UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

x

QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended

May 31, 2012

o

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from __________ to __________

Commission file number

333-102945

|

JETBLACK CORP.

|

|

(Exact name of small business issuer as specified in its charter)

|

|

Nevada

|

|

98-0379431

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(IRS Employer Identification No.)

|

|

Suite #219 10654 - 82 Avenue, Edmonton, Alberta T6E 2A7

|

|

(Address of principal executive offices)

|

|

780.710.9840

|

|

(Issuer's telephone number)

|

|

N/A

|

|

(Former name, former address and former fiscal year, if changed since last report)

|

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

x

No

o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes

x

No

o

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

x

|

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date

67,352,000

common shares issued and outstanding as of July 20, 2012

Check whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

o

No

x

JETBLACK CORP.

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED BALANCE SHEETS

|

|

|

May 31,

2012

$

(Unaudited)

|

|

|

August 31,

2011

$

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

|

26,564

|

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Current Assets

|

|

|

26,564

|

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

|

26,564

|

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

|

6,558

|

|

|

|

19,380

|

|

|

Shareholder advance

|

|

|

910

|

|

|

|

4,910

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Current Liabilities

|

|

|

7,468

|

|

|

|

24,290

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

7,468

|

|

|

|

24,290

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock, $.001 par value, 1,350,000,000

shares authorized, 67,352,000 and 66,963,000 shares issued and outstanding at May 31, 2012 and August 31, 2011 respectively

|

|

|

67,352

|

|

|

|

66,963

|

|

|

Additional paid in capital

|

|

|

128,496

|

|

|

|

77,487

|

|

|

Subscription receivable

|

|

|

–

|

|

|

|

(12,822

|

)

|

|

Deficit accumulated during the development stage

|

|

|

(176,752

|

)

|

|

|

(155,918

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total Shareholders’ Equity (Deficit)

|

|

|

19,096

|

|

|

|

(24,290

|

)

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY (DEFICIT)

|

|

|

26,564

|

|

|

|

–

|

|

See accompanying notes to consolidated financial statements.

JETBLACK CORP.

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED STATEMENTS OF OPERATIONS

Three and Nine Months Ended May 31, 2012 and May 31, 2011 and

the Period from April 17, 2002 (Inception) through May 31, 2012

(Unaudited)

|

|

|

Three Months Ended

May 31,

2012

|

|

|

Three Months Ended

May 31,

2011

|

|

|

Nine Months Ended

May 31,

2012

|

|

|

Nine Months Ended

May 31,

2011

|

|

|

April 17, 2002 (Inception) to

May 31,

2012

|

|

|

|

|

$

|

|

|

$

|

|

|

$

|

|

|

$

|

|

|

$

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUE

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

7,569

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST OF GOODS SOLD

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

(1,333

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

6,236

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inventory write-down

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

1,400

|

|

|

General and administrative

|

|

|

6,328

|

|

|

|

2,556

|

|

|

|

20,834

|

|

|

|

15,183

|

|

|

|

181,588

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Expenses

|

|

|

6,328

|

|

|

|

2,556

|

|

|

|

20,834

|

|

|

|

15,183

|

|

|

|

182,988

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Operating Loss

|

|

|

(6,328

|

)

|

|

|

(2,556

|

)

|

|

|

(20,834

|

)

|

|

|

(15,183

|

)

|

|

|

(176,752

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS

|

|

|

(6,328

|

)

|

|

|

(2,556

|

)

|

|

|

(20,834

|

)

|

|

|

(15,183

|

)

|

|

|

(176,752

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS PER SHARE:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BASIC AND DILUTED

|

|

|

(0.00

|

)

|

|

|

(0.00

|

)

|

|

|

(0.00

|

)

|

|

|

(0.00

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE SHARES OUTSTANDING:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BASIC AND DILUTED

|

|

|

67,207,315

|

|

|

|

127,955,326

|

|

|

|

67,091,018

|

|

|

|

144,496,962

|

|

|

|

|

|

See accompanying notes to the consolidated financial statements.

JETBLACK CORP.

