UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

|

¨

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE S ECURITIES EXCHANGE ACT OF 1934

|

OR

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended April 30, 2015

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ____________ to __________

OR

|

¨

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Date of event requiring this shell company report ____________

Commission file number 001-33439

JET METAL CORP.

(Exact name of Registrant as specified in its charter)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 1240, 1140 West Pender Street, Vancouver, B.C. Canada V6E 4G1

(Address of principal executive offices)

Jim Crawford, Phone: (604) 681-8030, jcrawford@kingandbay.com

Suite 1240, 1140 West Pender Street, Vancouver, B.C. Canada V6E 4G1

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of Exchange on which registered

|

|

Common Shares, without par value

|

OTCQB

|

Securities registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report:28,218,451

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes þ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

¨ Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

þ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

¨ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer þ

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

U.S. GAAP ¨

|

International Financial Reporting Standards as issued

by the International Accounting Standards Board þ

|

Other ¨

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes þ No

Index to Exhibits on Page 90

JET METAL CORP.

(the “Company” or “Jet Metal”)

FORM 20-F ANNUAL REPORT

TABLE OF CONTENTS

|

Part I

|

|

Page

|

|

Item 1.

|

Identity of Directors, Senior Management and Advisers

|

4

|

|

Item 2.

|

Offer Statistics and Expected Timetable

|

4

|

|

Item 3.

|

Key Information

|

4

|

|

Item 4.

|

Information on the Company

|

14

|

|

Item 4A.

|

Unresolved Staff Comments

|

27

|

|

Item 5.

|

Operating and Financial Review and Prospects

|

27

|

|

Item 6.

|

Directors, Senior Management and Employees

|

36

|

|

Item 7.

|

Major Shareholders and Related Party Transactions

|

49

|

|

Item 8.

|

Financial Information

|

51

|

|

Item 9.

|

The Offer and Listing

|

51

|

|

Item 10.

|

Additional Information

|

54

|

|

Item 11.

|

Quantitative and Qualitative Disclosures About Market Risk

|

60

|

|

Item 12.

|

Description of Securities Other Than Equity Securities

|

60

|

|

Part II

|

|

|

|

Item 13.

|

Defaults, Dividend Arrearages and Delinquencies

|

61

|

|

Item 14.

|

Material Modifications to the Rights of Security Holders and Use of Proceeds

|

61

|

|

Item 15.

|

Controls and Procedures

|

61

|

|

2Item 16A.

|

Audit Committee Financial Expert

|

62

|

|

Item 16B.

|

Code of Ethics

|

62

|

|

Item 16C.

|

Principal Accountant Fees and Services

|

62

|

|

Item 16D.

|

Exemptions from the Listing Standards for Audit Committees

|

63

|

|

Item 16E.

|

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

|

63

|

|

Item 16F.

|

Changes in Registrant’s Certifying Accountant

|

63

|

|

Item 16G

|

Corporate Governance

|

63

|

|

Item 16H

|

Mine Safety Disclosure

|

63

|

|

Part III

|

|

|

|

Item 17.

|

Financial Statements

|

64

|

|

Item 18.

|

Financial Statements

|

64

|

|

Item 19.

|

Exhibits

|

90

|

| |

Glossary of Geological Terms

|

93

|

RESOURCE AND RESERVE ESTIMATES

The terms “mineral reserve,” “proven mineral reserve” and “probable mineral reserve” used in our disclosure are Canadian mining terms that are defined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Best Practice Guidelines for the Estimation of Mineral Resource and Mineral Reserves (the “CIM Standards”), adopted by the CIM Council on December 11, 2005. These definitions differ from the definitions in the United States Securities and Exchange Commission (the “SEC” or the “Commission”) Industry Guide 7 under the U.S. Securities Act of 1933, as amended (the “Securities Act”). Under Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

Canadian standards, including NI 43-101, differ significantly from the requirements of the Commission, and reserve and resource information contained herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserves”. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The Commission’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the Commission. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the Commission normally only permits issuers to report mineralization that does not constitute “reserves” by the Commission’s standards as in place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the Commission. Accordingly, information concerning descriptions of mineralization and resources contained in this Annual Report on Form 20-F or in the documents incorporated by reference may not be comparable to information made public by U.S. companies subject to the reporting and disclosure requirements of the Commission.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this document constitute “forward-looking statements” under applicable securities laws. Forward-looking statements can be identified by the use of terminology such as “anticipate,” “believe,” “plan,” “estimate,” “expect,” and “intend,” and statements that an action or event “may,” “might,” “could,” or “should,” be taken or occur, or other similar expressions. Forward looking statements contained in this document include, but are not limited to, statements with respect to: (i) the estimation of inferred and indicated mineral resources; (ii) details and goals of exploration activities; (iii) estimations of future costs and expenditures; (iv) currency fluctuations; (v) requirements for additional capital and the sufficiency of working capital; (vi) government regulation of mining operations; (vii) environmental risks; (viii) unanticipated reclamation expenses; and (ix) increases in mineral resource estimates. These forward-looking statements are not guarantees or predictions of future performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control and which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks:

|

·

|

the risks associated with outstanding litigation, if any;

|

|

·

|

risks associated with project development;

|

|

·

|

the need for additional financing;

|

|

·

|

operational risks associated with mining and mineral processing, including risks related to accidents, equipment breakdowns, labor disputes or other unanticipated difficulties with or interruptions in operations which may or may not be insured;

|

|

·

|

fluctuations in metal prices;

|

|

·

|

environmental liability claims and insurance;

|

|

·

|

reliance on key personnel;

|

|

·

|

the receipt of necessary regulatory approvals;

|

|

·

|

the potential for conflicts of interest among certain officers, directors or promoters with certain other projects;

|

|

·

|

the absence of dividends;

|

|

·

|

the volatility of our common share price and volume;

|

|

·

|

tax consequences to U.S. shareholders;

|

|

·

|

risks related to our being subject to the penny stock rules;

|

|

·

|

risks related to our being a foreign private issuer; and

|

|

·

|

risks related to our possibly being a passive foreign investment company.

|

Forward-looking information and forward-looking statements are in addition based on various assumptions including, without limitation, the expectations and beliefs of management, the assumed long term price of commodities; that the Company can access financing, appropriate equipment and sufficient labour availability and that the political environment will continue to support the development and operation of mining projects. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further in “Item 3. Key Information—D. Risk Factors.” Accordingly, readers are advised not to place undue reliance on forward-looking statements. The Company does not intend to update forward-looking statements or information, except as may be required by applicable law. Except as required by applicable regulations or by law, we do not undertake any obligation to publicly update or review any forward-looking statements whether as a result of new information, future events or otherwise.

