WHERE YOU CAN FIND MORE INFORMATION

We are subject to the periodic reporting

and other informational requirements of the Exchange Act. Under the Exchange

Act we are required to file

or furnish

annual

and special reports and other information with the SEC. As a foreign private

issuer under the Exchange Act, we are exempt from rules thereunder prescribing

the furnishing and content of proxy statements, and our officers, directors and

principal shareholders are exempt from reporting and short-swing profit

recovery provisions contained in Section 16 of the Exchange Act. We are also

exempt from Regulation FD.

You may read

and copy any of the reports, statements, or other information we file or

furnish with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E.,

Washington, D.C. 20549 at prescribed rates. Information on the operation of

the Public Reference Room may be obtained by calling the SEC at

1-800-SEC-0330. The SEC filings are also available to the public from

commercial document retrieval services and are available at the Internet website

maintained by the SEC at

www.sec.gov

.

These reports

and other information filed or furnished by us with the SEC are also available

free of charge at our website at

www.goldreserveinc.com

, under our “Investor

Relations” tab. Our website also contains filings made with the Canadian

securities regulatory authorities, which can also be accessed at

www.sedar.com

.

The

information contained in our website is

not

incorporated by reference

and

does not

constitute a part of this prospectus.

INCORPORATION BY REFERENCE

We have filed

with the SEC a registration statement on Form F-3 under the Securities Act

covering the Securities offered by this prospectus. This prospectus does not

contain all of the information that you can find in our registration statement

and the exhibits to the registration statement. Statements contained in this

prospectus as to the contents of any contract or other document referred to are

not necessarily complete and in each instance such statement is qualified by

reference to each such contract or document filed or incorporated by reference

as an exhibit to the registration statement.

The SEC allows us to “incorporate by

reference” the information we file or furnish with them. This means that we

can disclose important information to you by referring you to other documents

that are legally considered to be part of this prospectus, and later

information that we file or furnish with the SEC will automatically update and

supersede the information in this prospectus. We incorporate by reference into

this prospectus the following documents:

·

Our annual report on Form 40-F, for our fiscal year ended

December 31, 2015, filed on April 20, 2016;

·

Our unaudited interim consolidated financial statements as of

March 31, 2016 and June 30, 2016, as filed on our reports on Form 6-K furnished

on May 11, 2016 and August 26, 2016, respectively;

·

Our reports on Form 6-K furnished on January 13, 2016, January

15, 2016, January 21, 2016, February 29, 2016, March 4, 2016, March 9, 2016,

April 25, 2016, May 5, 2016, May 6, 2016, May 11, 2016, May 17, 2016, May 26,

2016, May 31, 2016, June 9, 2016, June 24, 2016, August 2, 2016, August 9, 2016

and August 15, 2016;

·

The description of our capital stock set forth in our report on

Form 6-K furnished on September 19, 2014;

·

Our Articles of Continuance and By-law No. 1 contained in

Exhibits 99.1 and 99.2, respectively, to our report on Form 6-K furnished on

September 19, 2014; and

·

All other reports filed pursuant to Section 13(a) or 15(d) of the

Exchange Act since the end of the fiscal year covered by the Form 40-F

mentioned above.

In the event of conflicting information

in these documents, the information in the latest filed documents shall control.

PROSPECTUS

SUMMARY

The following

summary highlights certain information contained elsewhere in this prospectus

and in the documents incorporated by reference herein. It does not contain all

the information that may be important to you. You should carefully read this

prospectus and the documents incorporated by reference herein, before deciding

to invest in the Securities.

Overview

We are

incorporated under the laws of Alberta, Canada and are currently engaged

primarily in settling our dispute with the Venezuelan government. We also

continue to look for opportunities to acquire, explore and develop mining

projects. We consider ourselves an exploration stage company and were incorporated

in 1998 under the laws of Yukon, Canada. We are the successor issuer to Gold

Reserve Corporation, which was incorporated in 1956. In September 2014, we

changed our legal domicile from the Yukon, Canada to Alberta, Canada. From

1992 to 2008 we focused substantially all of our management and financial

resources on the development of the Brisas Project, a gold and copper project

located in the Kilometer 88 mining district of the State of Bolivar in southeastern

Venezuela (the “

Brisas Project

”). The Brisas Project was expropriated

by the Venezuelan government in 2008. On September 22, 2014, the ICSID

tribunal announced an Arbitral Award to the Company in the amount of $740.3

million in connection with the Brisas arbitration relating to such

expropriations.

Settlement and Mixed

Company Agreements

On August 8,

2016, we announced the execution of the Settlement Agreement with Venezuela

pursuant to which Venezuela would pay us the Arbitral Award, which amounts to approximately

$769.7 million, including accrued interest to February 24, 2016 (the date we

entered into a memorandum of understanding with Venezuela with respect to the

Settlement Agreement). The amount would be paid in two installments: (i)

$600.0 million on or before October 31, 2016, and (ii) approximately $169.7

million on or before December 31, 2016.

We have temporarily suspended the legal

enforcement of the Arbitral Award in contemplation of Venezuela making the

installment payments pursuant to the Settlement Agreement in a timely manner,

at which time we would formally cease all legal activities related to the

collection of the Arbitral Award.

I

f the first

installment with respect to the payment of the Arbitral Award is not timely

made by Venezuela, the Settlement Agreement would terminate in accordance with

its terms. To the extent the first payment is made on a timely basis, and

thereafter the second payment is not timely made by Venezuela, we would have

the right to terminate the Settlement Agreement by written notice, without

requiring any decision from any judicial authority.

Pursuant to

the Settlement Agreement, Venezuela would also purchase the Mining Data for $240.0

million in four quarterly installments of $50.0 million beginning October 31,

2016, with a fifth and final installment of $40.0 million due on or before

October 31, 2017. After the final installment payment with respect to the

Mining Data, the Mining Data would be transferred to the Venezuelan National

Mining Database.

In addition,

the Company has also entered into a mixed company agreement (the “

Mixed

Company Agreement

”), pursuant to which Venezuela and Gold Reserve would

form the Mixed Company to develop the Brisas Project and the adjacent Cristinas

gold and copper project as a combined project (the “

Brisas-Cristinas Project

”).

The Mixed Company would be beneficially owned 55% by Venezuela and 45% by a

wholly-owned subsidiary of Gold Reserve. The mining project term would be 40

years (20 years with two 10 year extensions).

Venezuela would

contribute to the Mixed Company the rights to the gold, copper, silver and

other strategic minerals contained within 18,000 hectares located in southeast

Bolivar State, which includes the Brisas-Cristinas Project. We would provide,

under a technical services agreement (the terms of which would be agreed upon

by the parties in the future), engineering, procurement and construction

services to the Mixed Company for a fee of 5% of all costs of construction and

development of the project. After commencement of commercial production, we would

be paid a fee of 5% of the technical assistance costs during operations.

The parties

have agreed to participate in the net profits of the Mixed Company, in accordance

with an agreed formula resulting in specified respective percentages based on

the sales price of gold per ounce. For sales up to $1,600 per ounce, net

profits would be allocated 55% to Venezuela and 45% to Gold Reserve. For sales

greater than $1,600 per ounce, the incremental amount would be allocated 70%

and 30%, respectively. For example, with sales at $1,600 and $3,500 per ounce,

net profits will be allocated 55% to 45% and 60.5% to 39.5%, respectively.

