UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

May 14, 2015

Date of Report (Date of earliest event reported)

il2m INTERNATIONAL CORP.

(Exact name of registrant as specified in its

charter)

| Nevada |

|

333-176587 |

|

27-3492854 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

3500 West Olive Avenue

Suite 810

Burbank, California |

|

91505 |

| (Address of principal executive offices) |

|

(Zip Code) |

(702) 726-0381

Registrant’s telephone number, including

area code

N/A

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION 5. CORPORATE GOVERNANCE AND MANAGEMENT

ITEM 5.02 DEPARTURE OF DIRECTORS OR PRINCIPAL

OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF PRINCIPAL OFFICERS

On May 14, 2015, there was a change in control

of il2m International Corp., a corporation organized under the laws of the State of Nevada (the "Company"). In accordance

with the terms and provisions of that certain stock purchase agreement dated May 14, 2015 (the "Stock Purchase Agreement")

by and between il2m Global Ltd., a Belize corporation ("il2m Global"), and Cirilo Tamarez Frias ("Frias"),

Frias purchased from il2m Global an aggregate 1,500,000,000 shares of common stock of the Company.

Therefore, in accordance with the terms and

provisions of the Stock Purchase Agreement, the Company accepted the resignation of its sole officer and director, Sarkis Tsaoussian

as President/Chief Executive Officer, Secretary, Treasurer/Chief Financial Officer and sole member of the Board of Directors,

effective May 14, 2015. Simultaneously, the Board of Directors appointed Jorge Armando Solorzano Reyes as the sole member of the

Board of Directors and as the President/Chief Executive Officer, Secretary and Treasurer/Chief Financial Officer of the Company.

Jorge Armando Solorzano Reyes Biography.

During the past six years, Mr. Reyes has been involved as a chemical engineer with expertise in water and wastewater treatment

processes, process engineering P&IDs, PFDs, turn key project integration, sales and the design and construction of advanced

oxidation processes. From approximately June 2013 to current date, Mr. Reyes has been employed with Aguas Latinas Mexico, S. De

R.L. De C.V. in Mexico City as a product and project engineer. His duties included, but not limited to, integrating projects for

advanced oxidation processes, preparing quotes for water and wastewater disinfection equipment, performing process engineering

for drinking water plants and advanced treatment, and integration of membrane filtration processes. Mr. Reyes' achievements included

an optimization of calculation of required dosing and contact time, automation of selection of required equipment for a given application

and integration of an anaerobic digestion process for the dairy industry.

From approximately March 2012 through December

2012, Mr. Reyes was employed with Uam Azcapotzalco in Azcapotzalco, Mexico, as a laboratory researcher. His duties included, but

not limited to, performing lixiviation and digestion tests of Ni-Cd batteries, data interpretation and experimentation analysis,

and managing atomic absorption. Mr. Reyes' achievements included an optimization of lixiviation time by a strict control of temperature

and agitation and a finding of an efficient combination of compounds and procedures to obtain a higher concentration of cadmium

in the resulting lixiviate.

From approximately May 2009 through November

2011, Mr. Reyes was employed with Sistemas Y Tecnoconstrucciones Antares S.A. de C.V. in Poza Rica, Veracruz, as a consultant.

His duties included, but not limited to, supervision of work on project sites, development of EPC projects and project management.

Mr. Reyes' achievements included timely completion of scheduled project and supervision and coordination of work progress.