FINANCIAL AND OTHER INFORMATION

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in Canadian Dollars (“CDN$” or “$”). The Government of Canada permits a floating exchange rate to determine the value of the Canadian Dollar against the U.S. Dollar (US$).

|

|

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

|

Not applicable

|

|

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

|

Not applicable

3.A. Selected Financial Data

Our selected financial data for the fiscal years ended April 30, 2015, 2014, 2013, 2012 and 2011 was derived from our financial statements that have been audited by Davidson & Company LLP, independent Chartered Accountants, as indicated in their audit reports. Davidson & Company LLP is a member of the Canadian Institute of Chartered Accountants.

The selected financial data should be read in conjunction with and is qualified in its entirety by reference to the financial statements and notes thereto included elsewhere in this Annual Report.

To date, we have not generated sufficient cash flow from operations to fund ongoing operational requirements and cash commitments. We have financed our operations principally through the sale of our equity securities. While we believe we have sufficient capital and liquidity to finance current operations, nevertheless, our ability to continue operations is dependent on our ability to obtain additional financing. See “Item 3. Key Information—D. Risk Factors.”

The information for years ended April 30, 2015, 2014, 2013, 2012 and 2011 in the following table is derived from our financial statements, which have been prepared in accordance with the International Financial Reporting Standards (“IFRS”).

| |

|

For the Year Ended April 30,

|

|

|

| |

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

| |

|

IFRS 1

|

|

|

IFRS 1

|

|

|

IFRS 1

|

|

|

IFRS 1

|

|

|

IFRS 1

|

|

|

Revenue

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

Income (Loss) for the Period

|

|

$ |

(357,729 |

) |

|

$ |

(3,967,283 |

) |

|

$ |

(11,674,061 |

) |

|

$ |

(11,977,829 |

) |

|

$ |

(4,077,470 |

) |

|

Basic and Diluted Income (Loss)

Per Share2 3

|

|

$ |

(0.02 |

) |

|

$ |

(0.60 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.24 |

) |

|

$ |

(0.10 |

) |

|

Dividends Per Share

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

Weighted Average Shares (#)2 3

|

|

|

19,659,075 |

|

|

|

6,578,035 |

|

|

|

65,782,178 |

|

|

|

50,377,698 |

|

|

|

41,193,459 |

|

|

Period-end Shares (#)2 3

|

|

|

28,218,451 |

|

|

|

6,578,035 |

|

|

|

65,782,178 |

|

|

|

65,782,178 |

|

|

|

47,477,151 |

|

|

Working Capital (Deficit)

|

|

$ |

2,099,399 |

|

|

$ |

(716,619 |

) |

|

$ |

94,253 |

|

|

$ |

5,466,961 |

|

|

$ |

10,815,170 |

|

|

Exploration and Evaluation Assets

|

|

$ |

2,509,791 |

|

|

$ |

2,509,791 |

|

|

$ |

5,670,409 |

|

|

$ |

11,592,105 |

|

|

$ |

10,180,650 |

|

|

Long-Term Debt

|

|

$ |

227,617 |

|

|

$ |

19,267 |

|

|

$ |

37,161 |

|

|

$ |

558,742 |

|

|

$ |

1,146,879 |

|

|

Capital Stock

|

|

$ |

90,663,999 |

|

|

$ |

87,411,032 |

|

|

$ |

87,411,032 |

|

|

$ |

87,457,513 |

|

|

$ |

81,021,668 |

|

|

Shareholders’ Equity

|

|

$ |

4,788,428 |

|

|

$ |

1,893,190 |

|

|

$ |

5,905,723 |

|

|

$ |

16,999,901 |

|

|

$ |

20,048,338 |

|

|

Total Assets

|

|

$ |

5,325,176 |

|

|

$ |

2,801,407 |

|

|

$ |

6,635,616 |

|

|

$ |

17,997,243 |

|

|

$ |

21,545,974 |

|

|

1

|

The financial information for years ended April 30, 2015, 2014, 2013, 2012 and 2011 are prepared using the International Financial Reporting Standards (“IFRS”). The Company’s transition date was May 1, 2010. The cumulative net loss under IFRS at April 30, 2015 is approximately $107 million.

|

|

2

|

Under IFRS, basic loss per share is calculated using the weighted average number of common shares outstanding during the year.

|

|

3

|

On October 28, 2010, the common shares of the Company were consolidated on the basis of four pre-consolidation shares for one post-consolidation share. The numbers presented for fiscal 2013, 2012 and 2011 are presented on the four to one post-consolidated basis. On September 17, 2013, the common shares of the Company were further consolidated on a ten pre-consolidation shares for one post-consolidation share. The numbers presented for fiscal 2015 and 2014 are presented on the ten to one post-consolidation basis.

|

Exchange Rates

The following table sets forth the high and low rates of exchange for the Canadian Dollar for each month during the previous six months. The table also sets forth the average exchange rates for the Canadian Dollar for the five most recent fiscal years ended April 30th. The yearly average rate means the average of the exchange rates based on the daily rates during each fiscal period.

For purposes of this table, the rates of exchange are those quoted by the Bank of Canada. The table sets forth the number of Canadian Dollars required under that formula to buy one U.S. Dollar.

|

Period

|

|

High (1)

|

Low (1)

|

| |

|

|

|

|

July 2015

|

|

1.3060

|

1.2566

|

|

June 2015

|

|

1.2550

|

1.2209

|

|

May 2015

|

|

1.2485

|

1.1951

|

|

April 2015

|

|

1.2612

|

1.1954

|

|

March 2015

|

|

1.2803

|

1.2400

|

|

February 2015

|

|

1.2635

|

1.2403

|

| |

|

|

|

| |

Average (2)

|

|

|

|

Fiscal year ended April 30, 2015

|

1.1570

|

|

|

|

Fiscal year ended April 30, 2014

|

1.0602

|

|

|

|

Fiscal year ended April 30, 2013

|

1.0054

|

|

|

|

Fiscal year ended April 30, 2012

|

0.9928

|

|

|

|

Fiscal year ended April 30, 2011

|

1.0138

|

|

|

The exchange rate was $1.3110 on August 19, 2015.

