus the $7.5 million overallotment option less

customary offering related expenses; Additionally, assumes sale of approximately $78 million AFS securities at a ~1.73% yield for a $10.0 million pre-tax loss ($7.9 million after-tax), & reinvestment of approximately $68 million repositioned

into securities at a ~4.75% yield; Estimated market prices as of 1/29/25 and may not represent executable levels (1)$7.9 million for the removal of the unrealized net gain (loss) from tier 1 capital from the FASB 115 adjustment due to the sale of

AFS securities

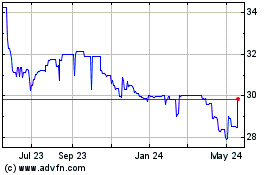

Eagle Financial Services (QX) (USOTC:EFSI)

Historical Stock Chart

From Jan 2025 to Feb 2025

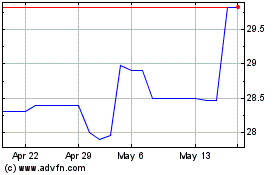

Eagle Financial Services (QX) (USOTC:EFSI)

Historical Stock Chart

From Feb 2024 to Feb 2025