false

0001527702

0001527702

2024-11-01

2024-11-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): November

1, 2024

iQSTEL Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55984 |

45-2808620 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| |

|

|

300 Aragon Avenue, Suite 375

Coral Gables, FL 33134 |

33134 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (954) 951-8191

|

________________________________________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| |

[ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

|

| |

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

SECTION 1 - REGISTRANT'S BUSINESS AND OPERATIONS

ITEM 1.01 - ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On November 1, 2024, we entered into a binding Memorandum of Understanding

(the “Agreement”) with Mr. Ralf Koehler ("Ralf"), SwissLink Carrier Ltd., ("SwissLink") and Impact Trading

& Consulting LLC ("Impact") for the purpose of outlining the understanding regarding the exchange of 49% ownership in SwissLink

for our shares. Pursuant to the Agreement, the parties agreed that the execution of the final agreement will be subject to mutual consent

and negotiations based on the terms already agreed below:

| |

• |

The agreed valuation to purchase Ralf’s

49% ownership interest in SwissLink is set at $750,000 USD. |

|

| |

• |

The term of this agreement will be for

five (5) years plus six (6) months (“Termination Date”), commencing on the date of the execution of the final agreement

("Final Agreement"). |

|

| |

• |

Ownership will be transferred from Ralf

to us in tranches, with each tranche comprising up to 10% of ownership per year. |

|

| |

• |

The option to execute each tranche can

be initiated by Ralf within each one-year period through the submission of a "trigger letter" by e-mail to us. If Ralf

does not exercise his right to trigger the agreement during any year, we reserve the right to initiate the tranche execution at any

point thereafter. |

|

| |

• |

Share Calculation: The number of iQSTEL

shares to be provided in exchange for each tranche will be determined based on the lowest closing price of iQSTEL shares over the

90 days preceding the delivery of the trigger letter. |

|

| |

• |

Discount: Ralf will receive a 20% discount

on the above calculated share price; provided however, that the above calculated share price, without the discount, shall count toward

the purchase price in determining whether Ralf has received the full $750,000 USD valuation for his 49% ownership interest in SwissLink. |

|

| |

• |

If, after the execution of all tranches,

Ralf has not received the full $750,000 USD valuation, we or our legal successor will pay the difference in cash until the full valuation

is realized based on the Weighted Volume Average Price (WVAP) of our shares for the last 15 trading days prior to the Termination

Date for shares still in Ralf's possession, and/or the actual selling price for shares already sold by Ralf. |

|

In addition, under the Agreement, Impact agrees to render advisory services

up to 60 hours per month to SwissLink and ETELIX, our wholly owned subsidiary, at 8,000 CHF per month (excluding VAT) for a maximum of

two years.

Next, SwissLink acknowledges a debt of 200,000 CHF owed to Ralf, which

will be repaid in monthly installments of 8,000 CHF until the debt is fully repaid.

Finally, Ralf will continue to grant SwissLink non-exclusive access to

the VAMP platform, with the same cost and expense structure as outlined in the Share Purchase Agreement between iQSTEL and Ralf, dated

April 1, 2019.

The foregoing description is qualified in its entirety by reference to

the Agreement, a copy of which is attached as Exhibit 10.1 hereto and is incorporated herein by reference.

SECTION 8 – OTHER EVENTS

Item 8.01

Other Events

On November 4, 2024, we issued a press release announcing the Agreement

with the parties. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Item 8.01 of this Current Report

on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in

such a filing.

SECTION 9 – Financial

Statements and Exhibits

Item 9.01 Financial Statements

and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

iQSTEL Inc.

/s/ Leandro Iglesias

Leandro Iglesias

Chief Executive Officer

Date November 4, 2024

Memorandum of Understanding

(MOU)

Effective Date: November 1st, 2024

This Memorandum of Understanding

("MOU") is entered into by and between iQSTEL Inc. ("iQSTEL"), a publicly traded company, Mr. Ralf Koehler

("Ralf"), SwissLink Carrier Ltd., ("SwissLink") and Impact Trading & Consulting LLC ("Impact").

Collectively, these entities are referred to as "the Parties" for the purpose of outlining the understanding regarding the exchange

of 49% ownership in SwissLink Carrier Ltd. for iQSTEL shares.

| · | Impact Trading & Consulting LLC |

This MOU outlines the intent

of Ralf to exchange his 49% ownership interest in SwissLink for iQSTEL shares, as further defined below. The Parties agree that the execution

of the final agreement will be subject to mutual consent and negotiations based on the terms already agreed below.

