UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

[X]

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended December 31, 2014

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ____________ to ____________

Commission

file number: 333-159300

GOLD

TORRENT, INC.

(Exact name of registrant as specified in its charter)

| Nevada

|

|

06-1791524 |

(State or other jurisdiction of

incorporation

or organization) |

|

(I.R.S. Employer

Identification No.)

|

960

Broadway Avenue

Suite

160

Boise,

Idaho 83707

(Address

of principal executive offices, including zip code)

(208)

343-1413

(Registrant’s

telephone number, including area code)

(Former

name, former address and former fiscal year, if changed since last report)

Securities

registered pursuant to Section 12(b) of the Exchange Act: None

Securities

registered pursuant to Section 12(g) of the Exchange Act: Common Stock, Par Value $0.001

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X]

No [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

Large

accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller

reporting company [X]

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No

[X]

APPLICABLE

ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate

by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the

Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes [ ]

No [ ]

APPLICABLE

ONLY TO CORPORATE ISSUERS

As

of February 4, 2015, the registrant’s outstanding common stock consisted of 4,835,000 shares.

Table

of Contents

PART

1 – FINANCIAL INFORMATION

Item

1. Interim Financial Statements

The

unaudited interim financial statements of GOLD TORRENT, INC. (“we”, “our”, “us”, the “Company”)

follow. All currency references in this report are to US dollars unless otherwise noted.

GOLD

TORRENT, INC.

December

31, 2014

GOLD

TORRENT, INC.

Interim

Balance Sheets

(Unaudited

- Expressed in US dollars)

| | |

December 31, 2014 | | |

March 31, 2014 | |

| | |

| | |

| |

| Assets | |

| | | |

| | |

| | |

| | | |

| | |

| Current | |

| | | |

| | |

| Cash | |

$ | - | | |

$ | 35,696 | |

| Prepaid and deposits | |

| 4,375 | | |

| - | |

| | |

| 4,375 | | |

| 35,696 | |

| Non-Current | |

| | | |

| | |

| Intangible asset (note 6) | |

| - | | |

| 2,060 | |

| | |

| | | |

| | |

| | |

$ | 4,375 | | |

$ | 37,756 | |

| | |

| | | |

| | |

| Liabilities | |

| | | |

| | |

| | |

| | | |

| | |

| Current | |

| | | |

| | |

| Bank indebtedness | |

$ | 858 | | |

$ | - | |

| Accounts payable (note 6) | |

| 82,519 | | |

| 453,355 | |

| Accrued liabilities (note 3) | |

| 10,000 | | |

| 10,000 | |

| Stockholders’ loans (note 7) | |

| 110,710 | | |

| 40,656 | |

| | |

| | | |

| | |

| | |

| 204,087 | | |

| 504,011 | |

| | |

| | | |

| | |

| Stockholders’

Deficiency | |

| | | |

| | |

| | |

| | | |

| | |

| Common Stock (note

4) | |

| | | |

| | |

| Authorized: | |

| | | |

| | |

| 200,000,000 common shares, $0.001 par value | |

| | | |

| | |

| 20,000,000 preferred shares, $0.001 par value | |

| | | |

| | |

| Issued and outstanding: | |

| | | |

| | |

| 4,635,000 common shares, $0.001 par value (March 31, 2014:

4,610,000 common shares) | |

| 22,963 | | |

| 22,938 | |

| Contributed Surplus

(notes 4 and 5) | |

| 191,483 | | |

| - | |

| Additional Paid-in

Capital | |

| 70,262 | | |

| 70,262 | |

| Deficit | |

| (484,420 | ) | |

| (559,455 | ) |

| | |

| | | |

| | |

| | |

| (199,712 | ) | |

| (466,255 | ) |

| | |

| | | |

| | |

| | |

$ | 4,375 | | |

$ | 37,756 | |

Nature

of operations and going concern (note 1)

See

accompanying notes to interim financial statements.

GOLD

TORRENT, INC.

Interim

Statements of Operations

(Unaudited

- Expressed in US dollars)

| | |

For

the Three

Months Ended

December 31, 2014 | | |

For the Three

Months

Ended

December 31, 2013 | | |

For

the Nine

Months Ended

December 31, 2014 | | |

For the Nine

Months

Ended

December 31, 2013 | |

| Expenses | |

| | | |

| | | |

| | | |

| | |

| Accounting and legal | |

$ | 22,750 | | |

$ | 42,000 | | |

$ | 72,671 | | |

$ | 60,134 | |

| Bank charges and finance fees (note 7) | |

| 2,745 | | |

| - | | |

| 5,448 | | |

| 340 | |

| Exploration and evaluation (note

9) | |

| 36,914 | | |

| - | | |

| 62,149 | | |

| - | |

| Finder’s fees

(note 4) | |

| - | | |

| - | | |

| 31,250 | | |

| - | |

| Licenses and fees | |

| 4,242 | | |

| 6,826 | | |

| 9,972 | | |

| 11,826 | |

| Office | |

| 459 | | |

| 1,079 | | |

| 1,660 | | |

| 1,079 | |

| Share-based payments (note 5) | |

| 53,970 | | |

| - | | |

| 160,258 | | |

| - | |

| Loss from Continuing

Operations | |

| (121,080 | ) | |

| (49,905 | ) | |

| (343,408 | ) | |

| (73,379 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from discontinued operations | |

| - | | |

| - | | |

| - | | |

| (35,000 | ) |

| Gain on sale of discontinued operations | |

| 418,443 | | |

| - | | |

| 418,443 | | |

| - | |

| Net Income (Loss)

from Discontinued Operations (note 6) | |

| 418,433 | | |

| - | | |

| 418,443 | | |

| (35,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Income (Loss)

and Comprehensive Income (Loss) for Period | |

$ | 297,363 | | |

$ | (49,905 | ) | |

$ | 75,035 | | |

$ | (108,379 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding | |

| 4,635,000 | | |

| 4,582,000 | | |

| 4,635,000 | | |

| 4,582,000 | |

| Basic and diluted (loss) per share –

continuing operations | |

| (0.03 | ) | |

| (0.01 | ) | |

| (0.07 | ) | |

| (0.01 | ) |

| Basic and diluted income (loss) per share

– discontinued operations | |

| 0.09 | | |

| - | | |

| 0.09 | | |

| (0.01 | ) |

| Basic and diluted income (loss) per share | |

$ | 0.06 | | |

$ | (0.01 | ) | |

$ | 0.02 | | |

$ | (0.02 | ) |

See

accompanying notes to interim financial statements.

GOLD

TORRENT, INC.

