Graphite to

follow in lithium's footsteps

October 20, 2021 -- InvestorsHub

NewsWire -- via aheadoftheherd.com -- A

lithium-ion (Li-ion) battery is a type of rechargeable battery

technology common to portable electronics, electric vehicles and

large grid-scale storage systems for renewable

energy.

These batteries consist of an

anode, cathode, separator, electrolyte and two current collectors

(positive and negative). The cathode contains lithium, either in

the form of lithium carbonate or lithium hydroxide, while the anode

is made up of graphite. There are no substitutes for either in a

Li-ion battery.

Schematic of a

lithium-ion battery

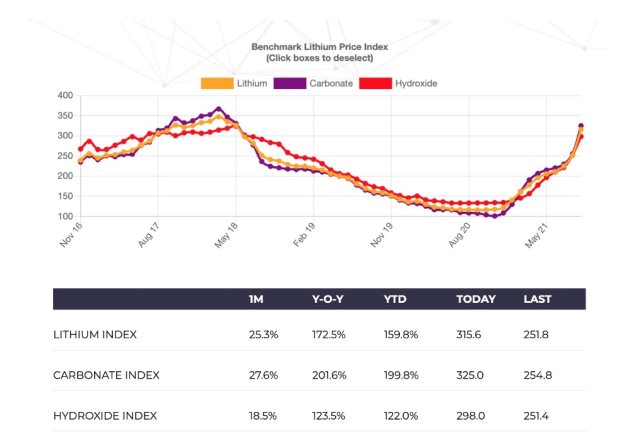

Favorable supply-demand dynamics,

in play mainly due to the growing electrification and

decarbonization trend, have sent lithium prices on a tear.

According to Asian Metal Inc. data, China lithium carbonate has

almost doubled in just two months, and lithium hydroxide is up more

than 70% over the same period. Remember, both lithium products are

used in the lithium-ion battery cathode.

Source:

Benchmark Minerals Intelligence

The rally comes amid a global

push for less polluting energy sources, which has automakers and

battery manufacturers racing to secure supplies of so-called

"future-facing commodities" such as lithium, obviously a key

battery ingredient.

Curiously, a metal that often

gets left out of the hype over lithium-ion batteries is

graphite.

There is no substitute for

graphite in an EV battery and lithium-ion batteries are expected to

be the technology that runs electric vehicles for the foreseeable

future, making graphite indispensable to the global shift towards

clean energy.

Before going deep into the

graphite market, a bit more on lithium and lithium batteries will

illustrate the fundamental shift that is going on, away from fossil

fuels and towards electrification, that will carry both lithium and

graphite along for what is almost certain to be a multi-year

ride.

Lithium has a

hot hand

The global lithium-ion battery

industry is expected to grow at a CAGR

of 16.4% from 2020 to 2025, reaching USD$94.4 billion by 2025 from

$44.2 billion in 2020. Growth will be driven not only by the need

for plug-in electric vehicles and hybrids, but grid storage

applications for which the dominant technology is

lithium-ion.

Demand for lithium carbonate is

expected to rise at a compound annual growth rate (CAGR) of 10-14%

until 2027, while lithium hydroxide demand is seen climbing at a

25-29% CAGR.

A recent study by BloombergNEF

shows that 5.3 times more lithium will be demanded by 2030 compared

to current levels.

Other reputable sources are

equally bullish on EVs and grid-scale electricity

storage.

Fitch Solutions predicts EV sales

to reach over 4.6 million units in 2021. That is 50% more than 2020

which in turn was 36.8% higher than 2019. (despite total passenger

vehicle sales falling last year by 20% due to the

pandemic)

Australian

bank Macquarie forecasts a global EV penetration rate of 16% by 2025

(battery electric vehicles and plug-in hybrids combined), and by

2030, 30% globally and 41% in China — a scenario that would push

spodumene (hard rock) prices above $720 a tonne, lithium carbonate

above $13,000/t, and lithium hydroxide over $16,000/t.

