false0001795139NONE00017951392025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 26, 2025 |

GREEN THUMB INDUSTRIES INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

British Columbia |

000-56132 |

98-1437430 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

325 West Huron Street Suite 700 |

|

Chicago, Illinois |

|

60654 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 312 471-6720 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On February 26, 2025, Green Thumb Industries Inc. issued a press release announcing its financial results for the quarter ended December 31, 2024, a copy of which is attached as Exhibit 99.1.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

GREEN THUMB INDUSTRIES INC. |

|

|

|

|

Date: |

February 26, 2025 |

By: |

/s/ Mathew Faulkner |

|

|

|

Mathew Faulkner

Chief Financial Officer |

Exhibit 99.1

Green Thumb Industries Reports Fourth Quarter and Full Year 2024 Results

CHICAGO and VANCOUVER, British Columbia, February 26, 2025 (GLOBE NEWSWIRE) – Green Thumb Industries Inc. (“Green Thumb” or the “Company”) (CSE: GTII) (OTCQX: GTBIF), a leading national cannabis consumer packaged goods company and owner of RISE Dispensaries, today reported its financial results for the quarter and full year ended December 31, 2024. Financial results are reported in accordance with U.S. generally accepted accounting principles (“GAAP”) and all currency is in U.S. dollars.

Highlights for the fourth quarter ended December 31, 2024:

•Revenue of $294 million, an increase of 6% over the prior year period.

•Cash at quarter end totaled $172 million.

•GAAP net income of $13 million or $0.05 per basic and $0.04 per diluted share.

•Adjusted EBITDA of $98 million or 33% of revenue.

•Repurchased approximately 1.2 million of the Company’s Subordinate Voting Shares for $9.6 million.

•Opened three RISE Dispensaries: one each in Florida, Minnesota and Nevada.

Highlights for the year ended December 31, 2024:

•Revenue of $1.1 billion, an increase of 8% over the prior year.

•Cash flow from operations of $195 million, net of $131 million of tax payments.

•GAAP net income of $73 million or $0.31 per basic and $0.30 per diluted share.

•Adjusted EBITDA of $371 million or 33% of revenue, a 14% increase year-over-year.

•Repurchased approximately 3.9 million of the Company’s Subordinate Voting Shares for $43 million.

•Opened ten RISE Dispensaries for a total of 101 retail locations nationwide.

•Strong balance sheet and disciplined capital allocation to support future growth.

See definitions and reconciliation of non-GAAP measures elsewhere in this release.

Management Commentary

“The Green Thumb team delivered another year of impressive results in 2024. In the fourth quarter, we achieved record high revenue and Adjusted EBITDA of $294 million and $98 million, respectively, and full year cash flow from operations of $195 million, net of the $131 million paid in taxes. We ended the year with a strong balance sheet including $172 million in cash after repurchasing $43 million of company shares,” said Green Thumb Founder, Chairman and Chief Executive Officer Ben Kovler. “Demand for THC in America is at an all-time high, and Green Thumb is well-positioned to deliver on this opportunity. Meanwhile, alcohol consumption trends in America are not positive, as the Surgeon General recently warned of the harms of alcohol and its link to cancer. In contrast, cannabis—now available to more Americans in more locations than ever—is enhancing the well-being of tens of millions across the nation. Over the past decade, our exceptional team has been consistently delivering best-in-class brands and experiences to promote well-being, and we are excited by the promising opportunity that lies ahead.”

Green Thumb President Anthony Georgiadis added, “We are incredibly proud of our team and the results we achieved together in 2024. We opened 10 new stores, bringing our total to 101 RISE Dispensaries across 14 states. We made tremendous progress elevating our brand awareness by connecting consumers to unique and memorable experiences, including our first-of-its-kind partnership with beloved Chicago music and entertainment venue, The Salt Shed, our expanded collaboration with New York’s iconic Magnolia Bakery, and our multi-brand partnership with influential media company, Barstool Sports. As we look ahead, we are confident that our focus on thoughtful capital allocation, operational excellence, superior product quality and brands that resonate with consumers is a winning combination for Green Thumb.”

Green Thumb Industries Inc.

Page 2 of 7

Fourth Quarter and Full Year 2024 Financial Overview

Total revenue for the fourth quarter was $294.3 million, up 5.8% from the prior year period. For the full year 2024, total revenue increased 7.8% to $1.1 billion. Revenue growth in the fourth quarter was driven by contributions from both the Retail and Consumer Packaged Goods segments.