Mr. Reyes earned a chemical engineering degree

and professional license from the Universidad Autonoma Metropolitana in Azcapotzalco, Mexico. in 2012.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Beneficial Ownership Chart

The following table sets forth certain information,

as of the date of this Current Report, with respect to the beneficial ownership of the outstanding common stock by: (i) any holder

of more than five (5%) percent; (ii) each of the Company's executive officers and directors; and (iii) the Company’s directors

and executive officers as a group. Except as otherwise indicated, each of the stockholders listed below has sole voting and investment

power over the shares beneficially owned. Unless otherwise indicated, each of the stockholders named in the table below has sole

voting and investment power with respect to such shares of common stock. Beneficial ownership consists of a direct interest

in the shares of common stock, except as otherwise indicated. As of the date of this Current Report, there are 1,831,757,244 shares

of common stock issued and outstanding.

| Name and Address of Beneficial Owner(1) |

|

Amount and

Nature of

Beneficial

Ownership(1) |

|

Percentage of Beneficial

Ownership |

|

| Directors and Officers: |

|

|

|

|

|

|

Jorge Armando Solorzano Reyes

Calle Campo Chilapilla No. 55

Col. San Antonio

C.P. 02720

Mexico, D.F

|

|

|

-0- |

|

|

0% |

|

| |

|

|

|

|

|

|

|

|

All executive officers and directors as a group (1 person)

|

|

|

-0- |

|

|

0% |

|

| |

|

|

|

|

|

|

|

| Beneficial Shareholders Greater than 10% |

|

|

|

|

|

|

|

|

Cirilo Tamarez Frias

Los Solares de Juan Dolio,

Calle 2 - Casa 4,

Juan Dolio, Dominican Republic |

|

|

1,500,000,000 |

|

|

81.88% |

|

| (1) |

Under Rule 13d-3, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (i) voting power, which includes the power to vote, or to direct the voting of shares; and (ii) investment power, which includes the power to dispose or direct the disposition of shares. Certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares outstanding is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of outstanding shares of any person as shown in this table does not necessarily reflect the person’s actual ownership or voting power with respect to the number of shares of common stock actually outstanding as of the date of this Current Report. As of the date of this Current Report, there are 1,831,757,244 shares of common stock issued and outstanding. |

BUSINESS OPERATIONS

Prior Business Operations

The Company has been

a fully operational development stage company engaged in the business of developing, creating and marketing a social media platform

called Ilink2music.com. Management believed that Ilink2music.com would be an unparalleled social media platform that would

allow users to unify their personal digital-mobile lifestyle while simultaneously providing exclusive international music entertainment

content, networking, events, products, services; featuring a unique internet radio station and exceptional co-creation content

aiming at facilitating and revolutionizing the management of an end-user's on-line “way of life”. Its platform was

a Horizontal - adaptable business model based on the strategic use of Multi-Sensory Branding, Co-Creation, Product Placement,

Immersion User Experience Applications, ROI Relationship/Currency with Economy and Licensing Structures. It was built to adapt

and to embrace the monumental shifts and disruptive technologies that are changing every facet of business. Management

believed that Ilink2music.com was positioned to leverage and facilitate change in the global end user driven digital/ mobile

content/product placement eco system.

Information Statement on Form 14C

A definitive information statement on Form

14(c) was filed with the Securities and Exchange Commission on May 11, 2015 (the "Information Statement"), pursuant to

which the Company advised shareholders that the Board of Directors and majority shareholders of the Company approved the termination

(the "Termination") of that certain intellectual property licensing agreement dated October 29, 2013 (the "Licensing

Agreement") between the Company's wholly-owned subsidiary, il2m Inc. ("il2m") and il2m Global Limited, a Belize

corporation ("il2m Global"), which constituted a transfer of substantially all of the assets of the Company (the "Transfer

of Assets").

