SCHEDULE 14C

(Rule 14c-101)

INFORMATION REQUIRED IN INFORMATION STATEMENT

Information Statement Pursuant to Section 14(c) of

the

Securities Exchange Act of 1934

Check the appropriate box:

| |

[x] |

Preliminary Information Statement [ ] Confidential, for use of the Commission only |

| |

[ ] |

Definitive Information Statement |

Healthtech Solutions, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| [x] |

No fee required. |

|

[ ]

[ ] |

Fee paid previously with preliminary materials

Fee computed on table in exhibit required by Item 25(b) of Schedule 14A

(17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11 |

HEALTHTECH SOLUTIONS, INC.

181 Dante Avenue

Tuckahoe, NY 10707

INFORMATION STATEMENT

To our shareholders:

This Information Statement and

enclosed consent card is furnished by Healthtech Solutions, Inc, a Utah corporation (the “Company”), to the holders of the

Company’s common stock, par value $0.001 per share (the “Common Stock”) and the Company’s Series A preferred stock,

par value $0.001 per share (the “Preferred Stock” and, collectively with the Common Stock, the “Voting Stock”)

in connection with the solicitation of written consents from the holders of Voting Stock to remove Manuel E. Iglesias as a member of the

Board of Directors (the “Director Removal Proposal”).

A solicitation of written consents

is a process that allows a company’s shareholders to act by submitting written consents to proposed shareholder actions in lieu

of voting in person or by proxy at an annual or special meeting of shareholders. Under the Company’s bylaws (the “Bylaws”),

the Director Removal Proposal requires the consent of the shareholders holding a majority of the shares issued and outstanding and entitled

to vote (the “Required Consents”). Therefore, in order for the Director Removal Proposal to be adopted, it must receive written

consents representing a majority of the issued and outstanding shares of Voting Stock. We are seeking your support in our solicitation

of written consents to take action to remove Mr. Iglesias.

This Information Statement and

consent cared is being mailed or given to holders of the Company’s Voting Stock on or about December 23, 2024. The Company will

pay the cost of this solicitation.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED

NOT TO SEND US A PROXY

Consent Procedures

Section 16-10a-704 of the Utah

Revised Business Corporation Act (the “URBC”) provides that, absent a contrary provision in a Utah corporation’s articles

of incorporation, any action that is required or permitted to be taken at a meeting of a corporation’s shareholders may be taken

without a meeting, without prior notice and without a vote, if one or more consents in writing, setting forth the action so taken, are

signed by the holders of outstanding shares having not less than the minimum number of votes that would be necessary to authorize or take

such action at a meeting at which all shares entitled to vote thereon were present and voted and such consents are properly delivered

to the corporation by delivery to its principal place of business or an officer or agent of the corporation having custody of the book

in which a proceedings of a meeting of shareholders is recorded. The Company’s Restated Articles of Incorporation, as amended to

date, does not contain any such contrary provision.

The Bylaws provide, consistent

with Section 16-10a-704 of the URBC, that any action required or permitted to be taken at any meeting of the Company’s shareholders

may be taken without a meeting, if a consent in writing, setting forth the action so taken, is signed by the holders of the Company’s

shares having not less than the minimum number of votes that would be necessary to authorize such action at a meeting of shareholders.

Therefore, pursuant to Section 16-10a-704 of the URBC and the Bylaws, shareholders of the Company are permitted to take any action by

written consent that is required or permitted to be taken at any annual or special meeting if written consents signed by shareholders

holding a majority of the shares of Voting Stock issued and outstanding and entitled to vote.

For the Director Removal

Proposal to be effective under Utah law and the Bylaws, properly completed and unrevoked written consents from the holders of record

as of the close of business on the Record Date representing at least a majority of the Company’s Voting Stock then outstanding

must be delivered to the Company within 60 days of the earliest dated written consent delivered to the Company and not

revoked. Pursuant to the URBC, the prosed action (in this case the Director Removal Proposal) is effective upon receipt of the

Required Consents (the “Effective Date”). In order to ensure that your consent is delivered to the Company in a

timely manner, we have set January 10, 2025 as the deadline for submission of written consents; however, we reserve the right, in

our sole discretion, to accelerate such deadline if the Required Consents are received before that date.