Interim

Statements of Cash Flows

(Unaudited

- Expressed in US dollars)

| | |

For

the Nine

Months Ended December 31, 2014 | | |

For

the Nine

Months Ended December 31, 2013 | |

| | |

| | |

| |

| Cash Flow from Operating

Activities | |

| | | |

| | |

| Net loss for the period | |

$ | (343,408 | ) | |

$ | (73,379 | ) |

| Items not involving cash: | |

| | | |

| | |

| Shares issued for finder’s fees | |

| 31,250 | | |

| - | |

| Share-based payments | |

| 160,258 | | |

| - | |

| Finance fees | |

| 5,224 | | |

| - | |

| Changes in assets and liabilities | |

| | | |

| | |

| Prepaid and deposits | |

| (4,375 | ) | |

| - | |

| Accounts payable | |

| 49,667 | | |

| 46,831 | |

| Cash Used in Continuing

Operating Activities | |

| (101,384 | ) | |

| (26,548 | ) |

| Cash Used in Discontinued

Operating Activities (note 6) | |

| - | | |

| - | |

| | |

| | | |

| | |

| Total Cash Used

in Operating Activities | |

| (101,384 | ) | |

| (26,548 | ) |

| | |

| | | |

| | |

| Cash Flow from Financing

Activities | |

| | | |

| | |

| Loans received from stockholders | |

| 80,000 | | |

| 23,687 | |

| Repayment of stockholders loans | |

| (15,170 | ) | |

| - | |

| | |

| | | |

| | |

| Cash Provided by

Financing Activities | |

| 64,830 | | |

| 23,687 | |

| | |

| | | |

| | |

| Decrease in Cash | |

| (36,554 | ) | |

| (2,861 | ) |

| Cash, Beginning of Period | |

| 35,696 | | |

| 2,861 | |

| | |

| | | |

| | |

| (Bank indebtedness)

cash, End of Period | |

$ | (858 | ) | |

$ | - | |

| | |

| | | |

| | |

| Supplemental Information | |

| | | |

| | |

| Tax paid | |

$ | - | | |

$ | - | |

| Interest paid | |

$ | - | | |

$ | - | |

See

accompanying notes to interim financial statements.

GOLD

TORRENT, INC.

Interim

Statements of Stockholders’ Deficiency

(Unaudited

- Expressed in US dollars)

| | |

Shares of

Common

Stock Issued | | |

Common Stock | | |

Contributed Surplus | | |

Additional

Paid-in Capital | | |

Deficit | | |

Total | |

| Balance, March 31, 2013 | |

| 4,582,000 | | |

$ | 22,910 | | |

$ | - | | |

| 35,290 | | |

$ | (428,319 | ) | |

$ | (370,119 | ) |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| (108,379 | ) | |

| (108,379 | ) |

| Balance, December 31, 2013 | |

| 4,582,000 | | |

$ | 22,910 | | |

$ | - | | |

| 35,290 | | |

$ | (536,698 | ) | |

$ | (478,498 | ) |

| | |

Shares of

Common

Stock Issued | | |

Common Stock | | |

Contributed Surplus | | |

Additional

Paid-in Capital | | |

Deficit | | |

Total | |

| Balance, March 31, 2014 | |

| 4,610,000 | | |

$ | 22,938 | | |

$ | - | | |

$ | 70,262 | | |

$ | (559,455 | ) | |

$ | (466,255 | ) |

| Shares issued for services | |

| 25,000 | | |

| 25 | | |

| 31,225 | | |

| - | | |

| - | | |

| 31,250 | |

| Share-based payments | |

| - | | |

| - | | |

| 160,258 | | |

| - | | |

| - | | |

| 160,258 | |

| Net income for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| 75,035 | | |

| 75,035 | |

| Balance, December 31, 2014 | |

| 4,635,000 | | |

$ | 22,963 | | |

$ | 191,483 | | |

$ | 70,262 | | |

$ | (484,420 | ) | |

$ | (199,712 | ) |

See

accompanying notes to interim financial statements.

GOLD

TORRENT, INC.

Notes

to Interim Financial Statements

Nine

Months Ended December 31, 2014

(Unaudited

- Expressed in US dollars)

| 1. | | Nature of Operations and

Going Concern |

GOLD

TORRENT, INC. (the “Company”) was incorporated as a Nevada company on August 15, 2006. Since inception, the Company

has been creating, testing and developing mobile applications, games and tools designed to engage consumers in transacting business

via mobile devices. On November 19, 2014, the Company entered into a Spin-off Agreement (the “Agreement”) with a company

controlled by a former shareholder to sell all intellectual property and assets associated with the previous business of the Company,

pursuant to which the Company was released from certain liabilities amounting to $420,503 (note 6).

Going

forward, the Company plans to focus on acquiring ownership in late-stage exploration to development stage gold mining projects

and/or royalty or streaming interests in low capital intensity, late-stage mining projects in North America. During the nine months

ended December 31, 2014, the Company entered into an Exploration and Option to enter Joint Venture Agreement with a third party

(note 9).

The

Company has incurred losses since inception and has an accumulated deficit of $484,420 as of December 31, 2014, with limited resources

and no source of operating cash flows. As at December 31, 2014, the Company has a working capital deficiency of $199,712 (March

31, 2014 - $468,315). As a result of the Agreement, the Company recognized a net income of $75,035 during the nine months ended

December 31, 2014.

The

Company’s continuance as a going concern is dependent on the success of the efforts of its directors and principal stockholders

in providing financial support in the short-term, raising additional capital through equity or debt financing either from its

own resources or from third parties, and achieving profitable operations. In the event that such resources are not secured, the

assets may not be realized or liabilities discharged at their carrying amounts, and the difference from the carrying amounts reported

in these unaudited interim financial statements could be material.

These

unaudited interim financial statements do not include any adjustments to reflect the possible future effects on the recoverability

and classification of the assets or the amounts and classifications of the liabilities that may result from the inability of the

Company to continue as a going concern.

| 2. | | Significant Accounting Policies |

These

unaudited interim financial statements are prepared in accordance with accounting principles generally accepted in the United

States of America (“US GAAP”). The Company’s functional and reporting currency is the US dollar.

These

unaudited interim financial statements reflect all adjustments (all of which are normal and recurring in nature) that, in the

opinion of management, are necessary for fair presentation of the interim financial information. The results of operations for

the interim period presented are not necessarily indicative of the results to be expected for any subsequent quarter or for the

entire year to end March 31, 2015. Certain information and footnote disclosures normally included in annual financial statements

prepared in accordance with US GAAP have been condensed or omitted. These unaudited interim financial statements and notes included

herein have been prepared on a basis consistent with, and should be read in conjunction with, the Company’s audited financial

statements and notes for the year ended March 31, 2014, as filed in its Form 10-K.