Much of lithium demand is being

pulled by the second-largest electric car market in the world

behind China, the United States.

President Biden has set an

ambitious target to make half of new vehicles sold in 2030

zero-emissions vehicles.

His $1.2 trillion infrastructure

package, passed by the Senate but not yet by the House of

Representatives, includes transitioning the US transportation

system to battery-powered vehicles and supporting renewable wind

and solar energies over carbon-based sources like coal and natural

gas.

An even larger $3.5 trillion

spending package is also under consideration by the House.

It includes:

-

$198 billion in direct payments

to utilities for hitting clean energy goals, providing consumers

with rebates to make homes more energy-efficient, and financing for

domestic manufacturing of clean energy and auto supply chain

technologies;

-

$67 billion to fund

climate-friendly technologies and impose fees on emitters of

methane, to reduce carbon emissions;

-

$37B to electrify the federal

vehicle fleet.

North America relies heavily on

foreign supplies of critical minerals — the raw materials it needs

to become a leader in high technology, transportation, energy, and

defense. Materials like lithium and graphite.

The United is thus scheming to

expand its domestic lithium sources, having listed the battery

metal as a critical mineral back in 2018, to lessen its reliance on

foreign production.

China produces roughly two-thirds

of the world's lithium-ion batteries and controls most of its

processing facilities.

One way to meet the threat of

foreign countries restricting, or embargoing, critical minerals, is

to encourage the domestic exploration and mining of these

metals.

Here at AOTH we have been

advocating for the creation of a "mine to battery" electric vehicle

supply chain in North America for years, something that is finally

appearing on the radar screens of governments, large mining

companies, automakers and battery manufacturers.

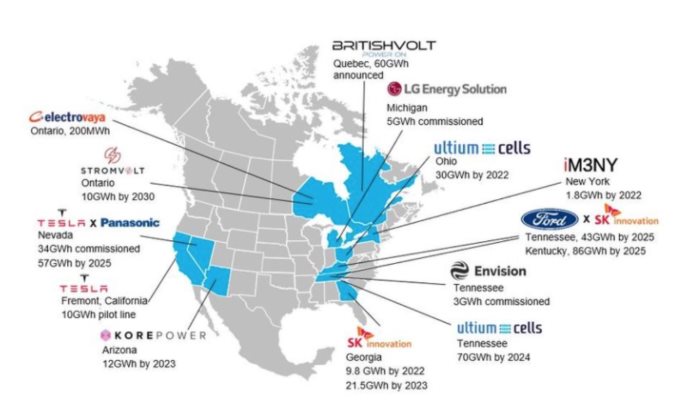

There are a number of battery

plants in the works to join Tesla, whose first gigafactory in

Nevada started production of battery cells in 2017. The company has

a plant in Buffalo, New York, and plans to open a third (US plant)

in Texas by the end of this year. Tesla also has a "pilot line" at

its facility in Fremont, California, for R&D

technologies.

In 2020 General

Motors announced

plans to install its first battery cell factory in

Ohio, a project called Ultium Cells launched with its Korean

partner LG Chem. The latter opened a plant in Holland, Michigan in

2013.

Another South Korean company, SK

Innovation, is planning on opening the first of two battery plants

in Georgia early next year; the company is a supplier to Volkswagen

and Ford.

The latter along with American

auto icon GM have big plans to electrify their fleets. Ford

announced plans to boost spending on electrification by more than a

third, and aims

to have 40% of its global volume electric by

2030, which translates to

more than 1.5 million EVs based on last year's sales.

GM reportedly aspires to halt all

sales of gas-powered vehicles by 2035, with plans to invest $27

billion in electric and autonomous vehicles over the next five

years.

The latest automaker to commit to

the US electric car market is Toyota, which said

this week it will invest about $3.4 billion on American battery development and

production through 2030.