If the Director Removal

Proposal becomes effective as a result of this Consent Solicitation by less than unanimous written consent, prompt notice of the effectiveness

of the Director Removal Proposal will be given under Section 16-10a-704(3)(b) of the URBC and the Bylaws to shareholders who have not

executed written consents. The Bylaws provide that notice, compliant with Subsection 16-10a-704(3)(c) of the URBC, of shareholder approval

of an action without a meeting must be provided:

(i) not more than 10 days after the later of the day

on which:

(A) the written consents sufficient to take

the action are delivered to the Company; or

(B) the tabulation of the written consents

is completed in accordance with Section 16-10a-704(1) of the URBC; and

(ii) to any shareholder

who:

(A) would be entitled to notice of a meeting

at which the action could be taken;

(B) would be entitled to vote if the action

were taken at a meeting; and

(C) did not consent in writing to the action.

WE URGE YOU TO ACT TODAY TO ENSURE THAT YOUR CONSENT

WILL COUNT.

Procedural Instructions

You may consent the Director Removal

Proposal on the enclosed consent card by marking the “CONSENT” box and signing, dating and returning the consent

card in the envelope provided. You may also withhold consent with respect to the Director Removal Proposal on the enclosed consent

card by marking the “WITHHELD” box, and signing, dating and returning the consent card in the envelope provided. You

may abstain from consenting to the Director Removal Proposal on the enclosed consent card by marking the “ABSTAIN” box and

signing, dating and returning the consent card in the envelope provided.

If you sign, date and return the consent

card, but give no direction with respect to the Director Removal Proposal, you will be deemed to consent to the Director Removal Proposal.

You may revoke a written consent

by a signed writing describing the action and stating that a shareholder's prior consent is revoked, if the writing is received by the

Company before the Effective Date

Please note that in addition to

signing the enclosed consent card, you must also date it to ensure its validity.

You also may deliver a written

consent by an electronic transmission that provides us with a complete copy of the written consent from which we can determine that: (i)

that the electronic transmission is transmitted by the shareholder or other person authorized to act for the shareholder; and (ii) the

date on which the electronic transmission is transmitted.

VOTING SECURITIES AND PRINCIPAL SHAREHOLDERS

We determined the shareholders

of record for purposes of this shareholder action at the close of business on December 20, 2024 (the “Record Date”). At that

date, there were two classes of voting stock of Healthtech Solutions, Inc. outstanding:

| |

· |

62,963,023 shares of common stock, each of which entitled the holder thereof to one vote. |

| |

· |

110,520 shares of Series A Preferred Stock, each of which entitled the holder thereof to fifty (50) votes. |

The following table sets

forth the number of shares of each class of voting stock owned by each person who, as of the Record Date, owned beneficially more than

5% of either class of voting stock, as well as the ownership of such shares by each member of the Healthtech Solutions, Inc. Board of

Directors and the shares beneficially owned by its officers and directors as a group.

| |

Common Stock |

Series A Preferred |

|

|

| Name of Beneficial Owner |

Amount and Nature of

Beneficial

Ownership(1) |

Percentage

of Class |

Amount and Nature of

Beneficial

Ownership(1) |

Percentage

of Class |

Total Voting

Power |

| Manuel Iglesias(2) |

129,309 |

0.2% |

3,137 |

2.8% |

2.3% |

| Steven Horowitz(3) |

836,199 |

1.3% |

17,252 |

16.6% |

12.4% |

| Paul Mann(4) |

-- |

-- |

-- |

-- |

-- |

| All officers and directors as a group (4 persons) |

965,508 |

1.5% |

20,389 |

18.4% |

14.7% |

| Richard F. Parker & Charlotte B. Parker Revocable Living Trust(5) |

7,122,270 |

11.3% |

-- |

-- |

2.5% |

| Jonathan Leinwand(6) |

-- |

-- |

43,946 |

39.7% |

30.9% |

| Exeter Life LLC(7) |

711,199 |

1.1% |

17,252 |

15.6% |

12.4% |

| CAI Family Trust(8) |

6,425,272 |

10.2% |

4,791 |

4.3% |

5.6% |

| MAI Family Trust(9) |

6,425,272 |

10.2% |

4,791 |

4.3% |

5.6% |

| Conestoga Revocable Family Trust(10) |

6,360,618 |

10.1% |

3,222 |

2.9% |

4.5% |

| Millersville Revocable Trust Declaration(11) |

6,360,618 |

10.1% |

3,222 |

2.9% |

4.5% |

| BSD Trust 1 2021(12) |

4,802,982 |

7.6% |

-- |

-- |

1.7% |

| BSD Trust 2 2021(13) |

4,802,982 |

7.6% |

-- |

-- |

1.7% |

| World Reach Med, LLC (14) |

5,903,946 |

5.616% |

-- |

-- |

5.616% |

| T2L2J3, LLC (15) |

5,987,913 |

5.696% |

-- |

-- |

5.696%

|

_________________________________________

| |

(1) |

Ownership is of record and beneficial unless otherwise

noted. |

| |

(2) |

Shares attributed to Manuel Iglesias are owned by Manuel E. Iglesias Trust, of which Mr. Iglesias is beneficiary. The Table does not reflect 500,000 shares of restricted stock units issued to Mr. Iglesias, which will vest during the first three years of his employment. |

