Proxy Statement - Other Information (preliminary) (pre 14c)

August 13 2021 - 12:19PM

Edgar (US Regulatory)

SCHEDULE

14C

(Rule

14c-101)

INFORMATION

REQUIRED IN INFORMATION STATEMENT

Information

Statement Pursuant to Section 14(c) of the

Securities

Exchange Act of 1934

Check

the appropriate box:

|

☒

|

Preliminary

Information Statement

|

☐

|

Confidential,

for use of the Commission only

|

|

☐

|

Definitive

Information Statement

|

|

|

ORGANIC

AGRICULTURAL COMPANY LIMITED.

(Name

of Registrant as Specified In Its Charter)

Payment

of Filing Fee (Check the appropriate box):

|

☒

|

No

fee required.

|

|

☐

|

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

3)

|

Price

per unit or other underlying value of transaction pursuant to Exchange Act Rule 0-11. (Set

forth the amount on which the filing fee is calculated and state how it was determined.)

|

|

|

|

|

|

|

|

|

|

4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

☐

|

Fee

paid previously with preliminary materials.

|

|

|

☐

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify

the filing for which the offsetting fee was paid previously. Identify the previous filing

by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount

Previously Paid:

|

|

|

|

|

|

|

|

|

|

2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

ORGANIC

AGRICULTURAL COMPANY LIMITED

6th

Floor A, Chuangxin Yilu, No. 2305, Technology Chuangxincheng,

Gaoxin

Jishu Chanye Technology Development District,

Harbin

City. Heilongjiang Province, China 150090

INFORMATION

STATEMENT

To

the Holders of the Voting Stock:

The

purpose of this Information Statement is to notify you that the holder of shares representing a majority of the voting power of Organic

Agricultural Company Limited (the “Company”) have given their written consent to a resolution adopted by the Board of Directors

of the Company to amend the articles of incorporation to increase the number of authorized shares of common stock from 74 million to

274 million and to implement a 5.16-for-1 split of the outstanding common stock. We anticipate that this Information Statement will be

mailed on August 27, 2021 to shareholders of record. On or after September 17, 2021, the amendment of the articles of incorporation will

be filed with the Nevada Secretary of State and will become effective.

The

Board of Directors approved the amendment primarily in order to comply with the Company’s agreement with Unbounded IOT Block Chain

Limited (“Unbounded”), an entity with offices in Xiamen City, China, with which the Company is carrying on a joint venture.

The agreement with Unbounded requires that the Company implement a 5.16-for-1 stock split and then, if Unbounded satisfies certain criteria,

the Company must issue 20 million of its common shares to Unbounded. Completion of that entire transaction would require more common

shares than are currently authorized and unissued. The increase in authorized shares and the stock split, therefore, will allow the Company

to satisfy its obligations in connection with its agreement with Unbounded.

Nevada

corporation law and the Company’s bylaws permit holders of a majority of the voting power to take shareholder action by written

consent. Accordingly, the Company will not hold a meeting of its shareholders to consider or vote upon the amendment of the Company’s

certificate of incorporation.

WE

ARE NOT ASKING YOU FOR A PROXY.

YOU

ARE REQUESTED NOT TO SEND US A PROXY.

|

August 27,

2021

|

Xun Jianjun,

Chief Executive Officer

|

VOTING

SECURITIES AND PRINCIPAL SHAREHOLDERS

We

determined the shareholders of record for purposes of this shareholder action at the close of business on August 13, 2021 (the “Record

Date”). On that date, the Company's common stock was the only class of authorized voting stock. On the Record Date, there were

74,000,000 shares of the Company's common stock authorized and 16,189,336 shares outstanding. The following table sets forth information

regarding the voting stock beneficially owned by each member of our Board of Directors, by our officers and directors as a group, and

by any person who, to our knowledge, owned beneficially more than 5% of the common stock as of August 13, 2021.

|

Name

of Beneficial Owner(1)

|

|

Position

|

|

|

Shares

Owned

Beneficially(2)

|

|

|

Percentage

of Outstanding Shares

|

|

|

Shen Zhenai

|

|

|

Chairman

|

|

|

|

100,000

|

|

|

|

0.62

|

%

|

|

Xun Jianjun

|

|

|

Director

|

|

|

|

900,000

|

|

|

|

5.56

|

%

|

|

Cao Yongmei

|

|

|

Director

|

|

|

|

100,000

|

|

|

|

0.62

|

%

|

|

Hao Shuping

|

|

|

Director

|

|

|

|

4,880,000

|

|

|

|

30.14

|

%

|

|

Zhang Yongchun

|

|

|

Director

|

|

|

|

4,119,500

|

(3)

|

|

|

25.45

|

%

|

|

All officers and directors as a group

(5 persons)

|

|

|

--

|

|

|

|

10,099,500

|

|

|

|

62.38

|

%

|

|

|

(1)

|

The

address of all members of the Board of Directors is c/o the Company.

|

|

|

(2)

|

All

shares recited in the table are owned of record and beneficially, except as specifically

noted.

|

|

|

(3)

|

Represents

shares owned by Jilin Jiufu Zhenyuan Technology Development Co., Ltd., of which Mr. Zhang

is the director and principal owner.

|

AMENDMENT

OF THE ARTICLES OF INCORPORATION

TO

INCREASE THE AUTHORIZED COMMON STOCK AND IMPLEMENT A SPLIT

OF THE OUTSTANDING COMMON STOCK

The

Board of Directors of the Company has adopted a resolution to amend the articles of incorporation so as to increase the number of shares

of common stock authorized for issuance by the Board of Directors from 74,000,000 to 274,000,000 and to implement a 5.16-for-1 forward

split of the outstanding common stock. The holders of shares representing a majority of the Company’s outstanding common stock

have given their written consent to the resolution.

The

Board of Directors approved the amendment primarily in order to comply with the Company's Cooperation Agreement with Unbounded. Pursuant

to the Cooperation Agreement, which was signed on November 6, 2020 and amended on July 19, 2021, the Company and Unbounded organized

Tianci Wanguan (Xiamen) Digital Technology Co., Ltd. ("Tianci Wanguan") for the purpose of developing applications of blockchain

technology for use in agricultural production and marketing. Ownership of Tianci Wanguan is allocated 51% to the Company and 49% to Unbounded;

but day-to-day management of Tianci Wanguan is the responsibility of Unbounded. The Cooperation Agreement provides that the Company will

implement a 5.16-for-1 forward stock split, and then issue 20 million shares of common stock to Unbounded as compensation for its services.

However, the shares issued to Unbounded will be vested in Unbounded's ownership only if Tianci Wanguan records a profit of at least five

million Renminbi (approximately US$771,724) during the twelve month period after the initial 10 million shares are issued to Unbounded.

The Cooperation Agreement provides that the voting rights of the 20 million shares issued to Unbounded will be exercised by Hao Shuping,

who is a member of the Company's Board of Directors.

There are currently 74 million shares of the Company's

common stock authorized and 16,189,336 outstanding, leaving 57,810,664 shares available to be issued. Assuming that Unbounded satisfies

the criteria for receiving the 20 million shares, compliance with the Cooperation Agreement will require issuance of 87,347,638 common

shares. Compliance with the Cooperation Agreement, therefore, requires that additional shares be authorized.

Under Nevada corporation law, the consent of the holder

of a majority of the voting power is effective as shareholders’ approval. We will file the Amendment with the Secretary of State

of Nevada on or after September 17, 2021, and it will become effective on the date of such filing (the “Effective Date”).

On the Effective Date, the number of outstanding common shares will increase to 83,536,974 by reason of the stock split. Promptly after

the Effective Date, the Company will issue 10 million restricted shares to Unbounded, and will issue an additional 10 million shares to

Unbounded within a year later if the criteria for the 20 million share grant is satisfied. Unbounded would then own 19.3% of the outstanding

shares in the Company. If the criteria are not satisfied, then Unbounded will surrender the initial 10 million shares.

The

Board of Directors and the majority shareholders have approved the increase of authorized common stock to 274 million shares in order

to provide the Company with flexibility in pursuing its long-term business objectives. The primary reason for the increase is the requirement

contained in the Cooperation Agreement with Unbounded. Additional reasons for the increase in authorized shares include:

|

Ø

|

Management

may in the future pursue opportunities to obtain capital in order to fully implement the

Company’s business plan. A reserve of common shares available for issuance from time-to-time

will enable the Company to entertain a broad variety of financing proposals.

|

|

Ø

|

Management

may utilize the additional shares in connection with corporate acquisitions, joint venture

arrangements, or for other corporate purposes, including the solicitation and compensation

of key personnel.

|

Management

has not entered into any commitment to issue any shares except pursuant to the Cooperation Agreement with Unbounded.

As a result of the increase in authorized common stock

and after implementing the 5.16-for-1 stock split, there will be 190,436,026 common shares available for issuance. The Board of Directors

will be authorized to issue the additional common shares without having to obtain the approval of the Company’s shareholders. Nevada

law requires that the Board use its reasonable business judgment to assure that the Company obtains “fair value” when it issues

shares. Nevertheless, the issuance of the additional shares would dilute the proportionate interest of current shareholders in the Company.

The issuance of the additional shares could also result in the dilution of the value of shares now outstanding, if the terms on which

the shares were issued were less favorable than the contemporaneous market value of the Company’s common stock.

The

increase in the number of common shares available for issuance is not being done for the purpose of impeding any takeover attempt. Nevertheless,

the power of the Board of Directors to provide for the issuance of shares of common stock without shareholder approval has potential

utility as a device to discourage or impede a takeover of the Company. In the event that a non-negotiated takeover were attempted, the

private placement of stock into “friendly” hands, for example, could make the Company unattractive to the party seeking control

of the Company. This would have a detrimental effect on the interests of any stockholder who wanted to tender his or her shares to the

party seeking control or who would favor a change in control.

No

Dissenters Rights

Under

Nevada law, shareholders are not entitled to dissenters’ rights with respect to the amendment of the Certificate of Incorporation

to increase the authorized common stock and to implement a forward stock split.

*

* * * *

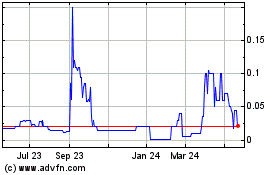

Organic Agricultural (CE) (USOTC:OGAA)

Historical Stock Chart

From Dec 2024 to Jan 2025

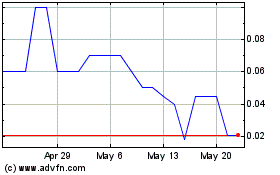

Organic Agricultural (CE) (USOTC:OGAA)

Historical Stock Chart

From Jan 2024 to Jan 2025