Overall retail revenue increased 0.5% versus the fourth quarter of 2023 and 4.2% for the full year 2023, reflecting continued growth in our existing markets of New York, Florida and Maryland, the addition of adult-use sales in Ohio, and the opening of 10 incremental RISE Dispensaries since the prior year period. The increase was partially offset by continued price compression in certain markets. Fourth quarter 2024 comparable sales (stores open at least 12 months) decreased 2.6% versus the prior year on a base of 84 stores.

Consumer Packaged Goods’ gross revenue for the fourth quarter increased 19.9% versus the prior year period and 15.9% compared to the full year 2023. This increase was driven by continued growth in our existing markets of New York and New Jersey, and the addition of adult-use sales in Ohio.

Gross profit for the fourth quarter was $158.1 million or 53.7% of revenue, up from $142.7 million or 51.3% of revenue over the prior year period. For the full year, gross profit was $601.1 million or 52.9% of revenue, up from $526.5 million or 49.9% in 2023. The Company was able to offset price compression headwinds through operational efficiencies.

Total selling, general and administrative expenses for the fourth quarter were $101.0 million or 34.3% of revenue, compared to $92.3 million or 33.2% of revenue for the fourth quarter 2023. Total selling, general and administrative expenses for the full year 2024 were $376.7 million or 33.1% of revenue, compared to $341.9 million or 32.4% of revenue in the prior year, primarily due to increased compensation costs during the year.

Net income attributable to the Company for the fourth quarter was $12.7 million or $0.05 and $0.04 per basic and diluted share, respectively, up from net income of $3.2 million, or $0.01 per basic and diluted share in the prior year period. Net income for the full year 2024 increased to $73.1 million or $0.31 per basic and $0.30 per diluted share, versus net income of $36.3 million or $0.15 per basic and diluted share in the prior year.

In the fourth quarter, EBITDA was $86.1 million or 29.2% of revenue, versus $77.8 million or 28% of revenue for the comparable prior year period. Adjusted EBITDA, which excluded non-cash stock-based compensation of $9.6 million and other non-operating adjustments of $2.1 million, was $97.8 million or 33.2% of revenue, up from $90.8 million or 32.6% of revenue for the fourth quarter 2023. Adjusted EBITDA for the full year 2024 increased to $371.3 million or 32.7% of revenue, compared to $325.8 million or 30.9% of revenue in 2023.

For additional information on the non-GAAP financial measures discussed above, see under “Non-GAAP Financial Information” below.

Balance Sheet and Liquidity

As of December 31, 2024, current assets were $403.9 million, including cash and cash equivalents of $171.7 million. Total debt outstanding was $255.0 million.

Total basic and diluted weighted average shares outstanding for the three months ended December 31, 2024, were 236.8 million shares and 239.1 million shares, respectively.

Capital Allocation

On September 13, 2024, the Company’s Board of Directors authorized up to $50 million to be used to repurchase up to 10,573,860 of the Company’s Subordinate Voting Shares from September 23, 2024, through September 22, 2025.

During the fourth quarter, the Company repurchased approximately 1.2 million Subordinate Voting Shares for $9.6 million.

Green Thumb Industries Inc.

Page 3 of 7

Fourth Quarter 2024 Business Developments

During the fourth quarter of 2024, the Company opened three retail stores:

•RISE Dispensary Carson City, Nevada on US HWY 50; profits from the grand opening were donated to The Boys & Girls Clubs of Western Nevada.

•RISE Dispensary Brooklyn Park, Minnesota; profits from the grand opening were donated to Metro Meals on Wheels.

•RISE Dispensary Orlando, Florida on Good Homes Road; profits from the grand opening were donated to Florida Rights Restoration Coalition.

Non-GAAP Financial Information

This press release includes certain non-GAAP financial measures as defined by the U.S. Securities and Exchange Commission. Reconciliations of these non-GAAP financial measures to the most directly comparable financial measure calculated and presented in accordance with GAAP are included in the financial schedules attached to this press release. This information should be considered as supplemental in nature and not as a substitute for, or superior to, any measure of performance prepared in accordance with GAAP.

Definitions

EBITDA: Earnings before interest, taxes, other income or expense and depreciation and amortization.

Adjusted EBITDA: Earnings before interest, taxes, depreciation, and amortization, adjusted for other income, non-cash stock-based compensation, one-time transaction related expenses, or other non-operating costs.

