SCHEDULE

14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the

Registrant x

Filed by a Party

other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 4a-6(e)(2))

|

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 240.14a-12 |

Micropac Industries,

Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

1) Title of each class of securities to which transaction

applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction

computed pursuant to Exchange Act rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as

provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous

filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

PROXY STATEMENT OF

MICROPAC INDUSTRIES, INC.

905 East Walnut Street

Garland, Texas 75040

ANNUAL MEETING OF STOCKHOLDERS

To Be Held At 10:00 A.M., LOCAL TIME ON

March 8, 2024

Dear Stockholder:

You are invited to attend

the Annual Meeting of Stockholders of Micropac Industries, Inc., to be held as a Virtual Meeting at 10:00 a.m. on March 8, 2024, for the

following purposes:

Proposal 1 - To elect six directors

to serve until the next annual meeting of stockholders or until their respective successors are elected and qualified;

and

To transact such other business that

may properly be brought before the meeting or any adjournment thereof.

The Board of Directors has

fixed the close of business on January 10, 2024, as the record date for the meeting. Only stockholders of record at that time are entitled

to notice of and to vote at the Annual Meeting or any adjournment thereof.

The enclosed proxy is solicited

by the Board of Directors of the Company. Further information regarding the matters to be acted upon at the Annual Meeting is contained

in the attached Proxy Statement.

Micropac Industries, Inc. stockholders as of January 10, 2024, the

record date for the Annual Meeting are invited to attend the virtual Annual Meeting by visiting https://stctransfer.zoom.us/webinar/register/WN_XbPVMEDKRgqajqe9dddy5w

to register for the shareholder meeting in advance

of the meeting date of March 8, 2024. Additional instructions will be provided after registration.

MANAGEMENT HOPES THAT YOU

WILL ATTEND THE VIRTUAL MEETING. IN ANY EVENT, PLEASE SIGN, DATE, AND RETURN THE ENCLOSED PROXY TO ASSURE THAT YOU ARE REPRESENTED AT

THE MEETING.

| |

By Order of the Board of Directors |

|

| |

|

|

| |

|

|

| |

/s/ Gerald Tobey |

|

| |

|

|

| |

Gerald W. Tobey, Secretary |

|

DATED: February 7, 2024

MICROPAC INDUSTRIES, INC.

905 EAST WALNUT STREET

GARLAND, TEXAS 75040

PROXY STATEMENT

FOR THE

ANNUAL MEETING OF STOCKHOLDERS

March 8, 2024

This Proxy Statement is furnished in connection

with the solicitation of proxies by the Board of Directors of Micropac Industries, Inc. (the "Company") for use at the Company's

Annual Meeting of Stockholders that will be held on March 8, 2024 at the time and place and for the purposes set forth in the foregoing

notice. This Proxy Statement, the foregoing notice and the enclosed proxy are first being sent to stockholders on or about February 7,

2024.

The Company's Annual Report to Stockholders for

the fiscal year ended November 30, 2023, is enclosed.

The Board of Directors does not intend to bring

any matter before the meeting except those specifically indicated in the foregoing notice and does not know of anyone else who intends

to do so. If any other matters properly come before the meeting, however, the persons named in the enclosed proxy, or their duly constituted

substitutes acting at the meeting, will be authorized to vote, or otherwise act thereon in accordance with their judgment on such matters.

If the enclosed proxy is executed and returned prior to voting at the meeting, the shares represented thereby will be voted in accordance

with the instructions marked thereon. In the absence of instructions, the shares will be voted FOR the election as directors of the Company

of the six persons named in the section captioned "Election of Directors.

Any proxy may be revoked at any time prior to

its exercise by notifying the Company's Secretary in writing, by delivering a duly executed proxy bearing a later date, or by attending

the meeting and voting in person.

Only holders of record of common stock at the

close of business on January 10, 2024, are entitled to notice of and to vote at the meeting. On that date there were 2,578,315 shares

of common stock outstanding, each of which is entitled to one vote in person or by proxy on all matters properly brought before the meeting.

Cumulative voting of shares in the election of directors is prohibited.

The presence, in person or by proxy, of the holders

of a majority of the outstanding common stock is necessary to constitute a quorum at the meeting. In order to be elected a director, a

nominee must receive a plurality of the votes cast at the meeting for the election of directors. Other matters, if any, to be voted on

at the meeting require the affirmative vote of a majority of the shares present in person or represented by proxy at the meeting.

