UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2024

| Innovative Food Holdings, Inc. |

| (Exact name of registrant as specified in its charter) |

| Florida | 0-9376 | 20-1167761 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

| 9696 Bonita Beach Rd, Suite 208, Bonita Springs, Florida | 34135 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (239) 596-0204

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act: None

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On August 6, 2024, igourmet LLC (“igourmet”), which is a wholly-owned subsidiary of Innovative Food Holdings, Inc. (the “Company”), and Advansiv Gourmet Group, Inc. (“Buyer”) entered into an Asset Purchase Agreement (the “APA”). Pursuant to the APA, igourmet will sell to Buyer substantially all of its assets related to marketing and selling certain artisan foods and related drop-ship fulfillment services (the “Purchased Assets”), for total consideration of $700,000. At signing, $175,000 was placed into escrow. At closing, $350,000 will be paid to igourmet, and the $175,000 escrow will be released. An additional $175,000 will be paid to igourmet 30 days after closing. The Company expects the transaction to close within the next 30 days. The APA contains customary representations, warranties and covenants, and provides for customary indemnification obligations of the parties. The closing of the transaction contemplated by the APA (the “Transaction”) is subject to customary closing conditions.

The foregoing summary of the APA is not complete and is subject to, and qualified in its entirety by, the provisions of the APA, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

On August 8, 2024, the Company issued a press release announcing the Transaction. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits

|

+ Certain portions of this exhibit are omitted pursuant to Item 601(b)(10)(iv) of Regulation S-K because they are not material and are the type that the Company treats as private or confidential. The Company hereby agrees to furnish a copy of any omitted portion to the SEC upon request.

^ Certain portions of the exhibit have been omitted pursuant to Item 601(a)(6) of Regulation S-K. The Company hereby agrees to furnish a copy of any omitted portion to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

INNOVATIVE FOOD HOLDINGS, INC.

|

| |

|

|

Dated: August 12, 2024

|

|

| |

By: /s/ Robert William Bennett

Robert William Bennett

|

| |

Chief Executive Officer and Director

(Principal Executive Officer)

|

false

0000312257

true

0000312257

2024-08-06

2024-08-06

Exhibit 10.1

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THE EXHIBIT BECAUSE IT IS EITHER (i) NOT MATERIAL AND (ii) IS THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL, OR DISCLOSURE OF SUCH INFORMATION WOULD CONSTITUTE A CLEARLY UNWARRANTED INVASION OF PERSONAL PRIVACY. REDACTED INFORMATION IS MARKED WITH A [*****]

ASSET PURCHASE AGREEMENT

This Asset Purchase Agreement (this “Agreement”) dated as of August 6, 2024 is entered into between iGourmet LLC, a New York limited liability company (“Seller”) and Advansiv Gourmet Group, Inc., a Florida corporation (“Buyer”). Capitalized terms used in this Agreement have the meanings given to such terms herein, as such definitions are identified by the cross-references set forth in Annex I attached hereto.

RECITALS

WHEREAS, Seller is engaged in the business of owning and operating online Shopify based storefronts igourmet.com and wholesale.igourmet.com, and igourmet branded marketplaces at Amazon and Walmart, to market and sell artisan foods to customers and provide drop-ship fulfillment services for two (2) businesses, [*****] and [*****] (the “B2B Vendors”), which sales are electronically processed by Seller and fulfilled by Seller or by third party drop ship vendors (the “Business”).

WHEREAS, Seller wishes to sell and assign to Buyer, and Buyer wishes to purchase and assume from Seller, specific assets and specific liabilities of the Business, subject to the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

PURCHASE AND SALE

1.01 Purchase and Sale of Assets. Subject to the terms and conditions set forth herein, at the closing of the transactions contemplated by this Agreement (the “Closing”), Seller shall sell, convey, assign, transfer and deliver to Buyer, and Buyer shall purchase from Seller, all of Seller’s right, title and interest in, to and under all of the tangible and intangible specified assets, properties and rights of every kind and nature and wherever located, which primarily relate to, or are primarily used or held for use in connection with, the Business (collectively, the “Purchased Assets”), including the following:

(a) all Contracts set forth on Section 1.01(a) of the Disclosure Schedules (the “Assigned Contracts”). For purposes of this Agreement: (i) “Contracts” means all contracts, leases, licenses, instruments, notes, commitments, undertakings, indentures, joint ventures and all other agreements, commitments and legally binding arrangements, whether written or oral; and (ii) “Disclosure Schedules” means the disclosure schedules delivered by Seller and Buyer concurrently with the execution and delivery of this Agreement;

(b) all of Seller’s rights under warranties, indemnities and all similar rights against third parties to the extent related to any Purchased Assets;

(c) all rights to the Intellectual Property, including all Copyrights, Trade Secrets, inventions and processes, Trademarks (including the Business Name), trademarks, service marks, logos, brand names, assumed names, domain names, URLs, websites, written content, photography, designed marketing and promotional materials used primarily in the Business, together with goodwill symbolized thereby set forth on Section 1.01(c) of the Disclosure Schedules; (d)all software, accounts, technology rights and licenses set forth on Section 1.01(d) of the Disclosure Schedules;

(e) all telephone and facsimile numbers and all email addresses and all social media and other internet accounts used primarily in the Business set forth on Section 1.01(e) of the Disclosure Schedules;

(f) any and all goodwill of the Business as going concern; and

(g) all assets set forth on Section 1.01(g) of the Disclosure Schedules.

Section 1.02 Excluded Assets. Other than the Purchased Assets, Buyer expressly understands and agrees that it is not purchasing or acquiring, and Seller is not selling or assigning, any other assets or properties of Seller, and all such other assets and properties shall be excluded from the Purchased Assets (collectively, the “Excluded Assets”). Excluded Assets include, without limitation, the assets, properties and rights specifically set forth on Section 1.02 of the Disclosure Schedules.

Section 1.03 Assumed Liabilities.

(a) Subject to the terms and conditions set forth herein and in the Transition Agreement, Buyer shall assume and agree to pay, perform and discharge when due any and all Liabilities of Seller arising out of or relating to the Purchased Assets that begin to accrue on or after the Closing Date, other than the Excluded Liabilities (collectively, the “Assumed Liabilities”), including, without limitation, the following:

(i) All Liabilities arising under or relating to the Assigned Contracts that begin to accrue on or after the Closing Date;

(ii) all Liabilities for (A) Taxes relating to the Purchased Assets or the Assumed Liabilities for any taxable period (or any portion thereof) beginning after the Closing Date and (B) Taxes for which Buyer is liable pursuant to Section 5.07;

(iii) all Liabilities for iGourmet gift certificates and reward balances as set forth on Section 1.03(a)(iii) of the Disclosure Schedules; and

(iv) all other Liabilities arising out of or relating to Buyer’s ownership or operation of the Purchased Assets on or after the Closing.

For purposes of this Agreement, “Liabilities” means liabilities, obligations or commitments of any nature whatsoever, whether asserted or unasserted, known or unknown, absolute or contingent, accrued or unaccrued, matured or unmatured or otherwise.

