UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

May 11, 2015

Date of Report (Date of earliest event reported)

il2m INTERNATIONAL CORP.

(Exact name of registrant as specified in its

charter)

| Nevada |

|

333-176587 |

|

27-3492854 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

3500 West Olive Avenue

Suite 810

Burbank, California |

|

91505 |

| (Address of principal executive offices) |

|

(Zip Code) |

(702) 726-0381

Registrant’s telephone number, including

area code

N/A

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION 1. REGISTRANT’S BUSINESS AND OPERATIONS

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

$100,000 Waiver and Release Agreement

On May 11, 2015, the Board of Directors of

il2m International Corp., a Nevada corporation (the "Company") authorized the execution of that certain general release

and waiver of debt (the "$100,000 Release Agreement") with il2m Global Ltd., a Belize corporation ("il2m Global").

The Company owed il2m Global an aggregate of $100,000.00 (the "Debt"), which Debt was evidenced in that certain convertible

promissory note dated March 14, 2014 in the principal amount of $100,000.00 issued by the Company to il2m Global (the "$100,000

Convertible Note"), and which $100,000 Convertible Note was reflected on the Company's

audited and/or reviewed financial statements filed with the Securities and Exchange Commission together with its annual and/or

quarterly reports on Form 10-K and 10-Q, respectively.

Vartan Pilavjyan ("Pilavjyan") had

simultaneously loaned il2m Global $100,000.00 for the purposes of providing working capital to the Company, which loan was evidenced

by that certain promissory note dated March 14, 2014 in the principal amount of $100,000.00 issued by il2m Global to Pilavyjan

(the "il2m Global Promissory Note"), which provided that in the event il2m Global was unable to repay the $100,000 on

the demand date, il2m Global in its sole discretion without the consent of Pilavjyan would transfer to Pilavjyan 400,000 shares

of common stock of the Company that il2m Global held of record. As of May 11, 2015, il2m Global has transferred the 400,000

shares of common stock of the Company held of record by il2m Global to Palavjyan and acknowledges that the il2m Global Promissory

Note is deemed satisfied.

Therefore, il2m Global entered into the $100,000

Release Agreement with the Company.

$125,000 Waiver and Release Agreement

On May 11, 2015, the Board of Directors of

il2m International Corp., a Nevada corporation (the "Company") authorized the execution of that certain general release

and waiver of debt (the "Release Agreement") with il2m Global Ltd., a Belize corporation ("il2m Global"). The

Company owed il2m Global an aggregate of $125,000.00 (the "Debt"), which Debt was evidenced in that certain convertible

promissory note dated March 14, 2014 in the principal amount of $125,000.00 issued by the Company to il2m Global (the "$125,000

Convertible Note"), and which $125,000 Convertible Note was reflected on the Company's

audited and/or reviewed financial statements filed with the Securities and Exchange Commission together with its annual and/or

quarterly reports on Form 10-K and 10-Q, respectively.

Hovsep Karapetian ("Karapetian")

had simultaneously loaned il2m Global $125,000.00 for the purposes of providing working capital to the Company, which loan was

evidenced by that certain promissory note dated March 14, 2014 in the principal amount of $125,000.00 issued by il2m Global to

Karapetian (the "il2m Global Promissory Note"), which provided that in the event il2m Global was unable to repay the

$125,000 on the demand date, il2m Global in its sole discretion without the consent of Karapetian would transfer to Karapetian

500,000 shares of common stock of the Company that il2m Global held of record. As of May 11, 2015, il2m Global has transferred

the 500,000 shares of common stock of the Company held of record by il2m

Global to Karapetian and acknowledges that the il2m Global Promissory Note is deemed satisfied.

Therefore, il2m Global entered into the $125,000

Release Agreement with the Company.