The Company has been unable to generate revenues

and currently has no prospects for generation of revenues. Despite continued efforts and numerous attempts through various channels,

management has not been able to raise sufficient funds over the last 16 months in order to successfully monetize and generate revenues

through use of the its intellectual property. The Board of Directors determined that it was in the Company’s best interests

to effect the Termination and the Transfer of Assets and considered certain factors including, but not limited to, the following:

| · |

Improved positioning for the Company to identify and negotiate new business opportunities in order to promote future growth based on a new and distinct corporate strategy, market opportunities and customer relationships. As part of the Company, Mr. Tsaoussian's time as Chief Executive Officer and expertise has been committed totally to the needs of the Company and attempting to maximize the earnings power by taking on a more diverse and profitable corporate strategy in the business of designing and developing iLink2Music.com, which has not been successful to date. |

| · |

More efficient allocation of capital, which will allow the Company to develop new and independent business operations and strategy without the constraints of its current business operations involving the Licensing Agreement. As a result, the flexibility of the Company to invest capital in operations other than its business involving iLink2Music.com in a time and manner as its operational strategy would dictate was limited. Current management believes that new management will be enabled to effectuate a more efficient allocation of capital by providing for new business prospects and to reinvest cash flow, utilize cash and investments and access the capital markets, if needed, in a manner responsive to the needs of the Company focusing on new business operations and prospectus and opportunities. Current management believes that new management with a new overall business operational strategy will provide for future efficient allocation of capital with greater flexibility to pursue their strategic initiatives within a capital-intensive industry. |

| · |

The posturing and streamlining of the Company and its future business operations to broaden its opportunities and operational strategies to enter into other lines of business that new management will believe represents positive growth. By eliminating the necessary time and resources required to resolve conflicting business priorities and strategic needs involving iLink2Music.com, the Company may be able to better compete through more efficient deployment of capital and corporate resources and enhanced responsiveness to different market demands. |

| · |

New management focus and strategic vision and alignment of management incentives with stockholder value creation. |

| · |

Possible reduction of debt and liabilities, stronger positioning of the Company in a different business and enhancement of opportunities regarding its involvement in the new business operations . |

Return

of Shares

Pursuant to the terms

and provisions of the Licensing Agreement, il2m was previously issued 125,000,000 shares of common stock. Upon the effective date

of the Transfer, il2m has returned approximately 124,100,000 shares of common stock to the Company for cancellation and return

to treasury.

Proposed Future Business Operations

Subsequent

to the Stock Purchase Agreement, the business operations of the Company will change. The proposed future business operations will

involve development of land located in Mexico. The proposed acquisition of the subject property is a compound parcel consisting

of two different adjacent parcels for which property title was provided. The first of the two parcels is identified, according

to property title # 45,626 at Cancun City, Benito Juarez, Quintana Roo, as Punta Maroma Fraction 1-D. This is a beachfront regular

shape land lot with a 27,196.11 Sq. M. (6.72 Acres) surface. The second parcel is an irregular polygon adjacent to the above described

parcel, identified in the property title # 46,513 at Cancun City, Benito Juarez, Quintana Roo, as El Sinai Lot 053-2 with a land

area of 263,192.77 Sq. M. (65.04 Acres).

The Company will be filing a current report

on Form 8-K in the future further detailing the new business operations.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial

Statements and Exhibits

(a) Financial Statements

of Business Acquired.

Not applicable.

(b) Pro forma Financial

Information.

Not applicable.

(c) Shell Company

Transaction.

Not applicable.

(d) Exhibits.

Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

il2m INTERNATIONAL CORP. |

|

| |

|

|

|

| DATE: May 14, 2015 |

|

/s/ Sarkis Tsaoussian |

|

| |

|

Sarkis Tsaoussian |

|

| |

|

President/Chief Executive Officer |

|

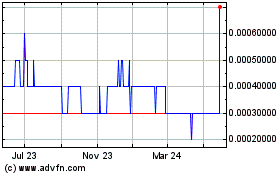

IL2M (PK) (USOTC:ILIM)

Historical Stock Chart

From Nov 2024 to Dec 2024

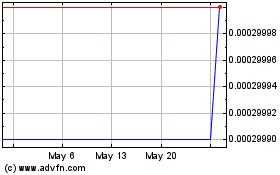

IL2M (PK) (USOTC:ILIM)

Historical Stock Chart

From Dec 2023 to Dec 2024