(b) Buyer shall not assume and shall not be responsible to pay, perform or discharge any of the following Liabilities of Seller (collectively, the “Excluded Liabilities”):

(i) any Liabilities arising out of or relating to Seller’s ownership or operation of the Business and the Purchased Assets prior to the Closing Date;

(ii) any Liabilities relating to or arising out of the Excluded Assets;

(iii) any Liabilities for (A) Taxes relating to the Business, the Purchased Assets or the Assumed Liabilities for any taxable period (or any portion thereof) ending on or prior to the Closing Date and (B) any other Taxes of Seller (other than Taxes allocated to Buyer under Section 5.07) for any taxable period; and

(iv) any Liabilities of Seller arising or incurred in connection with the negotiation, preparation, investigation and performance of this Agreement, the other Transaction Documents and the transactions contemplated hereby and thereby, including fees and expenses of counsel, accountants, consultants, advisers and others:

(v) Notwithstanding anything contained in this Agreement to the contrary, except for the Assumed Liabilities, Buyer shall not be deemed to have assumed any other claims, liabilities, obligations, or responsibilities of the Seller of any kind, character, and nature, whether matured or un-matured, liquidated or un-liquidated, fixed or contingent, or known or unknown, and regardless of when incurred.

Section 1.04 Purchase Price; Buyer Deposit. In consideration of and in full payment for the purchase of the Purchased Assets and subject to the provisions of this Agreement, the Buyer shall pay to the Seller the sum of Seven Hundred Thousand Dollars ($700,000) (the “Purchase Price”). The Purchase Price shall be paid as follows:

(a) Upon the complete execution of this Agreement, the Buyer shall deliver a deposit of $175,000 (the “Buyer Deposit”) to Weiss Serota Helfman Cole & Bierman, P.L. (the “Escrow Agent”), which will hold the Buyer Deposit in accordance with the terms of the escrow agreement in the form attached hereto as Exhibit A (the “Escrow Agreement”). As provided in the Escrow Agreement, the Buyer Deposit shall be deposited by the Escrow Agent with a banking institution in a non-interest-bearing account pending the Closing or termination of this Agreement. If the Closing occurs, the Buyer Deposit shall be credited to the Purchase Price and disbursed by the Escrow Agent to Seller at Closing.

(b) The balance of the Purchase Price (subject to prorations and adjustments pursuant to Section 1.04(c) below) shall be payable by wire transfer to the Seller (regarding the Closing Payment and Post-Closing Payment, each as defined below) or Escrow Agent (regarding the Buyer Deposit) of immediately available funds in accordance with the wire instructions set forth on Section 1.04 of the Disclosure Schedules as follows:

(i) At Closing, $525,000 by wire of immediately available funds to an account specified by Seller (the “Seller Account”), consisting of $350,000 (the “Closing Payment”) and the Buyer Deposit; and

(ii) On the date that is thirty calendar days after the Closing, $175,000 (the “Post-Closing Payment”) by wire of immediately available funds to the Seller Account.

(c) The Post-Closing Payment shall be reduced by the sum of all outstanding gift cards issued since December 1, 2023. The Post-Closing Payment shall be further adjusted to reflect credits or debits to the parties resulting from revenues received by the Seller prior to the date of Closing for order fulfillment by the Buyer after the date of Closing.

Section 1.05 Allocation of Purchase Price. The Purchase Price and the Assumed Liabilities shall be allocated among the Purchased Assets for all purposes (including Tax and financial accounting) as shown on the allocation schedule set forth on Section 1.05 of the Disclosure Schedules (the “Allocation Schedule”). The Allocation Schedule shall be prepared in accordance with Section 1060 of the Internal Revenue Code of 1986, as amended. Buyer and Seller shall file all returns, declarations, reports, information returns and statements and other documents relating to Taxes (including amended returns and claims for refund) (“Tax Returns”) in a manner consistent with the Allocation Schedule.

Section 1.06 Non-Assignable Assets.

(a) Notwithstanding anything to the contrary in this Agreement, this Agreement shall not constitute a sale, assignment or transfer of any Purchased Asset if such sale, assignment or transfer: (i) violates applicable Law; or (ii) requires the consent or waiver of a Person who is not a party to this Agreement or an Affiliate of a party to this Agreement and such consent or waiver has not been obtained prior to the Closing.

(b) Both prior to and following, the Closing, Seller and Buyer shall use commercially reasonable efforts, and shall cooperate with each other, to obtain any such required consent or waiver, or any release, substitution or amendment required to novate all Liabilities under any and all Assigned Contracts or other Liabilities that constitute Assumed Liabilities or to obtain in writing the unconditional release of all parties to such arrangements, so that, in any case, Buyer shall be solely responsible for such Liabilities from and after the Closing Date; provided, however, that neither Seller nor Buyer shall be required to pay any consideration therefor. Once such consent, waiver, release, substitution or amendment is obtained, Seller shall sell, assign and transfer to Buyer the relevant Purchased Asset to which such consent, waiver, release, substitution or amendment relates for no additional consideration.

(c) Except as set forth in Section 9.01(f) below, to the extent that any Purchased Asset or Assumed Liability cannot be transferred to Buyer pursuant to this Section 1.06, Buyer and Seller shall use commercially reasonable efforts to enter into such arrangements (such as subleasing, sublicensing or subcontracting) to provide to the parties the economic and, to the extent permitted under applicable Law, operational equivalent of the transfer of such Purchased Asset and/or Assumed Liability to Buyer as of the Closing. Buyer shall, as agent or subcontractor for Seller, pay, perform and discharge fully the liabilities and obligations of Seller thereunder from and after the Closing Date. To the extent permitted under applicable Law, Seller shall, hold in trust for and pay to Buyer promptly upon receipt thereof, all income, proceeds and other monies received by Seller from and after the Closing Date, to the extent related to such Purchased Asset in connection with the arrangements under this Section 1.06. Seller shall be permitted to set off against such amounts all direct costs associated with the retention and maintenance of such Purchased Assets.

ARTICLE II

CLOSING

Section 2.01 Closing. Subject to the terms and conditions of this Agreement, the consummation of the transactions contemplated by this Agreement (the “Closing”) shall take place remotely by exchange of documents and signatures (or their electronic counterparts), at 10:00 am Eastern Standard time, on the Closing Date (as defined below) at such other time or place or in such other manner as Seller and Buyer may mutually agree upon in writing. The date on which the Closing is to occur is herein referred to as the “Closing Date.”

Section 2.02 Closing Deliverables.

(a) At the Closing, Seller shall deliver to Buyer the following:

(i) a bill of sale in the form of Exhibit B attached hereto (the “Bill of Sale”) and duly executed by Seller, transferring the Purchased Assets to Buyer;

(ii) a transition agreement in the form of Exhibit C attached hereto (the “Transition Agreement”) and duly executed by Seller;

(iii) an assignment and assumption agreement in the form of Exhibit D attached hereto (the “Assignment and Assumption Agreement”) and duly executed by Seller, effecting the assignment to and assumption by Buyer of the Purchased Assets and the Assumed Liabilities;

(iv) an intellectual property assignment agreement in the form of Exhibit E attached hereto (the “Intellectual Property Assignment Agreement”) and duly executed by Seller;

(v) a certificate of the Secretary (or equivalent officer) of Seller certifying as to (A) the resolutions of the board of directors and the stockholders of Seller, which authorize the execution, delivery and performance of this Agreement, the Bill of Sale, the Assignment and Assumption Agreement, the Intellectual Property Assignment Agreement, the Transition Agreement, and the other agreements, instruments and documents required to be delivered in connection with this Agreement or at the Closing (collectively, the “Transaction Documents”) and the consummation of the transactions contemplated hereby and thereby and (B) the names and signatures of the officers of Seller authorized to sign this Agreement and the other Transaction Documents; and

(vi) such other customary instruments of transfer or assumption, filings or documents, in form and substance reasonably satisfactory to Buyer, as may be required to give effect to the transactions contemplated by this Agreement.

