Mortgage Rates Continue Ascent Amid Inflation Battle

September 08 2022 - 9:30AM

Dow Jones News

By Dean Seal

Mortgage rates rose again this week as the Federal Reserve

reaffirmed its commitment to reducing inflation through policy, and

the dispersion of rates also has increased, housing-finance agency

Freddie Mac said.

In the week ending Thursday, the average rate on a 30-year

fixed-rate mortgage rose to 5.89% from 5.66% last week. A year ago,

the average rate was 2.88%.

Average 15-year rates were 5.16%, up from 4.98% last week,

Freddie Mac said. A year ago, the 15-year fixed-rate mortgage rate

averaged 2.19%.

The average rate on a five-year Treasury-indexed hybrid

adjustable-rate mortgage, or ARM, was 4.64%, up from 4.51% last

week. A year ago, the five-year ARM averaged 2.42%.

"Mortgage rates rose again as markets continue to manage the

prospect of more aggressive monetary policy to combat elevated

inflation," said Sam Khater, Freddie Mac's chief economist. "Not

only are mortgage rates rising, but the dispersion of rates also

has increased, meaning that borrowers can benefit from shopping

around for a better rate. Our research indicates that borrowers

could save an average of $1,500 over the life of a loan by getting

one additional rate quote and an average of about $3,000 if they

get five quotes."

Write to Dean Seal at dean.seal@wsj.com

(END) Dow Jones Newswires

September 08, 2022 10:15 ET (14:15 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

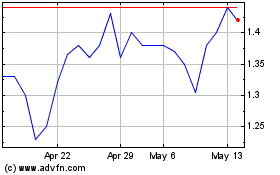

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about Federal Home Loan Mortgage Corporation (QB) (OTCMarkets): 0 recent articles

More Federal Home Loan Mortgage Corporation (QB) News Articles