The Mixed Company would also pay a net smelter return

royalty to Venezuela on the sale of gold, copper, silver and any other

strategic minerals of 5% for the first ten years of commercial production, 6%

for the next ten years and 7% thereafter. The

anticipated capital costs of the Brisas-Cristinas Project will be approximately

$2.1 billion. We expect to work together with Venezuela to obtain financing

sufficient to cover those costs.

RISK

FACTORS

Set out

below are certain risk factors that could materially adversely affect our

future business, operating results or financial condition. Investors should

carefully consider these risk factors and the other risk factors and

information in this prospectus, including under “Cautionary Note Regarding

Forward-Looking Statements and Information” and our filings with the SEC.

These filings include our annual report on Form 40-F for the year ended

December 31, 2015, filed with the SEC on April 20, 2016, which is incorporated

by reference in this prospectus, our reports on Form 6-K subsequently furnished

to the SEC which we have determined to incorporate by reference into this

prospectus, and the other documents incorporated by reference in this

prospectus, before making investment decisions involving the Securities.

Risks Related to the

Settlement or Other Collection of Arbitral Award

Delay or failure by Venezuela to make

payments or otherwise honor its commitments under the Settlement Agreement could

materially adversely affect the Company.

On August 8,

2016, we announced the execution of the Settlement Agreement pursuant to which

Venezuela would pay us approximately $769.7 million with respect to the

Arbitral Award in two installments―$600.0 million on or before October

31, 2016, and approximately $169.7 million on or before December 31, 2016. In

addition, Venezuela would acquire the Mining Data for $240.0 million in four quarterly installments of $50.0 million beginning

October 31, 2016, with a fifth and final installment of $40.0 million due on or

before October 31, 2017.

We have temporarily suspended the legal

enforcement of the Arbitral Award in contemplation of Venezuela making the

installment payments pursuant to the Settlement Agreement in a timely manner,

at which time we would formally cease all legal activities related to the

collection of the Arbitral Award.

Venezuela has agreed to use

the proceeds from any financing it closes after the execution of the Settlement

Agreement to pay amounts owed thereunder in preference to any other creditor,

though there can be no assurance that such financing will be obtained. There

can also be no assurance that Venezuela will make any or all of the payments

contemplated by the Settlement Agreement or honor its other commitments

thereunder. If the first installment with respect to the payment of the

Arbitral Award is not timely made by Venezuela, the Settlement Agreement would

terminate in accordance with its terms. To the extent the first payment is made

on a timely basis, and thereafter the second payment is not timely made by

Venezuela, we would have the right to terminate the Settlement Agreement by

written notice, without requiring any decision from any judicial authority.

In the event that any of the installment

payments are not made by Venezuela, we would either seek an extension, other

modification of the terms of our agreements with Venezuela or resume our

efforts to enforce and collect the Arbitral Award. Any failure or significant

delay by Venezuela to make payments under the Settlement Agreement, or any

resulting termination of our agreements with Venezuela, could have a material

adverse effect on the Company.

The Company and Venezuela may not be

successful in forming and operating the Mixed Company.

Pursuant to the

Mixed Company Agreement, Venezuela and Gold Reserve would form the Mixed

Company to develop the Brisas-Cristinas Project. Formation and operation of the

Mixed Company may be subject to certain legal and regulatory obstacles, the completion

of any additional definitive documentation between the parties and finalizing

remaining approvals, if any, for certain tax and economic benefits related to

the activities of the Mixed Company from the National Executive Branch of the

Venezuelan government. In addition, we expect to work together with Venezuela

to obtain financing sufficient to cover the capital costs of the project, which

we expect to be substantial. However, there can be no assurance that the

parties will be able to obtain sufficient financing in a timely manner. In the

event that the parties are unable to form the Mixed Company, including

completing any additional definitive documentation, obtain financing on a

timely basis and thereafter operate the Mixed Company, we could be forced to

either renegotiate our agreements with Venezuela or forego the opportunity to realize

the expected benefits of the Mixed Company, which could have a material adverse

effect on the Company.

Our activities

related to the Brisas-Cristinas Project are concentrated in Venezuela and are

subject to inherent local risks.

The

Brisas-Cristinas Project is located in Venezuela and, as a result, we will be

subject to traditional operational, regulatory, political and economic risks

specific to its location, including: (i) significant or abrupt

changes in the applicable regulatory or legal climate; (ii)

negative international response to Venezuelan domestic and international

policies; (iii) the potential for corruption and uncertain legal enforcement

and the potential impact of civil unrest, military actions or crime; and (iv)

the potential invalidation, confiscation, expropriation or rescission of

governmental orders, permits, agreements or property rights and changes in

regulations related to mining, environmental and social issues.

In the event that the Settlement Agreement

is terminated, our failure to otherwise collect the Arbitral Award could

materially adversely affect the Company.

We have

temporarily suspended the legal enforcement of the Arbitral Award in

contemplation of Venezuela making the installment payments pursuant to the

Settlement Agreement in a timely manner, at which time we would formally cease

all legal activities related to the collection of the Arbitral Award. If either

installment payment with respect to the payment of the Arbitral Award is not

made in accordance with the Settlement Agreement we may either seek an

extension, other modification of the terms of our agreements with Venezuela or,

if otherwise unsuccessful, resume our efforts to enforce and collect the

Arbitral Award. Enforcement and collection of the Arbitral Award is a lengthy

process and will be ongoing for the foreseeable future if the Settlement Agreement

is terminated. In addition, the cost of pursuing collection of the Arbitral

Award could be substantial and there is no assurance that we would be

successful. Failure to otherwise collect the Arbitral Award if the Settlement

Agreement is terminated, or a substantial passage of time before we are able to

otherwise collect the Arbitral Award, would have a material adverse effect on

the Company, including our ability to service debt and maintain sufficient

liquidity to operate as a going concern.

Risks Related to the Class A Common Shares

The price and liquidity of

our Class A Common Shares may be volatile.

The market price of our Class A Common

Shares may fluctuate based on a number of factors, some of which are beyond our

control, including:

·

the lack of an active market for our Class A Common Shares and

large sell or buy transactions may affect the market price;

·

developments with respect to the Settlement Agreement or the

efforts of the Company and Venezuela to form and operate the Mixed Company;

·

developments in our other efforts to collect the Arbitral Award

and/or sell the Mining Data, if the Settlement Agreement is terminated;

·

economic and political developments in Venezuela;

·

our ability to obtain additional financing for working capital,

capital expenditures, acquisitions or general purposes;

·

shareholder dilution resulting from restructuring or refinancing

our outstanding convertible notes and interest notes;

·

the public’s reaction to announcements or filings by us or other

companies;

·

the public’s reaction to negative news regarding Venezuela and/or

international responses to Venezuelan domestic and international policies

announcements or filings by us or other companies;

·

the price of gold, copper and silver; and

·

the addition to or changes to existing personnel.

The effect of these and other factors on

the market price of the Class A Common Shares has historically made our share

price volatile and suggests that our share price will continue to be volatile

in the future.

We may issue additional

Class A Common Shares, debt instruments convertible into Class A Common Shares

or other equity-based instruments to fund future operations, including in

connection with the funding of the Brisas-Cristinas Project.

We cannot predict the size of any future

issuances of securities, or the effect, if any, that future issuances and sales

of our securities will have on the market price of our Class A Common Shares.

Any transaction involving the issuance of previously authorized but unissued

shares, or securities convertible into shares, may result in dilution to

present and prospective holders of shares.

We do not intend to pay cash dividends or make other

distributions to shareholders unless we collect the Arbitral Award, or some

portion thereof, in the foreseeable future.