PRINCIPAL STOCKHOLDERS AND STOCKHOLDINGS OF

MANAGEMENT

The following table shows the number and percentage

of shares of the Company's common stock beneficially owned (a) by each person known by the Company to own 5% or more of the outstanding

common stock, (b) by each director and nominee, and (c) by all present officers and directors as a group.

| Name and Address |

Number of Shares |

|

Percent |

|

| of Beneficial Owner(1) |

Beneficially Owned |

|

of Class(1) |

|

| |

|

|

|

|

| Robert Hempel(2) (3) |

1,952,577 |

|

75.7% |

|

| |

|

|

|

|

| Shaunna Black (3) |

0 |

|

0% |

|

| |

|

|

|

|

| Patrick Cefalu |

0 |

|

0% |

|

| |

|

|

|

|

| Christine Dittrich (3) |

0 |

|

0% |

|

| |

|

|

|

|

| Mark King (3) |

17,000 |

|

Less than 0.7% |

|

| |

|

|

|

|

| Donald Robinson (3) |

0 |

|

0% |

|

| |

|

|

|

|

| Gerald Tobey (3) |

0 |

|

0% |

|

| |

|

|

|

|

| All officers and directors |

1,969,577 |

|

76.4% |

|

| as a group (7 Persons) |

|

|

|

|

_______________________

| (1) | Calculated on the basis of the 2,578,315 outstanding shares. There are no options,

warrants, or convertible securities outstanding. The address of each person listed is 1655 State Hwy 66, Garland, Texas 75040. |

| (2) | Mr. Hempel controls Micropac Industries, Inc. Vermoegensverwaltungsgesellschaft

buergerlichen Rechts, which owns the enumerated shares. Micropac Industries, Inc. Vermoegensverwaltungsgesellschaft buergerlichen Rechts

is a beneficiary of an Ancillary Agreement entered into in March 1987. The Ancillary Agreement primarily obligates the Company to register

Micropac Industries, Inc. Vermoegensverwaltungsgesellschaft buergerlichen Rechts’s stock and allows Micropac Industries, Inc. Vermoegensverwaltungsgesellschaft

buergerlichen Rechts to participate in any sale of stock by the Company. |

| (3) | A director of the Company. Each incumbent director has been nominated for re-election

at the Annual Meeting. |

PROPOSAL 1 - ELECTION OF DIRECTORS

The Board of Directors has determined that the

Board should be composed of six directors and six directors are to be elected at the Meeting to hold office until the next Annual Meeting

of Stockholders or until their respective successors are elected and qualified. Proxies solicited hereby will be voted FOR the election

of the six nominees named below unless authority is withheld by the stockholder. Messrs. Hempel, King, Robinson, Tobey, Ms. Dittrich and

Ms. Black are currently directors of the Company. All directors participate in the consideration of Director Nominees.

| Name |

Age |

Position with the Company |

Director Since |

| |

|

|

|

| Mark King |

69 |

CEO, President and |

|

| |

|

Member of Audit Committee |

|

| |

|

and Chairman of the Board |

October 2005 |

| |

|

|

|

| Robert Hempel |

66 |

Director and |

|

| |

|

Member of Audit Committee |

September 2023 |

| |

|

|

|

| Christine B. Dittrich |

71 |

Director and |

|

| |

|

Member of Audit Committee |

October 2015 |

| |

|

|

|

| Gerald Tobey |

70 |

Director and |

|

| |

|

Member of Audit Committee |

June 2017 |

| |

|

|

|

| Donald Robinson |

58 |

Director

and |

|

| |

|

Member of Audit Committee |

December 2019 |

| |

|

|

|

| Shaunna Black |

69 |

Director and |

|

| |

|

Member of Audit Committee |

December 2019 |

Mr. King is the current President and Chief Executive

of the Company. Prior to November 2002, Mr. King was the President and Chief Operating Officer of Lucas Benning Power Electronics. Mr.

King joined the Company in November of 2002, and was elected Chief Executive Officer, President and Director in October 2005.

Mr. Robert Hempel has served as the (Managing

Director) of Hanseatische Waren-Gesellschaft MBH & Co., KG, Bremen, Germany since 1994.

Ms. Dittrich was an Executive

Vice President of Raytheon Systems Company and the General Manager of the Sensor and Electronic Systems segment. Before working for Raytheon,

Ms. Dittrich was a Senior Vice President of Texas Instruments (TI) Systems Group, a Malcolm Baldrige Quality Award winner, and the General

Manager of the Electronic Systems Division. Her prior assignments include TI Systems Group Vice President and Engineering Manager, Software

Engineering Director for the defense business, and Senior Member of Technical Staff. She has had senior executive responsibility for product

engineering efforts that involve large scale software and hardware development and integration. Ms. Dittrich provided consulting services

with a focus on business strategy and operational performance to various technology companies after leaving Raytheon. She became a Visiting

Scientist at the Carnegie Mellon University Software Engineering Institute (SEI), a Federally Funded Research and Development Center and

chaired the SEI Board of Advisors for over 10 years. She was a Fellow of the Cutter Business Technical Council and a senior consultant

for Cutter Consortium. In addition, she has held membership positions on the Army Science Board, the Department of Defense Software Best

Practices - Airlie Software Council and other advisory boards.

