Form 8-K - Current report

May 21 2024 - 9:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 17, 2024

MITESCO, INC.

(Exact Name of Registrant as Specified in Charter)

| Nevada | | 000-53601 | | 87-0496850 |

| (State or another jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| 505 Beachland Blvd., Suite 1377 Vero Beach, Florida 32963 |

| (Address of principal executive offices) (Zip Code) |

(844) 383-8689

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| N/A | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 3.03

|

Material Modification to Rights of Security Holders |

Mitesco, Inc, (“the Company”) has issued and outstanding 22,221 shares of Series F Preferred Shares as of March 31, 2024. The Company has implemented the following changes which will result in savings of over $220,000 per month in accrued interest expense.

The holders of approximately 54.90% of the Series F Preferred shares, having met in person on May 8, 2024, have granted consent to the following modification to the terms of the Series F Preferred, executed in writing by all parties on May 17, 2024:

Effective May 15, 2024 all dividends, and any obligation to pay dividends shall cease. Any dividends accrued until May 15, 2024 shall be issued as noted in the original certificate of designation, a copy of which can be found in these filings with the SEC:

The original filings in Delaware:

https://www.sec.gov/ix?doc=/Archives/edgar/data/802257/000118518523000367/mitesco20230417_8k.htm

Same detail as noted when the Company redomiciled to Nevada in 2023:

https://www.sec.gov/ix?doc=/Archives/edgar/data/802257/000118518523001074/mitesco20231016_8k.htm

The original dividend policy can be found here:

4. Dividends. Holders of shares of the Series F Preferred Stock are entitled to receive, on each Dividend Payment Date, whether or not declared, set aside for payment or otherwise authorized by the Board of Directors, payment-in-kind dividends payable to the holder(s) of Series F Preferred Stock only in additional shares of Series F Preferred Stock (“PIK Dividends”) at the quarterly rate of three-hundredths (3/100th) of one share per outstanding Series F Share (equivalent to one-quarter (1/4) of 12% per annum per Series F Share) (the “Quarterly Dividend Rate”). Such PIK Dividends: (i) shall accrue on the outstanding Series F Preferred Shares commencing on the Original Issue Date to the first Dividend Payment Date thereafter (the “Initial Dividend Payment Date”) and, thereafter, on each Dividend Payment Date that Series F Shares are outstanding to the next following Dividend Payment Date, and (ii) shall be payable to the holders of record of outstanding Series F Shares as they appear on the relevant Dividend Record Date(s); provided that (x) PIK Dividends accrued and payable on the Initial Dividend Payment Date shall be prorated by multiplying the Quarterly Dividend Rate by a fraction, the numerator of which is the number of days from the Original Issue Date to the Initial Dividend Payment Date and the denominator of which is ninety (90), and (y) PIK Dividends accrued and payable on any day that is not a Dividend Payment Date (by reason of Conversion, repurchase or distribution of assets upon liquidation, dissolution or winding up of the Corporation) shall be prorated by multiplying the Quarterly Dividend Rate by a fraction, the numerator of which is the number of days from the immediately preceding Dividend Payment to the date of Conversion, repurchase or distribution of assets (as the case may be). For the avoidance of doubt, all Series F Share issued or issuable as PIK Dividends paid or required to be paid on any Dividend Payment Date shall thereafter for all purposes hereunder constitute outstanding Series F Shares and shall thereupon (without limiting any of the other rights, powers, privileges and preferences of the Series F Preferred Stock) accrue PIK Dividends hereunder.

The provision allowing a change in the terms with the written consent of 50.1% of the shareholders is here:

15. Amendment. This Certificate of Designations or any provision hereof may be modified or amended, or the provisions hereof waived with the written consent of the Corporation and the holders of at least 50.1%of the outstanding Series F Shares at the time of the waiver. No waiver shall be effective unless it is in writing and signed by an authorized representative of the waiving party.

As of March 31, 2024 there were 20,057 shares of Series F Preferred stock outstanding. The holders authorizing this change are here:

|

HOLDER

|

SERIES F SHARES HELD

|

PERCENT OF TOTAL

|

|

CAVALRY

|

6,363

|

29%

|

|

MERCER

|

3,202

|

14%

|

|

AJB

|

2,662

|

12%

|

| |

TOTAL

|

55%

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: May 21, 2024

|

MITESCO, INC.

|

|

| |

|

|

|

| |

|

|

|

| |

By:

|

/s/ Mack Leath

|

|

| |

|

Mack Leath

|

|

| |

|

Chairman and CEO

|

|

false

0000802257

true

0000802257

2024-05-17

2024-05-17

Exhibit 3.1

MEMO DIRECTING CHANGE IN THE TERMS OF THE MITESCO, INC. SERIES F PREFFERED STOCK

Mitesco, Inc, (“the Company”) has issued and outstanding 22,221 shares of Series F Preferred Shares as of March 31, 2024. The holders of approximately 54.90% of the Series F Preferred shares, having met in person on May 8, 2024, have granted consent to the following modification to the terms of the Series F Preferred:

Effective May 15, 2024 all dividends, and any obligation to pay dividends shall cease. Any dividends accrued until May 15, 2024 shall be issued as noted in the original certificate of designation, a copy of which can be found in these filings with the SEC:

Original filings in Delaware:

https://www.sec.gov/ix?doc=/Archives/edgar/data/802257/000118518523000367/mitesco20230417_8k.htm

Same detail as noted when the Company redomiciled to Nevada:

https://www.sec.gov/ix?doc=/Archives/edgar/data/802257/000118518523001074/mitesco20231016_8k.htm

The original dividend policy can be found here:

4. Dividends. Holders of shares of the Series F Preferred Stock are entitled to receive, on each Dividend Payment Date, whether or not declared, set aside for payment or otherwise authorized by the Board of Directors, payment-in-kind dividends payable to the holder(s) of Series F Preferred Stock only in additional shares of Series F Preferred Stock (“PIK Dividends”) at the quarterly rate of three-hundredths (3/100th) of one share per outstanding Series F Share (equivalent to one-quarter (1/4) of 12% per annum per Series F Share) (the “Quarterly Dividend Rate”). Such PIK Dividends: (i) shall accrue on the outstanding Series F Preferred Shares commencing on the Original Issue Date to the first Dividend Payment Date thereafter (the “Initial Dividend Payment Date”) and, thereafter, on each Dividend Payment Date that Series F Shares are outstanding to the next following Dividend Payment Date, and (ii) shall be payable to the holders of record of outstanding Series F Shares as they appear on the relevant Dividend Record Date(s); provided that (x) PIK Dividends accrued and payable on the Initial Dividend Payment Date shall be prorated by multiplying the Quarterly Dividend Rate by a fraction, the numerator of which is the number of days from the Original Issue Date to the Initial Dividend Payment Date and the denominator of which is ninety (90), and (y) PIK Dividends accrued and payable on any day that is not a Dividend Payment Date (by reason of Conversion, repurchase or distribution of assets upon liquidation, dissolution or winding up of the Corporation) shall be prorated by multiplying the Quarterly Dividend Rate by a fraction, the numerator of which is the number of days from the immediately preceding Dividend Payment to the date of Conversion, repurchase or distribution of assets (as the case may be). For the avoidance of doubt, all Series F Share issued or issuable as PIK Dividends paid or required to be paid on any Dividend Payment Date shall thereafter for all purposes hereunder constitute outstanding Series F Shares and shall thereupon (without limiting any of the other rights, powers, privileges and preferences of the Series F Preferred Stock) accrue PIK Dividends hereunder.

The provision allowing a change in the terms with the written consent of 50.1% of the shareholders is here:

15. Amendment. This Certificate of Designations or any provision hereof may be modified or amended, or the provisions hereof waived with the written consent of the Corporation and the holders of at least 50.1%of the outstanding Series F Shares at the time of the waiver. No waiver shall be effective unless it is in writing and signed by an authorized representative of the waiving party.

As of March 31, 2024 there were 20,057 shares of Series F Preferred stock outstanding. The holders authorizing this change are here:

|

HOLDER

|

SERIES F SHARES HELD

|

PERCENT OF TOTAL

|

|

CAVALRY

|

6,363

|

29%

|

|

MERCER

|

3,202

|

14%

|

|

AJB

|

2,662

|

12%

|

| |

TOTAL

|

55%

|

Therefore, effective this 15th day of May, 2024 the above described change shall be made effective.

Signed by Holders: Approved by the Board of Directors with a unanimous written consent:

| |

|

Cavalry

|

|

|

Mack Leath, Chairman

|

| |

|

|

|

|

|

| |

|

Mercer

|

|

|

John Mitchell, Treasurer

|

| |

|

|

|

|

|

| |

|

AJB

|

|

|

Dr. Jordan Balencic

|

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

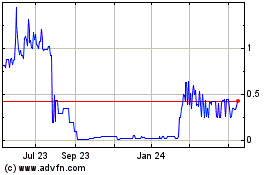

Mitesco (PK) (USOTC:MITI)

Historical Stock Chart

From Dec 2024 to Jan 2025

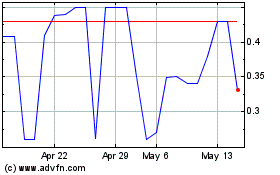

Mitesco (PK) (USOTC:MITI)

Historical Stock Chart

From Jan 2024 to Jan 2025