UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

June 2024

Commission File Number 0-26005

MICROMEM TECHNOLOGIES INC.

121 Richmond Street West, Suite 602, Toronto, ON M5H 2K1

[Indicate by checkmark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.]

Form 20-F [X] Form 40-F [ ]

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.]

Yes [ ] No [X]

[If "Yes" is marked, indicate below the file number assigned to the registrant in connection with rule 12g3-2(b): N/A

This report on Form 6-K is hereby incorporated by reference in the registration statement on Form F-3 (Registration No. 333-134309) of Micromem Technologies Inc. and in the prospectus contained therein, and this report on Form 6-K shall be deemed a part of such registration statement from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished by Micromem Technologies Inc. under the Securities Act of 1933 or the Securities Exchange Act of 1934.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

| |

MICROMEM TECHNOLOGIES INC.

|

| |

|

|

|

By: /s/ Joseph Fuda |

| Date: June 12, 2024 |

Name: Joseph Fuda |

|

|

Title: Chief Executive Officer |

Exhibit Index

Micromem Technologies Inc.

Unaudited Condensed Interim Consolidated Financial Statements

For the three and six months ended April 30, 2024 and 2023

(Expressed in United States Dollars)

Micromem Technologies Inc.

Unaudited Condensed Interim Consolidated Financial Statements

For the three and six months ended April 30, 2024 and 2023

(Expressed in United States Dollars)

Contents

Micromem Technologies Inc.

Unaudited Condensed Interim Consolidated Financial Statements

Notice of no auditor review of the condensed interim consolidated financial statements

Under National Instrument 51-102, Part 4, subsection 4.3(3)(a), if an auditor has not performed a review of the condensed interim consolidated financial statements, they must be accompanied by a notice indicating that the condensed interim consolidated financial statements have not been reviewed by an auditor.

The accompanying unaudited condensed interim consolidated financial statements of Micromem Technologies Inc. (the "Company") have been prepared by and are the responsibility of the Company's management and approved by the Board of Directors.

The Company's independent auditor has not performed a review of these condensed interim consolidated financial statements in accordance with the standards established by the Chartered Professional Accountants of Canada, for a review of condensed interim consolidated financial statements by an entity's auditor.

June 12, 2024

Micromem Technologies Inc.

Unaudited Condensed Interim Consolidated Statements of Financial Position

As at April 30, 2024 and October 31, 2023

(Expressed in United States dollars)

| |

|

|

|

|

As at |

|

|

As at |

|

| |

|

Notes |

|

|

April 30, 2024 |

|

|

October 31, 2023 |

|

| |

|

|

|

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

|

| Current |

|

|

|

|

|

|

|

|

|

| Cash |

|

20(a)(c) |

|

$ |

17,659 |

|

$ |

31,584 |

|

| Prepaid expenses and other receivables |

|

18 (d) |

|

|

91,374 |

|

|

103,999 |

|

| Total current assets |

|

|

|

|

109,033 |

|

|

135,583 |

|

| Property and equipment |

|

5 |

|

|

24,359 |

|

|

32,767 |

|

| Total assets |

|

|

|

$ |

133,392 |

|

$ |

168,350 |

|

| |

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

|

| Current |

|

|

|

|

|

|

|

|

|

| Trade payables and other liabilities |

|

20(a)(d) |

|

$ |

317,027 |

|

$ |

209,285 |

|

| Deposit liability |

|

18 (d) |

|

|

63,000 |

|

|

63,000 |

|

| Current lease liability |

|

6 |

|

|

18,196 |

|

|

17,036 |

|

| Debenture payable |

|

7 |

|

|

37,852 |

|

|

37,509 |

|

| Convertible debentures |

|

9 |

|

|

3,799,568 |

|

|

3,548,059 |

|

| Derivative liabilities |

|

9 |

|

|

299,677 |

|

|

1,079,393 |

|

| Total current liabilities |

|

|

|

|

4,535,320 |

|

|

4,954,282 |

|

| Non-current lease liability |

|

6 |

|

|

2,773 |

|

|

12,018 |

|

| Long-term loan |

|

8 |

|

|

27,379 |

|

|

43,254 |

|

| Total liabilities |

|

|

|

|

4,565,472 |

|

|

5,009,554 |

|

| |

|

|

|

|

|

|

|

|

|

| Shareholders' Deficiency |

|

|

|

|

|

|

|

|

|

| Share capital |

|

10 |

|

|

90,845,449 |

|

|

90,471,712 |

|

| Contributed surplus |

|

|

|

|

24,944,377 |

|

|

24,868,843 |

|

| Equity component of convertible debentures |

|

9 |

|

|

3,075,749 |

|

|

3,220,473 |

|

| Accumulated deficit |

|

|

|

|

(123,297,655 |

) |

|

(123,402,232 |

) |

| Total shareholders' deficiency |

|

|

|

|

(4,432,080 |

) |

|

(4,841,204 |

) |

| Total liabilities and shareholders' deficiency |

|

|

|

$ |

133,392 |

|

$ |

168,350 |

|

| |

|

|

|

|

|

|

|

|

|

| Going concern |

|

2 |

|

|

|

|

|

|

|

| Contingencies |

|

18 |

|

|

|

|

|

|

|

| Subsequent events |

|

21 |

|

|

|

|

|

|

|

The accompanying notes are an integral part of these unaudited condensed interim consolidated financial statements.

|

Approved on behalf of the Board of Directors:

|

|

|

| |

|

|

|

"Joseph Fuda"

|

|

"Alex Dey"

|

|

Director

|

|

Director

|

Micromem Technologies Inc.

Unaudited Condensed Interim Consolidated Statements of Operations and Comprehensive Income (Loss)

For the three and six months ended April 30, 2024 and 2023

(Expressed in United States dollars)

| |

|

|

|

Three months ended April 30, |

|

|

Six months ended April 30, |

|

| |

Notes |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| General and administrative |