We have not

declared or paid any dividends on our Class A Common Shares since 1984. We may

declare cash dividends or make distributions in the future only if our earnings

and capital are sufficient to justify the payment of such dividends or

distributions. Regarding the collection of the Arbitral Award and/or payment

for the Mining Data, subject to applicable regulatory requirements regarding

capital and reserves for operating expenses, accounts payable and taxes, we

expect to distribute, in the most cost efficient manner, a substantial majority

of any net proceeds pursuant to the Arbitral Award after fulfillment of our

corporate obligations.

Other Risks

Related to the Business

Operating losses are expected to continue.

We have no commercial production at this

time and, as a result, we have not recorded revenue or cash flows from mining

operations and have experienced losses from operations for each of the last

five years, a trend we expect to continue unless and until the Arbitral Award

is collected, proceeds from the sale of the Mining Data are collected and/or we

acquire or invest in alternative projects such as the Brisas-Cristinas Project

and we achieve commercial production.

Failure to attract new and/or retain existing personnel

could adversely affect us.

We are dependent upon the

abilities and continued participation of existing personnel to manage

activities related to the Settlement Agreement and the formation and operation

of the Mixed Company, other efforts related to the enforcement and collection

of the Arbitral Award and sale of the Mining Data and to identify, acquire and

develop new opportunities. Substantially all of our existing management

personnel have been employed by us for over 20 years. The loss of existing

employees (in particular those long time management personnel possessing

important historical knowledge related to the Brisas Project which is relevant

to the Brisas arbitration) or an inability to obtain new personnel necessary to

provide the contemplated services to the Mixed Company or to pursue future

efforts to acquire and develop new projects could have a material adverse

effect on our future operations.

Risks inherent in the

mining industry could adversely impact future operations.

Exploration for gold and other

metals is speculative in nature, involves many risks and frequently is

unsuccessful. As is customary in the industry, not all prospects will be

positive or progress to later stages (e.g., the feasibility, permitting,

development and operating stages), therefore, we can provide no assurances as

to the future success of our efforts related to the Brisas-Cristinas Project

and our LMS Gold Project. Exploration programs entail risks relating to

location, metallurgical processes, governmental permits and regulatory

approvals and the construction of mining and processing facilities. Development

can take a number of years, requiring substantial expenditures and there is no

assurance that we will have, or be able to raise, the required funds to engage

in these activities or to meet our obligations with respect to the

Brisas-Cristinas Project and the LMS Gold Project. Any one or more of these

factors or occurrence of other risks could cause us not to realize the

anticipated benefits of an acquisition of properties or companies.

U.S. Internal

Revenue Service designation as a “passive foreign investment company” may

result in adverse U.S. tax consequences to U.S. Holders.

U.S. taxpayers

should be aware that we have determined that we were a “passive foreign

investment company” (a “

PFIC

”) under Section 1297(a) of the U.S.

Internal Revenue Code (the “

Code

”) for the taxable year

ended December 31, 2015, we may be a PFIC for the current

taxable year, and we may continue to be a PFIC for future taxable years. We do

not believe that any of the Company’s subsidiaries were PFICs as to any

shareholder of the Company for the taxable year ended December 31, 2015,

however, due to the complexities of the PFIC determination detailed below, we

cannot guarantee this belief and, as a result, we cannot determine that the

Internal Revenue Service (the “

IRS

”) would not take the position that

certain subsidiaries are not PFICs. The determination of whether the Company

and any of its subsidiaries will be a PFIC for a taxable year depends, in part,

on the application of complex U.S. federal income tax rules, which are subject

to differing interpretations. In addition, whether the Company and any of its

subsidiaries will be a PFIC for any taxable year generally depends on the

Company’s and its subsidiaries’ assets and income over the course of each such

taxable year and, as a result, cannot be predicted with certainty as of the

date of this prospectus. Accordingly, there can be no assurance that the

Company and any of its subsidiaries will not be a PFIC for any taxable year.

For taxable years

in which the Company is a PFIC, any gain recognized on the sale of the Company’s

Class A Common Shares and any “excess distributions” (as specifically defined)

paid on the Company’s Class A Common Shares must be ratably allocated to each

day in a U.S. taxpayer’s holding period for the Class A Common Shares. The

amount of any such gain or excess distribution allocated to prior years of such

U.S. taxpayer’s holding period for the Class A Common Shares generally will be

subject to U.S. federal income tax at the highest tax rate applicable to

ordinary income in each such prior year, and the U.S. taxpayer will be required

to pay interest on the resulting tax liability for each such prior year,

calculated as if such tax liability had been due in each such prior year.

Alternatively, a

U.S. taxpayer that makes a timely and effective “QEF election” generally will

be subject to U.S. federal income tax on such U.S. taxpayer’s pro rata share of

the Company’s “net capital gain” and “ordinary earnings” (calculated under U.S.

federal income tax rules), regardless of whether such amounts are actually

distributed by the Company. For a U.S. taxpayer to make a QEF election, the

Company must agree to supply annually to the U.S. taxpayer the “PFIC Annual

Information Statement” and permit the U.S. taxpayer access to certain

information in the event of an audit by the U.S. tax authorities. We will

prepare and make the statement available to U.S. taxpayers, and will permit

access to the information. As a possible second alternative, a U.S. taxpayer

may make a “mark-to-market election” with respect to a taxable year in which

the Company is a PFIC and the Class A Common Shares are “marketable stock” (as

specifically defined). A U.S. taxpayer that makes a mark-to-market election

generally will include in gross income, for each taxable year in which the

Company is a PFIC, an amount equal to the excess, if any, of (a) the fair

market value of the Class A Common Shares as of the close of such taxable year

over (b) such U.S. taxpayer’s adjusted tax basis in such Class A Common Shares.

There are material tax risks associated

with holding and selling or otherwise disposing the Class A Common Shares.

There are material

tax risks associated with holding and selling or otherwise disposing the Class

A Common Shares, which are described in more detail under “

Taxation

.”

Each prospective investor is urged to consult its own tax advisor regarding the

tax consequences to him or her with respect to the ownership and disposition of

the Class A Common Shares.

It may be difficult to bring certain actions or

enforce judgments against the Company and/or its directors and executive

officers.

Investors in the U.S. or in other

jurisdictions outside of Canada may have difficulty bringing actions and

enforcing judgments against us, our directors or executive officers based on

civil liability provisions of federal securities laws or other laws of the U.S.

or any state thereof or the equivalent laws of other jurisdictions of

residence. We are organized under the laws of Alberta, Canada. Some of our

directors and officers, and some of the experts named from time to time in our

filings, are residents of Canada or otherwise reside outside of the U.S. and

all or a substantial portion of their and our assets, may be located outside of

the U.S. As a result, it may be difficult for investors in the U.S. or outside

of Canada to bring an action in the U.S. against our directors, officers or

experts who are not resident in the U.S. It may also be difficult for an

investor to enforce a judgment obtained in a U.S. court or a court of another

jurisdiction of residence predicated upon the civil liability provisions of

Canadian securities laws or U.S. federal securities laws or other laws of the

U.S. or any state thereof against us or those persons.

As a foreign private issuer in the United States, we are subject to

different U.S. securities laws and rules than a domestic U.S. issuer.