(b) At the Closing, pursuant to the terms of the Escrow Agreement, the Parties shall jointly instruct the Escrow Agent to release the Buyer Deposit to the Seller by wire transfer of immediately available funds to the Seller Account.

(c) At the Closing, Buyer shall deliver to Seller the following:

(i) The Closing Payment by wire transfer of immediately available funds to the Seller Account;

(ii) the Transition Agreement duly executed by Buyer;

(iii) the Assignment and Assumption Agreement duly executed by Buyer; and

(iv) a certificate of the Secretary (or equivalent officer) of Buyer certifying as to (A) the resolutions of the board of directors of Buyer, which authorize the execution, delivery and performance of this Agreement and the other Transaction Documents and the consummation of the transactions contemplated hereby and thereby and (B) the names and signatures of the officers of Buyer authorized to sign this Agreement and the other Transaction Documents.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF SELLER

Except as set forth in the Disclosure Schedules, Seller represents and warrants to Buyer that the statements contained in this Article III are true and correct as of the date hereof and as of the Closing Date.

Section 3.01 Organization and Authority of Seller. Seller is a limited liability company duly organized, validly existing and in good standing under the Laws of the State of New York. Seller has all

necessary limited liability company power and authority to enter into this Agreement and the other Transaction Documents to which Seller is a party, to carry out its obligations hereunder and thereunder, and to consummate the transactions contemplated hereby and thereby. The execution and delivery by Seller of this Agreement and any other Transaction Document to which Seller is a party, the performance by Seller of its obligations hereunder and thereunder, and the consummation by Seller of the transactions contemplated hereby and thereby have been duly authorized by all requisite corporate action on the part of Seller. This Agreement and the Transaction Documents constitute legal, valid and binding obligations of Seller enforceable against Seller in accordance with their respective terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar Laws affecting creditors’ rights generally and by general principles of equity (regardless of whether enforcement is sought in a proceeding at law or in equity).

Section 3.02 No Conflicts or Consents. The execution, delivery and performance by Seller of this Agreement and the other Transaction Documents to which it is a party, and the consummation of the transactions contemplated hereby and thereby, do not and will not: (a) violate or breach any provision of the articles of organization, operating agreement or other organizational documents of Seller; (b) violate or breach any provision of any Law or Governmental Order applicable to Seller, the Business as relates to the Purchased Assets or the Purchased Assets; (c) except as set forth in Section 3.02 of the Disclosure Schedules, require the consent, notice or other action by any Person under, conflict with, violate or breach, constitute a default under or result in the acceleration of any Assigned Contract; or (d) except as set forth in Section 3.02 of the Disclosure Schedules, require any consent, permit, Governmental Order, filing or notice from, with or to any Governmental Authority by or with respect to Seller in connection with the execution and delivery of this Agreement and the other Transaction Documents and the consummation of the transactions contemplated hereby and thereby; except, in the cases of clauses (b) and (c), where the violation, breach, conflict, default, acceleration or failure to obtain consent or give notice would not have a Material Adverse Effect and, in the case of clause (d), where such consent, permit, Governmental Order, filing or notice which, in the aggregate, would not have a Material Adverse Effect. For purposes of this Agreement: (i) “Law” means any statute, law, ordinance, regulation, rule, code, order, constitution, treaty, common law or other requirement or rule of law of any Governmental Authority; (ii) “Governmental Order” means any order, writ, judgment, injunction, decree, stipulation, determination or award entered by or with any Governmental Authority; (iii) “Person” means an individual, corporation, partnership, joint venture, limited liability company, Governmental Authority, unincorporated organization, trust, association or other entity; and (iv) “Material Adverse Effect” means any event, occurrence, fact, condition or change that is materially adverse to the Purchased Assets or the Business as relates to the Purchased Assets, results of operations, financial condition or Purchased Assets or the Business as relates to the Purchased Assets, taken as a whole.

Section 3.03 Absence of Certain Changes, Events and Conditions. Except as expressly contemplated by this Agreement or as set forth on Section 3.03 of the Disclosure Schedules, from the Balance Sheet Date until the date of this Agreement, Seller has operated the Business as relates to the Purchased Assets in the ordinary course of business in all material respects and there has not been any change, event, condition or development that is materially adverse to: (a) the business, results of operations, financial condition or assets of the Business as relates to the Purchased Assets, taken as a whole; or (b) the ability of Seller to consummate the transactions contemplated hereby.

Section 3.04 Assigned Contracts. Except as set forth on Section 3.04 of the Disclosure Schedules, Seller is not in breach of or default under any Assigned Contract, except for such breaches or defaults that would not have a Material Adverse Effect.

Section 3.05 Sufficiency of Assets. The Purchased Assets are sufficient for the continued conduct of the Business as relates to the Purchased Assets after the Closing in substantially the same manner as conducted prior to the Closing and constitute all of the rights, property and assets necessary to conduct the Business as relates to the Purchased Assets as currently conducted. It is understood that the Purchased Assets do not include product inventory or personnel that the Buyer will need to provide to continue the Business as relates to the Purchased Assets.

Section 3.06 Legal Proceedings; Governmental Orders.

(a) Except as set forth in Section 3.06(a) of the Disclosure Schedules, there are no claims, actions, suits, investigations or other legal proceedings (collectively, “Actions”) pending or, to Seller’s knowledge, threatened against or by Seller relating to or affecting the Business as relates to the Purchased Assets, the Purchased Assets or the Assumed Liabilities, which if determined adversely to Seller would result in a Material Adverse Effect.

(b) Except as set forth in Section 3.06(b) of the Disclosure Schedules, there are no outstanding Governmental Orders against, relating to or affecting the Business as relates to the Purchased Assets or the Purchased Assets, which would have a Material Adverse Effect.

Section 3.07 Compliance with Laws. Except as set forth in Section 3.07 of the Disclosure Schedules, Seller is in compliance with all Laws applicable to the conduct of the Business as relates to the Purchased Assets as currently conducted or the ownership and use of the Purchased Assets, except where the failure to be in compliance would not have a Material Adverse Effect.