The

preparation of interim financial statements in conformity with US GAAP requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the interim

financial statements, and the reported amounts of revenues and expenses during the reporting period. On an ongoing basis, the

Company evaluates its estimates, including, but not limited to, those related to accounts payable and accrued liabilities, the

fair value of warrants attached to common shares issued, the fair value of shares issued for services, the fair value of stock

options granted, and the recoverability of income tax assets. While management believes the estimates used are reasonable, actual

results could differ from those estimates and could impact future results of operations and cash flows.

| |

(c) |

Basic and diluted earnings (loss)

per share |

Basic earnings (loss) per share is computed using the weighted average number of common shares outstanding. Diluted earnings

(loss) per share assumes the exercise of common stock equivalents, such as stock issuable pursuant to the exercise of stock

options and warrants. However, the calculation of diluted loss per share excludes the effects of various conversions and

exercise of options and warrants that would be anti-dilutive.

| (d) | Foreign

currency translation |

Transactions

in currencies other than the US dollar are translated into US dollars at the exchange rate in effect at the balance sheet date

for monetary assets and liabilities, and at historical exchange rates for non-monetary assets and liabilities. Expenses are translated

at the average rates for the period, except amortization, which is translated on the same basis as the related assets. Resulting

translation gains or losses are reflected in net loss.

All

financial instruments are classified as one of the following: held-to-maturity, loans and receivables, held-for-trading, available-for-sale

or other financial liabilities. Financial assets and liabilities held-for-trading are measured at fair value with gains and losses

recognized in net income. Financial assets held-to-maturity, loans and receivables, and other financial liabilities are measured

at amortized cost using the effective interest method. Available-for-sale instruments are measured at fair value with unrealized

gains and losses recognized in other comprehensive income and reported in stockholders’ equity.

A

financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant

to the fair value measurement. The Company prioritizes the inputs into three levels that may be used to measure fair value:

| (i)

Level 1 – | Applies

to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities. |

| | | |

| (ii)

Level 2 – | Applies

to assets or liabilities for which there are inputs other than quoted prices included in Level 1 that are observable for the asset

or liability, either directly, such as quoted prices for similar assets or liabilities in active markets, or indirectly, such

as quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions. |

| | | |

| (iii)

Level 3 – | Applies

to assets or liabilities for which there are unobservable market data. |

Transaction

costs that are directly attributable to the acquisition or issue of financial instruments that are classified as held-to-maturity,

loans and receivables or other financial liabilities are included in the initial carrying value of such instruments and amortized

using the effective interest method. Transaction costs classified as held-for-trading are expensed when incurred, while those

classified as available-for-sale are included in the initial carrying value.

GOLD

TORRENT, INC.

Notes

to Interim Financial Statements

Nine

Months Ended December 31, 2014

(Unaudited

- Expressed in US dollars)

| 2. | | Significant Accounting Policies

(continued) |

The

Company uses the asset and liability approach in its method of accounting for income taxes that requires the recognition of deferred

tax liabilities and assets for expected future tax consequences of temporary differences between the carrying amounts and the

tax basis of assets and liabilities. The Company recognizes the effect of uncertain tax positions where it is more likely than

not based on technical merits that the position could be sustained where the tax benefit has a greater than 50% likelihood of

being realized upon settlement. A valuation allowance against deferred tax assets is recorded if based upon available evidence,

it is more likely than not that some or all of the deferred tax assets will not be realized.

The

Company records all share-based payments at fair value. Where equity instruments are granted to employees, they are recorded at

the fair value of the equity instrument granted at the grant date. The grant date fair value is recognized through profit or loss

over the vesting period, described as the period during which all the vesting conditions are to be satisfied.

Where

equity instruments are granted to non-employees, they are recorded at the fair value of the goods or services received. When the

value of goods or services received in exchange for the share-based payment cannot be reliably estimated, the fair value is measured

by use of a valuation model.

At

each balance sheet date, the amount recognized as an expense is adjusted to reflect the actual number of stock options expected

to vest. On the exercise of stock options, common stock is recorded for the consideration received and for the fair value amounts

previously recorded to contributed surplus. The Company uses the Black-Scholes option pricing model to estimate the fair value

of share-based payments.

| (h) | Exploration

and evaluation costs |

The

Company is primarily engaged in the acquisition and exploration of mining properties. Mineral property exploration costs are expensed

as incurred. Mineral property acquisition costs are initially capitalized when incurred. An impairment loss is recognized when

the sum of the expected undiscounted future cash flows is less than the carrying amount of the mineral property. Impairment losses,

if any, are measured as the excess of the carrying amount of the mineral property over its estimated fair value.

| (i) | Recent

accounting guidance adopted |

The

Company has adopted Accounting Standards Update (“ASU”) 2014-10, Development Stage Entities, which eliminates

certain financial reporting requirements. As such, these interim financial statements no longer present inception-to-date information

on the statements of operations, cash flows, and stockholders’ deficiency. In addition, these interim financial statements

are no longer labeled as a, “development stage entity”.

In

August 2014, the Financial Accounting Standards Board (“FASB”) issued ASU 2014-15, Presentation of Financial Statements-Going

Concern. This ASU is intended to define management’s responsibility to evaluate whether there is substantial doubt about

an organization’s ability to continue as a going concern and to provide related footnote disclosures. It is effective for

annual periods beginning after December 15, 2016, with early adoption permitted. The Company does not expect it to have a material

effect on the Company’s financial condition, results of operations, and cash flows.

In

April 2014, the FASB issued ASU 2014-08, Reporting Discontinued Operations and Disclosures of Disposals of Components of an

Entity. This ASU amends ASC 360, Property, Plant and Equipment and expands the disclosures for discontinued operations,

and requires new disclosures for disposals of individually significant components that do not meet the new definition of a discontinued

operation and are classified as assets held for sale. These provisions are effective for annual and interim periods beginning

after December 15, 2014. The Company does not expect it to have a material effect on the Company’s financial condition,

results of operations, and cash flows.

GOLD

TORRENT, INC.

Notes

to Interim Financial Statements

Nine

Months Ended December 31, 2014

(Unaudited

- Expressed in US dollars)

The

Company has designated its cash and bank indebtedness as held-for-trading; and accounts payable, accrued liabilities and stockholders’

loans, as other financial liabilities.

The

fair values of the Company’s cash and bank indebtedness, accounts payable, accrued liabilities and stockholders’ loans

approximate their carrying values due to the short-term maturity of these instruments.

Credit

risk is the risk of potential loss to the Company if the counterparty to a financial instrument fails to meet its contractual

obligations. The Company is not exposed to significant credit risk as at December 31, 2014.

The

Company’s functional currency is the US dollar. The Company translates transactions in foreign currencies into US currency

using rates on the date of the transactions. Translation risk is considered minimal, as the Company does not incur any significant

transactions in currencies other than US dollars.