15(a) |

|

$ |

31,791 |

|

$ |

45,544 |

|

$ |

62,367 |

|

$ |

71,958 |

|

| Professional, other fees and salaries |

15(b) |

|

|

85,387 |

|

|

115,132 |

|

|

202,723 |

|

|

196,302 |

|

| Stock-based compensation |

12 |

|

|

- |

|

|

145,714 |

|

|

6,517 |

|

|

151,406 |

|

| Travel and entertainment |

|

|

|

4,865 |

|

|

16,055 |

|

|

11,441 |

|

|

23,860 |

|

| Depreciation of property and equipment |

5 |

|

|

4,110 |

|

|

4,076 |

|

|

8,260 |

|

|

8,171 |

|

| Foreign exchange gain |

|

|

|

(183,528 |

) |

|

(140,883 |

) |

|

(85,301 |

) |

|

(82,379 |

) |

| Total operating expenses |

|

|

|

(57,375 |

) |

|

185,638 |

|

|

206,007 |

|

|

369,318 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accretion expense |

8,9 |

|

|

77,193 |

|

|

74,289 |

|

|

108,830 |

|

|

154,051 |

|

| Interest expense on convertible debt |

9 |

|

|

150,438 |

|

|

137,204 |

|

|

290,846 |

|

|

268,340 |

|

| Other finance expenses |

6,7 |

|

|

4,524 |

|

|

31,499 |

|

|

8,239 |

|

|

34,751 |

|

| (Gain) loss on revaluation of derivative liabilities |

9 |

|

|

(921,661 |

) |

|

1,583,394 |

|

|

(336,761 |

) |

|

1,278,545 |

|

| Loss on conversion of convertible debentures |

9 |

|

|

5,875 |

|

|

12,341 |

|

|

16,220 |

|

|

21,120 |

|

| (Gain) loss on repayment of convertible debentures |

9 |

|

|

(2,539 |

) |

|

(12,715 |

) |

|

49,124 |

|

|

(18,382 |

) |

| (Gain) loss on extinguishment of convertible debentures |

9 |

|

|

(702,629 |

) |

|

1,884,384 |

|

|

(368,167 |

) |

|

2,004,621 |

|

| Total other expenses |

|

|

|

(1,388,799 |

) |

|

3,710,396 |

|

|

(231,669 |

) |

|

3,743,046 |

|

| Income (loss) before income tax provision |

|

|

|

1,446,174 |

|

|

(3,896,034 |

) |

|

25,662 |

|

|

(4,112,364 |

) |

| Income tax provision |

14 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| Net income (loss) and comprehensive income (loss) |

|

|

$ |

1,446,174 |

|

$ |

(3,896,034 |

) |

$ |

25,662 |

|

$ |

(4,112,364 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

13 |

|

$ |

1,446,174 |

|

$ |

(3,896,034 |

) |

$ |

25,662 |

|

$ |

(4,112,364 |

) |

| Diluted |

13 |

|

$ |

1,529,192 |

|

$ |

(3,896,034 |

) |

$ |

185,611 |

|

$ |

(4,112,364 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of outstanding shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

13 |

|

|

517,868,552 |

|

|

474,546,633 |

|

|

515,705,432 |

|

|

474,546,633 |

|

| Diluted |

13 |

|

|

622,552,842 |

|

|

474,546,633 |

|

|

612,760,518 |

|

|

474,546,633 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

13 |

|

$ |

- |

|

$ |

(0.01 |

) |

$ |

- |

|

$ |

(0.01 |

) |

| Diluted |

13 |

|

$ |

- |

|

$ |

(0.01 |

) |

$ |

- |

|

$ |

(0.01 |

) |

The accompanying notes are an integral part of these unaudited condensed interim consolidated financial statements.

Micromem Technologies Inc.

Unaudited Condensed Interim Consolidated Statements of Changes in Shareholders' Deficiency

For the six months ended April 30, 2024 and 2023

(Expressed in United States dollars)

| |

|

|

|

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

component of |

|

|

|

|

|

|

|

| |

|

|

|

Number of |

|

|

|

|

|

Contributed |

|

|

convertible |

|

|

Accumulated |

|

|

|

|

| |

Notes |

|

|

shares |

|

|

Share capital |

|

|

surplus |

|

|

debentures |

|

|

deficit |

|

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at November 1, 2023 |

|

|

|

510,368,838 |

|

$ |

90,471,712 |

|

$ |

24,868,843 |

|

$ |

3,220,473 |

|

$ |

(123,402,232 |

) |

$ |

(4,841,204 |

) |

| Private placements of shares for cash |

10 |

|

|

3,716,007 |

|

|

175,858 |

|

|

- |

|

|

- |

|

|

- |

|

|

175,858 |

|

| Share issuance costs |

10 |

|

|

- |

|

|

(7,988 |

) |

|

- |

|

|

- |

|

|

- |

|

|

(7,988 |

) |

| Broker warrants issued |

10,11 |

|

|

- |

|

|

(3,208 |

) |

|

3,208 |

|

|

- |

|

|

- |

|

|

- |

|

| Expiry of options |

12 |

|

|

- |

|

|

- |

|

|

(78,915 |

) |

|

- |

|

|

78,915 |

|

|

- |

|

| Convertible debentures converted into common shares |

9 |

|

|

6,428,333 |

|

|

209,075 |

|

|

- |

|

|

- |

|

|

- |

|

|

209,075 |

|

| Expiry of convertible debenture conversion option |

9 |

|

|

- |

|

|

- |

|

|

2,323,745 |

|

|

(2,323,745 |

) |

|

- |

|

|

- |

|

| Renewal of convertible debentures |

9 |

|

|

- |

|

|

- |

|

|

(2,179,021 |

) |

|

2,179,021 |

|

|

- |

|

|

- |

|

| Stock-based compensation |

12 |

|

|

- |

|

|

- |

|

|

6,517 |

|

|

- |

|

|

- |

|

|

6,517 |

|

| Net income and comprehensive income for the period |

|

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

25,662 |

|

|

25,662 |

|

| Balance at April 30, 2024 |

|

|

|

520,513,178 |

|

|

90,845,449 |

|

$ |

24,944,377 |

|

$ |

3,075,749 |

|

$ |

(123,297,655 |

) |

$ |

(4,432,080 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at November 1, 2022 |

|

|

|

467,607,678 |

|

$ |

87,784,725 |

|

$ |

27,459,730 |

|

$ |

793,140 |

|

$ |

(120,785,595 |

) |

$ |

(4,748,000 |

) |

| Private placements of shares for cash |

10 |

|

|

8,660,000 |

|

|

454,377 |

|

|

- |

|

|

- |

|

|

- |

|

|

454,377 |

|

| Subscriptions for private placements |

10 |

|

|

379,500 |

|

|

33,618 |

|

|

- |

|

|

- |

|

|

- |

|

|

33,618 |

|

| Convertible debentures converted into common shares |

9 |

|

|

20,811,859 |

|

|

1,385,724 |

|

|

- |

|

|

(77,052 |

) |

|

- |

|

|

1,308,672 |

|

| Exercise of options |

12 |

|

|

750,000 |

|

|

83,756 |

|

|

(45,000 |

) |

|

- |

|

|

- |

|

|

38,756 |

|

| Expiry of options |

12 |

|

|

- |

|

|

- |

|

|

(6,000 |

) |

|

- |

|

|

6,000 |

|

|

- |

|

| Expiry of convertible debenture conversion option |

9 |

|

|

- |

|

|

- |

|

|

793,140 |

|

|

(793,140 |

) |

|

- |

|

|

- |

|

| Renewal of convertible debentures |

9 |

|

|

- |

|

|

- |

|

|

(1,150,833 |

) |

|

1,150,833 |

|

|

- |

|

|

- |

|

| Stock-based compensation |

12 |

|

|

- |

|

|

- |

|

|

151,406 |

|

|

- |

|

|

- |

|

|

151,406 |

|

| Net loss and comprehensive loss for the period |

|

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(4,112,364 |

) |

|

(4,112,364 |

) |

| Balance at April 30, 2023 |

|

|

|

498,209,037 |

|

$ |

89,742,200 |

|

$ |

27,202,443 |

|

$ |

1,073,781 |

|

$ |

(124,891,959 |

) |

$ |

(6,873,535 |

) |

The accompanying notes are an integral part of these unaudited condensed interim consolidated financial statements.

