Current Report Filing (8-k)

October 06 2021 - 4:24PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported) October 1, 2021

|

Laredo

Oil, Inc.

|

|

(Exact

Name of Registrant as Specified in Charter)

|

|

|

|

Delaware

|

|

(State

or Other Jurisdiction of Incorporation)

|

|

333-153168

|

|

26-2435874

|

|

(Commission

File Number)

|

|

(IRS

Employer Identification No.)

|

2021

Guadalupe Street, Ste. 260

Austin, Texas

|

78705

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

|

Registrant’s

telephone number, including area code

|

(720)

295-1214

|

|

Not

Applicable

|

|

(Former

Name or Former Address, if Changed Since Last Report.)

|

|

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

|

|

o

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

o

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

o

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

o

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company o

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item

1.01 Entry into a Material Definitive Agreement.

On

October 1, 2021, Laredo Oil, Inc. (the “Company” or “Laredo”) entered into a Securities Purchase Agreement (the

“Securities Purchase Agreement”) with Geneva Roth Remark Holdings, Inc., an accredited investor (“Geneva Roth”),

pursuant to which the Company sold Geneva Roth a convertible promissory note in the principal amount of $114,125 (the “Geneva Roth

Note”). The Geneva Roth Note accrues interest at a rate of 8% per annum (22% upon the occurrence of an event of default) and has

a maturity date of October 1, 2022. The Company has received net proceeds of $100,000 in cash from Geneva Roth pursuant to the note.

The

Company has the right to prepay the Geneva Roth Note at any time during the first six months the note is outstanding at the rate of (a)

110% of the unpaid principal amount of the note plus interest, during the first 120 days the note is outstanding, and (b) 115% of the

unpaid principal amount of the note plus interest between days 121 and 180 after the issuance date of the note. The Geneva Roth Note

may not be prepaid after the 180th day following the issuance date, unless Geneva Roth agrees to such repayment and such terms.

Geneva

Roth may in its option, at any time beginning 180 days after the date of the note, convert the outstanding principal and interest on

the Geneva Roth Note into shares of Laredo common stock at a conversion price per share equal to 75% of the average of the three lowest

closing bid prices on the applicable electronic quotation system or applicable trading market as reported by a reliable reporting service

(the “Trading Prices”) of Laredo common stock during the 15 days trading days prior to the date of conversion. The Company

agreed to reserve a number of shares of its common stock which may be issuable upon conversion of the Geneva Roth Note at all times.

The

Geneva Roth Note provides for standard and customary events of default such as failing to timely make payments under the Geneva Roth

Note when due, the failure of the Company to timely comply with the Securities Exchange Act of 1934, as amended, reporting requirements

and the failure to maintain a listing on the OTC Markets. The Geneva Roth Note also contains customary positive and negative covenants.

The Geneva Roth Note includes penalties and damages payable to Geneva Roth in the event we do not comply with the terms of such note,

including in the event we do not issue shares of common stock to Geneva Roth upon conversion of the note within the time periods set

forth therein. Additionally, upon the occurrence of certain defaults, as described in the Geneva Roth Note, we are required to pay Geneva

Roth liquidated damages in addition to the amount owed under the Geneva Roth Note (including in some cases up to 300% of the amount of

the note).

At

no time may the Geneva Roth Note be converted into shares of Laredo common stock if such conversion would result in Geneva Roth and its

affiliates owning an aggregate of in excess of 4.99% of the then outstanding shares of Laredo common stock.

The

proceeds from the Geneva Roth Note can be used by the Company for general corporate purposes.

The

foregoing description is qualified in its entirety by reference to the Securities Purchase Agreement and the Geneva Roth Note, both of

which are filed as exhibits to this current report and is incorporated herein by reference

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth in Item 1.01 of this current report relating to the Geneva Roth Note is incorporated by reference in its

entirety into this Item 2.03.

Item

3.02 Unregistered Sales of Securities.

As

described above in Item 1.01, which disclosures are incorporated by reference in this Item 3.02 in their entirety, on October

1, 2021, the Company sold Geneva Roth the Geneva Roth Note in the principal amount of $114,125. The Geneva Roth Note is convertible into

our common stock at a discount to the trading price of our common stock as described in greater detail above. We claim an exemption from

registration for the issuance of such convertible notes pursuant to Section 4(a)(2) and/or Rule 506(b) of Regulation D of the Securities

Act of 1933, as amended (the “Securities Act”), since the foregoing issuances did not involve a public offering, the

recipients were (i) “accredited investors”; and/or (ii) had access to similar documentation and information as would

be required in a Registration Statement under the Securities Act, and the recipients acquired the securities for investment only and

not with a view towards, or for resale in connection with, the public sale or distribution thereof. The securities were offered without

any general solicitation by us or our representatives. No underwriters or agents were involved in the foregoing issuances and we paid

no underwriting discounts or commissions. The securities sold are subject to transfer restrictions, and the certificates evidencing the

securities contain an appropriate legend stating that such securities have not been registered under the Securities Act and may not be

offered or sold absent registration or pursuant to an exemption therefrom.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

LAREDO

OIL, INC.

|

|

|

|

|

|

|

|

Date:

October 6, 2021

|

By:

|

/s/

Bradley E. Sparks

|

|

|

|

|

Bradley

E. Sparks

|

|

|

|

|

Chief

Financial Officer and Treasurer

|

|

EXHIBIT

INDEX

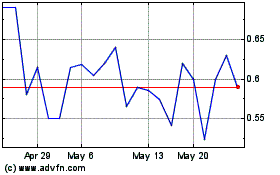

Laredo Oil (PK) (USOTC:LRDC)

Historical Stock Chart

From Jun 2024 to Jul 2024

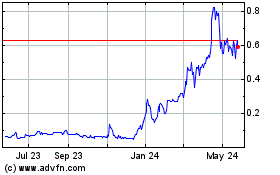

Laredo Oil (PK) (USOTC:LRDC)

Historical Stock Chart

From Jul 2023 to Jul 2024