Section 3.08 Tax Matters. All Tax returns and other Tax documents required to be filed with respect to the Seller and the Business as relates to the Purchased Assets have been timely filed with the appropriate governmental authorities in all jurisdictions in which such returns and documents are required to be filed, all of the foregoing as filed are true, correct and complete in all material respects and reflect accurately all liability for Taxes of the Seller and the Business as relates to the Purchased Assets for the periods to which such returns and documents relate, and all amounts shown as owing thereon have been paid or reserved against in the applicable Financial Statement. All Taxes, including but not limited to sales tax, collectible or payable by the Seller or the Business as relates to the Purchased Assets or relating to or chargeable against any assets, revenues, or income attributable to the Seller or the Business as relates to the Purchased Assets through the date hereof, were fully collected and paid by such date. No claims or deficiencies have been asserted against the Seller with respect to any Taxes or other governmental charges or levies pertaining to the Seller or the Business as relates to the Purchased Assets which have not been paid or otherwise satisfied. The Seller has not waived any restrictions on assessment or collection of Taxes pertaining to the Seller or the Business as relates to the Purchased Assets or consented to the extension of any statute of limitations relating to taxation.

The term “Taxes” means all federal, state, local, foreign and other income, gross receipts, sales, use, production, ad valorem, transfer, documentary, franchise, registration, profits, license, withholding, payroll, employment, unemployment, excise, severance, stamp, occupation, premium, property (real or personal), customs, duties or other taxes, fees, assessments or charges of any kind whatsoever, together with any interest, additions or penalties with respect thereto.

Section 3.09 Intellectual Property. Section 3.09 of the Disclosure Schedules sets forth: (i) all U.S. and foreign registrations of Intellectual Property (and applications therefor) which are owned and used by Seller in connection with the Business as relates to the Purchased Assets (the “Registered IP”); (ii) all material unregistered Intellectual Property owned or purported to be owned and used by Seller in connection with the Business as relates to the Purchased Assets (the “Unregistered IP” and together with Registered IP (but collectively, the “Seller IP”); and (iii) all third party licenses, sublicenses and other agreements or permissions used by Seller Parties in connection with the Business as relates to the Purchased Assets (“IP Licenses”) (other than shrink wrap licenses or other similar licenses for commercial off-the-shelf software with an annual license fee of $10,000 or less (which are not required to be listed, but are “IP Licenses” as that term is used herein)), under which Seller is a licensee or otherwise is authorized to use any Intellectual Property. All Registered IP is valid and in force and owned exclusively by Seller without obligation to pay royalties, licensing fees or other fees, or otherwise account to any other Person with respect to such Registered IP. Seller owns, free and clear of all royalties or other liens, has valid and enforceable rights in, and has the unrestricted right to use, sell, license, transfer or assign, all Seller IP, and there are no agreements which restrict or limit the use of Seller IP by Seller (or Buyer as its assignee), other than IP Licenses that require consent to assign. Seller has a valid and enforceable license to use all Intellectual Property that is the subject of the IP Licenses. Seller has

performed all material obligations imposed on it in the IP Licenses, has made all payments required to date under the IP Licenses, and is not, nor, to the knowledge of Seller, is any other party thereto, in breach or default thereunder, nor has any event occurred that with notice or lapse of time or both would constitute a default thereunder, Seller has not received in the last three (3) years any written notice of claim that any of the Seller IP has unintentionally expired, is not valid or enforceable or that the operation of the Business as relates to the Purchased Assets (as of the time of Closing) infringes upon, conflicts with or misappropriates any Intellectual Property of any third party, and, to the knowledge of Seller, no such claims or controversies currently exist. Seller has no knowledge that any third party has misappropriated or infringed Seller IP and not given in the last three (3) years any notice of infringement or misappropriation to any third party with respect to any Seller IP.

Section 3.10 Title to Assets. The Seller is the lawful owner of the Purchased Assets, and holds good, valid, and marketable title to the Purchased Assets, free and clear of all liens and encumbrances.

Section 3.11 Brokers. Except as set forth in Section 3.11 of the Disclosure Schedules, no broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the transactions contemplated by this Agreement or any other Transaction Document based upon arrangements made by or on behalf of Seller.

Section 3.12 No Other Representations and Warranties. Except for the representations and warranties contained in this Article III (including the related portions of the Disclosure Schedules), neither Seller nor any other Person has made or makes any other express or implied representation or warranty, either written or oral, on behalf of Seller, including any representation or warranty as to the accuracy or completeness of any information, documents or material regarding the Business as relates to the Purchased Assets and the Purchased Assets furnished or made available to Buyer and its Representatives in any form (including any information, documents, or material delivered to Buyer or made available to Buyer on behalf of Seller for purposes of this Agreement or any management presentations made in expectation of the transactions contemplated hereby), or as to the future revenue, profitability, or success of the Business as relates to the Purchased Assets, or any representation or warranty arising from statute or otherwise in Law. For purposes of this Agreement, “Representative” means, with respect to any Person, any and all directors, officers, employees, consultants, financial advisors, counsel, accountants and other agents of such Person.

Section 3.13 Related Parties. Except as set forth in Section 3.13 of the Disclosure Schedules, neither the Seller nor any, members, Member, directors, officers, (individually a “Related Party” and, collectively, the “Related Parties”) or any affiliate of the Seller or any Related Party: owns, directly or indirectly (through a subsidiary), any interest in any Person which

is a competitor, supplier or customer of the Seller or the Business as relates to the Purchased Assets; owns, directly or indirectly, in whole or in part, any property, asset or right, real, personal or mixed, tangible or intangible (including, but not limited to, any of the Intellectual Property) which is used or held for use in the conduct of the Business as relates to the Purchased Assets; or has an interest in or is, directly or indirectly (through a subsidiary), a party to any material contract, agreement, license, lease, extension of credit or other arrangement or relationship (whether or not in writing) pertaining or relating to the operations of the Seller or the Business as relates to the Purchased Assets.

Section 3.14 Disclosure. To its knowledge, the Seller has fully disclosed to the Buyer all sales channels and sources of revenue utilized by the Seller which pertain to the igourmet.com or Amazon accounts and storefronts.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF BUYER

Except as set forth in the Disclosure Schedules, Buyer represents and warrants to Seller that the statements contained in this Article IV are true and correct as of the date hereof and as of the Closing Date.

Section 4.01 Organization and Authority of Buyer. Buyer is a corporation duly organized, validly existing and in good standing under the Laws of the State of Florida. Buyer has all necessary corporate power and authority to enter into this Agreement and the other Transaction Documents to which Buyer is a party, to carry out its obligations hereunder and thereunder and to consummate the transactions contemplated hereby and thereby. The execution and delivery by Buyer of this Agreement and any other Transaction Document to which Buyer is a party, the performance by Buyer of its obligations hereunder and thereunder and the consummation by Buyer of the transactions contemplated hereby and thereby have been duly authorized by all requisite corporate action on the part of Buyer. This Agreement and the Transaction Documents constitute legal, valid and binding obligations of Buyer enforceable against Buyer in accordance with their respective terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar Laws affecting creditors’ rights generally and by general principles of equity (regardless of whether enforcement is sought in a proceeding at law or in equity).