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED STATEMENTS OF CASH FLOWS

Nine Months Ended May 31, 2012 and May 31, 2011 and

the Period from April 17, 2002 (Inception) through May 31, 2012

(Unaudited)

|

|

|

Nine Months

Ended

May 31,

2012

|

|

|

Nine Months

Ended

May 31,

2011

|

|

|

April 17, 2002 (Inception) to

May 31,

2012

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(20,834

|

)

|

|

$

|

(15,183

|

)

|

|

$

|

(176,752

|

)

|

|

Adjustments to reconcile net loss to cash used by

|

|

|

|

|

|

|

|

|

|

|

|

|

|

operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock issued for services

|

|

|

–

|

|

|

|

–

|

|

|

|

655

|

|

|

Impairment

|

|

|

–

|

|

|

|

–

|

|

|

|

1,800

|

|

|

Change in current assets and liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inventory

|

|

|

–

|

|

|

|

–

|

|

|

|

(1,800

|

)

|

|

Accounts payable and accrued expenses

|

|

|

(11,424

|

)

|

|

|

(3,162

|

)

|

|

|

7,956

|

|

|

CASH FLOWS USED IN OPERATING ACTIVITIES

|

|

|

(32,258

|

)

|

|

|

(18,345

|

)

|

|

|

(168,141

|

)

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advances from (repayment to) shareholders

|

|

|

(4,000

|

)

|

|

|

–

|

|

|

|

910

|

|

|

Proceeds from issuance of common stock

|

|

|

62,822

|

|

|

|

18,345

|

|

|

|

193,795

|

|

|

CASH FLOWS PROVIDED BY FINANCING ACTIVITIES

|

|

|

58,822

|

|

|

|

18,345

|

|

|

|

194,705

|

|

|

NET CHANGE IN CASH

|

|

|

26,564

|

|

|

|

–

|

|

|

|

26,564

|

|

|

Cash, beginning of period

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Cash, end of period

|

|

$

|

26,564

|

|

|

$

|

–

|

|

|

$

|

26,564

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL CASH FLOW INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest paid

|

|

$

|

–

|

|

|

$

|

–

|

|

|

$

|

–

|

|

|

Income taxes paid

|

|

$

|

–

|

|

|

$

|

–

|

|

|

$

|

–

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NON-CASH TRANSACTIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contributed Capital – Debt Forgiveness

|

|

$

|

1,398

|

|

|

$

|

–

|

|

|

$

|

1,398

|

|

See accompanying notes to the consolidated financial statements.

JETBLACK CORP.

(A DEVELOPMENT STAGE COMPANY)

Notes to the Consolidated Financial Statements

(Unaudited)

NOTE 1 - BASIS OF PRESENTATION

The accompanying unaudited interim consolidated financial statements of Jetblack Corp. (the "Company") have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission ("SEC"), and should be read in conjunction with the audited financial statements and notes thereto contained in the Company's Form 10-K. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the results of operations for the interim periods presented have been reflected herein. The results of operations for interim periods are not necessarily

indicative of the results to be expected for the full year. Notes to the financial statements which would substantially duplicate the disclosures contained in the audited financial statements for the most recent fiscal year ended August 31, 2011 as reported in Form 10-K, have been omitted.

NOTE 2 – SHAREHOLDER ADVANCE

During the year ended August 31, 2009 Ms. Avila, our former President and former majority shareholder, advanced $4,000 to the Company. There is no written loan agreement. Interest is accrued on these advances at the rate of 10% per annum. The advances and accrued interest were payable on demand and unsecured. On April 1, 2012 the principal amount of $4,000 was repaid and the interest accrued on the loan of $1,398 was forgiven and recorded as additional paid in capital.

During the year ended August 31, 2011, Mr. Farnsworth, our President and majority shareholder, advanced $910 to the Company. There is no written loan agreement. The loan is interest free and is payable on demand and unsecured.

NOTE 3 – COMMON STOCK

During the year ended August 31, 2010, the Company issued 1,500,000 common shares for a subscription of $25,000, of which $12,178 was paid by August 31, 2010 and the remaining $12,822 was paid on December 15, 2011.