Micromem Technologies Inc.

Unaudited Condensed Interim Consolidated Statements of Cash Flows

For the six months ended April 30, 2024 and 2023

(Expressed in United States dollars)

| |

|

|

|

Six months ended April 30 |

|

| |

Notes |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

| Operating activities |

|

|

|

|

|

|

|

|

| Net income/(loss) |

|

|

$ |

25,662 |

|

$ |

(4,112,364 |

) |

| Items not affecting cash: |

|

|

|

|

|

|

|

|

| Depreciation of property and equipment |

5 |

|

|

8,260 |

|

|

8,171 |

|

| Government grant |

8 |

|

|

(17,868 |

) |

|

- |

|

| Accretion expense |

8, 9 |

|

|

108,830 |

|

|

154,051 |

|

| Accrued interest on convertible debentures |

9,16 |

|

|

250,171 |

|

|

232,887 |

|

| Stock-based compensation |

12 |

|

|

6,517 |

|

|

151,406 |

|

| Loss on conversion of convertible debentures |

9,16 |

|

|

16,220 |

|

|

21,120 |

|

| Loss (gain) on repayment of convertible debentures |

9,16 |

|

|

49,124 |

|

|

(18,382 |

) |

| (Gain) loss on revaluation of derivative liabilities |

9,16 |

|

|

(336,761 |

) |

|

1,278,545 |

|

| (Gain) loss on extinguishment of convertible debentures |

9,16 |

|

|

(431,430 |

) |

|

2,004,621 |

|

| Foreign exchange gain |

|

|

|

(85,498 |

) |

|

(86,014 |

) |

| |

|

|

|

(406,773 |

) |

|

(365,959 |

) |

| |

|

|

|

|

|

|

|

|

| Net changes in non-cash working capital: |

|

|

|

|

|

|

|

|

| Prepaid expenses and other receivables |

|

|

|

12,625 |

|

|

(2,504 |

) |

| Trade payables and other liabilities |

|

|

|

107,742 |

|

|

(142,531 |

) |

| Cash flows used in operating activities |

|

|

|

(286,406 |

) |

|

(510,994 |

) |

| |

|

|

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

| Principal payments on lease liability |

6 |

|

|

(8,473 |

) |

|

(7,559 |

) |

| Private placements of shares for cash |

10 |

|

|

175,858 |

|

|

454,377 |

|

| Exercise of options |

12 |

|

|

- |

|

|

38,756 |

|

| Share issuance costs |

10 |

|

|

(7,988 |

) |

|

- |

|

| Proceeds from issuance of convertible debentures |

16 |

|

|

291,210 |

|

|

274,600 |

|

| Repayments of convertible debentures |

16 |

|

|

(178,126 |

) |

|

(66,500 |

) |

| Cash flows provided by financing activities |

|

|

|

272,481 |

|

|

693,674 |

|

| |

|

|

|

|

|

|

|

|

| Net change in cash |

|

|

|

(13,925 |

) |

|

182,680 |

|

| Cash - beginning of period |

|

|

|

31,584 |

|

|

33,227 |

|

| Cash - end of period |

|

|

$ |

17,659 |

|

$ |

215,907 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental cash flow information |

|

|

|

|

|

|

|

|

| Repayment penalties (classified in operating activities) |

|

|

$ |

63,263 |

|

$ |

- |

|

| Interest paid (classified in operating activities) |

9 |

|

$ |

37,240 |

|

$ |

30,799 |

|

| Interest converted (classified in operating activities) |

9 |

|

$ |

3,435 |

|

$ |

4,654 |

|

| Interest paid on non-convertible debt (classified in operating activities) |

7 |

|

$ |

4,561 |

|

$ |

4,578 |

|

| Interest paid on lease liability (classified in operating activities) |

6 |

|

$ |

1,109 |

|

$ |

1,832 |

|

| Private placement of shares for receivable |

|

|

$ |

- |

|

$ |

33,618 |

|

| Carrying amount of convertible debentures converted into common shares |

9 |

|

$ |

209,075 |

|

$ |

1,385,724 |

|

The accompanying notes are an integral part of these unaudited condensed interim consolidated financial statements.

1. Reporting entity and nature of business

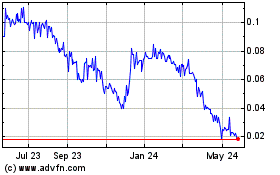

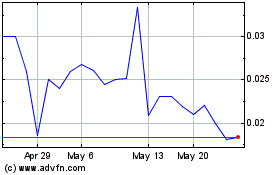

Micromem Technologies Inc. ("Micromem" or the "Company") is incorporated under the laws of the Province of Ontario, Canada. Micromem is a publicly traded company with its head office located at 121 Richmond Street West, Suite 602, Toronto, Ontario, Canada. The Company's common shares are currently listed on the Canadian Securities Exchange under the trading symbol "MRM" and on the Over the Counter Venture Market under the trading symbol "MMTIF".

The Company develops, based upon proprietary technology, customized sensor applications for companies (referred to as "Development Partners") operating internationally in various industry segments. The Company has not generated commercial revenues through April 30, 2024 and is devoting substantially all its efforts to securing commercial revenue opportunities.

2. Going concern

These unaudited condensed interim consolidated financial statements have been prepared with the assumption that the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future.

There are material uncertainties related to conditions and events that cast substantial doubt about the Company's ability to continue as a going concern and ultimately on the appropriateness of the use of the accounting principles applicable to a going concern. During the six months ended April 30, 2024, the Company reported a net income (loss) and comprehensive income (loss) of $25,662 (2023 - ($4,112,364)) and negative cash flow from operations of $286,406 (2023 - $510,994). The Company's working capital deficiency as at April 30, 2024 was $4,426,287 (October 31, 2023 - $4,818,699).

The Company's success depends on the profitable commercialization of its proprietary sensor technology. Based upon its current operating and financial plans, management of the Company believes that it will have sufficient access to financial resources to fund the Company's planned operations through the next twelve months; however, the ability of the Company to continue as a going concern is dependent upon its ability to secure additional financing and/or to profitably commercialize its technology. There is no assurance that the Company will be successful in the profitable commercialization of its technology, or will be able to secure the necessary additional financing. These unaudited condensed interim consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result from the possible inability of the Company to continue as a going concern. If the going concern assumption was not appropriate for these unaudited condensed interim consolidated financial statements then adjustments could be necessary to the carrying value of assets and liabilities, the reported expenses and the statement of financial position classifications used; in such cases, these adjustments could be material.