We are a

foreign private issuer under the Exchange Act and, as a result, are exempt from

certain rules under the Exchange Act. The rules we are exempt from include the

proxy rules that impose certain disclosure and procedural requirements for

proxy solicitations. In addition, we are not required to file periodic reports

and financial statements with the SEC as frequently, promptly or in as much

detail as U.S. companies with securities registered under the Exchange Act. We

are not required to comply with Regulation FD, which imposes certain

restrictions on the selective disclosure of material information. Moreover,

our officers, directors and principal shareholders are exempt from the

reporting and short-swing profit recovery provisions of Section 16 of the

Exchange Act and the rules under the Exchange Act with respect to their

purchases and sales of our Class A Common Shares.

PLAN OF DISTRIBUTION

Each Selling Shareholder and any of its

pledgees, assignees and successors-in-interest may, from time to time, sell any

or all of such Selling Shareholder’s Securities covered by this prospectus on

any securities exchange, market or trading facility on which the Securities are

traded or in private transactions. These sales may be at fixed or negotiated

prices. Each Selling Shareholder may use any one or more of the following

methods when selling Securities:

·

ordinary brokerage transactions and transactions in which the

broker-dealer solicits purchasers;

·

block trades in which the broker-dealer will attempt to sell the

Securities as agent but may position and resell a portion of the block as

principal to facilitate the transaction;

·

purchases by a broker-dealer as principal and resale by the

broker-dealer for its account;

·

an exchange distribution in accordance with the rules of the

applicable exchange;

·

privately negotiated transactions;

·

settlement of short sales entered into after the effective date

of the registration statement of which this prospectus is a part;

·

in transactions through broker-dealers that agree with such Selling

Shareholder to sell a specified number of such Securities at a stipulated price

per share;

·

through the writing or settlement of options or other hedging

transactions, whether through an options exchange or otherwise;

·

a combination of any such methods of sale; or

·

any other method permitted pursuant to applicable law.

Our Class A Common Shares are listed for

trading on the TSXV under the symbol “GRZ.V.” Each Selling Shareholder may

also sell Securities under Rule 144 or any other exemption from registration

available to such Selling Shareholder under the Securities Act, if available,

rather than under this prospectus. Broker-dealers engaged by a Selling Shareholder

may arrange for other brokers-dealers to participate in sales. Broker-dealers

may receive commissions or discounts from the Selling Shareholders (or, if any

broker-dealer acts as agent for the purchaser of shares, from the purchaser) in

amounts to be negotiated, but, except as set forth in a supplement to this

prospectus, in the case of an agency transaction not in excess of a customary

brokerage commission, in compliance with FINRA Rule 2440; and in the case of a

principal transaction a markup or markdown, in compliance with FINRA IM-2440.

In connection with the sale of the

Securities or interests therein, the Selling Shareholders may enter into

hedging transactions with broker-dealers or other financial institutions, which

may in turn engage in short sales of the Securities in the course of hedging

the positions they assume. The Selling Shareholders may also sell Securities

short and deliver these Securities to close out their short positions, or loan

or pledge the Securities to broker-dealers that in turn may sell these

Securities. The Selling Shareholders may also enter into option or other

transactions with broker-dealers or other financial institutions or create one

or more derivative securities which require the delivery to such broker-dealer

or other financial institution of Securities offered by this prospectus, which

Securities such broker-dealer or other financial institution may resell

pursuant to this prospectus (as supplemented or amended to reflect such

transaction).

The Selling Shareholders and any

broker-dealers or agents that are involved in selling the Securities may be

deemed to be an “underwriter” within the meaning of the Securities Act in

connection with such sales. In such event, any commissions received by such

broker-dealers or agents and any profit on the resale of the Securities

purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. Each Selling Shareholder has informed us that it

does not have any written or oral agreement or understanding, directly or

indirectly, with any person to distribute the Securities. In no event shall

any broker-dealer receive fees, commissions and markups which would exceed 8%

in the aggregate.

We are required

to pay certain fees and expenses incurred by us incident to the registration of

the Securities as described under “

Expenses

.”

Because a Selling Shareholder may be

deemed to be an “underwriter” within the meaning of the Securities Act, it will

be subject to the prospectus delivery requirements of the Securities Act,

including Rule 172 thereunder. Each Selling Shareholder has advised us that

there is no underwriter or coordinating broker acting in connection with the

proposed sale of the Securities by such Selling Shareholder.

Under applicable rules and regulations

under the Exchange Act, any person engaged in the distribution of the

Securities may not simultaneously engage in market making activities with

respect to the Securities for the applicable restricted period, as defined in

Regulation M, prior to the commencement of the distribution. In addition, the Selling

Shareholders will be subject to applicable provisions of the Exchange Act and

the rules and regulations thereunder, including Regulation M, which may limit

the timing of purchases and sales of shares of the Securities by the Selling

Shareholders or any other person. We will make copies of this prospectus

available to the Selling Shareholders and have informed them of the need to

deliver a copy of this prospectus to each purchaser at or prior to the time of

the sale (including by compliance with Rule 172 under the Securities Act).

EXCHANGE CONTROLS

There are currently no laws, decrees,

regulations or other legislation in Canada that restricts the export or import

of capital, including the availability of cash and cash equivalents for use by

the Company’s group, or that affects the remittance of dividends, interest or

other payments to non-resident holders of our Class A Common Shares other than

withholding tax requirements. There is no limitation imposed by Canadian law

or by our Articles of Continuance (which are deemed to be the Articles of

Incorporation of the Company upon our continuance under the ABCA pursuant to

which we changed our legal domicile to Alberta, Canada) or by-laws on the

rights of a non-resident of Canada to hold or vote our Class A Common Shares,

other than as provided in the North American Free Trade Agreement

Implementation Act (Canada) and in the Investment Canada Act, as amended by the

World Trade Organization Agreement Implementation Act.

The Investment Canada Act requires

notification and, in certain cases, advance review and approval by the

Government of Canada of the acquisition by a “non-Canadian” of “control of a

Canadian business,” all as defined in the Investment Canada Act. Generally the

threshold for review will be higher in monetary terms, and in certain cases an

exemption will apply, for an investor ultimately controlled by persons who are

nationals of a WTO Member or have the right of permanent residence in relation

thereto.

INSPECTION OF DOCUMENTS

Copies of the documents referred to in

this prospectus, or in the registration statement, may be inspected at our

corporate office at 926 W. Sprague Avenue, Suite 200, Spokane, Washington

99201, during normal business hours.

TAXATION

Certain Material U.S. Federal Income Tax Considerations for U.S.

Holders

Certain material U.S. federal income tax considerations

.

The following is a summary of certain material U.S. federal income

tax considerations relating to the acquisition, ownership and disposition of

Class A Common Shares by U.S. Holders (as defined herein).

This

summary is for general information purposes only and does not purport to be a

complete analysis or listing of all potential U.S. federal income tax

consequences that may apply to a U.S. Holder. This summary does not take into

account the U.S. federal income tax consequences related to any facts or circumstances

of any particular U.S. Holder. Accordingly, this summary is not intended to

be, and should not be construed as, legal or U.S. federal income tax advice

with respect to any U.S. Holder. Each U.S. Holder should consult his, her or

its own tax advisor regarding the U.S. federal income tax consequences relating

to the acquisition, ownership and disposition of Class A Common Shares.

Authorities

.

This

summary is based on the Code, temporary, proposed and final Treasury

Regulations promulgated thereunder, published rulings of the IRS, published

administrative positions of the IRS and U.S. court decisions that are

applicable and, in each case, as in effect and available, as of the date

hereof. All of the authorities on which this summary is based are subject to

differing interpretations and could be changed in a material and adverse manner

at any time, and any such change could be applied on a retroactive basis. In

such event, the U.S. federal income tax consequences applicable to a U.S.