North American

battery cell manufacturing landscape. Source: BloombergNEF, company

announcements

There are

currently 11

EV start-ups racing to catch up with market leader

Tesla, fueled by money

from Wall Street. They include Rivian out of Irvine, California,

Lucid Motors based in Newark, CA, Lordstown Motors from Ohio,

Nikola Corp (Phoenix), Fisker (Los Angeles), Faraday & Future

(Los Angeles), Canoo (Torrance), NIO, Li Auto and XPing from China,

and Arrival, based in London.

This gives you a sense of the

extent to which the EV lithium battery market in the US is

growing.

Graphite

poised for a breakout

A Tesla Model S with a 70kWh

battery uses 63 kilograms of lithium carbonate equivalent (LCE) —

the standard industry measure of lithium production. The Chevy Bolt

has a 60kWh battery so the weights are comparable.

The average plug-in EV has 70 kg

of graphite.

Every million EVs requires in the

order of 75,000 tonnes of natural graphite. This represents a 10%

increase in flake graphite demand.

In the last section we outlined

the criticality of lithium, however for the US graphite is more

difficult to come by.

Graphite is included on

a list

of 23 critical metals the US Geological Survey has deemed critical

to the national economy and national security.

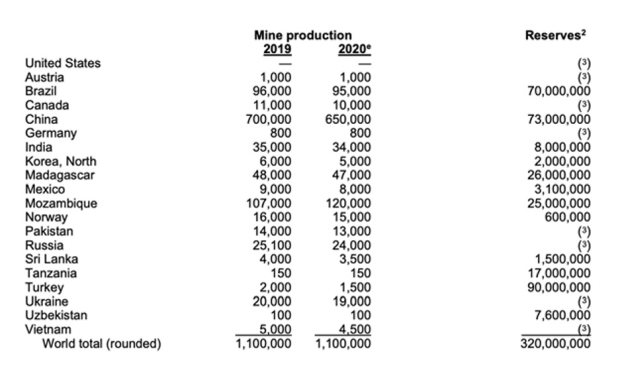

North America produces just 4% of

the world's graphite supply, from mines in Canada and

Mexico. No US natural graphite production was

reported to the USGS in 2019 or 2020.

China, Brazil and Mozambique are

responsible for most graphite mining, with China producing about

two-thirds. More importantly China controls 100% of the market for

spherical graphite, the kind needed for the anode part of a

lithium-ion battery.

Source:

USGS

Source:

USGS

According

to the USGS, in 2020 the

US imported 42,000 tons, of which 71% was high-purity flake

graphite, 28% was amorphous, and 1% was lump and chip graphite. The

top importers were China (33%), Mexico (23%), Canada (17%) and

India (9%). But remember, the US is not 33% dependent on China for

its battery-grade graphite, but 100%, since China controls all

spherical graphite processing.

It's thought that the increased

use of lithium-ion batteries could gobble up well over 1.6 million

tonnes of flake graphite per year (out of a total 2020 market, all

uses, of 1.1Mt) — only flake graphite, upgraded to 99.9%

purity, and synthetic graphite (made from petroleum coke, a very

expensive process) can be used in lithium-ion batteries.

The USGS believes that

large-scale fuel cell applications are being developed that could

consume as much graphite as all other uses combined. Tesla's Nevada

gigafactory alone consumes around 35,000 tons of spherical graphite

per year. We have clearly come to an inflection point much more

graphite needs to be discovered and mined.

Global graphite consumption has

been increasing steadily every year since 2013, although in 2019

there was a reduction of 14%. Roskill expects total graphite demand

over the next 10 years to grow around 5 to 6% per year.

A White House report on critical

supply chains showed that graphite demand for clean energy

applications will require 25 times more graphite by 2040 than was

produced worldwide in 2020.

Remember there is no substitute

for graphite in an EV battery and lithium-ion batteries are

expected to be the technology that runs electric vehicles for the

foreseeable future, making graphite indispensable to the global

shift towards clean energy.