3. Basis of presentation

These unaudited condensed interim consolidated financial statements for the three and six months ended April 30, 2024 and 2023 have been prepared in accordance with International Accounting Standard ("IAS") 34 Interim Financial Reporting. The accounting policies and methods of computation adopted in the preparation of the unaudited condensed interim consolidated financial statements are consistent with those followed in the preparation of the Company's audited annual consolidated financial statements for the year ended October 31, 2023. The Company has not early adopted any standard, interpretation or amendment that has been issued but is not yet effective.

These unaudited condensed interim consolidated financial statements were authorized for issuance and release by the Company's Board of Directors on June 12, 2024.

(a) Basis of consolidation

These unaudited condensed interim consolidated financial statements include the accounts of Micromem Technologies Inc. and its subsidiaries. All intercompany transactions and balances have been eliminated upon consolidation.

The Company's wholly-owned subsidiaries include:

|

(i)

|

Inactive

|

|

Domiciled in

|

|

|

Micromem Applied Sensors Technology Inc. ("MAST")

|

|

United States

|

|

|

707019 Canada Inc.

|

|

Canada

|

|

|

Memtech International Inc.

|

|

Bahamas

|

|

|

Memtech International (USA) Inc., Pageant Technologies (USA) Inc.

|

|

United States

|

|

|

Pageant Technologies Inc., Micromem Holdings (Barbados) Inc.

|

|

Barbados

|

3. Basis of presentation (continued)

(b) Basis of measurement

These unaudited condensed interim consolidated financial statements have been prepared on the historical cost basis, except for financial instruments designated at fair value through profit and loss which are measured at their fair value.

(c) Functional and presentation currency

These unaudited condensed interim consolidated financial statements are presented in United States dollars ("USD"), which is the functional currency of the Company and all of its subsidiaries.

(d) Use of estimates and judgments

The preparation of these unaudited condensed consolidated interim financial statements in conformity with IFRS requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the unaudited condensed interim consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. These estimates are reviewed periodically and adjustments are made as appropriate in the reporting period they become known. Items for which actual results may differ materially from these estimates are described in the following section.

(i) Fair value of options and conversion features

The Company makes estimates and utilizes assumptions in determining the fair value for stock options and conversion features based on the application of the Black-Scholes option pricing model or the binomial option pricing model, depending on the circumstances. These pricing models require management to make various assumptions and estimates that are susceptible to uncertainty, including the volatility of the share price, expected dividend yield, expected term, risk-free interest rate, and exercise price in the binomial option pricing model.

(ii) Useful lives and recoverability of long-lived assets

Long-lived assets consist of property and equipment and patents. Amortization is dependent upon estimates of useful lives and impairment is dependent upon estimates of recoverable amounts. These are determined through the exercise of judgment and are dependent upon estimates that take into account factors such as economic and market conditions, frequency of use, anticipated changes in laws, and technological improvements.

(iii) Income taxes

Income taxes and tax exposures recognized in the unaudited condensed interim consolidated financial statements reflect management's best estimate of the outcome based on facts known at the reporting date. When the Company anticipates a future income tax payment based on its estimates, it recognizes a liability. The difference between the expected amount and the final tax outcome has an impact on current and deferred taxes when the Company becomes aware of this difference.

When the Company incurs losses for income tax purposes, it assesses the probability of taxable income being available in the future, based on budgeted forecasts. These forecasts are adjusted for certain non-taxable income and expenses and specific rules on the use of unused credits and tax losses. When the forecasts indicate that sufficient future taxable income will be available to deduct the temporary differences, a deferred tax asset is recognized for all deductible temporary differences.

(iv) Going concern assumption

The Company applies judgment in assessing whether material uncertainties exist that would cause doubt as to the whether the Company could continue as a going concern.

4. New and revised standards and interpretations

Certain pronouncements were issued by the IASB or the IFRIC that are mandatory for accounting periods commencing on or after November 1, 2023. As appropriate, the Company has adopted these pronouncements as of their effective date. Many of the pronouncements are not applicable or do not have a significant impact on the Company and have been excluded.

The following amendments were issued but not yet effective. The Company will adopt these amendments as of their effective dates. The Company is currently assessing the impacts of adoption.

(a) Amendments to IAS 1, Presentation of Financial Statements

IAS 1 was amended in January 2020 to provide a more general approach to the classification of liabilities under IAS 1 based on the contractual arrangements in place at the reporting date. The amendments clarify that the classification of liabilities as current or noncurrent is based solely on a company's right to defer settlement at the reporting date. The right needs to be unconditional and must have substance. The amendments also clarify that the transfer of a company's own equity instruments is regarded as settlement of a liability, unless it results from the exercise of a conversion option meeting the definition of an equity instrument. The amendments are effective for annual periods beginning on January 1, 2024. Earlier adoption is permitted. The Company will adopt this amendment as of the effective date, and does not anticipate any material impacts on adoption. These amendments do not have any impact on the Company's accounting records.

(b) Amendments to IFRS 10, Consolidated Financial Statements and IAS 28, Investments in Associates and Joint Ventures

IFRS 10 and IAS 28 were amended in September 2014 to address a conflict between the requirements of IAS 28 and IFRS 10 and clarify that in a transaction involving an associate or joint venture, the extent of gain or loss recognition depends on whether the assets sold or contributed constitute a business. The effective date of these amendments is yet to be determined, however early adoption is permitted.

5. Property and equipment

| |

|

As at |

|

|

|

|

|

|

|

|

|

|

|

As at |

|

| |

|

November 1, |

|

|

|

|

|

|

|

|

Foreign |

|

|

April 30, |

|

| |

|

2023 |

|

|

Additions |

|

|

Disposals |

|

|

exchange |

|

|

2024 |

|

| Cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Computers |

$ |

9,510 |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

$ |

9,510 |

|

| Right-of-use assets |

|

48,408 |

|

|

- |

|

|

- |

|

|

- |

|

|

48,408 |

|

| |

|

57,918 |

|

|

- |

|

|

- |

|

|

- |

|

|

57,918 |

|

| Accumulated depreciation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Computers |

|

4,981 |

|

|

623 |

|

|

- |

|

|

(283 |

) |

|

5,321 |

|

| Right-of-use assets |

|

20,170 |

|

|

7,637 |

|

|

- |

|

|

431 |

|

|

28,238 |

|

| |

|

25,151 |

|

|

8,260 |

|

|

- |

|

|

148 |

|

|

33,559 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net book value |

$ |

32,767 |

|

|

|

|

|

|

|

|

|

|

$ |

24,359 |

|

6. Leases

(a) As a lessee

The lease obligation relates to the use of office space in Toronto, Ontario. On May 26, 2022, a new lease agreement was entered into for a term from August 1, 2022 to July 31, 2025 for office space in another location in Toronto, Ontario. The present value of the lease obligation was calculated using a discount rate of 9%.

| Continuity schedule of lease obligation: |

|

|

|

| |

|

|

|

| Balance, October 31, 2023 |

$ |

29,054 |

|

| Interest expense |

|

1,109 |

|

| Lease payments |

|

(9,582 |

) |

| Foreign exchange |

|

388 |

|

| Balance, April 30, 2024 |

$ |

20,969 |

|

6. Leases (continued)

(a) As a lessee (continued)

The following represents a maturity analysis of the Company's undiscounted contractual lease obligations as at April 30, 2024:

| |

|

USD |

|

| Less than one year |

$ |

19,099 |

|

| Between one and five years |

$ |

8,046 |

|

(b) As a lessor

The Company sub-leases a portion of its office space under a lease agreement for a term of three years, expiring July 31, 2025. The sub-lease is classified as an operating lease because it does not transfer substantially all of the risks and rewards incidental to ownership of the asset.

