0001304161false--10-31FY20230.00011000000000000.00015000000000013041612022-11-012023-10-310001304161us-gaap:SubsequentEventMember2023-12-012023-12-150001304161pbsv:GlobalCustomerEMember2022-11-012023-10-310001304161pbsv:GlobalCustomerEMember2021-11-012022-10-310001304161pbsv:GlobalCustomerTotalMember2022-11-012023-10-310001304161pbsv:GlobalCustomerDMember2022-11-012023-10-310001304161pbsv:GlobalCustomerCMember2022-11-012023-10-310001304161pbsv:GlobalCustomerBMember2022-11-012023-10-310001304161pbsv:GlobalCustomerAMember2022-11-012023-10-310001304161pbsv:GlobalCustomerTotalMember2021-11-012022-10-310001304161pbsv:GlobalCustomerDMember2021-11-012022-10-310001304161pbsv:GlobalCustomerCMember2021-11-012022-10-310001304161pbsv:GlobalCustomerBMember2021-11-012022-10-310001304161pbsv:GlobalCustomerAMember2021-11-012022-10-310001304161srt:EuropeMember2022-11-012023-10-310001304161srt:EuropeMember2021-11-012022-10-310001304161pbsv:MajorCustomerTotalMember2022-11-012023-10-310001304161country:US2021-11-012022-10-310001304161country:US2022-11-012023-10-310001304161pbsv:MajorCustomerDMember2022-11-012023-10-310001304161pbsv:MajorCustomerCMember2022-11-012023-10-310001304161pbsv:MajorCustomerBMember2022-11-012023-10-310001304161pbsv:MajorCustomerAMember2022-11-012023-10-310001304161pbsv:MajorCustomerTotalMember2021-11-012022-10-310001304161pbsv:PRMember2021-11-012022-10-310001304161pbsv:PRMember2022-11-012023-10-310001304161pbsv:MajorCustomerDMember2021-11-012022-10-310001304161pbsv:MajorCustomerCMember2021-11-012022-10-310001304161pbsv:MajorCustomerBMember2021-11-012022-10-310001304161pbsv:MajorCustomerAMember2021-11-012022-10-310001304161country:PR2023-08-012023-10-310001304161pbsv:OtherSegmentMember2022-11-012023-10-310001304161pbsv:OtherSegmentMember2021-11-012022-10-310001304161pbsv:EuropeConsultingMember2022-11-012023-10-310001304161pbsv:EuropeConsultingMember2021-11-012022-10-310001304161pbsv:UnitedStatesConsultingMember2022-11-012023-10-310001304161pbsv:UnitedStatesConsultingMember2021-11-012022-10-310001304161pbsv:PuertoRicoConsultingMember2022-11-012023-10-310001304161pbsv:PuertoRicoConsultingMember2021-11-012022-10-310001304161us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-11-012023-10-310001304161us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-11-012022-10-310001304161us-gaap:CostOfSalesMember2022-11-012023-10-310001304161us-gaap:CostOfSalesMember2021-11-012022-10-310001304161pbsv:Plan2014Member2023-10-310001304161pbsv:Plan2014Member2022-11-012023-10-310001304161pbsv:Plan2014Member2021-11-012022-10-310001304161pbsv:Plan2014Member2021-10-310001304161pbsv:Plan2014Member2022-10-310001304161us-gaap:EmployeeStockOptionMember2021-11-012022-10-310001304161us-gaap:EmployeeStockOptionMember2022-11-012023-10-3100013041612023-04-012023-04-140001304161pbsv:OfficeFacilityMember2022-11-012023-10-310001304161us-gaap:LeaseAgreementsMember2022-11-012023-10-310001304161pbsv:PRIDCOMember2022-11-012023-10-310001304161pbsv:TaxReformMember2017-12-220001304161pbsv:TaxReformMember2021-11-012022-10-310001304161pbsv:TaxReformMember2022-11-012023-10-310001304161us-gaap:FurnitureAndFixturesMember2022-11-012023-10-310001304161srt:MaximumMemberus-gaap:EquipmentMember2022-11-012023-10-310001304161srt:MinimumMemberus-gaap:EquipmentMember2022-11-012023-10-310001304161us-gaap:ComputerEquipmentMember2022-11-012023-10-310001304161us-gaap:VehiclesMember2022-11-012023-10-310001304161us-gaap:FurnitureAndFixturesMember2023-10-310001304161us-gaap:FurnitureAndFixturesMember2022-10-310001304161us-gaap:EquipmentMember2023-10-310001304161us-gaap:EquipmentMember2022-10-310001304161us-gaap:ComputerEquipmentMember2023-10-310001304161us-gaap:ComputerEquipmentMember2022-10-310001304161us-gaap:VehiclesMember2023-10-310001304161us-gaap:VehiclesMember2022-10-310001304161pbsv:TreasuryStocksMember2023-10-310001304161us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-310001304161us-gaap:RetainedEarningsMember2023-10-310001304161us-gaap:AdditionalPaidInCapitalMember2023-10-310001304161us-gaap:PreferredStockMember2023-10-310001304161us-gaap:CommonStockMember2023-10-310001304161pbsv:TreasuryStocksMember2022-11-012023-10-310001304161us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-11-012023-10-310001304161us-gaap:RetainedEarningsMember2022-11-012023-10-310001304161us-gaap:AdditionalPaidInCapitalMember2022-11-012023-10-310001304161us-gaap:PreferredStockMember2022-11-012023-10-310001304161us-gaap:CommonStockMember2022-11-012023-10-310001304161pbsv:TreasuryStocksMember2022-10-310001304161us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-310001304161us-gaap:RetainedEarningsMember2022-10-310001304161us-gaap:AdditionalPaidInCapitalMember2022-10-310001304161us-gaap:PreferredStockMember2022-10-310001304161us-gaap:CommonStockMember2022-10-310001304161pbsv:TreasuryStocksMember2021-11-012022-10-310001304161us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-11-012022-10-310001304161us-gaap:RetainedEarningsMember2021-11-012022-10-310001304161us-gaap:AdditionalPaidInCapitalMember2021-11-012022-10-310001304161us-gaap:PreferredStockMember2021-11-012022-10-310001304161us-gaap:CommonStockMember2021-11-012022-10-3100013041612021-10-310001304161pbsv:TreasuryStocksMember2021-10-310001304161us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-10-310001304161us-gaap:RetainedEarningsMember2021-10-310001304161us-gaap:AdditionalPaidInCapitalMember2021-10-310001304161us-gaap:PreferredStockMember2021-10-310001304161us-gaap:CommonStockMember2021-10-3100013041612021-11-012022-10-3100013041612022-10-3100013041612023-10-3100013041612024-01-1900013041612023-04-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

For the fiscal year ended October 31, 2023

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

For the transition period from _____________ to ______________

Commission File No. 000-50956

PHARMA-BIO SERV, INC. |

(Exact Name of Registrant as Specified in Its Charter) |

Delaware | | 20-0653570 |

(State or Other Jurisdiction of Incorporation or Organization) | | (IRS Employer Identification No.) |

Pharma-Bio Serv Building, #6 Road 696 Dorado, Puerto Rico | | 00646 |

(Address of Principal Executive Offices) | | (Zip Code) |

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act: None

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | |

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.0001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of common stock held by non-affiliates of the registrant, based on the closing price for the registrant’s common stock on April 30, 2023 (the last business day of the second quarter of the registrant’s current fiscal year), was $13,638,206.

