Kirkland's Optimistic About 1Q Earnings - Analyst Blog

May 07 2013 - 1:27PM

Zacks

Kirkland’s, Inc.'s (KIRK) has announced its

earnings and sales guidance for the first quarter of 2013. For the

13 weeks ended May 4, 2013, Kirkland’s expects to report on the

higher end of the guidance provided by the company during the

fourth-quarter conference call.

During the fourth-quarter conference call, the company announced

that it expects earnings per share to be in the range of 2 cents to

5 cents for the quarter. The company expects net sales to be in the

range of $99 million to $101 million. However, comparable store

sales are expected to decline 3% to 5% during the quarter. The

company also announced that it expects to open approximately one

store while closing about seven stores during the quarter.

In the first quarter of fiscal 2012, Kirkland’s delivered earnings

of 10 cents a share, in line with the Zacks Consensus Estimate.

However, it fell short of the year-ago quarter's earnings of 15

cents per share. Quarterly earnings declined due to weaker margin

on the back of high inflation in the economy.

Net sales went up 3.6% to $97.8 million from $94.4 million in the

year-ago quarter but failed to meet the Zacks Consensus Estimate of

$99.0 million. Consolidated comparable store sales declined 1.2%

compared with an 8.4% decrease in the year-ago quarter.

Comparable store sales fell due to a 5% decline in transactions

backed by a decline in conversion rate in its stores. Increase in

sales of art, mirrors, outdoor living and furniture were offset by

declines in decorative accessories, wall decor and lamps.

The company opened five stores and closed 17 stores during the

first quarter of 2012, bringing the total number of stores to

297.

For fiscal 2013, the company expects to earn between 70 cents and

85 cents. Kirkland's also expects sales to increase between 5% to

7% from fiscal 2012.

The Zacks Consensus Estimate for the first quarter of fiscal 2013

is pegged at a loss of 13 cents. For fiscal 2013, the estimate is

pegged at 93 cents.

Kirkland’s expects to open 25 to 35 new stores and close

approximately 10 to 15 stores in fiscal 2013. Store openings will

be skewed toward the second and third quarters of 2013. The company

expects capital expenditure to be in a range of $22 million to $25

million for the fiscal year.

Kirkland’s currently holds a Zacks Rank #3 (Hold). Other stocks in

the retail and wholesale sector worth considering include

New York & Company Inc. (NWY), H &

M Hennes & Mauritz AB (HNNMY) and Zumiez

Inc. (ZUMZ), all of which carry a Zacks Rank #2 (Buy).

HENNES&MAURIT (HNNMY): Get Free Report

KIRKLANDS INC (KIRK): Free Stock Analysis Report

NEW YORK & CO (NWY): Free Stock Analysis Report

ZUMIEZ INC (ZUMZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

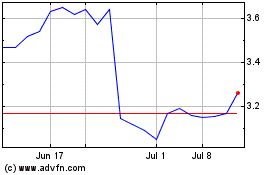

Hennes and Mauritz AB (PK) (USOTC:HNNMY)

Historical Stock Chart

From Jan 2025 to Feb 2025

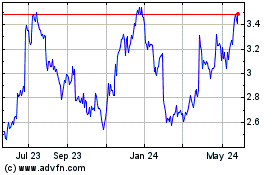

Hennes and Mauritz AB (PK) (USOTC:HNNMY)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Hennes and Mauritz AB (PK) (OTCMarkets): 0 recent articles

More Hennes & Mauritz Ab (PC) News Articles