Holder could materially differ from those described in this summary. This

summary does not discuss the potential effects, whether adverse or beneficial,

of any proposed legislation that, if enacted, could be applied on a retroactive

or prospective basis.

U.S. Holders

. For purposes of this summary, a “

U.S. Holder

” is a

beneficial owner of Class A Common Shares that, for U.S. federal income tax

purposes, is (a) an individual who is a citizen or resident of the U.S., (b) a

corporation, or other entity taxable as a corporation for U.S. federal income

tax purposes, that was created or organized in or under the laws of the U.S.,

any state thereof or the District of Columbia, (c) an estate the income of

which is subject to U.S. federal income taxation regardless of its source or

(d) a trust, if (1) a court within the U.S. can exercise primary supervision

over the trust and one or more U.S. persons have the authority to control all

substantial decisions of the trust or (2) the trust was in existence on August 20,

1996, and validly elected to be treated as a U.S. person.

Non-U.S. Holders

. For purposes of this summary, a “

non-U.S. Holder

” is a

beneficial owner of Class A Common Shares other than a U.S. Holder. A non-U.S.

Holder should consult his, her or its own tax advisor regarding the U.S.

federal income tax consequences (including the potential application of and

operation of any income tax treaties) of the acquisition, ownership and

disposition of Class A Common Shares.

U.S. Holders subject to special U.S. federal income tax rules not

addressed

. This

summary applies only to U.S. Holders that hold Class A Common Shares as “capital

assets” within the meaning of Section 1221 of the Code, and it does not purport

to deal with U.S. Holders that are subject to special provisions under the

Code, including U.S. Holders that: (a) are tax-exempt organizations, qualified

retirement plans, individual retirement accounts or other tax-deferred

accounts; (b) are financial institutions, insurance companies, real estate

investment trusts or regulated investment companies; (c) are dealers in

securities, commodities or currencies or U.S. Holders that are traders in

securities or commodities that elect to apply a mark-to-market accounting

method; (d) have a “functional currency” other than the U.S. dollar; (e) are

subject to the alternative minimum tax under the Code; (f) own Class A Common

Shares as part of a straddle, hedging transaction, conversion transaction,

constructive sale or other arrangement involving more than one position; (g) acquired

Class A Common Shares in connection with the exercise of employee stock options

or otherwise as compensation for services; (h) hold the Class A Common Shares

other than as capital assets within the meaning of Section 1221 of the Code; or

(i) own (directly, indirectly, or constructively) 10% or more, by voting power

or value, of our outstanding shares. U.S. Holders that are subject to

special provisions under the Code, including U.S. Holders described immediately

above, should consult their own tax advisors regarding the U.S. federal income

tax consequences of the acquisition, ownership and disposition of Class A

Common Shares.

If a partnership holds Class A Common

Shares, the tax treatment of a partner in the partnership will generally depend

on the status of the partner and the activities of the partnership. This

summary does not address partnerships or partners in partnerships. A person

that is a partner in a partnership that holds Class A Common Shares should

consult his, her or its own tax advisor regarding the tax consequences of the

acquisition, ownership and disposition of Class A Common Shares.

Tax consequences other than U.S. federal income tax consequences

to U.S. Holders not addressed

. Other than the discussion of certain Canadian tax consequences

set forth below, this summary does not address the consequences arising under

U.S. federal estate, gift or excise tax laws or the tax laws of any applicable

foreign, state, local or other jurisdiction. Each U.S. Holder should consult

his, her or its own tax advisor regarding the consequences of any of these laws

on the acquisition, ownership and disposition of Class A Common Shares. In

addition, this summary does not address the U.S. tax consequences to non-U.S.

Holders. Each non-U.S. Holder should consult his, her or its own tax advisor regarding

the U.S. tax consequences of the acquisition, ownership and disposition of

Class A Common Shares.

We have

determined that we have been and may continue to be a “passive foreign

investment company” under the

Code and, as a result,

there may be adverse U.S. tax consequences for U.S. Holders

.

We have determined that we were a PFIC for the taxable year ended

December 31, 2015, we may be a PFIC for the current taxable year, and we may

continue to be a PFIC for future taxable years. Accordingly, special U.S.

federal income tax rules that are summarized below apply to the acquisition,

ownership and disposition of Class A Common Shares.

Passive foreign investment company (PFIC) rules

.

Sections 1291 through 1298 of the Code contain special rules

applicable to non-U.S. corporations that are PFICs. A non-U.S.

corporation will be considered a PFIC if 75% or more of its gross income

(including a pro rata share of the gross income of any company (U.S. or non-U.S.)

in which the corporation is considered to own 25% or more of the shares by

value) in a taxable year is passive income. Alternatively, a non-U.S. corporation

will be considered a PFIC if at least 50% of the assets (averaged over the four

quarter ends of the year) of the corporation (including a pro rata share of the

assets of any company of which the corporation is considered to own 25% or more

of the shares by value) in a taxable year are held for the production of, or

produce, passive income.

We

have been and we may be a PFIC in the current and/or future taxable years. The

determination of whether we and any of our subsidiaries will be a PFIC for a

taxable year depends on (i) the application of complex U.S. federal income tax

rules, which are subject to differing interpretations, and (ii) our, and our

subsidiaries’, assets and income over the course of each such taxable year. As

a result, whether we and any of our subsidiaries will be PFICs for any taxable

year cannot be predicted with certainty as of the date of this prospectus. Accordingly,

there can be no assurance that we and any of our subsidiaries will or will not

be a PFIC for any taxable year.

For

taxable years in which we are a PFIC, each U.S. Holder, in the absence of an

election by such U.S. Holder to treat the Company as a “qualified electing fund”

(a “

QEF election

”), or an election by such U.S. Holder to “mark-to-market”

his or her Class A Common Shares (an “

MTM election

”), as discussed

below, will, upon certain “excess distributions” by the Company or upon

disposition of the Class A Common Shares at a gain, be liable to pay U.S.

federal income tax at the highest tax rate on ordinary income in effect for

each year to which the income is allocated plus interest on the tax, as if the

distribution or gain had been recognized ratably over each day in the U.S.

Holder’s holding period for the Class A Common Shares while we were a

PFIC.

A

U.S. Holder who owns Class A Common Shares during a period when we are a PFIC

will be subject to the foregoing PFIC rules, even if we cease to be a PFIC,

unless such U.S. Holder makes a QEF election in the first year of the U.S.

Holder’s holding period for the Class A Common Shares and in which we are

considered a PFIC (a “

timely QEF election”

). A U.S. Holder that makes a

timely and effective QEF election will not be subject to the adverse taxation

rules for PFICs discussed above with respect excess distributions or gains. Instead,

such U.S. Holder will be subject to U.S. federal income tax on his, her or its

pro rata share of our “net capital gain” and “ordinary earnings” (calculated

under U.S. federal income tax rules), regardless of whether such amounts are

actually distributed by us. A U.S. Holder who makes such a timely QEF election

will also be entitled to treat any future gain on the sale of the Class A Common

Shares as capital gain.

For

a U.S. Holder to make a QEF election, we must agree to supply annually to the

U.S. Holder the “PFIC Annual Information Statement” described in Treasury

Regulations and permit the U.S. Holder access to certain

information

in the event of an audit by the U.S. tax authorities. We will prepare and make

the statement available to U.S. Holders, and will permit access to the

information.

