Medinah Mining Chile Announces Formal Signing of an Option Agreement to Purchase All of the Shares of Compania Minera NUOCO M...

January 17 2015 - 8:42AM

Business Wire

Saturday, January 17, 2015, Medinah Minerals, Inc. (OTC PINK:

MDMN) reports that its 100% owned Chilean subsidiary, Medinah

Mining Chile (MMC) has now provided notice that the Option

Agreement among the parties, Medinah Mining Chile (MMC), Compania

Minera NUOCO Mining S.C.M. (NUOCO) and AURYN Mining Chile, SpA

(“AURYN”), has now been formally signed and notarized under Chilean

governing laws that grants to AURYN the ability to earn up to 85%

of the shares of Compania Minera NUOCO Mining S.C.M.

By Option Agreement, AURYN Mining Chile SpA can earn 60% of the

NUOCO Company shares by completing a minimum of 5,000 meters of

diamond drilling as well as conducting geophysical and geochemistry

work matters. AURYN, upon signing the Option Agreement, immediately

engaged the firm of Geodatas Chile, by contract, to commence an

airborne magnetometry survey and ground I.P. study of the NUOCO

property and abutting Altos de Lipangue claims.

Should AURYN continue to the secondary leg of the Option

Agreement they will invest a minimum of U.S. $2.5 million dollars

to conduct a full feasibility study in order to earn an additional

25% of the NUOCO Company shares. By completing these requirements

AURYN would then earn in 85% of the shares of the NUOCO

Company.

All costs for the Option Agreement will be the responsibility of

AURYN Mining Chile SpA, with no costs assigned to the NUOCO

Company. Should AURYN choose to vacate the Option Agreement the

NUOCO shares, materials and property claims would remain with

NUOCO. AURYN´s Option Agreement period expires on or before August

31, 2017.

If AURYN exercises the full terms of the purchase Option

Agreement as to the Altos de Lipangue, and then fulfills the terms

of the NUOCO Option Agreement, Medinah Mining Chile has the right

to purchase from the NUOCO Company the remaining 85% of the NUOCO

Company shares. Medinah Mining Chile, already an owner of 15% of

the NUOCO Company shares, would then aggregate 100% of the NUOCO

capital, which 85% would be earned in by AURYN through completing

the provisions of the Option Agreement.

In a separate notarized contract transaction, under notice by

AURYN, Medinah Mining Chile was required to make concessions to

comply with shortfall provisions in the Altos de Lipangue/AURYN

Option Agreement. In order to meet this obligation, NUOCO Company

provided title as to three of its Columbo claims to the benefit of

Medinah Mining Chile. The NUOCO Company maintains in excess of

2,000 Hectares after providing the required claims concessions.

For additional information please refer to the Medinah Minerals,

Inc. website at www.medinah-minerals.com.

Medinah Mining Chile

AURYN Mining Chile SpA

Compania Minera NUOCO Mining Chile S.C.M.

Vittal KarraChairman/PresidentMedinah Minerals, Inc.

South American Mining MediaRoberto de Silva,

702-727-8235Roberto@southamericanminingmedia.comhttp://www.medinah-minerals.com

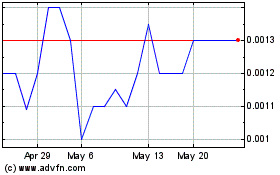

Medinah Mining (CE) (USOTC:MDMN)

Historical Stock Chart

From Nov 2024 to Dec 2024

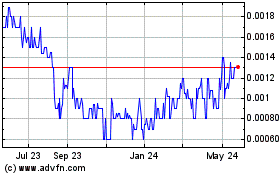

Medinah Mining (CE) (USOTC:MDMN)

Historical Stock Chart

From Dec 2023 to Dec 2024