Section 4.02 No Conflicts; Consents. The execution, delivery and performance by Buyer of this Agreement and the other Transaction Documents to which it is a party, and the consummation of the transactions contemplated hereby and thereby, do not and will not: (a) violate or breach any provision of the certificate of incorporation or by-laws of Buyer; (b) violate or breach any provision of any Law or Governmental Order applicable to Buyer; (c) require the consent, notice or other action by any Person under,

conflict with, violate or breach, constitute a default under or result in the acceleration of any agreement to which Buyer is a party; or (d) require any consent, permit, Governmental Order, filing or notice from, with or to any Governmental Authority by or with respect to Buyer in connection with the execution and delivery of this Agreement and the other Transaction Documents and the consummation of the transactions contemplated hereby and thereby; except, in the cases of clauses (b) and (c), where the violation, breach, conflict, default, acceleration or failure to obtain consent or give notice would not have a material adverse effect on Buyer’s ability to consummate the transactions contemplated hereby and, in the case of clause (d), where such consent, permit, Governmental Order, filing or notice which, in the aggregate, would not have a material adverse effect on Buyer’s ability to consummate the transactions contemplated hereby.

Section 4.03 Solvency; Sufficiency of Funds. Immediately after giving effect to the transactions contemplated hereby, Buyer shall be solvent and shall: (a) be able to pay its debts as they become due; (b) own property that has a fair saleable value greater than the amounts required to pay its debts (including a reasonable estimate of the amount of all Liabilities); and (c) have adequate capital to carry on its business. No transfer of property is being made and no obligation is being incurred in connection with the transactions contemplated hereby with the intent to hinder, delay or defraud either present or future creditors of Buyer or Seller. In connection with the transactions contemplated hereby, Buyer has not incurred, nor plans to incur, debts beyond its ability to pay as they become absolute and matured.

Section 4.04 Legal Proceedings. Except as set forth in Section 4.04 of the Disclosure Schedules, there are no Actions pending or, to Buyer’s knowledge, threatened against or by Buyer that challenge or seek to prevent, enjoin or otherwise delay the transactions contemplated by this Agreement.

Section 4.05 Brokers. No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the transactions contemplated by this Agreement or any other Transaction Document based upon arrangements made by or on behalf of Buyer.

Section 4.06 Independent Investigation. Buyer has conducted its own independent investigation, review and analysis of the Business and the Purchased Assets and acknowledges that it has been provided adequate access to the personnel, properties, assets, premises, books and records and other documents and data of Seller for such purpose. Buyer acknowledges and agrees that: (a) in making its decision to enter into this Agreement and to consummate the transactions contemplated hereby, Buyer has relied solely upon its own investigation and the express representations and warranties of Seller set forth in Article III of this Agreement (including related portions of the Disclosure Schedules); and (b) neither Seller nor any other Person has made any representation or warranty as to Seller, the Business, the Purchased Assets or this Agreement, except as expressly set forth in Article III of this Agreement (including the related portions of the Disclosure Schedules).

ARTICLE V

COVENANTS

Section 5.01 Information Access. Promptly following the execution of this Agreement, Seller shall provide Buyer with administrative level access to the software/application items listed on Section 5.01 of the Disclosure Schedules.

Section 5.02 Further Assurances. Seller agrees to execute and deliver such instruments, and take such other actions, as may reasonably be required, whether prior to, at, or after the Closing, to carry out the terms of this Agreement and consummate the transactions contemplated hereby.

Section 5.03 Confidentiality. Buyer acknowledges and agrees that the Confidentiality Agreement, dated as of January 18, 2024, between Buyer and Seller (the “Confidentiality Agreement”) remains in full force and effect and, in addition, covenants and agrees to keep confidential, in accordance with the provisions of the Confidentiality Agreement, information provided to Buyer pursuant to this Agreement.

Section 5.04 Public Announcements. Unless otherwise required by applicable Law, no party to this Agreement shall make any public announcements in respect of this Agreement or the transactions contemplated hereby without the prior written consent of the other party (which consent shall not be unreasonably withheld, conditioned or delayed), and the parties shall cooperate as to the timing and contents of any such announcement.

Section 5.05 Bulk Sales Laws. The parties hereby waive compliance with the provisions of any bulk sales, bulk transfer or similar Laws of any jurisdiction that may otherwise be applicable with respect to the sale of any or all of the Purchased Assets to Buyer.

Section 5.06 Non-Competition. Seller and IVFH each agree either personally or as shareholder member, officer, director, partner, employer, leaseholder, employee, or independent contractor of any other entity, that they shall not provide fulfillment services to [*****] or [*****] with respect to cheese, courtier or gift box products or offerings for a period of five (5) years immediately after the closing, except as required by the Transition Services Agreement or as mutually agreed to by the Buyer and Seller.

Section 5.07 Transfer Taxes. Seller and Buyer shall each bear 50% of all transfer, sales, use, registration, documentary, stamp, value added and

other such Taxes and fees (including any penalties and interest) incurred in connection with this Agreement and the other Transaction Documents, if any. Buyer shall timely file any Tax Return or other document with respect to such Taxes or fees (and Seller shall cooperate with respect thereto as necessary), and Seller and Buyer shall be equally responsible for the cost of such Tax Returns or other documents.

Section 5.08 Further Assurances. Following the Closing, each of the parties hereto shall, and shall cause their respective Affiliates to, execute and deliver such additional documents, instruments, conveyances and assurances and take such further actions as may be reasonably required to carry out the provisions hereof and give effect to the transactions contemplated by this Agreement and the other Transaction Documents.

ARTICLE VI

SURVIVAL

Section 6.01 Survival. Subject to the limitations and other provisions of this Agreement, the representations and warranties contained herein shall survive the Closing for a period of 12 months, provided, however, that any representations and warranties contained in Fundamental Representations or are the subject of a fraud claim will survive the Closing for a period of three years. “Fundamental Representations” shall mean the representations and warranties set forth in Sections 3.01 (Organization and Authority of Seller), 3.10 (Title to Assets) and 3.11 (Brokers). Covenants or other agreements contained in this Agreement shall survive the Closing Date for the period contemplated by their terms. Notwithstanding the foregoing, any claims asserted in good faith with reasonable specificity (to the extent known at such time) and in writing by notice from the non-breaching party to the breaching party prior to the expiration date of the applicable survival period shall not thereafter be barred by the expiration of such survival period and such claims shall survive until finally resolved.

ARTICLE VII

INDEMNIFICATION

Section 7.01 Indemnification by Seller. The Seller shall indemnify and hold harmless Buyer and its successors, assigns, members, personnel, representatives, affiliates, and agents (the “Buyer Indemnified Parties”) from and against any and all damages, losses, obligations, liabilities, claims, encumbrances, penalties, costs and expenses (including costs of investigation and defense and reasonable attorneys’ fees and expenses) (each, an “Indemnity Loss”), directly or indirectly arising from or relating to:

(a) any breach or alleged breach or non-fulfillment of any of the representations and warranties of Seller in this Agreement or any certificate, document, schedule, exhibit, or instrument executed in connection herewith or therewith;

(b) any breach or alleged breach by the Seller of or failure by the Seller to comply with any covenants or obligations of Seller in this Agreement or any certificate, document, schedule, or instrument executed in connection herewith or therewith, including, without limitation, any failure of Seller to pay, satisfy or discharge any Excluded Liability;

(c) any liability of Seller or liabilities relating to the Purchased Assets or the operations of the Business of Seller as relates to the Purchased Assets arising out of transactions entered into or events occurring prior to the Closing, including but not limited to any successor liability or responsible officer liability asserted against Buyer (or its personnel or other representatives) for Taxes or otherwise relating to events occurring prior to the Closing; and

(d) any and all proceedings, demands, losses, damages, penalties, assessments, audits, or judgments arising out of any of the foregoing.