(1) Means the intra-day high/low rate during the period.

(2) Means the average of the noon day rates on the last day of each month during the period.

|

3.B.

|

Capitalization and Indebtedness

|

Not applicable

|

3.C.

|

Reasons for the Offer and Use of Proceeds

|

Not applicable

We are subject to a number of risks due to the nature of our business, including our present exploration state. The following describes the material risks that could affect us.

There has been significant economic uncertainty since the second half of 2008 and it has affected the Company’s operations.

The unprecedented events in global financial markets that have occurred since mid-2008 have had a profound impact on the global economy. Many industries, including the mining industry, are impacted by these market conditions. Some of the key impacts of the current financial market turmoil include contraction in credit markets resulting in a widening of credit risk, devaluations and high volatility in global equity, commodity, foreign exchange and precious metal markets, and a lack of market liquidity. A continued or worsened slowdown in the financial markets or other economic conditions, including but not limited to, consumer spending, employment rates, business conditions, inflation, fuel and energy costs, consumer debt levels, lack of available credit, the state of the financial markets, interest rates, and tax rates may adversely affect the Company’s growth and profitability. Specifically:

|

|

•the global credit/liquidity crisis could impact the cost and availability of financing and the Company’s overall liquidity;

|

|

|

•the volatility of mineral prices would impact the Company’s revenues, profits, losses and cash flow potential;

|

|

|

•volatile energy prices, commodity and consumables prices and currency exchange rates would impact the Company’s production costs; and

|

|

|

•the devaluation and volatility of global stock markets would impact the valuation of the Company’s equity and other securities.

|

These factors could have a material adverse effect on the Company’s financial condition and results of operations. As a result, the Company will consider its plans and options carefully in fiscal 2016.

No known reserves

Our properties are in the exploration stage and are without a known body of mineral reserves.

We have no mineral producing properties at this time. Only those mineral deposits that we can economically and legally extract or produce, based on a comprehensive evaluation of cost, grade, recovery and other factors, are considered “reserves”. We have not defined or delineated any proven or probable reserves on any of our properties. Although the mineralized material and mineralized deposit estimates included herein have been carefully prepared by us, or, in some instances have been prepared, reviewed or verified by independent mining experts, these amounts are estimates only and no assurance can be given that any particular level of recovery of uranium, and other minerals from mineralized material will in fact be realized or that an identified mineralized deposit will ever qualify as a commercially mineable (or viable) reserve.

Our planned exploration programs may not result in profitable commercial mining operations

Our operations involve exploration, and there is no guarantee that any of our activities will result in commercial production of any mineral deposits. The exploration for and development of mineral deposits involves significant financial and other risks which even a combination of careful evaluation, experience and knowledge may not

eliminate. Most exploration projects do not result in the discovery of commercially mineable deposits. Major expenses are required to locate and establish mineral reserves, to develop metallurgical processes, and to construct mining and processing facilities at a particular site. Our planned exploration programs may not result in a profitable commercial mining operation. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as quantity and quality of the minerals, costs and efficiency of the recovery methods that can be employed; proximity to infrastructure; financing costs; mineral prices, which are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals, and environmental protection. The exact effect of these factors cannot be accurately predicted but could have a material adverse effect upon our operations and/or our ability to receive an adequate return on our invested capital. There is no certainty that our expenditures made towards the search and evaluation of uranium, and other minerals result in discoveries of mineral resources, mineral reserves or any other mineral occurrences, or in profitable commercial mining operations.

Mining operations generally involve a high degree of risk

Our operations are subject to all the hazards and risks normally encountered in the exploration, development and production of uranium and other minerals, including environmental pollution, accidents or spills, industrial accidents, labor disputes, changes in the regulatory environment, natural phenomena, unusual and unexpected geologic formations, seismic activity, rock bursts, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage, delays in or cessation of production, exploration or development, monetary losses and cost increases which could make us uncompetitive, and could lead to possible legal liability. Although adequate precautions to minimize risk will be taken, mining operations are subject to hazards such as equipment failure or failure of retaining dams around tailings disposal areas which may result in environmental pollution and consequent liability. In addition, due to the radioactive nature of the materials handled in uranium mining, applicable regulatory requirements result in additional costs that must be incurred.

Our resource estimates may not be reliable

There is no certainty that any of our mineral resources will be economically mineable. Until a deposit is actually mined and processed the quantity of mineral resources and grades must be considered as estimates only. Valid estimates made at a given time may significantly change when new information becomes available. In addition, the quantity of mineral resources may vary depending on, among other things, metal prices. Any material change in quantity of mineral resources, grade or stripping ratio may affect the economic viability of our properties or any project we undertake. In addition, there can be no assurance that mineral or other metal recoveries in small scale laboratory tests will be duplicated in a larger scale test under on-site conditions or during production.

Fluctuations in prices of uranium, and other minerals, results of drilling, metallurgical testing and production and the evaluation of studies, reports and plans subsequent to the date of any estimate may require revision of such estimate. Any material reductions in estimates of mineral resources could have a material adverse effect on our results of operations and financial condition.

We rely on a limited number of properties

Our only properties of interest are currently the Central Mineral Belt property in Labrador, and the Bootheel property in Wyoming, USA. As a result, unless we acquire additional property interests, any adverse developments affecting these properties could have a material adverse effect upon our business and would materially and adversely affect our potential mineral resource production, profitability, financial performance and results of operations.

Competition from other energy sources and public acceptance of nuclear energy may affect the demand for uranium

Nuclear energy competes with other sources of energy, including oil, natural gas, coal and hydro-electricity. These other energy sources are to some extent interchangeable with nuclear energy, particularly over the longer term. Lower prices of oil, natural gas, coal and hydro-electricity may result in lower demand for uranium concentrate and uranium conversion services. Furthermore, the growth of the uranium and nuclear power industry beyond its current level will depend upon continued and increased acceptance of nuclear technology as a means of generating electricity. Because of unique political, technological and environmental factors that affect the nuclear industry, the industry is subject to public opinion risks which could have an adverse impact on the demand for nuclear power and increase the regulation of the nuclear power industry.