Conference Call and Webcast

Green Thumb will host a conference call on Wednesday, February 26, 2025, at 5:00 pm Eastern Time to discuss its results for the fourth quarter and full year ended December 31, 2024. The earnings call may be accessed by dialing 844-883-3895 (toll-free) or 412-317-5797 (international). A live audio webcast of the call will also be available on the Investor Relations section of Green Thumb’s website at https://investors.gtigrows.com and will be archived for replay.

About Green Thumb Industries

Green Thumb Industries Inc. (“Green Thumb”), a national cannabis consumer packaged goods company and retailer, promotes well-being through the power of cannabis while giving back to the communities in which it serves. Green Thumb manufactures and distributes a portfolio of branded cannabis products including &Shine, Beboe, Dogwalkers, Doctor Solomon’s, Good Green, incredibles and RYTHM. The company also owns and operates a national chain of retail cannabis stores under the brand name of RISE Dispensary. Headquartered in Chicago, Illinois, Green Thumb has 20 manufacturing facilities, 101 open retail locations and operations across 14 U.S. markets. Established in 2014, Green Thumb employs approximately 4,800 people and serves millions of patients and customers each year. More information is available at www.gtigrows.com.

Cautionary Note Regarding Forward-Looking Information

This press release contains statements that we believe are, or may be considered to be, “forward-looking statements.” All statements other than statements of historical fact included in this document regarding the prospects of our industry or our prospects, plans, financial position or business strategy may constitute forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking words such as “may,” “will,” “expect,” “intend,” “estimate,” “foresee,” “opportunity,” “project,” “potential,” “risk,” “anticipate,” “believe,” “plan,” “forecast,” “continue,” “suggests” or “could” or the negative of these terms or variations of them or similar terms or expressions of similar meaning. Furthermore, forward-looking statements may be included in various filings that we make with the Securities and Exchange Commission (the “SEC”), or oral statements made by or with the approval of one of our authorized executive officers. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that these expectations will prove to be correct. These forward-looking statements are subject to certain known and unknown risks and uncertainties, as well as assumptions that could cause actual results to differ materially from those reflected in these forward-looking statements. These known and unknown risks include, without limitation: cannabis remains illegal under U.S. federal law, and enforcement of cannabis laws could change; state regulation of cannabis is uncertain; the Company may not

Green Thumb Industries Inc.

Page 4 of 7

be able to obtain or maintain necessary permits and authorizations; the Company may face limitations on ownership of cannabis licenses; the Company may become subject to U.S. Food and Drug Administration or the U.S. Bureau of Alcohol, Tobacco, Firearms, and Explosives regulation; as a cannabis business, the Company is subject to applicable anti-money laundering laws and regulations and have restricted access to banking and other financial services; the Company may face difficulties acquiring additional financing; the Company operates in a highly regulated sector and may not always succeed in complying fully with applicable regulatory requirements in all jurisdictions where it conducts business; the Company faces intense competition; the Company faces competition from the illicit market as well as hemp products that are actually or purportedly compliant with the Agricultural Improvement Act of 2018 (the Farm Bill); the Company is dependent upon the popularity and consumer acceptance of its brand portfolio; the Company has limited trademark protections; as a cannabis business, the Company is subject to unfavorable tax treatment and may incur significant tax liability; as a cannabis business, the Company may be subject to civil asset forfeiture; the Company is subject to proceeds of crime statutes; the Company faces exposure to fraudulent or illegal activity; the Company faces risks due to industry immaturity or limited comparable, competitive or established industry best practices; the Company faces risks related to its products; the Company’s business is subject to the risks inherent in agricultural operations; the Company faces an inherent risk of product liability and similar claims; the Company’s products may be subject to product recalls; the Company may face unfavorable publicity or consumer perception; the Company may be adversely impacted by rising or volatile energy costs and availability; the Company faces risks related to its information technology systems and potential cyber-attacks and security breaches; the Company relies on third-party software providers for numerous capabilities we depend upon to operate, and a disruption of one or more of these systems could adversely affect our business; the Company relies on the expertise of its management team and other employees experienced in the cannabis industry, and the loss of key personnel could negatively affect its business; the Company’s voting control is concentrated; the Company’s capital structure and voting control may cause unpredictability; and sales of substantial amounts Subordinate Voting Shares by the Company’s shareholders in the public market may have an adverse effect on the market price of the Company’s Subordinate Voting Shares. Further information on these and other potential factors that could affect the Company’s business and financial condition and the results of operations are included in the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K and elsewhere in the Company’s filings with the SEC, which are available on the SEC’s website or at https://investors.gtigrows.com. Readers are cautioned not to place undue reliance on any forward-looking statements contained in this document, which reflect management’s opinions only as of the date hereof. Except as required by law, we undertake no obligation to revise or publicly release the results of any revision to any forward-looking statements. You are advised, however, to consult any additional disclosures we make in our reports to the SEC. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained in this document.

