false

2024-05-17

0001098880

IntelGenx Technologies Corp.

0001098880

2024-05-17

2024-05-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 17, 2024

INTELGENX TECHNOLOGIES CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-31187

|

87-0638336

|

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

6420 Abrams

St- Laurent, Quebec, Canada

H4S 1Y2

(Address of principal executive offices) (ZIP Code)

Registrant’s telephone number, including area code: (514) 331-7440

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

|

Common Stock, $0.00001 par value

|

|

IGXT |

|

OTCQB |

| |

|

IGX |

|

TSX |

| |

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b -2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On May 17, 2024, the Board of Directors ("Board") of IntelGenx Technologies Corp. (the "Company") received the resignations of Clemens Mayr, Sahil Kirpekar and Ryan Barrett, effectively immediately (the "Resignations"). Mr. Kirpekar and Mr. Barret were previously appointed to the Board pursuant the purchaser rights agreement by and between the Company and ATAI Life Sciences AG. The Resignations were not due to any disagreement with the Company on any matters related to the Company's operations, policies or practices.

Item 7.01 Regulation FD Disclosure.

On May 17, 2024, the Company issued a press release announcing that the Board has authorized the Company and its subsidiary, IntelGenx Corp., to implement a restructuring plan under the Companies' Creditors Arrangement Act (Canada) (the "CCAA"). In connection therewith, the Québec Superior Court (Commercial Division) has issued an initial order granting the Company protection under the CCAA (R.S.C., 1985, c. C-36) to provide the Company with sufficient time and breathing room to implement a review of its strategic alternatives.

A copy of the press release related to this announcement is furnished as Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

The information contained in this Item, including the Exhibit attached hereto, is being furnished and shall not be deemed "filed" for any purpose, and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, regardless of any general incorporation language in any such filing.

Exhibit 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized

| |

INTELGENX TECHNOLOGIES CORP. |

| Date: May 21, 2024 |

|

|

| |

|

|

| |

By: |

/s/ Andre Godin |

| |

|

Name: Andre Godin |

| |

|

Title: President and CFO |

IntelGenx Initiates Restructuring Proceedings Under the CCAA to Implement a Review of its Strategic Alternatives

MONTREAL, May 17, 2024, Québec -(BUSINESS WIRE)- IntelGenx Technologies Corp. (the "Company" or "IntelGenx") (OCTQB: IGXT; TSX: IGX), a leading drug delivery company focused on the development and manufacturing of pharmaceutical films, announced today that the Québec Superior Court (Commercial Division) (the "Court") has issued an initial order (the "Initial Order") granting the Company and its subsidiaries protection under the Companies' Creditors Arrangement Act (R.S.C., 1985, c. C-36) (the "CCAA").

Since its inception, IntelGenx has funded its operations primarily through public and private equity offerings, loans from business partners and research and development support payments generated from collaborations with third parties. The Company is currently facing a short-term liquidity crisis as a result of its inability to secure necessary bridge financing - leading to a lack of time and financial resources to complete an ongoing digital offering - which liquidity crisis was exacerbated by delays in the regulatory approval process for the commercialization of certain of IntelGenx's products, resulting in the postponement of potential additional revenue streams.

After a careful review of all available alternatives and following thorough consultation with its legal and financial advisors, the Company's Board of Directors determined that it was in the best interest of IntelGenx and its stakeholders to file an application for creditor protection under the CCAA. The protection afforded by the CCAA is intended to provide the Company with the time and breathing room necessary to implement a strategic review process under the oversight of the Board of Directors and with the advice of IntelGenx's professional advisors. In this regard, IntelGenx anticipates that it will seek Court approval to initiate a formal sale and investment solicitation process intended to generate interest in either the business or the assets of IntelGenx, or in a recapitalization of IntelGenx, with the goal of implementing one or more transaction(s). The implementation of one or more transaction(s) may be in addition to, or as an alternative, to a CCAA plan of compromise or arrangement, to maximize return in respect of IntelGenx's business and assets.

The Initial Order provides a stay of creditor claims and exercise of contractual rights with a view to provide the Company some breathing room to implement its strategic review process IntelGenx hopes for an outcome that will allow its superior film technologies, including VersaFilm™ and VetaFilm™ technologies, to realize their full potential and ensure the continuation of its business as a going concern.

The Initial Order provides that the Company's management remains responsible for the day-to-day operations of the Company and that the Board of Directors remains intact. The Company is committed to completing the restructuring process quickly and efficiently.

The Court has appointed Ernst & Young Inc. to serve as Monitor in the CCAA proceedings and to assist the Company with its restructuring efforts and report to the Court during the restructuring.

The Initial Order authorizes interim debtor-in-possession financing (DIP) financing in order to allow the Company to continue its operations during the restructuring process and implement the necessary restructuring measures.