We face strong competition for the acquisition of mining properties

The mining industry is competitive in all of its phases. We face strong competition from other mining companies in connection with the acquisition of properties producing, or capable of producing, uranium and other minerals. Many of these companies have greater financial resources, operational experience and technical capabilities than we do. As a result of this competition, we may be unable to maintain or acquire attractive mining properties on terms we consider acceptable, if at all. Consequently, our revenues, operations and financial condition could be materially adversely affected.

We do not have a history of mineral production or operations

There is no assurance that commercial quantities of minerals will be discovered at our current properties or any future properties, nor is there any assurance that our exploration programs thereon will yield any positive results. Even if commercial quantities of minerals are discovered, there can be no assurance that any of our properties will ever be brought to a stage where mineral resources can profitably be produced thereon. Factors which may limit our ability to produce mineral resources from our properties include, but are not limited to, the price of the mineral resources which are being explored for, availability of additional capital and financing and the nature of any mineral deposits.

We do not have an extensive operating history and there can be no assurance of our ability to operate our projects profitably in the future.

Our insurance will not cover all the potential risks associated with our operations

Our business is subject to a number of risks and hazards generally, including adverse environmental conditions, industrial accidents, labor disputes, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods and earthquakes. Such occurrences could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to our properties or other properties, delays in mining, monetary losses and possible legal liability.

Our insurance will not cover all the potential risks associated with a mining company’s operations. We may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not be available or may not be adequate to cover any resulting liability. Moreover, there are risks against which we cannot insure or against which we may elect not to insure. Insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to us or to other companies in the uranium mining industry. We might also become subject to liability for pollution or other hazards which we may not be insured against or which we may elect not to insure against because of premium costs or other reasons. Losses from these events may cause substantial delays and require us to incur significant costs that could have a material adverse effect upon our financial condition, results of operations, competitive position and potentially our financial viability.

Our operations are subject to environmental regulation

All phases of our operations are subject to environmental regulation in the various jurisdictions in which we operate or may operate in the future. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulation, if any, will not adversely affect our operations. Environmental hazards may exist on the properties on which we hold interests which are unknown to us at present and which have been caused by previous or existing owners or operators of the properties.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations or in the exploration or development of mineral properties may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Our operations are dependent on adequate infrastructure

Mining, processing, development and exploration activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important determinants, which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect our operations, financial condition and results of operations.

Our properties may be subject to undetected title defects

It is possible there may still be undetected title defects affecting our properties. Title insurance generally is not available, and our ability to ensure that we have obtained secure claim to individual mineral properties or mining concessions may be severely constrained. Furthermore, we have not conducted surveys of the claims in which we hold interests and, therefore, the precise area and location of such claims may be in doubt. Accordingly, our properties may be subject to prior unregistered liens, agreements, transfers or claims, and title may be affected by, among other things, undetected defects which could have a material adverse impact on our operations. In addition, we may be unable to operate our properties as permitted or to enforce our rights with respect to our properties.

We may be subject to additional costs for land reclamation

It is difficult to determine the exact amounts which will be required to complete all land reclamation activities in connection with our properties. Reclamation bonds and other forms of financial assurance represent only a portion of the total amount of money that will be spent on reclamation activities over the life of a mine. Accordingly, it may be necessary to revise planned expenditures and operating plans in order to fund reclamation activities. Such costs may have a material adverse impact upon our financial condition and results of operations.

The inability to obtain necessary permits would adversely affect our ability to operate our business

We may not receive the necessary permits or receive them on acceptable terms, if at all, in order to conduct further exploration and to develop our properties. The failure to obtain such permits, or delays in obtaining such permits, could adversely affect our operations.

Government approvals, approval of aboriginal people and permits are currently and may in the future be required in connection with our operations. To the extent such approvals are required and not obtained; we may be curtailed or

prohibited from continuing our mining operations or from proceeding with planned exploration or development of mineral properties.

We will require additional capital for our operations

The development and exploration of our properties will require substantial additional financing. Failure to obtain sufficient financing may result in the delay or indefinite postponement of exploration, development or production on our properties or even a loss of property interest. There can be no assurance that additional capital will be available when needed or that, if available, the terms of financing such capital will be acceptable to us. In addition, any future financing may be dilutive to our existing shareholders.

Future production from our mining properties, if any, is dependent upon the prices of uranium and other minerals being adequate to make these properties economically viable

Mineral and base metals prices received, if any, could be such that our properties cannot be mined at a profit. The price of our common shares, and our financial results and exploration, development and mining activities may in the future be significantly and adversely affected by declines in the price of uranium, and other minerals. The price of uranium, and other minerals fluctuates widely and is affected by numerous factors beyond our control such as the sale or purchase of commodities by various central banks and financial institutions, interest rates, exchange rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, the political and economic conditions and production costs of major mineral-producing countries throughout the world, and the cost of substitutes, inventory levels and carrying charges. With respect to uranium, such factors include the demand for nuclear power, political and economic conditions in uranium producing and consuming countries, uranium supply from secondary sources, uranium production levels and costs of production. Future serious price declines in the market value of uranium, and other minerals could cause development of and commercial production from our properties to be impracticable. Depending on the price of uranium, and other minerals, cash flow from mining operations may not be sufficient and we could be forced to discontinue production and may lose our interest in, or may be forced to sell, some of our properties. Future production from our mining properties, if any, is dependent upon the prices of uranium, and other minerals being adequate to make these properties economically viable.

In addition to adversely affecting our reserve estimates, if any, and our financial condition, declining commodity prices can impact operations by requiring a reassessment of the feasibility of a particular project. Such a reassessment may be the result of a management decision or may be required under financing arrangements related to a particular project. Even if a project is ultimately determined to be economically viable, the need to conduct such a reassessment may cause substantial delays or may interrupt operations until the reassessment can be completed.

Exchange rate fluctuations may effectively increase our costs of exploration and production

Exchange rate fluctuations may affect the costs that we incur in our operations. Uranium, and other minerals are generally sold in U.S. dollars and our costs are incurred principally in Canadian dollars. We also maintain a mineral exploration project in the United States that require payments to be made in U.S. dollars. The appreciation of non-U.S. dollar currencies against the U.S. dollar can increase the cost of exploration and production in U.S. dollar terms, which could materially and adversely affect our profitability, results of operations and financial condition.