The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this release.

Investor Contacts:

Mathew Faulkner

Chief Financial Officer

InvestorRelations@gtigrows.com

310-622-8257

Andy Grossman

EVP, Capital Markets & Investor Relations

InvestorRelations@gtigrows.com

310-622-8257

Media Contact:

GTI Communications

media@gtigrows.com

Source: Green Thumb Industries Inc.

Green Thumb Industries Inc.

Page 5 of 7

Highlights from Unaudited Interim Condensed Consolidated Statements of Operations

For the For the Three and Twelve Months Ended December 31, 2024 and 2023

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

December 31, 2024 |

|

December 31, 2023 |

|

December 31, 2024 |

|

December 31, 2023 |

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

Revenues, Net of Discounts |

|

$294,323 |

|

$278,231 |

|

$1,137,141 |

|

$1,054,553 |

Cost of Goods Sold |

|

(136,254) |

|

(135,543) |

|

(536,032) |

|

(528,058) |

|

|

|

|

|

|

|

|

|

Gross Profit |

|

158,069 |

|

142,688 |

|

601,109 |

|

526,495 |

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

Total Expenses |

|

100,959 |

|

92,348 |

|

376,684 |

|

341,863 |

|

|

|

|

|

|

|

|

|

Income From Operations |

|

57,110 |

|

50,340 |

|

224,425 |

|

184,632 |

|

|

|

|

|

|

|

|

|

Other Income (Expense): |

|

|

|

|

|

|

|

|

Other Income (Expense), Net |

|

(9,505) |

|

(16,230) |

|

(9,094) |

|

(16,207) |

Interest Income |

|

1,992 |

|

1,859 |

|

9,074 |

|

6,697 |

Interest Expense, Net |

|

(5,475) |

|

(7,749) |

|

(24,266) |

|

(19,073) |

|

|

|

|

|

|

|

|

|

Total Other Expense |

|

(12,988) |

|

(22,120) |

|

(24,286) |

|

(28,583) |

|

|

|

|

|

|

|

|

|

Income Before Provision for Income Taxes And Non-Controlling Interest |

44,122 |

|

28,220 |

|

200,139 |

|

156,049 |

|

|

|

|

|

|

|

|

|

Provision For Income Taxes |

|

31,318 |

|

24,703 |

|

126,288 |

|

118,630 |

|

|

|

|

|

|

|

|

|

Net Income Before Non-Controlling Interest |

|

12,804 |

|

3,517 |

|

73,851 |

|

37,419 |

|

|

|

|

|

|

|

|

|

Net Income Attributable To Non-Controlling Interest |

|

125 |

|

301 |

|

768 |

|

1,152 |

|

|

|

|

|

|

|

|

|

Net Income Attributable To Green Thumb Industries Inc. |

$12,679 |

|

$3,216 |

|

$73,083 |

|

$36,267 |

|

|

|

|

|

|

|

|

|

Net Income Per Share - Basic |

|

$0.05 |

|

$0.01 |

|

$0.31 |

|

$0.15 |

|

|

|

|

|

|

|

|

|

Net Income Per Share - Diluted |

|

$0.04 |

|

$0.01 |

|

$0.30 |

|

$0.15 |

|

|

|

|

|

|

|

|

|

Weighted Average Number of Shares Outstanding - Basic |

|

236,848,914 |

|

236,934,348 |

|

236,827,774 |

|

237,927,867 |

|

|

|

|

|

|

|

|

|

Weighted Average Number of Shares Outstanding - Diluted |

|

239,061,803 |

|

239,162,831 |

|

241,925,957 |

|

239,827,390 |

Green Thumb Industries Inc.

Page 6 of 7

Green Thumb Industries Inc.

