FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934

For the month of January 2016

Commission File Number: 001-31819

Gold Reserve Inc.

(Exact name of registrant as specified in its charter)

926 W. Sprague Avenue, Suite 200

Spokane, Washington 99201

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

This

Report on Form 6-K and the exhibit attached hereto are hereby incorporated by

reference into the Company's current Registration Statements on Form F-3 on

file with the U.S. Securities and Exchange Commission. The following exhibit is

furnished with this Form 6-K:

99.1

News Release

Cautionary Statement Regarding

Forward-Looking Statements and information

The information presented or

incorporated by reference herein contains both historical information and

"forward-looking statements" within the meaning of the relevant sections

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended, and "forward-looking

information" within the meaning of applicable Canadian securities laws,

that state Gold Reserve Inc.’s (the “Company”) intentions, hopes, beliefs,

expectations or predictions for the future. Forward-looking statements and

forward-looking information are collectively referred to herein as

"forward-looking statements".

Forward-looking statements are necessarily based upon

a number of estimates and assumptions that, while considered reasonable by the

Company at this time, are inherently subject to significant business, economic

and competitive uncertainties and contingencies that may cause the Company’s

actual financial results, performance, or achievements to be materially

different from those expressed or implied herein and many of which are outside

its control. Some of the material factors or assumptions used to develop

forward-looking statements include, without limitation, the uncertainties

associated with: the timing of the enforcement

and collection of the amounts awarded (including pre and post award interest

and legal costs) (the "Arbitral Award") by the International Centre

for Settlement of Investment Disputes for the losses caused by Venezuela

violating the terms of the treaty between the Government of Canada and the

Government of Venezuela for the Promotion and Protection of Investments related

to the Brisas Project (the "Brisas Arbitration"), actions and/or

responses by the Venezuelan government to the Company's collection efforts

related to the Brisas Arbitration, economic and industry conditions influencing

the sale of the Brisas Project related equipment, and conditions or events

impacting the Company’s ability to fund its operations and/or service its debt.

Forward-looking statements

involve risks and uncertainties, as well as assumptions, including those set

out herein, that may never materialize, prove incorrect or materialize other

than as currently contemplated which could cause the Company’s results to

differ materially from those expressed or implied by such forward-looking

statements. The words "believe," "anticipate," "expect,"

"intend," "estimate," "plan," "may," "could"

and other similar expressions that are predictions of or indicate future events

and future trends which do not relate to historical matters, identify

forward-looking statements. Any such forward-looking statements are not

intended to provide any assurances as to future results.

Numerous factors could cause

actual results to differ materially from those described in the forward-looking

statements, including without limitation:

·

the timing of the

enforcement and collection of the Arbitral Award, if at all;

·

the costs associated

with the enforcement and collection of the Arbitral Award and the complexity

and uncertainty of varied legal processes in various international

jurisdictions;

·

the Company's current

liquidity and capital resources and access to additional funding in the future when

required;

·

continued servicing or

restructuring of the Company's outstanding notes or other obligations as they

come due;

·

shareholder dilution

resulting from restructuring or refinancing the Company's outstanding notes and

current accounts payable relating to the Company's legal fees;

·

shareholder dilution

resulting from the conversion of the Company’s outstanding notes in part or in

whole to equity;

·

shareholder dilution

resulting from the sale of additional equity;

·

value realized from the

disposition of the remaining Brisas Project related assets, if any;

·

value realized from the

disposition of the Brisas Project Technical Mining Data, if any;

·

prospects for

exploration and development of other mining projects by the Company;

·

ability to maintain

continued listing on the TSX Venture Exchange or continued trading on the

OTCQB;

·

corruption, uncertain

legal enforcement and political and social instability;

·

currency, metal prices

and metal production volatility;

·

adverse U.S. and/or

Canadian tax consequences;

·

abilities and continued

participation of certain key employees; and

·

risks normally incident

to the exploration, development and operation of mining properties.

This list is not exhaustive of

the factors that may affect any of the Company’s forward-looking statements.