The number of shares of the registrant’s common stock outstanding as of January 24, 2024 was 22,963,143.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement relative to the Annual Meeting of Stockholders for the year ended October 31, 2023 are incorporated by reference in Part III hereof.

PHARMA-BIO SERV, INC.

FORM 10-K

FOR THE YEAR ENDED OCTOBER 31, 2023

TABLE OF CONTENTS

PART I

ITEM 1. BUSINESS.

GENERAL

Pharma-Bio Serv, Inc. (“Pharma-Bio” or the “Company”) is a Delaware corporation organized on January 14, 2004. The Company operates in Puerto Rico, the United States, Europe and Brazil under the name of Pharma-Bio Serv, and is engaged in providing technical compliance consulting services to the pharmaceutical, chemical, biotechnology, medical devices, cosmetic and food industries, and allied products companies.

Our executive offices are located at Pharma-Bio Serv Building, #6 Road 696, Dorado, Puerto Rico 00646. Our telephone number is (787) 278-2709. The financial information about our reporting segments appear in Note J to our Consolidated Financial Statements included in this Annual Report on Form 10-K.

Our website is www.pharmabioserv.com. Information on our website or any other website is not part of this Annual Report on Form 10-K.

References to “we,” “us,” “our” and similar words in this Annual Report on Form 10-K refer to Pharma-Bio Serv, Inc. and its subsidiaries.

OVERVIEW

We are a regulatory affairs, quality, compliance and technology transfer services consulting firm with headquarters in Puerto Rico, servicing the Puerto Rico, United States, and European markets, and to a lesser extent the Brazilian market which is under development. The compliance consulting service sector in those markets consists of local compliance and validation consulting firms, United States dedicated validation and compliance consulting firms, and large publicly traded and private domestic and foreign engineering and consulting firms. We provide a broad range of compliance-related consulting services. We market our services to pharmaceutical, chemical, biotechnology, medical devices, cosmetic and food industries, and allied products companies principally in Puerto Rico, the United States, Europe and Brazil. Our consulting team includes experienced engineering and life science professionals, former quality assurance managers and directors, former health agencies officials, and professionals with bachelors, masters and doctorate degrees in health sciences and engineering.

We have a well-established and consistent relationships with the major pharmaceutical, biotechnology, medical device and chemical manufacturing companies in Puerto Rico and the United States, which provides us access to affiliated companies in other markets. We seek opportunities in markets that can yield profitable margins using our professional consulting force.

We believe the most significant factors to achieving future business growth include our ability to: (i) continue to provide quality value-added compliance services to our clients; (ii) recruit and retain highly educated and experienced consultants; (iii) further expand our products and services to address the expanding needs of our clients; and (iv) expand our market presence in the United States, Europe, Brazil and other emerging pharmaceutical markets to respond to the international compliance needs of our clients and potential clients. Our business is affected to the extent economic conditions impact the decisions of our clients and potential clients to establish operations, or continue or expand their existing operations.

Our revenue is derived from (i) time and materials contracts (representing approximately 99% of total revenue), where the clients are charged for the time, materials and expenses incurred on a particular project or service and (ii) fixed-fee contracts or from “not to exceed” contracts (approximately 1% of total revenue), which are generally short-term contracts, in which the value of the contract cannot exceed a stated amount. For time and materials contracts, our revenue is principally a function of the number of consultants and the number of hours billed per consultant. To the extent that our revenue is based on fixed-fee or “not to exceed” contracts, our ability to operate profitably is dependent upon our ability to estimate accurately the costs that we will incur on a project and to manage and monitor the project. If we underestimate our costs on any contract, we could sustain a loss on the contract or its profitability might be reduced.

The principal components for our consulting costs of services are resource compensation to our consulting team and expenses relating to the performance of the services. In order to ensure that our pricing is competitive yet minimize the impact on our margins, we manage increasing labor costs by (i) selecting consultants according to our cost for specific projects, (ii) negotiating, where applicable, rates with the consultant, (iii) subcontracting labor and (iv) negotiating and passing rate increases to our customers, as applicable. Although this strategy has been successful in the past, we cannot give any assurance that such strategy will continue to be successful.

We have established quality systems for our employees which include:

| · | Training Programs - including a current Good Manufacturing Practices exam prior to recruitment and periodic refreshers, |

| | |

| · | Recruitment Full Training Program - including employee manual, dress code, time sheets and good project management and control procedures, job descriptions, and firm operating and administration procedures, |

| | |

| · | Safety Program - including Occupational Safety and Health Act (“OSHA”) and Environmental Health and Safety, and |

| | |

| · | Code of Ethics and Business Conduct - a code of ethics and business conduct is used and enforced as one of the most significant company controls on personal behavior. |

In addition, we have implemented procedures to respond to client complaints and have in place customer satisfaction survey procedures. As part of our employee performance appraisal annual process, our clients receive an evaluation form for employee project performance feedback, including compliance with our code of ethics and business conduct.

The Company currently operates three reportable segments: (i) Puerto Rico technical compliance consulting, (ii) United States technical compliance consulting, and (iii) Europe technical compliance consulting.

BUSINESS STRATEGY AND OBJECTIVES

We are actively pursuing to expand our services in the United States, European and Brazilian markets as part of our growth strategy, while maintaining our position in the Puerto Rico market. We have a well-established and consistent relationship with the major pharmaceutical, biotechnology, medical device and chemical manufacturing companies in Puerto Rico and the United States which provides us access to affiliated companies in other markets. We seek opportunities in markets that can yield profitable margins using our professional consulting force.

Our business strategy is based on a commitment to provide premium quality and professional consulting services and reliable customer service to our customer base. Our business strategy and objectives are as follow:

| ● | Grow consulting services in each technical service, quality assurance, regulatory compliance, technology transfer, validation, engineering, and manufacturing departments by achieving greater market penetration from our marketing and sales efforts; |

| ● | Continue to enhance our technical consulting services through internal growth and acquisitions that provide solutions to our customers’ needs; |

| ● | Motivate our consulting and support staff by implementing a compensation program which includes both individual performance and overall company performance as elements of compensation; |

| ● | Create a pleasant corporate culture and emphasize operational quality, safety and timely service; |

| ● | Continue to maintain our reputation as a trustworthy and highly ethical partner; and |

| ● | Efficiently manage our operating and financial costs and expenses. |

TECHNICAL CONSULTING SERVICES

We have established a reputation as a premier technical consulting services firm to the pharmaceutical, chemical, biotechnology, medical devices, cosmetic and food industries, and allied products companies in various markets. These services include regulatory compliance, validation, technology transfer, engineering, project management and process support. During the year ended October 31, 2023, we have serviced approximately 80 customers that are among the largest pharmaceutical, chemical manufacturing, medical device and biotechnology companies. We participate in exhibitions, conferences, conventions and seminars as either exhibitors, sponsors or conference speakers.

MARKETING

We conduct our marketing activities in Puerto Rico, United States, Europe and other markets. We actively utilize our project managers and leaders who are currently managing consulting service contracts at various client locations to also market consulting services to their existing and past client relationships. Our senior management is also actively involved in the marketing process, especially in marketing to major accounts. Our senior management and staff also concentrate on developing new business opportunities and focus on the larger customer accounts (by number of consultants or dollar volume) and responding to prospective customers’ requests for proposals.