Section 7.02 Indemnification by Buyer. Buyer shall indemnify and hold harmless the Seller and their successors, Member, personnel, representatives, affiliates, and agents from and against any and all losses arising from or relating to:

(a) any misrepresentation, breach of warranty, or nonfulfillment of any of the representations, warranties, covenants, or agreements of Buyer in this Agreement or any certificate, document, schedule, exhibit, or instrument executed in connection herewith or therewith;

(b) any liability of Buyer or relating to the Purchased Assets or the operation of the business of Buyer arising out of transactions entered into or events occurring after the Closing, including any successor liability or responsible officer liability, asserted against the Seller (or its personnel or other representatives) for Taxes or events first occurring after the Closing; and

(c) any and all proceedings, demands, assessments, audits, or judgments arising out of any of the foregoing.

Section 7.03 Certain Limitations. The party making a claim under this Article VII is referred to as the “Indemnified Party,” and the party against whom such claims are asserted under this Article VII is referred to as the “Indemnifying Party.” The indemnification provided for in Section 7.01 and Section 7.02 shall be subject to the following limitations:

(a) The Indemnifying Party shall not be liable to the Indemnified Party for indemnification under Section 7.01 or Section 7.02, as the case may be, until the aggregate amount of all losses in respect of indemnification under Section 7.01 or Section 7.02 exceeds 0.5% of the Purchase Price (the “Deductible”), in which event the Indemnifying Party shall only be required to pay or be liable for losses in excess of the Deductible.

(b) The aggregate amount of all losses for which an Indemnifying Party shall be liable pursuant to Section 7.01 or Section 7.02, as the case may be, shall not exceed 15% of the Purchase Price for losses relating to representations and warranties that are not Fundamental Representations and do not arise from the fraudulent actions of the Seller.

(c) Except with respect to third party claims, in no event shall any Indemnifying Party be liable to any Indemnified Party for any punitive, incidental, consequential, special or indirect damages, including loss of future revenue or income, loss of business reputation or opportunity relating to the breach or alleged breach of this Agreement, or diminution of value or any damages based on any type of multiple.

Section 7.04 Indemnification Procedures. Whenever any claim arises for indemnification hereunder, the Indemnified Party shall promptly provide written notice of such claim to the Indemnifying Party. Such notice by the Indemnified Party shall: (a) describe the claim in reasonable detail; (b) include copies of all material written evidence thereof; and (c) indicate the estimated amount, if reasonably practicable, of the Loss that has been or may be sustained by the Indemnified Party. In connection with any claim giving rise to indemnity hereunder resulting from or arising out of any Action by a Person who is not a party to this Agreement, the Indemnifying Party, at its sole cost and expense and upon written notice to the Indemnified Party, may assume the defense of any such Action with counsel reasonably satisfactory to the Indemnified Party. The Indemnified Party shall be entitled to participate in the defense of any such Action, with its counsel and at its own cost and expense, subject to the Indemnifying Party's right to control the defense thereof. If the Indemnifying Party does not assume the defense of any such Action, the Indemnified Party may, but shall not be obligated to, defend against such Action in such manner as it may deem appropriate, including settling such Action, after giving notice of it to the Indemnifying Party, on such terms as the Indemnified Party may deem appropriate and no action taken by the Indemnified Party in accordance with such defense and settlement shall relieve the Indemnifying Party of its indemnification obligations herein provided with respect to any damages resulting therefrom. Seller and Buyer shall cooperate with each other in all reasonable respects in connection with the defense of any claim, including: (i) making available (subject to the provisions of Section 5.01) records relating to such claim; and (ii) furnishing, without expense (other than reimbursement of actual out-of-pocket expenses) to the defending party, management employees of the non-defending party as may be reasonably necessary for the preparation of the defense of such claim. The Indemnifying Party shall not settle any Action without the Indemnified Party's prior written consent (which consent shall not be unreasonably withheld, conditioned or delayed).

Section 7.05 Tax Treatment of Indemnification Payments. All indemnification payments made under this Agreement shall be treated by the parties as an adjustment to the Purchase Price for Tax purposes, unless otherwise required by Law.

Section 7.06 Exclusive Remedies. The parties acknowledge and agree that their sole and exclusive remedy with respect to any and all claims for any breach of any representation, warranty, covenant, agreement or obligation set forth herein or otherwise relating to the subject matter of this Agreement shall be pursuant to the indemnification provisions set forth in this Article VII. In furtherance of the foregoing, each party hereby waives, to the fullest extent permitted under Law, any and all rights, claims and causes of action for any breach of any representation, warranty, covenant, agreement or obligation set forth herein or otherwise relating to the subject matter of this Agreement it may have against the other parties hereto and their Affiliates and each of their respective Representatives arising under or based upon any Law, except pursuant to the indemnification provisions set forth in this Article VII. Nothing in this Section 7.06 shall limit any Person's right to seek and obtain any equitable relief to which such Person shall be entitled.

ARTICLE VIII

OPERATIONS PRIOR TO CLOSING

Section 8.01 Operations Prior to the Closing Date.

During the period from the Effective Date until the Closing, the Seller and the Buyer, as applicable, agree to perform the covenants set forth below.

(a) Except as otherwise agreed to in writing by the Buyer, the Seller shall:

(i) carry on the Business only in the ordinary course and consistent with past practices;

(ii) keep and maintain the Purchased Assets in good operating condition and repair condition (ordinary wear and tear excepted);

(iii) except as they may terminate in accordance with their respective terms (or by reason of a default committed by one or more of the other parties thereto), keep in full force and effect, and not cause a default of any of its obligations under, any Assumed Contracts and keep in full force and effect the insurance coverage in effect on the date hereof (unless a replacement policy with substantially equivalent coverage is obtained); and

(iv) duly comply with all laws applicable to the conduct of the Business.

(b) Except with the prior written consent of the Buyer, which consent shall not be unreasonably withheld, and as otherwise required or permitted by this Agreement, the Seller shall not directly or indirectly, do any of the following:

(i) make any material change in the general nature of the Business, including but not limited to, making any material changes to its class schedules. The Seller will not offer any sales outside of the ordinary discounts currently offered;

(ii) sell, lease (as lessor), transfer, surrender, abandon, or otherwise dispose of any of the Purchased Assets other than in the ordinary course of business consistent with past practices;

(iii) grant or make any mortgage or pledge or subject any of the Purchased Assets to any Lien (other than Permitted Encumbrances);

(iv) make, or agree to make, any distribution of the assets of the Business other than distributions of cash generated by the ordinary operations of the Business to the Seller and/or the Seller’s owners in the ordinary course of business consistent with past practice;

(v) take any action that would reasonably be expected to have a Material Adverse Effect on the Business;

(vi) Enter into any new fulfillment agreement or alter the existing fulfillment agreement with [*****] and [*****] without the express written approval of Buyer; or

(vii) agree, whether in writing or otherwise, to do any of the foregoing.

