PC Market Records Fastest Year-Over-Year Growth in Two Decades, Gartner Says

April 12 2021 - 3:30PM

Dow Jones News

By Maria Armental

Personal computer sales rose at the fastest year-over-year rate

in two decades, extending the pandemic-related boost as remote work

and learning took hold and cementing a fundamental shift around

PCs, according to industry data.

Gartner Inc. said PC shipments rose to 69.9 million in the first

quarter, a 32% increase that was the fastest year-over-year growth

since the firm began tracking the PC market in 2000.

While Gartner doesn't include Chromebooks in its tally, it said

Chromebook shipments more than tripled in the first quarter, driven

by schools and other educational institutions in North America.

International Data Corp., meanwhile, pegged world-wide shipments

at 84 million. Similarly, Canalys said PC shipments reached 82.7

million, which it said were the highest first-quarter shipment

figures since 2012 and were driven in part by backlogs on orders

from 2020, particularly for notebooks.

Much of the difference in the tallies from the data providers

comes from how each company defines PCs.

Analysts, which point to a reversal of a yearslong phone-first

focus, say gaming, higher performance notebooks and education are

driving PC demand.

In 2020, PC sales registered their strongest growth in a decade,

underscoring a shift to computers from mobile devices during the

coronavirus pandemic, according to industry data.

IDC and Canalys pointed to continued component shortages and

logistics issues that have contributed to the higher average

selling prices.

Semiconductor shortages are affecting the supply chain once

again, "with shipment lead times for some PCs extending to as long

as four months," said Mikako Kitagawa, research director at

Gartner.

"While this may lead to lower shipment numbers, it is still

reasonable to conclude that PC demand could remain strong even

after stay-home restrictions ease," Ms. Kitagawa said. "Moving

forward, vendors and suppliers will be closely balancing the need

to meet underlying demand without creating excess inventory."

Lenovo Group Ltd. was ranked as the No. 1 vendor, followed by HP

Inc. and Dell Technologies Inc., which Gartner said had lost some

market share. Apple Inc. and Acer Inc. rounded out the top

five.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

April 12, 2021 16:15 ET (20:15 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

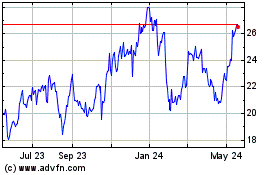

Lenovo (PK) (USOTC:LNVGY)

Historical Stock Chart

From Feb 2025 to Mar 2025

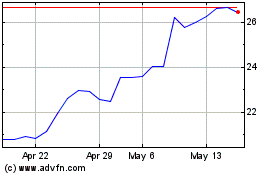

Lenovo (PK) (USOTC:LNVGY)

Historical Stock Chart

From Mar 2024 to Mar 2025