For the three and six months ended April 30, 2024, the Company recognized a total of $4,605 and $9,139 (2023 - $4,376 and $8,752) as rental income which has been recorded as a reduction to general and administrative expenses on the unaudited condensed interim consolidated statement of operations and comprehensive loss.

The following represents a maturity analysis of the Company's lease payments to be received after April 30, 2024:

| |

|

USD |

|

| Less than one year |

$ |

7,189 |

|

| Between one and five years |

$ |

4,023 |

|

7. Debenture payable

The Company issued a debenture on March 17, 2020, with a principal amount of $51,500 CAD ($37,126 USD) and an original maturity date of June 17, 2020. The debenture's maturity date was extended by six month intervals on June 17, 2020, December 17, 2020, June 17, 2021, December 17, 2021, June 17, 2022, December 17, 2022, June 17, 2023 and December 17, 2023. The most recent extension on December 17, 2023 extended the debenture to June 17, 2024. The extension of the debenture's maturity date resulted in a substantial modification of the existing terms of the debenture and accordingly was accounted for as an extinguishment. The debenture bears interest at a rate of 24% and is unsecured. At April 30, 2024, the debenture had an outstanding balance of $37,852 ($52,031 CAD) (October 31, 2023 - $37,509 ($52,031 CAD)). During the three and six months ended April 30, 2024, total interest expense of $2,276 and $4,561 (2023 -$2,286 and $4,578) was recognized in the unaudited condensed interim consolidated statement of operations and comprehensive loss.

8. Long-term loan

The Company was granted a $60,000 CAD ($43,650 USD) interest-free loan from the Government of Canada under the Canada Emergency Business Account ("CEBA") program to cover its operating costs (the "CEBA Loan"). If the Company were to have repaid $40,000 CAD ($29,100 USD) of the aggregate amount advanced on or before January 18, 2024, the repayment of the remaining $20,000 CAD would have been forgiven. The balance was not paid by January 18, 2024, and as a result, on January 19, 2024 the CEBA loan was converted to a 3-year term loan, bearing interest at 5% per annum, paid monthly. The total principal balance plus any accrued and unpaid interest is payable in full on December 31, 2026.

The conversion of the interest-free loan into an interest-bearing 3 year term loan resulted in a substantial modification of the existing terms of the CEBA loan and accordingly was accounted for as an extinguishment. On January 19, 2024, the CEBA loan was recognized at fair value using a market rate of interest of 24%. The difference between this discounted value of $35,841 CAD ($25,422 USD) and the carrying amount of $60,000 CAD ($43,254 USD) was recognized as a government grant of $24,159 CAD ($17,868 USD) in the unaudited condensed interim consolidated statement of operations and comprehensive loss.

The continuity of the long-term loan is summarized as follows:

| Balance, October 31, 2023 |

$ |

43,254 |

|

| Government grant |

|

(17,868 |

) |

| Fair value on January 19, 2024 |

|

25,386 |

|

| Accretion expense |

|

1,323 |

|

| Foreign exchange |

|

670 |

|

| Balance, April 30, 2024 |

$ |

27,379 |

|

9. Convertible debentures

The Company issues three types of convertible debentures: USD denominated convertible debentures with an equity component, Canadian dollar ("CAD") denominated convertible debentures with an embedded derivative due to variable consideration payable upon conversion caused by foreign exchange, and USD denominated convertible debentures with an embedded derivative caused by variable conversion prices.

During the three and six months ended April 30, 2024, the Company incurred $nil and $63,263 of financing costs (2023 - $nil). All loan principal amounts and conversion prices are expressed in original currency and all remaining dollar amounts are expressed in USD.

(a) Current period information presented in the unaudited condensed interim consolidated financial statements

Convertible debentures outstanding as at April 30, 2024:

| |

|

USD

(equity

component) |

|

|

CAD (embedded

derivative) |

|

|

USD (embedded

derivative) |

|

|

Total |

|

| Loan principal outstanding |

$ |

1,391,775 |

|

$ |

2,217,086 |

|

$ |

326,563 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Terms of loan |

|

|

|

|

|

|

|

|

|

|

|

|

| Annual stated interest rate |

|

12% - 24% |

|

|

12% - 24% |

|

|

2% - 4% |

|

|

|

|

| Effective annual interest rate |

|

24% |

|

|

22 - 131% |

|

|

24% - 4414% |

|

|

|

|

| Conversion price to common shares |

|

$0.03 - $0.04 |

|

|

$0.05 - $0.10 |

|

|

(i) - (ii) |

|

|

|

|

| Remaining life (in months) |

|

0 - 6 |

|

|

0 - 10 |

|

|

0 - 9 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Unaudited Condensed Interim Consolidated Statement of Financial Position |

|

|

|

|

|

|

|

|

|

|

|

|

| Carrying value of loan principal |

$ |

1,391,775 |

|

$ |

1,505,240 |

|

$ |

87,952 |

|

$ |

2,984,967 |

|

| Interest payable |

$ |

363,902 |

|

$ |

416,346 |

|

$ |

34,353 |

|

|

814,601 |

|

| Convertible debentures |

$ |

1,755,677 |

|

$ |

1,921,586 |

|

$ |

122,305 |

|

$ |

3,799,568 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Derivative liabilities |

$ |

- |

|

$ |

203,694 |

|

$ |

95,985 |

|

$ |

299,677 |

|

| Equity component of convertible debentures |

$ |

3,075,751 |

|

$ |

- |

|

$ |

- |

|

$ |

3,075,749 |

|

For the six months ended April 30, 2024:

| |

|

USD

(equity

component) |

|

|

CAD (embedded

derivative) |

|

|

USD (embedded

derivative) |

|

|

Total |

|

| Unaudited Condensed Interim Consolidated Statement of Operations and Comprehensive Loss |

|

|

|

|

|

|

|

| Accretion expense |

$ |

2,819 |

|

$ |

77,805 |

|

$ |

26,883 |

|

$ |

107,507 |

|

| Interest expense |

$ |

157,130 |

|

$ |

126,511 |

|

$ |

7,205 |

|

$ |

290,846 |

|

| Gain on revaluation of derivative liabilities |

$ |

- |

|

$ |

(113,564 |

) |

$ |

(223,197 |

) |

$ |

(336,761 |

) |

| Loss on conversion of convertible debentures |

$ |

- |

|

$ |

- |

|

$ |

16,220 |

|

$ |

16,220 |

|

| Loss on repayment of convertible debentures |

$ |

- |

|

$ |

- |

|

$ |

49,124 |

|

$ |

49,124 |

|

| (Gain) loss on extinguishment of convertible debentures |

$ |

- |

|

$ |

(453,433 |

) |

$ |

85,266 |

|

$ |

(368,167 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Unaudited Condensed Interim Consolidated Statement of Changes in Equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Amount of principal converted to common shares |