Trading in the common shares of the Company on the Toronto Stock Exchange (the "TSX") has been halted and it is anticipated that the trading thereof will continue to be halted until a review is undertaken by the TSX regarding the suitability of the Company for listing on the TSX.

Further news releases will be provided on an ongoing basis throughout the CCAA proceedings as required by law or otherwise as may be determined necessary by the Company or the Court. Documents relating to the restructuring process such as the Initial Order, the Monitor's reports to the Court as well as other Court orders and documents shall also be published and made accessible on the Monitor's website: www.ey.com/ca/intelgenx.

About IntelGenx

IntelGenx is a leading drug delivery company focused on the development and manufacturing of pharmaceutical films. IntelGenx's superior film technologies, including VersaFilm®, DisinteQ™, VetaFilm® and transdermal VevaDerm™, allow for next generation pharmaceutical products that address unmet medical needs. IntelGenx's innovative product pipeline offers significant benefits to patients and physicians for many therapeutic conditions. IntelGenx's highly skilled team provides comprehensive pharmaceutical services to pharmaceutical partners, including R&D, analytical method development, clinical monitoring, IP and regulatory services. IntelGenx's state-of-the-art manufacturing facility offers full service by providing lab-scale to pilot- and commercial-scale production. For more information, visit https://www.intelgenx.com/ and connect with us on X and LinkedIn.

IntelGenx Forward-Looking Statements

This press release contains forward-looking information under applicable securities law. All information that addresses activities or developments that we expect to occur in the future is forward-looking information. Forward-looking statements use such word as "will", "may", "potential", "believe", "expect", "continue", "anticipate" and other similar terminology. Forward-looking statements are based on the estimates and opinions of management on the date the statements are made. In the press release, such forward-looking statements include, but are not limited to, statements relating to: (i) the outcome of the CCAA proceedings, (ii) the obtaining of the approval of the Court to initiate a formal sale and investment solicitation process to secure additional financing, sell assets, or a combination thereof, (iii) the ability of the Company to secure additional financing or otherwise enter into one or more transaction(s), and (iv) halt trading of the common shares and review of the TSX regarding the suitability of the Company for listing on the TSX and any outcome of such review. However, they should not be regarded as a representation that any of the plans will be achieved. Actual results may differ materially from those set forth in this press release due to risks affecting the Company, including the outcome of the CCAA proceedings and the capacity of the Company to enter into one or more transaction(s) that would allow the Company to pursue its activities as a going concern and the continued listing of its common shares on a stock exchange. IntelGenx assumes no responsibility to update forward-looking statements in this press release except as required by law. These forward-looking statements involve known and unknown risks and uncertainties. Investors are cautioned not to rely on these forward-looking statements and are encouraged to read IntelGenx's continuous disclosure documents, including its current annual information form, as well as its audited annual consolidated financial statements which are available on SEDAR at http://www.sedar.com and on EDGAR at http://www.sec.gov/edgar

View source version on businesswire.com:

Source: IntelGenx Technologies Corp.

v3.24.1.1.u2

Document and Entity Information Document

|

May 17, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Creation Date |

May 17, 2024

|

| Document Period End Date |

May 17, 2024

|

| Amendment Flag |

false

|

| Entity Registrant Name |

IntelGenx Technologies Corp.

|

| Entity Address, Address Line One |

6420 Abrams

|

| Entity Address, City or Town |

St- Laurent

|

| Entity Address, State or Province |

QC

|

| Entity Address, Country |

CA

|

| Entity Address, Postal Zip Code |

H4S 1Y2

|

| Entity Incorporation, State Country Name |

DE

|

| City Area Code |

514

|

| Local Phone Number |

331-7440

|

| Entity File Number |

000-31187

|

| Entity Central Index Key |

0001098880

|

| Entity Emerging Growth Company |

false

|

| Entity Tax Identification Number |

87-0638336

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(g) Security |

Common Stock, $0.00001 par value

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe date the document was made available and submitted, in YYYY-MM-DD format. The date of submission, date of acceptance by the recipient, and the document effective date are all potentially different.

| Name: |

dei_DocumentCreationDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(g) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection g

| Name: |

dei_Security12gTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

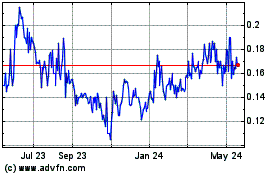

IntelGenx Technologies (CE) (USOTC:IGXT)

Historical Stock Chart

From Jan 2025 to Feb 2025

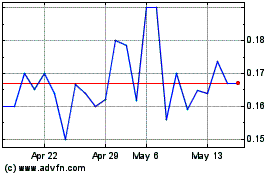

IntelGenx Technologies (CE) (USOTC:IGXT)

Historical Stock Chart

From Feb 2024 to Feb 2025