See "Risk Factors" contained in the Company's Annual Information Form

and Annual Report on Form 40-F filed on sedar.com and sec.gov, respectively for

additional risk factors that could cause results to differ materially from

forward-looking statements.

Investors are cautioned not to

put undue reliance on forward-looking statements, and investors should not

infer that there has been no change in the Company’s affairs since the date of

this report that would warrant any modification of any forward-looking

statement made in this document, other documents periodically filed with or

furnished to the U.S. Securities and Exchange Commission (the "SEC")

or other securities regulators or documents presented on the Company’s website.

Forward-looking statements speak only as of the date made. All subsequent

written and oral forward-looking statements attributable to the Company or

persons acting on its behalf are expressly qualified in their entirety by this

notice. The Company disclaims any intent or obligation to update publicly or

otherwise revise any forward-looking statements or the foregoing list of

assumptions or factors, whether as a result of new information, future events

or otherwise, subject to the Company’s disclosure obligations under applicable

U.S. and Canadian securities regulations. Investors are urged to read the

Company’s filings with U.S. and Canadian securities regulatory agencies, which

can be viewed online at www.sec.gov and www.sedar.com, respectively.

(Signature page follows)

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to

be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: January 15, 2016

GOLD RESERVE INC. (Registrant)

By: /s/ Robert A.

McGuinness

Name: Robert A. McGuinness

Title: Vice President – Finance & CFO

Exhibit 99.1

NR 16-02

Gold Reserve Provides Update to Legal Proceedings related to collection of arbitration award

SPOKANE, WASHINGTON, January 14, 2016

Gold Reserve Inc. (TSX.V:GRZ) (OTCQB:GDRZF) (“Gold Reserve” or the “Company”) reports on legal activities in relation to the various jurisdictions where is it attempting to collect on its $740 million ICSID (Additional Facility) arbitral award.

United States

As previously reported, the U.S. District Court in Washington, DC issued an order on November 20, 2015, confirming the Award and entering judgment in favor of the Company, which with interest accrued is now approximately $765 million. Venezuela has filed an appeal of the court’s order but it has not posted an appeal bond or sought a stay of enforcement of the judgment pending appeal. The U.S District Court of Appeals has not yet set a scheduling order but the Company expects one in the near future.

Under the Foreign Sovereign Immunities Act , no attachment or execution of Venezuela property in the U.S. is permitted without a court determination that (a) the property in question is used for a commercial activity in the United States and other criteria is satisfied and (b) a reasonable period of time has elapsed following the entry of judgment. Subsequent to the entry of judgment, the Company has filed a 1610(c) motion in the District Court for a determination that a reasonable period of time has elapsed. Venezuela has opposed that motion. The motion is fully briefed and the parties are waiting for a decision by the court.

In the District Court for the Southern District of Florida the Company has filed petitions relating to the Luxembourg proceedings as is allowed under U.S. law for discovery in aid of foreign proceedings. The banks covered by the Florida proceedings to date are Bank of New York Mellon Corporation, JP Morgan Chase NA, and Deutsche Bank Trust Company Americas. These institutions have produced varying amounts of documents and Gold Reserve has commenced the process of document review and appropriate depositions.

France

In October 2014 Venezuela applied for the annulment of the Award, and the Company applied for an exequatur or judgment declaring the Award to be recognized and enforceable in France. Venezuela responded to the Company’s request for exequatur by asking that the Company’s request be rejected and, in the alternative, that the provisional recognition and enforcement, which attaches to the exequatur pending a decision on annulment, be suspended. In January 2015 the Paris Court of Appeal fully upheld the Company’s position by granting the exequatur and rejecting Venezuela’s application for a suspension of the provisional effects of the exequatur. Venezuela’s application for annulment was subsequently scheduled to be heard in February 2016.

On January 6, 2016, the Paris Court of Appeal notified the Company that, as part of the general administration of its docket, it had postponed the February 2016 hearing related to Venezuela’s applications to October 13, 2016. On January 14, 2016, the Paris Court of Appeal advised the Company that a hearing date in March 2016 had recently become available, a date on which both parties must agree.