Treasury

Regulations provide that a holder of an option or warrant to acquire stock of a

PFIC may not make a QEF election that will apply to the option or warrant or to

the stock subject to the option or warrant. In addition, if a U.S. Holder owns

Class A Common Shares and has made a QEF election for that stock, the QEF

election will not apply to the stock that is subject to an option or a warrant.

Under Treasury Regulations, if a U.S. Holder holds an option or warrant to

acquire stock of a PFIC, the holding period with respect to the shares of stock

of the PFIC acquired upon exercise of the warrant or option shall include the

period that the warrant or option was held. The general effect of these rules

is that (a) under the adverse taxation rules for PFICs discussed above, excess

distributions and gains realized on the disposition of shares in a PFIC

received upon exercise of a warrant or option will be spread over the entire

holding period for the warrant or option and the shares acquired thereby and

(b) if a U.S. Holder makes a QEF election upon the exercise of the warrant or

option and receipt of the shares, that election generally will not be a timely

QEF election with respect to such shares and thus the adverse taxation rules

with respect to PFICs discussed above will continue to apply.

Therefore,

a U.S. Holder that receive Class A Common Shares upon the exercise of options

or warrants will not be able to make a timely QEF election with respect to such

Class A Common Shares. However, it appears that a U.S. Holder receiving Class

A Common Shares upon the exercise of options or warrants should be able to

avoid the adverse taxation rules for PFICs discussed above with respect to

future excess distributions and gains if such U.S. Holder makes a QEF election

effective as of the first day of the taxable year of such U.S. Holder beginning

after the receipt of such Class A Common Shares, and such U.S. Holder also makes

an election to recognize gain (which will be taxed under the adverse taxation

rules for PFICs rules discussed above) as if such Class A Common Shares were

sold on such date at fair market value (a “

Gain Recognition Election

”).

Each U.S. Holder should consult his, her or its own tax advisor concerning the

advisability of making a Gain Recognition Election to his, her or its

particular circumstances.

As

an alternative to the QEF election, a U.S. Holder may make a MTM election if we

are a PFIC and the Class A Common Shares are “marketable stock” (as

specifically defined under the rules governing MTM elections). We believe the

Class A Common Shares are currently “marketable stock” for this purpose. If a

U.S. Holder makes the MTM election, it must recognize as ordinary income or

loss each year an amount equal to the difference as of the close of the taxable

year (or actual disposition of the Class A Common Shares) between the fair

market value of the Class A Common Shares and his, her or its adjusted tax

basis in the Class A Common Shares. Losses would be allowed only to the extent

of net mark-to-market gain previously included in income by the U.S. Holder

under the election for prior taxable years. If the U.S. Holder makes the MTM

election, distributions from us with respect to the Class A Common Shares will

be treated as if we are not a PFIC, except that the lower tax rate on dividends

for U.S. Holder that are individuals would not be applicable.

Special

rules would apply to a U.S. Holder of the Class A Common Shares for any taxable

year in which we are a PFIC and have one or more subsidiaries that is also a

PFIC as to such U.S. Holder (a “

Subsidiary PFIC

”). In such case, a U.S.

Holder of the Class A Common Shares generally would be deemed to own his, her

or its proportionate interest in any Subsidiary PFIC and would be subject to

the PFIC rules with respect to such Subsidiary PFIC regardless of the

percentage ownership of such U.S. Holder in us. If one of our subsidiaries is

a PFIC and a U.S. Holder does not make a QEF election with respect to such

subsidiary, as described above, the U.S. Holder could incur liability for the

deferred tax and interest charge described above if the Subsidiary PFIC makes a

distribution, or an interest in the Subsidiary PFIC is disposed of in whole or

in part, or the U.S. Holder disposes of all or part of his, her or its Class A

Common Shares. A QEF election must be made separately for each PFIC and thus a

QEF election made with respect to us will not apply to any Subsidiary

PFIC. If one of our subsidiaries is a PFIC, a QEF election for such

subsidiary could accelerate the recognition of taxable income and may result in

the recognition of ordinary income. Additionally, a U.S. Holder of Class A

Common Shares that has made a MTM election for his, her or its Class A Common

Shares could be subject to the PFIC rules with respect to the income of a Subsidiary

PFIC even though the value of the Subsidiary PFIC has already been subject to

tax as a result of the MTM election. A MTM election would not be permitted for

a Subsidiary PFIC.

With certain limited exceptions, a U.S. Holder that is a direct or

indirect shareholder of a PFIC is generally required to file annually an IRS

Form 8621 (Information Return by a Shareholder of a Passive Foreign Investment

Company or Qualified Electing Fund) with its timely filed U.S. federal income

tax return (or directly with the IRS if

the U.S.

Holder is not required to file an income tax return) to report its stock

ownership interest in the PFIC and to report certain other information.

As a result, a U.S. Holder of our Class A Common Shares may be required to file

the IRS Form 8621 for each year that it owns the Class A Common Shares.

Due

to the complexity of the PFIC, QEF election and MTM election rules and the

associated U.S. reporting requirements, each U.S. Holder should consult his,

her or its own tax advisor regarding our and our subsidiaries’ status as PFICs,

the eligibility, manner and advisability of making a QEF election or a MTM

election and how the PFIC rules may affect the U.S. federal income tax

consequences of a U.S. Holder’s acquisition, ownership and disposition of Class

A Common Shares.

Taxation

of Distributions

.

Generally speaking, the gross amount of any dividend

(including any Canadian income taxes withheld) paid by a corporation out of its

current or accumulated earnings and profits (as determined for U.S. federal

income tax purposes) is subject to U.S. federal income taxation. Distributions

in excess of a corporation’s current and accumulated earnings and profits (as

determined for U.S. federal income tax purposes) are generally treated as a

non-taxable return of capital to the extent of a U.S. Holder’s basis in the

corporation’s stock and thereafter as capital gain. Subject to certain

limitations, any Canadian tax withheld is generally creditable or deductible

against a U.S. Holder’s U.S. federal income tax liability.

As

discussed above, we have been and may be a PFIC for the current and/or future

taxable years. As a result, the general rules for distributions, including the

rules for crediting or deducting any Canadian taxes withheld, may be overridden

by the PFIC rules discussed above. The rules applicable to distributions from

a PFIC are complex and depend, in part, on whether a U.S. Holder has made a QEF

election or MTM election. As a result, each U.S. Holder should consult its own

tax advisor regarding the U.S. tax treatment of distributions received with

respect to Class A Common Shares.

Sale or

Exchange of Class A Common Shares

.

Upon a sale or other taxable disposition of stock, a U.S. Holder

will generally recognize capital gain or loss equal to the difference between

the amount realized and the U.S. Holder’s adjusted tax basis in the stock. Capital

gain of a noncorporate U.S. Holder is generally taxed at preferential rates

where the property is held for more than one year. The deductibility of

capital losses is subject to limitations. A U.S. Holder’s gain or loss will

generally be income or loss from sources within the U.S. for foreign tax credit

limitation purposes.

As

discussed above, we have been and may be a PFIC for the current and/or future

taxable years. As a result, the general rules for recognizing gain or loss on

a sale or other taxable disposition of the Class A Common Shares may be

overridden by the PFIC rules discussed above. The rules applicable to sales or

other taxable dispositions of stock in a PFIC are complex and depend, in part,

on whether a U.S. Holder has made a QEF election or MTM election. As a result,

each U.S. Holder should consult its own tax advisor regarding the U.S. tax

treatment of a sale or other taxable disposition of the Class A Common

Shares.