ITEM 1.02 TERMINATION OF A MATERIAL DEFINITIVE

AGREEMENT

On May 11, 2015, the Board of Directors of

the Company authorized the execution of that waiver and release agreement dated May 11, 2015 (the "$100,000 Release Agreement")

between il2m Global and the Company relating to the $100,000 Convertible Note. Based on the transfer of shares by il2m Global to

Pilavjyan, il2m Global has waived the $100,000 Convertible Note and released the Company from any and all obligations under the

$100,000 Convertible Note.

On May 11, 2015, the Board of Directors of

the Company authorized the execution of that waiver and release agreement dated May 11, 2015 (the "$125,000 Release Agreement")

between il2m Global and the Company relating to the $125,000 Convertible Note. Based on the transfer of shares by il2m Global to

Karapetian, il2m Global has waived the $125,000 Convertible Note and released the Company from any and all obligations under the

$125,000 Convertible Note.

SECTION 9 –

FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01

Financial Statements and Exhibits

(a) Financial

Statements of Business Acquired.

Not applicable.

(b) Pro forma

Financial Information.

Not applicable.

(c) Shell Company Transaction.

Not applicable.

(d) Exhibits.

| 10.01 |

|

Waiver and Release Agreement dated May 11, 2015 between il2m International Corp. and il2m Global Ltd. |

| |

|

|

| 10.02 |

|

Waiver and Release Agreement dated May 11, 2015 between il2m International Corp. and il2m Global Ltd. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

il2m INTERNATIONAL CORP. |

| |

|

|

| DATE: May 13, 2015 |

|

/s/ Sarkis Tsaoussian |

| |

|

Sarkis Tsaoussian |

| |

|

President/Chief Executive Officer |

4

Exhibit 10.01

GENERAL RELEASE AND WAIVER OF DEBT

This General Release and Waiver of Debt (hereinafter

referred to as the "Agreement") is made this 11th day of May, 2015 by and between il2m Global Ltd., a Belize corporation

(hereinafter, the "Claimant") and il2m International Corp., a Nevada corporation (the “Company”).

RECITALS:

WHEREAS the Company owes the Claimant

an aggregate of $100,000.00 (the "Debt"), which Debt is evidenced in that certain convertible promissory note dated March

14, 2014 in the principal amount of $100,000.00 issued by the Company to the Claimant (the "Convertible Note"), and which

Convertible Note is reflected on the Company's audited and/or reviewed financial statements filed with the Securities and Exchange

Commission together with its annual and/or quarterly reports on Form 10-K and 10-Q, respectively;

WHEREAS Vartan Pilavjyan ("Pilavjyan")

had simultaneously loaned Claimant $100,000.00 for the purposes of providing working capital to the Company, which loan was evidenced

by that certain promissory note dated March 14, 2014 in the principal amount of $100,000.00 issued by il2m Global to Pilavyjan

(the "il2m Global Promissory Note"), which provided that in the event the Claimant was unable to repay the $100,000 on

the demand date, the Claimant in its sole discretion without the consent of Pilavjyan would transfer 400,000 shares of common stock

of the Company that Claimant held of record;

WHEREAS the Claimant acknowledges that

400,000 shares of common stock of the Company held of record by Claimant has been transferred to Palavjyan and that the il2m Global

Promissory Note is deemed satisfied;

WHEREAS the Claimant is willing to provide

to the Company a full waiver and release of the Debt and to deem the Convertible Note null and void (the "Waiver and Release");

and

WHEREAS the parties to this Agreement

have agreed to the Waiver and Release subject to the terms and conditions set forth below.