Mr. Tobey was a Vice President of Business Development

at Raytheon Missile Systems Company retiring in 2016 following a 38-year career in the defense, aerospace, and civil security sectors.

He also served as Vice President of International Business Development for both Raytheon's Missile Systems and Network Centric Systems

businesses. Until 1997, when Texas Instruments' Defense Systems and Electronics Group was acquired by Raytheon, Mr. Tobey served

as that company's Vice President of International Business Development and Managing Director of Texas Instruments UK, Ltd. (a wholly owned

TI subsidiary). During Mr. Tobey's career, he has served in various business creation and capture, strategy, program and manufacturing

management positions both in the U.S. and abroad. Mr. Tobey holds a Bachelor of Science and a Master of Business Administration

degree from Utah State University. He is a graduate of the U.S. Defense Department's Defense Acquisition University and has completed

Executive Study at the Anderson School of Management at UCLA.

Mr. Robinson is an executive leader and investor

with deep experience in corporate strategy, structuring and executing successful complex corporate initiatives, manufacturing, and mergers

and acquisitions. As a partner-level consultant, Mr. Robinson has led engagements in strategy development and M&A integration on transactions

ranging from $100M to over $1B in value. His industry experience includes time as an Industrial Engineer with Texas Instruments’

Defense Systems Group and as an executive over industrial engineering, safety and quality systems with Decibel Products, a telecom and

electronics manufacturer which grew into Allen Telecom. He served on the Chicago and North Texas chapter boards of the National

Association of Corporate Directors (NACD), a national organization focused on providing information and education to corporate directors.

Mr. Robinson served as a Business Leadership Center Instructor at the SMU Cox School of Business in Dallas, TX and is a two-time recipient

of the Teaching Excellence Award. He holds an MBA from the University of Dallas and a B.S. in Industrial Engineering from Texas

A&M University.

Ms. Shaunna Black is President of Shaunna Black

and Associates. Ms. Black advises companies on global operations, provides experienced executive talent, and coaches leadership teams.

The focus of her company is start-ups, business turnarounds and growth, strategy, organization and systems design, and leadership development.

Ms. Black is an innovative and highly accomplished operations/manufacturing executive, who enables leaders to rapidly solve complicated

problems. She has managed operations internationally in 25 countries. Ms. Black’s methodology delivers extraordinary performance

utilizing the power of diverse, multi-generational teams, creating high performance cultures and metrics-driven systems. She has expertise

in leadership and team development, technical and systems design, and production methodology in the technology, industrial, manufacturing

and hospitality sectors. Her executive career has provided significant experience in strategy, global operations, technology, risk management

and sustainability. Ms. Black has served on Audit, Governance, Safety/Risk and M&A Committees. Her industry experience includes Texas

Instruments Vice President, (24 years) Dallas/Fort Worth Area including Vice President, Worldwide Facilities - responsible for the design,

construction and operation of TI facilities, environmental, safety and health programs, global real estate, worldwide security, and TI's

sustainability strategy; Vice President, Dallas Fabrication - Manager for semiconductor manufacturing in one of TI's premier analog wafer

fabrication facilities; and Vice President, Worldwide Facilities and Worldwide Environmental, Safety and Health.

Board Meetings and Committees

The Board of Directors held five (5) board meetings

during the year ended November 2023. Directors received a fee of $1,500 (other than Mr. King) for each meeting attended during the year

ended November 2023. In addition, the Board agreed to pay an annual retainer of $10,000 to Mr. Donald Robinson, Ms. Dittrich, Ms. Shaunna

Black and Mr. Gerald Tobey.