During February 2011, the Company received $6,950 in gross proceeds for 139,000 common shares subscribed at $0.05 per share. These shares were issued on April 18, 2012.

On November 24, 2011, the Company received $30,000 as subscription for 150,000 common shares at $0.20 per share. The shares were issued on December 7, 2011.

On May 4, 2012, the Company issued 100,000 common shares for gross proceeds of $2

0,000.

Item 2. Management's Discussion and Analysis or Plan of Operation.

FORWARD-LOOKING STATEMENTS

This quarterly report contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors", that may cause our or our industry's

actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in conformity with generally accepted accounting principles in the United States of America for interim financial statements. The following discussion should be read in conjunction with our financial statements and the related notes that appear elsewhere in this quarterly report.

As used in this quarterly report, the terms "we", "us", "our company", and "Jetblack" mean Jetblack Corp., unless otherwise indicated. All dollar amounts refer to US dollars unless otherwise indicated.

General

Our Business – General

We were incorporated on April 17, 2002, under the laws of the State of Nevada. We have commenced limited operations, and have generated revenue of $7,569 to date. We are still a development stage corporation. On January 30, 2007, we approved a nine (9) for one (1) forward stock split of our authorized, issued and outstanding shares of common stock. The Company amended its Articles of Incorporation by the filing of a Certificate of Change with the Nevada Secretary of State wherein it stated that it would issue nine shares for every one share of common stock issued and outstanding immediately prior to the effective date of the forward stock split. The change in the Articles of

Incorporation was effected with the Nevada Secretary of State on March 1, 2007. As a result, the authorized capital of our company increased from 25,000,000 to 225,000,000 shares of common stock with a par value of $0.001.

Effective March 15, 2010, the Company changed its name from Tortuga Mexican Imports Inc. to Jetblack Corp., by way of a merger with the Company’s wholly owned subsidiary Jetblack Corp., which was formed solely for the change of name.

Effective March 15, 2010, the Company effected a six (6) for one (1) new forward stock split of the Company’s authorized and issued and outstanding common stock. As a result, the Company’s authorized capital increased from 225,000,000 to 1,350,000,000 shares, and outstanding shares increased from 25,435,450 shares of common stock to 152,612,700 shares of common stock, all with a par value of $0.001. The stock split is presented retroactively in these financial statements.

On May 4, 2011, Nigel Farnsworth returned 86,327,600 of his common shares to treasury. As of July 20, 2012, there are 67,352,000

common shares of the Company issued and outstanding.

Until March 15, 2010

we had launched our e-commerce site on the Internet for the purpose of engaging in the business of selling jewelry and crafts online. Our website was located at

www.shoptortuga.com

. Our initial website was located at

www.tortuga-imports.com

.

After reviewing the competitive market place of jewelry and giving consideration to the influx of much cheaper jewelry goods from areas such as China and Indonesia, management decided it was in the best interest of the Company to change business focus. Management has decided to commence work on developing an online

reservation system to access numerous private jet aircraft, airports worldwide and a network of pre-approved, safety-checked operators. Management believes a strong market opportunity exists to develop such a business. Our name was changed to Jetblack Corp. to better reflect this change of business

focus.

Properties

Our offices are located at Suite 219-10654 82

nd

Avenue NW, Edmonton, Alberta T6E 2A7. Our office space is an office sharing arrangement being provided as an accommodation to us by a business associate of our former President, Ms. Avila.We are currently searching for new lease office and warehouse space. We will require a location that provides us with the space necessary for office administration. We anticipate locating a suitable facility in the near future. Our telephone number is (780) 710-9840.

History

From 1995 to 1997, Ms. Avila, our former President and director, traveled extensively throughout the country of Mexico. During this time, Ms. Avila came in contact with various producers of fine furniture, jewelry and Mexican crafts. Ms. Avila was impressed by the opportunity she saw to obtain exceptional Mexican furniture, jewelry and crafts and effect its reliable delivery to international buyers. Initially Ms. Avila was traveling throughout Mexico in pursuit of personal purchases. However, Ms. Avila soon realized that there was an opportunity to export these fine products abroad. Ms. Avila cultivated relationships and contacts with various producers

throughout Mexico.