| |

(3) |

Includes 711,199 shares of common stock and 17,252 shares of Series A Preferred Stock owned by Exeter Life, LLC., of which Mr. Horowitz serves as Manager. Also includes 125,000 shares of common stock owned by Horowitz & Rubenstein, LLC, of which Mr. Horowitz is a Managing Member. The Table does not reflect 500,000 shares of restricted stock units issued to Mr. Horowitz, which will vest during the first three years of his tenure on the Board. |

| |

(4) |

The Table does not reflect (a) 500,000 shares of restricted stock units issued to Mr. Mann, which will vest during the first three years of his tenure on the Board, or (b) 1,000,000 performance stock units which will vest on July 13, 2024 |

| |

(5) |

Richard F. Parker has voting and dispositional control over shares owned by the Trust. |

| |

(6) |

Mr. Leinwand controls the Series A shares as voting trustee appointed by Keystone Capital Partners. |

| |

(7) |

Steven Horowitz has voting control over shares owned by Exeter Life LLC. |

| |

(8) |

Voting and dispositional control over the shares owned by the CAI Family Trust is held by Carlos Trueba, as Trustee of the Trust. |

| |

(9) |

Voting and dispositional control over the shares owned by the MAI Family Trust is held by Leonardo Miyares, as Trustee of the Trust. |

| |

(10) |

Voting and dispositional control over the shares owned by the Conestoga Revocable Family Trust is held by Leyiset Crespo, as Trustee of the Trust. |

| |

(11) |

Voting and dispositional control over the shares owned by the Millersville Revocable Trust Declaration is held by Victor Klingelhofer, as Trustee of the Trust. |

| |

(12) |

Voting and dispositional control over the shares owned by the BSD Trust 1 2021 is held by Pavel Rubinov, as Trustee of the Trust. |

| |

(13) |

Voting and dispositional control over the shares owned by the BSD Trust 2 2021 is held by Emma Rubinov, as Trustee of the Trust. |

| (14) |

James Pesoli has voting control over shares owned by World Reach Med, LLC. |

| (15) |

James Pesoli has voting control over shares owned by T2L2J3, LLC. |

REMOVAL OF MANUEL IGLESIAS AS A MEMBER

OF THE BOARD OF DIRECTORS

On December 20, 2024, the Healthtech Solutions,

Inc. Board of Directors approved the following resolutions recommending that Manuel E. Iglesias be removed as a member of the Board of

Directors:

WHEREAS, pursuant

to Section 2.9 of the bylaws (the “Bylaws”) of Healthtech Solutions, Inc. (the “Company”), any action required

to be taken at a meetings of the shareholders, or any action which may be taken at a meeting of the shareholders, may be taken without

a meeting if a consent in writing, setting forth the action so taken, shall be signed by the holders of shares having not less than the

minimum number of votes that would be necessary to authorize or take such action at a meeting of the shareholders; and

WHEREAS,

pursuant to Section 3.8 of the Bylaws, a director may be removed at any time, by a vote of the shareholders holding a majority of the

shares issued and outstanding and entitled to vote (the “Requisite Majority”);

NOW, THEREFORE,

BE IT RESOLVED, that Manuel E. Iglesias be, and hereby is, removed as a member of the Company’s Board of Directors, effective

immediately upon receipt by the Company of signed written consents from shareholders holding the Requisite Majority.

NO DISSENTERS RIGHTS

Under Utah law, shareholders

are not entitled to dissenters’ rights with respect to providing a written consent to the removal of a member of the Board of Directors.

* * * * *

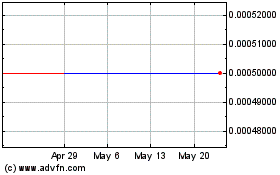

HealthTech Solutions (CE) (USOTC:HLTT)

Historical Stock Chart

From Jan 2025 to Feb 2025

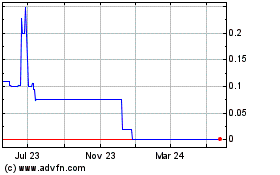

HealthTech Solutions (CE) (USOTC:HLTT)

Historical Stock Chart

From Feb 2024 to Feb 2025