It is unclear whether Venezuela will agree to

the earlier date. The Company has been advised that the Court has accumulated a

backlog of cases as a result of the president of the court being promoted to

the Court of Cassation (French Supreme Court), without being replaced to

date. A decision is expected within 90 days after the newly established hearing

date. In the interim, the Company is not prevented from seizing assets and

could have them liquidated, subject to the obligation to reimburse Venezuela if

the Award is set aside.

United

Kingdom

In May

2015 the Company filed an application to have the Award recognized and enforced

in the United Kingdom. Such application was granted and the Company obtained an

Order and Judgment in the terms of the Award on 20 May 2015. Venezuela has challenged

the Order and Judgment, asserting service, jurisdictional, and merits issues.

Certain of these arguments have been made in other jurisdictions. A hearing

has been scheduled in London for the time period January 18th to the

20th.

Gold

Reserve’s President Doug Belanger stated, “We continue to pursue all available

avenues to achieve our objective to collect the Award by bringing this matter

to its proper conclusion either through our continuing settlement discussions

with Venezuela or the seizure of assets in execution of a judgment of a

court.”

Further

information regarding the Company can be located at www.goldreserveinc.com, www.sec.gov

and www.sedar.com.

Gold

Reserve Inc.

Contact:

A.

Douglas Belanger, President

926

W. Sprague Ave., Suite 200

Spokane,

WA 99201 USA

Tel.

(509) 623-1500

Fax (509) 623-1634

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS

This release contains

“forward-looking statements” or “forward-looking information” as such terms are

defined under applicable U.S. and Canadian securities laws (collectively

referred to herein as “forward-looking statements”) with respect to the ICSID

Arbitral Award related to the wrongful actions of Venezuela that terminated the

Brisas Project in violation of the terms of the Treaty between the Government

of Canada and the Government of Venezuela for the Promotion and Protection of

Investments (the "Canada-Venezuela BIT"). (Gold Reserve Inc. v.

Bolivarian Republic of Venezuela (ICSID Case No. ARB(AF)/09/1).

Forward-looking statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by management at this time, are

inherently subject to significant business, economic and competitive

uncertainties and contingencies such as, among other things, the Company’s

ability to collect such Arbitral Award.

We caution that such

forward-looking statements involve known and unknown risks, uncertainties and

other risks that may cause the actual outcomes, financial results, performance,

or achievements of Gold Reserve to be materially different from our estimated

outcomes, future results, performance, or achievements expressed or implied by

those forward-looking statements.

This

list is not exhaustive of the factors that may affect any of Gold Reserve's

forward-looking statements. Investors are cautioned not to put undue reliance

on forward-looking statements. All subsequent written and oral forward-looking

statements attributable to Gold Reserve or persons acting on its behalf are

expressly qualified in their entirety by this notice. Gold Reserve disclaims

any intent or obligation to update publicly or otherwise revise any

forward-looking statements or the foregoing list of assumptions or factors,

whether as a result of new information, future events or otherwise, subject to

its disclosure obligations under applicable rules promulgated by the SEC.

In addition to being

subject to a number of assumptions, forward-looking statements in this release

involve known and unknown risks, uncertainties and other factors that may cause

actual results and developments to be materially different from those expressed

or implied by such forward-looking statements, including those factors outlined

in the "Cautionary Statement Regarding Forward-Looking Statements"

and "Risks Factors" contained in Gold Reserve's filings with the

Canadian provincial securities regulatory authorities and the SEC, including

Gold Reserve's Annual Information Form and Annual Report on Form 40-F for the

year ended December 31, 2014, filed with the Canadian provincial securities

regulatory authorities and the SEC, respectively.

“Neither

the TSX Venture Exchange nor its Regulation Services Provider (as that term is

defined in policies of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.”

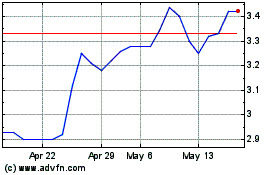

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Feb 2024 to Feb 2025