Our operations are subject to extensive governmental regulation that may adversely affect our operating costs

Our mining, processing, development and mineral exploration activities are subject to various laws governing prospecting, development, production, taxes, labor standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local people, and other matters. Although our exploration and development activities are currently carried out in accordance with all applicable rules and regulations, new rules and regulations may be enacted or existing rules and regulations may be applied in a manner which could limit or curtail production or development. Amendments to current laws and regulations governing operations and activities of mining and

milling or more stringent implementation thereof could have a substantial adverse impact on our operations. Worldwide demand for uranium is directly tied to the demand for energy produced by the nuclear electric industry, which is also subject to extensive government regulations and policies.

Amendments to current laws, regulations and permits governing operations and activities of mining and exploration companies, or more stringent implementation thereof, could have a material adverse impact on our operations and cause increases in exploration expenses, capital expenditures or production costs, or reduction in levels of production at producing properties, or require abandonment or delays in development of new mining properties.

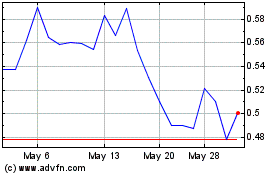

The market price of our common shares may experience substantial volatility

In recent years, the securities markets in the United States and Canada have experienced a high level of price and volume volatility, and the market price of securities of many mineral exploration companies have experienced wide fluctuations in price which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. The price of our common shares is also likely to be significantly affected by short-term changes in prices of uranium, and other minerals, or in our financial condition or results of operations as reflected in our quarterly earnings reports. Other factors unrelated to our performance that may have an effect on the price of our common shares include the following: the extent of analytical coverage available to investors concerning our business may be limited if investment banks with research capabilities do not follow our securities; lessening in trading volume and general market interest in our securities may affect an investor’s ability to trade significant numbers of our common shares; the size of our public float may limit the ability of some institutions to invest in our securities; and a substantial decline in the price of our common shares that persists for a significant period of time could cause our securities to be delisted from such exchange, further reducing market liquidity.

We have not paid dividends in the past and do not expect to pay dividends in the foreseeable future

No dividends on our common shares have been paid to date as we have no earnings. We currently plan to retain all future earnings and other cash resources, if any, for the future operation and development of our business. Payment of future dividends, if any, will be at the discretion of our Board of Directors after taking into account many factors, including our operating results, financial condition, and current and anticipated cash needs.

Future sales of common shares by existing shareholders could adversely affect the trading price of our common shares

Sales of a large number of our common shares in the public markets, or the potential for such sales, could decrease the trading price of the common shares and could impair our ability to raise capital through future sales of common shares.

We are dependent upon the services of our key executives

We are dependent upon the services of key executives, including our directors and a small number of highly skilled and experienced executives and personnel. Due to our relatively small size, the unanticipated and/or unplanned loss of our Chief Executive Officer or our Chairman or our inability to attract and retain additional highly-skilled employees may adversely affect our future operations.

Our directors and officers have certain conflicts of interest

Certain of our directors and officers also serve as directors and/or officers of other companies involved in natural resource exploration and development and, consequently, there exists the possibility for such directors and officers to be in a position of conflict.

We have no positive cash flow and no recent history of earnings and we are dependent upon public and private contributions of equity to obtain capital in order to sustain our operations

None of our properties have advanced to the commercial production stage and we have no history of earnings or positive cash flow from operations. Our cumulative loss, as of the year ended April 30, 2015 determined in accordance with IFRS is approximately $107 million. We do not know if we will ever generate material revenue from mining operations or if we will ever achieve self-sustaining commercial mining operations. Historically, the only source of funds available to us has been through the sale of our equity securities. Any future additional equity financing would cause dilution to current shareholders.

Dilution through employee, director and consultant stock options and warrants could adversely affect our shareholders by decreasing shareholder value

Because our success is highly dependent upon our employees, we have granted to some or all of our key employees, directors and consultants options to purchase common shares as non-cash incentives. In addition we have also issued share purchase units and warrants to investors and brokers in connection with equity financings. To the extent that significant numbers of such options, warrants and share purchase units may be granted and exercised, the interests of our other shareholders may be diluted.

As of August 19, 2015 we had 21,000 share purchase options, and 20,000,000 share purchase warrants outstanding. If all of these securities were exercised, the number of common shares issued and outstanding would increase from 28,218,451 to 48,239,451. This represents an increase of 70.10% in the number of shares issued and outstanding and would result in some dilution to current shareholders.

The Company is subject to the SEC’s penny stock rules, and the risks associated with penny stock classification could affect the marketability of our equity securities and shareholders could find it difficult to sell their common shares

Given that the trading price of our common shares on OTC Market Group’s OTCQB Marketplace is less than US $5.00 per share, our common stock is subject to the SEC’s “penny stock” rules as defined in Rule 3a51-1 under the Securities Exchange Act of 1934 (“Exchange Act”). The SEC has adopted the penny stock rules to regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks generally are equity securities with a price of less than US $5.00, other than securities registered on certain national securities exchanges, provided that current price and volume information with respect to transactions in such securities is provided by the exchange.

Transaction costs associated with purchases and sales of penny stocks are likely to be higher than those for other securities. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from such rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for our equity securities in the United States and shareholders may find it more difficult to sell their shares.

U.S. investors may not be able to enforce their civil liabilities against us or our directors, controlling persons and officers

It may be difficult to bring and enforce suits against us. We are incorporated in the province of British Columbia under the Business Corporations Act (British Columbia). The majority of our directors and officers are residents of Canada, and all or substantial portions of their assets are located outside of the United States, predominately in Canada. As a result, it may be difficult for U.S. holders of our common shares to effect service of process on these persons within the United States or to realize in the United States upon judgments rendered against them. In addition, a shareholder should not assume that the courts of Canada (i) would enforce judgments of U.S. courts obtained in actions against us or such persons predicated upon the civil liability provisions of the U.S. federal securities laws or other laws of the United States, or (ii) would enforce, in original actions, liabilities against us or such persons predicated upon the U.S. federal securities laws or other laws of the United States.