$ |

- |

|

$ |

60,000 |

|

$ |

161,875 |

|

|

|

|

| Amount of interest converted to common shares |

$ |

- |

|

$ |

197 |

|

$ |

3,238 |

|

|

|

|

| Number of common shares issued on conversion of convertible debentures |

|

- |

|

|

1,203,945 |

|

|

5,224,388 |

|

|

6,428,333 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Unaudited Condensed Interim Consolidated Statement of Cash Flows |

|

|

|

|

|

|

|

|

|

|

|

|

| Amount of principal repaid in cash |

$ |

- |

|

$ |

- |

|

$ |

178,126 |

|

$ |

178,126 |

|

| Amount of interest repaid in cash |

$ |

7,997 |

|

$ |

29,243 |

|

$ |

- |

|

$ |

37,240 |

|

(i) Conversion price defined as 75% multiplied by the average of the lowest 3 closing stock prices for the 10 trading days prior to conversion date.

(ii) Conversion price defined as 75% multiplied by the lowest stock price for the 20 trading days prior to conversion date.

9. Convertible debentures (continued)

(a) Current period information presented in the unaudited condensed interim consolidated financial statements (continued)

For the three months ended April 30, 2024:

| |

|

USD

(equity

component) |

|

|

CAD (embedded

derivative) |

|

|

USD (embedded

derivative) |

|

|

Total |

|

| Unaudited Condensed Interim Consolidated Statement of Operations and Comprehensive Loss |

|

|

|

|

|

|

|

| Accretion expense |

$ |

1,450 |

|

$ |

57,722 |

|

$ |

16,850 |

|

$ |

76,022 |

|

| Interest expense |

$ |

81,568 |

|

$ |

65,381 |

|

$ |

3,489 |

|

$ |

150,438 |

|

| Gain on revaluation of derivative liabilities |

$ |

- |

|

$ |

(774,867 |

) |

$ |

(146,794 |

) |

$ |

(921,661 |

) |

| Loss on conversion of convertible debentures |

$ |

- |

|

$ |

- |

|

$ |

5,875 |

|

$ |

5,875 |

|

| Gain on repayment of convertible debentures |

$ |

- |

|

$ |

- |

|

$ |

(2,539 |

) |

$ |

(2,539 |

) |

| (Gain) loss on extinguishment of convertible debentures |

$ |

- |

|

$ |

(705,702 |

) |

$ |

3,073 |

|

$ |

(702,629 |

) |

(b) Comparative information presented in the unaudited condensed interim consolidated financial statements

Convertible debentures outstanding as at October 31, 2023:

| |

|

USD

(equity

component) |

|

|

CAD (embedded

derivative) |

|

|

USD (embedded

derivative) |

|

|

Total |

|

| Loan principal outstanding |

$ |

1,261,265 |

|

$ |

2,146,715 |

|

$ |

405,001 |

|

|

|

|

| Terms of loan |

|

|

|

|

|

|

|

|

|

|

|

|

| Annual stated interest rate |

|

24% |

|

|

12% - 24% |

|

|

2% - 4% |

|

|

|

|

| Effective annual interest rate |

|

24% |

|

|

22% - 131% |

|

|

24% - 5158% |

|

|

|

|

| Conversion price to common shares |

|

$0.03 - $0.04 |

|

|

$0.05 - $0.10 |

|

|

(i) - (ii) |

|

|

|

|

| Remaining life (in months) |

|

0 - 4 |

|

|

0 - 11 |

|

|

0 - 11 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Unaudited Condensed Interim Consolidated Statement of Financial Position |

|

|

|

|

|

|

|

| Carrying value of loan principal |

$ |

1,261,265 |

|

$ |

1,499,667 |

|

$ |

77,238 |

|

$ |

2,838,170 |

|

| Interest payable |

|

344,993 |

|

|

334,511 |

|

|

30,385 |

|

|

709,889 |

|

| Convertible debentures |

$ |

1,606,258 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

$ |

1,834,178 |

|

$ |

107,623 |

|

$ |

3,548,059 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Derivative liabilities |

$ |

- |

|

$ |

783,650 |

|

$ |

295,743 |

|

$ |

1,079,393 |

|

| Equity component of convertible debentures |

$ |

3,220,473 |

|

$ |

- |

|

$ |

- |

|

$ |

3,220,473 |

|

(i) Conversion price defined as 75% multiplied by the average of the lowest 3 closing stock prices for the 10 trading days prior to conversion date.

(ii) Conversion price defined as 75% multiplied by the lowest stock price for the 20 trading days prior to conversion date.

For the six months ended April 30, 2023

| |

|

USD

(equity

component) |

|

|

CAD (embedded

derivative) |

|

|

US (embedded

derivative) |

|

|

Total |

|

| Unaudited Condensed Interim Consolidated Statement of Operations and Comprehensive Loss |

|

|

|

|

|

|

|

| Accretion expense |

$ |

13,772 |

|

$ |

124,923 |

|

$ |

15,356 |

|

$ |

154,051 |

|

| Interest expense |

$ |

138,994 |

|

$ |

123,503 |

|

$ |

5,843 |

|

$ |

268,340 |

|

| Loss (gain) on revaluation of derivative liabilities |

$ |

- |

|

$ |

1,351,268 |

|

$ |

(72,723 |

) |

$ |

1,278,545 |

|

| Loss on conversion of convertible debentures |

$ |

- |

|

$ |

- |

|

$ |

21,120 |

|

$ |

21,120 |

|

| (Gain) on repayment of convertible debentures |

$ |

- |

|

$ |

- |

|

$ |

(18,382 |

) |

$ |

(18,382 |

) |

| (Gain) loss on extinguishment of convertible debentures |

$ |

(14,004 |

) |

$ |

1,936,228 |

|

$ |

82,397 |

|

$ |

2,004,621 |

|

9. Convertible debentures (continued)

(b) Comparative information presented in the unaudited condensed interim consolidated financial statements (continued)

For the six months ended April 30, 2023

| |

|

USD

(equity

component) |

|

|

CAD (embedded

derivative) |

|

|

USD (embedded

derivative) |

|

|

Total |

|

| Unaudited Condensed Interim Consolidated Statement of Changes in Equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Amount of principal converted to common shares |