The Audit Committee held four (4) meetings during

the year ended November 30, 2023. Members of the Audit Committee received a fee of $750 for each meeting attended during the year ended

November 2023. Mr. King did not receive any payments for attending meetings of the Audit Committee.

| Director Compensation 2023 |

| | |

Director | | |

Audit Committee | | |

Other fees | | |

Total Fees | |

| Shaunna Black | |

$ | 17,500 | | |

$ | 3,000 | | |

| - | | |

$ | 20,500 | |

| Donald Robinson | |

$ | 17,500 | | |

$ | 3,000 | | |

| - | | |

$ | 20,500 | |

| Christine Dittrich | |

$ | 17,500 | | |

$ | 3,000 | | |

| - | | |

$ | 20,500 | |

| Gerald Tobey | |

$ | 17,500 | | |

$ | 3,000 | | |

| - | | |

$ | 20,500 | |

Mr. King does not receive any additional compensation

for serving as a Director and as a member of the Audit Committee.

Audit Committee

The Board of Directors

formed an Audit Committee on May 13, 2002. The members of the Audit Committee operate pursuant to a charter developed by the Board of

Directors. The Board has determined that all Audit Committee members qualify as an “audit committee financial expert” for

purposes of the rules and regulations of the SEC and that each of these members is sufficiently proficient in reading and understanding

our financial statements to serve on the Audit Committee.

With the exception of Mr. King and Mr. Hempel,

members of the Audit Committee are considered independent members under the Securities and Exchange Act rules and regulations.

The Audit Committee has reviewed with management

and the independent auditors the quality and adequacy of the Company's significant accounting policies. The Audit Committee has considered

and reviewed with the independent auditors their audit plans, the scope of the audit, and the identification of audit risks. The Audit

Committee has reviewed and discussed the audited financial statements with management and has discussed such financial statements with

the independent auditors.

The Audit Committee has received the written disclosures

and the report from the independent accountant required by the applicable requirements of the Public Company Accounting Oversight Board

(United States) regarding the independent accountant’s communications with the Audit Committee concerning independence and has discussed

with the independent accountants the independent accountant’s independence. Based upon the review and discussions referred to above,

the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s annual

report on Form 10-K for the fiscal year ended November 30, 2023, for filing with the Securities and Exchange Commission.

Management has the responsibility for the preparation

and integrity of the Company's financial statements and the independent registered public accounting firm have the responsibility for

the audit of those statements. It is not the duty of the Audit Committee to conduct audits to determine that the Company’s financial

statements are complete and accurate and are in accordance with accounting principles generally accepted in the United States. In giving

its recommendations, the Audit Committee considered (a) management's representation that such financial statements have been prepared

with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America, and (b)

the report of the Company’s independent auditors with respect to such financial statements.

Nominating, Compensation and Corporate Governance

The Board of Directors does not have a nominating,

compensation committee or corporate governance committee or committees performing similar functions.

The Directors of the Company are responsible for

developing and recommending corporate governance guidelines, identifying qualified individuals to become directors, recommending selected

nominees to serve on the Board, and overseeing the evaluation of the Board.

In addition, the independent Directors are responsible

for considering and recommending the compensation arrangements for senior management. As part of its other responsibilities, they provide

general oversight of our compensation structure, and, if deemed, necessary, retains and approves compensation consultants and other compensation

experts. Other specific duties and responsibilities of reviewing the performance of executive officers; reviewing and approving objectives

relevant to executive officer compensation; recommending incentive compensation plans; and recommending compensation policies and practices

for service on our Board of Directors.

Board Leadership Structure

Our Board of Directors does not have a policy

on whether the roles of Chief Executive Officer and Chairman of the Board of Directors should be separate and, if they are to be separate,

whether the Chairman of the Board should be selected from the non-employee directors or be an employee. Our Board of Directors believes

that it should be free to make a choice from time to time in any manner that is in the best interest of us and our stockholders.

The Board of Directors believes that Mr. King’s

service as both Chief Executive Officer and Chairman of the Board is in the best interest of us and our stockholders. Mr. King possesses

detailed and in-depth knowledge of the issues, opportunities and challenges we face and is thus best positioned to develop agendas, to

ensure that the Board’s time and attention are focused on the most critical matters. His combined role enables decisive leadership,

ensures clear accountability, and enhances our ability to communicate our message and strategy clearly and consistently to our stockholders,

employees, and customers and suppliers.

Our Board of Directors believes that the independent directors provide

effective oversight of management.

Board of Directors’ Role in the Oversight

of Risk Management

The Board of Directors has designated the Audit

Committee to take the lead in overseeing risk management at the Board of Directors level. Accordingly, the Audit Committee schedules time

for periodic review of risk management, in addition to its other duties. In this role, the Audit Committee receives reports from management,

independent registered public accounting firm, outside legal counsel, and other advisors, and strives to generate serious and thoughtful

attention to our risk management process and system, the nature of the material risks we face, and the adequacy of our policies and procedures

designed to respond to and mitigate these risks.