The agreed valuation of Ralf’s

49% ownership interest in SwissLink is set at $750,000 USD.

The term of this agreement will

be for five (5) years plus six (6) months (“Termination Date”), commencing on the date of the execution of the final

agreement ("Final Agreement").

| 5. | Ownership Transfer in Tranches |

Ownership will be transferred

from Ralf to iQSTEL in tranches, with each tranche comprising up to 10% of ownership per year. Any modifications to the

tranche size or time frame must be agreed upon in writing by both Parties.

The option to execute each tranche

can be initiated by Ralf within each one-year period through the submission of a "trigger letter" by e-mail to iQSTEL. If Ralf

does not exercise his right to trigger the agreement during any year, iQSTEL reserves the right to initiate the tranche execution at any

point thereafter.

| · | Share Calculation: The number of iQSTEL shares

to be provided in exchange for each tranche will be determined based on the lowest closing price of iQSTEL shares over the 90 days preceding

the delivery of the trigger letter. |

| · | Discount: Ralf will receive a 20% discount

on the above calculated share price; provided however, that the above calculated share price, without the discount, shall count toward

the purchase price in determining whether Ralf has received the full $750,000 USD valuation for his 49% ownership interest in SwissLink. |

If, after the execution of all

tranches, Ralf has not received the full $750,000 USD valuation, iQSTEL or its legal successor will pay the Difference in

cash until the full valuation is realized.

| · | The Difference will be calculated based on

the Weighted Volume Average Price (WVAP) of iQSTEL shares for the last 15 trading days prior to the Termination Date for shares

still in Ralf's possession, and/or the actual selling price for shares already sold by Ralf. |

| · | The

parachute clause expires once Ralf accumulates the full $750,000 USD valuation. |

| 8. | Complementary Terms | Additional Agreements |

| 1. | Consulting Services and Compensation: |

Impact agrees to render advisory services to SwissLink

and ETELIX as per the attached Scope of Work (Schedule 1). The consulting fee will be 8,000 CHF per month (excluding VAT)

for a maximum of two years. This compensation covers up to 60 hours of work per month. A separate mandate engagement will

be signed between Impact and SwissLink ("Mandate Agreement"). Effective Date Nov 1st, 2024.

SwissLink acknowledges a debt of 200,000 CHF owed to

Ralf, which will be repaid in monthly installments of 8,000 CHF until the debt is fully repaid. A separate debt repayment agreement

will be signed between SwissLink and Ralf ("Debt Repayment Agreement"). Effective Date Nov 1st, 2024

Ralf will continue to grant SwissLink non-exclusive access

to the VAMP platform, with the same cost and expense structure as outlined in the Share Purchase Agreement between iQSTEL and Ralf,

dated April 1, 2019.

The Parties agree to keep the

terms and conditions of this MOU strictly confidential. No Party shall disclose any information regarding this MOU to any third party,

except as required by law or regulatory authorities. However, as iQSTEL is a publicly traded company, the material terms of this agreement

will need to be disclosed in compliance with SEC regulations, including a Form 8-K filing, if deemed necessary. Both Parties agree to

cooperate in making any such required disclosures in a manner that complies with legal obligations while maintaining confidentiality to

the greatest extent possible.

This MOU, and any subsequent

agreements including the Final Agreement, will be governed by and construed in accordance with the substantive laws of Switzerland,

excluding Swiss Private International Law and international treaties. Any disputes arising out of or in connection with this MOU will

be subject to the exclusive jurisdiction of the courts in the city of Zurich (Zurich 1), Switzerland.

This MOU represents the terms

agreed by the Parties to enter into final binding agreements and is, where applicable, subject to required approvals by respective bodies

of the Parties. While this document itself is binding to the extent that it creates directly enforceable obligations under the

final binding agreements, it also creates the binding obligation between the Parties to enter into the following three final binding

agreements within 60 days after execution of this MOU:

| - | Final Agreement (as defined hereinabove) between Ralf and iQSTEL; |

| - | Mandate Agreement (as defined hereinabove) between Impact and SwissLink; |

| - | Debt Repayment Agreement (as defined hereinabove) between Ralf and SwissLink. |

The drafts of the final binding agreements

listed hereinabove will be provided by Ralf and/or Impact.

Signatures

iQSTEL Inc.