The question is, can the mining

industry crank out 5-6% more graphite every year to match this

demand? There is reason to be skeptical. Between 2018 and 2019,

world mine production actually declined by 20,000 tonnes, or

1.8%. Global production in 2019 and 2020 was

exactly the same, 1.1 million tonnes.

Currently there are no producing

graphite mines in the United States, and only 10,000 tonnes a year

is being mined from two facilities in Canada. The fact is, for the United States to develop

a "mine to battery" supply chain at home, it currently has no

choice but to import its raw materials from foreign

countries.

For battery-grade graphite, that

means China, which is growing increasingly adversarial, in terms of

trade, foreign policy and militarily.

For many years the United States

didn't mind being dependent on out-of-country suppliers for

critical mineral like lithium and graphite. Mining can be messy and

the political will just wasn't there. This is changing, thanks to

politicians like Alaska Senator Lisa Murkowski, who is trying to

reverse this dependency. They like the idea of developing domestic

critical metal mines and are working with the mining industry to

achieve results.

Murkowski helped draft the

bipartisan infrastructure bill currently making its way through the

House of Representatives. The $1.2 trillion proposal includes money

for research and demonstration projects and other efforts aimed at

lessening the reliance on China for the supply of critical minerals

like lithium and graphite.

Another provision calls for

streamlining the permitting process for mining and extracting

critical minerals. It can take 12 years now to line up the federal

permits needed to open a mine, making businesses hesitant to deploy

investment capital.

Graphite

One

Lately Murkowski has been getting

behind efforts to develop what would be America's largest graphite

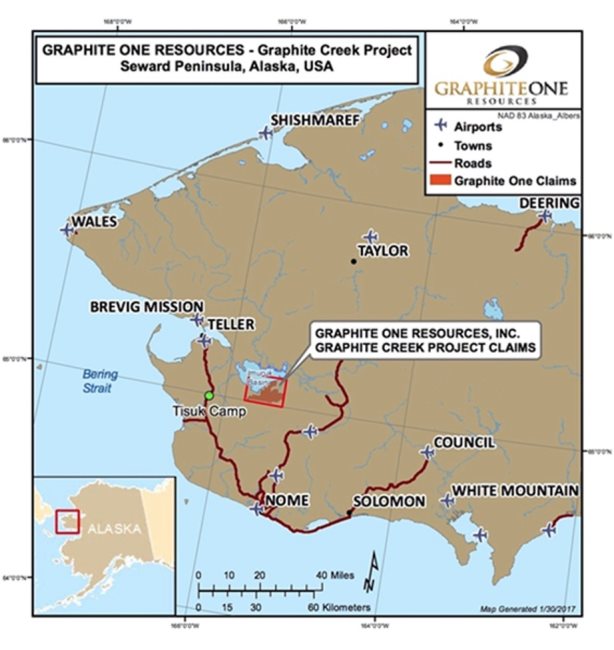

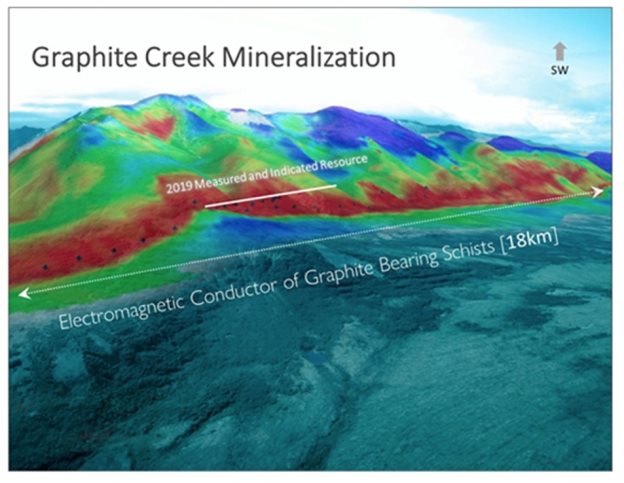

mine, Graphite Creek owned by Graphite One (TSXV:GPH, OTCQB:GPHOF). The deposit is the highest-grade and

largest known flake graphite deposit in the US, spanning 18

km.

The Project is envisioned as a

vertically integrated enterprise to mine, process and manufacture

Coated Spherical Graphite ("CSG") for the lithium-ion electric

vehicle battery market. Graphite One aims to become the first US

vertically integrated domestic producer to serve the US EV battery

market.

Located on the Seward Peninsula

in Alaska, Graphite Creek earlier this year was given High-Priority

Infrastructure Project (HPIP) status by the Federal Permitting

Improvement Steering Committee (FPISC). The HPIP designation allows

Graphite One to list on the US government's Federal Permitting

Dashboard, which ensures that the various federal permitting

agencies coordinate their reviews of projects as a means of

streamlining the approval process.

The Graphite

Creek property is located 55 km north of Nome, Alaska.

The latest resource estimate

(March 2019) for Graphite Creek showed 10.95 million tonnes of

measured and indicated resources at a graphite grade of 7.8% Cg,

for some 850,000 tonnes of contained graphite. Another 91.9 million

tonnes were tagged as inferred resources, with an average grade of

8.0% Cg containing 7.3 million tonnes.

A preliminary

economic assessment (PEA) for the project envisions a 40-year

operation with a mineral processing plant capable of producing

60,000 tonnes of graphite concentrate (at 95% purity) per

year.

Graphite One is continuing with

exploratory drilling and an environmental baseline study program to

gather more data for an upcoming prefeasibility study (PFS),

scheduled to be released in the fourth quarter.

A 3,000-meter drill program at

Graphite Creek this year was designed to infill and expand the

project's resource of graphitic carbon for a feasibility study, the

next step after the PFS.

Once in full production, Graphite

One's proposed graphite products manufacturing plant — the second

link in its proposed supply chain strategy — is expected to turn

graphite concentrates into 41,850 tonnes of battery-grade coated

spherical graphite and 13,500 tonnes of graphite powders per

year.

Material produced from Graphite

Creek would be almost sufficient to supply the entire nation's

graphite demand given current import totals.

But these production figures were

based on resource estimates prior to the 2019 update, leaving room

for potentially higher production.

Conclusion

The lithium market is one of the

brightest spots in the natural resource sector of late, with the

price of lithium carbonate almost doubling in two months, and

lithium hydroxide up more than 70% during the same

period.

All of this is being driven by an

acceleration of the transition from fossil-fueled transportation

and power generation to low-carbon sources like electric vehicles

and renewable electricity.

The trend is global, long term

and inexorable.

While there has been a general

understanding of the critical nature of lithium and the need to

develop more mines, tie up existing and future lithium deposits

through offtake agreements (hence the lithium "m&a"), and build

more battery plants to satisfy the ever-climbing demand for EVs,

the same cannot be said of graphite.

The grayish-black mineral is used

is in dozens of applications, from pencils to lubricants to

electric vehicle battery anodes, yet its utility so far has only

been appreciated by a few ahead of the herd investors.

Many do not realize do not

realize that without graphite, lithium-ion batteries cannot be

made, there is no substitution for graphite in a lithium batteries

anode, making graphite as crucial, as critical, to the green energy

transition as lithium itself.

That's a fact which should sound

the alarm for those following graphite demand and

supply.

A situation where US/ Canadian

graphite end users are 100% dependent on Chinese chemical companies

is both frightening, given how much power it gives them, and

unsustainable. The solution is to reduce America's dependence by

finding local sources of graphite and lithium and develop them,

ideally creating a closed-loop supply chain where all the mining,

processing and manufacturing, from mine to EV battery, to showroom,

is done by North American firms and workers.

US critical minerals have been

ignored for decades but they are finally getting the attention they

deserve. Graphite One is a company on the move with the largest and

highest-grade flake graphite deposit in the United

States.

At AOTH we like to use the

analogy of an area play. Area plays are the very foundation of

junior resource markets, where a first-mover comes into a nascent

mining district and makes a discovery. The company's stock price

goes bonkers and other juniors rush in to stake claims, establish

operations and conduct exploration in the hopes of making the next

big discovery.

Lithium is like the first mover

in an area play, and graphite is similar to the next company on

trend, the one you would want to invest in because that is the

direction the money flows. This isn't to suggest there is no longer

money to be made in lithium exploration & mining. We love what

we see happening in the lithium space and we are pleased to see the

stocks of our favorite lithium juniors rising.

But investing is all about

getting in early, and we see the graphite market as the next sector

to grab the market's attention.

If we can't find the materials to

put into lithium-ion batteries, we must knock on China's door — a

door that could be slammed shut anytime, certainly not a source we

want to be reliant on, given current economic, political and

military tensions.

Lithium and graphite are the

cornerstones of electrification and decarbonization. Without them,

positive change does not occur. Companies like Graphite One that

offer solutions to the need for more domestically mined supply will

in our opinion do very well. In fact to win the fight against

climate change and to reduce our reliance on fossil fuels, while

helping to build a brand-new electric vehicle industry

in the United

States, we see GPH as an

important piece of the Nation's supply chain, and for us at AOTH,

one that we have to own, and do.

Graphite One

Inc.

TSXV:GPH, OTCQB:GPHOF

Cdn$1.61, 2021.10.19

Shares Outstanding

81.5m

Market cap Cdn$134.1m

GPH website

Richard (Rick)

Mills

aheadoftheherd.com

subscribe

to my free newsletter

Legal Notice

/ Disclaimer

Ahead of the Herd

newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the

entire Disclaimer carefully before you use this website or read the

newsletter. If you do not agree to all the AOTH/Richard Mills

Disclaimer, do not access/read this website/newsletter/article, or

any of its pages. By reading/using this AOTH/Richard Mills

website/newsletter/article, and whether you actually read this

Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard

Mills document is not, and should not be, construed as an offer to

sell or the solicitation of an offer to purchase or subscribe for

any investment.

AOTH/Richard Mills

has based this document on information obtained from sources he

believes to be reliable, but which has not been independently

verified.

AOTH/Richard Mills

makes no guarantee, representation or warranty and accepts no

responsibility or liability as to its accuracy or

completeness.

Expressions of

opinion are those of AOTH/Richard Mills only and are subject to

change without notice.

AOTH/Richard Mills

assumes no warranty, liability or guarantee for the current

relevance, correctness or completeness of any information provided

within this Report and will not be held liable for the consequence

of reliance upon any opinion or statement contained herein or any

omission.

Furthermore,

AOTH/Richard Mills assumes no liability for any direct or indirect

loss or damage for lost profit, which you may incur as a result of

the use and existence of the information provided within this

AOTH/Richard Mills Report.

You agree that by

reading AOTH/Richard Mills articles, you are acting at your OWN

RISK. In no event should AOTH/Richard Mills liable for any direct

or indirect trading losses caused by any information contained in

AOTH/Richard Mills articles. Information in AOTH/Richard Mills

articles is not an offer to sell or a solicitation of an offer to

buy any security. AOTH/Richard Mills is not suggesting the

transacting of any financial instruments.

Our publications

are not a recommendation to buy or sell a security – no information

posted on this site is to be considered investment advice or a

recommendation to do anything involving finance or money aside from

performing your own due diligence and consulting with your personal

registered broker/financial advisor.

AOTH/Richard Mills

recommends that before investing in any securities, you consult

with a professional financial planner or advisor, and that you

should conduct a complete and independent investigation before

investing in any security after prudent consideration of all

pertinent risks.

Ahead of the Herd

is not a registered broker, dealer, analyst, or advisor. We hold no

investment licenses and may not sell, offer to sell, or offer to

buy any security.

Richard owns shares of

Graphite One

Inc. (TSXV:GPH). GPH is

a paid advertiser on his site aheadoftheherd.com

SOURCE: aheadoftheherd.com