On May 3, 2011, Vanessa Avila resigned as President, Secretary and Director of the Company. Effective May 3, 2011, Nigel Farnsworth was elected Director and appointed President, Secretary and Treasurer of the Company. Mr. Farnsworth is a graduate of The School of Business at The University of Exeter in Exeter, United Kingdom and has been involved with numerous business ventures in the both the United Kingdom and the United States. From 2005 to the present, Mr. Farnsworth has been a principal at Greenshoe Capital LLC.

We remain a development stage enterprise.

Current Business Operations

We have recently changed operations. We intend to develop an online reservation system to access to numerous private jet aircraft, airports worldwide and a network of pre-approved, safety-checked operators. We intend to develop a booking engine, which will provide real-time availability of small jets available for charter in certain areas and select the best option from the inventory of aircraft.

Products

For the period ended May 31, 2012 we did not have a product line. We are currently developing a booking engine, which will provide real-time availability of small jets available for charter in certain areas and select the best option from the inventory of aircraft.

Marketing, Advertising and Promotion

We intend to pursue strategic advertising and marketing campaigns. We intend to implement an aggressive online advertising and marketing campaign to increase awareness of our new name and business plan to acquire new customers through multiple channels, including traditional and online advertising, direct marketing and expansion and strengthening of strategic relationships. Initially, we will concentrate our efforts on the sale of private jet flight reservations on our e-commerce website which we have yet to complete. We will seek to promote its website and attract visitors to it by becoming predominant on major search engines and banner advertisements on highly trafficked web

sites that appeal to our target audience. In addition, we will promote our website and our products by conventional advertising and marketing.

Product Research and Development

We anticipate that we will expend approximately $20,000 on research and development over the twelve months ending May 31, 2013.

Employees

Currently there are no full time or part-time employees of our company. However, our president, Nigel Fransworth, is a consultant of our company. We do not expect an increase in the number of employees over the next 12 month period. If business is successful and we experience rapid growth, our current officers and directors may be required to hire new personnel to improve, implement and administer our operational, management, financial and accounting systems.

Purchase or Sale of Equipment

In addition to purchasing computer and office equipment necessary for operating our business, intend to purchase computer software to develop a booking engine, which will provide real-time availability of small jets available for charter in certain areas and select the best option from the inventory of aircraft. We also intend to purchase a new domain over the twelve months ending May 31, 2013.

Plan of Operations - Next 12 Months

We have commenced limited operations, and have generated revenue of $7,569 to date. We are still a development stage corporation.

We have recently changed operations and management. We intend to develop an online reservation system to access to numerous private jet aircraft, airports worldwide and a network of pre-approved, safety-checked operators. We intend to develop a booking engine, which will provide real-time availability of small jets available for charter in certain areas and select the best option from the inventory of aircraft.

Prior to this we launched our e-commerce site on the Internet for the purpose of engaging in the business of selling jewelry and crafts online. Our new website is located at

www.shoptortuga.com

. Our initial website was located at

www.tortuga-imports.com

.

Over the next twelve months we intend to use funds to develop our new reservation platform and website and for general and administrative expenditures, as follows:

Estimated Funding Required During the Next Twelve Months

|

General and Administrative

|

|

$

|

50,000

|

|

|

|

|

|

|

|

|

Operations

|

|

|

|

|

|

|

|

|

|

|

|

Website Development and Promotion

|

|

|

20,000

|

|

|

Total

|

|

$

|

70,000

|

|

Financial Condition, Liquidity and Capital Resources

Our principal capital resources have been through issuance of common stock and shareholder loans.

At May 31, 2012, there was a working capital of $19,096.

At May 31, 2012, our total current asset was cash of $26,564.

At May 31, 2012, our total current liabilities were $7,468.