In addition to the formal compliance program,

our Board of Directors encourage management to promote a corporate culture that understands risk management and incorporates it into our

overall corporate strategy and day-to-day business operations.

Employee, Officer and Director Hedging

None

Section 16(a) Beneficial Owner Reporting

Compliance

Section 16(a) of the Exchange Act requires the

Company's directors, executive officers, and 10% stockholders to file reports of ownership and reports of change in ownership of the Company's

equity securities with the Securities and Exchange Commission. Directors, executive officers, and 10% stockholders are required to furnish

the Company with copies of all Section16(a) forms they file. Based on information provided by such persons and a review of the copies

of such reports furnished, the Company believes that during the fiscal year ended November 30, 2023, the Company's directors, executive

officers, and 10% stockholders filed on a timely basis all reports required by Section 16(a) of the Exchange Act.

Code of Ethics

The Company has adopted a code of ethics that

applies to the Company’s principal executive officer and principal financial officer. In addition, the Company has a code of conduct

for all employees, officers and directors of the Company.

| Item 11. |

Executive Compensation |

The following table shows as of November 30, 2023,

all cash compensation paid to, or accrued and vested for the account of Mr. Mark King, President and Chief Executive Officer and Mr. Patrick

Cefalu, Vice President and Chief Financial Officer. Mr. King and Mr. Cefalu received no non-cash compensation during 2023.

Annual Compensation

| Name and | |

| | |

Annual | | |

| | |

| | |

All Other | | |

| |

| Principal Position | |

Year | | |

Salary | | |

Bonus | | |

Stock Grant | | |

Compensation (a) | | |

Total | |

| Mark King, | |

| 2023 | | |

$ | 322,032 | | |

$ | 23,981 | | |

$ | 28,328 | | |

$ | 44,950 | | |

$ | 419,291 | |

| President and | |

| 2022 | | |

$ | 309,936 | | |

$ | 39,500 | | |

$ | 0 | | |

$ | 42,696 | | |

$ | 392,132 | |

| Chief Executive Officer (1) | |

| 2021 | | |

$ | 301,924 | | |

$ | 13,400 | | |

$ | 0 | | |

$ | 42,672 | | |

$ | 357,996 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Patrick Cefalu, | |

| 2023 | | |

$ | 200,397 | | |

$ | 23,981 | | |

$ | 18,374 | | |

$ | 39,579 | | |

$ | 284,354 | |

| Vice President and | |

| 2022 | | |

$ | 192,856 | | |

$ | 39,500 | | |

$ | 0 | | |

$ | 34,809 | | |

$ | 267,165 | |

| Chief Financial Officer (2) | |

| 2021 | | |

$ | 187,873 | | |

$ | 13,400 | | |

$ | 0 | | |

$ | 32,918 | | |

$ | 234,191 | |

| (a) | Reflects amounts contributed by Micropac Industries, Inc., under Micropac’s 401(k) profit sharing

plan; unused vacation pays; life insurance premiums paid; and reimbursement for medical expenses under Micropac’s Family Medical

Reimbursement Plan. |

(1) Effective November 2005, Mr. King’s

existing employment agreement was revised to provide that Mr. King would serve as the Company’s President and Chief Executive Officer,

and a member on the Board of Directors and Audit Committee at a base salary of $186,400 for a term of three (3) years. In December 2005,

the Company and Mr. King amended his employment agreement to increase his annual base salary to $225,000. In June 2009, the Company and

Mr. King amended his employment agreement to increase his annual base salary to $247,104 for renewable terms of three (3) years with annual

increases based on consumer price index with additional increases to be determined by the Board of Directors. The June 2009 amendment

also provides under certain events, either the Company or Mr. King can terminate the agreement upon a payment to Mr. King of 18- or 36-months’

salary as severance payments.

(2) Effective February 2004, Mr. Cefalu entered

into an employment agreement that Mr. Cefalu would serve as Executive Vice President and Chief Financial Officer for a term of two (2)

years. On April 6, 2023, the employment agreement was amended to extend the term for three (3) years and the remaining terms and conditions

of the Employment Agreement shall remain if full force and effect.

The Board of Directors reviews and approves the

Company’s annual bonus payment’s structure. In 2023 Mr. King and Mr. Cefalu received a bonus payment of $23,981 in December

2022.

Amount included in all other compensation relating

to employee benefit plans

The Company maintains a Family Medical Reimbursement

Plan for the benefit of its executive officers and their dependents. The Plan is funded through a group insurance policy issued by an

independent carrier and provides for reimbursement of 100% of all bona fide medical and dental expenses that are not covered by other

medical insurance plans capped at an annual family maximum. During the fiscal year ended November 30, 2023, the Company paid $15,682 in

premiums each for Mr. King and Mr. Cefalu which amounts are included in the "All Other Compensation" column shown in the preceding

remuneration table.