However, U.S. laws would generally be enforced by a Canadian court provided that those laws are not contrary to Canadian public policy, are not foreign penal laws or laws that deal with taxation or the taking of property by a foreign government and provided that they are in compliance with applicable Canadian legislation regarding the limitation of actions. Also, a Canadian court would generally recognize a judgment obtained in a U.S. Court except, for example, where:

|

a)

|

the U.S. court that rendered the judgment had no jurisdiction according to applicable Canadian law;

|

|

b)

|

the judgment was subject to ordinary remedy (appeal, judicial review and any other judicial proceeding which renders the judgment not final, conclusive or enforceable under the laws of the applicable state) or not final, conclusive or enforceable under the laws of the applicable state;

|

|

c)

|

the judgment was obtained by fraud or in any manner contrary to natural justice or rendered in contravention of fundamental principles of procedure; or

|

|

d)

|

a dispute between the same parties, based on the same subject matter has given rise to a judgment rendered in a Canadian court or has been decided in a third country and the judgment meets the necessary conditions for recognition in a Canadian court.

|

As a "foreign private issuer”, we are exempt from the Section 14 proxy rules and Section 16 reporting rules under the Exchange Act which may result in shareholders having less complete and timely data

The submission of proxy and annual shareholder meeting information (prepared to Canadian standards) on Form 6-K may result in shareholders having less complete and timely data than if we were subject to the SEC’s domestic issuer proxy rules under Section 14 of the Exchange Act. The exemption from Section 16 rules under the Exchange Act that require the reporting of acquisitions and disposition of our equity securities by our officers, directors and greater than 10% shareholders also may result in shareholders having less data.

The Company believes that it may be a “passive foreign investment company” for the current taxable year which would likely result in materially adverse U.S. federal income tax consequences for U.S. investors

The Company believes that it may have been classified as a passive foreign investment company (“PFIC”) for the taxable year ending April 30, 2015, and, based on current business plans and financial expectations, the Company expects that it may be classified as a PFIC for the current taxable year and in future taxable years. If the Company is a PFIC for any taxable year during which a U.S. Holder (as defined under “Item 10.E. Taxation—U.S. Federal Income Tax Considerations”) holds the Common Shares, it would likely result in adverse U.S. federal income tax consequences for such U.S. Holder. U.S. holders should carefully read “Item 10.E. Taxation – U.S. Federal Income Tax Considerations—Passive Foreign Investment Company Rules” for more information and consult their own tax advisors regarding the likelihood and consequences of the Company being treated as a PFIC for U.S. federal income tax purposes, including the advisability of making a “qualified electing fund” election, which may mitigate certain possible adverse U.S. federal income tax consequences but may result in an inclusion in gross income

without receipt of such income. U.S. Holders are urged to consult their own tax advisers as to whether the Company may be treated as a PFIC and the tax consequences thereof.

Litigation

Due to the nature of our business, we may become subject to regulatory investigations, claims, lawsuits and other proceedings in the ordinary course of its business. The results of these legal proceedings cannot be predicted with certainty due to the uncertainty inherent in litigation, including the effects of discovery of new evidence or advancement of new legal theories, the difficulty of predicting decisions of judges and juries and the possibility that decisions may be reversed on appeal. There can be no assurances that these matters will not have a material adverse effect on our business.

|

ITEM 4.

|

INFORMATION ON THE COMPANY

|

4.A. History and Development of the Company

Introduction

Jet Metal Corp. (formerly Crosshair Energy Corporation) (the “Company” or “Jet Metal”) was incorporated as a specially limited company pursuant to the Company Act (British Columbia) (replaced by the Business Corporations Act (British Columbia) effective March 29, 2004) on September 2, 1966 under the name Shasta Mines & Oil Ltd. (Non-Personal Liability). We converted from a Private Company to a Public Company on February 20, 1967. On February 4, 1975 we changed our name to International Shasta Resources Ltd. (Non-Personal Liability) and consolidated our share capital on the basis of one new share for five old shares and increased our share capital from 600,000 common shares to 3,000,000 common shares. On September 14, 1977 we increased our authorized share capital from 3,000,000 common shares to 5,000,000 common shares. On April 5, 1982, we increased our authorized share capital from 5,000,000 common shares to 10,000,000 common shares by Special Resolution. On March 5, 1986 we converted from a Specially Limited Company into a Limited Company under the name of International Shasta Resources Ltd. and increased our authorized share capital from 10,000,000 common shares to 30,000,000 common shares. On May 20, 1994, we changed our name to Consolidated Shasta Resources Inc. and consolidated our share capital on the basis of one new share for ten old shares and increased our authorized share capital from 3,000,000 common shares to 20,000,000 common shares. On November 23, 1994 we changed our name to Lima Gold Corporation and on September 21, 1999 we changed our name to International Lima Resources Corp. and consolidated our share capital on the basis of one new share for three old shares and increased our authorized share capital from 6,666,667 common shares to 20,000,000 common shares. On November 5, 2003 we increased our authorized share capital from 20,000,000 common shares to 100,000,000 common shares. On March 1, 2004 we changed our name to Crosshair Exploration & Mining Corp. On June 1, 2004 we replaced our Memorandum with a Notice of Articles as required by the Business Corporations Act (British Columbia). On March 11, 2005 we changed our authorized capital to an unlimited number of common shares. On December 15, 2010, we consolidated our share capital on the basis of one new share for four old shares. On October 28, 2011 we changed our name from Crosshair Exploration & Mining Corp. to Crosshair Energy Corporation. On September 17, 2013, we consolidated our share capital on the basis of one new share for ten old shares and changed our name from Crosshair Energy Corporation to Jet Metal Corp.

Our executive office is located at:

Suite 1240 - 1140 West Pender Street

Vancouver, British Columbia, Canada V6E 4G1

Telephone: (604) 681-8030

Facsimile: (604) 681-8039

Website: www.jetmetalcorp.com

Email: jcrawford@kingandbay.com

The contact person is: Mr. Jim Crawford, Chief Executive Officer and President.

Our fiscal year ends April 30th.