Three months ended May 31, 2012 and May 31, 2011

For the three months ended May 31, 2012, we generated no revenue and incurred expenditures of $6,328 and posted losses of $6,328. For the three months ended May 31, 2011, we incurred expenditures of $2,556 and posted losses of $2,556. The principal components of the losses for the three months ended May 31, 2012, were administrative expenses and accounting and audit fees.

Operating expenses for the three months ending May 31, 2012 were $6,328 compared to operating expenses for the three months ended May 31, 2011 of $2,556. The increase in operating expenditures from 2011 to 2012 was due to increase in filing fees and administrative fees from 2011 to 2012.

Nine months ended May 31, 2012 and May 31, 2011

For the nine months ended May 31, 2012, we generated no revenue and incurred expenditures of $20,834 and posted losses of $20,834. For the nine months ended May 31, 2011, we incurred expenditures of $15,183 and posted losses of $15,183. From inception to May 31, 2012, we generated revenue of $7,569 and incurred losses of $176,752.

Operating expenses for the nine months ended May 31, 2012, were $20,834 compared to operating expenses for the nine months ended May 31, 2011 of $15,183. Operating expenses since inception to May 31, 2012, were $182,988. The increase in operating expenditures from 2011 to 2012 was due to increase in filing fees and administrative fees from 2011 to 2012.

We will require additional financing before we generate significant revenues. We intend to develop an online reservation system to access to numerous private jet aircraft, airports worldwide and a network of pre-approved, safety-checked operators. We intend to develop a booking engine, which will provide real-time availability of small jets available for charter in certain areas and select the best option from the inventory of aircraft.

We intend to raise the capital required through sales of our securities in secondary offerings or private placements. We have no agreements in place to do this at this time. We completed a financing in 2005 from which we raised $68,450 pursuant to an SB-2 registration statement, declared effective February 22, 2005, by selling 684,500 (pre-split) shares of common stock at a price of $0.10 per share. In October 2007, the Company received $15,000 for subscriptions for 450,000 shares of the Company’s common stock. In November 2008, the Company received $15,000 for subscriptions of 450,000 shares of the Company’s common stock. These shares were issued in December 2010.

On December 10, 2009 the Company issued 1,500,000 common shares for a subscription of $25,000. As of August 31, 2010, $12,178 was paid for the subscription and the remaining $12,822 paid on December 15, 2011. On December 10, 2010 the Company issued 227,900 shares at $0.05 per share for gross proceeds of $11,395. During February 2011, the Company received $6,950 in gross proceeds for 139,000 common shares subscribed at $0.05 per share. These shares were issued on April 18, 2012. On November 24, 2011, the Company received $30,000 from subscriptions for 150,000 common shares at $0.20 per share. The shares were issued on December 7, 2011. On May 4, 2012, the Company issued 100,000 common shares for gross proceeds of $20,000 at $0.20 per share. Management did not purchase shares in any of the foregoing transactions.

There are no assurances that we will be able to obtain additional funds required for our continued operations. In such event that we do not raise sufficient additional funds by secondary offering or private placement, we will consider alternative financing options, if any, or be forced to scale down or perhaps even cease our operations.

APPLICATION OF CRITICAL ACCOUNTING POLICIES

Our unaudited consolidated financial statements and accompanying notes have been prepared in conformity with generally accepted accounting principles in the United States of America for interim financial statements. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. These estimates and assumptions are affected by management's application of accounting policies. We believe that understanding the basis and nature of the estimates and assumptions involved with the following aspects of our financial statements is critical to an understanding of our financials.

Item 3.

Quantitative and Qualitative Disclosures About Market Risks

As a “smaller reporting company”, we are not required to provide the information under this Item 3.

Item 4. Controls and Procedures.

As required by Rule 13a-15 under the Exchange Act, we have carried out an evaluation of the effectiveness of the design and operation of our company's disclosure controls and procedures as of the end of the period covered by this quarterly report, being May 31, 2012. This evaluation was carried out under the supervision and with the participation of our company's management, including our company's President, Treasurer and Director (Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer). Based upon that evaluation, our company's President, Treasurer and Director (Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer)

concluded that our company's disclosure controls and procedures are effective as at the end of the period covered by this report. There have been no significant changes in our company's internal controls or in other factors, which could significantly affect internal controls subsequent to the date we carried out our evaluation.