$ |

200,000 |

|

$ |

300,000 |

|

$ |

232,700 |

|

|

|

|

| Amount of interest converted to common shares |

$ |

56,964 |

|

$ |

36,685 |

|

$ |

4,654 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Number of common shares issued on conversion of convertible debentures |

|

5,263,158 |

|

|

6,000,000 |

|

|

9,548,701 |

|

|

20,811,859 |

|

| Unaudited Condensed Interim Consolidated Statement of Cash Flows |

|

|

|

|

|

|

|

|

|

|

|

|

| Amount of principal repaid in cash |

$ |

- |

|

$ |

- |

|

$ |

66,500 |

|

$ |

66,500 |

|

| Amount of interest repaid in cash |

$ |

5,819 |

|

$ |

24,049 |

|

$ |

931 |

|

$ |

30,799 |

|

| For the three months ended April 30, 2023: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

USD

(equity

component) |

|

|

CAD (embedded

derivative) |

|

|

USD (embedded

derivative) |

|

|

Total |

|

| Unaudited Condensed Interim Consolidated Statement of Operations and Comprehensive Loss |

|

|

|

|

|

|

|

| Accretion expense |

$ |

6,906 |

|

$ |

65,880 |

|

$ |

1,503 |

|

$ |

74,289 |

|

| Interest expense |

$ |

72,690 |

|

$ |

61,996 |

|

$ |

2,518 |

|

$ |

137,204 |

|

| Loss (gain) on revaluation of derivative liabilities |

$ |

- |

|

$ |

1,607,062 |

|

$ |

(23,668 |

) |

$ |

1,583,394 |

|

| Loss on conversion of convertible debentures |

$ |

- |

|

$ |

- |

|

$ |

12,341 |

|

$ |

12,341 |

|

| Gain on repayment of convertible debentures |

$ |

- |

|

$ |

- |

|

$ |

(12,715 |

) |

$ |

(12,715 |

) |

| (Gain) loss on extinguishment of convertible debentures |

$ |

(2,801 |

) |

$ |

1,827,515 |

|

$ |

59,670 |

|

$ |

1,884,384 |

|

(c) Fair value of derivative liabilities outstanding

| |

As at |

|

As at |

| |

April 30, |

|

October 31, |

| |

2024 |

|

2023 |

| Share price |

$0.02 |

|

$0.05 |

| Exercise price |

$0.02 - $0.07 |

|

$0.03 - $0.07 |

| Volatility factor (based on historical volatility) |

121%-217% |

|

114% - 189% |

| Risk free interest rate |

4.71% - 4.91% |

|

5.11% - 5.48% |

| Expected life of conversion features (in months) |

0 - 9 |

|

0 - 11 |

| Expected dividend yield |

0% |

|

0% |

| CDN to USD exchange rate (as applicable) |

0.7275 |

|

0.7209 |

| Call value |

$0.00 - $0.01 |

|

$0.01 - $0.08 |

Volatility was estimated using the historical volatility of the Company's stock prices for common shares.

10. Share capital

(a) Authorized and outstanding shares

The Company has two classes of shares as follows:

(i) Special redeemable voting preference shares - 2,000,000 authorized, nil issued and outstanding.

(ii) Common shares without par value - an unlimited number authorized. The holders of the common shares are entitled to receive dividends which may be declared from time to time, and are entitled to one vote per share at shareholder meetings of the Company. All common shares are ranked equally with regards to the Company's residual assets.

(b) Private placements

During the six months ended April 30, 2024, the Company completed 3 private placements (2023 - 20 private placements), pursuant to prospectus and registration exemptions set forth in applicable securities law. The Company received net proceeds of $164,662 (2023 - $454,377) and issued a total of 3,716,007 (2023 - 8,660,000) common shares. During the six months ended April 30, 2024, the Company also received $nil in subscriptions for private placements (2023 - $33,618).

11. Warrants

On December 22, 2023, the Company issued 63,000 broker warrants in connection with its private placement, as described in Note 10 (b). The broker warrants can be exercised at any time, on a one for one basis, at a price of $0.07 ($0.095 CAD) per share, until December 22, 2025.

The Company uses the Black-Scholes pricing model to estimate fair value. Expected volatility has been based on an evaluation of the historical volatility of the Company's share price. The risk-free interest rate for the life of the warrants was based on the yield available on government benchmark bonds with an approximate equivalent remaining term at the time of issue. The life of the warrant is based on the contractual term.

| |

December 22, 2023 |

| Share price and Exercise price |

$0.07 ($0.095 CAD) |

| Volatility factor (based on historical volatility) |

146% |

| Risk free interest rate |

4.02% |

| Expected life of conversion features (in years) of warrant |

2 |

| Expected dividend yield |

0% |

The following table summarizes the warrants outstanding and exercisable as at April 30, 2024:

| Expiry date |

|

Number of warrants |

|

|

Weighted average exercise price |

|

|

Remaining contractual life |

|

| December 22, 2025 |

|

63,000 |

|

|

$0.07 ($0.095 CAD) |

|

|

1.65 years |

|

12. Stock options

(a) Stock option plan

Under the Company's fixed stock option plan (the "Plan"), the Company can grant up to 27,500,000 shares of common stock to directors, officers, employees or consultants of the Company and its subsidiaries. The exercise price of each option is equal to or greater than the market price of the Company's shares on the date of grant unless otherwise permitted by applicable securities regulations. An option's maximum term under the Plan is 10 years. Stock options are fully vested upon issuance by the Company unless the Board of Directors stipulates otherwise by Directors' resolution.

(b) Summary of changes

| |

|

Number of |

|

|

Weighted average |

|

| |

|

options |

|

|

exercise price |

|

| Outstanding at October 31, 2023 |

|

9,775,000 |

|

$ |

0.06 |

|

| Expired |

|

(1,025,000 |

) |

|

0.12 |

|

| Outstanding at April 30, 2024 |

|

8,750,000 |

|

$ |

0.06 |

|

12. Stock options (continued)

(c) Stock options outstanding at April 30, 2024

| |

|

|

Options |

|

|

Options |

|

|

Weighted average |

|

| |

|

|

|

|

|

Remaining |

|

| Date of issue |

Expiry date |

|

outstanding |

|

|

exercisable |

|

|

Exercise price |

|

|

contractual life |

|

| November 13, 2020 |

November 13, 2025 |

|

5,750,000 |

|

|

5,750,000 |

|

|

0.05 |

|

|

1.54 |

|

| October 8, 2021 |

October 8, 2026 |

|

1,000,000 |

|

|

1,000,000 |

|

|

0.07 |

|

|

2.44 |

|

| March 20, 2023 |

March 20, 2028 |

|

2,000,000 |

|

|

2,000,000 |

|

|

0.07 |

|

|

3.89 |

|

| As at April 30, 2024 |

|

|

8,750,000 |

|

|

8,750,000 |

|

$ |

0.06 |

|

|

2.18 |

|

During the three and six months ended April 30, 2024, the Company recorded an expense of $nil and $6,517 respectively for the vesting of stock options (2023 - $145,741 and $151,406).