In July 1984, the Company adopted a Salary Reduction

Plan pursuant to Section 401(k) of the Internal Revenue Code. The Plan's benefits are available to all Company employees who are at least

18 years of age and have completed at least six months of service to the Company as of the beginning of a Plan year. Plan participants

may elect to defer up to 15% of their total compensation as their contributions, subject to the maximum allowed by the Internal Revenue

code 401(k), and the Company matches their contributions up to a maximum of 6% of their total compensation. A participant's benefits vest

to the extent of 20% after two years of eligible service and become fully vested at the end of six years. During the fiscal year ended

November 30, 2023, the Company made contributions to the Plan for Mr. King in the amount of $18,300 and for Mr. Cefalu in the amount of

$13,457 which amount is included in the "All Other Compensation" column shown in the preceding remuneration table.

Employment agreements of the Company’s officers

provide that they may elect to carry over any unused vacation time to subsequent periods or elect to be paid for such unused vacation

time. Mr. King and Mr. Cefalu did not receive any unused vacation pay in 2023.

During the fiscal year ended November 30, 2023,

the Company paid life insurance premiums for the benefit of Mr. King and Mr. Cefalu valued at $10,968 and $10,440, respectively.

PAY VERSUS PERFORMANCE

The following table shows information about the relationship between

compensation actually paid for our principal executive officer (PEO) and our non-PEO named executive officers (NEO) and certain financial performance of

the Company for the fiscal years ending November 30, 2023 and November 30, 2022.

| |

|

|

|

|

|

|

|

| Year |

Summary Compensation Table Total for PEO |

Compensation Actually Paid to PEO |

Average Summary Compensation Table Total for non-PEO Named Executive Officers |

Average Compensation Actually Paid to non-PEO Named Executive Officers |

Value of Initial Fixed $100 Investment Based On Total Shareholder Return |

Net Income (Loss) |

|

| |

a |

b |

c |

d |

e |

|

|

| 2023 |

419,291 |

390,963 |

284,354 |

265,980 |

(24.4) |

632,000 |

|

| 2022 |

392,132 |

392,132 |

267,165 |

267,165 |

(14.0) |

2,787,000 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| a |

The dollar amounts reported are the amounts of total compensation reported for our PEO, Mark King, in the Summary Compensation Table for fiscal years 2023 and 2022. |

|

| b |

The dollar amounts reported represent the amount of “compensation actually paid”, as computed in accordance with SEC rules. The dollar amounts reported are the amounts of total compensation reported for Mr. King |

|

| c |

The dollar amounts reported are the average of the total compensation reported for our NEO, other than our PEO, Patrick Cefalu who served as Chief Financial Officer for fiscal years 2023 and 2022. |

|

| d |

The dollar amounts reported represent the amount of “compensation actually paid”, as computed in accordance with SEC rules. The dollar amounts reported are the amounts of total compensation reported for Mr. Cefalu. |

|

| e |

Total shareholder return is calculated as the difference between the price of the Company’s common stock at the end of each fiscal year, represented by the closing trading price as of that date, compared to the price of the Company’s common stock at the beginning of the measurement period, represented by the closing trading price as of the last day of the Company’s 2021 fiscal year plus dividends that were declared or paid during either of the fiscal years presented. |

|

| Grant Awards at Fiscal Year-End |

|

|

|

|

|

| |

Micropac Industries Inc.’s 2023 Equity Incentive Plan |

| |

Grant |

Number |

Number of |

Actual |

Actual |

Projected |

Projected |

| |

Date |

of Shares |

Vested Shares |

Fiscal 2022 |

Fiscal 2023 |

Fiscal 2024 |

Fiscal 2025 |

| |

RSUs |

|

|

|

|

|

|

| Mark King |

12/1/2022 |

10,355 |

2,158 |

- |

28,328 |

45,325 |

45,312 |

| Patrick Cefalu |

12/1/2022 |

6,718 |

1,399 |

- |

18,374 |

29,398 |

29,411 |

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

The following table shows the number and percentage

of shares of the Company's common stock beneficially owned (a) by each person known by the Company to own 5% or more of the outstanding

common stock, (b) by each director and nominee, and (c) by all present officers and directors as a group.