PRINCIPAL CUSTOMERS

We provide a substantial portion of our services to four customers, each of whom accounted for 10% or more of our revenues in either of the years ended October 31, 2023 and 2022. During the years ended October 31, 2023 and 2022, these customers accounted for, in the aggregate, 37.6% and 38.8% of total revenue, respectively. Although a few customers represent a significant source of revenue, our functions are not a continuous process, accordingly, the client base for which our services are typically rendered, on a project-by-project basis, changes regularly. Therefore, in any given year a small number of customers could represent a significant source of our revenue for that year. The loss of, or significant reduction in the scope of work performed for any major customer or our inability to replace customers upon completion of contracts could adversely affect our revenue and impair our ability to operate profitably.

COMPETITION

We are engaged in a highly competitive and fragmented industry. Some of our competitors are, on an overall basis, larger than we are or are subsidiaries of larger companies, and therefore may possess greater resources than we do. Furthermore, because the technical professional aspects of our consulting business do not usually require large amounts of capital, there is relative ease of market entry for a new entrant possessing acceptable professional qualifications. Accordingly, we compete with regional, national, and international firms. Within our major markets, certain competitors, including local competitors, may possess greater resources than we do as well as better access to clients and potential clients.

Competition for validation and consulting services used to be primarily based on reputation, track record, experience, and quality of service. However, given our clients’ strategies to reduce costs, price of service has become a major factor in sourcing our services. We believe we benefit from competitive advantages over other consulting service firms because of our historical market share within Puerto Rico (over 30 years), brand name, reputation and track record with many of the major pharmaceutical, biotechnology, medical device and chemical manufacturing companies, which have a presence in the markets we serve and are pursuing.

The market of qualified and experienced consultants that can provide technical consulting services is very competitive and consists primarily of our competitors as well as companies in the pharmaceutical, chemical, biotechnology and medical device industries who are our clients and potential clients. In seeking qualified personnel, we market our name recognition in the Puerto Rico market, our reputation with our clients, and salary and benefit packages.

INTELLECTUAL PROPERTY RIGHTS

We have no proprietary software or products. We rely on non-disclosure agreements with our employees to protect the proprietary software and other proprietary information of our clients. Any unauthorized use or disclosure of this information could harm our business.

HUMAN CAPITAL

Our “workforce” (which includes approximately 100 employees, plus independent contractors), is vital to our success. As a human capital-intensive business, our ability to attract, develop, and retain exceptional and diverse employees and independent contractors is critical, not only in the current competitive labor market, but also to our long-term success. A diverse and inclusive workforce is a natural extension of our culture and original foundation. We are committed to ensuring that our workforce feels welcomed, valued, respected, and heard, so that they can fully contribute their unique talents for the benefit of their careers, our clients, our Company, and our communities.

The physical, emotional, and financial well-being of our employees is a high priority of our Company. To that end and to compete effectively, we offer competitive compensation, healthcare insurance, wellness programs, paid time off, family leave, and workplace flexibility, among others.

We also endeavor to foster and maintain our unique and long-standing values-based culture. Our workforce is expected to exhibit and promote honest, ethical and respectful conduct in the workplace. Employee satisfaction, morale, engagement and feedback is monitored through satisfaction surveys conducted by management.

All of our employees are full-time employees. None are represented by a labor union, and we consider our employee relations to be good.

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The following table sets forth certain information with respect to our executive officers.

Name | | Age | | | Position | |

Victor Sanchez | | | 53 | | | Chief Executive Officer, President and President of European Operations | |

Pedro J. Lasanta | | | 64 | | | Chief Financial Officer, Vice President - Finance and Administration and Secretary | |

Victor Sanchez has served as our Chief Executive Officer and President since January 1, 2015 and as the President of the European Operations of the Company since January 2011. Prior to joining the Company, he served as Operations Manager in the LOCM and OSD divisions of Merck Sharp & Dohme (“MSD”), a pharmaceutical company, in Madrid, Spain from April 2010 to January 2011 and as Operations Manager of the LOCM division of Schering-Plough S.A., a pharmaceutical company, in Madrid, Spain, from September 2004 to April 2010. He served as Quality Control Validations Manager for Schering-Plough Products, LLC, a pharmaceutical company (“Schering-Plough”), in Puerto Rico from December 2000 to August 2004 and as Quality Control Laboratory Supervisor of Schering-Plough from April 1996 to December 2000. Mr. Sanchez holds a Bachelor of Science in Chemistry, summa cum laude, and a M.B.A. in Industrial Management, cum laude, from the Interamerican University of Puerto Rico. He holds a Post Graduate Diploma in Pharmaceutical Validation Technology from the Dublin Institute of Technology, Ireland. He also has a US Regulatory Affairs certification from the Regulatory Affairs Professional Society. Mr. Sanchez is a chemist licensed by the Puerto Rico State Department and a member of the American Chemical Society, the Parenteral Drug Association, the Regulatory Affairs Professional Society, and the International Society for Pharmaceutical Engineers.

Pedro J. Lasanta has served as our Chief Financial Officer and Vice President - Finance and Administration since November 2007, and our Secretary since December 1, 2014. From 2006 until October 2007, Mr. Lasanta was in private practice as an accountant, tax and business counselor. From 1999 until 2006, Mr. Lasanta was the Chief Financial Officer for Pearle Vision Center PR, Inc. In the past, Mr. Lasanta was also an audit manager for Ernst & Young, formerly Arthur Young & Company. He is a cum laude graduate in business administration (accounting) from the University of Puerto Rico. Mr. Lasanta is a Certified Public Accountant. In 2012, he was awarded the Puerto Rico Manufacturers Association (North Region) Service Manager of the Year. Mr. Lasanta served as a Member of the Puerto Rico District Export Council for the U.S. Department of Commerce from January 2014 until December 2018.

ITEM 1A. RISK FACTORS.

This Annual Report on Form 10-K includes “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, including certain statements about our plans, strategies and prospects. Although we believe that our plans, intentions and expectations reflected in or suggested by such forward-looking statements are reasonable, we cannot assure you that such plans, intentions or expectations will be achieved. Important factors that could cause our actual results to differ materially from our forward-looking statements include those set forth in this Risk Factors section.

If any of the following risks, or other risks not presently known to us or that we currently believe to not be significant, develop into actual events, then our business, financial condition, results of operations, cash flows or prospects could be materially adversely affected.

Operational Risks

Because our business is concentrated in the life science and medical devices industries in Puerto Rico, the United States and Europe, any changes in those industries or in those markets could impair our ability to generate revenue and realize a profit.

Since most of our business is performed in Puerto Rico, the United States and Europe, for pharmaceutical, biotechnology, medical device and chemical manufacturing companies, our ability to generate revenue and realize a profit could be impaired by factors impacting those markets. For example, changes in tax laws or regulatory, political or economic conditions, exposure to foreign exchange variations, high inflation levels or interest rates, which discourage businesses from operating in the markets we serve, which affect the need for services such as those provided by us, could impair our ability to generate revenue and realize a profit.

Companies in the pharmaceutical and related industries for which we perform services are subject to economic pressures, which affect their global operations, and which may influence the decision to reduce or increase the scope of their operations in the markets we serve. These companies consider a wide range of factors in making such a decision, and may be influenced by a need to consolidate operations, to reduce expenses, to increase their business in geographical regions where there are large customer bases, tax, regulatory, economic and political considerations and many other factors. We cannot assure you that our customers and potential customers will not make extensive reductions or terminate their operations in the markets we serve, and/or our operations may be adversely affected by: changes in tax legislation, foreign exchange variations, high inflation levels or interest rates, which could significantly impair our ability to generate revenue and realize a profit.