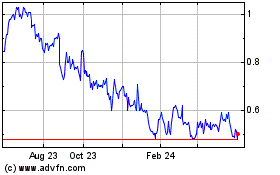

Our common shares first began trading on the Vancouver Stock Exchange under the name Shasta Mines & Oil Ltd. on March 14, 1969. Our common shares began trading on the TSX Venture Exchange with the trading symbol “CXX” on March 1, 2004. On February 10, 2006, we graduated to Tier 1 on the TSX Venture Exchange. On May 7, 2007, our common shares began trading on the American Stock Exchange (now NYSE MKT) with the trading symbol “CXZ.” On May 12, 2008, our common shares began trading on the Toronto Stock Exchange with the trading symbol “CXX” and ceased trading on the TSX Venture Exchange. On June 18, 2013 the Company filed a Form 25 – Notice of Removal from Listing and/or Registration under section 12(b) of the Securities Exchange Act of 1934 with the United States Securities and Exchange Commission (“SEC”). Our common shares were voluntarily delisted from NYSE MKT on July 1, 2013 and began trading on the OTC Market Group’s OTCQB Marketplace on July 1, 2013 with the trading symbol “CRHRF”. On October 22, 2013, our trading symbol on OTCQB was changed to “JETMF” to reflect the Company’s name change to Jet Metal Corp. On January 17, 2014, our common shares were voluntarily delisted from the Toronto Stock Exchange and on January 20, 2014 began trading on the TSX Venture Exchange under the trading symbol “JET”.

On January 19, 2015, 20,000,000 warrants (“Warrants”) began trading on the TSX Venture Exchange under the symbol “JET.WT”. The Warrants were issued on September 16, 2014 to accredited investors pursuant to a non-brokered private placement of units (“Units”) for gross proceeds of $3,000,000. Each Unit comprised one common share and one Warrant, with each Warrant exercisable to acquire one common share at an exercise price of $0.25 for a period of five years following closing of the private placement.

On March 29, 2004, the Company Act (British Columbia) (the “Company Act”) was replaced by the Business Corporations Act (British Columbia) (the “BCBCA”). Accordingly, we are now subject to the BCBCA and are no longer governed by the Company Act. There are a number of differences under the BCBCA, which differences are designed to provide greater flexibility and efficiency for British Columbia companies.

Under the BCBCA, every company incorporated under the Company Act was required to complete a mandatory transition rollover under the BCBCA to substitute a Notice of Articles for its Memorandum within two years of March 29, 2004. On June 1, 2004 we replaced our Memorandum with a Notice of Articles as is required by the BCBCA. The only information contained in the Notice of Articles is the authorized share structure of the Company, the name of the Company, the address of the registered and records office of the Company, and the names and addresses of the directors of the Company.

On March 31, 2009, the Company and Target Exploration and Mining Corp. (“Target”) successfully closed a plan of arrangement whereby the Company acquired all the outstanding common shares of Target and Target has become a wholly owned subsidiary of the Company. Target shareholders received approximately 14.7 million common shares of the Company (1.2 Company shares for each Target common share outstanding) with an estimated market value of approximately $2.6 million. In addition, each outstanding Target warrant and stock option which gave the holder the right to acquire common shares of Target was exchanged for a warrant or stock option which gave the holder the right to acquire common shares of the Company on the exchange ratio of 1.2 Company shares for each Target warrant or stock option exercised, with all other terms of such warrants and options (such as term and expiry) remaining unchanged. As a result of the acquisition of Target, the Company acquired an interest in the Bootheel and Sinbad projects in Wyoming and Utah, USA respectively. During fiscal 2010, we allowed all 62 mineral claims on the Sinbad property located in Emery County, Utah, to lapse, and the State Lease with the State of Utah was not renewed.

Property Acquisitions

Since the beginning of fiscal 2015, we have acquired no additional properties.

Property Terminations

Since the beginning of fiscal 2015, we have dropped a total of 558 mineral claims from the CMB project. The Company has reviewed its exploration and evaluation assets accordingly in its financial statements to reflect the above developments.

Capital Expenditures

Our capital expenditures, excluding property, plant and equipment, for the last three fiscal years were as follows:

|

Fiscal Year

|

Expenditures

|

|

Fiscal 2013

|

$224,816(1)

|

|

Fiscal 2014

|

$--(2)

|

|

Fiscal 2015

|

$--(3)

|

(1) These funds were spent as outlined below:

|

Expense ($)

|

CMB Moran Lake

|

CMB

Silver Spruce

|

Bootheel Project

|

Golden Promise

|

Juniper Ridge

|

Other Claims

|

|

Acquisition costs

|

200,000

|

--

|

1,283

|

20,000

|

3,533

|

--

|

(2) These funds were spent as outlined below:

|

Expense ($)

|

CMB Moran Lake

|

CMB

Silver Spruce

|

Bootheel Project

|

Golden Promise

|

Juniper Ridge

|

Other Claims

|

|

Acquisition costs

|

--

|

--

|

--

|

--

|

--

|

--

|

(3) These funds were spent as outlined below:

|

Expense ($)

|

CMB Moran Lake

|

CMB

Silver Spruce

|

Bootheel Project

|

Golden Promise

|

Juniper Ridge

|

Other Claims

|

|

Acquisition costs

|

--

|

--

|

--

|

--

|

--

|

--

|

We do not expect to incur any significant capital expenditures with respect to the Company’s existing properties for fiscal year 2016. Our capital expenditures are financed through sales of our common shares.

Exploration and evaluation expenses

The Company recorded the following exploration and evaluation expenses in relation to its mineral properties:

|

Fiscal Year

|

Expenditures

|

|

Fiscal 2013

|

$2,835,066 (1)

|

|

Fiscal 2014

|

$34,225 (2)

|

|

Fiscal 2015

|

$21,481(3)

|

|

(1)

|

These funds were spent as outlined below:

|

|

Expense ($)

|

CMB Moran Lake

|

CMB

Silver Spruce

|

Bootheel Project

|

Golden Promise

|

Juniper Ridge

|

Other Claims

|

|

Drilling and trenching

|

$731,850

|

$ --

|

$13,433

|

$ --

|

$328,080

|

$ --

|

|

Geology

|

1,456,437

|

--

|

35,816

|

24,524

|

339,683

|

--

|

|

Geophysics

|

11,591

|

--

|

--

|

--

|

44,918

|

--

|

|

Geochemistry

|

--

|

--

|

--

|

--

|

--

|

--

|

|

Metallurgy

|

--

|

--

|

--

|

--

|

15,892

|

--

|

|

Administration

|

10,434

|

--

|

45,981

|

--

|

44,902

|

--

|

|

Permitting

|

--

|

--

|

--

|

--

|

37,395

|

--

|

|

Hydrology

|

--

|

--

|

271

|

--

|

--

|

--

|

|

Technical analysis

|

--

|

--

|

--

|

--

|

--

|

--

|

|

Reclamation Costs

|

--

|

--

|

--

|

22,741

|

--

|

--

|

|

Pre-acquisition costs

|

--

|

--

|

--

|

--

|

--

|

--

|

|

JCEAP refunds

|

(150,000)