NOW THEREFORE THIS AGREEMENT WITNESSES

that for and in consideration of the mutual premises and the mutual covenants and agreements contained herein, the parties covenant

and agree each with the other as follows:

| 1 | In consideration of this Agreement, Claimant individually and on behalf of his successors, heirs

and assigns, forever releases, remises, waives, acquits, covenants not to sue or file any complaints with any court of competent

jurisdiction or with any regulatory office, and specifically releases and waives any claims or rights it may have under common

law and statutory law, common law fraud or deceit, and discharges the Company, together with any firms, successors, predecessors,

assigns, directors, officers, shareholders, supervisors, employees, attorneys, agents and representatives from any and all actions,

causes of action, claims, demands, losses, damages, costs, attorneys' fees, causes in action, indebtedness and liabilities, known

or unknown, which he may now have resulting or arising from the Debt, or any other matter, occurrence or event whatsoever from

the beginning of time to the date of this Agreement. |

| 2. | It is understood and agreed by Claimant and the Company that the entering into of this Agreement

is not any admission of liability by the Company nor is it to be construed as an admission by the Company or Claimant as to the

merits of any claim not expressly set forth in this Agreement relating to the Debt. |

| 3. | As a result of Claimant's decision to provide to the Company the Waiver and Release, Claimant acknowledges

that it is foregoing the possibility of any future accrual of interest or repayment of interest and principal by any other terms,

and that the consideration for the Waiver and Release agreed upon with the Company is in its view fair and reasonable. |

| 4. | This Agreement shall be interpreted pursuant to Nevada law. If any provision in this Agreement

shall be declared unenforceable by any administrative agency or court of law, the remainder of the Agreement shall remain in full

force and effect and shall be binding upon the parties hereto as if the invalidated provisions were not part of this Agreement.

Each party has cooperated in the drafting and preparation of this Agreement. As a result, in any construction to be made of this

Agreement, the same shall not be construed against any party on the basis that the party was the drafter. |

| 5. | Each covenant, agreement and provision of this Agreement shall be construed to be a separate covenant,

agreement and provision. If any covenant, agreement or provision of this Agreement is breached, the remainder of this Agreement

shall not be effected thereby. No waiver of any breach of any term or provision of this Agreement shall be considered to be, nor

shall be, a waiver of any other breach of this Agreement. No waiver shall be binding unless in writing and signed by the party

waiving the breach. |

APPROVED AND ACCEPTED this 13th day of

May, 2015.

| Date: May

13, 2014 |

IL2M

INTERNATIONAL CORP. |

| |

|

|

| |

By: |

/s/

Sarkis Tsaoussian |

| |

|

Sarkis

Tsaoussian, President/CEO |

| |

|

|

| Date: May

13, 2014 |

IL2M

GLOBAL LTD. |

| |

|

|

| |

By: |

/s/

Sarkis Tsaoussian |

| |

|

President |

-2-

Exhibit 10.02

GENERAL RELEASE AND WAIVER OF DEBT

This General Release and Waiver of Debt (hereinafter

referred to as the "Agreement") is made this 11th day of May, 2015 by and between il2m Global Ltd., a Belize corporation

(hereinafter, the "Claimant") and il2m International Corp., a Nevada corporation (the “Company”).

RECITALS:

WHEREAS the Company owes the Claimant

an aggregate of $125,000.00 (the "Debt"), which Debt is evidenced in that certain convertible promissory note dated

March 14, 2014 in the principal amount of $125,000.00 issued by the Company to the Claimant (the "Convertible Note"),

and which Convertible Note is reflected on the Company's audited and/or reviewed financial statements filed with the Securities

and Exchange Commission together with its annual and/or quarterly reports on Form 10-K and 10-Q, respectively;

WHEREAS Hovsep Karapetian ("Karapetian")

had simultaneously loaned Claimant $125,000.00 for the purposes of providing working capital to the Company, which loan was evidenced

by that certain promissory note dated March 14, 2014 in the principal amount of $125,000.00 issued by il2m Global to Karapetian

(the "il2m Global Promissory Note"), which provided that in the event the Claimant was unable to repay the $125,000

on the demand date, the Claimant in its sole discretion without the consent of Karapetian would transfer 500,000 shares of common

stock of the Company that Claimant held of record;

WHEREAS the Claimant acknowledges that

500,000 shares of common stock of the Company held of record by Claimant has been transferred to Karapetian and that the il2m

Global Promissory Note is deemed satisfied;

WHEREAS the Claimant is willing to

provide to the Company a full waiver and release of the Debt and to deem the Convertible Note null and void (the "Waiver

and Release"); and

WHEREAS the parties to this Agreement

have agreed to the Waiver and Release subject to the terms and conditions set forth below.