The

Company is not exposed to significant interest rate risk due to the short-term maturity of its monetary current assets and liabilities.

Liquidity

risk is the risk that the Company will encounter difficulty in satisfying its financial obligations as they become due. The Company

manages its liquidity risk by forecasting cash flows from operations and anticipated investing and financing activities. At December

31, 2014, the Company had accounts payable of $82,519 (March 31, 2014 - $453,355), which are due within 30 days or less. The Company’s

stockholders’ loans (note 7) of $110,710 (March 31, 2014 - $40,656) are due within one year and are 10 % interest-bearing.

As

at December 31, 2014, accrued liabilities consist of accrued accounting and legal fees of $10,000 (March 31, 2014 - $10,000).

On

April 22, 2014, the Company entered into a Finder’s Fee agreement for the issuance of 25,000 common shares at an estimated

fair value of $1.25 per share for a total amount of $31,250 as a retainer for services. The agreement continues for one year and

will continue from year to year thereafter unless terminated by either party.

The

stock options have been granted in conjunction with an Equity Incentive Plan (the “Plan”) for employees, directors

and consultants, whereby a maximum aggregate number of common shares that may be issued under the Plan are 20,000,000 common shares.

The term of the options is determined by the Board of Directors and cannot exceed 10 years. The exercise price of the stock options

is determined by Board of Directors, but shall not be less than the fair market value of the common stock on the date of grant.

Stock options granted under the Plan vest over varying periods at the discretion of the Board of Directors.

GOLD

TORRENT, INC.

Notes

to Interim Financial Statements

Nine

Months Ended December 31, 2014

(Unaudited

- Expressed in US dollars)

| 5. | | Stock Options (continued) |

During

the nine months ended December 31, 2014, the Company granted 175,000 options to officers and directors of the Company with the

following vesting terms: 1/3 on date of grant, 1/3 six months from date of grant, and 1/3 one year from date of grant.

The

following table summarizes information about the Company’s share options in accordance with its Plan:

| | | |

Number | | |

Weighted-average

exercise price | |

| Balance, March 31, 2014 | | |

| - | | |

$ | - | |

| Granted | | |

| 175,000 | | |

$ | 1.27 | |

| Balance, December 31, 2014 | | |

| 175,000 | | |

$ | 1.27 | |

The

Company’s stock options are outstanding and exercisable as follows:

| | |

| | |

2014 | | |

2013 | |

| Expiry date | |

Exercise price | | |

Options outstanding | | |

Options exercisable | | |

Options outstanding | | |

Options exercisable | |

| July 30, 2019 | |

$ | 1.25 | | |

| 150,000 | | |

| 50,000 | | |

| - | | |

| - | |

| July 30, 2019 | |

$ | 1.38 | | |

| 25,000 | | |

| 8,333 | | |

| - | | |

| - | |

| | |

| | | |

| 175,000 | | |

| 58,333 | | |

| - | | |

| - | |

The

weighted average remaining contractual life of stock options outstanding at December 31, 2014 is 4.58 (March 31, 2014 - nil) years.

As at December 31, 2014, unamortized share-based payment expense on the outstanding options is $49,492.

The

fair value of all stock options granted are estimated using the Black-Scholes option pricing model with the following weighted-average

assumptions and resulting in the following weighted-average fair values:

| | |

2014 | | |

2013 | |

| Risk-free interest rate | |

| 1.77 | % | |

| N/A | |

| Expected dividend yield | |

| 0 | % | |

| N/A | |

| Expected share price volatility | |

| 178 | % | |

| N/A | |

| Expected option life in years | |

| 5 | | |

| N/A | |

| Fair value | |

$ | 1.20 | | |

| N/A | |

Companies

are required to utilize an estimated forfeiture rate when calculating the expense for the reporting period. Based on the best

estimate, management applied the estimated forfeiture rate of nil% (2013 – N/A) in determining the expense recorded in the

accompanying statements of operations. Expected share price volatility is determined with reference to the Company’s historical

daily share price volatility.

GOLD

TORRENT, INC.

Notes

to Interim Financial Statements

Nine

Months Ended December 31, 2014

(Unaudited

- Expressed in US dollars)

| 6. | | Discontinued Operations |

During

the year ended March 31, 2013, the Company purchased a domain name for $2,060. On November 19, 2014, the Company entered into

a Spin-off Agreement (the “Agreement”) with a company controlled by a former shareholder to sell all intellectual

property and assets associated with the previous business of the Company. In exchange for all assets and property related to the

previous business, the Company was released from certain liabilities amounted to $420,503 previously recorded in accounts payable

owing to the former shareholder or companies controlled by them.

The

disposal of the net liabilities of the operations resulted in a gain of $418,443. The carrying amounts of the net obligations

on the date of disposal were as follows:

| | |

2014 | |

| Intangible

asset | |

$ | 2,060 | |

| Total

asset disposed | |

| 2,060 | |

| | |

| | |

| Accounts payable | |

$ | 420,503 | |

| Total

liabilities disposed | |

| 420,503 | |

| | |

| | |

| Gain

on sale of discontinued operations | |

$ | 418,443 | |

All

prior period statements of operations and statements of cash flows presented in these unaudited interim financial statements have

been reclassified to segregate the impact of discontinued operations.

Net

loss from discontinued operations of $35,000 during the nine months ended December 31, 2013 pertains to consulting and development

fees of $35,000 which is included in the accounts payable balance as at March 31, 2014 and subsequently disposed of as described

above.

As

at December 31, 2014, current officers and shareholders of the Company loans outstanding amounted to of $110,710 (March 31, 2014

- $40,656). These loans are due one year after issue and are 10 % interest-bearing. The Company has accrued interest of $5,224

(March 31, 2014 - $nil).

Subsequent

to December 31, 2014, the Company entered into loan extension agreements with its current officers and shareholders. The loans

are due December 31, 2015 and are 11% interest-bearing.

The

Company operates primarily in one business segment being the identification and development of mining projects with substantially

all of its assets and operations located in the United States (2013 – Canada).

| 9. | | Exploration and Evaluation |

On

July 24, 2014, the Company entered into a non-binding LOI agreement with a third party to negotiate and enter into a joint venture

agreement for the development of the gold property known as Willow Creek, Alaska. On

November 5, 2014, the Company signed an Exploration and Option to Enter Joint Venture Agreement for the Willow Creek project in

Alaska. The Exploration and Option Agreement provides the Company with the right to earn up to 70% interest in a joint venture

with Miranda Gold Corp. by making certain expenditures over the next three years totaling US$10 million. The principal terms of

the Exploration and Option to Enter Joint Venture Agreement provides that the Company can earn an initial 20% interest in the

project by incurring an initial work commitment before November 5, 2015 in costs related to exploration and development of the

project.