Puerto Rico’s economy, including its governmental budgetary constraints, declining population growth, and the impact of hurricanes or any other natural disasters, including earthquakes, may affect the willingness of businesses to commence or expand operations in Puerto Rico, or may also consider closing operations located in Puerto Rico.

As a result of Puerto Rico’s governmental budgetary constraints being imposed by the Oversight and Management Board for Puerto Rico under the Puerto Rico Management and Economic Stability Act (PROMESA), the declining population growth, and the impacts of hurricanes or other natural disasters, including earthquakes, businesses may be reluctant to establish or expand their operations in Puerto Rico, or might consider closing operations currently in Puerto Rico. Also, the damage resulting from the hurricanes or other natural disasters to the operating conditions of our clients, and insufficient federal recovery and rebuilding assistance may cause lasting and severe damage to the island’s economic base. Furthermore, since Puerto Rico’s economy is petroleum-based, the fluctuating price of oil, combined with Puerto Rico’s debt, and a weak energy infrastructure, may make Puerto Rico a less attractive place to expand existing operations or commence new business activities. In the event that companies in the pharmaceutical and related industries decide not to commence new operations or not to expand their existing operations in Puerto Rico, or consider closing operations in Puerto Rico, the demand for our services could be negatively affected.

Because our business is dependent upon a small number of clients, the loss of a major client could impair our ability to operate profitably.

Our business is currently and has historically been dependent upon a small number of clients. During the years ended October 31, 2023 and 2022, a small number of clients accounted for a disproportionately large percentage of our revenue. In the years ended October 31, 2023 and 2022, four customers accounted for, in aggregate, approximately 37.6% and 38.8% of total revenue, respectively.

The loss of, or significant reduction in the scope of work performed for, or any significant change in the financial terms related to, any major customer could impair our ability to operate profitably. We cannot assure that we will not sustain significant decreases in revenue from our major customers or that we will be able to replace any major customers or the resulting decline in revenue.

The collectability of our accounts receivable may be subject to our customers’ operations and funding sources.

If our customers’ cash flow, working capital, financial conditions or results of operations deteriorate, they may be unable to pay the accounts receivable owed to us promptly or at all. If a major customer experiences, or a significant number of customers experience, financial difficulties, the effect on us could be material and have an adverse effect on our business, financial condition and results of operations.

Customer procurement and sourcing practices intended to reduce costs could have an adverse effect on our margins and profitability.

To reduce their costs, many of our customers are establishing or extending the scope of their procurement departments to include consulting and project management services, such as ours. As a result, we have less interaction with the end user of our services (typically labs or production units) when bidding on a project, which we believe decreases the focus on the quality of service provided and increases the emphasis on cost of the service. This may cause us to lower the price of our bids, which would reduce the margins in a given project. Also, some customers have established vendor management/vendor neutral-programs with third-parties (some of whom are also our competitors). Because these vendor management programs may receive a percentage of our fees, without a corresponding increase in the fee itself, our margins may be adversely affected. In addition, where a vendor management program is a competitor for a particular service we provide, we may have difficulty securing that particular project, which would adversely impact revenue. Some of these vendor neutral programs are intended to limit our interaction with our direct end user, and our interaction is limited to the representative of the vendor neutral agency. This limitation impairs our ability to establish and maintain our relationships with our customers and recognition of the value added in the service.

We may be unable to pass on increased labor costs to our clients.

The principal components of our cost of revenues are employee compensation (salaries, wages, taxes and benefits), independent contractors fees and expenses relating to the performance of the services we provide. We face increasing labor costs which we seek to pass on to our customers through increases in our rates. To remain competitive, we may not be able to pass these increased costs on to our clients, and, to the extent that we are not able to pass these increased costs on to our clients, our operating margin may be reduced.

Consolidation in the pharmaceutical industry may have a harmful effect on our business.

In recent years, the pharmaceutical industry has undergone consolidation, and may in the future undergo further substantial consolidation which may reduce the number of our existing and potential customers. The consolidation in the pharmaceutical industry may have a harmful effect on our business and our ability to maintain and replace customers.

We may be held liable for the actions of our employees or contractors when on assignment.

We may be exposed to liability for actions taken by our employees or contractors while on assignment, such as damages caused by their errors, misuse of client proprietary information or theft of client property. Due to the nature of our assignments, we cannot assure you that we will not be exposed to liability as a result of our employees or contractors being on assignment. Furthermore, our reputation may be damaged and our ability to generate business may be affected.

To the extent that we perform services pursuant to fixed-price or incentive-based contracts, our cost of services may exceed our revenue on the contract.

Some of our revenue is derived from fixed-price contracts. Our costs of services may exceed the revenue of these contracts if we do not accurately estimate the time and complexity of an engagement. Further, we are seeking contracts by which our compensation is based on specified performance objectives, such as the realization of cost savings, quality improvements or other performance objectives. Our failure to achieve these objectives would reduce our revenue and could impair our ability to operate profitably.

Our profit margin is largely a function of the rates we are able to charge and collect for our services and the utilization rate of our consultants. Accordingly, if we are not able to maintain our pricing for our services or an appropriate utilization rate for our consultants without corresponding cost reductions, our profit margin and profitability will suffer. The rates we are able to charge for our services are affected by a number of factors, including:

| ● | Our clients’ perception of our ability to add value through our services; |

| ● | Our ability to complete projects on time; |

| ● | Pricing policies of competitors; |

| ● | Our ability to accurately estimate, attain and sustain engagement revenues, margins and cash flows over increasingly longer contract periods; and |

| ● | General economic and political conditions. |

Our utilization rates are also affected by a number of factors, including:

| ● | Our ability to shift employees and contractors from completed projects to new engagements; and |

| ● | Our ability to manage attrition of our employees and contractors. |

Because most of our contracts may be terminated on little or no advance notice, our failure to maintain or generate new business could impair our ability to operate profitably.

Most of our contracts can be terminated by our clients with little or no advance notice. Our clients typically retain us on a non-exclusive, engagement-by-engagement basis, and the client may terminate, cancel or delay any engagement or the project for which we are engaged, at any time and on no advance notice. As a result, the termination, cancellation, expiration or delay of contracts could have a significant impact on our ability to operate profitably.

Because of the competitive nature of the pharmaceutical, biotechnology, medical device and chemical manufacturing consulting market, we may not be able to compete effectively if we cannot efficiently respond to changes in the structure of the market and developments in technology.

Because of consolidations in the pharmaceutical, biotechnology, medical device and chemical manufacturing consulting business, we are faced with an increasing number of larger companies that offer a wider range of services and have better access to capital than us. We believe that larger and better-capitalized competitors have enhanced abilities to compete for both clients and skilled consultants. In addition, one or more of our competitors may develop and implement methodologies that result in superior productivity and price reductions without adversely affecting their profit margins. We cannot assure you that we will be able to compete effectively in an increasingly competitive market.

Because we are dependent upon our management and technical personnel, our ability to develop our business may be impaired if we are not able to engage skilled personnel.