NOW THEREFORE THIS AGREEMENT WITNESSES

that for and in consideration of the mutual premises and the mutual covenants and agreements contained herein, the parties

covenant and agree each with the other as follows:

| 1 | In consideration of this Agreement, Claimant

individually and on behalf of his successors, heirs and assigns, forever releases, remises,

waives, acquits, covenants not to sue or file any complaints with any court of competent

jurisdiction or with any regulatory office, and specifically releases and waives any

claims or rights it may have under common law and statutory law, common law fraud or

deceit, and discharges the Company, together with any firms, successors, predecessors,

assigns, directors, officers, shareholders, supervisors, employees, attorneys, agents

and representatives from any and all actions, causes of action, claims, demands, losses,

damages, costs, attorneys' fees, causes in action, indebtedness and liabilities, known

or unknown, which he may now have resulting or arising from the Debt, or any other matter,

occurrence or event whatsoever from the beginning of time to the date of this Agreement. |

| 2. | It is understood and agreed by Claimant

and the Company that the entering into of this Agreement is not any admission of liability

by the Company nor is it to be construed as an admission by the Company or Claimant as

to the merits of any claim not expressly set forth in this Agreement relating to the

Debt. |

| 3. | As a result of Claimant's decision to

provide to the Company the Waiver and Release, Claimant acknowledges that it is foregoing

the possibility of any future accrual of interest or repayment of interest and principal

by any other terms, and that the consideration for the Waiver and Release agreed upon

with the Company is in its view fair and reasonable. |

| 4. | This Agreement shall be interpreted

pursuant to Nevada law. If any provision in this Agreement shall be declared unenforceable

by any administrative agency or court of law, the remainder of the Agreement shall remain

in full force and effect and shall be binding upon the parties hereto as if the invalidated

provisions were not part of this Agreement. Each party has cooperated in the drafting

and preparation of this Agreement. As a result, in any construction to be made of this

Agreement, the same shall not be construed against any party on the basis that the party

was the drafter. |

| 5. | Each covenant, agreement and provision

of this Agreement shall be construed to be a separate covenant, agreement and provision.

If any covenant, agreement or provision of this Agreement is breached, the remainder

of this Agreement shall not be effected thereby. No waiver of any breach of any term

or provision of this Agreement shall be considered to be, nor shall be, a waiver of any

other breach of this Agreement. No waiver shall be binding unless in writing and signed

by the party waiving the breach. |

APPROVED AND ACCEPTED this 13th day of

May, 2015.

| Date: May

13, 2014 |

IL2M

INTERNATIONAL CORP. |

| |

|

|

| |

By: |

/s/

Sarkis Tsaoussian |

| |

|

Sarkis

Tsaoussian, President/CEO |

| |

|

|

| Date: May

13, 2014 |

IL2M

GLOBAL LTD. |

| |

|

|

| |

By: |

/s/

Sarkis Tsaoussian |

| |

|

President |

-2-

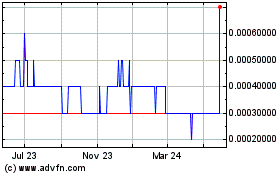

IL2M (PK) (USOTC:ILIM)

Historical Stock Chart

From Oct 2024 to Nov 2024

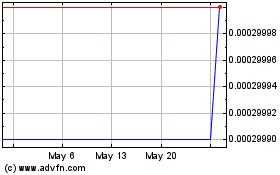

IL2M (PK) (USOTC:ILIM)

Historical Stock Chart

From Nov 2023 to Nov 2024