The

exploration and evaluation costs for the period ended December 31, 2014 are associated with travel costs to Alaska and helicopter

services for surveying the site.

Subsequent

to December 31, 2014, the Company entered into the following agreements:

| |

(i) |

|

A

loan agreement with Daniel Kunz (shareholder) for $150,000, 10% interest-bearing, and effective January 8, 2015. The loan

is payable on January 8, 2016. In conjunction with the loan agreement, the Company is required to pay a fee of $10,000 to

Daniel Kunz; |

| |

|

|

|

| |

(ii) |

|

Loan

extension agreements with the current officers and shareholders. The loans were extended to December 31, 2015 and are 11%

interest-bearing (note 7); |

| |

|

|

|

| |

(iii) |

|

An

investors relations consulting agreement for a period of two months effective January 1, 2015. As compensation, the consultant

will be issued 200,000 common shares. |

Item

2. Management’s Discussion and Analysis of Financial Condition and Result of Operations

Forward

Looking Statements

This

quarterly report on Form 10-Q contains forward-looking statements that involve risks and uncertainties. These statements relate

to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology

such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”,

“estimates”, “predicts”, “potential” or “continue” or the negative of these terms

or other comparable terminology. These statements are only predictions.

While

these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current

judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates,

predictions, projections, assumptions or other future performance suggested in this report. Except as required by applicable law,

we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our

unaudited interim financial statements for the three and nine months ended December 31, 2014 are expressed in US dollars and are

prepared in accordance with generally accepted accounting principles in the United States of America. They reflect all adjustments

(all of which are normal and recurring in nature) that, in the opinion of management, are necessary for fair presentation of our

interim financial information. The results of operations for the interim periods presented are not necessarily indicative of the

results to be expected for any subsequent quarter or for our fiscal year ending March 31, 2015. Our unaudited financial statements

and notes included therein have been prepared on a basis consistent with and should be read in conjunction with our audited financial

statements and notes for the year ended March 31, 2014, as filed in our annual report on Form 10-K.

The

following discussion should be read in conjunction with our interim financial statements and the related notes that appear elsewhere

in this quarterly report.

Business

Overview

GOLD

TORRENT, INC. (the “Company”) was incorporated as a Nevada corporation on August 15, 2006 under the name “Celldonate

Inc.” and we have no subsidiaries. Historically we were in the business of developing mobile monetization solutions and

applications. On January 16, 2014, the Company changed its name to “Gold Torrent, Inc.” in order to better reflect

the direction and business of the Company. On November 19, 2014, the Company entered into a Spin-off Agreement with a company

controlled by a former shareholder to sell all intellectual property associated with the previous business of the Company, pursuant

to which the Company was released from liabilities of $420,503.

Going

forward, we plan to focus on acquiring ownership in late-stage exploration to development-stage gold mining projects and/or royalty

or streaming interests in low capital intensity, late-stage mining projects in North America but may pursue other profitable business

opportunities that are available to us. Our main focus will be on identifying solid resources, and then utilize funding to bring

a distressed asset into production, while either securing equity ownership or rights of title in the form of royalties. We are

targeting pre-production resource projects that are well understood, show strong financial projections and low capital intensity,

where we can apply capital to take the projects into production within 12-36 months.

On

July 28, 2014, the Company entered into a non-binding Letter of Intent (“LOI”) with a third party to negotiate and

enter into a Joint Venture Agreement (“JV Agreement”) for the development of the gold property known as Willow Creek,

Alaska. Accordingly, the Company has undertaken a due diligence investigation into the project, which was completed on September

26, 2014. On November 5, 2014, the Company signed an Exploration and Option to Enter Joint Venture Agreement for the Willow Creek

project in Alaska (“Exploration and Option Agreement”) with Miranda U.S.A., Inc. (“Miranda”). The Exploration

and Option Agreement provides the Company with the right to earn up to 70% interest in a joint venture with Miranda Gold Corp.

by making certain expenditures over the next three years totaling US$10 million. The principal terms of the Exploration and Option

Agreement provide that the Company can earn an initial 20% interest in the Willow Creek gold project by incurring an initial work

commitment of $1,070,000 before November 5, 2015 in costs related to exploration and development of the project. The Company shall

be the manager of the initial joint venture. The management committee during the initial earn–in period shall be comprised

of one nominee from the Company and one nominee from Miranda

Upon

completion of the initial work commitment, the Company can then either terminate the agreement or exercise an option to enter

into a limited liability company (“JV”) with Miranda under the following terms:

| |

● |

Miranda

will assign the underlying twenty-year lease that includes 8700 acres of patented mining claims and State Claims on the Willow

Creek project to the JV and Miranda will retain a 30% participating interest in the JV; |

| |

|

|

| |

● |

The

Company will sole fund the next US$8.93 million of expenditures on the JV to earn a 70% interest in the JV in two stages over

the next two years; and |

| |

|

|

| |

● |

The

Company shall be entitled to 90% of the cash flow from production at the Willow Creek project until it recovers its US$10

million initial capital investment, and 80% of the cash flow from production thereafter until it recovers any of its initial

investment that exceeds $10 million, and thereafter shall be entitled to 70% of project cash flows. Miranda shall be entitled

to 10%, 20% and 30%, respectively, of the Willow Creek cash flow |

The

Company plans to complete initial engineering, resource, permitting, and economic studies during the initial earn-in period with

a goal to bring the initial Coleman area gold resource into production as soon as possible. Expansion and exploration drilling

is planned during construction and during commercial production and is expected to expand the initial known mineralization well

beyond the current levels.

Since

our inception, we have incurred operational losses. We have also accumulated net losses since our inception and incurred a net

loss for the most recent audited and interim periods. To finance our operations, we have received advances from related parties,

loan payables and completed several rounds of financing, raising $92,050 through private placements of our common stock.

Results

of Operations

For

the Three Months ended December 31, 2014

During

the three months ended December 31, 2014, we recognized income of $418,443 from discontinued operations, compared to $nil during

the same period in the prior year due to the Spin-off Agreement. During the three month period ended December 31, 2014, we recognized

a loss from continuing operations of $121,080, compared to a loss of $49,905 during the same period in the prior year.

During

the three months ended December 31, 2014, we recognized net income $297,363, compared to a net loss of $49,905 during the same

period in the prior year.

Our

net income per share for the three months ended December 31, 2014 was $0.06, our income per share for discontinued operations

in the period was $0.09 while our loss per share for continuing operations was $0.03. Our net loss per share for the three months

ended December 31, 2013 was $0.01, our gain per share for discontinued operations in the period was $nil while our loss per share

for continuing operations was $0.01.

During

the three months ended December 31, 2014, we incurred total expenses of $121,080, compared to total expenses of $49,905 during

the same period in the prior year.