Medicare

Tax

.

A

U.S. Holder that is an individual or estate, or a trust that does not fall into

a special class of trusts that is exempt from such tax, is subject to a 3.8%

tax on the lesser of (1) the U.S. Holder’s “net investment income” for the

relevant taxable year and (2) the excess of the U.S. Holder’s modified adjusted

gross income for the taxable year over a certain threshold (which in the case

of individuals is between $125,000 and $250,000, depending on the individual’s

circumstances). A U.S. Holder’s net investment income generally includes its

dividend or interest income and its net gains from the disposition of

securities, unless such dividend or interest income or net gains are derived in

the ordinary course of the conduct of a trade or business (other than a trade

or business that consists of certain passive or trading activities). Each U.S.

Holder should consult his, her or its own tax advisor regarding the

applicability of the Medicare tax to his, her or its income and gains in

respect of an investment in the Class A Common Shares.

Information

with Respect to Foreign Financial Assets

.

Owners of “specified foreign financial

assets” with an aggregate value in excess of $50,000 (and in some circumstances

a higher threshold) may be required to file an information report with respect

to such assets with their tax returns. “Specified foreign financial assets”

include any financial accounts maintained by foreign financial institutions, as

well as any of the following, but only if they are held for investment and not

held in accounts maintained by financial institutions: (i) stocks and

securities issued by non-U.S. persons; (ii) financial instruments and contracts

that have non-U.S. issuers or counterparties; and (iii) interests in foreign

entities. The Class A Common Shares may be subject to these rules. Each U.S.

Holder should

consult his, her or its own tax advisor

regarding the application of these rules to the ownership of the Class A Common

Shares.

Information Reporting; Backup Withholding

. In general, interest payments, dividend

payments, other taxable distributions on the Class A Common Shares, proceeds

from the disposition of Class A Common Shares and other so-called “reportable

payments” (as defined by the Code) paid by a U.S. paying agent or other U.S. intermediary

to a noncorporate U.S. Holder may be subject to information reporting to the

IRS and possible U.S. backup withholding (currently imposed at a rate of 28%).

Backup withholding generally would not apply to a U.S. Holder that timely

furnishes a correct taxpayer identification number and makes any other required

certifications or if the U.S. Holder is otherwise exempt from backup

withholding. A U.S. Holder that is required to establish his, her or its exempt

status generally must provide such certification on IRS Form W-9 (Request

for Taxpayer Identification Number and Certification) or a substitute Form W-9.

Amounts

withheld as backup withholding may be credited against the U.S. Holder’s U.S. federal

income tax liability. Additionally, a U.S. Holder may obtain a refund of any

excess amounts withheld under the backup withholding regime by timely filing

the appropriate claim for refund with the IRS and furnishing any required

information.

Each

U.S. Holder should consult his, her or its own tax advisor regarding the

information reporting and backup withholding rules.

The

foregoing summary does not discuss all aspects of U.S. taxation that may be

relevant to particular U.S. Holders in light of their particular circumstances

and income tax situations. Each U.S. Holder should consult his, her or

its own tax advisor as to the particular tax consequences to him, her or it of

the acquisition, ownership and disposition of Class A Common Shares, including

the effect of any U.S. federal, state, local, foreign or other tax laws.

Certain

Material Canadian Federal Income Tax Considerations

The following is, as of the date hereof, a general summary of the

principal Canadian federal income tax considerations generally applicable to a

beneficial holder who acquires, holds or disposes of Class A Common Shares

under this prospectus.

This summary is based upon the current provisions of the Income Tax

Act (Canada) and the regulations thereunder (the “

Canadian Tax Act

”),

specific proposals to amend the Canadian Tax Act (the “

Tax Proposals

”)

which have been announced by or on behalf of the Minister of Finance (Canada)

prior to the date hereof, and of the current published administrative policies

and assessing practices of the Canada Revenue Agency (the “

CRA

”). This

summary assumes that the Tax Proposals will be enacted in the form proposed and

does not take into account or anticipate any other changes in law, whether by

way of judicial, legislative or governmental decision or action, nor does it

take into account provincial, territorial or foreign income tax legislation or

considerations, which may differ from the Canadian federal income tax considerations

discussed in this prospectus.

No assurances can be given that the Tax Proposals will be enacted

as proposed or at all, or that legislative, judicial or administrative changes

will not modify or change the statements expressed in this prospectus.

This summary is of a general nature only and is not intended to

be, nor should it be construed to be, legal or tax advice to any particular

holder, and no representations with respect to the income tax consequences to

any particular prospective holder are made. Accordingly, holders should consult

their own tax advisors for advice with respect to the tax consequences to them.

This summary does not apply to any Selling Shareholder and each Selling

Shareholder should consult their own tax advisors prior to selling Class A

Common Shares.

This summary is not applicable to: (i) a holder that is a “financial

institution” (as defined for purposes of the mark-to-market rules); (ii) a

holder that is a “specified financial institution”; (iii) a holder an

interest in which is a “tax shelter investment”; (iv) a holder that has

elected to report

his, her or

its “Canadian tax results” in

a currency other than Canadian currency; or (v) a holder who enters into a

“derivative forward agreement” with respect to the Class A Common Shares (all

as defined in the Canadian Tax Act). Additional considerations, not discussed

herein, may apply to a holder that is a corporation resident in Canada, and

that is, or becomes, controlled by a non-resident

corporation,

for purposes of the foreign affiliate dumping rules in section 212.3 of the

Canadian Tax Act. Any such holders should consult their own tax advisors having

regard to their particular circumstances.

Except as expressly provided, this summary does not deal with

special situations, such as particular circumstances of traders or dealers in

securities, tax exempt entities, insurers and financial institutions.

For the purposes of the Canadian Tax Act, all amounts arising in

respect of the Class A Common Shares must generally be converted into Canadian

dollars based on the applicable noon rate quoted by the Bank of Canada for the

day on which the amounts arise or another rate of exchange that is acceptable

to the Minister of National Revenue (Canada).

Holders

resident in Canada

This portion of the summary is applicable only to a beneficial

holder who, at all relevant times, for the purposes of the Canadian Tax Act:

(i) is, or deemed to be, resident in Canada; (ii) deals at arm’s length with,

and is not affiliated with, us or any person from whom the Class A Common

Shares are acquired; and (iii) holds any Class A Common Shares as capital

property (a “

Resident Holder

”). Any Class A Common Shares will generally

be considered to be capital property to a Resident Holder unless the Resident Holder

holds such properties in the course of carrying on a business or has acquired

them in a transaction or transactions considered to be an adventure in the

nature of trade. Certain Resident Holders whose Class A Common Shares might not

otherwise qualify as capital property may be entitled to make the irrevocable

election provided by subsection 39(4) of the Canadian Tax Act to have such

Class A Common Shares and every other “Canadian security” (as defined by the

Canadian Tax Act) owned by such Resident Holders in the taxation year of the

election and in all subsequent taxation years deemed to be capital property.

Resident Holders should consult their own advisors in light of their own

circumstances in determining whether the Class A Common Shares will be capital

property to them for purposes of the Canadian Tax Act.

Disposition

of Class A Common Shares

A Resident Holder who disposes of or is deemed to have disposed of

a Class A Common Share will realize a capital gain (or a capital loss) equal to

the amount by which the proceeds of disposition in respect of the Class A

Common Share exceed (or are exceeded by) the aggregate of the adjusted cost

base of such Class A Common Share and any reasonable costs of

disposition. In certain circumstances, the amount of any resulting

capital loss must be reduced by the amount of any dividends or deemed dividends

received by the Resident Holder on the Class A Common Share, to the extent and

under the circumstances set forth in the detailed provisions of the Canadian

Tax Act. Such capital gains and capital losses will be subject to tax in

the manner described herein under the sub-heading “Capital gains and losses.”

Capital

gains and losses

One-half of the amount of any capital gain (a “

taxable capital

gain

”) realized by a Resident Holder in a taxation year generally is

included in the Resident Holder’s income for that year, and one-half of the

amount of any capital loss (an “

allowable capital loss

”) realized by a

Resident Holder in a taxation year is deducted from taxable capital gains

realized by the Resident Holder in that year. Allowable capital losses in

excess of taxable capital gains may be carried back and deducted in any of the

three preceding taxation years or carried forward and deducted in any

subsequent taxation year against net taxable capital gains realized in such

years, to the extent and under the circumstances described in the Canadian Tax

Act.

A Resident Holder that is, throughout the relevant taxation year,

a “Canadian-controlled private corporation”, as defined in the Canadian Tax

Act, may be liable to pay a 10 2/3% refundable tax on

their

“aggregate investment income”, which is defined

in the Canadian Tax Act to include taxable capital gains.

Capital gains realized by a Resident Holder who is an individual

(including certain trusts) may give rise to liability for alternative minimum

tax as calculated under the detailed rules set out in the Canadian Tax

Act. Resident Holders who are individuals should consult their own tax

advisors in this regard.

Dividends

on Class A Common Shares

Dividends (including deemed dividends)

received on Class A Common Shares by a Resident Holder who is an individual

(and certain trusts) will be included in income and will be subject to the

gross-up and dividend tax credit rules normally applicable to taxable dividends

received by an individual from taxable Canadian corporations. An enhanced

dividend tax credit will be available in respect of “eligible dividends” (as

defined in the Canadian Tax Act) received or deemed to be received from us.

Taxable dividends (including deemed dividends) received by Resident Holders who

are individuals and certain trusts may give rise to alternative minimum tax

under the Canadian Tax Act.

Dividends (including deemed dividends) received on Class A Common

Shares by a Resident Holder that is a corporation will be included in income

and normally will be deductible in computing such corporation’s taxable income.

However, the Canadian Tax Act will generally impose a 38 1/3% refundable tax on

such dividends received by a corporation that is a “private corporation” or a “subject

corporation” for purposes of Part IV of the Canadian Tax Act to the extent that

such dividends are deductible in computing the corporation’s taxable income. In

certain circumstances, subsection 55(2) of the Canadian Tax Act will deem a

taxable dividend received by a Resident Holder that is a Corporation to be

proceeds of a disposition or a capital gain. Such Resident Holder should

consult their own tax advisor having regard to their own circumstances.

Holders

not resident in Canada

This portion of the summary is applicable to a beneficial holder

who, at all relevant times for purposes of the Canadian Tax Act: (i) is not

resident or deemed to be resident in Canada; (ii) deals at arm’s length with,

and is not affiliated with, us and any person from whom the Class A Common

Shares are acquired; and (iii) does not use or hold, and is not deemed to use

or hold such shares in the course of carrying on, or otherwise in connection

with, a business carried on in Canada (a “

Non-Resident Holder

”). This

summary does not apply to an insurer who carries on an insurance business in

Canada and elsewhere.

Acquisition,

holding and disposition of Class A Common Shares

Dividends on Class A Common Shares paid or credited to a

Non-Resident Holder by us are subject to Canadian non-resident withholding tax

at the rate of 25%, subject to a reduction of such rate under an applicable

income tax convention. The rate of withholding tax on dividends paid by us to a

Non-Resident Holder that is a resident of the United States and that is

entitled to the full benefits of the Canada United States Income Tax Convention

(the “

Convention

”) is generally limited to 15% of the gross amount of

the dividend (or 5% in the case of a Non-Resident Holder that is a corporation

beneficially owning at least 10% of our voting stock). Under the Convention,

dividends paid by us to certain religious, scientific, charitable, certain

other tax-exempt organizations and certain pension organizations that are

resident in, and exempt from tax in, the United States are exempt from Canadian

non-resident withholding tax. Provided that certain administrative procedures

are observed regarding registration of such organizations, we will not be

required to withhold such tax from dividends paid to such organizations. If

qualifying organizations fail to follow the required administrative procedures,

we will be required to withhold tax and the organizations will have to file

with the CRA a claim for refund to recover amounts withheld.

A Non-Resident Holder will generally not be subject to tax under

the Canadian Tax Act in respect of a capital gain realized on the disposition

of a Class A Common Share unless the Class A Common Share constitutes “taxable

Canadian property” as defined in the Canadian Tax Act at the time of the

disposition and the Non-Resident Holder is not entitled to relief under an

applicable income tax convention between Canada and the country in which the

Non-Resident Holder is a resident. A Class A Common Share that is listed on a

designated stock exchange (which includes the TSXV) will generally not be

taxable Canadian property to a Non-Resident Holder unless at any time during

the 60-month period immediately preceding the disposition: (i) (a) the

Non-Resident Holder, (b) persons with whom the Non-Resident Holder did not deal

at arm’s length, (c) partnerships in which the Non-Resident Holder or a person

described in (b) held a membership interest directly or indirectly through one

or more partnerships, or (d) the Non-Resident Holder together with one or more

persons described in (b) and (c), owned 25% or more of the issued shares of any

class or series of our capital stock; and (ii) more than 50% of the fair market

value of the Class A Common Share was derived directly or indirectly from

certain resource properties, timber resource properties, real or immovable

properties situated in Canada, or options in respect of, or interests in, or

for civil law rights in, any of the foregoing whether or not the property

exists (or any combination thereof). Notwithstanding the foregoing, in certain

circumstances set out in the Canadian Tax Act, Class A Common Shares

could be deemed to be taxable Canadian property.

Non-Resident Holders whose Class A Common Shares may constitute taxable

Canadian property should consult their own tax advisor.

DISCLOSURE OF COMMISSION

POSITION ON INDEMNIFICATION

FOR SECURITIES ACT LIABILITY

Insofar as

indemnification for liabilities arising under the Securities Act may be

permitted to directors, officers or persons c

o

ntrolling us, we have been informed that in the opinion of

the SEC such indemnification is against public policy as expressed in the

Securities Act and is therefore unenforceable.

We have not

authorized any dealer, sales person or any other person to give any information

or to represent anything not contained in this prospectus. You must not rely on

any unauthorized information. This prospectus does not offer to sell or buy

any securities in any jurisdiction where it is unlawful.

LEGAL MATTERS

The validity of

the Class A Common Shares offered by this prospectus and certain other matters

has been passed upon for us by Norton Rose Fulbright Canada LLP.

EXPERTS

The consolidated

financial statements and management’s assessment of the effectiveness of

internal control over financial reporting (which is included in Management’s

Report on Internal Control over Financial Reporting included in Exhibit 99.2 to

the Form 40-F) incorporated in this prospectus by reference to the Annual

Report on Form 40-F for the year ended December 31, 2015, have been so

incorporated in reliance on the report of PricewaterhouseCoopers LLP, independent

auditor, given on the authority of said firm as experts in auditing and

accounting.

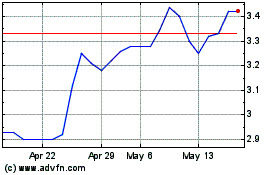

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Feb 2024 to Feb 2025