0001599117

false

0001599117

2023-10-10

2023-10-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 10, 2023 (October 4, 2023)

| MENTOR

CAPITAL, INC. |

| (Exact

name of Registrant as specified in its charter) |

| Delaware |

|

000-55323 |

|

77-0395098 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 5964

Campus Court, Plano, Texas |

|

75093 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (760) 788-4700

| N/A |

| (Former

name or former address, if changed since last report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(g) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock |

|

MNTR |

|

OTCQB |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

Growth Company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act

Items

1.01 and 2.01. Entry Into a Material Definitive Agreement, and Completion of Acquisition or Disposition of Assets.

On

October 4, 2023 Mentor Capital, Inc. (the “Company”) entered into, and closed, a Stock Purchase Agreement for Waste Consolidators,

Inc. by and among Kyle Thomas, the Company, and Ally Waste Services, LLC under which the Company sold its 51% interest in Waste Consolidators,

Inc. to Ally Waste Services, LLC for $5,000,000 and a one year unsecured, subordinated, Promissory Note in initial principal face amount

of $1,000,000. Waste Consolidators, Inc. had been a subsidiary of the Company.

Item

7.01 Regulation FD Disclosure

In

connection with the transaction set forth above, the Company issued the press release attached hereto as Exhibit 99.1.

The

information included in this Item 7.01 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as expressly set forth by specific reference in such filing.

Item

9.01. Financial Statement and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Mentor

Capital, Inc. |

| |

|

|

| Date:

October 10, 2023 |

By: |

/s/

Chet Billingsley |

| |

|

Chet

Billingsley, Chairman and Chief Executive Officer |

Exhibit 99.1

October

5, 2023

Mentor

Capital Subsidiary Divestiture Nets 500% of Market Cap in Cash Strategic Buyer Pays Premium for MNTR’s

Investment in Trash Company

PLANO,

Texas—(BUSINESS WIRE)— Mentor Capital, Inc. (OTCQB: MNTR) reports the sale to a strategic buyer of Mentor’s legacy

51% stock interest in an Arizona-based trash consolidating business for $5.0 million in cash received October 4, 2023, plus $1.0 million

in an additional note payable due in one-year, pending any unforeseen adjustments. This compares to Mentor’s current market capitalization

of $930,000 and recent book value of approximately $1,640,000. On June 30, 2023, Mentor estimated and reported that “the theoretical

cash breakup value of the business, net of liabilities, may significantly exceed the current market price of the Company’s stock.”

Mentor

has initiated the expansion of its planned focus in the classic energy sector with paced stock purchases in the oil, gas, uranium, coal,

and related companies. Until divested, Mentor will continue to operate and collect on its other various business interests. In addition,

during the late second and early third quarters of 2023, Mentor completed its second of two long-term stock repurchase programs.

About

Mentor Capital: The Company seeks to come alongside and assist private companies and their founders and investors in meeting their

liquidity, equity financing, and acquisition objectives. Mentor is currently focusing its new efforts on adding assets in the classic

energy sectors.

This

press release is neither an offer to sell nor a solicitation of offers to purchase securities.

Forward-Looking

Statements: This press release contains forward-looking statements within the meaning of federal securities laws, including

statements concerning financial projections, financing activities, corporate combinations, product development activities, and sales

and licensing activities. Such forward-looking statements are not guarantees of future results or performance and are sometimes identified

by words of condition such as “should,” “could,” “expects,” “may,” “intends,”

“seeks,” “looks,” “moves,” or “plans” and are subject to a number of risks and uncertainties,

known and unknown, that could cause actual results or direction to differ materially from those intended or anticipated. Such risks include,

without limitation: nonperformance of investments, partner and portfolio difficulties, potential delays in marketing and sales, problems

securing the necessary financing to continue operations, the potential of competitive products, services, and technologies, difficulties

experienced in product development, in recruiting knowledgeable personnel, in protecting intellectual property, and the effects of adverse

worldwide economic events, such as the coronavirus recovery, government regulations, ESG challenges, energy prices, and inflation. Further

information concerning these and other risks is included in the Company’s Form 10-Q and Form 10-K filings, which, along with additional

very important details on the Company, can be found here: https://ir.mentorcapital.com/all-sec-filings

The

Company undertakes no obligation to update or revise such forward-looking statements to reflect new information, events, or circumstances

occurring after the date of this press release.

View

source version on businesswire.com: https://www.businesswire.com/news/home/20231005565206/en/

Mentor

Capital, Inc.

Chet

Billingsley, CEO

(760)

788-4700

info@mentorcapital.com

Source:

Mentor Capital, Inc.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

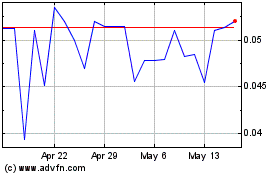

Mentor Capital (QB) (USOTC:MNTR)

Historical Stock Chart

From Feb 2025 to Mar 2025

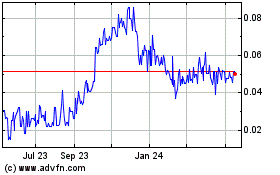

Mentor Capital (QB) (USOTC:MNTR)

Historical Stock Chart

From Mar 2024 to Mar 2025