Enel 2011 Ebitda Up 1.1%, Tops View; EUR44.6 Billion Net Debt

January 31 2012 - 12:10PM

Dow Jones News

Italian utility Enel SpA (ENEL.MI) said Tuesday its 2011

preliminary earnings before interest, tax, depreciation and

amortization, or Ebitda, rose 1.1% on the year, slightly better

than expectations, on higher revenue and contribution from

renewable energy operations.

The Italian utility also said its key net debt figure at the end

of December slipped to EUR44.6 billion from EUR47.77 billion posted

three months earlier.

Enel said Ebitda was EUR17.7 billion, up from EUR17.5 billion in

2010. Revenue increased to EUR79.5 billion, up 8.3% on the

year.

A Dow Jones Newswires poll of seven analysts estimated an

average 2011 Ebitda of EUR17.40 billion on revenue of EUR74.87

billion. Average net debt was forecast at EUR44.39 billion for the

end of December.

Enel became Europe's most-indebted utility after acquiring

control of Spain's Endesa SA (ELE.MC), allowing it to expand in

Spain and Latin America. Cutting the debt pile has been a priority

to maintain its single-A credit rating.

Earlier this month, Standard & Poor's kept Enel's credit

rating at "A-", while it downgraded the credit rating of Italy by

two notches to BBB+. The Italian government controls Enel.

The Rome-based company is slated to release full year 2011 and

dividend proposal in March.

Tuesday, Enel shares closed up 0.3% at EUR3.13, roughly in line

with the 0.5% gain in Italy's FTSE Mib Index.

-By Liam Moloney, Dow Jones Newswires; +39 06 6976 6924;

liam.moloney@dowjones.com

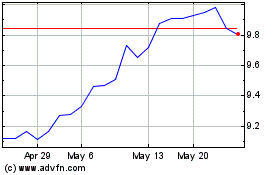

Endesa (PK) (USOTC:ELEZY)

Historical Stock Chart

From Jun 2024 to Jul 2024

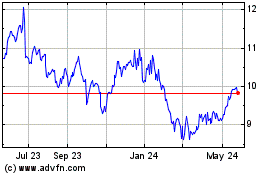

Endesa (PK) (USOTC:ELEZY)

Historical Stock Chart

From Jul 2023 to Jul 2024

Real-Time news about Endesa SA (PK) (OTCMarkets): 0 recent articles

More Endesa S.A. ADS News Articles