| Name and Address |

Number of Shares |

Percent |

| of Beneficial Owner(1) |

Beneficially Owned |

of Class(1) |

| |

|

|

| Robert Hempel(2) (3) |

1,952,577 |

75.7% |

| |

|

|

| Shaunna Black (2) |

0 |

0% |

| |

|

|

| Patrick Cefalu |

0 |

0% |

| |

|

|

| Christine Dittrich (2) |

0 |

0% |

| |

|

|

| Mark King (2) |

17,000 |

Less than 0.7% |

| |

|

|

| Donald Robinson (2) |

0 |

0% |

| |

|

|

| Gerald Tobey (2) |

0 |

0% |

| |

|

|

| All officers and directors |

1,969,577 |

76.4% |

| as a group (7 Persons) |

|

|

_______________________

| (1) | Calculated on the basis of the 2,578,315 outstanding shares. There are no options,

warrants, or convertible securities outstanding. The address of each person listed is 1655 State Hwy 66, Garland, Texas 75040. |

| (3) | A director of the Company. Each incumbent director has been nominated for re-election

at the Annual Meeting. |

| (3) | Effective October 10, 2007, the Hempel family transferred all of the shares of

the Company’s common stock owned by him and consisting of 1,952,577 shares, to a partnership organized under the laws of Germany.

Robert Hempel has the sole voting and management control. |

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

None.

| Item 14. |

Principal Accountant Fees and Services |

Whitley Penn LLP was selected as the Company’s

independent registered public accounting firm in 2016 and has been responsible for the Company's financial audit for the fiscal years

ended November 30, 2016, through November 30, 2023.

Management anticipates that a representative from

Whitley Penn LLP will be present at the Annual Meeting and will be given the opportunity to make a statement if he or she desires to do

so. It is also anticipated that such representative will be available to respond to appropriate questions from stockholders.

AUDIT FEES

The fees for professional services rendered for

the audit of our annual financial statements for each of the fiscal years ended November 30, 2023, and November 30, 2022, and the reviews

of the financial statements included in our Quarterly Reports on Form 10-Q during those periods were $154,000 and $145,000, respectively.

TAX FEES

Whitley Penn LLP fees for tax return preparation

services were $29,500 in 2023, and $29,500 in 2022, respectively.

ALL OTHER FEES

Whitley Penn LLP fees for audit of the Company’s

401K plan was $12,360 in 2023 and $11,000 2022, respectively.

The Audit Committee requests that the Principal

Accounting Firm provide the committee with the anticipated charges of all accounting and tax related services to be performed in advance

of performing such services. The Audit Committee approves all services in advance of the performance of such services.

REVIEW OF AUDITED FINANCIAL

STATEMENTS

The Audit Committee has discussed with management

and the independent auditors the quality and adequacy of the Company's internal controls. The Audit Committee has considered and reviewed

with the independent auditors their audit plans, the scope of the audit, and the identification of audit risks. The Audit Committee has

reviewed and discussed the audited financial statements with management and has discussed such financial statements with the independent

auditors.

The Audit Committee has received the written disclosures

and the report from the independent accountant required by the applicable requirements of the Public Company Accounting Oversight Board

regarding the independent accountant’s communications with the Audit Committee concerning independence and has discussed with the

independent accountant the independent accountant’s independence. Based upon the review and discussions referred to above, the Audit

Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s annual report

on Form 10-K for the fiscal year ended November 30, 2023, for filing with the Securities and Exchange Commission.

Management has the responsibility

for the preparation and integrity of the Company's financial statements and the independent auditors have the responsibility for the audit

of those statements. It is not the duty of the Audit Committee to conduct audits to determine that the Company’s financial statements

are complete and accurate and are in accordance with accounting principles generally accepted in the United States. In giving its recommendations,

the Audit Committee considered (a) management's representation that such financial statements have been prepared with integrity and objectivity

and in conformity with accounting principles generally accepted in the United States, and (b) the report of the Company’s independent

auditors with respect to such financial statements.

COST OF SOLICITATION OF PROXIES

The Company will bear the costs of the solicitation

of proxies for the Annual Meeting, including the cost of preparing, assembling and mailing proxy materials, the handling and tabulation

of proxies received and all charges to brokerage houses and other institutions, nominees and fiduciaries in forwarding such materials

to beneficial owners. In addition to the mailing of the proxy material, such solicitation may be made in person or by telephone or telegraph

by directors, officers and regular employees of the Company.

STOCKHOLDERS PROPOSALS

Any stockholder proposing to have any appropriate

matter brought before the next Annual Meeting of Stockholders scheduled for March 8, 2025 ,must submit such proposal in accordance with

the proxy rules not more than 180 days and not less than 120 days before February 7, 2025. Such proposal should be sent to Gerald Tobey,

Secretary, P. 0. Box 469017, Garland, Texas 75046.