Our

total expenses during the three months ended December 31, 2014 consisted of $22,750 in accounting and legal fees, $36,914 in development

exploration costs, $4,242 in licenses and fees, $2,745 in bank charges, $459 in office expenses, and $53,970 in share-based payments.

For the same period in fiscal 2013, we incurred expenses of $42,000 in accounting and legal fees, $6,826 in licenses and fees,

$nil in bank charges and $1,079 in office expenses. Our total expenses are significantly higher. The variation in expenses is

mainly due to the lower accounting, legal and license fees, increased share-based payments, and higher development exploration

fees consisting mainly of travel expenses for site visits and consultations related to the Willow Creek property.

For

the Nine Months ended December 31, 2014

During

the nine months ended December 31, 2014, we recognized income of $418,443 from discontinued operations, compared to a loss from

discontinued operations of $35,000 during the same period in the prior year. During the nine month period ended December 31, 2014,

we recognized a loss from continuing operations of $343,408, compared to a loss of $73,379 during the same period in the prior

year.

During

the nine months ended December 31, 2014, we recognized income of $75,035, compared to a net loss of $108,379 during the same period

in the prior year.

Our

net income per share for the nine months ended December 31, 2014 was $0.02, our gain per share for discontinued operations was

$0.09 while our loss per share for continuing operations was $0.07. Our net loss per share for the nine months ended December

31, 2013 was $0.02, our loss per share for discontinued operations was $0.01 while our loss per share for continuing operations

was $0.02.

During

the nine months ended December 31, 2014, we incurred total expenses of $343,408, compared to total expenses of $108,379 during

the same period in the prior year.

Our

total expenses during the nine months ended December 31, 2014 consisted of $72,671 in accounting and legal fees, $62,149 in development

exploration cost, $9,972 in licenses and fees, $31,250 in finders’ fees, $5,448 in bank charges, $1,660 in office expenses,

and $160,258 in shares-based payments. For the same period in fiscal 2013, we incurred expenses of $60,134 in accounting and legal

fees, $11,826 in licenses and fees, $35,000 in consulting and development fees, $340 in bank charges and $1,079 in office expenses.

Our total expenses are significantly higher. The variation in expenses is mainly due to the higher accounting, legal, exploration,

finder’s fees and share-based payments, and we incurred consulting and development fees as a result of our change in business

focus. The $31,250 finders’ fee pertains to the common shares issued as a retainer for services.

Liquidity

and Capital Resources

We

have limited operational history, and did not generate any revenues. As of December 31, 2014, we had $nil in cash, $204,087 in

total liabilities and a working capital deficit of $199,712. As of December 31, 2014, we had an accumulated deficit of $484,420.

We are dependent on funds raised through equity financing, related parties, and loan payables. Our operations were funded by equity

financing and advances from shareholders and former related parties. We anticipate that we will incur substantial losses for the

foreseeable future and our ability to generate any revenues in the next 12 months continues to be uncertain.

During

the nine months ended December 31, 2014, we used $101,384 in cash on continuing operating activities, compared to cash gained

of $8,452 on continuing operating activities during the same period in fiscal 2013. During the nine month period ended December

31, 2014, we used $nil on discontinued operating activities, compared to cash used of $35,000 on discontinued operating activities

in the same period in fiscal 2013. Our increase in total cash spending on operating activities between the two periods was primarily

due to making cash payments for operating costs as described above.

During

the nine months ended December 31, 2014 and 2013, we did not engage in any investing activities.

During

the nine months ended December 31, 2014, we made payments of approximately $15,000 on the outstanding stockholders’ loan

balance and received an additional $80,000 in loans from stockholders, compared to receiving $23,687 in cash during the same period

in fiscal 2013. The loan agreements entered during the current period are due one year from issuance, bearing 10% interest per

annum compounded monthly.

During

the nine months ended December 31, 2014, our monthly cash requirements to fund our operating activities, including advances from

former related parties, was approximately $12,074 compared to approximately $2,950 during the same period in fiscal 2013. In the

absence of the continued sale of our common stock or advances from the former or new related parties, our cash of $nil as of December

31, 2014 is not sufficient to cover our current monthly burn rate for the foreseeable future and not enough to pay our current

liabilities balance of $204,087. Until we are able to complete private and/or public financing as described below, we anticipate

that we will rely on loans from shareholders to proceed with our plan of operations. Subsequent to December 31, 2014, we received

another shareholder loan for $150,000, 10% interest-bearing, and effective January 8, 2015. The loan is payable on January 8,

2016.

Our

business strategy going forward is to acquire ownership in late-stage exploration to development-stage gold mining projects and/or

royalty or streaming interests in low capital intensity, mining projects in North America. Our main focus will be on identifying

solid resources, and then utilize funding to bring a distressed asset into production, while either securing equity ownership

or rights of title in the form of royalties.

We

expect to require approximately $1,200,000 to carry out our business strategy. Our plan of operations over the next 12 months

is to obtain the necessary financing to fill a number of key operational positions. If we secure less than the full amount of

financing that we require, we will not be able to carry out our complete business plan and we will be forced to proceed with a

scaled back business plan based on our available financial resources.

Future

Financings

We

have not generated any revenues, have achieved losses since our inception, and rely upon the sale of our securities, loans and

advances from former related parties to fund our operations. We anticipate that we will incur substantial losses for the foreseeable

future, and we are dependent upon obtaining outside financing to carry out our operations. Our unaudited financial statements

for the three and nine months ended December 31, 2014 have been prepared on a going concern basis and do not include any adjustments

that might result from the outcome of this uncertainty.

We

will require approximately $1,200,000 over the next 12 months in order to enable us to proceed with our plan of operations, including

paying our ongoing expenses. These cash requirements are in excess of our current cash and working capital resources. Accordingly,

we intend to raise the balance of our cash requirements for the next 12 months from private placements, advances from related

parties or possibly a registered public offering (either self-underwritten or through a broker-dealer). If we are unsuccessful

in raising enough money through such efforts, we may review other financing possibilities such as bank loans. At this time we

do not have a commitment from any broker-dealer to provide us with financing, and there is no guarantee that any financing will

be available to us or if available, on terms that will be acceptable to us.

If

we are unable to obtain the necessary additional financing, then we plan to reduce the amounts that we spend on our operations

so as not to exceed the amount of capital resources that are available to us. If we do not secure additional financing our current

cash reserves and working capital will not be sufficient to enable us to sustain our operations for the next 12 months, even if

we do decide to scale back our operations.

Off-Balance

Sheet Arrangements

To

provide incentive towards the development of the goals, an Equity Incentive Plan for employees, executives, directors and consultants

awards 220,000 shares when certain performance goals have been achieved. One third will be triggered upon closing of corporate

financing, one third upon commencement of construction of the mine and one third upon commencement of construction of the mill.