/s/ Leandro Iglesias

Name: Leandro

Iglesias

Date:

October 30, 2024

Ralf

Koehler

/s/

Ralf Koehler

Name: Ralf Koehler

Date:

30.10.2024

SwissLink

Carrier Ltd.

/s/ Leandro Iglesias

Name: Leandro

Iglesias

Date:

October 30, 2024

Impact Trading & Consulting LLC

/s/ Ralf Koehler

Name: Ralf

Koehler

Date: 30.10.2024

Schedule 1: Scope of Work

Expected Activities from Impact Trading &

Consulting LLC for SwissLink Carrier Ltd. and Etelix (Estimated Time)

| 1. | Swisscom Relationship Management: Support for managing Swisscom

relations (1 hour/month). |

| 2. | Regulatory Affairs: Assistance with regulatory compliance required

by Swiss law for telecommunications (2 hours/month). |

| 3. | VAMP Platform Operations: Support for VAMP operations and network

issues (15 hours/month). |

| 4. | Training and Assistance: Training and assistance with administrative

tools and the VAMP platform (3 hours/month). |

| 5. | Tax Support: Assistance with VAT and tax matters in Switzerland

and Germany (3 hours/month). |

| 6. | Credit Suisse Relationship Management: Training on banking relationships

(1 hour/month). |

| 7. | Additional Activities: Additional tasks as requested by SwissLink

Carrier Ltd. or Etelix, to be agreed in advance. |

Total working time: Up to 60 hours/month.

Any work exceeding 60 hours/month requires prior approval

from SwissLink in writing, with an hourly rate of 270 CHF (excluding VAT) for additional work.

Effective Date, Nov 1st, 2024.

IQST - iQSTEL Advances

Global Expansion with Strategic Acquisition Agreement to Fully Consolidate SwissLink Carrier AG., Enhancing Telecom Powerhouse Vision

New York, NY, November

4, 2024 — iQSTEL Inc. (OTC: IQST), a rapidly expanding leader in telecommunications, proudly announces a major step in its

journey to global telecom dominance with the signing of a transformative Memorandum of Understanding (MOU) to acquire the remaining

49% of SwissLink Carrier AG. This strategic agreement accelerates iQSTEL’s consolidation of international telecom assets, enhancing

its operational strength and advancing its mission to become a worldwide telecom powerhouse.

The MOU gives Mr. Koehler

to swap his 49% ownership in SwissLink, valued at $750,000, for iQSTEL common shares, with the transaction unfolding over the next five

years at 10% ownership per year. This thoughtful, phased structure minimizes dilution at iQSTEL’s current stock price, allowing

for a prudent approach that maximizes shareholder value. This seamless, scalable arrangement underscores iQSTEL’s commitment

to investor-friendly decisions, laying a foundation for exponential growth and industry consolidation.

Mr. Koehler’s choice

to transition his SwissLink ownership into iQSTEL shares highlights his confidence in iQSTEL’s ambitious vision for growth. With

a partnership history spanning over six years, Mr. Koehler is deeply aligned with iQSTEL’s mission and goals. Beyond ownership exchange,

he will continue to play a pivotal role in shaping our European business strategy, ensuring continuity and leveraging his seasoned expertise

to drive innovation across the region.

Adding to the excitement,

this transaction is part of a larger plan designed to deliver operational efficiencies projected to save iQSTEL up to $2 million annually—a

substantial boost to profitability that reflects the efficiency and scalability of this consolidation. Investors should take note of this

critical milestone, as it enhances iQSTEL’s operational strength and represents a key advancement in the company’s roadmap

to high-margin, next-generation telecom solutions.

The transition will be

seamless for SwissLink’s customers, maintaining uninterrupted service and operational excellence. Juan Carlos Lopez Silva will

continue as CEO of both SwissLink and Etelix, ensuring stability and leadership in our European operations.

Leandro Jose Iglesias, CEO

of iQSTEL, commented: “The trust and dedication Ralf has demonstrated by committing to this ownership exchange are testaments to

the strength of our shared vision. This transaction not only benefits our shareholders with a structured, non-dilutive approach but also

strengthens our footing in Europe, setting the stage for increased value creation. We are moving fast, adding high-tech, high-margin products

like our recent Cycurion partnership and our AI-powered AIRWEB.ai service. In parallel, we are actively consolidating our telecom operations

to deliver up to $2 million in annual savings. This combination of innovation and operational efficiency is accelerating our path to global

leadership.”

This ownership exchange

represents a significant advancement in iQSTEL’s strategy to build a resilient, consolidated telecom framework that supports next-generation

communication technologies on a global scale.

About SwissLink Carrier AG

SwissLink Carrier AG is a licensed Swiss-based

telecommunications provider, specializing in domestic and international voice and SMS termination. With over 200 interconnections across

Tier 1, Tier 2, and Tier 3 telecommunications providers, SwissLink holds a prominent position in the industry.

SwissLink Carrier plays a key role in

the European telecom market, managing essential connectivity across countries in the region. The company maintains several direct interconnections

with the largest European telecom operators, which serve the most extensive end-user bases. This strategic positioning enables SwissLink

to efficiently handle significant traffic flows from various global origins into Europe and the European Economic Area (EEA). Its tailored

voice analysis and management platform ensures optimal performance and reliability.

With a team boasting over 75 years of

industry expertise, SwissLink Carrier AG invites partners to join its network and benefit from its innovative, customer-centric approach

to telecommunications.

About iQSTEL (Updated Oct. 2024):

iQSTEL Inc. (OTC-QX:

IQST) (www.iQSTEL.com) is a US-based multinational publicly listed company in the final stages of the path to becoming listed on NASDAQ.

With FY2023 revenues of $144 million and a forecasted $290 million in revenue, alongside positive operating income of seven digits for

FY-2024, iQSTEL is positioning itself for explosive growth. iQSTEL's mission is to serve basic human needs in today's modern world by

making essential tools accessible, regardless of race, ethnicity, religion, socioeconomic status, or identity. The company recognizes

that modern human needs such as physiological, safety, relationship, esteem, and self-actualization are marginalized without access to

ubiquitous communications, financial freedom, clean, affordable mobility, and information.

iQSTEL has been building

a strong business platform with its customers, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin

products across its divisions. iQSTEL is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions,

and high-margin product expansion.

| · | Telecommunications Services Division (Communications):

Includes VoIP, SMS, International Fiber-Optic, Proprietary Internet of Things (IoT), and a Proprietary Mobile Portability Blockchain Platform. |

|

| · | Fintech Division (Financial Freedom):

Provides remittance services, top-up services, a MasterCard Debit Card, US bank accounts (no SSN required), and a Mobile App. |

|

| · | Electric Vehicles (EV) Division (Mobility):

Offers Electric Motorcycles and plans to launch a Mid-Speed Car. |

|

| · | Artificial Intelligence (AI) Services Division (Information

and Content):

Provides AI solutions for unified customer engagement across web and phone channels, along with a white-label platform offering seamless

access to services, entertainment, and support in a virtual 3D interface. |

|

| · | Cybersecurity Services:

Through a new partnership with Cycurion, iQSTEL will offer advanced cybersecurity solutions, including 24/7 monitoring, threat detection,

incident response, vulnerability assessments, and compliance management, providing essential protection to telecommunications clients

and beyond. |

|

iQSTEL

has completed 11 acquisitions since June 2018 and continues to develop an active pipeline of potential future acquisitions, further expanding

its suite of products and services both organically and through mergers and acquisitions.

Safe

Harbor Statement: Statements in this news release may be "forward-looking statements". Forward-looking statements include, but

are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions, or any other information relating

to our future activities or other future events or conditions. These statements are based on current expectations, estimates, and projections

about our business based partly on assumptions made by management. These statements are not guarantees of future performance and involve

risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual outcomes and results may and are likely to differ

materially from what is expressed or forecasted in forward-looking statements due to numerous factors. Any forward-looking statements

speak only as of the date of this news release, and iQSTEL Inc. undertakes no obligation to update any forward-looking statement to reflect

events or circumstances after the date of this news release. This press release does not constitute a public offer of any securities for

sale. Any securities offered privately will not be or have not been registered under the Act and may not be offered or sold in the

United States absent registration or an applicable exemption from registration requirements.

iQSTEL

Inc.

IR US Phone: 646-740-0907

IR Email: investors@iqstel.com

Contact

Details

iQSTEL Inc.

+1 646-740-0907

investors@iqstel.com

Company

Website

www.iqstel.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

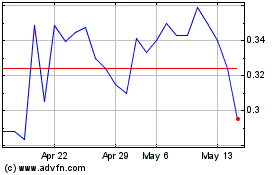

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Dec 2024 to Jan 2025

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Jan 2024 to Jan 2025