ARTICLE IX

CONDITIONS PRECEDENT TO CLOSING

Section 9.01 Conditions to the Obligations of Buyer. The obligations of Buyer to consummate the transactions contemplated hereby are subject to the satisfaction (or waiver by Buyer) as of the Closing of the following further conditions:

(a) All of the representations and warranties of the Seller set forth in this Agreement and in any certificate delivered by or on behalf of the Seller pursuant hereto shall be true and correct on and as of the Closing Date as if made on the Closing Date, (other than those representations and warranties that address matters only as of a particular date, which representations and warranties shall have been accurate as of such date), except for any failures to be true and correct that (without giving effect to any qualifications or limitations as to materiality or Material Adverse Effect), individually or in the aggregate, have not had and would not reasonably be expected to have a Material Adverse Effect on, or with respect to, the Seller.

(b) Seller has performed or complied in all material respects, with all obligations and covenants hereunder required to be performed or complied with by it or prior to the Closing Date;

(c) No applicable law or order enacted, entered, promulgated, enforced, or issued by any governmental entity, or other legal restraint or prohibition shall be pending, threatened, or in effect, which would (i) prevent consummation of any of the transactions contemplated by this Agreement, (ii) cause any of the transactions contemplated by this Agreement to be rescinded following consummation, or (iii) affect adversely the right of Buyer to own the Assets or to operate the Business as relates to the Purchased Assets;

(d) The Seller shall not be subject to any injunction, preliminary restraining order, or other similar decree of a court of competent jurisdiction prohibiting the consummation of the transactions contemplated by this Agreement. Since the date of this Agreement, there shall not have been commenced or threatened against the Seller any proceeding (i) involving any challenge to, or seeking damages or other relief in connection with, any of the transactions contemplated by this Agreement; or (ii) that may have the effect of preventing, delaying, making illegal, imposing limitations or conditions on or otherwise interfering with any of the transactions contemplated by this Agreement; and

(e) Seller shall have provided Buyer with administrator level access to each of the software/application items listed on Section 1.01(c) on the Disclosure Schedules;

ARTICLE X

MISCELLANEOUS

Section 10.01 Expenses. Except as otherwise expressly provided herein (including Section 5.07 hereof), all costs and expenses incurred in connection with this Agreement and the transactions contemplated hereby shall be paid by the party incurring such costs and expenses.

Section 10.02 Notices. All notices, claims, demands and other communications hereunder shall be in writing and shall be deemed to have been given: (a) when delivered by hand (with written confirmation of receipt); (b) when received by the addressee if sent by a nationally recognized overnight courier (receipt requested); (c) on the date sent by email of a PDF document (with confirmation of transmission) if sent during normal business hours of the recipient, and on the next business day if sent after normal business hours of the recipient; or (d) on the third day after the date mailed, by certified or registered mail, return receipt requested, postage prepaid. Such communications must be sent to the respective parties at the following addresses (or at such other address for a party as shall be specified in a notice given in accordance with this Section 10.02):

|

If to Seller:

|

iGourmet, LLC

c/o Innovative Food Holdings, Inc.

9696 Bonita Beach Road, Ste #208,

Bonita Springs, FL 34135

Attn: Bill Bennett

|

|

with a copy to:

(which shall not constitute notice)

|

Ellenoff Grossman & Schole LLP

1345 Avenue of the Americas, 11th Floor

New York, New York 10105

Attn: Sarah E. Williams, Esq.; Jonathan P. Cramer, Esq.

|

|

If to Buyer:

|

Advansiv Gourmet Group, Inc.

3212 NW 64th St.

Boca Raton, FL 33496

Attn: Jon Knigin

|

|

with a copy to:

(which shall not constitute notice)

|

Weiss Serota Helfman Cole + Bierman

2255 Glades Road, Ste: 200-E

Boca Raton, Florida 33431

Attn: Marc Solomon, Esq.

|

Section 10.03 Interpretation; Headings. This Agreement shall be construed without regard to any presumption or rule requiring construction or interpretation against the party drafting an instrument or causing any instrument to be drafted. The headings in this Agreement are for reference only and shall not affect the interpretation of this Agreement.

Section 10.04 Severability. If any term or provision of this Agreement is invalid, illegal or unenforceable in any jurisdiction, such invalidity, illegality or unenforceability shall not affect any other term or provision of this Agreement.

Section 10.05 Entire Agreement. This Agreement and the other Transaction Documents constitute the sole and entire agreement of the parties to this Agreement with respect to the subject matter contained herein and therein, and supersede all prior and contemporaneous representations, warranties, understandings and agreements, both written and oral, with respect to such subject matter. In the event of any inconsistency between the statements in the body of this Agreement and those in the other Transaction Documents, the Annex, the Exhibits and the Disclosure Schedules (other than an exception expressly set forth as such in the Disclosure Schedules), the statements in the body of this Agreement will control.

Section 10.06 Successors and Assigns; Assignment. This Agreement is binding upon and inures to the benefit of the parties hereto and their respective successors and permitted assigns. Neither party may assign any of its rights or obligations hereunder without the prior written consent of the other party, which consent shall not be unreasonably withheld, conditioned or delayed. Any purported assignment in violation of this Section shall be null and void. No assignment shall relieve the assigning party of any of its obligations hereunder.

Section 10.07 Amendment and Modification; Waiver. This Agreement may only be amended, modified or supplemented by an agreement in writing signed by each party hereto. No waiver by any party of any of the provisions hereof shall be effective unless explicitly set forth in writing and signed by the party so waiving. No failure to exercise, or delay in exercising, any right or remedy arising from this Agreement shall operate or be construed as a waiver thereof; nor shall any single or partial exercise of any right or remedy hereunder preclude any other or further exercise thereof or the exercise of any other right or remedy.

Section 10.08 Governing Law; Submission to Jurisdiction; Waiver of Jury Trial.

(a) All matters arising out of or relating to this Agreement shall be governed by and construed in accordance with the internal laws of the State of New York, without giving effect to the conflict of law provisions thereof to the extent such provisions would require or permit the application of the laws of any jurisdiction other than the State of New York. Any legal suit, action, proceeding or dispute arising out of or relating to this Agreement, the other Transaction Documents or the transactions contemplated hereby or thereby may be instituted in the federal courts of the United States of America or the courts of the State of New York, and each party irrevocably submits to the exclusive jurisdiction of such courts in any such suit, action, proceeding or dispute.

(b) EACH PARTY ACKNOWLEDGES AND AGREES THAT ANY CONTROVERSY WHICH MAY ARISE UNDER THIS AGREEMENT OR THE OTHER TRANSACTION DOCUMENTS IS LIKELY TO INVOLVE COMPLICATED AND DIFFICULT ISSUES AND, THEREFORE, EACH PARTY IRREVOCABLY AND UNCONDITIONALLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL ACTION, PROCEEDING, CAUSE OF ACTION OR COUNTERCLAIM ARISING OUT OF OR RELATING TO THIS AGREEMENT, INCLUDING ANY EXHIBITS AND SCHEDULES ATTACHED TO THIS AGREEMENT, THE OTHER TRANSACTION DOCUMENTS OR THE TRANSACTIONS CONTEMPLATED HEREBY OR THEREBY. EACH PARTY CERTIFIES AND ACKNOWLEDGES THAT:

(I) NO REPRESENTATIVE OF THE OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT THE OTHER PARTY WOULD NOT SEEK TO ENFORCE THE FOREGOING WAIVER IN THE EVENT OF A LEGAL ACTION; (II) EACH PARTY HAS CONSIDERED THE IMPLICATIONS OF THIS WAIVER; (III) EACH PARTY MAKES THIS WAIVER KNOWINGLY AND VOLUNTARILY; AND (IV) EACH PARTY HAS BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION.