Our future success will depend in part upon our ability to attract and retain qualified management and technical personnel. Competition for such personnel is intense and we compete for qualified personnel with numerous other employers, including consulting firms, some of which have greater resources than we have, as well as pharmaceutical companies, most of which have significantly greater financial and other resources than we do. We may experience increased costs to retain and attract skilled employees. Our failure to attract additional personnel or to retain the services of key personnel and independent contractors could have a material adverse effect on our ability to operate profitably.

Our cash could be adversely affected if the financial institutions in which we hold our cash fail.

The Company maintains domestic cash deposits in Federal Deposit Insurance Corporation (“FDIC”) insured banks and in money market obligation trusts registered under the US Investment Company Act of 1940, as amended. The domestic bank deposit balances may exceed the FDIC insurance limits. In the foreign markets we serve, we also maintain cash deposits in foreign banks, some of which are not insured or partially insured by the FDIC or other similar agency. These balances could be impacted if one or more of the financial institutions in which we deposit monies fails or is subject to other adverse conditions in the financial or credit markets. We can provide no assurance that access to our invested cash will not be impacted by adverse conditions in the financial and credit markets.

We may be harmed if we do not penetrate markets and grow our current business operations.

If we fail to further penetrate target markets, or to successfully expand our business into new markets, the growth in sales of our services, along with our operating results, could be materially adversely impacted. A key element of our growth strategy may be to grow our business through acquisitions. Acquisitions involve many different risks, including (1) the ability to finance acquisitions, either with cash, debt, or equity issuances; (2) the ability to integrate acquisitions; (3) the ability to realize anticipated benefits of the acquisitions; (4) the potential to incur unexpected costs, expenses, or liabilities; and (5) the diversion of management’s attention and Company resources. Many of our competitors may also compete with us for acquisition candidates, which can increase the price of acquisitions and reduce the number of available acquisition candidates. We cannot assure you that efforts to increase market penetration in our core markets and existing geographic markets will be successful. Our failure to penetrate markets and grow our current business operations could have a material adverse effect on our business, financial condition, results of operations, and cash flow.

Disruptions in our information technology systems could adversely affect our business and the results of operations. If these systems fail or become unavailable for any period of time this could limit our ability to effectively monitor and control our operations and adversely affect our operations. Additionally, a breach or an alleged breach of our information technology systems could subject us to liability or reputational damage.

Our information technology systems facilitate our ability to transact business, monitor and control our operations and adjust to changing market conditions. Any disruption in our information technology systems or the failure of these systems to operate as expected could, depending on the magnitude of the problem, adversely affect our operating results by limiting our capacity to effectively transact business, monitor and control our operations and adjust to changing market conditions in a timely manner.

In addition, because of recent advances in technology and well-known efforts on the part of computer hackers and cyber-terrorists to breach data security of companies, we may face risks associated with potential failure to detect breaches or adequately protect critical corporate, customer and employee data, which, if released, could adversely impact our customer relationships, our reputation, and even violate privacy laws. As part of our business, we develop, receive and retain confidential data about our company and our customers.

There can be no assurance that our efforts to protect our data and information technology systems will prevent breaches in our systems (or that of our third-party providers) that could adversely affect our business and result in financial and reputational harm to us, theft of trade secrets and other proprietary information, legal claims or proceedings, liability under laws that protect the privacy of personal information, and regulatory penalties.

Regulatory Risks

Because the pharmaceutical industry is subject to government regulations, changes in government regulations relating to this industry may affect the need for our services.

Because government regulations affect all aspects of the pharmaceutical, biotechnology, medical device and chemical manufacturing industries, including regulations relating to the testing and manufacturing of pharmaceutical products and the disposal of materials which are or may be considered toxic, any change in government regulations could have a profound effect upon not only these companies but companies, such as ours, that provide services to these industries. If we are not able to adapt and provide necessary services to meet the requirements of these companies in response to changes in government regulations, our ability to generate business may be impaired.

Government regulatory agencies proposals or interpretations of existing rules and regulations that would change, or at least challenge, the classification of our independent contractors may affect our costs and taxes which could adversely affect our business, financial condition, results of operations and prospects.

We have a diversified and skilled workforce which is contracted to cover the different project opportunities which vary ratably from time to time. Depending on the project, the workforce may be either employees or independent contractors with backgrounds that vary from experienced engineering and life science professionals, former quality assurance managers and directors, and professionals with bachelors, masters and doctorate degrees in health sciences and engineering. Although we believe we have properly classified our independent contractors, there can be no assurance that Government regulatory agencies new proposals or interpretations of existing rules and regulations may change, or at least challenge, the classification of our independent contractors. Consequently, our costs and taxes may adversely affect our business, financial condition, results of operations and prospects.

Changes in tax laws in the United States, Puerto Rico or in other jurisdictions where we do business may adversely impact the willingness of our customers to continue or to expand their operations where we do business and may also impact our tax business model.

As a result of the continued changes in tax laws in the United States, Puerto Rico or other jurisdictions where we do business, the tax business model of various US or foreign companies and their subsidiaries, doing business in Puerto Rico and other foreign jurisdictions may be affected, making them a less attractive investment. For example, the US implemented the Global Intangible Low-Tax Income ("GILTI") as part of the 2017 Tax Cuts and Jobs Act, and under the sponsor of the Organization for Economic Cooperation and Development (the “OECD”), various other countries entered into an agreement to establish a global minimum corporate tax rate of 15%, effective for the year 2024. Consequently, this may affect the willingness of such companies to continue, expand and/or bring new operations to jurisdictions where we do business, which may impair our ability to generate business in those markets, and may also impact our tax business model.

If we are unable to renegotiate the term of the tax grant issued by the Puerto Rico Industrial Development Company (“PRIDCO”) we may incur increased tax payments, which could have a material adverse effect on our business, financial condition, results of operations, and cash flow.

The Company holds a tax grant issued by PRIDCO, which provides relief on various Puerto Rico taxes, including income tax, with certain limitations, for most of the activities carried on within Puerto Rico, including those that are for services to parties located outside of Puerto Rico. The grant was effective as of November 1, 2009 and covers a fifteen-year period, ending on October 31, 2024. Under provisions of Puerto Rico Acts 60-2019 and 73-2008, we have requested the renegotiation of the grant from PRIDCO for an additional term of fifteen years. As of the date of this filing, we have not received from PRIDCO a status for this request. If we are unable to renegotiate the term of the grant, we may incur increased tax payments, which could have a material adverse effect on our business, financial condition, results of operations, and cash flow.

Intellectual Property Risks

Since our business is dependent upon the development and enhancement of patented pharmaceutical products or processes by our clients, the failure of our clients to obtain and maintain patents could impair our ability to operate profitably.

Companies in the pharmaceutical industry are highly dependent on their ability to obtain and maintain patents for their products or processes. The inability by our clients to obtain new patents and the expiration of active patents may reduce the need for our services and thereby impair our ability to operate profitably.

If we are unable to protect our clients’ intellectual property, our ability to generate business will be impaired.

Our services either require us to develop intellectual property for clients or provide our personnel with access to our clients’ intellectual property. Because of the highly competitive nature of the pharmaceutical, biotechnology, medical device and chemical manufacturing industries and the sensitivity of our clients’ intellectual property rights, our ability to generate business would be impaired if we fail to protect those rights. Although our employees and contractors are required to sign non-disclosure agreements, any disclosure of a client’s intellectual property by an employee or contractor may subject us to litigation and may impair our ability to generate business either from the affected client or other potential clients. In addition, we are required to enter into confidentiality agreements and our failure to protect the confidential information of our clients may impair our business relationship.

We may be subject to liability if our services or solutions for our clients infringe upon the intellectual property rights of others.

It is possible that in performing services for our clients, we may inadvertently infringe upon the intellectual property rights of others. In such event, the owner of the intellectual property may commence litigation seeking damages and an injunction against both us and our client, and the client may bring a claim against us. Any infringement litigation would be costly. Even if we prevail, we will incur significant expenses and our reputation could be hurt, which would affect our ability to generate business and the terms on which we would be engaged, if at all.

Common Stock Risks

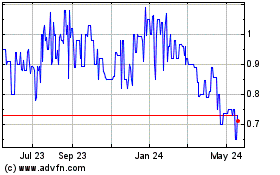

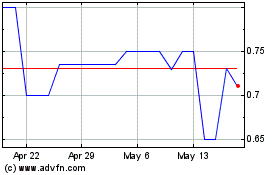

Because there is a limited market in our common stock, stockholders may have difficulty in selling our common stock and our common stock may be subject to significant price swings.

There is a limited market for our common stock. Since trading commenced in December 2006, there has been limited volume and on some days there has been no trading in our common stock. Because of the limited market for our common stock, the purchase or sale of a relatively small number of shares may have an exaggerated effect on the market price for our common stock. We cannot assure stockholders that they will be able to sell common stock or, that if they are able to sell their shares, that they will be able to sell the shares in any significant quantity at the quoted price.

Our revenues, operating results and profitability will vary from quarter to quarter, which may result in increased volatility of our stock price.

Our quarterly revenues, operating results and profitability have varied in the past and are likely to vary significantly from quarter to quarter, making them difficult to predict. This may lead to volatility in our share price. The factors that are likely to cause these variations are:

| ● | Number of workdays, holidays and vacations; |

| ● | The business decisions of clients regarding the use of our services; |

| ● | Periodic differences between clients’ estimated and actual levels of business activity associated with ongoing engagements, including the delay, reduction in scope and cancellation of projects; |

| ● | The stage of completion of existing projects and their termination; |

| ● | Our ability to move employees quickly from completed projects to new engagements and our ability to replace completed contracts with new contracts with the same clients or other clients; |

| ● | The introduction of new services by us or our competitors; |

| ● | Changes in pricing policies by us or our competitors; |

| ● | Our ability to manage costs, including personnel compensation, support-services and severance costs; |

| ● | Acquisition and integration costs related to possible acquisitions of other businesses; |

| ● | Changes in estimates, accruals and payments of variable compensation to our employees or contractors; and |

| ● | Global economic and political conditions and related risks, including acts of terrorism. |

We cannot guarantee that our Stock Repurchase Program will be fully implemented or that it will enhance long-term stockholder value.

On June 13, 2014, the Board of Directors of the Company approved the Company Stock Repurchase Program authorizing the Company to repurchase up to two million shares of its outstanding common stock. The timing, manner, price and amount of any repurchases is at the discretion of the Company, subject to the requirements of the Securities Exchange Act of 1934, as amended, and related rules. As a result, there can be no guarantee around the timing or volume of our share repurchases. We intend to finance any stock repurchases through operating cash flow. There is no guarantee as to the number of shares that will be repurchased, and the Stock Repurchase Program may be extended, suspended or discontinued at any time without notice at our discretion, which may result in a decrease in the trading price of our common stock. The Stock Repurchase Program could increase volatility in and affect the price of our common stock. The existence of our Stock Repurchase Program could also cause the price of our common stock to be higher than it would be in the absence of such a program and could potentially reduce the market liquidity for our common stock. Additionally, repurchases under our Stock Repurchase Program will diminish our cash reserves. There can be no assurance that any share repurchases will enhance stockholder value because the market price of our common stock may decline below the levels at which we repurchased such shares. Any failure to repurchase shares after we have announced our intention to do so may negatively impact our reputation and investor confidence in us and may negatively impact our stock price. Although our Stock Repurchase Program is intended to enhance long-term stockholder value, short-term stock price fluctuations could reduce the program’s effectiveness.

The issuance of securities, whether in connection with an acquisition or otherwise, may result in significant dilution to our stockholders.

If we are required to issue securities either as payment of all or a portion of the purchase price of an acquisition or in order to obtain financing for the acquisition or for other corporate purposes, such an issuance could result in dilution to our stockholders. The amount of such dilution will be dependent upon the terms on which we issue securities. The issuance of securities at a price which is less than the exercise price of outstanding warrants or the conversion price of securities could result in additional dilution if we are required to reduce the exercise price or conversion price of the then outstanding options or warrants or other convertible securities.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not applicable.

ITEM 1C. CYBER SECURITY.

Not applicable.

ITEM 2. PROPERTIES.

The Company conducts its headquarters administrative operations in office facilities located in Dorado, Puerto Rico (the “Office Facilities”). The lease agreement was for an initial five-year term commencing January 1, 2016, with a renewal option for five additional years which was exercised and became effective January 1, 2021. The lease agreement, as amended, has monthly rental payments of $14,561 through the end of the renewal option term. The lease agreement also requires the payment of utilities, property taxes, insurance and expenses incurred by the affiliate in connection with the maintenance of common areas.

Also, the Company maintains an office facility in Madrid, Spain, which is under a month-to-month lease with monthly payment of approximately $500.

We believe that our present facilities are adequate to meet our needs and that, if we require additional space, it will be available on commercially reasonable terms.

ITEM 3. LEGAL PROCEEDINGS.

From time to time, we may be a party to legal proceedings incidental to our business. Currently, there are no proceedings threatened or pending against us, which, if determined adversely to us, would have a material effect on our financial position or results of operations and cash flows.

On March 15, 2023, the Company’s subsidiaries Pharma-Bio Serv PR, Inc., Pharma Serv, Inc. and Scienza Labs, Inc., filed a complaint against Romark Global Pharma, LLC, Romark Properties, LLC, Romark Biosciences, LLC and Romark Holdings, LLC (collectively, “Romark”) with the Commonwealth of Puerto Rico Court of First Instance San Juan Superior Section. The complaint sets forth a breach of contract by Romark for lack of payment of $5,246,782 for services rendered by the Company’s subsidiaries, plus interest pursuant to the specific terms of the agreements signed between the parties. On April 26, 2023, the Company’s subsidiaries requested from the Court an entry of default against Romark for the full amount owed to the Company’s subsidiaries. On April 27, 2023, the Court granted such request and made the entry of default against Romark, which default was granted following Romark’s failure to timely answer the complaint. On November 7th, 2023 the Company’s subsidiaries filed a motion requesting the entry of summary judgment. On November 13, 2023, a judgment was entered by the Court ordering Romark to pay jointly all monetary amounts claimed by the Company’s subsidiaries, plus interests to be counted from the judgment date at an annual rate of 9.25%. The Company’s subsidiaries will continue to pursue the collection from Romark. However, we cannot guarantee a successful outcome in collecting any of the funds owed to the Company’s subsidiaries. No further losses are expected to be incurred in relation to this.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Our common stock has been quoted on the Over the Counter Bulletin Board under the trading symbol PBSV since December 4, 2006. Any over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

On January 19, 2024, there were approximately 62 holders of record of our common stock.

During the year ended October 31, 2023, the Company paid dividends of $0.075 per share of common stock on April 14, 2023 to shareholders of record at the close of business on March 29, 2023. On December 15, 2023, the Board of Directors of the Company declared a cash dividend of $0.075 per common share. The dividend is payable on or about February 15, 2024 to shareholders of record as of the close of business on January 30, 2024. The Board of Directors will continue to evaluate the Company’s strategic plan, which might include future acquisitions, sales of business units, dividends or any combination of these opportunities while continuing its stock repurchase plan.

Equity Compensation Plan Information

The following table summarizes the equity compensation plan under which our securities may be issued as of October 31, 2023.

Plan Category | | Number of securities to be issued upon exercise of outstanding options | | | Weighted-average exercise price per share of outstanding options | | | Number of securities remaining available for future issuance under equity compensation plans | |

Equity compensation plans approved by security holders: | | | | | | | | | |

2014 Long-Term Incentive Plan | | | 343,350 | | | $ | 1.0081 | | | | 1,200,000 | |

Equity compensation plans not approved by security holders | | | - | | | $ | - | | | | - | |

Total | | | 343,350 | | | | | | | | 1,200,000 | |

The 2014 Long-Term Incentive Plan was approved by stockholders in April 2014.

Stock Repurchase Program

The following table provides information about purchases by the Company of its shares of common stock under the Company Stock Repurchase Program during the three-month period ended October 31, 2023:

Period | | Total Number of Shares Purchased (1) | | | Average Price Paid per Share | | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs (1) | |

August 1, 2023 through August 31, 2023 | | | 800 | | | $ | 0.99 | | | | 800 | | | | 1,513,543 | |

September 1, 2023 through September 30, 2023 | | | - | | | $ | - | | | | - | | | | 1,513,543 | |

October 1, 2023 through October 31, 2023 | | | - | | | $ | - | | | | - | | | | 1,513,543 | |

Total | | | 800 | | | $ | 0.99 | | | | 800 | | | | | |

(1) | On June 13, 2014, the Board of Directors of the Company approved the Company Stock Repurchase Program authorizing the Company to repurchase up to two million shares of its outstanding common stock. The timing, manner, price and amount of any repurchases will be at the discretion of the Company, subject to the requirements of the Securities Exchange Act of 1934, as amended, and related rules. The Company Stock Repurchase Program does not oblige the Company to repurchase any shares and it may be modified, suspended or terminated at any time and for any reason. Under the program no shares will be repurchased directly from directors or officers of the Company. The Company Stock Repurchase Program does not have an expiration date. |

ITEM 6. [RESERVED.]

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following discussion of our results of operations and financial condition should be read in conjunction with Part I, including matters set forth in the “Risk Factors” section of this Annual Report on Form 10-K, and our Consolidated Financial Statements and notes thereto included elsewhere in this Annual Report on Form 10-K.

Overview

We are a compliance and technology transfer services consulting firm with headquarters in Puerto Rico, servicing the Puerto Rico, United States, and European markets, and to a lesser extent the Brazilian market which is under development. The compliance consulting service sector in those markets consists of local compliance and validation consulting firms, United States dedicated validation and compliance consulting firms and large publicly traded and private domestic and foreign engineering and consulting firms. We provide a broad range of compliance-related consulting services. We market our services to pharmaceutical, chemical, biotechnology, medical devices, cosmetics and food industries, and allied products companies in Puerto Rico, the United States, Europe and Brazil. Our consulting team includes experienced engineering and life science professionals, former quality assurance managers and directors, and professionals with bachelors, masters and doctorate degrees in health sciences and engineering.

We actively operate in Puerto Rico, the United States, Europe and, to a lesser extent, Brazil and pursue to further expand these markets by strengthening our business development infrastructure and by constantly realigning our business strategies as new opportunities and challenges arise.

We market our services with a presence in industry trade shows, professional conventions, industry publications and company provided seminars to the industry. Our senior management is also actively involved in the marketing process, especially in marketing to major accounts. Our senior management and staff also concentrate on developing new business opportunities and focus on the larger customer accounts (by number of consultants or dollar volume) and responding to prospective customers’ requests for proposals.

We consider our core business to be Food and Drug Administration (“FDA”) and international agencies regulatory compliance consulting related services.

The Company holds a tax grant issued by PRIDCO, which provides relief on various Puerto Rico taxes, including income tax, with certain limitations, for most of the activities carried on within Puerto Rico, including those that are for services to parties located outside of Puerto Rico. The grant was effective as of November 1, 2009 and covers a fifteen-year period, ending on October 31, 2024. Under provisions of Puerto Rico Acts 60-2019 and 73-2008, we have requested PRIDCO the renegotiation of the tax grant for an additional term of fifteen years. As of the date of this filing, we have not received a status from PRIDCO for this request, accordingly, we cannot provide assurance on the outcome for our renegotiation application. For additional information relating to the tax grant issued by PRIDCO, please see Note D – Income Taxes of the consolidated financial statements.

The following table sets forth information as to our revenue for the years ended October 31, 2023 and 2022, by geographic regions (dollars in thousands).

| | Year ended October 31, | |

Revenues by Region | | 2023 | | | 2022 | |

Puerto Rico | | $ | 8,038 | | | | 47.4 | % | | $ | 12,142 | | | | 62.6 | % |

United States | | | 4,672 | | | | 27.5 | % | | | 4,558 | | | | 23.5 | % |

Europe | | | 4,260 | | | | 25.1 | % | | | 2,651 | | | | 13.7 | % |

Other | | | 6 | | | | 0.0 | % | | | 48 | | | | 0.2 | % |

Total revenue | | $ | 16,976 | | | | 100.0 | % | | $ | 19,399 | | | | 100.0 | % |

For the year ended October 31, 2023, the Company’s revenues were approximately $17.0 million, a net decrease of $2.4 million when compared to last year. The Puerto Rico consulting market had a revenue decrease in projects of approximately $4.1 million, which was partially offset by the increase in projects revenue in the European and United States markets of approximately $1.6 and $0.1 million, respectively. When compared to last year, gross profit increased by 4.6 percentage points. The net improvement in gross profit percentage points is mainly attributable to projects yielding higher margins in the European market for the year ended October 31, 2023. Selling, general and administrative expenses were approximately $3.9 million, a net increase of approximately $0.2 million when compared to last year. The increase is mostly attributable to investments in industry and employee activities aimed at solidifying our business and human capital position, plus the overall increase in expenses which support our operations. When compared to last year, other income increased by approximately $0.6 million as the result of the increase in interest income of $0.5 million, plus the net settlement of foreign exchange rates on intercompany balances of approximately $0.1 million. For the year ended October 31, 2023, these factors resulted in net income of approximately $1.3 million, or an increase of approximately $0.3 million when compared to last year.

Regional or global conflicts, including war or economic sanctions between nations, price inflation, pandemics, the Tax Reform, possible tax changes on jurisdictions where we do business, bio-pharmaceutical industry consolidations and the trends on managing contract resources, all pose current and future challenges which may adversely affect our future performance. We believe that our future profitability and liquidity will be dependent on the effect the local and global economy, including any impacts of regional or global conflicts, price inflation, pandemics, changes in tax laws, worldwide life science manufacturing industry consolidations, operational constraints imposed by our customers due to pandemics and resources management trends will have on our operations, and our ability to seek service opportunities and adapt to industry trends.

Results of Operations

The following table sets forth our statements of operations for the year ended October 31, 2023 and 2022 (dollars in thousands, and as a percentage of revenues):

| | Year ended October 31, | |

| | 2023 | | | 2022 | |

Revenues | | $ | 16,976 | | | | 100.0 | % | | $ | 19,399 | | | | 100.0 | % |

Cost of services | | | 11,910 | | | | 70.2 | % | | | 14,517 | | | | 74.8 | % |

Gross profit | | | 5,066 | | | | 29.8 | % | | | 4,882 | | | | 25.2 | % |

Selling, general and administrative expenses | | | 3,949 | | | | 23.2 | % | | | 3,707 | | | | 19.1 | % |

Other income, net | | | 570 | | | | 3.3 | % | | | 13 | | | | 0.0 | % |

Income before income taxes | | | 1,687 | | | | 9.9 | % | | | 1,188 | | | | 6.1 | % |

Income tax expense | | | 377 | | | | 2.2 | % | | | 181 | | | | 0.9 | % |

Net income | | | 1,310 | | | | 7.7 | % | | | 1,007 | | | | 5.2 | % |

Revenues. Revenues for the year ended October 31, 2023 were approximately $17.0 million, a net decrease of $2.4 million when compared to last year. The net decrease is mainly attributable to the decrease in Puerto Rico project revenue of approximately $4.1 million, partially offset by the increase in consulting revenue in the European and United States markets for approximately $1.6 and $0.1 million, respectively. The Brazilian market sustained no major revenue change when compared to the same period last year, which is still not significant.

Cost of Services; Gross Profit. Cost of services for the year ended October 31, 2023 were $11.9 million, a decrease of $2.6 million when compared to last year. Gross profit for the year ended October 31, 2023 increased by 4.6 percentage points when compared to last year. The net improvement in gross profit percentage points is mainly attributable to projects yielding higher margins in the European market for the year ended October 31, 2023.

Selling, General and Administrative Expenses. Selling, general and administrative expenses were approximately $3.9 million, a net increase of approximately $0.2 million when compared to last year. The increase is mostly attributable to investments in industry and employee activities aimed at solidifying our business and human capital position, plus the overall increase in expenses which support our operations.

Other Income, Net. Other income, net for the year ended October 31, 2023, increased by approximately $0.6 million when compared to last year. The increase is mostly attributable to the increase in interest income of $0.5 million, plus the net settlement of foreign exchange rates on intercompany balances of $0.1 million.

Net Income. Net income for the year ended October 31, 2023 was approximately $1.3 million, an improvement of approximately $0.3 million when compared to last year.

For the year ended October 31, 2023, net income per share of common stock for both basic and diluted was $0.057, an improvement of $0.013 per share when compared to last year.

Liquidity and Capital Resources

Liquidity is a measure of our ability to meet potential cash requirements, including planned capital expenditures. As of October 31, 2023, the Company had approximately $17.2 million in working capital.

On June 13, 2014, the Board of Directors of the Company authorized the Company to repurchase up to two million shares of its common stock (the “Repurchase Program”). The Repurchase Program does not have an expiration date. During the year ended October 31, 2023, the Company purchased an aggregate of 35,400 shares of its common stock under the Repurchase Program. As of October 31, 2023, the Company has 1,513,543 shares of common stock available for future repurchases under the Repurchase Program.

Our primary cash needs consist of the payment of compensation to our consulting team, overhead expenses, and statutory taxes. Additionally, we may use cash for the repurchase of our common stock under the Repurchase Program, capital expenditures and business development expenses. Management believes that based on the current level of working capital, operations and cash flows from operations, and the collectability of high-quality customer receivables are sufficient to fund anticipated expenses and satisfy other possible long-term contractual commitments.

To the extent that we pursue possible opportunities to expand our operations, either by acquisition or by the establishment of operations in a new market, we will incur additional overhead, and there may be a delay between the period we commence operations and our generation of net cash flow from operations.

While uncertainties relating to the current local and global economic condition, competition, the industries and geographical regions served by us and other regulatory matters exist within the consulting services industry, as described above, management is not aware of any other trends or events likely to have a material adverse effect on liquidity or its financial statements.

Off-Balance Sheet Arrangements

We were not involved in any significant off-balance sheet arrangements during the fiscal year ended October 31, 2023.

Critical Accounting Policies and Estimates

The discussion and analysis of our financial condition and results of operations are based upon our Consolidated Financial Statements, which have been prepared in accordance with generally accepted accounting principles (“GAAP”) in the United States. We believe the following are the critical accounting policies that impact the consolidated financial statements, some of which are based on management’s best estimates available at the time of preparation. Actual experience may differ from these estimates.

Consolidation - The accompanying consolidated financial statements include the accounts of all of our wholly owned subsidiaries. All intercompany transactions and balances have been eliminated in consolidation.

Segments - The Company operates in three reportable business segments: (i) Puerto Rico technical compliance consulting, (ii) United States technical compliance consulting, and (iii) Europe technical compliance consulting. Accordingly, the accompanying consolidated financial statements are presented to show these three reportable segments.

Use of Estimates - The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results may differ from these estimates.

Fair Value of Financial Instruments - The carrying value of the Company’s financial instruments, cash and cash equivalents, accounts receivable, accounts payable and accrued liabilities, are considered reasonable estimates of fair value due to their liquidity or short-term nature.

Revenue Recognition - The Company records revenue under Accounting Standards Codification (“ASC”) Topic 606, Revenue from Contracts with Customers. We evaluate our revenue contracts with customers based on the five-step model under ASC 606: (i) Identify the contract with the customer; (ii) Identify the performance obligations in the contract; (iii) Determine the transaction price; (iv) Allocate the transaction price to separate performance obligations; and (v) Recognize revenue when (or as) each performance obligation is satisfied.

Revenue is primarily derived from: (1) time and material contracts (representing approximately 99% of total revenues), and (2) short-term fixed-fee contracts or “not to exceed” contracts (representing approximately 1% of total revenues). Time and material contracts are typically based on the number of hours worked at contractually agreed upon rates. These service contracts relate to work which have no alternative use and for which the Company has an enforceable right to payment for the work completed to date. As a result, revenue is recognized over time when or as the Company transfers control of the promised products or services (known as performance obligations) to its customers. Revenue for short term fixed fee contracts or “not to exceed” contracts is recognized similarly, except that certain milestones also have to be reached before revenue is recognized. If the Company determines that a contract will result in a loss, the Company recognizes the estimated loss in the period in which such a determination is made.

Cash and Cash Equivalents - For purposes of the consolidated statements of cash flows, cash and cash equivalents include investments in a money market obligations trust that is registered under the U.S. Investment Company Act of 1940, as amended, and liquid investments, including US Treasury securities, with original maturities of three months or less.

Accounts Receivable - Accounts receivable are recorded at their estimated realizable value. Accounts are deemed past due when payment has not been received within the stated time period. The Company’s policy is to review individual past due amounts periodically and write off amounts for which all collection efforts are deemed to have been exhausted. Due to the nature of the Company’s customers, bad debts are mainly accounted for using the direct write-off method whereby an expense is recognized only when a specific balance is determined to be uncollectible in full. The effect of using this method approximates that of the allowance method. However, in the event the Company determines that the collectability of any account receivable reaches a certain uncertainty threshold, the Company will provide an allowance for doubtful account to reduce said balance.