13. Loss per share

Basic and diluted loss per share are calculated using the following numerators and denominators:

| |

|

Three months ended April 30, |

|

|

Six months ended April 30, |

|

| Numerator |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net loss attributable to common shareholders and used in computation of basic income (loss) per share |

$ |

1,446,174 |

|

$ |

(3,896,034 |

) |

$ |

25,662 |

|

$ |

(4,112,364 |

) |

| Add: adjustments for dilutive effects |

|

83,018 |

|

|

- |

|

|

159,949 |

|

|

- |

|

| Net loss attributable to common shareholders and used in computation diluted income (loss) per share |

$ |

1,529,192 |

|

$ |

(3,896,034 |

) |

$ |

185,611 |

|

$ |

(4,112,364 |

) |

| Denominator |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares for computation of basic income (loss) per share |

|

517,868,552 |

|

|

474,546,633 |

|

|

515,705,432 |

|

|

474,546,633 |

|

| Dilutive effects of convertible features (Note 9) and stock options (Note 12) |

|

104,684,290 |

|

|

- |

|

|

97,055,086 |

|

|

- |

|

| Weighted average number of common shares for computation of diluted income (loss) per share |

|

622,552,842 |

|

|

474,546,633 |

|

|

612,760,518 |

|

|

474,546,633 |

|

Basic income (loss) per share amounts are calculated by dividing the net income (loss) attributable to common shareholders for the periods by the weighted average number of common shares outstanding during the periods.

14. Income taxes

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and amounts used for income tax purposes.

As at April 30, 2024, the Company has non-capital losses of approximately $33 million, $28.8 million in Canada and $4.4 million in other foreign jurisdictions, available to reduce future taxable income. Non-capital losses expire commencing in 2026. In addition, the Company has available capital loss carry forwards of approximately $1.2 million to reduce future taxable capital gains. Capital losses carry forward indefinitely.

As at April 30, 2024, and October 31, 2023, the Company assessed that it is not probable that sufficient taxable income will be available to use deferred income tax assets based on operating losses in prior years; therefore, there are no balances recognized in the unaudited condensed interim consolidated statements of financial position for such assets.

15. Operating expenses

(a) General and administration

The components of general and administration expenses are as follows:

| |

|

Three months ended April 30, |

|

|

Six months ended April 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| General and administration |

$ |

14,165 |

|

$ |

12,274 |

|

$ |

22,658 |

|

$ |

29,876 |

|

| Investor relations, listing and filing fees |

|

16,472 |

|

|

31,875 |

|

|

36,938 |

|

|

39,602 |

|

| Telephone |

|

1,154 |

|

|

1,395 |

|

|

2,771 |

|

|

2,480 |

|

| |

$ |

31,791 |

|

$ |

45,544 |

|

$ |

62,367 |

|

$ |

71,958 |

|

(b) Professional, other fees and salaries

The components of professional, other fees and salaries expenses are as follows:

| |

|

Three months ended April 30, |

|

|

Six months ended April 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Professional and consulting fees |

$ |

44,027 |

|

$ |

54,273 |

|

$ |

113,728 |

|

$ |

85,791 |

|

| Salaries and benefits |

|

41,360 |

|

|

60,859 |

|

|

88,995 |

|

|

110,511 |

|

| |

$ |

85,387 |

|

$ |

115,132 |

|

$ |

202,723 |

|

$ |

196,302 |

|

16. Supplemental cash flow information

The following provides a reconciliation of the cash flows from convertible debentures and derivative liabilities :

| |

|

Six months ended April 30, |

|

| |

|

2024 |

|

|

2023 |

|

| Balance - beginning of period |

$ |

4,627,452 |

|

$ |

4,433,363 |

|

| Cash flows from financing activities: |

|

|

|

|

|

|

| Proceeds from issuance of convertible debentures |

|

291,210 |

|

|

274,600 |

|

| Repayments of convertible debentures |

|

(178,126 |

) |

|

(66,500 |

) |

| Non-cash changes: |

|

|

|

|

|

|

| Accretion expense |

|

107,507 |

|

|

154,051 |

|

| Accrued interest on convertible debentures |

|

250,171 |

|

|

232,887 |

|

| Loss (gain) on repayment of convertible debentures |

|

49,124 |

|

|

(18,382 |

) |

| Loss on conversion of convertible debentures |

|

16,220 |

|

|

21,120 |

|

| (Gain) loss on revaluation of derivative liabilities |

|

(336,761 |

) |

|

1,278,545 |

|

| (Gain) loss on extinguishment of debt |

|

(431,430 |

) |

|

2,004,621 |

|

| Convertible debentures converted into common shares |

|

(209,075 |

) |

|

(1,308,672 |

) |

| Foreign exchange loss |

|

(87,047 |

) |

|

(87,766 |

) |

| Balance - end of period |

$ |

4,099,245 |

|

$ |

6,917,867 |

|

17. Key management compensation and related party transactions

The Company reports the following related party transactions:

(a) Key management compensation

Key management personnel are persons responsible for planning, directing and controlling activities of the Company, including officers and directors. Compensation paid or payable to these individuals (or companies controlled by such individuals) are summarized as follows:

| |

|

Three months ended April 30, |

|

|

Six months ended April 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Professional, other fees, and salaries |

$ |

16,732 |

|

$ |

40,667 |

|

$ |

46,390 |

|

$ |

50,428 |

|

| Stock-based compensation |

|

- |

|

|

45,424 |

|

|

- |

|

|

45,424 |

|

| |

$ |

16,732 |

|

$ |

86,091 |

|

$ |

46,390 |

|

$ |

95,852 |

|

During the three and six months ended April 30, 2024, key management was awarded nil stock options (2023 - 680,000).

(b) Trade payables and other liabilities

Included in accounts payable is $nil payable to a corporation controlled by an officer of the Company as at April 30, 2024 (October 31, 2023 - $2,173).

18. Contingencies

(a) The Company has agreed to indemnify its directors and officers and certain of its employees in accordance with the Company's by-laws. The Company maintains insurance policies that may provide coverage against certain claims.

(b) The Company has previously reported on the lawsuit filed by Mr. Steven Van Fleet against Micromem, the Company's response to the lawsuit and its counterclaims against Mr. Van Fleet.

On April 29, 2021 the matter was resolved in Micromem's favor when the Court dismissed Mr. Van Fleet's claims and ruled that he was liable to the Company and to MAST on their counterclaims. On June 16, 2021, the Court ruled that Micromem and MAST had established damages totaling $765,579 representing the full amount that had been requested; furthermore, the Court awarded costs and statutory prejudgment interest from May 9, 2017. On June 29, 2021 the Court entered a judgement in favor of Micromem and MAST for a total amount of $1,051,739.