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in our company's reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in our company's reports filed under the Exchange Act is accumulated and communicated to management, including our company's President, Treasurer and Director (Principal Executive Officer, Principal

Financial Officer and Principal Accounting Officer) as appropriate, to allow timely decisions regarding required disclosure.

There have been no changes in our internal controls over financial reporting during the most recently completed fiscal quarter that have materially affected or are reasonably likely to materially affect the Company’s internal control over financial reporting.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings.

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

Item 1A. Risk Factors

Much of the information included in this quarterly report includes or is based upon estimates, projections or other "forward-looking statements". Such forward-looking statements include any projections or estimates made by us and our management in connection with our business operations. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions, or other future performance suggested herein. We undertake no obligation to update

forward-looking statements to reflect events or circumstances occurring after the date of such statements.

Such estimates, projections or other "forward-looking statements" involve various risks and uncertainties as outlined below. We caution readers of this quarterly report that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other "forward-looking statements". In evaluating us, our business and any investment in our business, readers should carefully consider the following factors.

We may not be able to obtain the financing and capital required to maintain and grow our business.

We have incurred a net loss of $20,834 for the nine months ended May 31, 2012. As of May 31, 2012, we had an accumulated deficit of $176,752. There can be no assurance that we will generate significant revenues or achieve profitable operations. Our independent registered public accounting firm’s report on the August 31, 2011 financial statements included in our Form 10-K includes an explanatory paragraph which raises substantial doubt about our ability to continue as a going concern that our ability to continue our business is dependent upon our ability to obtain additional capital, among other things.

We are in the early stages of our growth and we have not earned significant revenue, which makes it difficult to evaluate whether we will operate profitably.

We are in the early stages of the growth of our company. As a result, we do not have a meaningful historical record of sales and revenues nor an established business track record. We have only recently begun to earn revenues.

Unanticipated problems, expenses and delays are frequently encountered in ramping up production and sales and developing new products, especially in the current stage of our business. Our ability to continue to successfully develop, produce and sell our products and to generate significant operating revenues will depend on our ability to, among other things, successfully market, distribute and sell our

products or enter into agreements with third parties to perform these functions on our behalf.

Given our limited operating history, lack of long-term sales history and other sources of revenue, there can be no assurance that we will be able to achieve any of these goals and develop a sufficiently large customer base to be profitable.

The future of our company will depend upon our ability to continue to obtain adequate orders for our products and prompt payment for our products. To the extent that we cannot achieve our plans and generate revenues which exceed expenses on a consistent basis and in a timely manner, our business, results of operations, financial condition and prospects could be materially adversely affected.

We will depend on third party providers to deliver our products in a timely manner and as such we are subject to delays which are out of our control and may lead to a loss of business.

Our product distribution will rely on third-party aircraft providers. Lack of availability and other interruptions may delay the timely delivery of customer orders, and customers may refuse to purchase our products because of this loss of convenience.

Because our director has a foreign addresses this may create potential difficulties relating to service of process in the event that you wish to serve her with legal documents.

Our current director and officer is not resident addresses in the United States. Because our officer and director has foreign addresses this may create potential difficulties relating to the service of legal or other documents on any of them in the event that you wish to serve them with legal documents. This is because the laws related to service of process may differ between Canada and the US. Similar difficulties could not be encountered in serving the company, proper, since our registered address is located in the United States at 880 - 50 West Liberty Street, Reno, Nevada, 89501.

Because the SEC imposes additional sales practice requirements on brokers who deal in our shares which are penny stocks, some brokers may be unwilling to trade them. This means that you may have difficulty in reselling your shares and may cause the price of the shares to decline.