Section 10.09 Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall be deemed to be one and the same agreement. A signed copy of this Agreement delivered by facsimile, email or other means of electronic transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

Section 10.10 Non-Recourse. Except in the event of fraud, this Agreement may only be enforced against, and any claim, action, suit or other legal proceeding based upon, arising out of or related to this Agreement, or the negotiation, execution or performance of this Agreement, may only be brought against the entities that are expressly named as parties hereto and then only with respect to the specific obligations set forth herein with respect to such party. Except in the event of fraud, no past, present or future director, officer, employee, incorporator, manager, member, partner, stockholder, Affiliate, agent, attorney or other Representative of any party hereto or of any Affiliate of any party hereto, or any of their successors or permitted assigns, shall have any liability for any obligations or liabilities of any party hereto under this Agreement or for any claim, action, suit or other legal proceeding based on, in respect of or by reason of the transactions contemplated hereby.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the date first written above by their respective officers thereunto duly authorized.

| |

SELLER:

iGourmet LLC,

a New York limited liability company

By: Innovative Food Holdings, Inc.,

as sole Member

/s/ Bill Bennett

Name: Bill Bennett

Title: Chief Executive Officer

|

| |

BUYER:

|

| |

Advansiv Gourmet Group, Inc.,

a Florida corporation

/s/ Bill Bennett

Name: Bill Bennett

Title: Chief Executive Officer

/s/ Jonathan Knigin

Name: Jonathan Knigin

Title: President

|

Definitions

1. Certain Defined Terms. As used in the Agreement, the following terms shall have the following meanings:

“Affiliate” of a Person means any other Person that directly or indirectly, through one or more intermediaries, controls, is controlled by or is under common control with, such Person.

“Business Name” means “igourmet”, either alone or in combination with other words, graphics or designs, including all rights in said term as a trade name, trade mark, corporate name, service mark and domain name, and any confusingly similar variation, derivative or translation thereof.

“control” (including the terms “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise.

“Copyrights” means all works of authorship, mask works and all copyrights therein, including all renewals and extensions, copyright registrations and applications for registration and renewal, and non-registered copyrights.

“Governmental Authority” means any federal, state, local or foreign government or political subdivision thereof, or any agency or instrumentality of such government or political subdivision, or any arbitrator, court or tribunal of competent jurisdiction.

“Intellectual Property” means all of the following, including any applications to register any of the following, as they exist in any jurisdiction throughout the world: (a) Patents; (b) Trademarks; (c) Copyrights; (d) Trade Secrets; (e) all domain name and domain name registrations, web sites and web pages and related rights, registrations, items and documentation related thereto; (f) Software; (g) rights of publicity and privacy, and moral rights, and (h) all licenses, sublicenses, permissions, and other agreements related to the preceding property.

“Patents” means all patents, patent applications and the inventions, designs and improvements described and claimed therein, patentable inventions, and other patent rights (including any divisionals, continuations, continuations-in-part, substitutions, or reissues thereof, whether or not patents are issued on any such applications and whether or not any such applications are amended, modified, withdrawn, or refiled).

“Software” means all computer software, including all source code, object code, and documentation related thereto and all software modules, assemblers, applets, compilers, flow charts or diagrams, tools and databases.

“Trade Secrets” means, as they exist in any jurisdiction throughout the world, any trade secrets, confidential business information, Software, concepts, ideas, designs, research or development information, processes, procedures, techniques, technical information, specifications, operating and maintenance manuals, engineering drawings, methods, know-how, data, mask works, discoveries, inventions, modifications, extensions, improvements, and any other information, however documented, that is a trade secret within the meaning of the applicable trade secret protection Laws, including the Uniform Trade Secrets Act.

“Trademarks” means, as they exist in any jurisdiction throughout the world, any trademarks, service marks, trade dress, trade names, brand names, Internet domain names, designs, logos, or corporate/company names (including, in each case, the goodwill associated therewith and common law rights therein), whether registered or unregistered, and all registrations and applications for registration and renewal thereof.

Annex I

[*****]

Exhibit 99.1

FOR IMMEDIATE RELEASE

INNOVATIVE FOOD HOLDINGS, INC. ANNOUNCES SALE OF

IGOURMET.COM BUSINESS

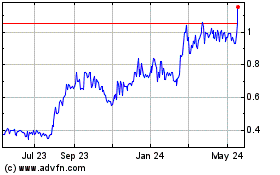

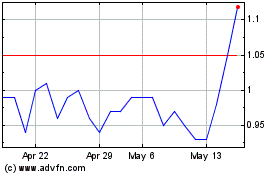

BONITA SPRINGS, Fla., Aug. 08, 2024 (GLOBE NEWSWIRE) -- Innovative Food Holdings, Inc. (OTCQB: IVFH) (“IVFH” or the “Company”), a national seller of gourmet specialty foods to professional chefs, announced today the signing of an agreement to sell its consumer e-commerce business igourmet.com for $700,000. The Company expects the transaction to close within the next 30 days. The Company’s Pennsylvania facility is not included in the transaction. Acting as sell-side advisors on the transaction were Sampford Advisors, Inc. and Erben M&A Advisors.

Chief Executive Officer (“CEO”) Bill Bennett stated, “With today’s announcement, we mark continued progress against our strategic stabilization plan of selling off unproductive assets and redirecting resources and focus to our profitable foodservice business, as first discussed in our November 2023 earnings call. The cash for this sale will be used to support our anticipated M&A strategy, as well as investment into new growth initiatives in our foodservice business. We look forward to continuing to further develop our core, profitable Professional Chef business.”

About Innovative Food Holdings, Inc.

At IVFH, we help make meals special. We provide access to foods that are hard to find, have a compelling story, or are on the forefront of food trends. Our gourmet foods marketplace connects the world’s best artisan food makers with top professional chefs nationwide. We curate the assortment, experience, and tech enabled tools that help our professional chefs create unforgettable experiences for their guests. Additional information is available at www.ivfh.com.

Forward-Looking Statements

This release contains certain forward-looking statements and information relating to Innovative Food Holdings, Inc. (the “Company”) that are based on the current beliefs of the Company’s management, as well as assumptions made by, and information currently available to, the Company. Such statements reflect the current views of the Company with respect to future events and are subject to certain assumptions, including those described in this release. Should one or more of these underlying assumptions prove incorrect, actual results may vary materially from those described herein as “should,” “could,” “will,” “anticipate,” “believe,” “intend,” “plan,” “might,” “potentially” “targeting” or “expect.” Additional factors that could also cause actual results to differ materially relate to international crises, environmental and economic issues and other risk factors described in our public filings. The Company does not intend to update these forward-looking statements. The content of the websites referenced above are not incorporated herein.

Investor and Media contact:

Gary Schubert

Chief Financial Officer

Innovative Food Holdings, inc.

investorrelations@ivfh.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |