UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 19, 2014

GOLD TORRENT, INC.

(Exact name of registrant as specified in its

charter)

| Nevada |

|

333-159300 |

|

None |

| (State of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

960 Broadway Avenue

Suite

160

Boise

ID 83706

(Address

of principal executive offices) (Zip code)

208-343-1413

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Copies

to:

Andrea

Cataneo, Esq.

Sichenzia

Ross Friedman Ference LLP

61

Broadway, 32nd Floor

New

York, NY 10006

(212)

930-9700

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

[ ] Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item

1.01 Entry into a Material Definitive Agreement.

On

November 19, 2014, Gold Torrent, Inc. (the “Company”) entered into a Spin-Off Agreement with David Strebinger (“Spin-Off

Agreement”) pursuant to which the Company sold all intellectual property associated with the previous business of the Company,

including all domain names, programming code and mobile technology platforms. In connection with the Spin-Off Agreement, the Company

entered into Releases with David Strebinger, Wantsa Media (Canada) Inc., Caring Capital Corporation, and Chelber Real Estate (collectively,

the “Releasors”) pursuant to which the Releasors released the Company from all liabilities in connection with an aggregate

of $420,502.71 that the Company owed the Releasors.

The

foregoing description of the principal terms of the Spin-Off Agreement and the Releases is a general description only, does not

purport to be complete, and is qualified in its entirety by reference to the terms of the Exploration and Option Agreement, which

is attached as Exhibits 10.1, 10.2, 10.3, 10.4 and 10.5 to this Current Report and incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d) Exhibits.

The

following exhibits are filed herewith:

Exhibit

10.1 Spin-Off Agreement between the Company and David Strebinger

Exhibit

10.2 Release between the Company and David Strebinger

Exhibit

10.3 Release between the Company and Wantsa Media (Canada) Inc.

Exhibit

10.4 Release between the Company and Caring Capital Corporation

Exhibit

10.5 Release between the Company and Chelber Real Estate

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

GOLD TORRENT, INC. |

| |

|

|

| Dated:

November 20, 2014 |

By:

|

/s/ Ryan Hart |

| |

Name: |

Ryan Hart |

| |

Title: |

Chief Executive Officer |

SPIN-OFF

AGREEMENT

THIS

SPIN-OFF AGREEMENT (this “Agreement”) is entered into as of this 18 day of November, 2014, by and

among Gold Torrent, Inc., a Nevada corporation (the “Company” or “Seller”)

and David Strebinger, an individual (“Buyer”), each a “Party” and collectively

the “Parties”, upon the following premises:

BACKGROUND

WHEREAS,

on September 10, 2013, certain stockholders of the Company entered into stock purchase agreements with certain purchasers (collectively,

the “Purchasers”) pursuant to which the Purchasers purchased an aggregate of 12,824,875 shares of the Company’s

common stock for the aggregate amount of $275,000 (the “Purchase Agreement”);

WHEREAS,

the Purchase Agreement also contemplated Buyer and the Company entering into an agreement to affect the spin-off of the Company’s

pre-Purchase Agreement operations, assets and liabilities to the Buyer; and

WHEREAS,

the Company desires to sell and transfer to Buyer and Buyer desires to purchase and acquire from Seller, the Assets (as defined

below), on such terms and subject to the conditions hereinafter set forth.

AGREEMENT

NOW,

THEREFORE, in consideration of the mutual promises, warranties and covenants set forth herein, the Parties hereto hereby agree

as follows:

1. Purchased

Assets. Seller hereby sells, assigns, transfers, conveys and delivers to Buyer ON AN “AS IS”

“WHERE IS” BASIS, and Buyer hereby accepts and purchases, all of Seller’s right, title

and interest in and to all intellectual property associated with the pre-Purchase Agreement business of the Company, including,

without limitation, all domain names, programming code and mobile technology platforms (the “Assets”).

2. Assumption

of Liabilities.

(a)

As consideration for the purchase of the Assets, Buyer hereby assumes, and agrees to perform, and otherwise pay, satisfy and discharge

all existing and future liabilities and obligations in relation to the Assets including all accounts payable and accrued liabilities,

accrued expenses, deferred revenues and notes payable (including those notes payable to the Buyers) existing on the date hereof

(the “Assumed Liabilities”). Seller also agrees to assign any and all claims, causes of action, and

affirmative defenses which it ever had, now has, or hereafter may have, whether currently known or unknown relating to the Assumed

Liabilities to Buyer.

(b)

As further consideration for the purchase of the Assets, Buyer hereby assumes, and agrees to perform, and otherwise pay, satisfy

and discharge all existing and future liabilities and obligations in relation to the Assets (whether known or unknown, whether

asserted or unasserted, whether absolute or contingent, whether accrued or unaccrued, whether liquidated or unliquidated, and

whether due or to become due), including (a) all liabilities of Seller for transfer, sales, use, and other non-income taxes arising

in connection with the consummation of the transactions contemplated hereby, and (b) all liabilities and obligations of Seller

under the agreements, contracts, leases, licenses, and other arrangements referred to in the definition of Assets, including but

not limited to any claims, debts, expenses, liabilities, and claims or legal fees whatsoever associated with or incurred as a

result of such Assumed Liabilities (collectively, the “Assumed Liability Expenses”), and that Buyer

will forever indemnify and hold harmless the Company against such Assumed Liabilities and any Assumed Liability Expenses following

the closing.

3. Further

Assurances. Seller hereby covenants that it will, whenever and as reasonably requested by Buyer and at Seller’s

sole cost and expense, do, execute, acknowledge and deliver any and all such other and further acts, deeds, assignments, transfers,

conveyances, confirmations, powers of attorney and any instruments of further assurance, approvals and consents as Buyer may reasonably

require in order to complete, insure and perfect the transfer, conveyance and assignment to Buyer of all the right, title and

interest of Seller in and to the Assets.

4. Seller

Makes no Representations or Warranties. Seller’s interest in the Assets and obligations under the Assumed Liabilities

are being acquired and assumed by the Buyer on an AS IS WHERE IS basis and the Seller makes no representations as to the

Assets, the Assumed Liabilities or any other matter.

5.

Confidential Information. The Company shall use its commercially reasonable efforts to insure that all confidential

information which the Company or any of its respective officers, directors, employees, counsel, agents, investment bankers, or

accountants (each, a “Company Party”) may now possess or may hereafter create or obtain relating to

the financial condition, results of operations, businesses, properties, assets, liabilities, or future prospects of Buyer and/or,

any affiliate thereof, or any customer or supplier thereof or of any such affiliate shall not be published, disclosed, or made

accessible by any of them to any other person or entity at any time or used by any of them; provided, however, that the restrictions

of this sentence shall not apply (i) as may be required by law, (ii) as may be necessary or appropriate in connection with the

enforcement of this Agreement, or (iii) to the extent the information shall have otherwise become publicly available, through

no improper action of any Company Party.

6. Miscellaneous.

(a)

Since a breach of the provisions of this Agreement could not adequately be compensated by monetary damages, any Party shall be

entitled, in addition to any other right or remedy available to him, her or it, to an injunction restraining such breach or a

threatened breach and to specific performance of any such provision of this Agreement, and in either case no bond or other security

shall be required in connection therewith, and the Parties hereby consent to the issuance of such an injunction and to the ordering

of specific performance.

(b)

The covenants, agreements, representations, and warranties contained in or made pursuant to this Agreement shall survive any delivery

of the consideration described herein.

(c)

This Agreement sets forth the entire understanding of the Parties with respect to the subject matter hereof, supersedes all existing

agreements between them concerning such subject matter, and may be modified only by a written instrument duly executed by each

Party.

(d)

The provisions of this Agreement shall be binding upon and inure to the benefit of the Parties hereto, and their respective successors

and assigns (if not a natural person) and his assigns, heirs, and personal representatives (if a natural person).

(e)

If any provision of this Agreement is invalid, illegal, or unenforceable, the balance of this Agreement shall remain in effect,

and if any provision is inapplicable to any person or circumstance, it shall nevertheless remain applicable to all other persons

and circumstances.

(f)

The headings in this Agreement are solely for convenience of reference and shall be given no effect in the construction or interpretation

of this Agreement.

(g)

All representations, warranties and agreements in this Agreement shall survive the closing until the expiration of the applicable

statute of limitations.

(h)

This Agreement may be executed in one or more counterparts, all of which shall be considered one and the same agreement and shall

become effective when one or more counterparts have been signed by each of the Parties and delivered to the other Party, it being

understood that all Parties need not sign the same counterpart. Facsimile execution and delivery of this Agreement is legal, valid

and binding execution and delivery for all purposes. This Agreement shall be governed in all respects, including validity, interpretation

and effect, by the internal laws of the State of Nevada, without regard to the conflicts of law principles thereof.

(i)

This Agreement may not be amended except by an instrument in writing signed by each of the Parties hereto. This Agreement constitutes

the entire agreement of the Parties with respect to the subject matter hereof and supersedes in its entirety any other agreement

relating to or granting any rights with respect to the subject matter hereof.

(j)

Each Party acknowledges that its legal counsel participated in the preparation of this Agreement and, therefore, stipulates that

the rule of construction that ambiguities are to be resolved against the drafting Party shall not be applied in the interpretation

of this Agreement to favor any Party against the other. In this Agreement, the word “include”, “includes”,

“including” and “such as” are to be construed as if they were immediately

followed by the words, without limitation.

(k)

In this Agreement words importing the singular number include the plural and vice versa; words importing the masculine gender

include the feminine and neuter genders. The word “person” includes an individual, body corporate, partnership,

trustee or trust or unincorporated association, executor, administrator or legal representative.

IN

WITNESS WHEREOF, the Parties have duly executed this Agreement as of the date first above written.

| |

BUYER: |

| |

|

|

| |

/s/

David Strebinger |

| |

|

|

| |

SELLER: |

| |

|

|

| |

Gold Torrent, Inc. |

| |

|

|

| |

By: |

/s/ Ryan Hart |

| |

Name: |

Ryan

Hart |

| |

Title: |

President |

RELEASE

This

Release is entered into as of the 15 day of November 2014 by and between Gold Torrent, Inc. (f/k/a/ Cell Donate, Inc.)

(“Company”), and David Strebinger, on his own behalf and on behalf of his affiliates, heirs and assigns

(collectively, the “Releasor”).

WHEREAS,

the Company owes an aggregate of $32,838.56 (the “Owed Amount”) to the Releasor;

WHEREAS,

in connection with the return of certain domain name, the Releasor will release the Company from any liabilities in connection

therewith.

NOW,

THEREFORE, in consideration of the mutual covenants and agreements contained herein and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound, the parties hereby agree as follows:

1. Representations

and Warranties. The Releasor hereby represents and warrants to the Company that (i) this Release is a valid and binding obligation

of the Releasor, enforceable against the Releasor in accordance with its terms, and (ii) the Owed Amount represents all of the

outstanding liabilities and accounts payable of the Company to the Releasor on the date hereof.

2. Release.

The Releasor hereby irrevocably and unconditionally releases the Company and its past, present and future officers, directors,

agents, consultants, employees, representatives, and insurers, as applicable, together with all successors and assigns of any

of the foregoing (collectively, the “Released Parties”), of and from all claims, demands, actions, causes of action,

rights of action, contracts, controversies, covenants, obligations, agreements, damages, penalties, interest, fees, expenses,

costs, remedies, reckonings, extents, responsibilities, liabilities, suits, and proceedings of whatsoever kind, nature, or description,

direct or indirect, vested or contingent, known or unknown, suspected or unsuspected, in contract, tort, law, equity, or otherwise,

under the laws of any jurisdiction, that the Releasor or his predecessors, legal representatives, successors or assigns, ever

had, now has, or hereafter can, shall, or may have, against the Released Parties, including but not limited to the Owed Amount,

for, upon, or by reason of any matter, cause, or thing whatsoever from the beginning of the world through, and including, the

date of this Release (“Claims”).

The

Releasor understands that this Release releases claims that the Releasor may not know about. This is the Releasor’s knowing

and voluntary intent, even though the Releasor recognizes that someday he might learn that some or all of the facts that he currently

believes to be true are untrue and even though he might then regret having signed this Release.

The

Releasor agrees that it will not pursue, file or assert or permit to be pursued, filed or asserted any civil action, suit or legal

proceeding seeking equitable or monetary relief (nor will it seek or in any way obtain or accept any such relief in any civil

action, suit or legal proceeding) in connection with any matter concerning its relationship with the Company and/or the Owed Amount

with respect to all of the claims released herein arising from the beginning of the world up to and including the date of execution

of this Release (whether known or unknown to it and including any continuing effects of any acts or practices prior to the date

of execution of this Release). The Releasor acknowledges that he is not entitled to any other payments or benefits of any kind

from the Company.

3. Future

Cooperation. The Releasor agrees to reasonably cooperate with the Company, and its financial and legal advisors, in connection

with any business matters for which the Releasor’s assistance may be required and in any claims, investigations, administrative

proceedings or lawsuits which relate to the Company and for which the Releasor may possess relevant knowledge or information.

4. Applicable

Law. This Release shall be governed by and construed in accordance with the laws of the State of Nevada.

5. Entire

Agreement. This Release may not be changed or altered, except by a writing signed by the parties. This Release constitutes

an integrated, written contract, expressing the entire agreement and understanding between the parties with respect to the subject

matter hereof and supersedes any and all prior agreements and understandings, oral or written, between the parties, except as

otherwise provided herein.

6. Assignment.

The Releasor confirms that it has not assigned or transferred any claim it is releasing, nor has it purported to do so. If any

provision in this Release is found to be unenforceable, all other provisions will remain fully enforceable. This Release binds

the Releasor’s heirs, administrators, representatives, executors, successors, and assigns, and will insure to the benefit

of all Released Parties and their respective heirs, administrators, representatives, executors, successors, and assigns.

7. Binding

Effect. THE RELEASOR UNDERSTANDS THAT FOR ALL PURPOSES THIS RELEASE WILL BE FINAL, EFFECTIVE, BINDING, AND IRREVOCABLE IMMEDIATELY

UPON ITS EXECUTION.

8. Counterparts.

This Release may be executed in one or more counterparts, each of which shall be deemed an original and all of which counterparts,

taken together, shall constitute one and the same instrument.

9.

Acknowledgement. The Releasor acknowledges that he: (a) has carefully read this Release in its entirety; (b) has been advised

to consult and has been provided with an opportunity to consult with legal counsel of his choosing in connection with this Release;

(c) fully understands the significance of all of the terms and conditions of this Release and has discussed them with his independent

legal counsel or has been provided with a reasonable opportunity to do so; (d) has had answered to his satisfaction any questions

asked with regard to the meaning and significance of any of the provisions of this Release; and (e) is signing this Release voluntarily

and of his own free will and agrees to abide by all the terms and conditions contained herein.

| |

GOLD TORRENT, INC. (F/K/A/ CELL DONATE, INC.) |

| |

|

|

| |

By: |

/s/

Ryan E. Hart |

| |

Name: |

Ryan E. Hart |

| |

Title: |

CEO |

RELEASOR:

| By:

|

/s/

David Strebinger |

|

| Name: |

David Strebinger |

|

| Title: |

CEO |

|

RELEASE

This

Release is entered into as of the 15 day of November 2014 by and between Gold Torrent, Inc. (f/k/a/ Cell Donate, Inc.) (“Company”),

and Wantsa Media Inc., on his own behalf and on behalf of his affiliates, heirs and assigns (collectively, the “Releasor”).

WHEREAS,

the Company owes an aggregate of $ 70,000.00 (the “Owed Amount”) to the Releasor;

WHEREAS,

the Releasor wishes to release the Company from any liabilities in connection therewith.

NOW,

THEREFORE, in consideration of the mutual covenants and agreements contained herein and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound, the parties hereby agree as follows:

1. Representations

and Warranties. The Releasor hereby represents and warrants to the Company that (i) this Release is a valid and binding obligation

of the Releasor, enforceable against the Releasor in accordance with its terms, and (ii) the Owed Amount represents all of the

outstanding liabilities and accounts payable of the Company to the Releasor on the date hereof.

2. Release.

The Releasor hereby irrevocably and unconditionally releases the Company and its past, present and future officers, directors,

agents, consultants, employees, representatives, and insurers, as applicable, together with all successors and assigns of any

of the foregoing (collectively, the “Released Parties”), of and from all claims, demands, actions, causes of action,

rights of action, contracts, controversies, covenants, obligations, agreements, damages, penalties, interest, fees, expenses,

costs, remedies, reckonings, extents, responsibilities, liabilities, suits, and proceedings of whatsoever kind, nature, or description,

direct or indirect, vested or contingent, known or unknown, suspected or unsuspected, in contract, tort, law, equity, or otherwise,

under the laws of any jurisdiction, that the Releasor or his predecessors, legal representatives, successors or assigns, ever

had, now has, or hereafter can, shall, or may have, against the Released Parties, including but not limited to the Owed Amount,

for, upon, or by reason of any matter, cause, or thing whatsoever from the beginning of the world through, and including, the

date of this Release (“Claims”).

The

Releasor understands that this Release releases claims that the Releasor may not know about. This is the Releasor’s knowing

and voluntary intent, even though the Releasor recognizes that someday he might learn that some or all of the facts that he currently

believes to be true are untrue and even though he might then regret having signed this Release.

The

Releasor agrees that it will not pursue, file or assert or permit to be pursued, filed or asserted any civil action, suit or legal

proceeding seeking equitable or monetary relief (nor will it seek or in any way obtain or accept any such relief in any civil

action, suit or legal proceeding) in connection with any matter concerning its relationship with the Company and/or the Owed Amount

with respect to all of the claims released herein arising from the beginning of the world up to and including the date of execution

of this Release (whether known or unknown to it and including any continuing effects of any acts or practices prior to the date

of execution of this Release). The Releasor acknowledges that he is not entitled to any other payments or benefits of any kind

from the Company.

3. Future

Cooperation. The Releasor agrees to reasonably cooperate with the Company, and its financial and legal advisors, in connection

with any business matters for which the Releasor’s assistance may be required and in any claims, investigations, administrative

proceedings or lawsuits which relate to the Company and for which the Releasor may possess relevant knowledge or information.

4. Applicable

Law. This Release shall be governed by and construed in accordance with the laws of the State of Nevada.

5. Entire

Agreement. This Release may not be changed or altered, except by a writing signed by the parties. This Release constitutes

an integrated, written contract, expressing the entire agreement and understanding between the parties with respect to the subject

matter hereof and supersedes any and all prior agreements and understandings, oral or written, between the parties, except as

otherwise provided herein.

6. Assignment.

The Releasor confirms that it has not assigned or transferred any claim it is releasing, nor has it purported to do so. If any

provision in this Release is found to be unenforceable, all other provisions will remain fully enforceable. This Release binds

the Releasor’s heirs, administrators, representatives, executors, successors, and assigns, and will insure to the benefit

of all Released Parties and their respective heirs, administrators, representatives, executors, successors, and assigns.

7. Binding

Effect. THE RELEASOR UNDERSTANDS THAT FOR ALL PURPOSES THIS RELEASE WILL BE FINAL, EFFECTIVE, BINDING, AND IRREVOCABLE IMMEDIATELY

UPON ITS EXECUTION.

8. Counterparts.

This Release may be executed in one or more counterparts, each of which shall be deemed an original and all of which counterparts,

taken together, shall constitute one and the same instrument.

9.

Acknowledgement. The Releasor acknowledges that he: (a) has carefully read this Release in its entirety; (b) has been advised

to consult and has been provided with an opportunity to consult with legal counsel of his choosing in connection with this Release;

(c) fully understands the significance of all of the terms and conditions of this Release and has discussed them with his independent

legal counsel or has been provided with a reasonable opportunity to do so; (d) has had answered to his satisfaction any questions

asked with regard to the meaning and significance of any of the provisions of this Release; and (e) is signing this Release voluntarily

and of his own free will and agrees to abide by all the terms and conditions contained herein.

| |

GOLD TORRENT, INC. (F/K/A/ CELL DONATE, INC.) |

| |

|

| |

By: |

/s/

Ryan E. Hart |

| |

Name: |

Ryan E. Hart |

| |

Title: |

CEO |

RELEASOR:

| By: |

/s/ David Strebinger |

|

| Name: |

David Strebinger |

|

| Title: |

CEO |

|

RELEASE

This Release

is entered into as of the 15 day of November 2014 by and between Gold Torrent, Inc. (f/k/a/ Cell Donate, Inc.)

(“Company”), and Caring Capital, on his own behalf and on behalf of his affiliates, heirs and assigns

(collectively, the “Releasor”).

WHEREAS, the Company owes an aggregate

of $309,813.65 (the “Owed Amount”) to the Releasor;

WHEREAS, the Releasor wishes to

release the Company from any liabilities in connection therewith.

NOW, THEREFORE, in consideration

of the mutual covenants and agreements contained herein and for other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, and intending to be legally bound, the parties hereby agree as follows:

1. Representations and Warranties.

The Releasor hereby represents and warrants to the Company that (i) this Release is a valid and binding obligation of the Releasor,

enforceable against the Releasor in accordance with its terms, and (ii) the Owed Amount represents all of the outstanding liabilities

and accounts payable of the Company to the Releasor on the date hereof.

2. Release. The Releasor hereby irrevocably

and unconditionally releases the Company and its past, present and future officers, directors, agents, consultants, employees,

representatives, and insurers, as applicable, together with all successors and assigns of any of the foregoing (collectively, the

“Released Parties”), of and from all claims, demands, actions, causes of action, rights of action, contracts, controversies,

covenants, obligations, agreements, damages, penalties, interest, fees, expenses, costs, remedies, reckonings, extents, responsibilities,

liabilities, suits, and proceedings of whatsoever kind, nature, or description, direct or indirect, vested or contingent, known

or unknown, suspected or unsuspected, in contract, tort, law, equity, or otherwise, under the laws of any jurisdiction, that the

Releasor or his predecessors, legal representatives, successors or assigns, ever had, now has, or hereafter can, shall, or may

have, against the Released Parties, including but not limited to the Owed Amount, for, upon, or by reason of any matter, cause,

or thing whatsoever from the beginning of the world through, and including, the date of this Release (“Claims”).

The Releasor understands that this Release

releases claims that the Releasor may not know about. This is the Releasor’s knowing and voluntary intent, even though the

Releasor recognizes that someday he might learn that some or all of the facts that he currently believes to be true are untrue

and even though he might then regret having signed this Release.

The Releasor agrees that it will not

pursue, file or assert or permit to be pursued, filed or asserted any civil action, suit or legal proceeding seeking equitable

or monetary relief (nor will it seek or in any way obtain or accept any such relief in any civil action, suit or legal proceeding)

in connection with any matter concerning its relationship with the Company and/or the Owed Amount with respect to all of the claims

released herein arising from the beginning of the world up to and including the date of execution of this Release (whether known

or unknown to it and including any continuing effects of any acts or practices prior to the date of execution of this Release).

The Releasor acknowledges that he is not entitled to any other payments or benefits of any kind from the Company.

3. Future Cooperation. The Releasor

agrees to reasonably cooperate with the Company, and its financial and legal advisors, in connection with any business matters

for which the Releasor’s assistance may be required and in any claims, investigations, administrative proceedings or lawsuits

which relate to the Company and for which the Releasor may possess relevant knowledge or information.

4. Applicable Law. This Release shall

be governed by and construed in accordance with the laws of the State of Nevada.

5. Entire Agreement. This Release

may not be changed or altered, except by a writing signed by the parties. This Release constitutes an integrated, written contract,

expressing the entire agreement and understanding between the parties with respect to the subject matter hereof and supersedes

any and all prior agreements and understandings, oral or written, between the parties, except as otherwise provided herein.

6. Assignment. The Releasor confirms

that it has not assigned or transferred any claim it is releasing, nor has it purported to do so. If any provision in this Release

is found to be unenforceable, all other provisions will remain fully enforceable. This Release binds the Releasor’s heirs,

administrators, representatives, executors, successors, and assigns, and will insure to the benefit of all Released Parties and

their respective heirs, administrators, representatives, executors, successors, and assigns.

7. Binding Effect. THE RELEASOR UNDERSTANDS

THAT FOR ALL PURPOSES THIS RELEASE WILL BE FINAL, EFFECTIVE, BINDING, AND IRREVOCABLE IMMEDIATELY UPON ITS EXECUTION.

8. Counterparts. This Release may

be executed in one or more counterparts, each of which shall be deemed an original and all of which counterparts, taken together,

shall constitute one and the same instrument.

9. Acknowledgement. The Releasor

acknowledges that he: (a) has carefully read this Release in its entirety; (b) has been advised to consult and has been provided

with an opportunity to consult with legal counsel of his choosing in connection with this Release; (c) fully understands the significance

of all of the terms and conditions of this Release and has discussed them with his independent legal counsel or has been provided

with a reasonable opportunity to do so; (d) has had answered to his satisfaction any questions asked with regard to the meaning

and significance of any of the provisions of this Release; and (e) is signing this Release voluntarily and of his own free will

and agrees to abide by all the terms and conditions contained herein.

| |

GOLD TORRENT, INC. (F/K/A/ CELL DONATE, INC.) |

| |

|

| |

By: |

/s/

Ryan E. Hart |

| |

Name: |

Ryan E. Hart |

| |

Title: |

CEO |

RELEASOR:

| By: |

/s/ David Strebinger |

|

| Name: |

David Strebinger |

|

| Title: |

CEO |

|

RELEASE

This

Release is entered into as of the 15 day of November 2014 by and between Gold Torrent, Inc. (f/k/a/ Cell Donate, Inc.) (“Company”),

and Chelber Real Estate, on his own behalf and on behalf of his affiliates, heirs and assigns (collectively, the “Releasor”).

WHEREAS,

the Company owes an aggregate of $7,850.50 (the “Owed Amount”) to the Releasor;

WHEREAS,

the Releasor wishes to release the Company from any liabilities in connection therewith.

NOW,

THEREFORE, in consideration of the mutual covenants and agreements contained herein and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound, the parties hereby agree as follows:

1. Representations

and Warranties. The Releasor hereby represents and warrants to the Company that (i) this Release is a valid and binding obligation

of the Releasor, enforceable against the Releasor in accordance with its terms, and (ii) the Owed Amount represents all of the

outstanding liabilities and accounts payable of the Company to the Releasor on the date hereof.

2. Release.

The Releasor hereby irrevocably and unconditionally releases the Company and its past, present and future officers, directors,

agents, consultants, employees, representatives, and insurers, as applicable, together with all successors and assigns of any

of the foregoing (collectively, the “Released Parties”), of and from all claims, demands, actions, causes of action,

rights of action, contracts, controversies, covenants, obligations, agreements, damages, penalties, interest, fees, expenses,

costs, remedies, reckonings, extents, responsibilities, liabilities, suits, and proceedings of whatsoever kind, nature, or description,

direct or indirect, vested or contingent, known or unknown, suspected or unsuspected, in contract, tort, law, equity, or otherwise,

under the laws of any jurisdiction, that the Releasor or his predecessors, legal representatives, successors or assigns, ever

had, now has, or hereafter can, shall, or may have, against the Released Parties, including but not limited to the Owed Amount,

for, upon, or by reason of any matter, cause, or thing whatsoever from the beginning of the world through, and including, the

date of this Release (“Claims”).

The

Releasor understands that this Release releases claims that the Releasor may not know about. This is the Releasor’s knowing

and voluntary intent, even though the Releasor recognizes that someday he might learn that some or all of the facts that he currently

believes to be true are untrue and even though he might then regret having signed this Release.

The

Releasor agrees that it will not pursue, file or assert or permit to be pursued, filed or asserted any civil action, suit or legal

proceeding seeking equitable or monetary relief (nor will it seek or in any way obtain or accept any such relief in any civil

action, suit or legal proceeding) in connection with any matter concerning its relationship with the Company and/or the Owed Amount

with respect to all of the claims released herein arising from the beginning of the world up to and including the date of execution

of this Release (whether known or unknown to it and including any continuing effects of any acts or practices prior to the date

of execution of this Release). The Releasor acknowledges that he is not entitled to any other payments or benefits of any kind

from the Company.

3. Future

Cooperation. The Releasor agrees to reasonably cooperate with the Company, and its financial and legal advisors, in connection

with any business matters for which the Releasor’s assistance may be required and in any claims, investigations, administrative

proceedings or lawsuits which relate to the Company and for which the Releasor may possess relevant knowledge or information.

4. Applicable

Law. This Release shall be governed by and construed in accordance with the laws of the State of Nevada.

5. Entire

Agreement. This Release may not be changed or altered, except by a writing signed by the parties. This Release constitutes

an integrated, written contract, expressing the entire agreement and understanding between the parties with respect to the subject

matter hereof and supersedes any and all prior agreements and understandings, oral or written, between the parties, except as

otherwise provided herein.

6. Assignment.

The Releasor confirms that it has not assigned or transferred any claim it is releasing, nor has it purported to do so. If any

provision in this Release is found to be unenforceable, all other provisions will remain fully enforceable. This Release binds

the Releasor’s heirs, administrators, representatives, executors, successors, and assigns, and will insure to the benefit

of all Released Parties and their respective heirs, administrators, representatives, executors, successors, and assigns.

7. Binding

Effect. THE RELEASOR UNDERSTANDS THAT FOR ALL PURPOSES THIS RELEASE WILL BE FINAL, EFFECTIVE, BINDING, AND IRREVOCABLE IMMEDIATELY

UPON ITS EXECUTION.

8. Counterparts.

This Release may be executed in one or more counterparts, each of which shall be deemed an original and all of which counterparts,

taken together, shall constitute one and the same instrument.

9.

Acknowledgement. The Releasor acknowledges that he: (a) has carefully read this Release in its entirety; (b) has been advised

to consult and has been provided with an opportunity to consult with legal counsel of his choosing in connection with this Release;

(c) fully understands the significance of all of the terms and conditions of this Release and has discussed them with his independent

legal counsel or has been provided with a reasonable opportunity to do so; (d) has had answered to his satisfaction any questions

asked with regard to the meaning and significance of any of the provisions of this Release; and (e) is signing this Release voluntarily

and of his own free will and agrees to abide by all the terms and conditions contained herein.

| |

GOLD TORRENT, INC. (F/K/A/ CELL DONATE, INC.) |

| |

|

|

| |

By: |

/s/

Ryan E. Hart |

| |

Name: |

Ryan

E. Hart |

| |

Title: |

CEO |

RELEASOR:

| By:

|

/s/

Chelsea Greene |

|

| Name: |

Chelsea

Greene |

|

| Title: |

President

of Chelber Real Estate |

|

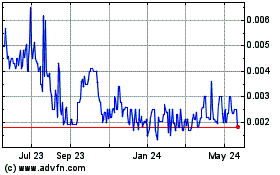

GGToor (CE) (USOTC:GTOR)

Historical Stock Chart

From Feb 2025 to Mar 2025

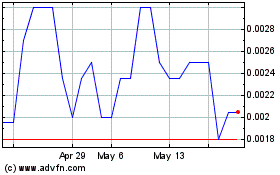

GGToor (CE) (USOTC:GTOR)

Historical Stock Chart

From Mar 2024 to Mar 2025