Our shares qualify as penny stocks and are covered by Section 15(g) of the Securities Exchange Act of 1934 which imposes additional sales practice requirements on broker/dealers who sell our securities in this offering or in the aftermarket. For sales of our securities, the broker/dealer must make a special suitability determination and receive from you a written agreement prior to making a sale to you. Because of the imposition of the foregoing additional sales practices, it is possible that brokers will not want to make a market in our shares. This could prevent you from reselling your shares and may cause the price of the shares to decline.

We need to continue as a going concern if our business is to succeed, if we do not we will go out of business.

Our independent accountant's report to our audited consolidated financial statements for the year ended August 31, 2011 indicates that there are a number of factors that raise substantial doubt about our ability to continue as a going concern. Such factors identified in the report are our accumulated deficit since inception, our failure to attain profitable operations and our dependence upon adequate financing to pay our liabilities. If we are not able to continue as a going concern, it is likely investors will lose their investments.

The loss of Mr. Farnsworth or other key management personnel would have an adverse impact on our future development and could impair our ability to succeed.

Our performance is substantially dependent upon the expertise of our President, Mr. Nigel Farnsworth, and other key management personnel, and our ability to continue to hire and retain personnel. Mr. Farnsworth spends the majority of his working time working with our company. It may be difficult to find sufficiently qualified individuals to replace Mr. Farnsworth or other key management personnel if we were to lose any one or more of them. The loss of Mr. Farnsworth or any of our key management personnel could have a material adverse effect on our business, development, financial condition, and operating results.

We do not maintain “key person” life insurance on any of our directors or senior executive officers.

We do not expect to declare or pay any dividends.

We have not declared or paid any dividends on our common stock since our inception, and we do not anticipate paying any such dividends for the foreseeable future.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

None.

Item 3. Defaults Upon Senior Securities

None

Item 4. Mine Safety Disclosures

None

Item 5. Other Information

None.

Item 6. Exhibits.

Exhibits required by Item 601 of Regulation S-K

|

Exhibits

|

|

Description

|

|

|

|

|

|

3.1

|

|

Articles of Incorporation (incorporated by reference from our Registration Statement on Form SB-2, filed on February 4, 2003).

|

|

|

|

|

|

3.2

|

|

By-laws (incorporated by reference from our Registration Statement on Form SB-2, filed on February 4, 2003).

|

|

|

|

|

|

4.1

|

|

Specimen Stock Certificate (incorporated by reference from our Registration Statement on Form SB-2, filed on February 4, 2003).

|

|

|

|

|

|

31.1

|

|

Section 302 Certification

|

|

|

|

|

|

32.1

|

|

Section 906 Certification

|

|

101.INS **

|

|

XBRL Instance Document

|

|

|

|

|

|

101.SCH **

|

|

XBRL Taxonomy Extension Schema Document

|

|

|

|

|

|

101.CAL **

|

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

|

|

|

|

101.DEF **

|

|

XBRL Taxonomy Extension Definition Linkbase Document

|

|

|

|

|

|

101.LAB **

|

|

XBRL Taxonomy Extension Label Linkbase Document

|

|

|

|

|

|

101.PRE **

|

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

** XBRL (Extensible Business Reporting Language) information is furnished and not filed or a part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, is deemed not filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and otherwise is not subject to liability under these sections.

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

JETBLACK CORP.

|

|

|

|

|

|

|

|

Date

: July 20, 2012

|

By:

|

/s/ Nigel Farnsworth

|

|

|

|

|

Nigel Farnsworth, President, Treasurer, Chief Executive

Officer, Chief Financial Officer and Director (Principal

Executive Officer, Principal Financial Officer

and Principal Accounting Officer)

|

|

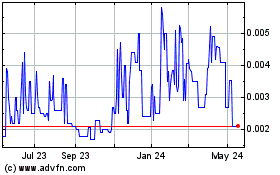

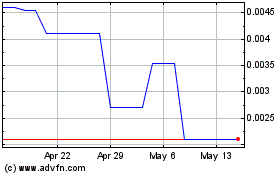

Jetblack (PK) (USOTC:JTBK)

Historical Stock Chart

From Nov 2024 to Dec 2024

Jetblack (PK) (USOTC:JTBK)

Historical Stock Chart

From Dec 2023 to Dec 2024