Additional options have been granted in conjunction with the Equity Incentive Plan for employees, directors and consultants. During

the period ended December 31, 2014, the Company granted 175,000 options.

A cash bonus

of $40,000 each will be awarded to Mr. Pete Parsley and Mr. Ryan Hart upon the successful funding of the Company of at least $5

million.

Critical

Accounting Policies

Our

unaudited interim financial statements are affected by the accounting policies used and the estimates and assumptions made by

management during their preparation. A complete summary of these policies is included in Note 2 of the notes to our unaudited

interim financial statements. We have identified below the accounting policies that are of particular importance in the presentation

of our financial position, results of operations and cash flows, and which require the application of significant judgment by

our management.

Foreign

Currency Translation

Our

unaudited financial statements are presented in United States dollars. Transactions in currencies other than the U.S. dollar are

translated into U.S. dollars at the exchange rate in effect at the balance sheet date for monetary assets and liabilities, and

at historical exchange rates for non-monetary assets and liabilities. Expenses are translated at the average rates for the period,

excluding amortization, which is translated on the same basis as the related assets. Resulting translation gains or losses are

reflected in net loss.

Share-Based

Payments

The

Company records all share-based payments at fair value. Where equity instruments are granted to employees, they are recorded at

the fair value of the equity instrument granted at the grant date. The grant date fair value is recognized through profit or loss

over the vesting period, described as the period during which all the vesting conditions are to be satisfied.

Where

equity instruments are granted to non-employees, they are recorded at the fair value of the goods or services received. When the

value of goods or services received in exchange for the share-based payment cannot be reliably estimated, the fair value is measured

by use of a valuation model.

At

each balance sheet date, the amount recognized as an expense is adjusted to reflect the actual number of stock options expected

to vest. On the exercise of stock options, common stock is recorded for the consideration received and for the fair value amounts

previously recorded to contributed surplus. The Company uses the Black-Scholes option pricing model to estimate the fair value

of share-based payments.

Recent

Accounting Guidance Adopted

The

Company has adopted Accounting Standards Update (“ASU”) 2014-10, Development Stage Entities, which eliminates certain

financial reporting requirements. As such, these interim financial statements no longer present inception-to-date information

on the statements of operations, cash flows, and stockholders’ deficiency. In addition, these interim financial statements

are no longer labeled as a, “development stage entity”.

In

August 2014, the Financial Accounting Standards Board (“FASB”) issued ASU 2014-15, Presentation of Financial Statements-Going

Concern. This ASU is intended to define management’s responsibility to evaluate whether there is substantial doubt about

an organization’s ability to continue as a going concern and to provide related footnote disclosures. It is effective for

annual periods beginning after December 15, 2016, with early adoption permitted. The Company does not expect it to have a material

effect on the Company’s financial condition, results of operations, and cash flows.

In

April 2014, the FASB issued ASU 2014-08, Reporting Discontinued Operations and Disclosures of Disposals of Components of an

Entity. This ASU amends ASC 360, Property, Plant and Equipment and expands the disclosures for discontinued operations,

and requires new disclosures for disposals of individually significant components that do not meet the new definition of a discontinued

operation and are classified as assets held for sale. These provisions are effective for annual and interim periods beginning

after December 15, 2014. The Company does not expect it to have a material effect on the Company’s financial condition,

results of operations, and cash flows.

Inflation

The

amounts presented in the unaudited interim financial statements do not provide for the effect of inflation on our operations or

financial position. The net operating losses shown would be greater than reported if the effects of inflation were reflected either

by charging operations with amounts that represent replacement costs or by using other inflation adjustments.

Item

3. Quantitative and Qualitative Disclosures About Market Risk

Not

required.

Item

4. Controls and Procedures

Disclosure

Controls

We

maintain disclosure controls and procedures (as defined in Rule 13a-15(e) and Rule 15d-15(e) under the Exchange Act) designed

to provide reasonable assurance the information required to be reported in our Exchange Act filings is recorded, processed, summarized

and reported within the time periods specified and pursuant to Securities and Exchange Commission (“SEC”) rules and

forms, including controls and procedures designed to ensure that this information is accumulated and communicated to our management,

including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required

disclosure.

As

of the end of the period covered by this report, our management, with the participation of our Chief Executive Officer and Chief

Financial Officer, carried out an evaluation of the effectiveness of our disclosure controls and procedures. Based upon this evaluation,

our Chief Executive Officer and our Chief Financial Officer concluded that our disclosure controls and procedures were effective

to ensure that information we are required to disclose in the reports we file or submit under the Exchange Act is recorded, processed,

summarized and reported within the time periods specified in the SEC’s rules and forms.

Changes

in Internal Control

There

were no changes in our internal control over financial reporting (as defined in Rule 13a-15(e) and Rule 15d-15(e) under the Exchange

Act) during the Nine months ended December 31, 2014 that have materially affected, or are reasonably likely to materially affect,

our internal control over financial reporting.

PART

II – OTHER INFORMATION

Item

1. Legal Proceedings

We are not

aware of any legal proceedings to which we are a party or of which our property is the subject. None of our directors, officers,

affiliates, any owner of record or beneficially of more than 5% of our voting securities, or any associate of any such director,

officer, affiliate or security holder are (i) a party adverse to us in any legal proceedings, or (ii) have a material interest

adverse to us in any legal proceedings. We are not aware of any other legal proceedings that have been threatened against us.

Item

2. Unregistered Sales of Equity Securities

None.

Item

3. Defaults Upon Senior Securities

None.

Item

4. Mine Safety Disclosures

Not applicable.

Item

5. Other Information

None

Item

6. Exhibits

| Exhibit Number |

|

Exhibit Description |

| |

|

|

| 31.1 |

|

Certification

of Chief Executive Officer pursuant to Rule 13a-14(a) or Rule 15d-14(a) under the Securities Exchange Act of 1934, as adopted

pursuant to Section 302 of the Sarbanes-Oxley Act of 2002* |

| |

|

|

| 31.2 |

|

Certification

of Chief Financial Officer pursuant to Rule 13a-14(a) or Rule 15d-14(a) under the Securities Exchange Act of 1934, as adopted

pursuant to Section 302 of the Sarbanes-Oxley Act of 2002* |

| |

|

|

| 32.1 |

|

Certification

of Chief Executive Officer pursuant to 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

** |

| |

|

|

| 32.2 |

|

Certification

of Chief Financial Officer pursuant to 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

8** |

| |

|

|

| 101.INS |

|

XBRL Instance

Document* |

| |

|

|

| 101.SCH |

|

XBRL Taxonomy

Extension Schema* |

| |

|

|

| 101.CAL |

|

XBRL Taxonomy

Extension Calculation Linkbase* |

| |

|

|

| 101.DEF |

|

XBRL Taxonomy

Extension Definition Linkbase* |

| |

|

|

| 101.LAB |

|

XBRL Taxonomy

Extension Label Linkbase* |

| |

|

|

| 101.PRE |

|

XBRL Taxonomy

Presentation Linkbase* |

* Filed

herewith.