|

(150,000)

|

--

|

--

|

--

|

--

|

|

Recovery

|

--

|

--

|

(28,882)

|

--

|

--

|

--

|

|

(2)

|

These funds were spent as outlined below:

|

|

Expense ($)

|

CMB Moran Lake

|

CMB

Silver Spruce

|

Bootheel Project

|

Golden Promise

|

Juniper Ridge

|

Other Claims

|

|

Drilling and trenching

|

$ --

|

$ --

|

$ --

|

$ --

|

$ --

|

$ --

|

|

Geology

|

--

|

--

|

--

|

--

|

--

|

--

|

|

Geophysics

|

--

|

--

|

--

|

--

|

--

|

--

|

|

Geochemistry

|

--

|

--

|

--

|

--

|

--

|

--

|

|

Metallurgy

|

--

|

--

|

--

|

--

|

--

|

--

|

|

Administration

|

560

|

--

|

34,673

|

--

|

(392)

|

--

|

|

Permitting

|

--

|

--

|

--

|

--

|

--

|

376

|

|

Hydrology

|

--

|

--

|

--

|

--

|

--

|

--

|

|

Technical analysis

|

--

|

--

|

--

|

--

|

--

|

--

|

|

Reclamation Costs

|

--

|

--

|

10,921

|

--

|

--

|

--

|

|

Pre-acquisition cost

|

--

|

--

|

--

|

--

|

--

|

--

|

|

JCEAP refunds

|

--

|

--

|

--

|

--

|

--

|

--

|

|

Recovery

|

--

|

--

|

(11,913)

|

--

|

--

|

--

|

|

(3)

|

These funds were spent as outlined below:

|

|

Expense ($)

|

CMB Moran Lake

|

CMB

Silver Spruce

|

Bootheel Project

|

Golden Promise

|

Juniper Ridge

|

Other Claims

|

|

Drilling and trenching

|

$ --

|

$ --

|

$ --

|

$ --

|

$ --

|

$ --

|

|

Geology

|

--

|

--

|

--

|

--

|

--

|

--

|

|

Geophysics

|

--

|

--

|

--

|

--

|

--

|

--

|

|

Geochemistry

|

--

|

--

|

--

|

--

|

--

|

--

|

|

Metallurgy

|

--

|

--

|

--

|

--

|

--

|

--

|

|

Administration

|

--

|

--

|

27,367

|

--

|

--

|

--

|

|

Permitting

|

--

|

--

|

--

|

--

|

--

|

--

|

|

Hydrology

|

--

|

--

|

--

|

--

|

--

|

--

|

|

Technical analysis

|

--

|

--

|

1,925

|

--

|

--

|

--

|

|

Reclamation Costs

|

--

|

--

|

--

|

--

|

--

|

--

|

|

Pre-acquisition cost

|

--

|

--

|

--

|

--

|

--

|

--

|

|

JCEAP refunds

|

--

|

--

|

--

|

--

|

--

|

--

|

|

Recovery

|

--

|

--

|

(7,811)

|

--

|

--

|

--

|

4.B. Business Overview

Corporate Development

We are a mineral exploration company engaged in the acquisition and exploration of mineral properties (primarily uranium, base and precious metals). We do not have any producing mineral properties at this time. Our business is presently focused on the exploration and evaluation of various mineral deposits in North America. See “Item 4.D – Property, Plants and Equipment” below for a detailed description of the Company’s properties.

We are currently focusing our exploration and evaluation activities in the Province of Newfoundland and Labrador and the State of Wyoming on the following properties:

|

·

|

CMB property located in Labrador, Canada.

|

|

·

|

The Bootheel Project located in Wyoming, U.S.A.

|

Material Effects of Government Regulations

Our current and anticipated future operations, including further exploration activities, require permits from various Canadian Federal and Provincial and U.S. Federal and State governmental authorities. Such operations are subject to various laws governing land use, the protection of the environment, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, well safety and other matters. Unfavorable amendments to current laws, regulations and permits governing operations and activities of resource exploration companies, or more stringent implementation thereof, could have a materially adverse impact on us and cause increases in capital expenditures which could result in our ceasing operations. We have had no material costs related to compliance and/or permits in recent years, and anticipate no material costs in the next year.

Field work is prohibited on certain parts of the Bootheel Project due to the presence of sage grouse mating areas during the period March 15th to June 30th.

Seasonality

We can only carry out exploration when weather is favorable. Typically, we cannot carry out any work at a reasonable cost during the months of November and December for winter freeze-up and March and April for spring break-up on our Canadian properties.

Dependency upon Patents/Licenses/Contracts/Processes

Not applicable

Sources/Availability of Raw Materials

Not applicable

|

4.C.

|

Organization Structure

|

The Company is a corporation subject to the BCBCA. Jet Metal owns 100% of the issued and outstanding shares in each of the following subsidiaries:

|

1.

|

Target Exploration and Mining Corp. (“Target”), a British Columbia corporation.

|

|

a.

|

Target owns all of the issued and outstanding shares in Crosshair Energy USA, Inc. (formerly 448018 Exploration Inc.), a Nevada Corporation.

|

|

i.

|

Crosshair Energy USA, Inc. holds an 81% interest in The Bootheel Project LLC.

|

|

2.

|

Gemini Metals Corp., a British Columbia corporation.

|

|

4.D.

|

Property, Plants and Equipment

|

Our properties are in the exploration stage and a substantial amount of capital will have to be spent on each property before we will know if they contain commercially viable mineral deposits. Our properties are located in the Province of Newfoundland and Labrador, Canada and Wyoming, USA. Our properties are without known reserves and the work being done by us is exploratory in nature.

Our executive offices are located in shared office premises of approximately 10,630 square feet at Suite 1240, 1140 West Pender Street, Vancouver, British Columbia Canada. We have occupied these facilities since 2006. Beginning on January 1, 2010 (revised on October 1, 2010 and September 16, 2014), we entered into a management services agreement with King & Bay West Management Corp. (“King & Bay West”) under which King & Bay West provides shared office space for the Company and other companies that King & Bay West provides management services to. As part of this agreement, King & Bay West has assumed the lease for the office facilities occupied by the Company.

National Instrument 43-101 Compliance