UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of

Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934

For the month of November

2021

Commission File Number: 001-31819

Gold Reserve Inc.

(Exact name of registrant as specified in its charter)

999 W. Riverside Avenue, Suite 401

Spokane, Washington 99201

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ¨

Form 40-F x

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by furnishing

the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked,

indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

This Report on Form 6-K

and the exhibits attached hereto are hereby incorporated by reference into Gold Reserve Inc.’s (the “Company”) current

Registration Statements on Form F-3 and Form S-8 on file with the U.S. Securities and Exchange Commission (the “SEC”).

The following exhibits are furnished with this Form

6-K:

99.1 September 30, 2021 Interim Consolidated Financial Statements

99.2 September 30, 2021 Management’s Discussion and Analysis

99.3 Chief Executive Officer’s Certification of Interim Filings

99.4 Chief Financial Officer’s Certification of Interim Filings

The information presented

or incorporated by reference in this report contains both historical information and "forward-looking statements" (within the

meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act) or "forward-looking information" (within the

meaning of applicable Canadian securities laws) (collectively referred to herein as "forward-looking statements") that may state

our intentions, hopes, beliefs, expectations or predictions for the future.

Forward-looking statements

are necessarily based upon a number of estimates and assumptions that, while considered reasonable by us at this time, are inherently

subject to significant business, economic and competitive uncertainties and contingencies that may cause our actual financial results,

performance or achievements to be materially different from those expressed or implied herein, many of which are outside our control.

Forward-looking statements

involve risks and uncertainties, as well as assumptions, including those set out herein, that may never materialize, prove incorrect or

materialize other than as currently contemplated which could cause our results to differ materially from those expressed or implied by

such forward-looking statements. The words "believe," "anticipate," "expect," "intend," "estimate,"

"plan," "may," "could" and other similar expressions that are predictions of or indicate future events and

future trends, which do not relate to historical matters, identify forward-looking statements, although not all forward-looking statements

contain these words. Any such forward-looking statements are not intended to provide any assurances as to future results.

Numerous factors could

cause actual results to differ materially from those described in the forward-looking statements, including, without limitation:

|

|

●

|

risks associated with the substantial concentration of our activities and

assets in Venezuela which are and will continue to be subject to risks specific to Venezuela, including the effects of political, economic

and social developments, social instability and unrest; international response to Venezuelan domestic and international policies; Sanctions

(as defined below) by the U.S. or Canadian governments or other jurisdictions and potential invalidation, confiscation, expropriation

or rescission of governmental orders, permits, agreements or property rights either by the existing or a future administration or power,

de jure or de facto;

|

●

risks associated with sanctions imposed by the U.S. and Canadian governments targeting the Bolivarian

Republic of Venezuela ("Venezuela") (the "Sanctions"):

|

|

-

|

Sanctions imposed by the U.S. government generally block all property of

the government of Venezuela and prohibit the Company and its directors, management and employees (who are considered U.S. Persons as defined

by U.S. Sanction statutes) from dealing with the Venezuelan government and/or state-owned/controlled entities, entering into certain transactions

or dealing with Specially Designated Nationals ("SDNs") and target corruption in, among other identified sectors, the gold sector

of the Venezuelan economy,

|

|

|

-

|

Sanctions imposed by the Canadian government include asset freezes and prohibitions

on dealings, by Canadian entities and/or citizens as well as other individuals in Canada, with certain named Venezuelan officials under

the Special Economic Measures (Venezuela) Regulations of the Special Economic Measures Act and the Justice for Victims of Corrupt Foreign

Officials Regulations of the Justice for Victims of Corrupt Foreign Officials Act (Sergei Magnitsky Law),

|

|

|

-

|

Sanctions have adversely impacted our ability to collect the remaining funds

owed by Venezuela and our ability to finance, develop and operate the Siembra Minera Project, which is expected to continue for an indeterminate

period of time;

|

●

risks that U.S. and Canadian government agencies that enforce Sanctions may not issue licenses that

the Company may request in the future to engage in certain Venezuela-related transactions;

●

risks associated with the continued failure by Venezuela to honor its remaining commitments under

the Settlement Agreement (as defined below). As of the date of this report, Venezuela still owes the Company an estimated $920 million

(including interest of approximately $142 million) related to the original settlement obligation of approximately $1.032 billion, which

was payable in a series of monthly payments ending on or before June 15, 2019 (the "Settlement Agreement");

●

risks associated with our ability to resume our efforts to enforce and collect the September 2014

arbitral award granted pursuant to the Additional Facility Rules of the International Centre for the Settlement of Investment Disputes

(the "Award"). These risks include incurring the costs of enforcement and collection of the Award and the timing and success

of that effort, if Venezuela ultimately fails to honor its commitments pursuant to the Settlement Agreement, it is terminated and further

efforts related to executing the Settlement Agreement are abandoned;

|

|

●

|

risks associated with the announced phase out of LIBOR and our ability,

if and when it's possible to engage with the Venezuelan government, to either agree with Venezuela on a new interest benchmark or, alternatively,

petition the court responsible for the enforcement of our Award judgement to rule on a new benchmark;

|

●

risks associated with Venezuela's failure to honor its remaining commitments associated with the

formation and operation of Siembra Minera (a company formed to develop the Siembra Minera Project (as defined below) which is comprised

of certain gold, copper, silver and other strategic mineral rights located in Bolivar State, Venezuela);

●

risks associated with the ability of the Company and Venezuela to (i) successfully overcome legal

or regulatory obstacles to operate Siembra Minera for the purpose of developing the Siembra Minera Project, (ii) complete any additional

definitive documentation and finalize remaining governmental approvals and (iii) obtain financing to fund the capital costs of the Siembra

Minera Project;

●

risks associated with filing a claim, if warranted, for damages against Venezuela in the event they

breach the terms of the underlying agreements governing the formation of Siembra Minera and the future development of the Siembra Minera

Project. The cost of prosecuting such a claim over a number of years could be substantial, and there is no assurance that we would be

successful in our claim or, if successful, could collect any compensation from the Venezuelan government. If we are unable to prevail,

in the event we filed a claim against the Venezuelan government related to our stake in the Siembra Minera Project or were unable to collect

compensation in respect of our claim, the Company would be adversely affected;

|

|

●

|

risks associated with the existence of "dual" governments in Venezuela

as a result of certain non-Venezuelan countries (including the United States and Canada) recognizing a presidency and government led by

Juan Guaidó, instead of Nicolás Maduro, including associated challenges as to governing and decision-making authority related

thereto, and the U.S. government's previous indictment of Venezuelan President Nicolás Maduro and a number of key associates for

human rights abuses and drug trafficking;

|

|

|

●

|

risks that any future Venezuelan administration or power, de jure or de

facto, will fail to respect the agreements entered into by Gold Reserve and Venezuela, including past or future actions of any branch

of Government challenging the formation of Siembra Minera and Presidential Decree No. 2.248 creating the National Strategic Development

Zone Mining Arc of the Orinoco;

|

●

the risk that the conclusions of management and its qualified consultants contained in the Preliminary

Economic Assessment of the Siembra Minera Gold Copper Project in accordance with Canadian National Instrument 43-101-

Standards of Disclosure for Mineral Projects ("NI 43-101") may not be realized in the future;

●

risks associated with exploration, delineation of sufficient reserves, regulatory and permitting

obstacles and other risks associated with the development of the Siembra Minera Project;

●

risks associated with our ability to service outstanding obligations as they come due and access

future additional funding, when required, for ongoing liquidity and capital resources, pending the receipt of payments under the Settlement

Agreement or collection of the Award in the courts;

●

risks associated with our prospects in general for the identification, exploration and development

of mining projects and other risks normally incident to the exploration, development and operation of mining properties, including our

ability to achieve revenue producing operations in the future;

|

|

●

|

risks that estimates and/or assumptions required to be made by management

in the course of preparing our financial statements are determined to be inaccurate, resulting in a negative impact on the reported amounts

of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts

of revenues and expenses during the reporting period;

|

●

risks associated with shareholder dilution resulting from the future sale of additional equity, if

required;

●

risks associated with the value realized, if any, from the disposition of the assets related to our

previous mining project in Venezuela known as the "Brisas Project";

●

risks associated with the abilities of and continued participation by certain employees;

●

risks associated with the impact of current or future U.S., Canadian and/or other jurisdiction's

tax laws to which we are or may be subject; and

●

risks associated with the impact of new diseases, epidemics and pandemics, including the effects

and potential effects of the global coronavirus disease (COVID-19) pandemic.

See “Risk Factors” contained in

our Annual Information Form and Annual Report on Form 40-F filed on www.sedar.com and www.sec.gov, respectively for additional risk factors

that could cause results to differ materially from forward-looking statements.

Investors are cautioned

not to put undue reliance on forward-looking statements, and investors should not infer that there has been no change in our affairs since

the date of this report that would warrant any modification of any forward-looking statement made in this document, other documents periodically

filed with the U.S. Securities and Exchange Commission (the "SEC"), the Ontario Securities Commission or other securities regulators

or presented on the Company's website. Forward-looking statements speak only as of the date made. All subsequent written and oral forward-looking

statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this notice. We disclaim any

intent or obligation to update publicly or otherwise revise any forward-looking statements or the foregoing list of assumptions or factors,

whether as a result of new information, future events or otherwise, subject to our disclosure obligations under applicable U.S. and Canadian

securities regulations. Investors are urged to read the Company's filings with U.S. and Canadian securities regulatory agencies, which

can be viewed online at www.sec.gov and www.sedar.com, respectively. The forward-looking information contained herein is presented for

the purpose of assisting investors in understanding the Company’s expected financial and operational performance and results as

at and for the periods ended on the dates presented in the Company’s plans and objectives and may not be appropriate for other purposes.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: November 9, 2021

GOLD RESERVE INC. (Registrant)

By: /s/ Robert A. McGuinness

Robert A. McGuinness, its Vice President of Finance,

Chief Financial Officer and its Principal Financial

and Accounting Officer

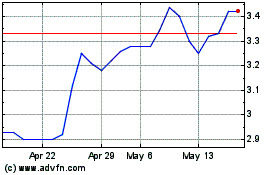

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Feb 2024 to Feb 2025