Highlights from the Unaudited Interim Condensed Consolidated Balance Sheet

(Amounts Expressed in Thousands of United States Dollars)

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

|

2024 |

|

|

|

|

(Unaudited) |

Cash and Cash Equivalents |

|

|

|

$171,687 |

Other Current Assets |

|

|

|

232,213 |

Property and Equipment, Net |

|

|

|

716,014 |

Right of Use Assets, Net |

|

|

|

246,281 |

Intangible Assets, Net |

|

|

|

488,287 |

Goodwill |

|

|

|

589,691 |

Other Long-term Assets |

|

|

|

92,839 |

Total Assets |

|

|

|

$2,537,012 |

Total Current Liabilities |

|

|

|

$164,969 |

Notes Payable, Net of Current Portion and Debt Discount |

|

|

|

242,896 |

Lease Liabilities, Net of Current Portion |

|

|

|

261,446 |

Other long-Term Liabilities |

|

|

|

78,621 |

Total Equity |

|

|

|

1,789,080 |

Total Liabilities and Equity |

|

|

|

$2,537,012 |

Green Thumb Industries Inc.

Page 7 of 7

Green Thumb Industries Inc.

Supplemental Information (Unaudited) Regarding Non-GAAP Financial Measures

For the For the Three and Twelve Months Ended December 31, 2024 and 2023

(Amounts Expressed in Thousands of United States Dollars)

EBITDA, and Adjusted EBITDA are non-GAAP measures and do not have standardized definitions under GAAP. We define each term as follows:

(1) EBITDA is defined as earnings before interest, taxes, other income or expense and depreciation and amortization.

(2) Adjusted EBITDA is defined as earnings before interest, taxes, depreciation, and amortization, adjusted for other income, non-cash share-based compensation, one-time transaction related expenses, or other non-operating (income) or costs.

The following information provides reconciliations of the supplemental non-GAAP financial measures, presented herein to the most directly comparable financial measures calculated and presented in accordance with GAAP. The Company has provided the non-GAAP financial measures, which are not calculated or presented in accordance with GAAP, as supplemental information and in addition to the financial measures that are calculated and presented in accordance with GAAP. These supplemental non-GAAP financial measures are presented because management has evaluated the financial results both including and excluding the adjusted items and believes that the supplemental non-GAAP financial measures presented provide additional perspective and insights when analyzing the core operating performance of the business. These supplemental non-GAAP financial measures should not be considered superior to, as a substitute for or as an alternative to, and should be considered in conjunction with, the GAAP financial measures presented.

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

Adjusted EBITDA |

|

December 31, 2024 |

|

December 31, 2023 |

|

December 31, 2024 |

|

December 31, 2023 |

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

Net Income Before Noncontrolling Interest (GAAP) |

|

$12,804 |

|

$3,517 |

|

$73,851 |

|

$37,419 |

Interest Income |

|

(1,992) |

|

(1,859) |

|

(9,074) |

|

(6,697) |

Interest Expense, Net |

|

5,475 |

|

7,749 |

|

24,266 |

|

19,073 |

Provision For Income Taxes |

|

31,318 |

|

24,703 |

|

126,288 |

|

118,630 |

Other (Income) Expense, Net |

|

9,505 |

|

16,230 |

|

9,094 |

|

16,207 |

Depreciation and Amortization |

|

28,958 |

|

27,427 |

|

113,210 |

|

100,790 |

Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) (non-GAAP measure) |

|

$86,068 |

|

$77,767 |

|

$337,635 |

|

$285,422 |

Share-based Compensation, Non-Cash |

|

9,607 |

|

7,354 |

|

33,312 |

|

28,189 |

Acquisition, Transaction, and Other Non-Operating (Income) Costs |

|

2,107 |

|

5,679 |

|

371 |

|

12,228 |

Adjusted EBITDA (non-GAAP measure) |

|

$97,782 |

|

$90,800 |

|

$371,318 |

|

$325,839 |

|

|

|

|

|

|

|

|

|

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

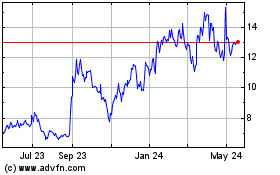

Green Thumb Industries (QX) (USOTC:GTBIF)

Historical Stock Chart

From Feb 2025 to Mar 2025

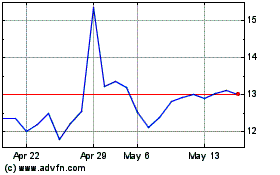

Green Thumb Industries (QX) (USOTC:GTBIF)

Historical Stock Chart

From Mar 2024 to Mar 2025