Control Number:

Number of shares:

Registered Shareholder:

PROXY FOR ANNUAL MEETING OF SHAREHOLDERS

MICROPAC INDUSTRIES, INC.

March 8, 2024

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD

OF DIRECTORS

KNOW ALL MEN BY THESE PRESENTS: That the undersigned

stockholder of Micropac Industries, Inc., a Delaware Corporation, hereby constitutes and appoints Tracy Dotson and Patrick Cefalu, and

each of them acting individually, the true and lawful attorneys, agents and proxies of the undersigned, with full power of substitution

and revocation thereof, for and in the name, place and stead of the undersigned, to vote upon and act with respect to all shares of stock

of the Corporation standing in the name of the undersigned, or with respect to which the undersigned is entitled to vote and act if personally

present, at the Annual Meeting of Shareholders of said Corporation to be held March 8, 2024, at the place and time specified in Notice

of Annual Meeting of Shareholders and Proxy Statement dated February 7, 2024, and at any and all adjournments thereof, with all of the

powers the undersigned would possess if personally present at said meeting.

Resolved, that the following nominees be elected as Directors of

the Corporation, to serve until the next annual meeting of the stockholders or until their respective successors are elected and qualified:

| FOR

all nominees listed below (except as |

WITHHOLD

AUTHORITY to vote for ALL |

| marked to contrary below)__________ |

nominees listed below__________ |

(Instruction: To withhold authority to vote for

any individual nominee, strike a line through the nominee’s name in the list

below.)

| Robert Hempel |

Mark

W. King |

Gerald W. Tobey |

| Christine B. Dittrich |

Donald E. Robinson |

Shaunna F. Black |

THE SHARES REPRESENTED BY THIS PROXY WILL BE

VOTED IN ACCORDANCE WITH THE INSTRUCTIONS MADE ABOVE. IN THE ABSENCE OF INSTRUCTIONS, SUCH SHARES WILL BE VOTED FOR THE ELECTION OF THE

NOMINEES LISTED ABOVE. THIS PROXY ALSO DELEGATES DISCRETIONARY AUTHORITY TO VOTE WITH RESPECT TO ANY OTHER BUSINESS UPON WHICH THE UNDERSIGNED

IS ENTITLED TO VOTE AND THAT MAY PROPERLY COME BEFORE THIS ANNUAL MEETING OR ANY ADJOURNMENT THEREOF.

The undersigned hereby revokes all previous proxies

for the Annual Meeting and hereby acknowledges receipt of the notice of such Annual Meeting and the proxy statement furnished therewith.

| |

Dated |

,

2024 |

| |

|

|

| |

|

|

| |

(Stockholder’s Signature) |

| |

|

|

| |

|

|

| |

(Stockholder’s Signature) |

| |

|

|

| |

|

|

| |

(Title or Representative Capacity, if applicable) |

NOTE: If shares are registered in more than

one name, all owners should sign. If signing in a representative or fiduciary capacity, please give full title and attach evidence of

authority. Corporations please sign with full corporate name by duly authorized officer and affix corporate seal.

VOTING INSTRUCTIONS

Please sign, date and mail this Proxy Card promptly

to the following address in the enclosed postage-paid envelope or send the Proxy Card through facsimile or the e-mail address listed below:

Securities Transfer Corporation

2901 N. Dallas Parkway, Suite 380

Plano, Texas 75093

Attention: Proxy Department

You may also submit your Proxy Card by facsimile

to (469) 633-0088 or scan and email to proxyvote@stctransfer.com.

The Proxy Statement, the form of Proxy Card and

the Company’s Annual Report to Shareholders are available at http://onlineproxyvote.com/MPAD.

How to vote online:

| Step 1: |

Go to http://onlineproxyvote.com/MPAD at any time 24 hours a day. |

| Step 2: |

Login using the control number located in the top left-hand corner of this proxy card. |

| Step 3: |

Access the proxy voting link within that website to vote your proxy. |

- 13 -

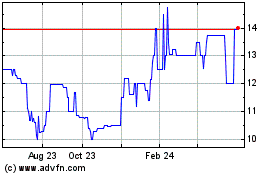

Micropac Industries (PK) (USOTC:MPAD)

Historical Stock Chart

From Oct 2024 to Nov 2024

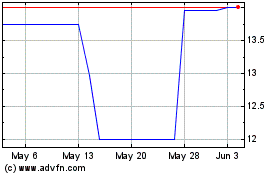

Micropac Industries (PK) (USOTC:MPAD)

Historical Stock Chart

From Nov 2023 to Nov 2024