** Furnished

herewith.

SIGNATURES

Pursuant

to the requirements of Section 13 or 15(d) of the Exchange Act, the registrant has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

| Date: February 17,

2015 |

GOLD TORRENT, INC. |

| |

|

|

| |

By: |

/s/

Ryan Hart |

| |

|

Ryan Hart |

| |

|

Chief Executive Officer, President and Director |

| |

|

|

| |

By: |

/s/

Alexander Kunz |

| |

|

Alexander Kunz |

| |

|

Chief Financial Officer and Director |

Exhibit

31.1

Certification

of the Chief Executive Officer pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange Act of 1934, as adopted pursuant

to Section 302 of the Sarbanes-Oxley Act of 2002

I, Ryan

Hart, certify that:

| 1. |

I have reviewed this quarterly report

on Form 10-Q of GOLD TORRENT, INC.; |

| |

|

| 2. |

Based on my knowledge, this report

does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements

made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered

by this report; |

| |

|

| 3. |

Based on my knowledge, the interim

financial statements, and other financial information included in this report, fairly present in all material respects the

financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this

report; |

| |

|

| 4. |

The registrant’s other certifying

officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange

Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f)

and 15(d)-15(f)) for the registrant and have: |

| |

a. |

Designed such disclosure controls and

procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material

information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those

entities, particularly during the period in which this report is being prepared; |

| |

|

|

| |

b. |

Designed such internal control over

financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide

reasonable assurance regarding the reliability of financial reporting and the preparation of Interim Financial Statements

for external purposes in accordance with generally accepted accounting principles; |

| |

|

|

| |

c. |

Evaluated the effectiveness of the

registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness

of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

|

|

| |

d. |

Disclosed in this report any change

in the registrant’s internal control over financial reporting that occurred during the registrant’s fourth fiscal

quarter that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control

over financial reporting; and |

| 5. |

The registrant’s other certifying

officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the

registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the

equivalent functions): |

| |

a. |

All significant deficiencies and material

weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely

affect the registrant’s ability to record, process, summarize and report financial information; and |

| |

|

|

| |

b. |

Any fraud, whether or not material,

that involves management or other employees who have a significant role in the registrant’s internal control over financial

reporting. |

| Date: February 17, 2015 |

|

| |

|

|

| By: |

/s/ Ryan Hart |

|

| |

Ryan Hart |

|

| |

Chief Executive Officer, President and Director (Principal

Executive Officer) |

Exhibit

31.2

Certification

of the Chief Financial Officer pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange Act of 1934, as adopted pursuant

to Section 302 of the Sarbanes-Oxley Act of 2002

I, Alexander

Kunz, certify that:

| 1. |

I have reviewed this quarterly report

on Form 10-Q of GOLD TORRENT, INC.; |

| |

|

| 2. |

Based on my knowledge, this report

does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements

made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered

by this report; |

| |

|

| 3. |

Based on my knowledge, the interim

financial statements, and other financial information included in this report, fairly present in all material respects the

financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this

report; |

| |

|

| 4. |

The registrant’s other certifying

officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange

Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f)

and 15(d)-15(f)) for the registrant and have: |

| |

a. |

Designed such disclosure controls and

procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material

information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those

entities, particularly during the period in which this report is being prepared; |

| |

|

|

| |

b. |

Designed such internal control over

financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide

reasonable assurance regarding the reliability of financial reporting and the preparation of Interim Financial Statements

for external purposes in accordance with generally accepted accounting principles; |

| |

|

|

| |

c. |

Evaluated the effectiveness of the

registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness

of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| |

|

|

| |

d. |

Disclosed in this report any change

in the registrant’s internal control over financial reporting that occurred during the registrant’s fourth fiscal

quarter that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control

over financial reporting; and |

| 5. |

The registrant’s other certifying

officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the

registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the

equivalent functions): |

| |

a. |

All significant deficiencies and material

weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely

affect the registrant’s ability to record, process, summarize and report financial information; and |

| |

|

|

| |

b. |

Any fraud, whether or not material,

that involves management or other employees who have a significant role in the registrant’s internal control over financial

reporting. |

| Date: February 17, 2015 |

|

| |

|

|

| By: |

/s/ Alexander Kunz |

|

| |

Alexander Kunz |

|

| |

Chief

Financial Officer and Director

(Principal

Financial and Accounting Officer) |

Exhibit

32.1

Certification

of the Chief Executive Officer pursuant to

18

U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

In

connection with the quarterly report of GOLD TORRENT, INC. (the “Company”) on Form 10-Q for the period ended December

31, 2014 as filed with the Securities and Exchange Commission (the “Report”), I, Ryan Hart, certify pursuant to 18

U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that to my knowledge:

| 1. |

The Report fully complies with the

requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and |

| |

|

| 2. |

The information contained in the Report

fairly presents, in all material respects, the financial condition and results of operations of the Company. |

| Date: February 17, 2015 |

|

| |

|

|

| By: |

/s/ Ryan Hart |

|

| |

Ryan Hart |

|

| |

Chief Executive Officer, President and Director (Principal

Executive Officer) |

Exhibit

32.2

Certification

of the Chief Financial Officer pursuant to

18

U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

In

connection with the quarterly report of GOLD TORRENT, INC. (the “Company”) on Form 10-Q for the period ended December

31, 2014 as filed with the Securities and Exchange Commission (the “Report”), I, Alexander Kunz, certify pursuant

to 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that to my knowledge:

| 1. |

The Report fully complies with the

requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and |

| |

|

| 2. |

The information contained in the Report

fairly presents, in all material respects, the financial condition and results of operations of the Company. |

| Date: February 17, 2015 |

|

| |

|

|

| By: |

/s/ Alexander Kunz |

|

| |

Alexander Kunz |

|

| |

Chief

Financial Officer and Director

(Principal Financial and Accounting Officer) |

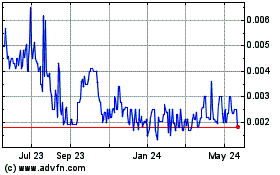

GGToor (CE) (USOTC:GTOR)

Historical Stock Chart

From Feb 2025 to Mar 2025

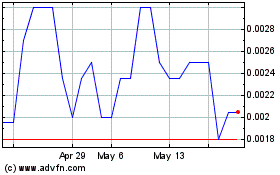

GGToor (CE) (USOTC:GTOR)

Historical Stock Chart

From Mar 2024 to Mar 2025